444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America surveillance analog camera market represents a significant segment within the broader security infrastructure landscape across the region. Analog surveillance systems continue to maintain substantial market presence despite the growing adoption of digital alternatives, driven by cost-effectiveness and established infrastructure compatibility. The market encompasses countries including Brazil, Mexico, Argentina, Colombia, Chile, and Peru, each contributing unique demand patterns based on local security requirements and economic conditions.

Market dynamics indicate robust growth potential, with the region experiencing a 6.2% CAGR driven by increasing security concerns across residential, commercial, and industrial sectors. Traditional analog cameras remain particularly attractive to small and medium enterprises seeking reliable surveillance solutions without significant infrastructure overhaul requirements. The technology’s proven reliability and lower maintenance costs continue to support sustained demand across diverse applications.

Regional adoption patterns show Brazil and Mexico leading market consumption, accounting for approximately 58% of total regional demand. Infrastructure development initiatives across Latin American countries have created substantial opportunities for surveillance system integration, particularly in urban development projects and industrial facilities. The market benefits from established distribution networks and local technical expertise supporting analog camera deployment and maintenance.

The Latin America surveillance analog camera market refers to the regional ecosystem encompassing the manufacturing, distribution, installation, and maintenance of analog-based video surveillance systems across Latin American countries. Analog surveillance cameras utilize traditional coaxial cable transmission technology to deliver video signals to recording and monitoring equipment, representing a mature technology platform with established performance characteristics.

Market scope includes various analog camera types such as dome cameras, bullet cameras, PTZ (pan-tilt-zoom) systems, and specialized variants designed for specific environmental conditions. The technology operates through analog signal transmission, converting optical information into electrical signals transmitted via coaxial cables to digital video recorders or monitoring stations. System integration typically involves camera units, transmission infrastructure, recording equipment, and monitoring interfaces.

Application domains span residential security, commercial surveillance, industrial monitoring, government facilities, educational institutions, healthcare facilities, and transportation infrastructure. The market encompasses both new installations and replacement systems, with significant demand driven by system upgrades and capacity expansion requirements across diverse sectors.

Market performance across Latin America demonstrates sustained demand for analog surveillance camera systems, supported by cost-effectiveness considerations and compatibility with existing infrastructure. Key growth drivers include increasing security awareness, urbanization trends, and government initiatives promoting public safety infrastructure development. The market benefits from established supply chains and local technical expertise supporting system deployment and maintenance.

Technology adoption patterns reveal continued preference for analog solutions among price-sensitive segments, particularly small businesses and residential applications where budget constraints influence purchasing decisions. Competitive dynamics feature both international manufacturers and regional suppliers, creating diverse product offerings across different price points and performance specifications.

Regional variations in market development reflect economic conditions, security requirements, and regulatory frameworks across different countries. Brazil and Mexico represent the largest markets, while emerging economies show increasing adoption rates driven by infrastructure development and security enhancement initiatives. Future prospects indicate sustained growth potential, with analog systems maintaining relevance alongside digital alternatives in specific application segments.

Strategic market insights reveal several critical factors shaping the Latin America surveillance analog camera landscape:

Primary growth drivers propelling the Latin America surveillance analog camera market include escalating security concerns across residential and commercial sectors. Crime rate increases in major urban centers have intensified demand for comprehensive surveillance solutions, with analog cameras providing cost-effective security coverage for diverse applications. Government initiatives promoting public safety infrastructure development create substantial opportunities for surveillance system deployment in municipal and transportation projects.

Economic factors significantly influence market dynamics, with analog cameras offering attractive value propositions for price-sensitive segments. Small and medium enterprises particularly benefit from lower initial investment requirements and reduced maintenance complexity compared to digital alternatives. Infrastructure development across the region creates opportunities for integrated security system deployment in new construction projects and facility upgrades.

Technological reliability continues driving adoption among users prioritizing proven performance over advanced features. Analog systems demonstrate consistent operational characteristics in challenging environmental conditions common across Latin America, including high humidity, temperature variations, and power supply fluctuations. Local technical expertise availability supports efficient system deployment and maintenance, reducing total cost of ownership concerns.

