444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America physical security market represents a rapidly evolving landscape driven by increasing security concerns, urbanization, and technological advancement across the region. This comprehensive market encompasses various security solutions including access control systems, video surveillance, intrusion detection, perimeter security, and integrated security management platforms. Regional growth has been particularly robust, with the market experiencing a compound annual growth rate (CAGR) of 8.2% over recent years, reflecting the growing emphasis on safety and security infrastructure throughout Latin American countries.

Market dynamics in Latin America are shaped by diverse factors including rising crime rates in urban areas, increased investment in critical infrastructure, and growing awareness of security threats among businesses and government entities. Countries such as Brazil, Mexico, Argentina, and Colombia are leading the adoption of advanced physical security technologies, with Brazil accounting for approximately 35% of the regional market share. The integration of artificial intelligence, IoT connectivity, and cloud-based security solutions has transformed traditional security approaches, creating new opportunities for market expansion and technological innovation.

Government initiatives and regulatory frameworks have played a crucial role in driving market growth, with many Latin American countries implementing mandatory security standards for public infrastructure, commercial buildings, and residential complexes. The increasing focus on smart city development and digital transformation has further accelerated the adoption of sophisticated physical security solutions, positioning the region as an emerging hub for security technology deployment and innovation.

The Latin America physical security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect people, property, and assets from physical threats across Latin American countries. This market encompasses traditional security measures such as locks, barriers, and guards, as well as advanced technological solutions including biometric access control, intelligent video analytics, perimeter detection systems, and integrated security management platforms.

Physical security solutions in this context involve the protection of tangible assets through various means of detection, deterrence, delay, and response mechanisms. The market includes both standalone security products and integrated systems that combine multiple technologies to provide comprehensive protection. Key components range from basic surveillance cameras and alarm systems to sophisticated AI-powered threat detection platforms and automated response systems that can identify, analyze, and respond to security incidents in real-time.

Regional characteristics of the Latin America physical security market include adaptation to local security challenges, compliance with regional regulations, and integration with existing infrastructure. The market serves diverse sectors including government facilities, commercial enterprises, industrial sites, residential complexes, transportation hubs, and critical infrastructure, each requiring tailored security solutions to address specific threats and operational requirements.

Strategic positioning of the Latin America physical security market reflects a dynamic environment characterized by rapid technological advancement and increasing security awareness. The market has demonstrated remarkable resilience and growth potential, driven by urbanization trends, infrastructure development, and evolving threat landscapes. Technology adoption rates have accelerated significantly, with cloud-based security solutions experiencing adoption growth of 42% among enterprise customers seeking scalable and cost-effective security management.

Market segmentation reveals diverse opportunities across various technology categories, with video surveillance systems maintaining the largest market share, followed by access control solutions and intrusion detection systems. The integration of artificial intelligence and machine learning capabilities has emerged as a key differentiator, enabling predictive analytics, automated threat detection, and enhanced operational efficiency. Mobile security applications and remote monitoring capabilities have become increasingly important, particularly in response to changing work patterns and distributed security management requirements.

Competitive landscape features a mix of international technology providers and regional security specialists, creating a dynamic ecosystem that balances global innovation with local market expertise. The market continues to evolve toward integrated security platforms that combine multiple technologies and provide centralized management capabilities, reflecting customer demand for simplified operations and comprehensive protection strategies.

Technological transformation represents the most significant trend shaping the Latin America physical security market, with organizations increasingly adopting intelligent security solutions that leverage advanced analytics and automation. The following key insights highlight critical market developments:

Market maturation is evident in the increasing sophistication of customer requirements and the growing emphasis on total cost of ownership considerations. Organizations are moving beyond basic security installations toward comprehensive security ecosystems that provide integrated protection, operational intelligence, and business insights.

Primary growth drivers in the Latin America physical security market stem from multiple interconnected factors that create sustained demand for advanced security solutions. Urbanization trends continue to accelerate across the region, with urban populations growing at rates that strain existing security infrastructure and create new protection requirements for expanding metropolitan areas.

