444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America pharmaceutical cold chain logistics market represents a critical infrastructure component supporting the region’s healthcare ecosystem. This specialized logistics sector focuses on maintaining temperature-controlled environments for pharmaceutical products, vaccines, biologics, and other temperature-sensitive medical supplies throughout the supply chain. Market dynamics indicate robust growth driven by increasing healthcare demands, expanding pharmaceutical manufacturing, and stringent regulatory requirements for drug safety and efficacy.

Regional expansion across Latin America has accelerated significantly, with countries like Brazil, Mexico, Argentina, and Colombia leading market development. The market encompasses various temperature ranges, from frozen storage at -80°C to controlled room temperature environments, ensuring pharmaceutical products maintain their therapeutic properties from manufacturing to patient delivery. Growth projections suggest the market will experience a compound annual growth rate of 8.2% over the forecast period, reflecting increasing investment in healthcare infrastructure and pharmaceutical distribution networks.

Technology integration has become paramount, with advanced monitoring systems, IoT-enabled tracking devices, and automated temperature control mechanisms driving market evolution. The sector serves diverse pharmaceutical categories including vaccines, insulin, blood products, oncology drugs, and specialty medications requiring precise temperature maintenance. Market penetration varies significantly across the region, with urban centers achieving higher adoption rates of 75% compared to rural areas at approximately 45%.

The Latin America pharmaceutical cold chain logistics market refers to the comprehensive network of temperature-controlled storage, transportation, and distribution services specifically designed to maintain the integrity of pharmaceutical products throughout their journey from manufacturers to end consumers. This specialized logistics ecosystem ensures that temperature-sensitive medications, vaccines, and biological products remain within specified temperature ranges to preserve their safety, potency, and therapeutic effectiveness.

Cold chain logistics encompasses multiple components including refrigerated warehouses, temperature-controlled vehicles, monitoring equipment, packaging solutions, and trained personnel capable of handling sensitive pharmaceutical products. The system operates across various temperature zones, from ultra-low freezing conditions for certain vaccines to controlled ambient temperatures for specific medications. Regulatory compliance forms a fundamental aspect, ensuring adherence to local and international pharmaceutical distribution standards.

Market significance extends beyond simple transportation, incorporating sophisticated tracking systems, real-time monitoring capabilities, and comprehensive documentation processes. The sector addresses critical healthcare needs across Latin America’s diverse geographical landscape, from dense urban centers to remote rural communities, ensuring equitable access to life-saving medications regardless of location or infrastructure challenges.

Market transformation in Latin America’s pharmaceutical cold chain logistics sector reflects broader healthcare modernization trends across the region. The market demonstrates strong growth momentum driven by increasing pharmaceutical consumption, expanding healthcare coverage, and rising awareness of temperature-sensitive medication requirements. Investment patterns show significant capital allocation toward infrastructure development, technology adoption, and capacity expansion across major regional markets.

Key market drivers include growing pharmaceutical manufacturing within the region, increasing vaccine distribution requirements, and expanding access to specialty medications requiring cold chain management. The COVID-19 pandemic accelerated market development, highlighting critical infrastructure gaps while simultaneously driving investment increases of approximately 35% in cold chain capabilities. Regulatory harmonization across Latin American countries has facilitated cross-border pharmaceutical trade and standardized cold chain requirements.

Competitive dynamics feature a mix of international logistics providers, regional specialists, and emerging technology companies offering innovative cold chain solutions. Market consolidation trends indicate strategic partnerships between pharmaceutical manufacturers and logistics providers, creating integrated supply chain networks. Technology adoption rates have accelerated, with digital monitoring systems achieving penetration rates of 68% among major logistics providers, significantly improving supply chain visibility and compliance capabilities.

Strategic insights reveal several critical factors shaping the Latin America pharmaceutical cold chain logistics market. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary growth drivers propelling the Latin America pharmaceutical cold chain logistics market encompass diverse factors reflecting regional healthcare evolution and pharmaceutical industry expansion. Demographic trends including aging populations and increasing chronic disease prevalence are driving higher demand for temperature-sensitive medications and specialized pharmaceutical products requiring cold chain management.

