444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America pharmaceutical glass packaging market represents a dynamic and rapidly evolving sector within the broader pharmaceutical packaging industry. This market encompasses the production, distribution, and utilization of specialized glass containers designed specifically for pharmaceutical applications across countries including Brazil, Mexico, Argentina, Colombia, and Chile. Glass packaging solutions in this region serve critical roles in maintaining drug stability, ensuring product integrity, and meeting stringent regulatory requirements for pharmaceutical products.

Market dynamics in Latin America are characterized by increasing healthcare investments, growing pharmaceutical manufacturing capabilities, and rising demand for high-quality packaging solutions. The region’s pharmaceutical glass packaging sector is experiencing robust growth driven by expanding generic drug production, increasing biologics manufacturing, and enhanced focus on patient safety standards. Growth rates in the sector are projected to maintain a 6.2% CAGR through the forecast period, reflecting strong underlying demand fundamentals.

Regional characteristics include diverse regulatory environments, varying levels of pharmaceutical infrastructure development, and distinct market preferences across different countries. Brazil and Mexico dominate the market landscape, accounting for approximately 65% of regional demand, while emerging markets like Colombia and Peru show significant growth potential. The market encompasses various glass packaging formats including vials, ampoules, bottles, syringes, and cartridges, each serving specific pharmaceutical applications and therapeutic categories.

The Latin America pharmaceutical glass packaging market refers to the comprehensive ecosystem of glass-based packaging solutions specifically designed and manufactured for pharmaceutical products within the Latin American region. This market encompasses the entire value chain from raw material sourcing and glass manufacturing to final packaging applications for various pharmaceutical formulations including injectable drugs, oral medications, vaccines, and biologics.

Pharmaceutical glass packaging serves as a critical barrier system that protects drug products from environmental factors, contamination, and degradation while maintaining product efficacy throughout the supply chain. The market includes various glass types such as borosilicate glass, soda-lime glass, and specialized pharmaceutical glass formulations that meet international standards for pharmaceutical packaging applications.

Market scope extends beyond simple container manufacturing to include value-added services such as custom glass forming, surface treatments, coating applications, and integrated packaging solutions. The sector plays a vital role in supporting the region’s pharmaceutical industry growth while ensuring compliance with regulatory requirements from agencies including ANVISA, COFEPRIS, and other national health authorities across Latin America.

Market performance in the Latin America pharmaceutical glass packaging sector demonstrates strong momentum driven by expanding pharmaceutical production, increasing healthcare access, and growing demand for high-quality packaging solutions. The market benefits from favorable demographic trends, rising healthcare expenditure, and significant investments in pharmaceutical manufacturing infrastructure across the region.

Key growth drivers include the expansion of generic drug manufacturing, increasing biologics production, and growing emphasis on pharmaceutical quality standards. The market is experiencing approximately 8.5% annual growth in the biologics packaging segment, reflecting the region’s increasing focus on advanced therapeutic products. Regulatory harmonization efforts across Latin American countries are creating opportunities for standardized packaging solutions and improved market efficiency.

Competitive landscape features a mix of international glass packaging manufacturers and regional players, with increasing consolidation and strategic partnerships. Market leaders are investing in advanced manufacturing technologies, sustainable packaging solutions, and expanded production capabilities to serve growing demand. Innovation trends focus on smart packaging technologies, enhanced barrier properties, and environmentally sustainable glass formulations that align with global pharmaceutical industry requirements.

Strategic insights reveal several critical factors shaping the Latin America pharmaceutical glass packaging market landscape:

Primary growth drivers propelling the Latin America pharmaceutical glass packaging market include expanding healthcare infrastructure, increasing pharmaceutical production capabilities, and rising demand for high-quality packaging solutions. The region’s growing middle class and improved healthcare access are creating sustained demand for pharmaceutical products, directly benefiting the packaging sector.

Pharmaceutical industry expansion represents a fundamental driver, with countries like Brazil, Mexico, and Colombia investing heavily in domestic drug manufacturing capabilities. This expansion includes both generic drug production and increasing focus on specialized therapeutic areas including biologics, vaccines, and complex pharmaceutical formulations. Local production growth is estimated at approximately 12% annually for biologics packaging applications, reflecting the sector’s dynamic expansion.

