444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America pharmaceutical plastic packaging market represents a dynamic and rapidly evolving sector within the broader healthcare packaging industry. This market encompasses a comprehensive range of plastic packaging solutions specifically designed for pharmaceutical products, including bottles, containers, blister packs, pouches, and specialized drug delivery systems. Market growth is being driven by increasing healthcare expenditure, rising pharmaceutical production, and growing demand for advanced packaging technologies that ensure product safety and efficacy.

Regional dynamics in Latin America present unique opportunities and challenges for pharmaceutical plastic packaging manufacturers. Countries such as Brazil, Mexico, Argentina, and Colombia are experiencing significant expansion in their pharmaceutical sectors, creating substantial demand for innovative packaging solutions. The market is characterized by a robust growth trajectory with an estimated compound annual growth rate of 6.8% CAGR over the forecast period, reflecting the region’s increasing focus on healthcare infrastructure development and pharmaceutical manufacturing capabilities.

Technological advancements in plastic packaging materials and manufacturing processes are revolutionizing the industry landscape. Smart packaging solutions, child-resistant closures, tamper-evident features, and barrier protection technologies are becoming increasingly important for pharmaceutical companies seeking to enhance product integrity and patient safety. The integration of sustainable packaging materials and eco-friendly manufacturing processes is also gaining momentum, driven by environmental regulations and corporate sustainability initiatives across the region.

The Latin America pharmaceutical plastic packaging market refers to the comprehensive ecosystem of plastic-based packaging solutions specifically designed, manufactured, and distributed for pharmaceutical products across Latin American countries. This market encompasses all forms of plastic packaging materials, containers, and systems used to protect, preserve, and deliver pharmaceutical products from manufacturing facilities to end consumers while maintaining product efficacy, safety, and regulatory compliance.

Pharmaceutical plastic packaging serves multiple critical functions including product protection from environmental factors, contamination prevention, dose accuracy maintenance, and regulatory compliance assurance. These packaging solutions must meet stringent quality standards established by regulatory authorities such as ANVISA in Brazil, COFEPRIS in Mexico, and other national pharmaceutical regulatory bodies throughout the region. The packaging must also accommodate various pharmaceutical forms including tablets, capsules, liquids, injectables, and specialized drug delivery systems.

Market scope includes primary packaging that comes into direct contact with pharmaceutical products, secondary packaging for product grouping and protection, and tertiary packaging for distribution and logistics purposes. The integration of advanced materials science, manufacturing technologies, and regulatory compliance requirements creates a sophisticated market environment that demands continuous innovation and adaptation to evolving healthcare needs and regulatory standards.

Market expansion in the Latin America pharmaceutical plastic packaging sector is being fueled by multiple converging factors including increasing pharmaceutical production, growing healthcare awareness, and rising investment in healthcare infrastructure. The region’s pharmaceutical industry is experiencing unprecedented growth, with local manufacturing capabilities expanding rapidly to meet domestic demand and export opportunities. This growth directly translates into increased demand for sophisticated packaging solutions that can ensure product quality and regulatory compliance.

Key market drivers include the region’s aging population, increasing prevalence of chronic diseases, and expanding access to healthcare services. Government initiatives to strengthen local pharmaceutical manufacturing capabilities are creating substantial opportunities for packaging suppliers. Additionally, the growing emphasis on generic drug production in countries like Brazil and Mexico is driving demand for cost-effective yet high-quality packaging solutions that can compete in both domestic and international markets.

Technological innovation is reshaping the competitive landscape, with manufacturers investing heavily in advanced packaging technologies including smart packaging, serialization capabilities, and sustainable materials. The market is witnessing a shift toward more sophisticated packaging solutions that offer enhanced functionality, improved patient compliance, and better supply chain visibility. Sustainability concerns are also driving innovation in recyclable and biodegradable packaging materials, with approximately 42% of pharmaceutical companies in the region prioritizing sustainable packaging initiatives.

Competitive dynamics feature a mix of international packaging giants and regional specialists, each bringing unique strengths to the market. The industry is characterized by ongoing consolidation, strategic partnerships, and technology licensing agreements that enable companies to expand their capabilities and market reach across the diverse Latin American landscape.