Healthcare infrastructure development across Latin American countries has accelerated investment in pharmaceutical distribution networks. Government initiatives promoting universal healthcare access and expanded pharmaceutical coverage are creating substantial demand for reliable cold chain logistics services. Regulatory compliance requirements have become increasingly stringent, mandating sophisticated temperature monitoring and documentation systems throughout the pharmaceutical supply chain.

Pharmaceutical manufacturing growth within the region is generating increased demand for domestic cold chain capabilities. Local production of vaccines, biologics, and specialty medications requires comprehensive cold storage and distribution infrastructure. International trade expansion in pharmaceutical products is driving cross-border cold chain logistics requirements, with import volumes increasing by 28% annually for temperature-sensitive medications.

Technology advancement is enabling more sophisticated cold chain management capabilities, making previously challenging distribution scenarios economically viable. Digital transformation initiatives across the healthcare sector are creating demand for integrated logistics solutions with real-time monitoring and data analytics capabilities. Investment flows from both public and private sectors are supporting infrastructure development and technology adoption across the cold chain logistics ecosystem.

Significant challenges constrain the Latin America pharmaceutical cold chain logistics market despite strong growth potential. Infrastructure limitations across many regional markets create operational difficulties, particularly in rural and remote areas where reliable electricity supply and transportation networks remain inadequate for sophisticated cold chain operations.

High capital requirements for establishing comprehensive cold chain facilities present barriers to market entry and expansion. The substantial investment needed for refrigerated warehouses, temperature-controlled vehicles, monitoring equipment, and trained personnel creates financial challenges for smaller logistics providers. Operational costs associated with maintaining temperature-controlled environments, including energy consumption and equipment maintenance, significantly impact profit margins.

Regulatory complexity across different Latin American countries creates compliance challenges for regional logistics providers. Varying standards, documentation requirements, and approval processes complicate cross-border pharmaceutical distribution and increase operational complexity. Skills shortages in specialized cold chain management present ongoing challenges, with qualified personnel availability meeting only 60% of market demand in several key markets.

Technology adoption barriers include high implementation costs, integration challenges with existing systems, and resistance to change among traditional logistics providers. Economic volatility in several Latin American markets creates uncertainty for long-term infrastructure investments and affects pharmaceutical import capabilities, impacting overall cold chain logistics demand.

Substantial opportunities exist within the Latin America pharmaceutical cold chain logistics market, driven by evolving healthcare needs and technological advancement. Rural market expansion represents significant untapped potential, with innovative delivery solutions and mobile cold chain units enabling pharmaceutical access in previously underserved areas.

Digital transformation initiatives offer opportunities for technology providers to develop specialized cold chain management platforms. Integration of artificial intelligence, machine learning, and predictive analytics can optimize temperature control, reduce product loss, and improve supply chain efficiency. Blockchain technology presents opportunities for enhanced traceability and compliance documentation throughout the pharmaceutical supply chain.

Specialty pharmaceutical growth creates demand for ultra-low temperature storage and specialized handling capabilities. The expanding market for cell and gene therapies, personalized medicines, and advanced biologics requires sophisticated cold chain infrastructure. Vaccine market expansion driven by routine immunization programs and pandemic preparedness creates sustained demand for cold chain logistics services.

Sustainability initiatives offer opportunities for developing environmentally friendly cold chain solutions. Energy-efficient refrigeration systems, renewable energy integration, and sustainable packaging solutions align with corporate sustainability goals while reducing operational costs. Public-private partnerships present opportunities for infrastructure development and market expansion, particularly in underserved regions where government support can facilitate private sector investment.

Complex market dynamics shape the Latin America pharmaceutical cold chain logistics landscape through interconnected factors influencing supply, demand, and operational efficiency. Supply chain integration trends indicate increasing collaboration between pharmaceutical manufacturers, logistics providers, and technology companies to create seamless cold chain networks.

Demand patterns reflect growing pharmaceutical consumption across therapeutic categories requiring temperature-controlled distribution. Seasonal variations in vaccine distribution, chronic disease medication requirements, and emergency pharmaceutical supplies create dynamic demand scenarios requiring flexible logistics capabilities. Market consolidation trends show strategic acquisitions and partnerships aimed at expanding geographic coverage and service capabilities.

