444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America protection relays market represents a critical segment of the region’s electrical infrastructure landscape, experiencing robust growth driven by expanding power generation capacity and modernization of transmission networks. Protection relays serve as essential safety devices that detect abnormal conditions in electrical systems and initiate protective actions to prevent equipment damage and maintain system stability.

Regional dynamics indicate significant investment in renewable energy projects, with countries like Brazil, Mexico, and Chile leading the charge in solar and wind power installations. The market demonstrates strong growth potential with an estimated CAGR of 6.8% through the forecast period, supported by increasing industrial automation and smart grid implementations across major economies.

Key market drivers include the urgent need for grid modernization, rising electricity demand from growing urban populations, and regulatory mandates for improved power system reliability. The region’s diverse energy mix, encompassing hydroelectric, thermal, and renewable sources, creates substantial demand for sophisticated protection relay solutions capable of handling complex grid configurations.

Technology adoption patterns show a clear shift toward digital and microprocessor-based protection relays, with traditional electromechanical systems gradually being phased out. This transition is particularly evident in countries with advanced electrical infrastructure, where utilities prioritize enhanced functionality and remote monitoring capabilities.

The Latin America protection relays market refers to the comprehensive ecosystem of electrical protection devices, systems, and services designed to safeguard power generation, transmission, and distribution infrastructure across Central and South American countries. These sophisticated devices continuously monitor electrical parameters and automatically isolate faulty sections to prevent cascading failures and equipment damage.

Protection relays function as the nervous system of electrical networks, providing real-time fault detection, system monitoring, and automated response capabilities. They encompass various technologies including overcurrent protection, differential protection, distance protection, and frequency protection, each tailored to specific applications and voltage levels.

Market scope includes manufacturing, installation, maintenance, and upgrade services for protection relay systems across diverse sectors including utilities, industrial facilities, commercial buildings, and renewable energy installations. The market encompasses both hardware components and associated software solutions for system integration and management.

Market performance in Latin America’s protection relays sector demonstrates strong momentum, driven by substantial infrastructure investments and regulatory reforms promoting grid reliability. The region’s commitment to renewable energy integration creates significant opportunities for advanced protection technologies capable of managing bidirectional power flows and variable generation patterns.

Technology trends show accelerating adoption of digital protection relays, with microprocessor-based systems capturing approximately 78% market share in new installations. This shift reflects utilities’ preferences for enhanced functionality, improved accuracy, and integrated communication capabilities that support modern grid management requirements.

Regional leadership positions Brazil as the dominant market, accounting for significant portion of regional demand, followed by Mexico and Argentina. These countries benefit from established electrical infrastructure, active utility modernization programs, and supportive regulatory frameworks encouraging technology upgrades.

Competitive dynamics feature a mix of global technology leaders and regional specialists, with companies focusing on localized manufacturing, technical support, and customized solutions for specific market requirements. Strategic partnerships between international vendors and local distributors drive market penetration and service delivery.

Strategic insights reveal several critical factors shaping the Latin America protection relays market landscape:

Infrastructure modernization serves as the primary catalyst for protection relay market growth, with governments and utilities across Latin America investing heavily in grid upgrades to improve reliability and efficiency. Aging transmission and distribution networks require comprehensive protection system replacements to meet modern performance standards and regulatory requirements.

Renewable energy expansion creates substantial demand for advanced protection technologies capable of managing complex grid interactions. Solar and wind installations require specialized protection schemes to handle variable generation patterns, reverse power flows, and grid synchronization challenges, driving adoption of sophisticated digital relay systems.

Industrial growth across key sectors including mining, oil and gas, manufacturing, and petrochemicals generates significant demand for robust protection solutions. These industries require reliable electrical systems to maintain continuous operations, creating opportunities for specialized protection relay applications designed for harsh environments.

Urbanization trends drive electricity demand growth, necessitating expansion and reinforcement of distribution networks. Growing cities require enhanced protection systems to ensure reliable power supply to residential, commercial, and industrial consumers, supporting market expansion across urban centers.

Regulatory mandates for improved grid reliability and safety standards compel utilities to upgrade protection systems. Government initiatives promoting electrical infrastructure modernization provide policy support and funding mechanisms that accelerate protection relay deployment across the region.

