444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America surveillance IP cameras market represents a rapidly evolving security technology landscape driven by increasing urbanization, rising crime rates, and growing demand for advanced monitoring solutions across commercial, residential, and government sectors. This dynamic market encompasses countries including Brazil, Mexico, Argentina, Colombia, Chile, and Peru, each contributing to the region’s expanding surveillance infrastructure needs.

Market dynamics indicate robust growth potential as organizations and governments prioritize security investments to protect assets, monitor public spaces, and enhance overall safety measures. The transition from analog to digital surveillance systems has accelerated significantly, with IP camera adoption rates reaching approximately 68% across major Latin American markets as businesses recognize the superior image quality, remote accessibility, and integration capabilities of modern surveillance solutions.

Regional growth drivers include increasing infrastructure development projects, smart city initiatives, and heightened security awareness following various socio-economic challenges. The market demonstrates strong momentum across multiple application segments, including retail establishments, manufacturing facilities, transportation hubs, educational institutions, and residential complexes seeking comprehensive security coverage.

Technology advancement continues to reshape the surveillance landscape, with artificial intelligence integration, cloud-based storage solutions, and mobile monitoring capabilities becoming standard features. The market benefits from improved internet connectivity infrastructure and declining hardware costs, making advanced surveillance systems more accessible to small and medium-sized enterprises throughout the region.

The Latin America surveillance IP cameras market refers to the comprehensive ecosystem of internet protocol-based video surveillance systems, including hardware, software, and associated services deployed across Latin American countries for security monitoring, crime prevention, and operational oversight purposes. These systems utilize digital technology to capture, transmit, and store video footage through network connections, enabling remote monitoring and advanced analytics capabilities.

IP surveillance systems differ from traditional analog cameras by converting video signals into digital data packets transmitted over computer networks, allowing for higher resolution imaging, two-way communication, and integration with other security technologies. The market encompasses various camera types including dome cameras, bullet cameras, PTZ (pan-tilt-zoom) systems, and specialized models designed for specific environmental conditions and security requirements.

Market participants include hardware manufacturers, software developers, system integrators, installation service providers, and end-users across diverse industry verticals. The ecosystem supports comprehensive security solutions combining video surveillance with access control systems, alarm monitoring, and intelligent analytics platforms to deliver integrated security management capabilities.

Market expansion across Latin America demonstrates significant momentum as organizations increasingly recognize the critical importance of advanced surveillance technologies for protecting assets, ensuring personnel safety, and maintaining operational continuity. The regional market benefits from favorable economic conditions, government security initiatives, and growing awareness of IP camera advantages over traditional surveillance methods.

Key growth factors driving market development include rising urbanization rates, increasing retail sector expansion, growing manufacturing investments, and enhanced focus on public safety infrastructure. The market experiences particularly strong demand from countries with developing economies seeking to modernize their security infrastructure and attract international business investments.

Technology trends shaping market evolution include artificial intelligence integration for automated threat detection, cloud-based video management systems, mobile surveillance applications, and edge computing capabilities. These innovations enable more sophisticated security solutions while reducing total cost of ownership and improving system reliability across diverse deployment scenarios.

Competitive dynamics feature both international technology leaders and regional solution providers competing to deliver cost-effective, reliable surveillance systems tailored to Latin American market requirements. The market demonstrates increasing consolidation as larger players acquire specialized companies to expand their regional presence and service capabilities.

Market segmentation reveals diverse opportunities across multiple dimensions, with commercial applications representing the largest deployment category, followed by residential and government installations. The following insights highlight critical market characteristics:

Security concerns represent the primary catalyst driving surveillance IP camera adoption across Latin America, as organizations and governments respond to evolving security challenges through advanced monitoring technologies. Rising crime rates in urban areas, increasing terrorist threats, and growing awareness of security vulnerabilities motivate substantial investments in comprehensive surveillance infrastructure.

