444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America motorcycle loan market represents a dynamic and rapidly evolving financial services sector that plays a crucial role in enhancing mobility and economic opportunities across the region. This specialized lending market caters to the growing demand for two-wheeler financing solutions, driven by urbanization trends, traffic congestion challenges, and the increasing popularity of motorcycles as cost-effective transportation alternatives. The market encompasses various financing products including traditional installment loans, lease-to-own arrangements, and innovative digital lending platforms specifically designed for motorcycle purchases.

Market dynamics in Latin America reflect unique regional characteristics, with countries like Brazil, Mexico, Colombia, and Argentina leading in terms of loan origination volumes and market sophistication. The sector has experienced robust growth, with financing penetration rates reaching 42% of total motorcycle sales across major markets. Digital transformation has emerged as a key catalyst, enabling financial institutions to streamline approval processes and expand access to previously underserved customer segments.

Economic factors significantly influence market performance, including interest rate fluctuations, currency stability, and employment levels. The market serves diverse customer segments, from individual consumers seeking personal transportation to commercial users requiring delivery vehicles for e-commerce and food service applications. Regulatory frameworks vary across countries, creating both opportunities and challenges for lenders operating in multiple jurisdictions within the region.

The Latin America motorcycle loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate motorcycle purchases through various lending mechanisms across Latin American countries. This market encompasses traditional banking institutions, specialized automotive finance companies, motorcycle dealership financing programs, and emerging fintech platforms that provide credit solutions specifically tailored for two-wheeler acquisitions.

Core components of this market include secured and unsecured loan products, varying repayment terms typically ranging from 12 to 60 months, competitive interest rate structures, and diverse collateral requirements. The market serves both individual consumers seeking personal mobility solutions and commercial entities requiring motorcycles for business operations, including delivery services, ride-sharing platforms, and small-scale transportation businesses.

Market participants include commercial banks, credit unions, automotive finance specialists, motorcycle manufacturers’ captive finance arms, and innovative digital lending platforms. These entities collaborate with motorcycle dealerships, independent brokers, and online marketplaces to deliver comprehensive financing solutions that meet diverse customer needs across different income segments and credit profiles throughout the Latin American region.

Strategic positioning of the Latin America motorcycle loan market demonstrates significant growth potential driven by expanding urban populations, increasing traffic congestion, and rising demand for affordable transportation alternatives. The market has evolved from traditional bank-dominated lending to include diverse financial service providers offering innovative digital solutions and flexible repayment structures tailored to regional economic conditions.

Key performance indicators reveal strong market momentum, with loan approval rates improving to 68% for qualified applicants and average processing times decreasing substantially through digital automation. The market benefits from favorable demographic trends, including a growing middle class, increased smartphone penetration, and expanding e-commerce activities that drive demand for delivery motorcycles.

Competitive landscape features established financial institutions competing alongside emerging fintech companies, creating a dynamic environment that promotes innovation in product offerings, customer experience, and risk assessment methodologies. Market leaders are investing heavily in technology infrastructure, data analytics capabilities, and strategic partnerships to capture market share in this expanding sector.

Future prospects indicate continued market expansion supported by economic recovery trends, infrastructure development initiatives, and evolving consumer preferences toward sustainable and cost-effective transportation solutions. The integration of artificial intelligence, machine learning, and alternative credit scoring models is expected to further enhance market accessibility and operational efficiency.

Market penetration analysis reveals significant opportunities for expansion, particularly in underserved rural and suburban markets where traditional banking services remain limited. The following key insights demonstrate the market’s current dynamics and future potential:

Market maturity varies significantly across countries, with established markets focusing on product sophistication while emerging markets prioritize access expansion and infrastructure development. These insights guide strategic decision-making for market participants seeking to optimize their competitive positioning.

Urbanization trends serve as the primary catalyst for motorcycle loan market expansion throughout Latin America. Rapid urban population growth creates increased demand for efficient, affordable transportation solutions that can navigate congested city streets and provide reliable mobility for work and personal activities. This demographic shift drives consistent demand for motorcycle financing across all major metropolitan areas.

Economic accessibility represents another crucial driver, as motorcycles offer significantly lower total ownership costs compared to automobiles while providing similar mobility benefits. The financing market enables consumers to spread purchase costs over manageable monthly payments, making motorcycle ownership accessible to broader income segments. Fuel efficiency advantages and reduced maintenance costs further enhance the value proposition for budget-conscious consumers.

