444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America oil and gas drone services market represents a rapidly evolving sector that is transforming traditional energy operations across the region. This dynamic market encompasses the deployment of unmanned aerial vehicles (UAVs) for various applications including pipeline inspection, offshore platform monitoring, environmental compliance, and emergency response services. The region’s extensive oil and gas infrastructure, spanning from Mexico’s Gulf coast to Argentina’s shale formations, presents significant opportunities for drone technology integration.

Market dynamics indicate substantial growth potential driven by increasing operational efficiency demands and safety requirements. The adoption of drone services has accelerated at approximately 12.5% annually across major Latin American oil and gas operations, with countries like Brazil, Mexico, and Colombia leading the implementation. These advanced aerial systems provide cost-effective solutions for monitoring vast pipeline networks, conducting routine inspections, and ensuring regulatory compliance while reducing human exposure to hazardous environments.

Regional characteristics of the Latin America oil and gas drone services market include diverse geographical challenges ranging from dense Amazon rainforests to offshore deepwater operations. The market benefits from supportive regulatory frameworks in key countries and increasing investment in digital transformation initiatives by major energy companies operating in the region.

The Latin America oil and gas drone services market refers to the comprehensive ecosystem of unmanned aerial vehicle technologies, services, and solutions specifically designed for petroleum industry applications across Latin American countries. This market encompasses drone hardware, specialized software platforms, data analytics services, and professional operational support tailored to meet the unique requirements of oil and gas exploration, production, and transportation activities.

Core components of this market include advanced sensor technologies, real-time data transmission systems, artificial intelligence-powered analytics, and specialized drone platforms capable of operating in challenging environmental conditions. The services range from routine infrastructure monitoring and predictive maintenance to emergency response and environmental impact assessment, providing energy companies with actionable insights for optimized operations.

Market scope extends beyond traditional inspection services to include advanced applications such as methane leak detection, thermal imaging analysis, 3D mapping, and autonomous monitoring systems that operate continuously without human intervention.

Strategic positioning of the Latin America oil and gas drone services market reflects the region’s commitment to modernizing energy infrastructure through innovative technology adoption. The market demonstrates robust growth momentum driven by increasing operational efficiency requirements, stringent environmental regulations, and the need for cost-effective monitoring solutions across vast geographical areas.

Key market drivers include the region’s extensive pipeline networks requiring regular inspection, growing emphasis on worker safety, and regulatory mandates for environmental monitoring. Major oil and gas companies operating in Latin America are increasingly recognizing drone services as essential tools for maintaining operational excellence while reducing costs by approximately 35-40% compared to traditional inspection methods.

Technological advancement in drone capabilities, including extended flight times, enhanced payload capacity, and improved data processing capabilities, continues to expand the addressable market. The integration of artificial intelligence and machine learning technologies enables predictive maintenance strategies that significantly reduce unplanned downtime and maintenance costs.

Market segmentation reveals diverse applications across upstream, midstream, and downstream operations, with pipeline inspection and offshore platform monitoring representing the largest service categories. The competitive landscape features both international drone service providers and emerging regional specialists developing solutions tailored to Latin American market requirements.

Primary market insights reveal several critical trends shaping the Latin America oil and gas drone services landscape:

Infrastructure modernization represents a fundamental driver for the Latin America oil and gas drone services market. The region’s aging pipeline infrastructure, much of which was constructed decades ago, requires comprehensive monitoring and maintenance programs to ensure operational integrity. Drone services provide cost-effective solutions for continuous monitoring of these extensive networks, enabling early detection of potential issues before they escalate into costly failures.

Regulatory compliance requirements continue to drive market growth as governments across Latin America implement stricter environmental and safety standards. Environmental protection agencies are mandating regular monitoring of oil and gas operations, particularly in environmentally sensitive areas such as the Amazon basin. Drone services offer comprehensive monitoring capabilities that ensure compliance while minimizing operational disruption.

Safety considerations remain paramount in driving drone adoption across the oil and gas sector. Traditional inspection methods often require personnel to work in hazardous environments, including offshore platforms, remote pipeline locations, and potentially dangerous industrial facilities. Drone services eliminate or significantly reduce human exposure to these risks while maintaining inspection quality and frequency.

Cost reduction pressures facing the oil and gas industry globally have accelerated the adoption of drone services in Latin America. Companies are seeking innovative solutions to maintain operational excellence while reducing operational expenditures. Drone services deliver measurable cost savings through reduced personnel requirements, decreased equipment needs, and improved operational efficiency.