Significant market restraints include the growing preference for digital surveillance solutions offering advanced features and higher image quality. Technology migration trends toward IP-based systems create competitive pressure on analog camera adoption, particularly in high-end commercial and government applications. Image quality limitations of analog systems compared to digital alternatives may restrict adoption in applications requiring detailed surveillance coverage.

Infrastructure modernization initiatives across the region increasingly favor digital-ready installations, potentially limiting long-term analog system viability. Integration challenges with modern security management platforms may complicate analog system deployment in comprehensive security architectures. Scalability constraints of traditional analog systems compared to network-based alternatives can limit expansion capabilities in growing organizations.

Economic volatility across Latin American countries affects capital investment decisions, potentially delaying surveillance system upgrades and new installations. Currency fluctuations impact imported component costs, affecting overall system pricing and market competitiveness. Regulatory changes promoting digital technology adoption may create policy-driven barriers to analog system deployment in certain applications.

Substantial opportunities exist in the retrofit and upgrade segment, where existing analog installations require capacity expansion or performance enhancement. Hybrid system integration approaches combining analog and digital components offer cost-effective migration paths for organizations transitioning toward advanced surveillance capabilities. Emerging market segments including small retail establishments, residential complexes, and local government facilities present significant growth potential.

Regional expansion opportunities in secondary cities and rural areas where digital infrastructure remains limited create sustained demand for analog surveillance solutions. Vertical market specialization in sectors such as agriculture, mining, and manufacturing offers opportunities for customized analog camera solutions addressing specific environmental and operational requirements.

Technology enhancement initiatives focusing on improved analog camera performance, including better low-light capabilities and weather resistance, can extend market relevance and competitive positioning. Service sector development encompassing installation, maintenance, and system integration services presents opportunities for value-added revenue streams. Partnership strategies with local distributors and system integrators can enhance market penetration and customer support capabilities.

Market dynamics reflect the complex interplay between cost considerations, technology preferences, and security requirements across Latin America. Competitive pressures from digital surveillance solutions drive continuous improvement in analog camera performance and cost-effectiveness. Supply chain optimization efforts focus on reducing distribution costs and improving product availability across diverse geographic markets.

Customer behavior patterns demonstrate pragmatic approach to surveillance technology selection, with total cost of ownership considerations often outweighing advanced feature requirements. Market segmentation reveals distinct preferences across different user categories, with residential and small business segments showing stronger analog camera adoption rates compared to large enterprises.

Technology evolution within the analog camera segment includes improvements in image sensors, lens quality, and environmental durability. Integration capabilities with modern recording and monitoring systems help maintain analog technology relevance in contemporary security architectures. Regional variations in market dynamics reflect local economic conditions, security threats, and infrastructure development patterns across different Latin American countries.

Comprehensive research methodology employed in analyzing the Latin America surveillance analog camera market incorporates multiple data collection and analysis approaches. Primary research includes structured interviews with industry participants, including manufacturers, distributors, system integrators, and end-users across key regional markets. Secondary research encompasses analysis of industry publications, trade association data, government statistics, and company financial reports.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing demand patterns across different application segments and geographic regions. Competitive analysis examines market share distribution, product positioning, pricing strategies, and technological capabilities of key market participants. Trend analysis identifies emerging patterns in technology adoption, customer preferences, and market development across the region.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure accuracy and reliability. Regional analysis methodology accounts for country-specific factors including economic conditions, regulatory frameworks, and market maturity levels. Forecasting models incorporate historical trends, current market conditions, and identified growth drivers to project future market development scenarios.

Brazil dominates the Latin America surveillance analog camera market, representing approximately 35% of regional demand driven by large urban centers and extensive industrial infrastructure. São Paulo and Rio de Janeiro metropolitan areas generate substantial surveillance system requirements across commercial, residential, and government sectors. Industrial applications in manufacturing and mining sectors create consistent demand for robust analog surveillance solutions.

Mexico accounts for roughly 23% of market share, with strong growth in border security applications and urban development projects. Manufacturing sector expansion along the US border creates opportunities for industrial surveillance system deployment. Government initiatives promoting public safety infrastructure development support sustained market growth across major cities.