E-commerce expansion and the growing gig economy create substantial demand for commercial motorcycle financing. Delivery services, ride-sharing platforms, and independent contractors increasingly rely on motorcycles for income generation, driving loan demand from business users. Digital platform growth has accelerated this trend, with many entrepreneurs entering delivery and transportation services.

Infrastructure challenges in many Latin American cities favor motorcycle adoption over traditional vehicles. Limited parking availability, traffic congestion, and inadequate public transportation systems make motorcycles attractive alternatives. Government initiatives promoting sustainable transportation and reduced emissions also support market growth through favorable policies and incentive programs.

Economic volatility poses significant challenges for the motorcycle loan market across Latin America. Currency fluctuations, inflation pressures, and periodic economic downturns affect consumer purchasing power and lender risk appetite. These macroeconomic factors create uncertainty in loan pricing, approval criteria, and overall market stability, particularly impacting longer-term financing arrangements.

Credit risk concerns remain a persistent challenge, especially in markets with limited credit history data and informal employment patterns. Many potential borrowers lack traditional credit profiles, making risk assessment difficult and expensive for lenders. Default rates can be elevated during economic stress periods, leading to tighter lending standards and reduced market accessibility.

Regulatory complexity across different countries creates operational challenges for regional lenders. Varying interest rate caps, consumer protection requirements, and licensing obligations increase compliance costs and limit market entry for some financial service providers. Regulatory changes can also disrupt established business models and require significant operational adjustments.

Security concerns related to motorcycle theft and personal safety impact both consumer demand and lender risk calculations. High crime rates in certain areas affect insurance costs and loan terms, while safety perceptions may limit market adoption among some demographic segments. Infrastructure limitations including poor road conditions and inadequate traffic management systems also constrain market growth potential.

Digital innovation presents substantial opportunities for market expansion and operational efficiency improvements. Advanced mobile applications, artificial intelligence-powered credit scoring, and blockchain-based documentation systems can streamline loan processes while expanding access to underserved populations. Fintech partnerships enable traditional lenders to leverage cutting-edge technology without significant internal development investments.

Financial inclusion initiatives create opportunities to serve previously excluded customer segments through alternative credit assessment methods and flexible product structures. Government programs promoting financial access, combined with innovative lending approaches, can unlock significant market potential in rural and low-income urban areas. Microfinance integration offers pathways to serve small-scale entrepreneurs and informal sector workers.

Sustainable transportation trends align with growing environmental consciousness and government sustainability initiatives. Electric motorcycle financing represents an emerging opportunity as battery technology improves and charging infrastructure expands. Green financing programs may offer preferential terms for environmentally friendly vehicle purchases, creating competitive advantages for forward-thinking lenders.

Cross-border expansion opportunities exist for successful market players to leverage proven business models across multiple Latin American countries. Regional economic integration and standardization efforts may facilitate multi-country operations while diversifying risk exposure. Strategic acquisitions and partnerships can accelerate market entry and scale development in new territories.

Competitive intensity continues to increase as traditional financial institutions face challenges from innovative fintech companies and specialized automotive finance providers. This competition drives product innovation, improved customer service, and more competitive pricing structures. Market consolidation trends are emerging as larger players acquire smaller competitors to achieve scale advantages and expand geographic coverage.

Technology adoption rates vary significantly across market segments and geographic regions, creating both opportunities and challenges for service providers. While urban, younger demographics embrace digital solutions rapidly, traditional customer segments may require hybrid service models combining digital efficiency with personal interaction. Data analytics capabilities are becoming crucial competitive differentiators for risk assessment and customer acquisition.

Regulatory evolution continues to shape market dynamics through consumer protection enhancements, interest rate regulations, and financial inclusion mandates. Lenders must balance compliance requirements with profitability objectives while adapting to changing regulatory environments. Industry standards are gradually emerging through regulatory guidance and best practice adoption across leading market participants.

Economic cycles significantly influence market performance, with growth periods driving expansion and downturns requiring defensive strategies. Successful market participants develop flexible business models capable of adapting to changing economic conditions while maintaining service quality and risk management standards. Diversification strategies across customer segments and geographic markets help mitigate cyclical risks.