Market segmentation reveals distinct patterns in packaging preferences and growth opportunities across different pharmaceutical categories and geographic regions. The following insights provide a comprehensive understanding of market dynamics:

Healthcare infrastructure development across Latin America is creating unprecedented demand for pharmaceutical plastic packaging solutions. Government investments in healthcare systems, hospital construction, and medical facility upgrades are driving pharmaceutical consumption and, consequently, packaging demand. Countries like Colombia and Peru are implementing comprehensive healthcare reforms that expand access to medications, directly benefiting the packaging industry.

Pharmaceutical manufacturing expansion represents a primary growth driver, with multinational pharmaceutical companies establishing production facilities throughout the region to serve both local and export markets. Brazil’s pharmaceutical sector, in particular, is experiencing significant growth with local manufacturing accounting for approximately 73% of domestic consumption. This trend toward local production creates substantial opportunities for packaging suppliers who can provide cost-effective, high-quality solutions that meet international standards.

Demographic transitions including population aging and increasing prevalence of chronic diseases are fundamentally reshaping pharmaceutical demand patterns. The region’s elderly population is projected to grow significantly over the next decade, creating sustained demand for medications and specialized packaging solutions that enhance patient compliance and safety. Additionally, rising incidence of diabetes, cardiovascular diseases, and other chronic conditions requires sophisticated packaging that can maintain drug stability and facilitate proper dosing.

Regulatory modernization efforts across Latin American countries are driving demand for advanced packaging technologies. New regulations requiring serialization, tamper-evidence, and enhanced product traceability are compelling pharmaceutical companies to upgrade their packaging systems. These regulatory changes, while initially challenging, create opportunities for packaging suppliers who can provide compliant solutions that meet evolving requirements.

Economic volatility across Latin American countries poses significant challenges for the pharmaceutical plastic packaging market. Currency fluctuations, inflation pressures, and political instability can impact investment decisions and market growth trajectories. Countries like Argentina and Venezuela have experienced particular economic challenges that affect pharmaceutical imports and local manufacturing capabilities, creating uncertainty for packaging suppliers operating in these markets.

Regulatory complexity and inconsistency across different Latin American countries create operational challenges for packaging manufacturers seeking regional expansion. Each country maintains its own regulatory framework, approval processes, and compliance requirements, making it difficult and expensive for companies to develop standardized packaging solutions that can be used across multiple markets. This fragmentation increases costs and slows market penetration for innovative packaging technologies.

Raw material price volatility significantly impacts the pharmaceutical plastic packaging industry, particularly given the region’s dependence on imported petrochemical feedstocks. Fluctuations in oil prices, supply chain disruptions, and trade policy changes can dramatically affect packaging costs, making it challenging for manufacturers to maintain stable pricing and profit margins. This volatility is particularly problematic for long-term supply contracts common in the pharmaceutical industry.

Infrastructure limitations in certain regions constrain market growth and operational efficiency. Inadequate transportation networks, unreliable power supply, and limited cold chain capabilities can impact packaging distribution and pharmaceutical product integrity. These infrastructure challenges are particularly pronounced in rural areas and smaller countries, limiting market penetration and growth opportunities for sophisticated packaging solutions.

Generic drug expansion presents substantial opportunities for pharmaceutical plastic packaging suppliers throughout Latin America. The region’s growing focus on affordable healthcare solutions is driving increased production of generic medications, which require cost-effective packaging solutions that maintain quality standards while optimizing manufacturing costs. Countries like Brazil and Mexico are becoming major generic drug producers, creating sustained demand for efficient packaging systems.

E-commerce growth in pharmaceutical distribution is creating new packaging requirements and opportunities. The COVID-19 pandemic accelerated adoption of online pharmaceutical sales, requiring packaging solutions that can withstand shipping stresses while maintaining product integrity and regulatory compliance. This trend toward direct-to-consumer pharmaceutical distribution demands innovative packaging designs that combine protection, convenience, and cost-effectiveness.

Biotechnology sector development across the region is generating demand for specialized packaging solutions capable of handling sensitive biological products. Countries like Brazil and Argentina are investing heavily in biotechnology research and manufacturing, creating opportunities for packaging suppliers who can provide temperature-controlled, sterile, and specialized containment systems for biological pharmaceuticals.