Regulatory compliance requirements are driving demand for premium glass packaging solutions that meet international quality standards. Pharmaceutical manufacturers are increasingly selecting glass packaging that complies with USP, EP, and JP standards to ensure product quality and facilitate potential export opportunities. Quality enhancement initiatives are creating opportunities for advanced glass packaging technologies including enhanced barrier properties, improved chemical resistance, and specialized surface treatments.

Innovation in pharmaceutical formulations is creating new packaging requirements, particularly for sensitive biological products, personalized medicines, and combination drug-device products. These advanced formulations require specialized glass packaging with precise dimensional tolerances, enhanced chemical compatibility, and superior protection properties.

Significant challenges facing the Latin America pharmaceutical glass packaging market include high capital investment requirements, complex regulatory environments, and intense price competition from alternative packaging materials. The specialized nature of pharmaceutical glass manufacturing requires substantial investments in equipment, technology, and quality control systems that can be prohibitive for smaller market participants.

Regulatory complexity across different Latin American countries creates challenges for manufacturers seeking to serve multiple markets efficiently. Varying standards, approval processes, and documentation requirements can increase compliance costs and extend time-to-market for new packaging solutions. Regulatory harmonization remains incomplete, with approximately 35% of packaging standards still varying significantly between major markets in the region.

Raw material costs and supply chain vulnerabilities represent ongoing challenges, particularly for specialized glass formulations and high-quality raw materials that may require importation. Currency fluctuations, trade restrictions, and logistics challenges can impact cost structures and pricing competitiveness for regional manufacturers.

Competition from alternative materials including plastic packaging solutions poses ongoing challenges, particularly in cost-sensitive market segments. While glass offers superior barrier properties and chemical compatibility, plastic alternatives may provide cost advantages for certain pharmaceutical applications, creating pressure on glass packaging market share.

Substantial opportunities exist within the Latin America pharmaceutical glass packaging market, driven by expanding pharmaceutical production, increasing healthcare investments, and growing demand for specialized packaging solutions. The region’s pharmaceutical industry is experiencing significant growth, creating corresponding demand for high-quality glass packaging across various therapeutic categories.

Biologics manufacturing expansion presents particularly attractive opportunities, as these products require specialized glass packaging with enhanced chemical resistance and stability properties. The growing focus on biosimilar production in countries like Brazil and Mexico is creating demand for cost-effective yet high-quality glass packaging solutions that meet international standards.

Export market development offers significant potential for Latin American glass packaging manufacturers to serve broader international markets. Regional manufacturers with competitive cost structures and quality capabilities can potentially capture market share in North American and European markets, particularly for standard pharmaceutical glass packaging products.

Technology integration opportunities include the development of smart packaging solutions, enhanced barrier technologies, and sustainable packaging innovations. Market research indicates that approximately 28% of pharmaceutical companies in the region are actively seeking advanced packaging technologies that provide enhanced product protection and supply chain visibility.

Dynamic market forces shaping the Latin America pharmaceutical glass packaging sector include evolving regulatory requirements, changing pharmaceutical industry needs, and increasing focus on supply chain efficiency. The interplay between these factors creates both challenges and opportunities for market participants across the value chain.

Supply and demand dynamics are influenced by pharmaceutical production cycles, seasonal variations in drug demand, and long-term trends in therapeutic area development. The market experiences relatively stable demand patterns for standard packaging formats while showing more volatility in specialized packaging segments such as biologics and personalized medicine applications.

Competitive dynamics feature increasing consolidation among glass packaging manufacturers, strategic partnerships between packaging suppliers and pharmaceutical companies, and growing emphasis on value-added services. Market concentration is moderate, with the top five manufacturers accounting for approximately 42% of regional market share, allowing room for both large-scale operations and specialized niche players.

Technological evolution continues to reshape market dynamics through automation, quality enhancement technologies, and sustainable manufacturing processes. According to MarkWide Research analysis, technological advancement is driving approximately 15% improvement in manufacturing efficiency across the sector, enabling better cost competitiveness and quality consistency.

Comprehensive research methodology employed for analyzing the Latin America pharmaceutical glass packaging market incorporates both primary and secondary research approaches to ensure accuracy and depth of market insights. The methodology combines quantitative data analysis with qualitative market intelligence to provide a complete market perspective.

Primary research activities include extensive interviews with industry executives, pharmaceutical manufacturers, glass packaging suppliers, and regulatory experts across major Latin American markets. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the industry landscape.