Economic development initiatives throughout the region create favorable conditions for security technology investments, with governments prioritizing public safety infrastructure and businesses expanding operations requiring enhanced security measures. The growing middle class and increasing disposable income levels support residential surveillance system adoption as homeowners seek to protect their properties and families.

Regulatory compliance requirements across various industries mandate surveillance system implementation for operational oversight, employee safety monitoring, and incident documentation purposes. Financial institutions, healthcare facilities, educational institutions, and transportation companies must maintain comprehensive video surveillance capabilities to meet regulatory standards and insurance requirements.

Technology advancement continues to improve surveillance system capabilities while reducing costs, making IP cameras more accessible to small and medium-sized enterprises. Enhanced image quality, improved low-light performance, wireless connectivity options, and user-friendly management software eliminate traditional barriers to surveillance system adoption across diverse market segments.

Smart city initiatives launched by major Latin American cities drive significant demand for integrated surveillance solutions supporting traffic management, public safety monitoring, and emergency response coordination. These comprehensive projects require scalable IP camera networks capable of supporting multiple municipal applications while providing centralized monitoring and management capabilities.

Economic volatility across several Latin American countries creates budgetary constraints limiting surveillance system investments, particularly among small businesses and government agencies operating with restricted financial resources. Currency fluctuations, inflation pressures, and economic uncertainty can delay or reduce planned security infrastructure projects.

Technical complexity associated with IP surveillance system design, installation, and maintenance requires specialized expertise that may be limited in certain regional markets. Organizations often struggle with network configuration, bandwidth management, storage requirements, and system integration challenges that can increase deployment costs and implementation timelines.

Privacy concerns and regulatory restrictions regarding surveillance system deployment create compliance challenges for organizations seeking to implement comprehensive monitoring solutions. Data protection regulations, employee privacy rights, and public surveillance limitations require careful consideration during system planning and deployment phases.

Infrastructure limitations in rural and developing areas may restrict IP camera deployment due to inadequate internet connectivity, unreliable power supply, or limited network infrastructure. These challenges particularly affect remote locations, smaller communities, and industrial facilities operating in areas with limited telecommunications infrastructure.

Cybersecurity risks associated with network-connected surveillance systems create additional security concerns as organizations must protect their monitoring infrastructure from potential cyber attacks, unauthorized access, and data breaches. The need for ongoing security updates, network monitoring, and access control management adds complexity and cost to surveillance system operations.

Artificial intelligence integration presents significant opportunities for surveillance system enhancement through automated threat detection, behavioral analysis, and predictive security capabilities. AI-powered video analytics can identify suspicious activities, recognize faces, detect abandoned objects, and provide real-time alerts, creating substantial value for security operations across various application segments.

Cloud-based solutions offer scalable, cost-effective alternatives to traditional on-premises surveillance systems, particularly attractive to small and medium-sized enterprises seeking advanced security capabilities without substantial infrastructure investments. Cloud video management platforms provide remote access, automatic updates, and flexible storage options while reducing maintenance requirements.

Mobile surveillance applications create new market opportunities as organizations seek portable, temporary, or remote monitoring solutions for construction sites, special events, emergency response, and temporary facilities. Battery-powered, wireless IP cameras with cellular connectivity enable surveillance deployment in locations without traditional infrastructure support.

Integration opportunities with other security technologies including access control systems, alarm monitoring, fire detection, and building automation create comprehensive security platforms delivering enhanced value to end users. Integrated solutions provide centralized management, coordinated responses, and improved operational efficiency while reducing total system costs.

Vertical market specialization enables solution providers to develop industry-specific surveillance systems tailored to unique requirements in healthcare, education, retail, manufacturing, transportation, and government sectors. Specialized features, compliance capabilities, and industry expertise create competitive advantages and premium pricing opportunities.