Technological advancement in drone capabilities continues to expand their applicability in oil and gas operations. Enhanced battery life, improved sensor accuracy, and advanced data processing capabilities make drones increasingly attractive for complex monitoring and inspection tasks that were previously challenging or impossible to perform remotely.

Regulatory complexity presents significant challenges for drone service providers operating across multiple Latin American countries. Each nation maintains distinct regulatory frameworks governing commercial drone operations, creating compliance complexities that can delay project implementation and increase operational costs. Navigating these varied regulatory environments requires specialized expertise and ongoing regulatory monitoring.

Technical limitations of current drone technology continue to constrain certain applications in oil and gas operations. Weather sensitivity, limited payload capacity, and flight duration restrictions can impact service reliability, particularly in challenging environmental conditions common across Latin America. These limitations require careful operational planning and may necessitate hybrid approaches combining drone and traditional inspection methods.

Initial investment requirements for comprehensive drone service implementation can be substantial, particularly for smaller oil and gas operators. The costs associated with acquiring specialized equipment, training personnel, and developing operational procedures may present barriers to adoption, especially for companies with limited capital resources.

Data security concerns regarding sensitive operational information collected through drone services create hesitation among some oil and gas companies. The transmission and storage of critical infrastructure data raise cybersecurity considerations that require robust security protocols and may limit adoption among security-conscious organizations.

Skills shortage in specialized drone operations and data analysis capabilities presents ongoing challenges for market expansion. The successful implementation of drone services requires trained personnel capable of operating sophisticated equipment and interpreting complex data, creating workforce development requirements that may constrain rapid market growth.

Emerging applications in environmental monitoring present substantial growth opportunities for drone services in the Latin American oil and gas sector. As environmental regulations become increasingly stringent, companies require comprehensive monitoring solutions for emissions tracking, water quality assessment, and biodiversity impact evaluation. Drone services equipped with advanced sensors can provide continuous environmental monitoring capabilities that exceed traditional methods.

Digital transformation initiatives across the energy sector create opportunities for integrated drone service solutions. Oil and gas companies are investing in comprehensive digital platforms that combine drone data with other operational information to create holistic asset management systems. This integration enables predictive maintenance strategies and optimized operational decision-making.

Offshore operations expansion in countries like Brazil and Mexico presents significant opportunities for specialized drone services. Offshore platforms require regular inspection and monitoring services that are particularly well-suited to drone capabilities. The challenging logistics of offshore operations make drone services especially valuable for routine monitoring tasks.

Cross-border pipeline projects connecting multiple Latin American countries create opportunities for standardized drone service solutions. These large-scale infrastructure projects require consistent monitoring capabilities across different regulatory environments, presenting opportunities for service providers capable of managing complex, multi-jurisdictional operations.

Technology partnerships between drone service providers and energy companies offer opportunities for customized solution development. Collaborative approaches enable the development of specialized applications tailored to specific operational requirements, creating competitive advantages and deeper market penetration.

Competitive dynamics in the Latin America oil and gas drone services market reflect a evolving landscape characterized by both established international providers and emerging regional specialists. Market participants are differentiating through specialized service offerings, advanced technology integration, and deep understanding of local operational requirements. The competitive environment encourages continuous innovation and service enhancement.

Technology evolution continues to reshape market dynamics as drone capabilities expand and costs decrease. Advances in artificial intelligence, sensor technology, and data analytics create new service possibilities while improving the value proposition for existing applications. These technological improvements drive market expansion by making drone services accessible to a broader range of oil and gas operations.

Customer relationships in this market are characterized by long-term partnerships rather than transactional service arrangements. Oil and gas companies prefer working with drone service providers that demonstrate deep industry knowledge, regulatory compliance expertise, and proven operational reliability. These relationship dynamics favor providers capable of delivering comprehensive, integrated solutions.

Pricing dynamics reflect the market’s maturation with increasing price competition balanced against service quality and reliability requirements. While cost reduction remains important, oil and gas companies prioritize service providers capable of delivering consistent, high-quality results that support operational objectives and regulatory compliance.

Innovation cycles in drone technology create ongoing market dynamics as new capabilities enable expanded applications. Service providers must continuously evaluate and integrate new technologies to maintain competitive positioning while managing the costs associated with technology adoption and workforce training.

Comprehensive research approach employed in analyzing the Latin America oil and gas drone services market combines primary and secondary research methodologies to ensure accurate and actionable market insights. The research framework encompasses quantitative analysis of market trends, qualitative assessment of industry dynamics, and detailed evaluation of competitive positioning across key market segments.

