444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America military surveillance drone market represents a rapidly evolving sector within the region’s defense modernization initiatives. Military surveillance drones have become increasingly critical for border security, counter-narcotics operations, and territorial monitoring across Latin American nations. The market demonstrates significant growth potential, driven by rising security concerns, technological advancements, and increasing defense budgets allocated to unmanned aerial systems.

Regional dynamics indicate that countries such as Brazil, Mexico, Colombia, and Argentina are leading the adoption of military surveillance drone technologies. The market is experiencing robust expansion with a projected CAGR of 8.5% through the forecast period, reflecting the growing recognition of drone capabilities in modern military operations. Defense modernization programs across the region are prioritizing unmanned systems to enhance surveillance capabilities while reducing operational risks to personnel.

Technological integration within Latin American military forces is accelerating, with emphasis on indigenous development capabilities and strategic partnerships with international drone manufacturers. The market encompasses various drone categories, from tactical surveillance units to strategic long-endurance platforms, each serving specific operational requirements within the region’s diverse security landscape.

The Latin America military surveillance drone market refers to the comprehensive ecosystem of unmanned aerial vehicles specifically designed and deployed for military reconnaissance, intelligence gathering, and surveillance operations across Latin American countries. These sophisticated systems integrate advanced sensors, communication technologies, and autonomous flight capabilities to provide real-time situational awareness for defense forces.

Military surveillance drones encompass a wide range of platforms, from small tactical units capable of short-range reconnaissance to large strategic systems designed for extended surveillance missions. The market includes the complete value chain of drone development, manufacturing, deployment, maintenance, and support services tailored to meet the specific operational requirements of Latin American military organizations.

Operational capabilities of these systems extend beyond traditional surveillance to include border monitoring, maritime patrol, counter-terrorism operations, and disaster response coordination. The market represents the convergence of aerospace technology, defense requirements, and regional security priorities, creating a dynamic environment for innovation and strategic partnerships.

Market dynamics in the Latin America military surveillance drone sector reflect a strategic shift toward advanced unmanned systems across the region’s defense establishments. The market is characterized by increasing adoption rates, with military drone utilization growing by approximately 12% annually as countries modernize their surveillance capabilities. Key market drivers include escalating security threats, border control requirements, and the need for cost-effective surveillance solutions.

Technology advancement remains a central theme, with Latin American countries investing in both imported systems and indigenous development programs. The market demonstrates strong growth potential, supported by favorable government policies and increasing defense budget allocations to unmanned aerial systems. Regional cooperation initiatives are fostering knowledge sharing and joint development projects, enhancing the overall market ecosystem.

Competitive landscape features a mix of international drone manufacturers and emerging regional players, creating opportunities for technology transfer and local production capabilities. The market’s evolution is closely tied to geopolitical developments, technological innovations, and the region’s commitment to enhancing military surveillance capabilities through advanced drone technologies.

Strategic insights reveal several critical factors shaping the Latin America military surveillance drone market landscape:

Market maturation is evident through the establishment of dedicated drone units within military organizations and the development of comprehensive operational doctrines. These insights highlight the market’s evolution from experimental technology adoption to strategic integration within defense planning frameworks.

Security imperatives represent the primary driving force behind military surveillance drone adoption across Latin America. Rising concerns about transnational crime, drug trafficking, and border security have created urgent demand for advanced surveillance capabilities. Military modernization programs prioritize unmanned systems as force multipliers that enhance operational effectiveness while reducing personnel exposure to dangerous situations.

Technological accessibility has significantly improved, making military-grade drone systems more attainable for Latin American defense forces. The proliferation of commercial drone technologies has accelerated military applications, creating cost-effective solutions that were previously prohibitively expensive. Government initiatives supporting defense industry development are fostering local manufacturing capabilities and reducing dependence on foreign suppliers.

Operational advantages of drone systems include extended flight endurance, reduced operational costs compared to manned aircraft, and enhanced safety for military personnel. The ability to conduct persistent surveillance over vast territories makes drones particularly valuable for countries with extensive borders and challenging terrain. International cooperation agreements are facilitating technology transfer and joint development programs, accelerating market growth through shared expertise and resources.

Financial constraints pose significant challenges for many Latin American countries seeking to modernize their military surveillance capabilities. Limited defense budgets require careful prioritization of procurement decisions, often delaying or reducing the scope of drone acquisition programs. Economic volatility in the region can impact long-term defense planning and investment commitments, creating uncertainty for market participants.

Technical complexity associated with advanced drone systems requires substantial investment in training, maintenance infrastructure, and support systems. The shortage of qualified technical personnel capable of operating and maintaining sophisticated surveillance drones creates operational bottlenecks. Regulatory frameworks governing military drone operations are still evolving, creating compliance challenges and operational restrictions.