Sustainability initiatives are driving innovation in eco-friendly packaging materials and manufacturing processes. MarkWide Research indicates that approximately 35% of pharmaceutical companies in Latin America are actively seeking sustainable packaging alternatives. This trend creates opportunities for suppliers who can develop recyclable, biodegradable, or bio-based packaging materials that meet pharmaceutical quality standards while addressing environmental concerns.

Supply chain evolution is fundamentally reshaping the Latin America pharmaceutical plastic packaging market, with companies increasingly focusing on regional sourcing strategies to reduce costs and improve supply chain resilience. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting pharmaceutical companies to diversify their packaging supplier base and establish more robust regional partnerships. This shift creates opportunities for local and regional packaging manufacturers who can provide reliable, cost-effective solutions.

Technology integration is accelerating across the industry, with smart packaging solutions gaining traction among pharmaceutical companies seeking to enhance product differentiation and patient engagement. Digital printing technologies, NFC-enabled packaging, and IoT integration are becoming more prevalent, enabling pharmaceutical companies to provide enhanced product information, authentication capabilities, and patient compliance monitoring. These technological advances are driving demand for more sophisticated packaging solutions that can accommodate electronic components and digital interfaces.

Consolidation trends within the pharmaceutical industry are influencing packaging market dynamics, as larger pharmaceutical companies seek to standardize packaging across their product portfolios and geographic markets. This consolidation creates opportunities for packaging suppliers who can provide comprehensive solutions that meet diverse product requirements while achieving economies of scale. However, it also increases competitive pressure and demands for cost optimization.

Regulatory harmonization efforts across Latin American countries are gradually creating more unified market conditions, though progress remains uneven. Initiatives such as the Pacific Alliance and Mercosur are working to align pharmaceutical regulations, including packaging requirements, which could simplify market entry and expansion for packaging suppliers. These harmonization efforts are expected to accelerate market growth by reducing regulatory complexity and enabling more efficient regional distribution strategies.

Comprehensive market analysis for the Latin America pharmaceutical plastic packaging market was conducted using a multi-faceted research approach combining primary and secondary data sources. The methodology incorporated extensive industry interviews, regulatory analysis, and market observation to ensure accurate representation of current market conditions and future growth prospects. Research activities spanned multiple countries across Latin America, including major markets such as Brazil, Mexico, Argentina, Colombia, and Chile.

Primary research activities included structured interviews with key industry stakeholders including pharmaceutical packaging manufacturers, pharmaceutical companies, regulatory officials, and industry association representatives. These interviews provided insights into market trends, competitive dynamics, regulatory challenges, and future growth opportunities. Survey data was collected from over 150 industry participants to quantify market preferences, investment priorities, and technology adoption patterns.

Secondary research encompassed comprehensive analysis of industry reports, regulatory documents, trade publications, and company financial statements. Patent analysis was conducted to identify emerging technologies and innovation trends within the pharmaceutical packaging sector. Market data was cross-validated using multiple sources to ensure accuracy and reliability of findings and projections.

Data validation processes included triangulation of findings across multiple sources, expert review panels, and statistical analysis to identify and resolve inconsistencies. Market sizing and forecasting models were developed using historical data, current market indicators, and forward-looking industry analysis. The research methodology ensures comprehensive coverage of market dynamics while maintaining analytical rigor and objectivity.

Brazil dominates the Latin America pharmaceutical plastic packaging market, accounting for approximately 45% of regional market share due to its large pharmaceutical industry, substantial domestic market, and growing export capabilities. The country’s pharmaceutical sector benefits from strong government support, established manufacturing infrastructure, and a large patient population requiring diverse medication types. Brazilian packaging manufacturers are increasingly focusing on advanced technologies including serialization, tamper-evidence, and sustainable materials to meet evolving market demands.

Mexico represents the second-largest market with approximately 22% market share, driven by its strategic location for North American pharmaceutical trade, growing domestic pharmaceutical production, and increasing healthcare access. The country’s proximity to the United States creates opportunities for packaging suppliers serving both domestic and export markets. Mexican pharmaceutical companies are increasingly investing in advanced packaging technologies to meet international quality standards and regulatory requirements.