Pricing dynamics are influenced by infrastructure costs, regulatory compliance requirements, and competitive pressures. Premium pricing for specialized services contrasts with cost pressures from pharmaceutical manufacturers seeking efficient distribution solutions. Service differentiation through technology integration, quality assurance, and geographic coverage creates competitive advantages for leading providers.

Innovation cycles drive continuous improvement in cold chain technologies, packaging solutions, and monitoring systems. Regulatory evolution creates both challenges and opportunities as standards become more stringent while potentially harmonizing across regional markets. Economic factors including currency fluctuations, inflation rates, and healthcare spending levels significantly impact market dynamics and investment decisions.

Comprehensive research methodology employed for analyzing the Latin America pharmaceutical cold chain logistics market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, logistics providers, pharmaceutical manufacturers, regulatory officials, and healthcare professionals across major Latin American markets.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, trade publications, and government healthcare statistics. Market sizing methodologies combine top-down and bottom-up approaches, analyzing pharmaceutical trade data, cold storage capacity, and distribution network coverage across regional markets.

Data validation processes include cross-referencing multiple sources, expert interviews for verification, and statistical analysis to ensure data consistency and accuracy. Quantitative analysis incorporates statistical modeling, trend analysis, and forecasting techniques to project market growth and identify key performance indicators.

Qualitative insights are gathered through in-depth interviews, focus groups, and expert consultations to understand market dynamics, competitive strategies, and emerging trends. Regional analysis methodology accounts for country-specific factors including regulatory environments, healthcare infrastructure, economic conditions, and pharmaceutical market characteristics. Continuous monitoring ensures research findings remain current and relevant to evolving market conditions.

Brazil dominates the Latin America pharmaceutical cold chain logistics market, accounting for approximately 40% of regional market share due to its large population, advanced healthcare infrastructure, and significant pharmaceutical manufacturing base. São Paulo and Rio de Janeiro serve as major distribution hubs with sophisticated cold storage facilities and comprehensive transportation networks supporting nationwide pharmaceutical distribution.

Mexico represents the second-largest market with 25% regional market share, driven by proximity to North American pharmaceutical markets and growing domestic healthcare demand. Mexico City, Guadalajara, and Monterrey function as key logistics centers with expanding cold chain infrastructure supporting both domestic distribution and cross-border pharmaceutical trade.

Argentina maintains significant market presence with 15% market share, supported by established pharmaceutical manufacturing and advanced healthcare systems in major urban centers. Buenos Aires serves as the primary distribution hub with sophisticated cold chain facilities serving domestic and regional export markets.

Colombia demonstrates rapid growth potential with 8% current market share but projected growth rates of 12% annually. Bogotá, Medellín, and Cali are developing comprehensive cold chain infrastructure to support expanding pharmaceutical access and regional distribution capabilities.

Chile, Peru, and other regional markets collectively represent 12% market share with varying development levels. Santiago, Lima, and other major cities are investing in cold chain infrastructure to support growing pharmaceutical imports and domestic healthcare expansion. Cross-border trade facilitation through regional agreements is driving integrated cold chain network development across multiple countries.

Competitive dynamics in the Latin America pharmaceutical cold chain logistics market feature diverse players ranging from global logistics giants to specialized regional providers. Market leadership is distributed among several key categories of service providers, each offering distinct capabilities and geographic coverage.

Strategic partnerships between logistics providers and pharmaceutical manufacturers are creating integrated supply chain networks. Technology differentiation through advanced monitoring systems, data analytics, and regulatory compliance capabilities provides competitive advantages in this specialized market segment.

Market segmentation analysis reveals diverse categories within the Latin America pharmaceutical cold chain logistics market, each with distinct characteristics and growth patterns. Segmentation approaches include product type, temperature range, end-user, and service type classifications.

By Product Type:

By Temperature Range:

By End-User:

Vaccine distribution represents the most dynamic category within the pharmaceutical cold chain logistics market, driven by expanded immunization programs and pandemic preparedness initiatives. Growth acceleration in this category reflects increasing government investment in public health infrastructure and rising awareness of vaccine-preventable diseases. Technical requirements for vaccine distribution include ultra-low temperature storage capabilities and sophisticated monitoring systems to ensure product efficacy.