Primary research activities include extensive interviews with industry executives, drone service providers, regulatory officials, and technology vendors operating in the Latin American market. These interviews provide firsthand insights into market challenges, opportunities, and emerging trends that shape industry development. Survey methodologies capture quantitative data regarding adoption rates, service preferences, and investment priorities.

Secondary research sources encompass industry publications, regulatory documents, company financial reports, and technical specifications from leading drone manufacturers and service providers. This comprehensive secondary research provides historical context, market sizing information, and competitive intelligence necessary for thorough market analysis.

Data validation processes ensure research accuracy through triangulation of information sources, expert review panels, and statistical verification of quantitative findings. Multiple data sources are cross-referenced to confirm market trends and validate key findings before inclusion in the final analysis.

Regional analysis methodology incorporates country-specific research to account for varying regulatory environments, market maturity levels, and operational requirements across Latin American markets. This localized approach ensures that regional variations are accurately captured and reflected in market assessments.

Brazil dominates the Latin America oil and gas drone services market, accounting for approximately 40-45% of regional activity. The country’s extensive offshore operations, comprehensive pipeline networks, and progressive regulatory framework create favorable conditions for drone service adoption. Petrobras and other major operators have implemented comprehensive drone programs that serve as regional benchmarks for best practices.

Mexico represents the second-largest market with significant growth potential driven by energy sector reforms and increasing foreign investment. The country’s diverse oil and gas operations, including both onshore and offshore activities, create substantial demand for drone services. Recent regulatory improvements have streamlined commercial drone operations, facilitating market expansion.

Colombia demonstrates strong growth momentum with approximately 15-18% market share, driven by expanding pipeline infrastructure and increasing focus on environmental monitoring. The country’s challenging geographical terrain makes drone services particularly valuable for pipeline inspection and monitoring activities in remote areas.

Argentina’s market is characterized by growing adoption in unconventional oil and gas operations, particularly in the Vaca Muerta shale formation. The country’s expanding shale development activities create opportunities for specialized drone services supporting exploration and production operations.

Other regional markets including Peru, Ecuador, and Venezuela present emerging opportunities despite varying levels of market maturity and regulatory development. These markets are characterized by specific operational challenges that create niche opportunities for specialized drone service providers.

Market leadership in the Latin America oil and gas drone services sector is distributed among several key categories of providers, each bringing distinct capabilities and market positioning strategies.

Competitive differentiation strategies focus on specialized service capabilities, regulatory compliance expertise, technology innovation, and operational reliability. Leading providers demonstrate comprehensive understanding of oil and gas operational requirements combined with advanced drone technology capabilities.

Strategic partnerships between drone service providers and energy companies are becoming increasingly common, creating integrated service offerings that combine operational expertise with advanced technology capabilities. These partnerships enable customized solutions that address specific operational challenges while leveraging specialized technical expertise.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand geographical coverage, enhance service capabilities, and achieve operational scale advantages.

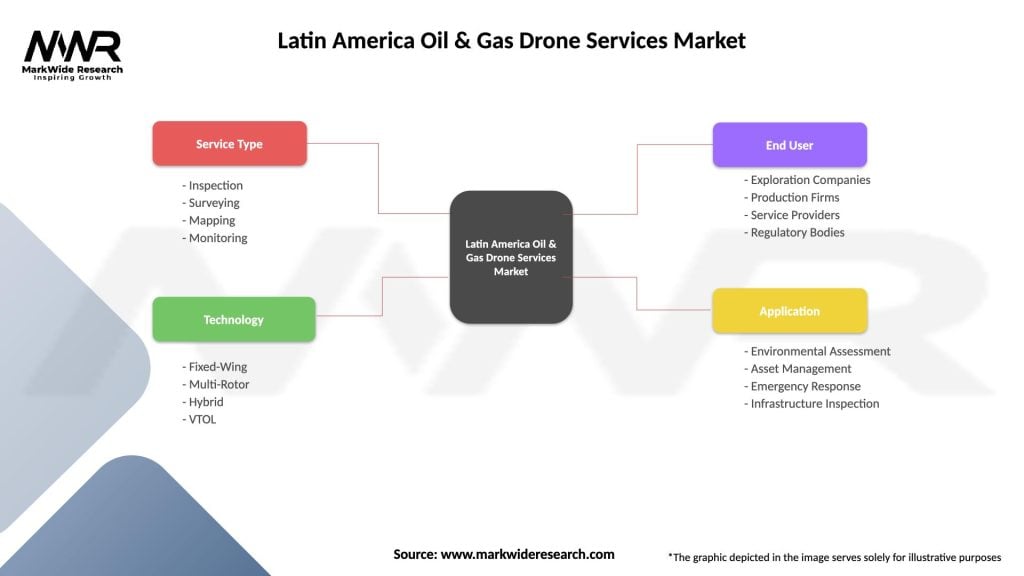

By Service Type:

By Technology Platform:

By End-User Segment:

Pipeline inspection services represent the largest segment of the Latin America oil and gas drone services market, driven by extensive pipeline networks requiring regular monitoring and maintenance. These services typically achieve 25-30% cost savings compared to traditional inspection methods while providing more comprehensive coverage and detailed documentation. Advanced sensor technologies enable detection of potential issues before they develop into costly failures.

Offshore platform monitoring demonstrates strong growth potential as countries like Brazil expand deepwater operations. The challenging logistics of offshore operations make drone services particularly valuable, providing regular monitoring capabilities without the costs and risks associated with helicopter-based inspections. Specialized maritime drone platforms are being developed specifically for offshore applications.

Environmental monitoring services are experiencing rapid growth driven by increasingly stringent regulatory requirements across Latin America. Drone-based monitoring systems provide continuous surveillance capabilities that exceed traditional methods while reducing operational costs. These services are particularly important in environmentally sensitive areas where oil and gas operations must demonstrate minimal environmental impact.

Emergency response applications showcase the unique capabilities of drone services in providing rapid assessment and monitoring during incident response situations. The ability to quickly deploy drone systems for damage assessment, leak detection, and ongoing monitoring provides significant operational advantages during emergency situations.

Asset management integration represents an emerging category where drone services are combined with comprehensive asset management platforms to provide holistic operational oversight. These integrated solutions enable predictive maintenance strategies and optimized operational decision-making based on comprehensive data analysis.

Operational efficiency improvements represent primary benefits for oil and gas companies implementing drone services. These improvements include reduced inspection timeframes, enhanced data quality, and improved maintenance planning capabilities. Companies typically experience 40-50% reduction in inspection costs while achieving more comprehensive coverage of their assets.

Safety enhancements provide significant value through reduced personnel exposure to hazardous environments. Drone services eliminate the need for personnel to access dangerous locations including offshore platforms, remote pipeline sections, and potentially hazardous industrial facilities. This risk reduction translates to improved safety records and reduced insurance costs.

Regulatory compliance support enables companies to meet increasingly stringent environmental and safety requirements through comprehensive monitoring and documentation capabilities. Drone services provide detailed records and continuous monitoring that support regulatory reporting requirements while demonstrating proactive environmental stewardship.

Data-driven decision making capabilities emerge from the comprehensive data collection and analysis capabilities of modern drone services. Advanced analytics platforms process drone-collected data to provide actionable insights for maintenance planning, operational optimization, and strategic decision-making.

Competitive advantages accrue to early adopters of drone services through improved operational efficiency, reduced costs, and enhanced safety performance. These advantages become increasingly important as the technology matures and becomes standard practice across the industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend in the Latin America oil and gas drone services market. Advanced AI algorithms enable automated data analysis, predictive maintenance capabilities, and real-time decision support systems. This integration significantly enhances the value proposition of drone services by providing actionable insights rather than simply collecting data.

Autonomous operations are becoming increasingly prevalent as drone technology advances and regulatory frameworks evolve. Fully autonomous monitoring systems capable of continuous operation without human intervention are being deployed for routine monitoring tasks, providing cost-effective solutions for ongoing surveillance requirements.

Multi-sensor platforms combining various detection technologies including thermal imaging, LiDAR, gas detection, and high-resolution cameras are becoming standard offerings. These comprehensive sensor suites enable multiple inspection tasks to be completed during single flights, improving operational efficiency and reducing costs.

Cloud-based data platforms are transforming how drone-collected data is processed, stored, and analyzed. These platforms enable real-time data sharing, collaborative analysis, and integration with existing asset management systems, creating comprehensive operational oversight capabilities.

Regulatory harmonization efforts across Latin American countries are creating more consistent operational frameworks for commercial drone services. This harmonization reduces compliance complexity and enables more efficient cross-border operations for regional service providers.

Sustainability focus is driving demand for drone services that support environmental monitoring and compliance objectives. Companies are increasingly using drone services to demonstrate environmental stewardship and meet sustainability commitments while maintaining operational efficiency.