Argentina maintains a significant market position despite economic challenges, with its pharmaceutical industry focusing on generic drug production and regional export opportunities. The country’s established pharmaceutical manufacturing base creates sustained demand for packaging solutions, though economic volatility impacts investment in advanced packaging technologies. Argentine companies are increasingly seeking cost-effective packaging solutions that maintain quality while optimizing manufacturing costs.

Colombia and Chile represent emerging markets with growing pharmaceutical sectors and increasing investment in healthcare infrastructure. Colombia’s pharmaceutical industry is expanding rapidly, driven by healthcare reforms and increasing access to medications. Chile’s stable economic environment and strong regulatory framework make it an attractive market for international packaging suppliers seeking regional expansion opportunities. Both countries are experiencing increased demand for specialized packaging solutions including child-resistant closures and serialization capabilities.

Market leadership in the Latin America pharmaceutical plastic packaging sector is characterized by a diverse mix of international corporations and regional specialists, each bringing unique capabilities and market positioning strategies. The competitive environment features ongoing innovation, strategic partnerships, and geographic expansion initiatives as companies seek to capture growing market opportunities.

Competitive strategies focus on technology innovation, regulatory compliance capabilities, and cost optimization to meet diverse customer requirements across the region. Companies are investing heavily in advanced manufacturing technologies, quality systems, and local market presence to compete effectively in this dynamic market environment.

By Product Type: The pharmaceutical plastic packaging market segments into several distinct categories based on packaging format and application requirements. Primary packaging includes bottles, containers, vials, and blister packs that come into direct contact with pharmaceutical products. Secondary packaging encompasses cartons, labels, and protective wrapping materials. Tertiary packaging includes shipping containers and logistics solutions for pharmaceutical distribution.

By Material Type: Packaging materials segment into various plastic types including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), and specialized barrier materials. Each material type offers specific properties including chemical resistance, barrier protection, clarity, and cost-effectiveness. Advanced materials including bio-based plastics and recyclable formulations are gaining market traction driven by sustainability requirements.

By Application: Market applications segment by pharmaceutical product type including solid dosage forms (tablets, capsules), liquid medications, injectable drugs, topical preparations, and specialized drug delivery systems. Each application requires specific packaging characteristics including moisture protection, light barrier, chemical compatibility, and dosing accuracy. Biologics and biosimilar products represent a growing application segment requiring specialized packaging solutions.

By End User: The market serves diverse end-user segments including pharmaceutical manufacturers, contract packaging organizations, generic drug producers, biotechnology companies, and specialty pharmaceutical companies. Each segment has distinct requirements for packaging volume, customization capabilities, regulatory compliance, and cost optimization. Contract manufacturing organizations represent a growing segment driven by pharmaceutical industry outsourcing trends.

Solid Dosage Packaging represents the largest market category, driven by high volume production of tablets and capsules across the region. Blister packaging technology dominates this segment, offering excellent product protection, dose accuracy, and patient compliance benefits. Innovation in blister materials and forming technologies is enabling improved barrier properties and cost optimization. Child-resistant blister packs are becoming increasingly important as regulatory requirements expand across Latin American countries.

Liquid Packaging Solutions encompass bottles, vials, and specialized containers for liquid pharmaceutical products including syrups, suspensions, and injectable medications. This category requires sophisticated barrier properties to prevent contamination and maintain product stability. Advanced closure systems including tamper-evident caps and precision dosing mechanisms are driving innovation in this segment. The growing biologics market is creating demand for specialized vials and pre-filled syringe systems.

Flexible Packaging is experiencing rapid growth driven by applications in powder medications, single-dose formulations, and specialty pharmaceutical products. Pouches and sachets offer advantages including material efficiency, customization capabilities, and enhanced patient convenience. Advanced barrier films and sealing technologies are enabling expanded applications for moisture-sensitive and oxygen-sensitive pharmaceutical products.

Specialty Packaging includes child-resistant containers, senior-friendly packaging, and smart packaging solutions incorporating digital technologies. This category is driven by regulatory requirements, patient safety concerns, and pharmaceutical company differentiation strategies. MWR analysis indicates that specialty packaging solutions command premium pricing while offering enhanced functionality and market positioning benefits for pharmaceutical companies.