Technology transfer restrictions imposed by some supplier countries limit access to advanced drone technologies and components. Export control regulations can complicate procurement processes and increase acquisition timelines. Infrastructure limitations in some regions may constrain drone deployment and operational effectiveness, requiring additional investments in supporting systems and facilities.

Indigenous development programs present substantial opportunities for local defense industries to establish drone manufacturing capabilities. Government initiatives supporting technology transfer and joint ventures with international partners create pathways for developing domestic expertise. Regional cooperation frameworks enable shared development costs and create larger market opportunities for specialized drone systems.

Dual-use applications expand market potential by enabling military surveillance drones to support civilian missions such as disaster response, environmental monitoring, and border patrol operations. This versatility increases the value proposition for government investments and creates additional revenue streams for manufacturers. Technology integration opportunities exist in combining artificial intelligence, advanced sensors, and communication systems to create next-generation surveillance platforms.

Export potential emerges as Latin American countries develop indigenous drone capabilities, creating opportunities to serve regional and international markets. The growing global demand for military surveillance drones positions successful regional manufacturers to expand beyond domestic markets. Service sector growth in maintenance, training, and operational support creates sustainable business opportunities throughout the drone lifecycle.

Competitive dynamics in the Latin America military surveillance drone market reflect a complex interplay between international suppliers and emerging regional capabilities. Established drone manufacturers are adapting their strategies to address specific regional requirements while competing with cost-effective local alternatives. Technology evolution continues to reshape market dynamics, with artificial intelligence and autonomous capabilities becoming increasingly important differentiators.

Supply chain considerations are influencing market structure as countries seek to reduce dependence on foreign suppliers through local production initiatives. The development of regional supply chains creates opportunities for component manufacturers and system integrators while enhancing supply security. Procurement patterns are evolving toward longer-term partnerships that include technology transfer and local production components.

Operational integration challenges are driving demand for comprehensive solutions that include training, maintenance, and support services alongside hardware procurement. The market is shifting toward outcome-based contracts that emphasize operational capability rather than simple equipment delivery. Innovation cycles are accelerating as military requirements drive rapid technological advancement and system upgrades.

Comprehensive analysis of the Latin America military surveillance drone market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with military procurement officials, defense industry executives, and technology providers to gather firsthand insights into market dynamics and trends. Secondary research encompasses analysis of government defense budgets, procurement announcements, and industry publications to validate market assessments.

Data collection processes include structured interviews with key stakeholders, analysis of public procurement records, and evaluation of technology demonstration programs across the region. Market sizing methodologies incorporate bottom-up analysis of individual country markets combined with top-down validation through regional defense spending patterns. Qualitative assessment techniques examine regulatory frameworks, policy developments, and strategic partnerships that influence market evolution.

Validation procedures ensure data accuracy through cross-referencing multiple sources and expert review processes. The methodology incorporates scenario analysis to account for various market development possibilities and risk factors. Continuous monitoring of market developments enables real-time updates to research findings and projections.

Brazil dominates the Latin America military surveillance drone market with approximately 35% market share, driven by extensive border security requirements and advanced defense industrial capabilities. The country’s investment in indigenous drone development programs and strategic partnerships with international manufacturers positions it as a regional leader. Mexico follows with significant market presence, focusing on border security and counter-narcotics operations that require sophisticated surveillance capabilities.

Colombia represents a rapidly growing market segment, with military drone adoption increasing by 15% annually as the country addresses internal security challenges and border monitoring requirements. The nation’s experience in counter-insurgency operations drives demand for tactical surveillance systems. Argentina and Chile demonstrate steady market growth, with emphasis on maritime surveillance and territorial monitoring applications.

Central American countries collectively represent an emerging market opportunity, with increasing recognition of drone capabilities for border security and anti-trafficking operations. Regional cooperation initiatives are facilitating shared procurement programs and joint training exercises, creating economies of scale for smaller markets. The Caribbean region shows growing interest in maritime surveillance applications, particularly for exclusive economic zone monitoring.