Argentina represents approximately 15% of regional market, with demand concentrated in Buenos Aires and major industrial centers. Economic challenges have increased focus on cost-effective surveillance solutions, benefiting analog camera adoption. Colombia shows emerging market potential with 12% market share, driven by infrastructure development and security enhancement initiatives. Chile and Peru contribute the remaining market share, with growing adoption in mining and commercial applications.

Competitive landscape features diverse mix of international manufacturers and regional suppliers serving the Latin America surveillance analog camera market. Market leaders maintain competitive positioning through comprehensive product portfolios, established distribution networks, and local technical support capabilities.

Regional manufacturers compete through localized product offerings, competitive pricing, and specialized customer support services. Distribution strategies emphasize partnership development with local system integrators and security solution providers.

Market segmentation analysis reveals distinct patterns across multiple dimensions including product type, application, end-user, and geographic distribution. Product segmentation encompasses various analog camera configurations designed for specific surveillance requirements and environmental conditions.

By Product Type:

By Application:

Residential segment demonstrates strong preference for analog cameras due to budget constraints and simplicity requirements. Homeowner adoption patterns favor dome and bullet cameras offering straightforward installation and reliable performance. DIY installation trends support analog camera popularity among residential users seeking cost-effective security solutions.

Commercial applications show varied adoption patterns based on business size and security requirements. Small retail establishments prefer analog systems for basic surveillance needs, while larger commercial facilities increasingly migrate toward digital alternatives. Cost-benefit analysis remains crucial factor in commercial segment purchasing decisions.

Industrial sector maintains strong analog camera adoption due to harsh environmental conditions and reliability requirements. Manufacturing facilities benefit from proven analog technology performance in challenging operational environments. Mining and energy sectors demonstrate sustained demand for ruggedized analog surveillance solutions capable of withstanding extreme conditions.

Government segment shows mixed adoption patterns, with budget-constrained municipalities favoring analog solutions while federal agencies increasingly adopt digital alternatives. Public safety initiatives create opportunities for analog camera deployment in cost-sensitive applications requiring reliable surveillance coverage.

Manufacturers benefit from sustained market demand across diverse application segments, enabling continued production optimization and cost reduction initiatives. Product differentiation opportunities exist through enhanced analog camera features, environmental durability improvements, and specialized application solutions. Regional manufacturing strategies can reduce costs and improve market responsiveness.

Distributors gain from established market demand and proven product reliability, supporting stable revenue streams and customer relationship development. Value-added services including technical support, installation assistance, and maintenance programs create additional revenue opportunities. Market expansion into underserved geographic regions offers growth potential.

System integrators benefit from continued analog system demand, particularly in retrofit and upgrade applications. Hybrid solution development combining analog and digital components creates competitive advantages and expanded service offerings. Specialized expertise in analog system integration maintains relevance in specific market segments.

End-users receive cost-effective surveillance solutions with proven reliability and straightforward maintenance requirements. Lower total cost of ownership compared to digital alternatives provides budget-friendly security coverage. Compatibility advantages with existing infrastructure reduce upgrade complexity and costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology enhancement trends focus on improving analog camera performance through better image sensors, enhanced low-light capabilities, and improved weather resistance. Manufacturers invest in research and development to extend analog technology competitiveness against digital alternatives. Integration improvements enable better compatibility with modern recording and monitoring systems.

Market consolidation trends show increasing focus on cost optimization and operational efficiency among manufacturers and distributors. Strategic partnerships between international suppliers and regional distributors enhance market coverage and customer support capabilities. Vertical specialization emerges as companies develop targeted solutions for specific industry segments.

Customer preference trends indicate continued demand for cost-effective surveillance solutions, particularly among price-sensitive segments. Hybrid system adoption grows as organizations seek migration paths toward digital technology while leveraging existing analog infrastructure. Service integration trends emphasize comprehensive solution offerings including installation, maintenance, and technical support.

Regional development trends show expanding market penetration in secondary cities and rural areas where digital infrastructure remains limited. Government initiatives promoting public safety infrastructure create opportunities for analog camera deployment in municipal applications. Economic recovery patterns across Latin America influence capital investment decisions and surveillance system adoption rates.