Comprehensive analysis of the Latin America motorcycle loan market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive surveys of market participants, including lenders, borrowers, dealers, and industry experts across major Latin American countries. Quantitative data collection focuses on loan volumes, interest rates, approval rates, and market share information from participating financial institutions.

Secondary research incorporates analysis of regulatory filings, industry reports, economic indicators, and market statistics from government agencies and industry associations. MarkWide Research utilizes proprietary databases and analytical frameworks to identify trends, patterns, and market dynamics across different countries and customer segments within the region.

Qualitative insights are gathered through in-depth interviews with industry executives, regulatory officials, and market analysts to understand strategic perspectives and future outlook considerations. Focus groups with consumers provide valuable insights into purchasing behavior, financing preferences, and satisfaction levels with existing market offerings.

Data validation processes ensure information accuracy through cross-referencing multiple sources and statistical verification methods. Market modeling techniques incorporate economic indicators, demographic trends, and industry-specific factors to project future market development scenarios and identify key growth opportunities for stakeholders.

Brazil dominates the Latin America motorcycle loan market, accounting for approximately 45% of regional loan originations due to its large population, established financial services infrastructure, and strong motorcycle adoption rates. The Brazilian market features sophisticated product offerings, competitive interest rates, and extensive dealer financing networks. Regulatory stability and mature banking systems support consistent market growth and innovation.

Mexico represents the second-largest market with significant growth potential driven by urbanization, cross-border trade activities, and expanding e-commerce sectors. Mexican lenders are increasingly adopting digital technologies to improve customer experience and operational efficiency. NAFTA relationships and manufacturing presence create unique opportunities for commercial motorcycle financing.

Colombia and Argentina demonstrate strong market development with growing middle-class populations and increasing motorcycle adoption rates. These markets benefit from improving economic stability and expanding financial inclusion initiatives. Regional banks and international financial institutions are investing in market expansion and product development to capture growth opportunities.

Smaller markets including Chile, Peru, and Central American countries show higher growth rates despite smaller absolute volumes. These markets offer significant untapped potential for lenders willing to invest in market development and customer education. Cross-border expansion strategies are becoming more common as successful lenders seek to replicate proven business models across multiple countries.

Market leadership is distributed among several categories of financial service providers, each bringing unique strengths and competitive advantages to the motorcycle loan market. The competitive environment continues to evolve as traditional players adapt to digital transformation while new entrants introduce innovative business models.

Competitive strategies focus on digital transformation, customer experience enhancement, and strategic partnerships with motorcycle manufacturers and dealers. Market leaders are investing in data analytics, artificial intelligence, and mobile technologies to improve operational efficiency and customer acquisition capabilities.

By Loan Type: The market segments into secured loans using the motorcycle as collateral, unsecured personal loans for motorcycle purchases, and lease-to-own arrangements. Secured loans dominate with approximately 72% market share due to lower interest rates and extended repayment terms, while unsecured options serve customers with limited collateral or preference for faster approval processes.

By Customer Segment: Individual consumers represent the largest segment, followed by commercial users including delivery services, ride-sharing drivers, and small business operators. Commercial lending is experiencing rapid growth due to e-commerce expansion and gig economy development, with specialized products designed for income-generating motorcycle use.

By Loan Term: Financing terms typically range from 12 to 60 months, with 24-36 month terms being most popular among consumers seeking balance between affordable payments and total interest costs. Extended terms are increasingly available for higher-value motorcycles and commercial applications requiring lower monthly payments.

By Distribution Channel: Dealer financing remains the dominant channel, complemented by direct bank lending, online platforms, and broker networks. Digital channels are gaining market share rapidly, particularly among younger demographics comfortable with online financial services and mobile applications for loan management.

Personal Transportation Loans constitute the largest category, serving individual consumers seeking reliable, affordable mobility solutions for commuting and personal use. This segment benefits from standardized underwriting processes, competitive interest rates, and extensive dealer partnerships. Customer loyalty programs and repeat purchase incentives are common features in this mature market segment.

Commercial Vehicle Financing represents the fastest-growing category, driven by e-commerce expansion and delivery service demand. Lenders are developing specialized products with flexible repayment structures aligned to seasonal business patterns and income variability. Fleet financing options serve larger commercial customers requiring multiple motorcycles for business operations.