Secondary research components encompass analysis of industry reports, regulatory filings, company financial statements, trade association data, and government statistics related to pharmaceutical manufacturing and packaging industries. This comprehensive data collection ensures robust market analysis and reliable trend identification.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market findings. The methodology incorporates regional market variations, regulatory differences, and economic factors that influence market dynamics across different Latin American countries.

Brazil dominates the Latin America pharmaceutical glass packaging market, representing approximately 38% of regional demand due to its large pharmaceutical industry, substantial healthcare investments, and well-developed manufacturing infrastructure. The country’s focus on generic drug production and increasing biologics manufacturing creates significant demand for various glass packaging formats.

Mexico represents the second-largest market with approximately 27% market share, benefiting from its proximity to North American markets, established pharmaceutical manufacturing base, and growing export-oriented production. Mexican manufacturers are increasingly focusing on high-quality glass packaging solutions that meet international standards for export markets.

Argentina and Colombia collectively account for approximately 22% of regional market share, with both countries showing strong growth potential driven by expanding pharmaceutical industries and increasing healthcare investments. These markets demonstrate particular strength in generic drug production and growing interest in biologics manufacturing.

Smaller regional markets including Chile, Peru, and Central American countries represent emerging opportunities with growing pharmaceutical industries and increasing demand for quality packaging solutions. These markets often rely on imports for specialized glass packaging but show potential for local manufacturing development as pharmaceutical industries expand.

Market leadership in the Latin America pharmaceutical glass packaging sector is characterized by a mix of international manufacturers and regional specialists, each bringing distinct capabilities and market positioning strategies.

Competitive strategies focus on technology innovation, quality enhancement, customer service excellence, and strategic partnerships with pharmaceutical manufacturers. Leading companies are investing in advanced manufacturing capabilities, sustainable packaging solutions, and expanded regional presence to capture growing market opportunities.

By Product Type:

By Glass Type:

By Application:

Injectable pharmaceuticals represent the largest and fastest-growing category within the Latin America pharmaceutical glass packaging market, driven by increasing vaccine production, expanding biologics manufacturing, and growing demand for sterile injectable medications. This category requires the highest quality glass packaging with superior chemical resistance and dimensional precision.

Biologics packaging shows exceptional growth potential with specialized requirements for enhanced chemical compatibility, reduced protein adsorption, and superior barrier properties. MWR data indicates this segment is experiencing approximately 11% annual growth, reflecting the region’s increasing focus on biological pharmaceutical production.

Generic drug packaging represents a substantial market opportunity, particularly for cost-effective glass packaging solutions that maintain quality standards while providing competitive pricing. This category benefits from the region’s strong generic pharmaceutical manufacturing capabilities and export-oriented production strategies.

Vaccine packaging has gained increased importance following global health initiatives and expanded immunization programs across Latin America. This category requires specialized glass packaging with enhanced stability properties and compatibility with cold chain distribution requirements.

Pharmaceutical manufacturers benefit from access to high-quality glass packaging solutions that ensure product integrity, regulatory compliance, and market competitiveness. Regional glass packaging suppliers provide cost advantages, reduced lead times, and customized solutions that meet specific pharmaceutical application requirements.

Glass packaging manufacturers gain access to a growing market with diverse application requirements and opportunities for value-added services. The expanding pharmaceutical industry in Latin America provides sustained demand growth and potential for long-term customer relationships and strategic partnerships.

Healthcare systems benefit from improved pharmaceutical product quality, enhanced patient safety, and reliable drug supply chains supported by quality glass packaging solutions. The availability of locally produced packaging reduces supply chain risks and supports healthcare system resilience.

Regulatory authorities benefit from improved pharmaceutical product quality and compliance with international standards, supporting public health objectives and facilitating trade relationships with other regions. Quality glass packaging contributes to overall pharmaceutical industry credibility and export competitiveness.

Investors and stakeholders gain exposure to a growing market with strong fundamentals, increasing demand drivers, and opportunities for technological innovation and market expansion. The sector offers attractive growth prospects supported by demographic trends and healthcare infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives are driving significant changes in the Latin America pharmaceutical glass packaging market, with manufacturers increasingly focusing on recyclable glass formulations, energy-efficient production processes, and reduced environmental impact throughout the product lifecycle. This trend aligns with global pharmaceutical industry sustainability goals and regulatory requirements.