Crime prevention initiatives have become a top priority for governments and private organizations, driving significant investments in comprehensive security systems. The increasing sophistication of criminal activities has necessitated corresponding advances in security technology, creating demand for intelligent detection systems, predictive analytics, and automated response capabilities. Infrastructure development projects across transportation, energy, and telecommunications sectors require integrated security frameworks from the initial planning stages.

Regulatory compliance requirements continue to expand, with governments implementing stricter security standards for public buildings, commercial facilities, and critical infrastructure. The growing awareness of terrorism threats and organized crime has prompted enhanced security measures across various sectors, including aviation, maritime, and border security. Economic growth in key Latin American markets has enabled increased security spending by both public and private sector organizations, supporting market expansion and technology adoption.

Digital transformation initiatives are driving demand for connected security solutions that integrate with broader organizational technology ecosystems. The need for remote monitoring capabilities, centralized management platforms, and data-driven security insights has become increasingly important as organizations seek to optimize security operations and demonstrate return on investment.

Economic volatility across Latin American countries presents significant challenges for sustained security market growth, with currency fluctuations and budget constraints affecting both public and private sector security investments. Capital expenditure limitations often force organizations to defer security upgrades or opt for lower-cost solutions that may not provide comprehensive protection or long-term value.

Technical infrastructure limitations in certain regions create barriers to advanced security system deployment, particularly for solutions requiring high-bandwidth connectivity, reliable power supply, or sophisticated IT support capabilities. The digital divide between urban and rural areas affects market penetration and limits the adoption of cloud-based and IoT-enabled security technologies in less developed regions.

Skills shortage in security technology installation, maintenance, and management represents a persistent challenge, with limited availability of qualified technicians and security professionals constraining market growth. The complexity of modern security systems requires specialized expertise that may not be readily available in all markets, leading to implementation delays and increased operational costs.

Regulatory complexity and varying standards across different countries create challenges for security solution providers seeking to operate across multiple Latin American markets. Compliance requirements, certification processes, and local content regulations can increase costs and complexity for both vendors and end-users. Privacy concerns and data protection regulations are becoming increasingly stringent, requiring careful consideration of surveillance system deployment and data management practices.

Emerging technologies present substantial opportunities for market expansion and innovation in the Latin America physical security sector. Artificial intelligence integration offers potential for advanced threat detection, predictive analytics, and automated response systems that can significantly enhance security effectiveness while reducing operational costs. The growing adoption of IoT devices and edge computing creates opportunities for distributed security architectures and real-time threat intelligence.

Smart city development initiatives across major Latin American urban centers represent significant market opportunities, with comprehensive security frameworks becoming integral components of urban planning and infrastructure development. These projects require integrated security solutions that combine video surveillance, access control, emergency response, and traffic management systems into cohesive platforms.

Public-private partnerships are creating new models for security infrastructure development and financing, enabling large-scale deployments that might not be feasible through traditional procurement approaches. The increasing focus on critical infrastructure protection presents opportunities for specialized security solutions in energy, transportation, telecommunications, and water management sectors.

Vertical market specialization offers opportunities for tailored security solutions that address specific industry requirements, such as retail loss prevention, healthcare security, educational institution protection, and industrial facility monitoring. The growing emphasis on business continuity and risk management creates demand for comprehensive security frameworks that integrate physical protection with operational resilience capabilities.

Technological convergence is fundamentally reshaping market dynamics in the Latin America physical security sector, with traditional boundaries between physical security, cybersecurity, and operational technology becoming increasingly blurred. Integration requirements are driving demand for unified security platforms that can manage multiple technologies through centralized interfaces, reducing complexity and improving operational efficiency.

Customer expectations have evolved significantly, with organizations seeking security solutions that provide not only protection but also business intelligence, operational insights, and return on investment demonstration. The shift toward outcome-based security services and managed security offerings reflects changing procurement preferences and the desire for predictable operational costs.