Premium Motorcycle Loans cater to higher-income consumers purchasing expensive motorcycles for recreational and lifestyle purposes. This segment features longer repayment terms, lower down payment requirements, and additional services such as extended warranties and insurance packages. Relationship banking approaches are common for high-value customers.

Entry-Level Financing serves first-time motorcycle buyers and price-sensitive consumers with simplified application processes and flexible qualification criteria. This category often incorporates financial education components and graduated payment structures to support customer success. Government partnerships may provide additional support for financial inclusion objectives.

Financial Institutions benefit from diversified loan portfolios, attractive interest margins, and growing customer bases in expanding markets. Motorcycle loans typically offer higher yields than traditional consumer loans while maintaining manageable risk profiles through collateral security. Cross-selling opportunities for insurance, maintenance financing, and other financial products enhance customer lifetime value.

Motorcycle Manufacturers gain increased sales volumes through accessible financing options that expand their addressable markets. Captive finance arms provide competitive advantages in dealer relationships and customer acquisition. Brand loyalty programs integrated with financing solutions create stronger customer relationships and repeat purchase opportunities.

Dealers and Retailers benefit from increased sales conversion rates, higher average transaction values, and improved customer satisfaction through comprehensive financing solutions. Commission income from loan originations provides additional revenue streams while financing availability reduces sales cycle times and inventory turnover periods.

Consumers access affordable transportation solutions through manageable monthly payments, competitive interest rates, and flexible repayment terms. Credit building opportunities help establish or improve credit histories while motorcycle ownership provides mobility, employment opportunities, and lifestyle benefits that may not otherwise be accessible.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Lending has emerged as a dominant trend, with lenders investing heavily in mobile applications, online platforms, and automated underwriting systems. Customer expectations for instant approvals and seamless digital experiences are driving rapid technology adoption across the industry. Artificial intelligence and machine learning applications are improving credit decisions while reducing operational costs.

Alternative Credit Scoring is revolutionizing risk assessment through incorporation of non-traditional data sources including mobile phone usage, utility payments, and social media activity. This trend enables lenders to serve previously excluded customer segments while maintaining acceptable risk levels. Financial inclusion initiatives benefit significantly from these technological advances.

Flexible Product Structures are becoming standard offerings, with lenders providing seasonal payment options, income-based repayment schedules, and customizable loan terms. Commercial borrowers particularly benefit from products aligned to business cash flow patterns and seasonal demand variations in delivery and transportation services.

Ecosystem Integration involves deeper partnerships between lenders, manufacturers, dealers, and service providers to create comprehensive customer solutions. Value-added services including insurance, maintenance financing, and loyalty programs are increasingly bundled with loan products to enhance customer relationships and competitive differentiation.

Regulatory modernization efforts across Latin American countries are creating more standardized frameworks for consumer lending while promoting financial inclusion objectives. Recent developments include interest rate cap adjustments, digital lending guidelines, and enhanced consumer protection requirements. Open banking initiatives in several countries are facilitating data sharing and improving credit assessment capabilities.

Strategic partnerships between traditional banks and fintech companies are accelerating digital transformation and market expansion. Major announcements include joint ventures for motorcycle lending platforms, technology licensing agreements, and acquisition activities targeting innovative lending companies. Cross-border collaborations are enabling regional expansion strategies.

Product innovation continues with introduction of electric motorcycle financing programs, subscription-based ownership models, and integrated mobility solutions. Several lenders have launched specialized products for gig economy workers with flexible repayment structures aligned to income patterns. Insurance integration and comprehensive protection packages are becoming standard offerings.

Market expansion activities include new market entries, branch network expansions, and digital platform launches across multiple countries. International financial institutions are increasing their Latin American presence while regional players are expanding beyond their home markets. Investment flows into fintech companies and digital lending platforms continue to accelerate market development.

MarkWide Research recommends that market participants prioritize digital transformation initiatives to remain competitive in the evolving landscape. Investment in mobile-first platforms, artificial intelligence capabilities, and data analytics infrastructure will be crucial for long-term success. Customer experience optimization should focus on reducing application processing times while maintaining thorough risk assessment standards.