Recent industry developments include significant investments in manufacturing capacity optimization and supply chain efficiency improvements. Major manufacturers have expanded regional distribution networks to enhance market coverage and customer support capabilities across Latin America. Technology partnerships between analog camera suppliers and system integrators have strengthened solution offerings and market penetration.

Product innovation initiatives focus on enhanced analog camera performance, including improved image quality, better environmental durability, and extended operational life. Manufacturing process improvements have enabled cost reductions while maintaining quality standards, supporting competitive positioning against digital alternatives. Quality certification programs have enhanced product reliability and customer confidence.

Market expansion activities include entry into previously underserved geographic regions and vertical market segments. Strategic acquisitions among regional distributors have consolidated market presence and improved operational efficiency. Service capability development has enhanced value propositions through comprehensive technical support and maintenance programs.

Regulatory compliance initiatives have addressed evolving security standards and environmental requirements across different Latin American countries. Sustainability programs focus on reducing environmental impact through improved manufacturing processes and product lifecycle management. Training and certification programs have enhanced technical expertise among installation and maintenance service providers.

Strategic recommendations for market participants include focusing on cost optimization and value proposition enhancement to maintain competitive positioning against digital alternatives. MarkWide Research analysis suggests that companies should invest in hybrid solution development, enabling customers to gradually migrate toward digital technology while leveraging existing analog infrastructure investments.

Market development strategies should emphasize expansion into underserved geographic regions and vertical segments where analog cameras maintain competitive advantages. Partnership development with local distributors and system integrators can enhance market penetration and customer support capabilities. Service integration initiatives should focus on comprehensive solution offerings including installation, maintenance, and technical support.

Product development priorities should address analog camera performance improvements, particularly in image quality, environmental durability, and integration capabilities. Manufacturing optimization efforts should focus on cost reduction while maintaining quality standards to support competitive pricing strategies. Technology roadmap development should consider long-term market evolution and potential migration paths toward advanced surveillance technologies.

Customer engagement strategies should emphasize total cost of ownership advantages and proven reliability benefits of analog surveillance systems. Market education initiatives can help customers understand appropriate applications for analog technology and hybrid system opportunities. Competitive positioning should focus on specific market segments where analog cameras provide clear advantages over digital alternatives.

Future market prospects indicate sustained demand for analog surveillance cameras across specific application segments and geographic regions in Latin America. Growth projections suggest continued market expansion at approximately 5.8% CAGR over the next five years, driven by cost-sensitive applications and infrastructure compatibility requirements. Market evolution will likely focus on performance enhancement and integration capability improvements.

Technology development trends point toward enhanced analog camera capabilities, including better image quality, improved environmental performance, and advanced integration features. Hybrid system adoption is expected to increase as organizations seek cost-effective migration paths toward digital surveillance technology. Regional market development will continue expanding into secondary cities and rural areas where digital infrastructure remains limited.

Competitive dynamics will likely intensify as digital surveillance costs continue declining, requiring analog camera suppliers to focus on specific market niches and value propositions. Market segmentation will become increasingly important as different user categories demonstrate distinct preferences and requirements. Service integration will play crucial role in maintaining market relevance and customer relationships.

Long-term sustainability of the analog camera market depends on continued cost advantages, reliability benefits, and infrastructure compatibility in specific applications. MWR projections suggest that while overall market growth may moderate, certain segments will maintain strong analog camera adoption rates. Strategic positioning in appropriate market niches will determine long-term success for industry participants.

The Latin America surveillance analog camera market demonstrates remarkable resilience and continued relevance despite the broader industry trend toward digital surveillance solutions. Market fundamentals remain strong, supported by cost-effectiveness advantages, infrastructure compatibility, and proven reliability across diverse applications. Regional demand patterns reflect pragmatic approach to surveillance technology selection, with total cost of ownership considerations often outweighing advanced feature requirements.

Strategic opportunities exist across multiple dimensions, including geographic expansion, vertical market specialization, and hybrid solution development. Market participants who focus on appropriate positioning, cost optimization, and value proposition enhancement will likely maintain competitive advantages in specific segments. Technology evolution within the analog camera segment continues improving performance characteristics while preserving fundamental cost and simplicity benefits.