Competitive intensity continues to increase as both international technology leaders and regional solution providers compete for market share through product innovation, competitive pricing, and enhanced service capabilities. Market dynamics favor companies offering comprehensive solutions combining hardware, software, and professional services to deliver complete surveillance system implementations.

Technology evolution drives continuous market transformation as new capabilities including 4K resolution, thermal imaging, panoramic views, and advanced analytics become standard features. The rapid pace of innovation requires market participants to maintain ongoing research and development investments while managing product lifecycle transitions and customer upgrade requirements.

Customer expectations continue to evolve toward more sophisticated, user-friendly surveillance solutions offering mobile access, cloud integration, and intelligent automation capabilities. End users increasingly demand systems that provide actionable insights rather than simply recording video footage, driving demand for analytics-enabled surveillance platforms.

Supply chain dynamics influence market development through component availability, manufacturing costs, and distribution efficiency. Regional manufacturing capabilities, import regulations, and logistics infrastructure affect product pricing, availability, and service support across different Latin American markets.

Partnership strategies become increasingly important as surveillance system complexity requires collaboration between hardware manufacturers, software developers, system integrators, and service providers. Strategic alliances enable comprehensive solution delivery while allowing companies to focus on their core competencies and market strengths.

Primary research methodologies employed for market analysis include comprehensive surveys of end users, system integrators, distributors, and technology vendors across major Latin American markets. Direct interviews with industry executives, security managers, and procurement decision-makers provide insights into purchasing criteria, technology preferences, and market trends influencing surveillance system adoption.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial disclosures to validate market trends and quantify market dynamics. Regulatory filings, patent applications, and technology announcements provide additional context for understanding competitive positioning and innovation trends.

Market modeling techniques combine quantitative analysis of historical market data with qualitative assessment of future trends to develop accurate market projections and segment analysis. Statistical modeling incorporates economic indicators, demographic trends, and technology adoption patterns to forecast market development across different time horizons.

Expert validation processes involve consultation with industry specialists, technology experts, and regional market analysts to verify research findings and ensure accuracy of market assessments. Expert panels provide additional perspective on market dynamics, competitive trends, and future development scenarios.

Brazil represents the largest surveillance IP camera market in Latin America, driven by extensive urban development, significant retail sector expansion, and comprehensive public safety initiatives. The country demonstrates strong demand across commercial, residential, and government segments, with São Paulo and Rio de Janeiro accounting for 34% of national installations. Brazilian market growth benefits from local manufacturing capabilities, established distribution networks, and increasing technology adoption rates.

Mexico shows robust market development supported by manufacturing sector expansion, retail modernization, and border security requirements. The market demonstrates particular strength in industrial surveillance applications, with manufacturing facilities representing 28% of commercial installations. Mexico’s proximity to North American markets facilitates technology transfer and creates opportunities for advanced surveillance system deployment.

Argentina presents significant growth opportunities despite economic challenges, with strong demand from financial institutions, retail establishments, and government agencies seeking enhanced security capabilities. The market benefits from high urbanization rates and increasing security awareness, particularly in Buenos Aires and other major metropolitan areas.

Colombia demonstrates accelerating market growth driven by improved security conditions, economic development, and infrastructure modernization projects. The country shows strong adoption rates in commercial and government segments, with particular emphasis on transportation security and public safety monitoring applications.

Chile maintains a mature surveillance market characterized by high technology adoption rates and sophisticated system requirements. The market demonstrates strong demand for premium surveillance solutions with advanced analytics capabilities, particularly in mining, retail, and financial services sectors.

Other regional markets including Peru, Ecuador, and Central American countries show emerging opportunities as economic development and security awareness drive initial surveillance system deployments across various application segments.

Market leadership is distributed among several international technology companies and regional solution providers, each offering distinct advantages in terms of product capabilities, market presence, and customer service. The competitive environment favors companies providing comprehensive solutions combining hardware, software, and professional services.