Capital constraints represent a significant challenge for market growth, as many utilities and industrial customers face budget limitations that restrict large-scale protection system upgrades. Economic volatility in several Latin American countries affects investment decisions and project timelines, creating uncertainty for market participants.

Technical complexity associated with modern protection relay systems requires specialized expertise for proper implementation and maintenance. The shortage of qualified technical personnel in some regions limits adoption rates and increases implementation costs, particularly for advanced digital protection technologies.

Legacy system integration challenges arise when upgrading existing electrical infrastructure with modern protection relays. Compatibility issues between new digital systems and older equipment create technical hurdles and additional costs that may delay modernization projects.

Economic instability in certain countries affects long-term investment planning and project financing. Currency fluctuations, inflation, and political uncertainty can impact equipment procurement decisions and delay infrastructure development projects that drive protection relay demand.

Standardization gaps across different countries create complexity for manufacturers and system integrators. Varying technical standards, certification requirements, and regulatory frameworks increase costs and complexity for companies operating across multiple Latin American markets.

Smart grid initiatives across Latin America present substantial opportunities for advanced protection relay technologies. Governments and utilities increasingly recognize the benefits of intelligent grid infrastructure, creating demand for protection systems with communication capabilities, remote monitoring, and automated response features.

Renewable energy integration offers significant growth potential as countries pursue ambitious clean energy targets. Protection relay manufacturers can capitalize on the need for specialized solutions that address the unique challenges of solar, wind, and hydroelectric installations, including grid synchronization and power quality management.

Industrial automation trends create opportunities for integrated protection and control solutions. Manufacturing facilities, mining operations, and process industries seek comprehensive electrical management systems that combine protection, monitoring, and control functions in unified platforms.

Retrofit and upgrade projects represent a substantial market opportunity as utilities modernize aging infrastructure. The replacement of electromechanical and early digital protection systems with advanced microprocessor-based solutions drives sustained demand across the region.

Regional manufacturing expansion offers opportunities for cost reduction and improved market access. Companies establishing local production facilities can benefit from reduced logistics costs, faster delivery times, and enhanced customer support capabilities while supporting local economic development.

Technology evolution drives fundamental changes in the protection relays market, with digital transformation reshaping customer expectations and system capabilities. The transition from traditional electromechanical devices to sophisticated microprocessor-based systems enables enhanced functionality, improved accuracy, and integrated communication features that support modern grid management requirements.

Competitive pressures intensify as global manufacturers expand their presence in Latin American markets while regional players strengthen their positions through strategic partnerships and localized offerings. This dynamic environment promotes innovation, drives down costs, and improves customer service levels across the market.

Regulatory evolution continues to shape market dynamics as governments implement new standards for grid reliability, cybersecurity, and environmental performance. These regulatory changes create both opportunities and challenges for market participants, requiring continuous adaptation and investment in compliance capabilities.

Customer preferences shift toward comprehensive solutions that integrate protection, control, and monitoring functions. Utilities and industrial customers increasingly value systems that provide operational efficiency gains of approximately 25-30% through reduced maintenance requirements and enhanced diagnostic capabilities.

Supply chain considerations become increasingly important as companies balance global sourcing strategies with local market requirements. Regional manufacturing and service capabilities provide competitive advantages in terms of responsiveness, customization, and total cost of ownership.

Comprehensive analysis of the Latin America protection relays market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, utility managers, system integrators, and end-users across major regional markets to gather firsthand insights on market trends and requirements.

Secondary research encompasses detailed analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Market sizing methodology combines bottom-up and top-down approaches to establish accurate market parameters. Bottom-up analysis aggregates demand from individual market segments and applications, while top-down analysis validates findings through macroeconomic indicators and industry benchmarks.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure information accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of analytical integrity.

Forecasting models incorporate historical trends, current market conditions, and future growth drivers to project market development scenarios. These models account for regional variations, technology adoption patterns, and regulatory changes that influence market evolution.

Brazil dominates the Latin America protection relays market, representing approximately 42% of regional demand due to its large electrical infrastructure base and active modernization programs. The country’s diverse energy mix, including significant hydroelectric capacity and growing renewable installations, drives substantial demand for sophisticated protection solutions.

Mexico emerges as the second-largest market, accounting for roughly 23% market share, supported by ongoing energy sector reforms and industrial expansion. The country’s strategic location and manufacturing growth create opportunities for protection relay applications across utilities and industrial sectors.

