444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Latin America Parametric Insurance Market is a dynamic sector within the insurance industry, characterized by innovative risk management solutions. This market overview explores the unique features of parametric insurance and its growing significance in the Latin American region.

Meaning: Parametric insurance is a type of insurance that pays out a predetermined amount based on the occurrence of a specific trigger event, such as a natural disaster or a predefined parameter reaching a certain threshold. This insurance model provides faster payouts and greater transparency compared to traditional insurance products.

Executive Summary: The Latin America Parametric Insurance Market is experiencing notable growth as businesses and governments seek efficient and timely risk transfer solutions. The market offers an alternative to conventional insurance, providing financial protection against predefined risks through transparent and automated processes.

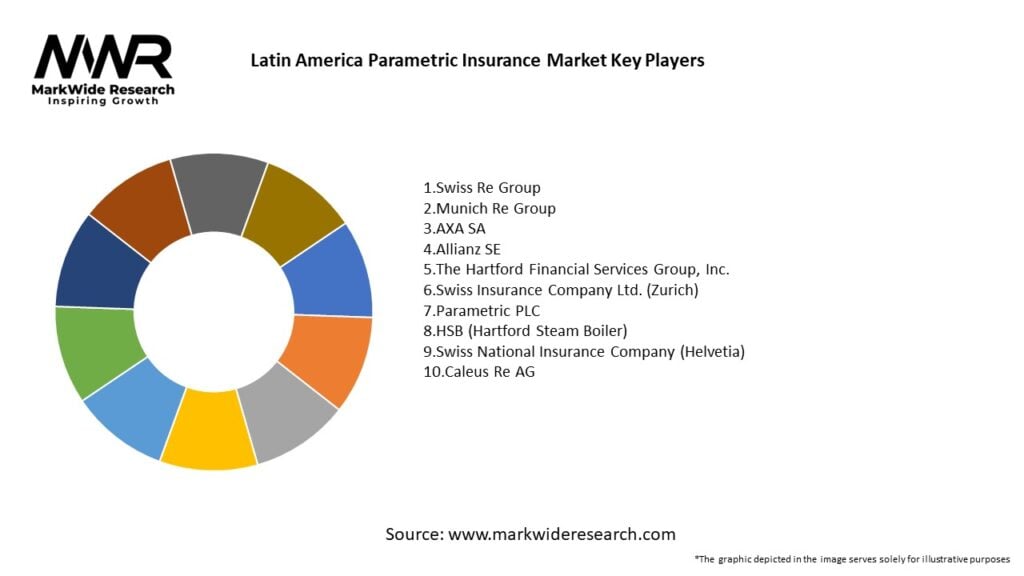

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Latin America Parametric Insurance Market operates within a dynamic environment influenced by factors such as climate patterns, economic development, technological advancements, and the evolving risk landscape. Understanding these dynamics is essential for insurers to design effective parametric solutions.

Regional Analysis: A regional analysis of the Latin America Parametric Insurance Market delves into the specific risk profiles of countries within the region. Different countries may face distinct risks, and parametric insurance solutions can be tailored accordingly.

Competitive Landscape:

Leading Companies in Latin America Parametric Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: Parametric insurance products can be segmented based on various parameters, including the type of risk covered (natural disasters, agricultural risks, etc.), the trigger mechanism (weather conditions, seismic activity, etc.), and the industry served (agribusiness, infrastructure, etc.).

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing participants in the Latin America Parametric Insurance Market.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has highlighted the need for innovative risk management solutions. While parametric insurance is not specifically designed for pandemics, the principles of quick payouts and transparent processes align with the challenges posed by global health crises.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Latin America Parametric Insurance Market is optimistic, with continued growth expected as businesses recognize the value of proactive risk management. Insurers leveraging advanced technologies and developing tailored solutions will be well-positioned for success.

Conclusion: In conclusion, the Latin America Parametric Insurance Market presents a unique and evolving landscape within the broader insurance industry. As businesses and governments increasingly prioritize risk management, parametric insurance offers a nimble and effective solution. Ongoing collaboration, technological advancements, and educational efforts will play pivotal roles in shaping the market’s future and ensuring its continued relevance in addressing diverse risk scenarios.

What is Parametric Insurance?

Parametric insurance is a type of insurance that provides benefits based on predetermined parameters or triggers, such as weather events or natural disasters, rather than traditional loss assessments. This approach allows for quicker payouts and can be particularly useful in regions prone to specific risks.

What are the key players in the Latin America Parametric Insurance Market?

Key players in the Latin America Parametric Insurance Market include companies like Swiss Re, Munich Re, and AXA, which offer innovative parametric solutions tailored to local needs. These companies are focusing on expanding their product offerings to address climate-related risks and enhance customer engagement, among others.

What are the growth factors driving the Latin America Parametric Insurance Market?

The growth of the Latin America Parametric Insurance Market is driven by increasing awareness of climate risks, the need for rapid disaster response, and the demand for innovative insurance solutions. Additionally, advancements in technology and data analytics are enabling more accurate risk assessments and product development.

What challenges does the Latin America Parametric Insurance Market face?

The Latin America Parametric Insurance Market faces challenges such as regulatory hurdles, limited consumer understanding of parametric products, and the need for reliable data to set parameters. These factors can hinder market penetration and the development of tailored insurance solutions.

What opportunities exist in the Latin America Parametric Insurance Market?

Opportunities in the Latin America Parametric Insurance Market include the potential for product innovation, particularly in agriculture and natural disaster coverage. Additionally, partnerships with technology firms can enhance data collection and analysis, leading to more effective risk management solutions.

What trends are shaping the Latin America Parametric Insurance Market?

Trends shaping the Latin America Parametric Insurance Market include the increasing integration of technology in insurance processes, the rise of climate-related insurance products, and a growing focus on sustainability. These trends are encouraging insurers to develop more flexible and responsive offerings to meet evolving consumer needs.

Latin America Parametric Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Weather Insurance, Crop Insurance, Earthquake Insurance, Flood Insurance |

| End User | Agriculture, Construction, Energy, Transportation |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Insurance Aggregators |

| Application | Risk Management, Disaster Recovery, Financial Planning, Asset Protection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at