Pharmaceutical Manufacturers benefit from advanced packaging solutions that enhance product protection, regulatory compliance, and market differentiation. Modern packaging technologies enable improved supply chain efficiency, reduced product losses, and enhanced brand positioning. Serialization and track-and-trace capabilities provide valuable supply chain visibility while combating counterfeiting threats. Sustainable packaging options help pharmaceutical companies meet environmental goals while maintaining product quality standards.

Packaging Suppliers gain access to a growing market with diverse opportunities for innovation and expansion. The pharmaceutical packaging market offers stable demand patterns, premium pricing opportunities, and long-term customer relationships. Investment in advanced technologies and regulatory compliance capabilities creates competitive advantages and market differentiation. Regional manufacturing capabilities provide cost advantages and improved customer service capabilities.

Healthcare Providers benefit from packaging innovations that improve medication management, reduce dispensing errors, and enhance patient safety. Advanced packaging features including clear labeling, dose indicators, and tamper-evidence help healthcare professionals ensure proper medication administration. Unit-dose packaging and compliance packaging solutions reduce medication errors and improve patient outcomes.

Patients and Consumers experience improved medication safety, convenience, and compliance through advanced packaging solutions. Child-resistant packaging protects families while senior-friendly designs accommodate aging populations. Clear labeling, dose indicators, and compliance packaging help patients take medications correctly and consistently. Sustainable packaging options align with consumer environmental preferences while maintaining product quality and safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Packaging Revolution is transforming the pharmaceutical plastic packaging landscape across Latin America, with companies increasingly adopting recyclable materials, bio-based plastics, and circular economy principles. This trend is driven by environmental regulations, corporate sustainability commitments, and consumer preferences for eco-friendly products. Packaging manufacturers are investing in research and development to create sustainable alternatives that maintain pharmaceutical quality standards while reducing environmental impact.

Smart Packaging Integration represents a significant technological trend, with pharmaceutical companies incorporating digital technologies into packaging systems to enhance patient engagement, product authentication, and supply chain visibility. NFC-enabled packaging, QR codes, and IoT sensors are becoming more prevalent, enabling real-time monitoring of product conditions and patient compliance. These technologies create new revenue opportunities while addressing counterfeiting concerns and improving patient outcomes.

Serialization Implementation is accelerating across the region as countries adopt track-and-trace requirements to combat pharmaceutical counterfeiting and improve supply chain security. Brazil, Mexico, and Argentina are implementing comprehensive serialization programs that require unique identification codes on pharmaceutical packages. This trend is driving investment in advanced printing technologies, data management systems, and supply chain integration capabilities.

Child-Resistant Packaging Expansion is gaining momentum as regulatory authorities across Latin America implement stricter safety requirements for pharmaceutical products. The trend toward child-resistant closures and packaging systems is driven by public health concerns and international regulatory harmonization efforts. Packaging suppliers are developing innovative child-resistant solutions that balance safety requirements with senior-friendly accessibility and cost-effectiveness.

Manufacturing Capacity Expansion initiatives are reshaping the competitive landscape, with major packaging companies investing in new production facilities across Latin America to serve growing market demand. Recent investments include state-of-the-art manufacturing plants in Brazil and Mexico that incorporate advanced automation, quality control systems, and sustainable manufacturing practices. These capacity expansions enable companies to reduce costs, improve delivery times, and better serve regional customers.

Strategic Partnership Formation between pharmaceutical companies and packaging suppliers is becoming increasingly common as companies seek to develop customized solutions and optimize supply chain efficiency. These partnerships often involve long-term supply agreements, joint product development initiatives, and shared investment in advanced technologies. Such collaborations enable pharmaceutical companies to access specialized packaging expertise while providing packaging suppliers with stable revenue streams and market insights.

Regulatory Milestone Achievements include successful implementation of serialization programs in major markets and approval of innovative packaging technologies by regulatory authorities. Brazil’s ANVISA has approved several advanced packaging systems that incorporate tamper-evidence and authentication features. Mexico’s COFEPRIS has streamlined approval processes for sustainable packaging materials, facilitating faster market introduction of eco-friendly alternatives.

Technology Innovation Breakthroughs encompass development of advanced barrier materials, smart packaging systems, and sustainable manufacturing processes. Recent innovations include bio-based plastic formulations that meet pharmaceutical quality standards, intelligent packaging systems that monitor product conditions, and advanced printing technologies that enable high-resolution graphics and security features. These technological advances are driving market differentiation and creating new growth opportunities.