Risk management enhancement through alternative credit scoring models and real-time monitoring systems can improve portfolio performance while expanding market access. Lenders should develop comprehensive strategies for serving underbanked populations through innovative product structures and flexible qualification criteria. Partnership strategies with motorcycle manufacturers and dealers remain essential for market penetration and customer acquisition.

Geographic diversification across multiple Latin American markets can reduce concentration risk while capturing growth opportunities in emerging markets. Successful business models should be adapted to local market conditions, regulatory requirements, and customer preferences. Regulatory compliance capabilities must be strengthened to navigate complex multi-country operating environments.

Sustainability initiatives including electric motorcycle financing and environmental impact programs can create competitive advantages while aligning with government policy objectives. Financial inclusion programs supported by technology innovation and alternative credit assessment methods represent significant long-term growth opportunities for forward-thinking market participants.

Market expansion is expected to continue driven by urbanization trends, economic development, and increasing motorcycle adoption across Latin America. The integration of advanced technologies including artificial intelligence, blockchain, and mobile platforms will further enhance operational efficiency and customer accessibility. Growth projections indicate sustained expansion with annual growth rates potentially reaching 8-12% across major markets over the next five years.

Digital transformation will accelerate as customer preferences shift toward online and mobile-first financial services. Traditional lenders must adapt quickly to remain competitive against innovative fintech companies offering superior digital experiences. Automation capabilities will become essential for cost management and scalability in expanding markets.

Regulatory evolution is expected to continue promoting financial inclusion while enhancing consumer protection standards. Harmonization efforts across countries may facilitate regional expansion strategies and reduce operational complexity for multi-country lenders. Open banking implementations will create new opportunities for data-driven lending solutions.

Market consolidation trends may accelerate as larger players acquire smaller competitors to achieve scale advantages and expand geographic coverage. MWR analysis suggests that successful market participants will be those that effectively combine technological innovation with deep understanding of local market conditions and customer needs across diverse Latin American economies.

The Latin America motorcycle loan market presents compelling opportunities for growth and innovation as urbanization, economic development, and technological advancement converge to create favorable market conditions. The sector’s evolution from traditional bank-dominated lending to a diverse ecosystem including fintech companies, specialized finance providers, and integrated manufacturer solutions demonstrates the dynamic nature of this expanding market.

Key success factors for market participants include digital transformation capabilities, innovative risk assessment methodologies, strategic partnerships, and deep understanding of local market conditions across diverse Latin American countries. The integration of technology, customer-centric product design, and comprehensive service offerings will differentiate successful players in an increasingly competitive environment.

Future market development will be shaped by continued urbanization, e-commerce expansion, regulatory modernization, and evolving consumer preferences toward sustainable and affordable transportation solutions. Financial institutions that effectively balance innovation with risk management while serving diverse customer segments across multiple markets will be best positioned to capture the significant growth opportunities ahead in this dynamic and expanding sector.

What is Latin America Motorcycle Loan?

Latin America Motorcycle Loan refers to financial products specifically designed to help consumers purchase motorcycles in Latin America. These loans typically cover a portion of the motorcycle’s cost and are repaid over a set period with interest.