Smart packaging integration represents an emerging trend with growing interest in glass packaging solutions that incorporate digital technologies, track-and-trace capabilities, and enhanced supply chain visibility. These advanced packaging solutions provide benefits including improved inventory management, authentication capabilities, and patient safety enhancements.

Customization and specialization trends show increasing demand for tailored glass packaging solutions that meet specific pharmaceutical application requirements. Manufacturers are developing specialized glass formulations, custom container designs, and value-added services that address unique customer needs and therapeutic area requirements.

Quality enhancement focus continues to drive market evolution with approximately 73% of pharmaceutical manufacturers prioritizing packaging quality improvements to ensure product integrity and regulatory compliance. This trend supports premium glass packaging solutions and advanced quality control technologies.

Manufacturing capacity expansion represents a major industry development with several international and regional manufacturers investing in new production facilities and equipment upgrades across Latin America. These investments aim to serve growing local demand while reducing import dependency and improving supply chain efficiency.

Technology partnerships between glass packaging manufacturers and pharmaceutical companies are creating opportunities for collaborative innovation, customized solutions, and integrated supply chain optimization. These partnerships focus on developing specialized packaging solutions for emerging therapeutic areas and advanced drug formulations.

Regulatory harmonization efforts across Latin American countries are progressing, with initiatives to align pharmaceutical packaging standards with international requirements. These developments support market efficiency, reduce compliance costs, and facilitate cross-border trade in pharmaceutical products.

Sustainability investments include development of eco-friendly glass formulations, energy-efficient manufacturing processes, and circular economy initiatives that support environmental objectives while maintaining product quality and performance standards.

Strategic recommendations for market participants include focusing on quality enhancement, technology integration, and customer relationship development to capture growing opportunities in the Latin America pharmaceutical glass packaging market. Companies should prioritize investments in advanced manufacturing capabilities and quality control systems to meet evolving pharmaceutical industry requirements.

Market entry strategies should consider regional variations, regulatory requirements, and competitive dynamics when developing business plans for Latin American markets. Successful market entry often requires local partnerships, regulatory expertise, and understanding of specific country requirements and customer preferences.

Innovation priorities should focus on sustainable packaging solutions, smart packaging technologies, and specialized glass formulations that address emerging pharmaceutical industry needs. According to MarkWide Research analysis, companies investing in innovation capabilities show approximately 18% higher growth rates compared to traditional manufacturers.

Partnership development with pharmaceutical manufacturers, regulatory consultants, and technology providers can accelerate market penetration and enhance competitive positioning. Strategic partnerships provide access to market intelligence, customer relationships, and technical expertise that support business growth and market success.

Long-term prospects for the Latin America pharmaceutical glass packaging market remain highly positive, supported by expanding pharmaceutical industries, increasing healthcare investments, and growing demand for quality packaging solutions. The market is expected to maintain robust growth momentum driven by demographic trends, healthcare infrastructure development, and pharmaceutical industry expansion.

Growth projections indicate continued market expansion with particularly strong performance expected in biologics packaging, specialized pharmaceutical applications, and export-oriented manufacturing. The market is projected to achieve approximately 7.1% compound annual growth over the next five years, reflecting strong underlying demand fundamentals and favorable industry trends.

Technology evolution will continue to shape market development with increasing adoption of advanced manufacturing technologies, smart packaging solutions, and sustainable production processes. These technological advances will enhance product quality, improve manufacturing efficiency, and create new market opportunities for innovative packaging solutions.

Regional integration trends suggest increasing harmonization of regulatory standards, improved trade relationships, and enhanced supply chain connectivity across Latin American countries. These developments will support market efficiency, reduce barriers to trade, and create opportunities for regional market leaders to expand their geographic presence and market share.

The Latin America pharmaceutical glass packaging market presents compelling opportunities for growth and development, driven by expanding pharmaceutical industries, increasing quality requirements, and growing demand for specialized packaging solutions. The market benefits from favorable demographic trends, healthcare infrastructure investments, and increasing focus on pharmaceutical manufacturing capabilities across the region.

Market fundamentals remain strong with sustained demand growth expected across various pharmaceutical applications, particularly in biologics, vaccines, and specialized therapeutic areas. The combination of cost competitiveness, improving quality standards, and expanding manufacturing capabilities positions the region favorably for continued market development and potential export market penetration.

