444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Latin America neo banking market is witnessing remarkable growth and transforming the financial services landscape across the region. Neo banks, also known as digital banks or challenger banks, leverage technology and innovation to provide seamless, customer-centric banking experiences. By offering a range of services through digital platforms, neo banks are challenging traditional banking models and attracting a growing customer base.

Meaning

Neo banking refers to a new breed of financial institutions that operate exclusively online, without physical branch networks. These digital-first banks aim to simplify banking processes, enhance accessibility, and deliver personalized services to customers. With user-friendly interfaces, advanced mobile apps, and round-the-clock customer support, neo banks are reshaping the way people manage their finances.

Executive Summary

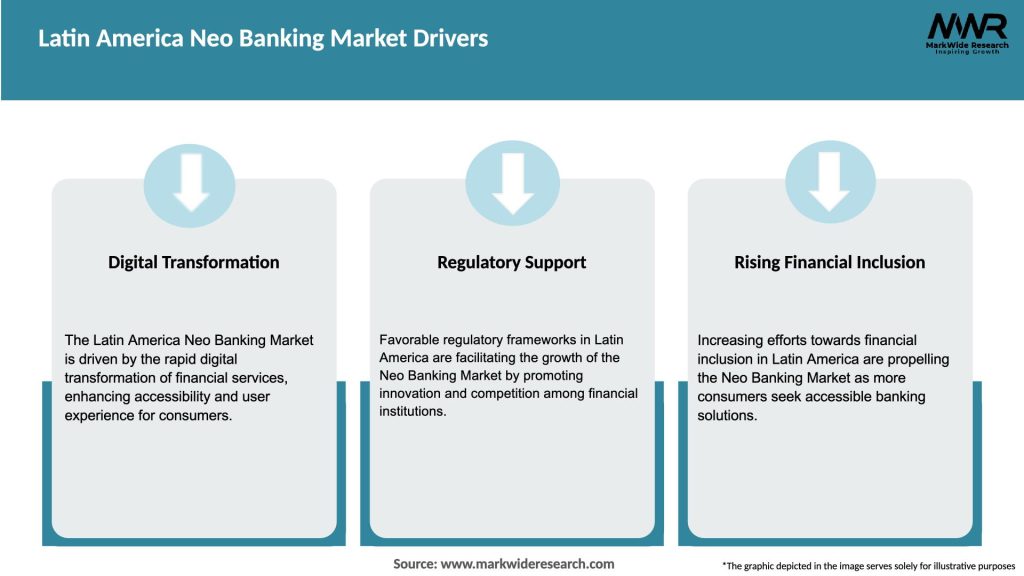

The Latin America neo banking market has experienced significant growth in recent years, driven by increasing smartphone penetration, rising internet usage, and the demand for convenient banking solutions. These digital disruptors are capturing market share by offering features such as instant account opening, budgeting tools, real-time transaction tracking, and competitive interest rates. As a result, traditional banks are facing stiff competition and are compelled to innovate to retain their customer base.

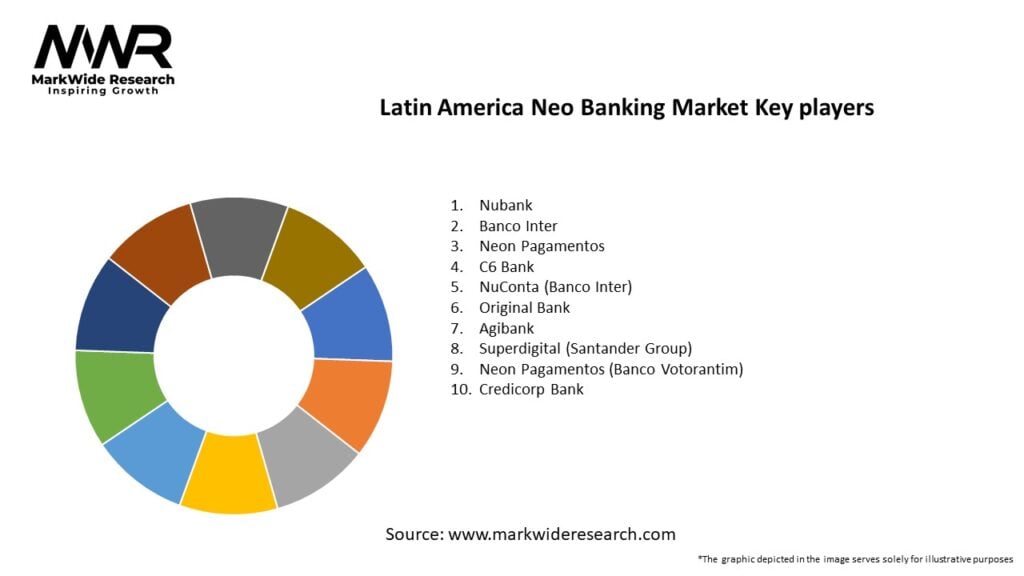

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Dynamics

The Latin America neo banking market is characterized by intense competition, technological advancements, and evolving customer expectations. Key market dynamics include:

Regional Analysis

The Latin America neo banking market is experiencing robust growth across the region, with countries such as Brazil, Mexico, Colombia, and Argentina emerging as key players in the digital banking space. Brazil, with its large population and tech-savvy consumers, holds the largest market share. Mexico and Colombia are also witnessing significant growth, driven by favorable regulatory environments and partnerships between neo banks and established financial institutions.

Competitive Landscape

Leading Companies in the Latin America Neo Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Latin America neo banking market can be segmented based on various factors such as service offerings, target customer segments, and geographical presence. Service offerings may include digital-only accounts, payments and remittances, lending services, investment platforms, and personal finance management tools. Target customer segments range from tech-savvy millennials to small and medium-sized enterprises (SMEs) seeking simplified banking solutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of digital banking solutions, including neo banks, across Latin America. Lockdowns and social distancing measures forced customers to rely on digital channels for their banking needs, driving increased demand for contactless payments, remote account management, and online financial services. Neo banks, with their agile digital infrastructure, were able to quickly adapt to the changing circumstances and cater to customers’ evolving requirements.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Latin America neo banking market is poised for substantial growth in the coming years. With increasing smartphone penetration, expanding internet connectivity, and a favorable regulatory environment, the adoption of digital banking solutions is expected to rise. Neo banks will continue to disrupt the traditional banking landscape, catering to the evolving needs of tech-savvy customers, fostering financial inclusion, and driving the transformation of the financial services industry.

Conclusion

The Latin America neo banking market is revolutionizing the way people manage their finances. By leveraging technology and customer-centric approaches, neo banks are offering convenient, accessible, and personalized banking experiences. While facing challenges related to trust, regulation, and cybersecurity, neo banks have demonstrated their potential to reshape the financial services industry and drive financial inclusion. As the market continues to evolve, strategic partnerships, innovation, and a relentless focus on customer experience will be vital for neo banks to thrive in the dynamic Latin American market.

What is Neo Banking?

Neo Banking refers to digital-only banks that operate without physical branches, offering services such as online accounts, payment solutions, and financial management tools. These banks leverage technology to provide a seamless banking experience to consumers and businesses.

What are the key players in the Latin America Neo Banking Market?

Key players in the Latin America Neo Banking Market include Nubank, Banco Inter, and C6 Bank, which are known for their innovative digital banking solutions and customer-centric services. These companies are reshaping the financial landscape in the region, among others.

What are the growth factors driving the Latin America Neo Banking Market?

The growth of the Latin America Neo Banking Market is driven by increasing smartphone penetration, a growing preference for digital financial services, and the need for financial inclusion among unbanked populations. Additionally, the rise of fintech innovations is enhancing customer engagement.

What challenges does the Latin America Neo Banking Market face?

The Latin America Neo Banking Market faces challenges such as regulatory compliance, cybersecurity threats, and competition from traditional banks. These factors can hinder the growth and adoption of neo banking services in the region.

What opportunities exist in the Latin America Neo Banking Market?

Opportunities in the Latin America Neo Banking Market include expanding services to underserved populations, integrating advanced technologies like AI for personalized banking experiences, and partnerships with e-commerce platforms to enhance customer reach.

What trends are shaping the Latin America Neo Banking Market?

Trends shaping the Latin America Neo Banking Market include the rise of mobile-first banking solutions, increased focus on user experience, and the adoption of blockchain technology for secure transactions. These trends are influencing how consumers interact with financial services.

Latin America Neo Banking Market

| Segmentation Details | Description |

|---|---|

| Service Type | Digital Wallets, Payment Processing, Personal Finance Management, Investment Services |

| Customer Type | Millennials, Small Businesses, Freelancers, Tech-Savvy Users |

| Deployment | Cloud-Based, Mobile-First, API-Driven, On-Premises |

| End User | Retail Customers, Corporates, Startups, Non-Profit Organizations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Latin America Neo Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at