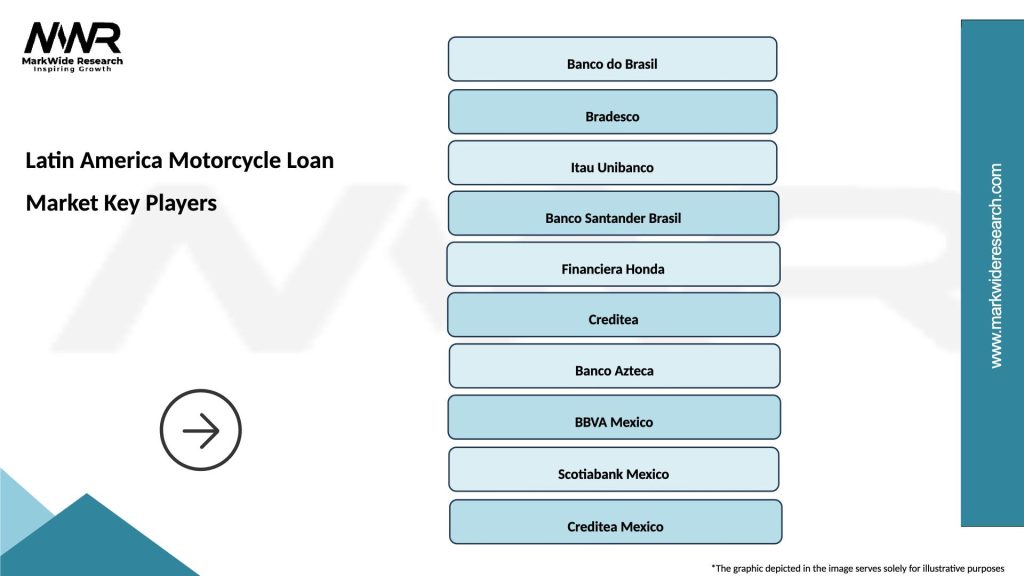

What are the key players in the Latin America Motorcycle Loan Market?

Key players in the Latin America Motorcycle Loan Market include Banco do Brasil, Santander, and Banco Nacional de México, among others. These institutions offer various financing options tailored to motorcycle buyers.

What are the main drivers of growth in the Latin America Motorcycle Loan Market?

The main drivers of growth in the Latin America Motorcycle Loan Market include increasing urbanization, rising disposable incomes, and the growing popularity of motorcycles as a cost-effective mode of transportation.

What challenges does the Latin America Motorcycle Loan Market face?

Challenges in the Latin America Motorcycle Loan Market include high-interest rates, economic instability, and regulatory hurdles that can affect loan accessibility for consumers.

What opportunities exist in the Latin America Motorcycle Loan Market?

Opportunities in the Latin America Motorcycle Loan Market include the expansion of digital lending platforms, increasing demand for electric motorcycles, and potential partnerships with motorcycle manufacturers to offer financing solutions.

What trends are shaping the Latin America Motorcycle Loan Market?

Trends shaping the Latin America Motorcycle Loan Market include the rise of online loan applications, the integration of technology in loan processing, and a growing focus on sustainable transportation options.

Latin America Motorcycle Loan Market

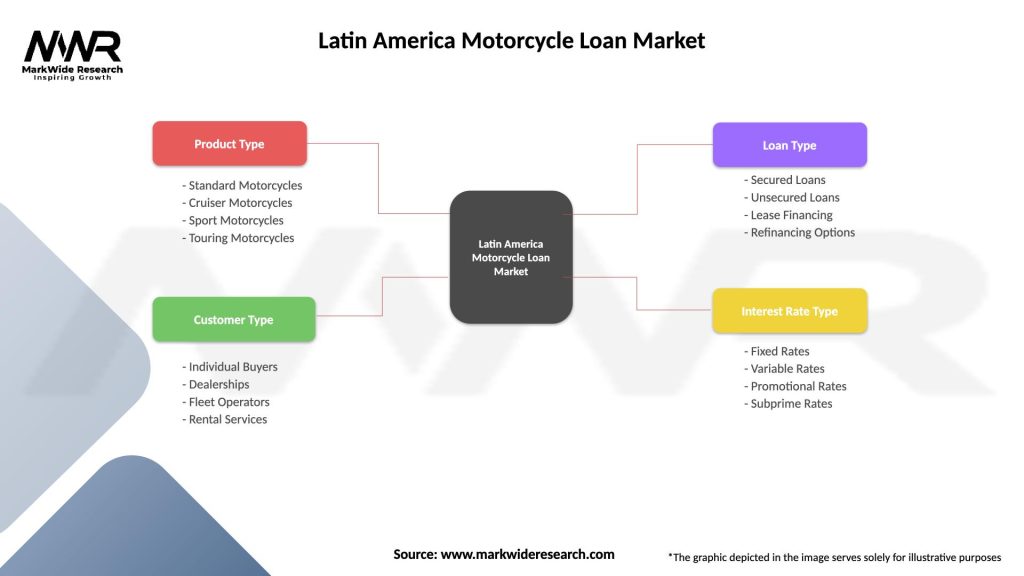

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Motorcycles, Cruiser Motorcycles, Sport Motorcycles, Touring Motorcycles |

| Customer Type | Individual Buyers, Dealerships, Fleet Operators, Rental Services |

| Loan Type | Secured Loans, Unsecured Loans, Lease Financing, Refinancing Options |

| Interest Rate Type | Fixed Rates, Variable Rates, Promotional Rates, Subprime Rates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Motorcycle Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at