Success factors for market participants include commitment to quality excellence, investment in advanced technologies, and development of strong customer relationships with pharmaceutical manufacturers. Companies that focus on innovation, sustainability, and customer service excellence are well-positioned to capture growing market opportunities and achieve sustainable competitive advantages in this dynamic and evolving market landscape.

What is Pharmaceutical Glass Packaging?

Pharmaceutical Glass Packaging refers to the use of glass containers and materials specifically designed for the storage and protection of pharmaceutical products, including liquids, powders, and injectables. This type of packaging is essential for maintaining the integrity and stability of medications.

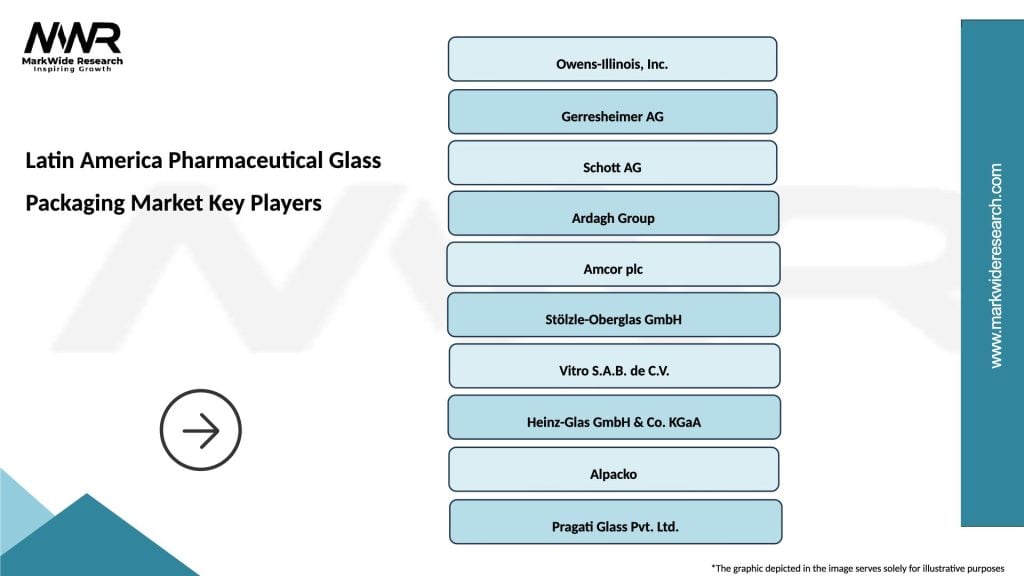

What are the key players in the Latin America Pharmaceutical Glass Packaging Market?

Key players in the Latin America Pharmaceutical Glass Packaging Market include Schott AG, Gerresheimer AG, and Owens-Illinois, among others. These companies are known for their innovative glass packaging solutions tailored for the pharmaceutical industry.

What are the main drivers of growth in the Latin America Pharmaceutical Glass Packaging Market?

The main drivers of growth in the Latin America Pharmaceutical Glass Packaging Market include the increasing demand for biologics and injectables, the rise in healthcare spending, and the growing focus on sustainable packaging solutions. Additionally, the expansion of the pharmaceutical industry in the region contributes to this growth.

What challenges does the Latin America Pharmaceutical Glass Packaging Market face?

The Latin America Pharmaceutical Glass Packaging Market faces challenges such as the high cost of glass production and the competition from alternative packaging materials like plastics. Additionally, regulatory compliance and the need for advanced manufacturing technologies can pose significant hurdles.

What opportunities exist in the Latin America Pharmaceutical Glass Packaging Market?

Opportunities in the Latin America Pharmaceutical Glass Packaging Market include the increasing adoption of eco-friendly packaging solutions and the growing trend of personalized medicine. Furthermore, advancements in glass manufacturing technologies present new avenues for innovation.

What trends are shaping the Latin America Pharmaceutical Glass Packaging Market?

Trends shaping the Latin America Pharmaceutical Glass Packaging Market include the shift towards sustainable and recyclable packaging materials, the integration of smart packaging technologies, and the increasing focus on patient safety and product integrity. These trends are driving innovation and investment in the sector.

Latin America Pharmaceutical Glass Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vials, Ampoules, Bottles, Jars |

| Packaging Type | Blister Packs, Cartons, Labels, Inserts |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Institutions, Biotech Firms |

| Grade | Type I, Type II, Type III, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Pharmaceutical Glass Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at