Strategic partnerships between major oil and gas companies and drone service providers continue to reshape the competitive landscape. These partnerships enable the development of customized solutions tailored to specific operational requirements while leveraging specialized expertise from both partners. Recent partnerships have focused on developing integrated platforms that combine drone services with comprehensive asset management capabilities.

Regulatory advancements in key markets including Brazil and Mexico have streamlined approval processes for commercial drone operations. These regulatory improvements reduce operational barriers and enable more efficient service delivery while maintaining safety and security standards. Progressive regulatory frameworks are facilitating market expansion and encouraging investment in advanced drone technologies.

Technology innovations continue to expand the capabilities and applications of drone services in oil and gas operations. Recent developments include extended battery life systems, improved weather resistance, and advanced sensor technologies that enable new monitoring capabilities. These innovations are expanding the addressable market and creating new service opportunities.

Market consolidation activities including mergers and acquisitions are creating larger, more capable service providers with expanded geographical coverage and enhanced service capabilities. This consolidation trend is driven by the need for scale advantages and comprehensive service offerings that meet the complex requirements of major oil and gas operations.

Investment increases in drone service capabilities by both service providers and oil and gas companies demonstrate growing confidence in the technology’s long-term value proposition. These investments are funding technology development, operational expansion, and workforce development initiatives that support market growth.

MarkWide Research analysis indicates that companies seeking to maximize value from drone services should focus on comprehensive integration strategies that combine drone capabilities with existing operational systems. This integration approach enables companies to leverage drone-collected data for broader operational optimization rather than treating drone services as standalone solutions.

Regulatory compliance should remain a primary focus for both service providers and end users as regulatory frameworks continue to evolve across Latin American markets. Companies should invest in compliance expertise and maintain close relationships with regulatory authorities to ensure continued operational authorization and early awareness of regulatory changes.

Technology partnerships offer significant opportunities for companies to access advanced capabilities without substantial internal investment. Strategic partnerships with technology providers, service companies, and academic institutions can accelerate capability development and provide access to specialized expertise.

Workforce development initiatives should be prioritized to address the skills shortage in drone operations and data analysis capabilities. Companies should invest in training programs and certification processes to develop internal capabilities while working with educational institutions to develop broader industry expertise.

Data management strategies require careful consideration as drone services generate substantial amounts of operational data. Companies should develop comprehensive data management platforms that enable effective storage, analysis, and integration of drone-collected information with existing operational systems.

Risk management approaches should address both operational and cybersecurity risks associated with drone services. Comprehensive risk assessment and mitigation strategies should cover equipment reliability, data security, and operational continuity considerations.

Market expansion is expected to continue at a robust pace driven by increasing adoption across all segments of the oil and gas value chain. The market is projected to grow at approximately 14-16% annually over the next five years as companies recognize the operational and economic benefits of drone services. This growth will be supported by continued technology advancement and expanding regulatory acceptance.

Technology evolution will continue to expand the capabilities and applications of drone services in oil and gas operations. Advances in artificial intelligence, sensor technology, and autonomous systems will enable new service offerings while improving the efficiency and effectiveness of existing applications. These technological improvements will drive market expansion by making drone services accessible to a broader range of operations.

Geographic expansion across Latin America will create new market opportunities as regulatory frameworks mature and infrastructure development accelerates. Countries with emerging oil and gas sectors will present significant growth opportunities for drone service providers capable of adapting their offerings to local requirements and regulatory environments.

Service integration trends will continue as drone services become components of comprehensive digital transformation initiatives. The integration of drone services with broader technology platforms will create more valuable and differentiated service offerings while improving operational efficiency for end users.

Competitive dynamics will evolve as the market matures with increasing emphasis on specialized capabilities, operational reliability, and comprehensive service offerings. Companies that can demonstrate clear value propositions and operational excellence will be best positioned for long-term success in this growing market.

Regulatory development will continue to support market growth through harmonized standards and streamlined approval processes. Progressive regulatory frameworks will facilitate cross-border operations and encourage continued investment in advanced drone technologies and services.

The Latin America oil and gas drone services market represents a dynamic and rapidly expanding sector that is fundamentally transforming how energy companies approach operational monitoring, maintenance, and compliance activities. The market’s strong growth trajectory, supported by compelling operational benefits and progressive regulatory frameworks, positions drone services as essential tools for modern oil and gas operations across the region.