Investment Prioritization should focus on advanced manufacturing technologies, regulatory compliance capabilities, and sustainable packaging solutions to capture emerging market opportunities. Companies should prioritize investments in serialization capabilities, quality management systems, and flexible manufacturing platforms that can accommodate diverse customer requirements. MarkWide Research recommends that packaging suppliers invest approximately 15-20% of revenue in research and development to maintain competitive positioning and drive innovation.

Market Entry Strategies for international companies should emphasize local partnerships, regulatory expertise, and customer relationship development to navigate complex market conditions successfully. Establishing local manufacturing presence or strategic partnerships with regional players can provide market access while reducing operational risks. Companies should also invest in understanding local regulatory requirements and building relationships with key pharmaceutical manufacturers and regulatory authorities.

Product Development Focus should prioritize sustainable materials, smart packaging technologies, and cost-effective solutions that address specific regional market needs. Developing packaging solutions that can accommodate both domestic and export requirements provides competitive advantages in the growing generic drug market. Companies should also focus on creating modular packaging platforms that can be customized for different pharmaceutical applications while achieving economies of scale.

Risk Management Approaches should address economic volatility, regulatory changes, and supply chain disruptions through diversification strategies and operational flexibility. Maintaining diverse supplier networks, flexible manufacturing capabilities, and strong financial reserves can help companies navigate market uncertainties. Developing contingency plans for various economic and regulatory scenarios ensures business continuity and competitive positioning.

Market expansion prospects for the Latin America pharmaceutical plastic packaging market remain highly positive, driven by continued growth in pharmaceutical production, increasing healthcare access, and ongoing technology innovation. The market is expected to maintain robust growth momentum with projected compound annual growth rates of 6.8% CAGR over the next five years. This growth trajectory reflects the region’s expanding pharmaceutical industry, increasing investment in healthcare infrastructure, and growing demand for advanced packaging solutions.

Technology evolution will continue to reshape the market landscape, with smart packaging, sustainable materials, and advanced manufacturing processes becoming increasingly important competitive differentiators. The integration of digital technologies into packaging systems will create new value propositions for pharmaceutical companies seeking to enhance patient engagement and supply chain visibility. Artificial intelligence and machine learning applications in packaging design and manufacturing optimization will drive efficiency improvements and cost reductions.

Regulatory harmonization efforts across Latin American countries are expected to accelerate, creating more unified market conditions and facilitating regional expansion strategies for packaging suppliers. The implementation of comprehensive serialization programs and standardized quality requirements will drive investment in advanced packaging technologies while creating barriers to entry for smaller suppliers lacking necessary capabilities.

Sustainability imperatives will become increasingly important, with pharmaceutical companies and packaging suppliers investing heavily in circular economy principles, recyclable materials, and carbon footprint reduction initiatives. The development of bio-based packaging materials and closed-loop recycling systems will create new market opportunities while addressing environmental concerns. Companies that successfully integrate sustainability into their value propositions will gain competitive advantages in an increasingly environmentally conscious market.

The Latin America pharmaceutical plastic packaging market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by expanding pharmaceutical production, increasing healthcare access, and ongoing technology innovation. Market fundamentals remain strong, supported by demographic trends, regulatory modernization, and growing investment in healthcare infrastructure across the region. The market’s projected growth trajectory reflects the convergence of multiple positive factors including generic drug expansion, biotechnology development, and sustainability initiatives.

Strategic positioning in this market requires comprehensive understanding of regional dynamics, regulatory requirements, and customer needs across diverse Latin American countries. Successful companies will be those that can effectively balance innovation, cost optimization, and regulatory compliance while building strong customer relationships and local market presence. The integration of advanced technologies, sustainable practices, and flexible manufacturing capabilities will be essential for long-term competitive success.

Future success in the Latin America pharmaceutical plastic packaging market will depend on companies’ ability to adapt to evolving market conditions, embrace technological innovation, and address sustainability imperatives while maintaining operational excellence and customer focus. The market offers substantial opportunities for companies that can effectively navigate its complexities and capitalize on its growth potential through strategic investment, partnership development, and continuous innovation in packaging solutions that serve the evolving needs of the pharmaceutical industry and patients across Latin America.