Argentina maintains a significant market position with approximately 12% regional share, driven by utility modernization initiatives and industrial development. The country’s focus on renewable energy development and grid reliability improvements supports protection relay demand growth.

Chile demonstrates strong market potential despite its smaller size, with advanced renewable energy projects and mining operations driving demand for specialized protection solutions. The country’s commitment to clean energy creates opportunities for innovative protection technologies.

Colombia and Peru represent emerging markets with growing infrastructure investment and industrial development. These countries offer significant growth potential as they modernize electrical systems and expand generation capacity to support economic development.

Central American markets including Costa Rica, Panama, and Guatemala show increasing activity in protection relay adoption, driven by regional integration initiatives and renewable energy development projects that require advanced grid protection capabilities.

Market leadership features a diverse mix of global technology companies and regional specialists competing across different market segments and applications. The competitive environment promotes innovation and drives continuous improvement in product capabilities and service offerings.

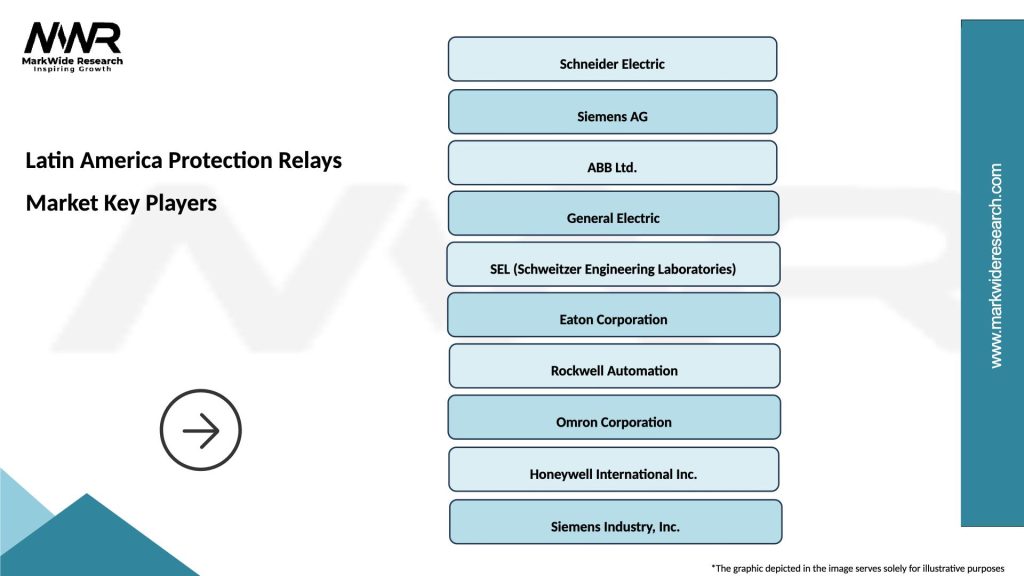

Key players in the Latin America protection relays market include:

Competitive strategies focus on technology innovation, local manufacturing, strategic partnerships, and comprehensive service offerings. Companies invest in research and development to advance protection relay capabilities while building regional presence through acquisitions and joint ventures.

By Technology:

By Voltage Level:

By Application:

Digital protection relays dominate new installations, capturing approximately 85% of market demand due to their superior functionality, reliability, and integration capabilities. These advanced systems offer comprehensive protection schemes, remote monitoring, and diagnostic features that reduce maintenance costs and improve system reliability.

Transmission applications represent the largest market segment by revenue, driven by high-value protection systems required for critical transmission infrastructure. These applications demand the most sophisticated protection technologies with advanced communication capabilities and fault analysis features.

Industrial segment shows strong growth potential as manufacturing and mining operations expand across the region. Industrial customers increasingly value protection systems that integrate with plant automation systems and provide detailed operational data for process optimization.

Renewable energy applications emerge as a high-growth category, with specialized protection requirements for variable generation sources. Solar and wind installations require protection systems capable of handling bidirectional power flows and grid synchronization challenges.

Retrofit projects constitute a significant portion of market activity as utilities upgrade aging protection infrastructure. These projects often involve replacing multiple generations of protection equipment with modern digital systems that provide enhanced functionality and reduced lifecycle costs.

Utilities benefit from modern protection relay systems through improved grid reliability, reduced outage duration, and enhanced operational efficiency. Advanced protection technologies enable faster fault detection and isolation, minimizing customer impact and reducing revenue losses from service interruptions.