Biologics transportation demonstrates strong growth potential due to expanding access to specialty medications and advanced therapeutic products. Insulin distribution represents a significant portion of this category, with growing diabetes prevalence across Latin America driving sustained demand for reliable cold chain services. Blood product logistics require specialized handling protocols and emergency response capabilities to support healthcare systems.

Oncology drug distribution presents high-value opportunities with stringent quality requirements and specialized handling protocols. Market expansion in cancer treatment access is driving demand for sophisticated cold chain capabilities supporting expensive and temperature-sensitive oncology medications. Regulatory compliance in this category requires comprehensive documentation and quality assurance systems.

Generic medication logistics focus on cost-effective distribution solutions while maintaining temperature integrity. Volume growth in generic pharmaceutical consumption creates opportunities for efficient cold chain networks optimized for high-volume, standardized distribution requirements. Market penetration strategies emphasize operational efficiency and competitive pricing while ensuring regulatory compliance.

Pharmaceutical manufacturers benefit from reliable cold chain logistics through reduced product loss, improved market access, and enhanced regulatory compliance. Quality assurance provided by professional cold chain services ensures product integrity from manufacturing to patient delivery, protecting brand reputation and patient safety. Market expansion capabilities enable pharmaceutical companies to reach previously inaccessible geographic markets through specialized distribution networks.

Healthcare providers gain access to expanded pharmaceutical options through reliable cold chain distribution, improving patient care capabilities and treatment outcomes. Supply chain reliability ensures consistent availability of temperature-sensitive medications, reducing treatment interruptions and improving patient satisfaction. Cost optimization through professional logistics services eliminates the need for healthcare facilities to invest in specialized cold storage infrastructure.

Patients and communities benefit from improved access to life-saving medications and vaccines through expanded cold chain networks. Geographic equity in pharmaceutical access is enhanced through innovative distribution solutions reaching rural and remote areas. Product safety is ensured through professional temperature management, reducing risks associated with compromised medication efficacy.

Logistics providers capture value through specialized service offerings and long-term partnerships with pharmaceutical companies. Market differentiation through cold chain expertise creates competitive advantages and premium pricing opportunities. Technology integration enables operational efficiency improvements and enhanced service capabilities, supporting business growth and profitability.

Regulatory authorities benefit from improved pharmaceutical distribution standards and enhanced traceability throughout the supply chain. Public health outcomes improve through reliable vaccine distribution and consistent access to essential medications across diverse populations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Latin America pharmaceutical cold chain logistics market. IoT integration enables real-time monitoring of temperature, humidity, and location throughout the supply chain, providing unprecedented visibility and control over pharmaceutical distribution. Blockchain technology is emerging as a solution for enhanced traceability and regulatory compliance documentation.

Sustainability initiatives are driving adoption of environmentally friendly cold chain solutions across the region. Energy-efficient refrigeration systems reduce operational costs while supporting corporate sustainability goals. Renewable energy integration in cold storage facilities demonstrates commitment to environmental responsibility while improving long-term cost competitiveness.

Last-mile innovation focuses on reaching underserved populations through mobile cold chain units and innovative delivery solutions. Drone technology is being explored for pharmaceutical delivery in remote areas where traditional transportation infrastructure is inadequate. Micro-distribution centers strategically located in rural areas extend cold chain coverage to previously inaccessible markets.

Regulatory harmonization across Latin American countries is facilitating cross-border pharmaceutical trade and standardizing cold chain requirements. Quality standardization initiatives improve operational efficiency while ensuring consistent service quality across regional markets. Data analytics applications enable predictive maintenance, demand forecasting, and supply chain optimization, improving overall system efficiency and reliability.

Infrastructure expansion initiatives across major Latin American markets have significantly enhanced cold chain logistics capabilities. Brazil’s investment in automated cold storage facilities has increased national capacity while improving operational efficiency. Mexico’s cross-border pharmaceutical logistics infrastructure has been modernized to support increased trade with North American markets.

Technology partnerships between logistics providers and technology companies are creating innovative cold chain management solutions. MarkWide Research indicates that strategic alliances have resulted in efficiency improvements of 30% in temperature monitoring and compliance documentation processes. Artificial intelligence applications are being deployed for predictive analytics and supply chain optimization.