Future success in this market requires understanding of customer needs, competitive positioning in appropriate segments, and continued investment in product development and customer support capabilities. The Latin America surveillance analog camera market will continue serving important role in regional security infrastructure, providing cost-effective solutions for diverse surveillance requirements across the region.

What is Surveillance Analog Camera?

Surveillance Analog Camera refers to traditional video cameras that transmit analog signals for security and monitoring purposes. These cameras are commonly used in various sectors, including retail, transportation, and residential security.

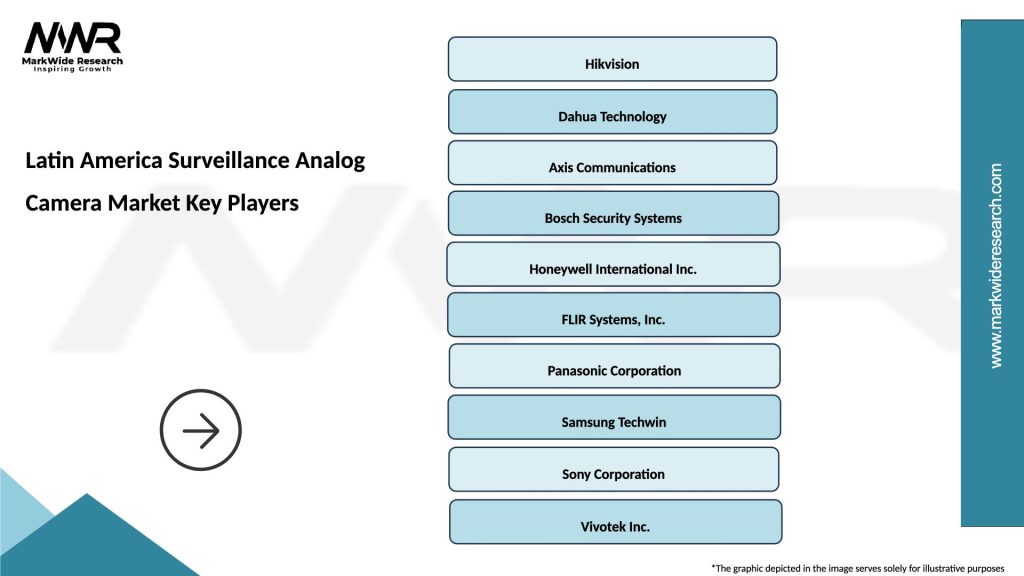

What are the key players in the Latin America Surveillance Analog Camera Market?

Key players in the Latin America Surveillance Analog Camera Market include Hikvision, Dahua Technology, and Axis Communications, among others. These companies are known for their innovative products and extensive distribution networks in the region.

What are the growth factors driving the Latin America Surveillance Analog Camera Market?

The growth of the Latin America Surveillance Analog Camera Market is driven by increasing security concerns, urbanization, and the expansion of smart city initiatives. Additionally, the rise in crime rates has led to higher demand for surveillance solutions across various sectors.

What challenges does the Latin America Surveillance Analog Camera Market face?

Challenges in the Latin America Surveillance Analog Camera Market include high installation costs and the rapid advancement of digital surveillance technologies. These factors can hinder the adoption of analog systems in favor of more modern solutions.

What opportunities exist in the Latin America Surveillance Analog Camera Market?

Opportunities in the Latin America Surveillance Analog Camera Market include the integration of advanced features such as remote monitoring and cloud storage. Additionally, the growing demand for cost-effective security solutions presents avenues for market expansion.

What trends are shaping the Latin America Surveillance Analog Camera Market?

Trends in the Latin America Surveillance Analog Camera Market include the shift towards hybrid systems that combine analog and digital technologies. Furthermore, there is an increasing focus on enhancing image quality and incorporating artificial intelligence for better surveillance analytics.

Latin America Surveillance Analog Camera Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, C-Mount Cameras |

| Technology | Analog, HD-TVI, AHD, CVI |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Surveillance Analog Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at