Regional competitors include local system integrators, distributors, and service providers offering specialized solutions tailored to specific market requirements and customer preferences. These companies often provide competitive advantages through local market knowledge, customer relationships, and customized service offerings.

By Technology:

By Resolution:

By Application:

By Installation Type:

Commercial segment dominates market activity with retail establishments leading adoption rates due to loss prevention requirements, customer behavior analysis, and operational oversight needs. Shopping centers, supermarkets, and specialty retailers increasingly deploy comprehensive surveillance systems with advanced analytics capabilities to optimize security and business operations.

Residential applications show accelerating growth as homeowners recognize the value of IP surveillance systems for property protection, family safety, and remote monitoring capabilities. The segment benefits from declining system costs, simplified installation procedures, and user-friendly mobile applications enabling convenient system management.

Industrial surveillance requirements focus on perimeter security, equipment monitoring, and safety compliance across manufacturing facilities, warehouses, and distribution centers. These applications often require specialized cameras with enhanced durability, environmental protection, and integration with existing industrial control systems.

Government installations emphasize public safety monitoring, critical infrastructure protection, and emergency response support. Municipal surveillance projects require scalable systems capable of supporting multiple agencies while maintaining strict security and privacy compliance standards.

Transportation security represents a specialized market segment requiring cameras designed for vehicle mounting, mobile connectivity, and integration with fleet management systems. Applications include public transit monitoring, cargo security, and traffic surveillance across various transportation modes.

End users benefit from enhanced security capabilities, improved operational visibility, and reduced security staffing requirements through automated monitoring and intelligent analytics. IP surveillance systems provide superior image quality, remote access capabilities, and integration with other security technologies to deliver comprehensive protection solutions.

System integrators gain opportunities to expand service offerings, develop specialized expertise, and build long-term customer relationships through comprehensive surveillance system implementation and support services. The market provides recurring revenue opportunities through maintenance contracts, system upgrades, and expansion projects.

Technology vendors access growing market opportunities across diverse application segments while benefiting from increasing demand for advanced surveillance capabilities. The market supports premium pricing for innovative features including artificial intelligence, cloud integration, and mobile accessibility.

Service providers develop new revenue streams through cloud-based video management services, remote monitoring offerings, and managed security services. These recurring revenue models provide stable income while delivering value-added services to customers seeking comprehensive security solutions.

Government agencies achieve improved public safety outcomes, enhanced emergency response capabilities, and more effective resource allocation through comprehensive surveillance infrastructure. Smart city initiatives benefit from integrated surveillance systems supporting multiple municipal applications and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming surveillance capabilities through automated threat detection, facial recognition, behavioral analysis, and predictive security features. MarkWide Research indicates that AI-enabled surveillance systems demonstrate 43% higher effectiveness in identifying security incidents compared to traditional monitoring approaches.

Cloud-based video management continues gaining adoption as organizations seek scalable, cost-effective alternatives to on-premises infrastructure. Cloud solutions provide automatic updates, remote access capabilities, and flexible storage options while reducing maintenance requirements and capital investments.

Mobile surveillance applications enable convenient system monitoring and management through smartphones and tablets, supporting remote access, real-time alerts, and video playback capabilities. Mobile integration enhances operational flexibility and enables faster response to security incidents.

Edge computing capabilities allow IP cameras to perform local video processing, reducing bandwidth requirements and enabling real-time analytics without dependence on centralized servers. Edge processing supports applications requiring immediate response times and reduces network infrastructure demands.

Wireless connectivity options including WiFi, cellular, and mesh networking eliminate traditional cabling requirements and enable surveillance deployment in challenging locations. Wireless solutions provide installation flexibility and support temporary or mobile surveillance applications.

Integration platforms combine video surveillance with access control, alarm monitoring, and building automation systems to create comprehensive security management solutions. Integrated platforms provide centralized monitoring, coordinated responses, and improved operational efficiency.