Industrial customers gain significant value from reliable protection systems that prevent costly equipment damage and production interruptions. Modern protection relays provide detailed diagnostic information that supports predictive maintenance strategies and optimizes asset utilization.

System integrators capitalize on growing demand for comprehensive electrical protection solutions by offering specialized expertise in design, installation, and commissioning services. The complexity of modern protection systems creates opportunities for value-added services and long-term customer relationships.

Equipment manufacturers benefit from sustained demand for protection relay upgrades and new installations driven by infrastructure modernization and renewable energy development. Technology innovation provides competitive differentiation and premium pricing opportunities.

Regulatory authorities achieve improved grid reliability and safety through mandated protection system standards and upgrades. Modern protection technologies support regulatory objectives for system performance and environmental compliance.

End consumers ultimately benefit from more reliable electricity supply and improved power quality resulting from advanced protection system deployment across generation, transmission, and distribution networks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the protection relays market as utilities and industrial customers embrace advanced technologies that provide enhanced functionality and operational insights. This trend drives demand for microprocessor-based systems with integrated communication capabilities and comprehensive diagnostic features.

Cybersecurity focus intensifies as protection systems become increasingly connected and vulnerable to cyber threats. Manufacturers respond by developing hardened devices with advanced encryption, secure communication protocols, and robust authentication mechanisms to protect critical infrastructure.

Integration convergence emerges as a key trend, with protection, control, and monitoring functions being combined in unified platforms. This convergence reduces system complexity, improves operational efficiency, and provides cost advantages for customers seeking comprehensive electrical management solutions.

Predictive maintenance capabilities gain prominence as protection relays incorporate advanced diagnostic features and condition monitoring technologies. These capabilities enable utilities and industrial customers to optimize maintenance schedules and prevent unexpected equipment failures.

Renewable integration drives development of specialized protection schemes designed for variable generation sources and bidirectional power flows. Protection relay manufacturers invest in technologies that address the unique challenges of solar, wind, and energy storage installations.

Cloud connectivity becomes increasingly important as customers seek remote monitoring and management capabilities. Protection systems with cloud integration enable centralized monitoring, data analytics, and predictive maintenance across distributed electrical infrastructure.

Technology partnerships between protection relay manufacturers and software companies accelerate development of advanced analytics and artificial intelligence capabilities. These collaborations enable predictive maintenance, fault analysis, and optimization features that provide significant customer value.

Manufacturing expansion continues across Latin America as global companies establish regional production facilities to reduce costs and improve market access. Recent investments in Brazil, Mexico, and Colombia demonstrate industry commitment to local manufacturing capabilities.

Acquisition activity intensifies as companies seek to expand their technology portfolios and regional presence. Strategic acquisitions enable rapid market entry, technology acquisition, and customer base expansion for both global and regional players.

Regulatory developments across multiple countries establish new standards for protection system performance, cybersecurity, and environmental compliance. These regulatory changes drive market demand while creating challenges for manufacturers to ensure compliance across diverse markets.

Research initiatives focus on next-generation protection technologies including artificial intelligence, machine learning, and advanced communication protocols. Industry collaboration with universities and research institutions accelerates innovation and technology development.

Service expansion becomes a strategic priority as companies develop comprehensive support offerings including installation, commissioning, maintenance, and upgrade services. This trend reflects customer preferences for turnkey solutions and long-term partnerships.

Market participants should prioritize digital transformation initiatives to remain competitive in the evolving protection relays landscape. MarkWide Research analysis indicates that companies investing in advanced digital technologies and integrated solutions achieve superior market positioning and customer satisfaction.

Regional manufacturing strategies deserve serious consideration for companies seeking to optimize costs and improve market responsiveness. Local production capabilities provide competitive advantages through reduced logistics costs, faster delivery times, and enhanced customer support capabilities.

Partnership development with local distributors, system integrators, and service providers enables effective market penetration and customer relationship building. These partnerships provide market knowledge, customer access, and service capabilities that support sustainable growth.

Technology investment in cybersecurity, artificial intelligence, and cloud connectivity becomes essential as customer requirements evolve toward more sophisticated protection solutions. Companies that anticipate these trends and invest accordingly will capture disproportionate market share.