Regulatory developments include updated pharmaceutical distribution standards and enhanced traceability requirements across multiple countries. Colombia’s new regulations mandate comprehensive temperature monitoring for all pharmaceutical imports, driving demand for advanced cold chain services. Regional cooperation initiatives are standardizing cold chain requirements to facilitate cross-border pharmaceutical trade.

Market consolidation through strategic acquisitions and partnerships is creating larger, more capable cold chain networks. International expansion by global logistics providers is bringing advanced technologies and best practices to Latin American markets. Investment flows from both public and private sectors continue supporting infrastructure development and technology adoption across the region.

Strategic recommendations for market participants focus on leveraging technology advancement and geographic expansion opportunities. Investment priorities should emphasize digital transformation initiatives, particularly IoT integration and data analytics capabilities that enhance operational efficiency and regulatory compliance. Partnership strategies with pharmaceutical manufacturers can create long-term revenue streams and competitive advantages.

Geographic expansion into underserved rural markets presents significant growth opportunities through innovative delivery solutions and mobile cold chain units. Technology differentiation through advanced monitoring systems and predictive analytics can justify premium pricing and create competitive moats. Regulatory expertise development is essential for navigating complex compliance requirements across multiple countries.

Sustainability initiatives should be integrated into operational strategies to align with corporate responsibility goals while reducing long-term operational costs. Energy-efficient systems and renewable energy integration provide both environmental and economic benefits. Skills development programs for specialized cold chain personnel are critical for supporting operational expansion and service quality improvement.

Market consolidation opportunities through strategic acquisitions can rapidly expand geographic coverage and service capabilities. Vertical integration strategies linking cold chain logistics with pharmaceutical manufacturing or distribution can create synergistic value propositions. Innovation investment in emerging technologies like drone delivery and automated systems positions companies for future market leadership.

Long-term projections for the Latin America pharmaceutical cold chain logistics market indicate sustained growth driven by expanding healthcare access, pharmaceutical innovation, and infrastructure development. Market evolution will be characterized by increased technology integration, improved regulatory harmonization, and expanded geographic coverage reaching previously underserved populations.

Technology advancement will continue transforming cold chain operations through artificial intelligence, machine learning, and automated systems. Predictive analytics capabilities will enable proactive maintenance, demand forecasting, and supply chain optimization, significantly improving operational efficiency. Blockchain integration will enhance traceability and regulatory compliance while reducing administrative costs.

Geographic expansion into rural and remote areas will accelerate through innovative delivery solutions and mobile cold chain technologies. Cross-border integration will improve through regulatory harmonization and infrastructure development, creating seamless regional pharmaceutical distribution networks. Market penetration rates are projected to reach 85% in urban areas and 65% in rural regions within the next five years.

Sustainability focus will drive adoption of environmentally friendly technologies and operational practices throughout the cold chain ecosystem. Renewable energy integration and energy-efficient systems will become standard features of modern cold chain facilities. MWR analysis suggests that sustainability initiatives will contribute to operational cost reductions of 20% while supporting corporate environmental goals.

The Latin America pharmaceutical cold chain logistics market represents a dynamic and rapidly evolving sector critical to regional healthcare infrastructure development. Strong growth fundamentals driven by expanding pharmaceutical consumption, infrastructure investment, and technology advancement create substantial opportunities for market participants across the value chain.

Market transformation through digital technologies, sustainability initiatives, and geographic expansion is reshaping the competitive landscape while improving service capabilities and operational efficiency. Strategic positioning requires balancing investment in advanced technologies with geographic expansion to capture emerging opportunities in underserved markets.

Future success will depend on companies’ ability to navigate regulatory complexity, invest in technology differentiation, and develop sustainable operational models that support long-term growth. Collaboration strategies between logistics providers, pharmaceutical manufacturers, and technology companies will be essential for creating integrated cold chain ecosystems that serve diverse market needs effectively and efficiently.

What is Pharmaceutical Cold Chain Logistics?