Competitive dynamics are intensifying as traditional security vendors compete with technology companies, system integrators, and cloud service providers entering the physical security market. This competition is driving innovation, improving solution quality, and creating more favorable pricing conditions for end-users. Partnership strategies are becoming increasingly important as vendors seek to combine complementary technologies and capabilities.

Market consolidation trends are evident as larger organizations acquire specialized technology providers and regional security companies to expand their capabilities and market reach. This consolidation is creating opportunities for comprehensive solution offerings while potentially reducing the number of independent vendors in certain market segments. Service-oriented business models are gaining traction as organizations prefer subscription-based and managed service approaches over traditional capital expenditure models.

Comprehensive market analysis for the Latin America physical security market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include structured interviews with industry executives, security professionals, end-users, and technology providers across key Latin American markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, company financial statements, and technology specifications to validate primary findings and provide comprehensive market context. Quantitative analysis involves statistical modeling of market data, trend analysis, and forecasting methodologies to project future market developments and growth patterns.

Market segmentation analysis examines various dimensions including technology categories, end-user industries, geographic regions, and deployment models to identify specific growth opportunities and competitive dynamics. Competitive intelligence gathering involves monitoring vendor activities, product launches, partnership announcements, and strategic initiatives to understand market positioning and competitive strategies.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control measures and analytical frameworks to deliver actionable market intelligence that supports strategic decision-making for industry stakeholders.

Brazil dominates the Latin America physical security market with approximately 35% market share, driven by large-scale infrastructure projects, urban security initiatives, and significant private sector investments in security technology. The country’s diverse industrial base, including manufacturing, mining, and energy sectors, creates substantial demand for comprehensive security solutions. São Paulo and Rio de Janeiro metropolitan areas represent the largest market concentrations, with extensive deployments of video surveillance, access control, and integrated security management systems.

Mexico accounts for approximately 22% of regional market share, with strong growth driven by manufacturing sector expansion, border security requirements, and urban development projects. The country’s strategic location and trade relationships have created significant demand for transportation and logistics security solutions. Government initiatives focused on public safety and critical infrastructure protection continue to drive market growth across federal, state, and municipal levels.

Argentina represents approximately 15% market share, with security investments concentrated in Buenos Aires and other major urban centers. The country’s focus on modernizing public infrastructure and improving citizen safety has created opportunities for advanced security technology deployment. Colombia contributes approximately 12% market share, with significant growth potential driven by economic development, infrastructure investment, and enhanced security requirements across various sectors.

Chile, Peru, and other regional markets collectively account for the remaining market share, with varying growth rates and technology adoption patterns. These markets present opportunities for specialized security solutions tailored to specific industry requirements and local security challenges. Cross-border security initiatives and regional cooperation programs are creating additional market opportunities for integrated security platforms and information sharing systems.

Market leadership in the Latin America physical security sector is characterized by a diverse ecosystem of international technology providers, regional specialists, and local system integrators. The competitive landscape reflects varying strengths in technology innovation, market presence, and customer relationships across different market segments and geographic regions.

Regional players and system integrators play crucial roles in market development, providing localized expertise, installation services, and ongoing support. These organizations often partner with international technology providers to deliver comprehensive solutions tailored to specific market requirements and customer needs.

Technology-based segmentation reveals distinct market dynamics across various physical security categories, with each segment addressing specific security requirements and operational challenges. Video surveillance systems represent the largest market segment, encompassing IP cameras, analog systems, video management software, and analytics platforms that provide comprehensive monitoring and recording capabilities.

By Technology:

By End-User Industry:

Video surveillance category maintains market leadership with continuous innovation in image quality, analytics capabilities, and integration features. IP-based systems have largely replaced analog installations, offering superior image quality, remote accessibility, and advanced analytics capabilities. The integration of artificial intelligence and machine learning has enabled automated threat detection, behavior analysis, and predictive security capabilities that significantly enhance operational effectiveness.