What is Pharmaceutical Plastic Packaging?

Pharmaceutical Plastic Packaging refers to the use of plastic materials to package pharmaceutical products, ensuring their safety, integrity, and efficacy. This type of packaging is crucial for protecting medications from environmental factors and contamination.

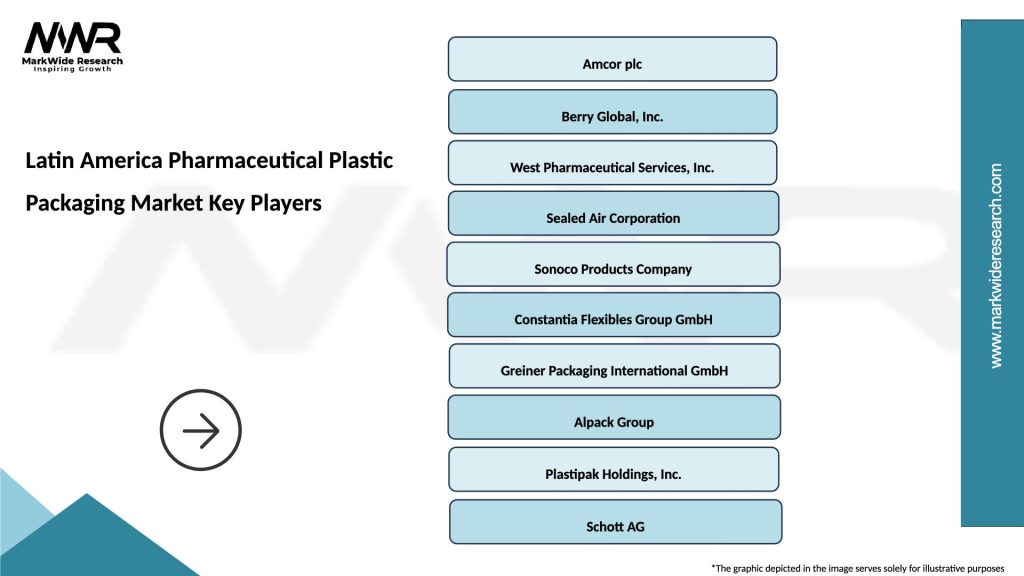

What are the key players in the Latin America Pharmaceutical Plastic Packaging Market?

Key players in the Latin America Pharmaceutical Plastic Packaging Market include Amcor, West Pharmaceutical Services, and Berry Global, among others. These companies are known for their innovative packaging solutions and commitment to quality in the pharmaceutical sector.

What are the main drivers of growth in the Latin America Pharmaceutical Plastic Packaging Market?

The growth of the Latin America Pharmaceutical Plastic Packaging Market is driven by the increasing demand for pharmaceuticals, advancements in packaging technology, and the rising focus on patient safety. Additionally, the expansion of the healthcare sector in the region contributes to this growth.

What challenges does the Latin America Pharmaceutical Plastic Packaging Market face?

The Latin America Pharmaceutical Plastic Packaging Market faces challenges such as regulatory compliance, environmental concerns regarding plastic waste, and competition from alternative packaging materials. These factors can impact the market’s growth and innovation.

What opportunities exist in the Latin America Pharmaceutical Plastic Packaging Market?

Opportunities in the Latin America Pharmaceutical Plastic Packaging Market include the development of sustainable packaging solutions, the integration of smart packaging technologies, and the increasing demand for personalized medicine. These trends can lead to innovative products and market expansion.

What trends are shaping the Latin America Pharmaceutical Plastic Packaging Market?

Trends shaping the Latin America Pharmaceutical Plastic Packaging Market include the shift towards eco-friendly materials, the rise of child-resistant packaging, and the adoption of advanced manufacturing techniques. These trends reflect the industry’s response to consumer preferences and regulatory requirements.

Latin America Pharmaceutical Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Blisters, Pouches, Jars |

| Material | Polyethylene, Polypropylene, PVC, PET |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Institutions, Distributors |

| Packaging Type | Primary Packaging, Secondary Packaging, Tertiary Packaging, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Pharmaceutical Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at