Technology partnerships between surveillance equipment manufacturers and artificial intelligence companies accelerate development of intelligent video analytics capabilities. These collaborations combine hardware expertise with advanced software algorithms to deliver sophisticated threat detection and behavioral analysis features.

Regional manufacturing expansion by international surveillance companies establishes local production capabilities to reduce costs, improve supply chain efficiency, and better serve Latin American market requirements. Local manufacturing supports competitive pricing and faster product delivery while creating employment opportunities.

Government initiatives promoting smart city development drive significant investments in integrated surveillance infrastructure supporting public safety, traffic management, and emergency response applications. These comprehensive projects create substantial market opportunities for surveillance system providers and system integrators.

Cybersecurity enhancements address growing concerns about network-connected surveillance systems through improved encryption, secure authentication, and regular security updates. Enhanced cybersecurity features become essential requirements for government and enterprise surveillance deployments.

Standards development by industry organizations establishes compatibility requirements, performance benchmarks, and interoperability guidelines supporting multi-vendor surveillance system integration. Standardization efforts reduce deployment complexity and improve system reliability across diverse applications.

Market entry strategies should focus on establishing strong local partnerships with experienced system integrators and distributors who understand regional market dynamics, customer preferences, and regulatory requirements. Successful market penetration requires comprehensive support including technical training, marketing assistance, and competitive pricing structures.

Product development priorities should emphasize artificial intelligence integration, cloud connectivity, and mobile accessibility to meet evolving customer expectations for intelligent, convenient surveillance solutions. Companies should invest in user-friendly interfaces and simplified installation procedures to expand market accessibility.

Competitive positioning requires clear value propositions differentiating products and services through superior image quality, advanced analytics capabilities, comprehensive integration options, or specialized industry expertise. Premium positioning should be supported by demonstrated performance advantages and comprehensive customer support.

Service expansion opportunities include cloud-based video management, remote monitoring services, and managed security offerings providing recurring revenue streams while delivering additional value to customers. Service-based business models can provide competitive advantages and improve customer retention rates.

Regional customization should address specific market requirements including language support, local compliance standards, environmental conditions, and cultural preferences. Tailored solutions demonstrate market commitment and create competitive advantages over generic product offerings.

Market growth is projected to continue at robust rates driven by increasing security awareness, technology advancement, and expanding application opportunities across diverse industry segments. The market benefits from favorable demographic trends, economic development, and infrastructure modernization initiatives throughout Latin America.

Technology evolution will focus on artificial intelligence enhancement, cloud service expansion, and mobile application development to deliver more sophisticated, user-friendly surveillance solutions. Advanced analytics capabilities will become standard features rather than premium options as processing costs decline and algorithms improve.

Application expansion beyond traditional security monitoring will create new market opportunities in areas including business intelligence, operational optimization, and customer experience enhancement. Surveillance systems will evolve into comprehensive business platforms supporting multiple organizational objectives.

Regional development patterns suggest continued market concentration in major metropolitan areas while expanding into secondary cities and rural regions as infrastructure development and economic growth create new opportunities. MWR analysis projects that secondary markets will represent 38% of new installations within the next five years.

Industry consolidation may accelerate as larger companies acquire specialized providers to expand their technology capabilities, market presence, and service offerings. Consolidation will create more comprehensive solution providers while potentially reducing competitive intensity in certain market segments.

The Latin America surveillance IP cameras market presents substantial growth opportunities driven by increasing security requirements, technology advancement, and expanding application possibilities across commercial, residential, and government sectors. Market development benefits from favorable economic conditions, infrastructure modernization initiatives, and growing awareness of advanced surveillance system capabilities.

Technology trends including artificial intelligence integration, cloud-based services, and mobile accessibility continue reshaping market dynamics while creating new value propositions for end users seeking sophisticated, convenient security solutions. These innovations enable more effective threat detection, improved operational efficiency, and enhanced user experiences across diverse application environments.