Access control systems are experiencing rapid evolution with the adoption of mobile credentials, biometric authentication, and cloud-based management platforms. Contactless technologies have gained particular importance, with organizations seeking solutions that provide secure access while minimizing physical contact requirements. The integration of access control with video surveillance and visitor management systems creates comprehensive identity verification and tracking capabilities.

Intrusion detection systems continue to advance with improved sensor technologies, reduced false alarm rates, and enhanced integration capabilities. Perimeter security solutions are becoming increasingly sophisticated, incorporating multiple detection technologies and intelligent analytics to provide early warning and threat assessment capabilities. The combination of physical sensors with video analytics creates layered security approaches that improve detection accuracy and response effectiveness.

Integrated security platforms represent the fastest-growing category as organizations seek unified solutions that combine multiple technologies through centralized management interfaces. These platforms provide operational efficiency, reduced complexity, and improved situational awareness by correlating information from various security systems and providing comprehensive threat intelligence.

Technology providers benefit from expanding market opportunities driven by increasing security awareness, regulatory requirements, and infrastructure development across Latin America. The growing sophistication of customer requirements creates opportunities for advanced solution offerings and higher-value service engagements. Market diversification across multiple countries and industry sectors provides risk mitigation and growth stability for vendors operating in the region.

System integrators and service providers gain from the increasing complexity of security deployments and the growing demand for professional services, maintenance, and managed security offerings. The shift toward integrated platforms and comprehensive security ecosystems creates opportunities for specialized expertise and long-term customer relationships. Local market knowledge and regulatory compliance expertise provide competitive advantages for regional service providers.

End-user organizations benefit from improved security effectiveness, operational efficiency, and risk management capabilities through advanced physical security solutions. Technology integration enables better resource utilization, reduced operational costs, and enhanced situational awareness for security personnel. The availability of cloud-based and managed service options provides scalable solutions that align with organizational growth and budget requirements.

Government agencies gain enhanced public safety capabilities, improved emergency response coordination, and better resource allocation through comprehensive security infrastructure. Smart city initiatives benefit from integrated security frameworks that support urban planning, traffic management, and citizen services while providing comprehensive protection for public assets and infrastructure.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the Latin America physical security market, with AI-powered analytics enabling automated threat detection, behavior analysis, and predictive security capabilities. Machine learning algorithms are being deployed to reduce false alarms, improve detection accuracy, and provide actionable intelligence for security personnel. The adoption of edge computing allows AI processing to occur directly on security devices, reducing bandwidth requirements and improving response times.

Cloud-based security platforms are gaining rapid adoption as organizations seek scalable, cost-effective solutions with remote management capabilities. Software-as-a-Service (SaaS) models are becoming increasingly popular, particularly among small and medium-sized enterprises that require professional-grade security capabilities without significant capital investments. Cloud platforms enable centralized management of distributed security systems and provide access to advanced analytics and reporting capabilities.

Mobile integration has become a standard requirement for modern security systems, with smartphone applications providing remote monitoring, alert notifications, and system control capabilities. Mobile credentials are replacing traditional access cards, offering improved security and user convenience while reducing administrative overhead. The integration of mobile devices with security systems enables real-time communication and coordination among security personnel.

Cybersecurity convergence is driving the integration of physical and cyber security operations, with organizations recognizing the interconnected nature of modern threat landscapes. Network security for IP-based physical security systems has become a critical consideration, requiring specialized expertise and security protocols to protect against cyber threats targeting surveillance and access control systems.

Strategic partnerships between technology providers and regional system integrators are reshaping the competitive landscape, enabling global vendors to expand their market presence while providing local partners with access to advanced technologies. These collaborations facilitate knowledge transfer, market development, and customer support capabilities across diverse Latin American markets.