Key success factors for market participants include comprehensive service capabilities, regulatory compliance expertise, technology innovation, and deep understanding of oil and gas operational requirements. Companies that can effectively combine these elements while maintaining operational reliability and cost competitiveness will be best positioned to capitalize on the substantial growth opportunities in this evolving market.

Future market development will be characterized by continued technology advancement, expanding applications, and increasing integration with broader digital transformation initiatives. The market’s evolution from specialized inspection services to comprehensive operational support platforms demonstrates the growing strategic importance of drone services in modern energy operations. As the Latin America oil and gas drone services market continues to mature, it will play an increasingly critical role in supporting the region’s energy sector efficiency, safety, and environmental stewardship objectives.

What is Oil & Gas Drone Services?

Oil & Gas Drone Services refer to the use of unmanned aerial vehicles (UAVs) to support various operations in the oil and gas sector, including surveying, inspection, and monitoring of infrastructure and environmental conditions.

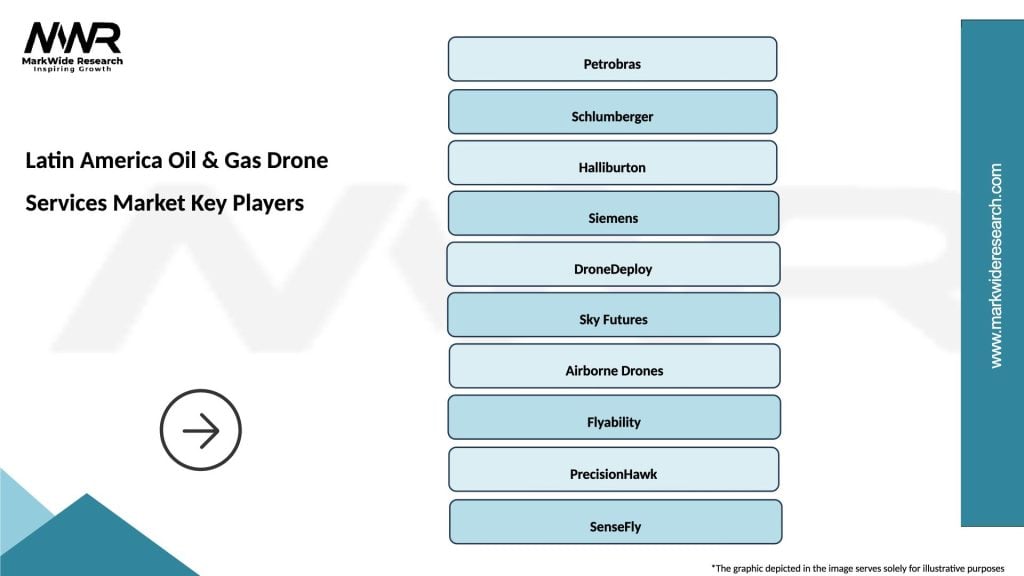

What are the key players in the Latin America Oil & Gas Drone Services Market?

Key players in the Latin America Oil & Gas Drone Services Market include companies like Sky-Futures, DroneDeploy, and Aerial Services, among others.

What are the main drivers of growth in the Latin America Oil & Gas Drone Services Market?

The main drivers of growth in the Latin America Oil & Gas Drone Services Market include the increasing demand for efficient monitoring solutions, advancements in drone technology, and the need for cost-effective inspection methods in remote areas.

What challenges does the Latin America Oil & Gas Drone Services Market face?

Challenges in the Latin America Oil & Gas Drone Services Market include regulatory hurdles, limited infrastructure in certain regions, and concerns regarding data security and privacy.

What opportunities exist in the Latin America Oil & Gas Drone Services Market?

Opportunities in the Latin America Oil & Gas Drone Services Market include the potential for expanding applications in environmental monitoring, pipeline inspections, and emergency response operations, driven by increasing investments in the energy sector.

What trends are shaping the Latin America Oil & Gas Drone Services Market?

Trends shaping the Latin America Oil & Gas Drone Services Market include the integration of artificial intelligence for data analysis, the use of drones for real-time monitoring, and the growing emphasis on sustainability and environmental compliance.

Latin America Oil & Gas Drone Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Inspection, Surveying, Mapping, Monitoring |

| Technology | Fixed-Wing, Multi-Rotor, Hybrid, VTOL |

| End User | Exploration Companies, Production Firms, Service Providers, Regulatory Bodies |

| Application | Environmental Assessment, Asset Management, Emergency Response, Infrastructure Inspection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Oil & Gas Drone Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at