Pharmaceutical Cold Chain Logistics refers to the temperature-controlled supply chain processes that ensure the safe transportation and storage of pharmaceutical products, including vaccines and biologics, which require specific temperature ranges to maintain their efficacy.

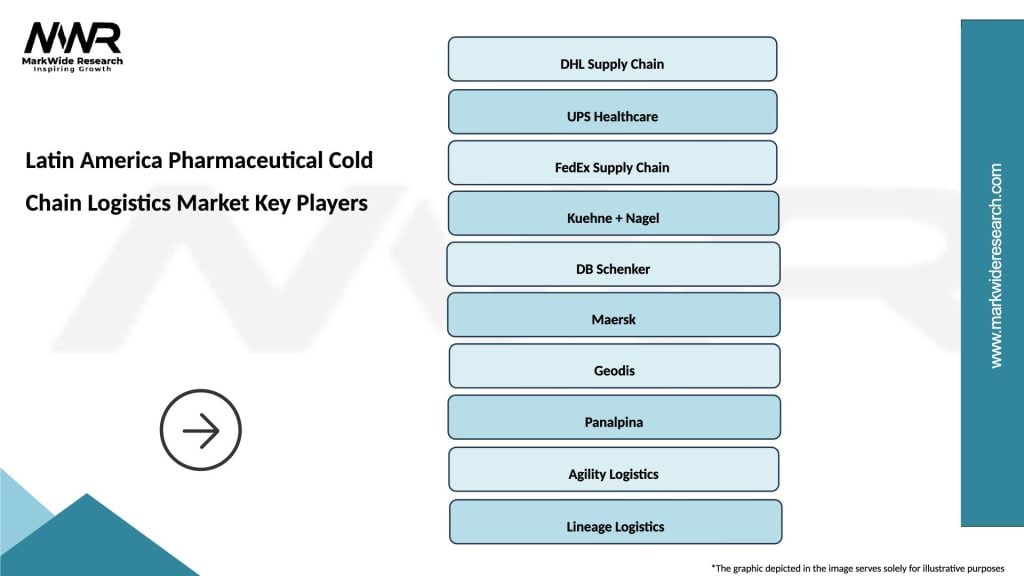

What are the key players in the Latin America Pharmaceutical Cold Chain Logistics Market?

Key players in the Latin America Pharmaceutical Cold Chain Logistics Market include DHL Supply Chain, Kuehne + Nagel, and FedEx, among others. These companies provide specialized services to ensure compliance with regulatory standards and maintain product integrity during transit.

What are the main drivers of growth in the Latin America Pharmaceutical Cold Chain Logistics Market?

The main drivers of growth in the Latin America Pharmaceutical Cold Chain Logistics Market include the increasing demand for temperature-sensitive medications, the expansion of the biopharmaceutical sector, and the rising prevalence of chronic diseases requiring advanced therapies.

What challenges does the Latin America Pharmaceutical Cold Chain Logistics Market face?

Challenges in the Latin America Pharmaceutical Cold Chain Logistics Market include inadequate infrastructure in certain regions, regulatory compliance complexities, and the high costs associated with maintaining temperature control throughout the supply chain.

What opportunities exist in the Latin America Pharmaceutical Cold Chain Logistics Market?

Opportunities in the Latin America Pharmaceutical Cold Chain Logistics Market include the growing adoption of advanced tracking technologies, the increasing focus on sustainability in logistics, and the potential for partnerships between logistics providers and pharmaceutical companies to enhance service offerings.

What trends are shaping the Latin America Pharmaceutical Cold Chain Logistics Market?

Trends shaping the Latin America Pharmaceutical Cold Chain Logistics Market include the integration of IoT for real-time monitoring, the rise of automated warehousing solutions, and the emphasis on regulatory compliance to ensure product safety and efficacy.

Latin America Pharmaceutical Cold Chain Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerated Containers, Temperature-Controlled Vehicles, Cold Storage Facilities, Insulated Packaging |

| Delivery Mode | Air Freight, Sea Freight, Road Transport, Rail Transport |

| End User | Pharmaceutical Manufacturers, Distributors, Hospitals, Research Laboratories |

| Technology | IoT Monitoring, GPS Tracking, Automated Temperature Control, Data Loggers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Pharmaceutical Cold Chain Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at