Product innovation continues to accelerate with the introduction of advanced analytics capabilities, improved sensor technologies, and enhanced integration features. Thermal imaging systems have gained increased adoption for perimeter security and health screening applications, while advanced video analytics provide automated detection of suspicious activities and security policy violations.

Regulatory developments across various Latin American countries are establishing new standards for security system deployment, data protection, and privacy compliance. These regulations are driving systematic upgrades of existing security infrastructure and creating opportunities for compliant solution providers. Government procurement processes are increasingly emphasizing technology innovation, local content requirements, and long-term support capabilities.

Investment activities in the security technology sector include venture capital funding for innovative startups, acquisition of specialized technology companies, and expansion of manufacturing and support capabilities within the region. MarkWide Research analysis indicates that these investments are contributing to market maturation and technology advancement across the Latin American physical security ecosystem.

Technology providers should focus on developing solutions that address specific regional requirements while maintaining compatibility with global standards and platforms. Localization strategies should include language support, local regulatory compliance, and partnerships with regional system integrators and service providers. The emphasis should be on providing comprehensive solutions that combine multiple technologies through unified management platforms.

Market entry strategies for international vendors should prioritize establishing local presence through partnerships, joint ventures, or direct investment in key markets such as Brazil and Mexico. Customer education and demonstration programs are essential for promoting advanced security technologies and building market awareness of emerging capabilities such as AI-powered analytics and cloud-based management platforms.

Service-oriented business models present significant opportunities for sustainable revenue growth and customer retention. Organizations should consider developing managed security services, subscription-based offerings, and comprehensive maintenance programs that provide predictable revenue streams while delivering ongoing value to customers. Training and certification programs for local technicians and security professionals are essential for supporting market growth and ensuring proper system deployment and maintenance.

Innovation focus areas should include mobile integration, cloud connectivity, artificial intelligence, and cybersecurity features that address evolving customer requirements and threat landscapes. Vertical market specialization can provide competitive advantages by addressing specific industry requirements and regulatory compliance needs across sectors such as healthcare, education, and critical infrastructure.

Market growth prospects for the Latin America physical security market remain positive, with continued expansion expected across all major technology categories and geographic regions. Digital transformation initiatives will continue to drive demand for integrated security platforms that combine physical protection with operational intelligence and business insights. The projected CAGR of 8.5% over the next five years reflects sustained investment in security infrastructure and technology advancement.

Technology evolution will focus on artificial intelligence, machine learning, and edge computing capabilities that enable autonomous security operations and predictive threat detection. 5G connectivity will enable new applications for mobile security, real-time video streaming, and IoT device integration that enhance security system capabilities and operational efficiency. The convergence of physical and cyber security will create comprehensive protection frameworks that address modern threat landscapes.

Market consolidation is expected to continue as larger organizations acquire specialized technology providers and regional security companies to expand their capabilities and market reach. This consolidation will create opportunities for comprehensive solution offerings while potentially reducing the number of independent vendors in certain market segments. MWR projects that successful vendors will be those that can provide integrated platforms, professional services, and ongoing support capabilities.

Regulatory developments will continue to shape market dynamics, with increasing emphasis on data protection, privacy compliance, and cybersecurity requirements for physical security systems. Smart city initiatives will create significant opportunities for large-scale security deployments that integrate with urban infrastructure and provide comprehensive protection for public assets and citizen services.

The Latin America physical security market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing security awareness, technological advancement, and infrastructure development across the region. Market fundamentals remain strong, supported by government initiatives, regulatory requirements, and growing private sector investment in comprehensive security solutions.

Technology innovation continues to reshape the competitive landscape, with artificial intelligence, cloud computing, and mobile integration creating new opportunities for enhanced security effectiveness and operational efficiency. The convergence of physical and cyber security is establishing new paradigms for comprehensive threat protection and risk management across various industry sectors.

Strategic success in this market will require a combination of technological innovation, local market expertise, and comprehensive service capabilities. Organizations that can provide integrated solutions, professional services, and ongoing support while adapting to regional requirements and regulatory frameworks will be best positioned for sustained growth and market leadership in the evolving Latin America physical security landscape.