Service capabilities expansion offers opportunities for recurring revenue and customer retention. Companies should develop comprehensive service portfolios including maintenance, upgrade, and consulting services that provide ongoing customer value.

Market diversification across multiple countries and applications reduces risk and provides growth opportunities. Companies should balance market concentration with diversification to optimize growth potential while managing regional risks.

Market growth prospects remain positive for the Latin America protection relays market, with sustained demand driven by infrastructure modernization, renewable energy development, and industrial expansion. The market is expected to maintain robust growth momentum with projected CAGR of 6.8% through the forecast period.

Technology evolution will continue toward more intelligent, connected, and integrated protection systems that provide comprehensive electrical management capabilities. Artificial intelligence and machine learning integration will enable predictive maintenance and autonomous system optimization features.

Regional leadership patterns may shift as emerging markets including Colombia, Peru, and Central American countries accelerate infrastructure development and modernization programs. These markets offer significant growth potential for companies with appropriate market entry strategies.

Competitive dynamics will intensify as technology barriers decrease and new entrants challenge established players. Success will depend on innovation capabilities, customer relationships, and comprehensive solution offerings that address evolving market requirements.

Regulatory influence will continue shaping market development through evolving standards for grid reliability, cybersecurity, and environmental performance. Companies must maintain compliance capabilities while anticipating future regulatory trends.

Investment opportunities remain substantial across the protection relays value chain, from technology development and manufacturing to service delivery and system integration. MWR projects continued strong investor interest in companies with innovative technologies and regional market presence.

The Latin America protection relays market presents compelling growth opportunities driven by infrastructure modernization, renewable energy expansion, and industrial development across the region. Market dynamics favor companies that combine advanced technology capabilities with strong regional presence and comprehensive service offerings.

Technology trends toward digital transformation, cybersecurity, and system integration create both opportunities and challenges for market participants. Success requires continuous innovation investment and adaptation to evolving customer requirements for more sophisticated protection solutions.

Regional diversity provides multiple growth avenues while requiring tailored market approaches that account for local regulations, customer preferences, and competitive dynamics. Companies with flexible strategies and local partnerships are best positioned to capitalize on market opportunities.

Future success in the Latin America protection relays market will depend on companies’ ability to anticipate technological trends, build strong customer relationships, and deliver comprehensive solutions that address the complex challenges of modern electrical infrastructure. The market outlook remains positive for organizations that embrace innovation and maintain focus on customer value creation.

What is Protection Relays?

Protection relays are devices used in electrical systems to detect faults and initiate corrective actions to prevent damage. They play a crucial role in ensuring the safety and reliability of power systems by monitoring electrical parameters and responding to abnormal conditions.

What are the key players in the Latin America Protection Relays Market?

Key players in the Latin America Protection Relays Market include Siemens, Schneider Electric, and ABB, among others. These companies are known for their innovative solutions and extensive product offerings in the field of electrical protection.

What are the main drivers of the Latin America Protection Relays Market?

The main drivers of the Latin America Protection Relays Market include the increasing demand for reliable power supply, the expansion of renewable energy sources, and the growing need for grid modernization. These factors are pushing utilities and industries to invest in advanced protection technologies.

What challenges does the Latin America Protection Relays Market face?

The Latin America Protection Relays Market faces challenges such as the lack of skilled workforce and the high cost of advanced protection systems. Additionally, regulatory hurdles and varying standards across countries can complicate market entry for new players.

What opportunities exist in the Latin America Protection Relays Market?

Opportunities in the Latin America Protection Relays Market include the increasing adoption of smart grid technologies and the rising investments in infrastructure development. Furthermore, the shift towards digitalization in the energy sector presents avenues for innovative relay solutions.

What trends are shaping the Latin America Protection Relays Market?

Trends shaping the Latin America Protection Relays Market include the integration of IoT technologies for enhanced monitoring and control, as well as the development of multifunctional relays that combine various protective functions. Additionally, there is a growing emphasis on sustainability and energy efficiency in relay design.

Latin America Protection Relays Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electromechanical Relays, Solid State Relays, Hybrid Relays, Time Delay Relays |

| End User | Utilities, Industrial Manufacturing, Renewable Energy, Transportation |

| Technology | Microprocessor-Based, Analog, Digital, Smart Relays |

| Installation | Panel Mount, DIN Rail Mount, Rack Mount, Surface Mount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Protection Relays Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at