Market participants must navigate competitive challenges while capitalizing on emerging opportunities through strategic partnerships, product innovation, and comprehensive service offerings. Success requires understanding regional market dynamics, customer preferences, and regulatory requirements while maintaining competitive positioning through superior technology and customer support.

Future market development will be characterized by continued growth, technology evolution, and application expansion as surveillance systems become integral components of comprehensive security and business intelligence platforms. Organizations investing in advanced surveillance IP camera solutions will benefit from enhanced security capabilities, operational insights, and competitive advantages in an increasingly complex business environment.

What is Surveillance IP Cameras?

Surveillance IP Cameras are digital video cameras that transmit data over a network, allowing for remote monitoring and recording. They are widely used in security systems for various applications, including residential, commercial, and public safety.

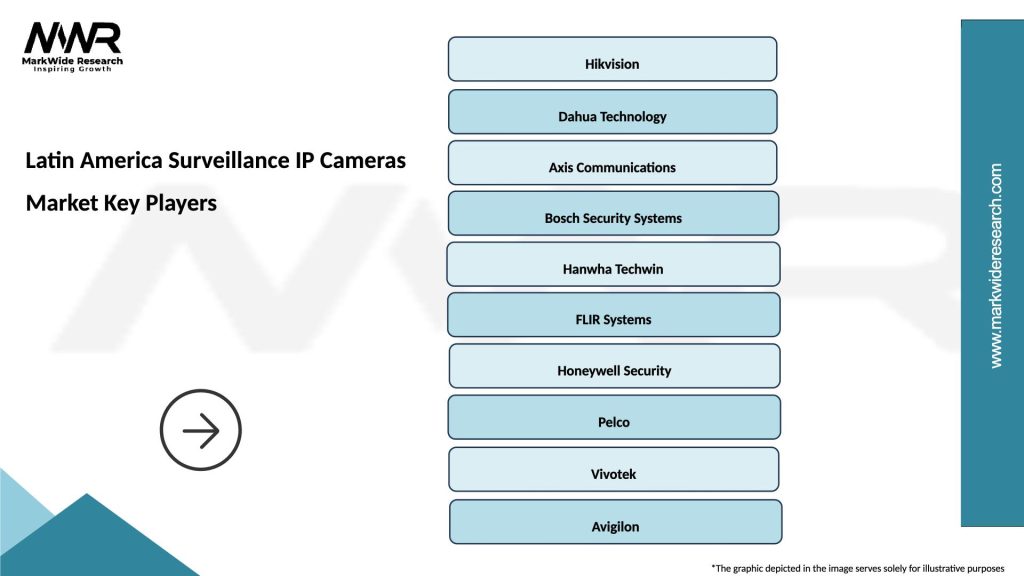

What are the key players in the Latin America Surveillance IP Cameras Market?

Key players in the Latin America Surveillance IP Cameras Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others.

What are the main drivers of growth in the Latin America Surveillance IP Cameras Market?

The main drivers of growth in the Latin America Surveillance IP Cameras Market include increasing security concerns, the rise in crime rates, and the growing adoption of smart city initiatives that require advanced surveillance solutions.

What challenges does the Latin America Surveillance IP Cameras Market face?

Challenges in the Latin America Surveillance IP Cameras Market include high installation costs, concerns over privacy and data security, and the need for skilled personnel to manage and maintain the systems.

What opportunities exist in the Latin America Surveillance IP Cameras Market?

Opportunities in the Latin America Surveillance IP Cameras Market include the integration of artificial intelligence for enhanced analytics, the expansion of cloud-based storage solutions, and the increasing demand for smart home security systems.

What trends are shaping the Latin America Surveillance IP Cameras Market?

Trends shaping the Latin America Surveillance IP Cameras Market include the shift towards wireless technology, the development of high-definition cameras, and the growing use of video analytics for proactive security measures.

Latin America Surveillance IP Cameras Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, Cloud-Based |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Surveillance IP Cameras Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at