What is Physical Security?

Physical security refers to the measures taken to protect physical assets, facilities, and personnel from threats such as theft, vandalism, and natural disasters. It encompasses various strategies, including access control, surveillance, and environmental design.

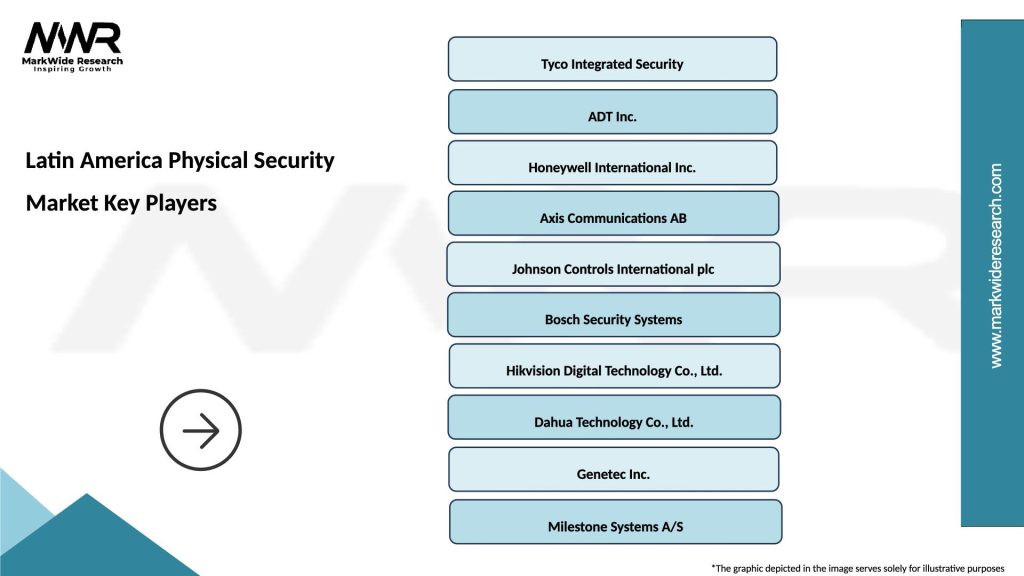

What are the key players in the Latin America Physical Security Market?

Key players in the Latin America Physical Security Market include companies like Tyco International, Honeywell, and Axis Communications, which provide a range of security solutions such as surveillance systems and access control technologies, among others.

What are the main drivers of growth in the Latin America Physical Security Market?

The growth of the Latin America Physical Security Market is driven by increasing concerns over crime rates, the need for enhanced safety in public spaces, and the rising adoption of smart technologies in security systems. Additionally, government initiatives to improve security infrastructure contribute to market expansion.

What challenges does the Latin America Physical Security Market face?

The Latin America Physical Security Market faces challenges such as budget constraints in public and private sectors, varying regulatory standards across countries, and the need for skilled personnel to manage advanced security systems. These factors can hinder the implementation of comprehensive security solutions.

What opportunities exist in the Latin America Physical Security Market?

Opportunities in the Latin America Physical Security Market include the growing demand for integrated security solutions, advancements in artificial intelligence and IoT technologies, and the increasing focus on cybersecurity measures. These trends present avenues for innovation and investment in the sector.

What trends are shaping the Latin America Physical Security Market?

Trends shaping the Latin America Physical Security Market include the rise of cloud-based security solutions, the integration of AI for threat detection, and the increasing use of mobile applications for security management. These innovations are transforming how security is approached in various sectors.

Latin America Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | CCTV Cameras, Access Control Systems, Intrusion Detection Systems, Alarms |

| Technology | Biometrics, RFID, Video Analytics, Cloud-Based Solutions |

| End User | Government, Commercial, Residential, Transportation |

| Installation | On-Premises, Remote, Integrated, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at