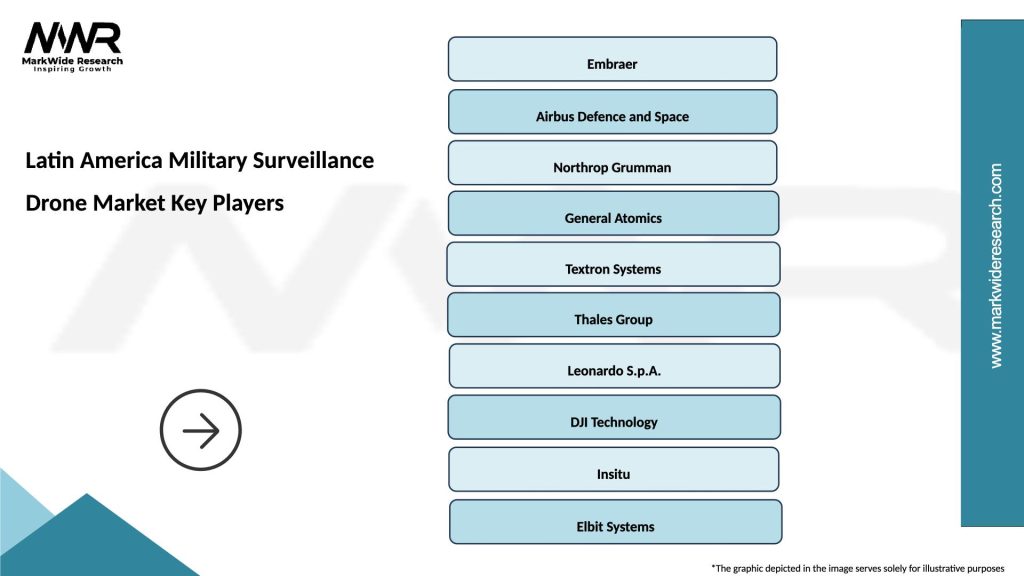

Market leadership in the Latin America military surveillance drone sector features a diverse mix of international and regional players:

Competitive strategies emphasize technology transfer, local production partnerships, and comprehensive support packages that address regional operational requirements. Market participants are increasingly focusing on long-term relationships that include training, maintenance, and upgrade services.

By Platform Type:

By Range Category:

By Application:

Fixed-wing platforms dominate the strategic surveillance segment, accounting for approximately 60% of procurement value due to their extended endurance capabilities and operational efficiency. These systems are particularly valuable for countries with extensive borders requiring persistent monitoring capabilities. Advanced sensor integration in fixed-wing platforms enables multi-mission flexibility and enhanced intelligence gathering capabilities.

Rotary-wing systems serve critical tactical roles in urban environments and confined operational areas where maneuverability is essential. The growing emphasis on counter-terrorism and urban security operations is driving demand for sophisticated rotary-wing surveillance platforms. Hybrid platforms represent an emerging category that combines the advantages of both fixed-wing and rotary-wing systems, offering operational flexibility for diverse mission requirements.

Long-range systems are experiencing the highest growth rates as countries prioritize strategic surveillance capabilities for border security and maritime patrol operations. The integration of artificial intelligence and autonomous flight capabilities is enhancing the effectiveness of long-range platforms while reducing operational costs. Medium-range platforms provide cost-effective solutions for regional surveillance requirements and represent the largest volume segment in the market.

Military organizations benefit from enhanced surveillance capabilities that provide persistent monitoring of critical areas while reducing risks to personnel. The cost-effectiveness of drone operations compared to manned aircraft enables more frequent surveillance missions within existing budget constraints. Operational flexibility allows military forces to adapt quickly to changing security threats and mission requirements.

Defense contractors gain access to growing market opportunities through technology transfer programs and local production partnerships. The development of indigenous capabilities creates sustainable business models and reduces dependence on foreign suppliers. Government stakeholders achieve improved border security and counter-narcotics effectiveness while supporting domestic defense industry development.

Technology providers benefit from long-term partnerships that include training, maintenance, and upgrade services throughout the system lifecycle. The growing market creates opportunities for specialized component suppliers and service providers. Regional cooperation initiatives enable smaller countries to access advanced surveillance capabilities through shared procurement and joint training programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming military surveillance drone capabilities, enabling autonomous target recognition and intelligent data analysis. The incorporation of machine learning algorithms enhances operational efficiency and reduces operator workload. Swarm technology development is creating opportunities for coordinated multi-drone operations that provide comprehensive area coverage and redundant surveillance capabilities.

Sensor miniaturization trends are enabling smaller platforms to carry sophisticated surveillance equipment previously limited to larger systems. Advanced electro-optical and infrared sensors provide enhanced imaging capabilities in challenging environmental conditions. Communication system improvements are extending operational ranges and enabling real-time data transmission to command centers.

Modular design approaches are becoming standard, allowing military organizations to customize drone configurations for specific mission requirements. The trend toward open architecture systems facilitates integration with existing military networks and equipment. Sustainability considerations are driving development of more efficient propulsion systems and environmentally friendly operational practices.

Strategic partnerships between international drone manufacturers and Latin American defense companies are accelerating technology transfer and local production capabilities. Recent agreements include comprehensive packages covering manufacturing, training, and long-term support services. Government initiatives supporting indigenous defense industry development are creating favorable conditions for domestic drone manufacturing.

Technology demonstrations and evaluation programs are becoming more frequent as military organizations assess various drone platforms for specific operational requirements. These programs often include extended trial periods and comprehensive performance evaluations. Regional cooperation agreements are facilitating joint procurement initiatives and shared training programs that reduce individual country costs.

Regulatory developments are establishing clearer frameworks for military drone operations while addressing safety and security concerns. New certification processes are streamlining procurement procedures and reducing acquisition timelines. Infrastructure investments in drone training facilities and maintenance centers are supporting market growth and operational capability development.

MarkWide Research analysis indicates that successful market participation requires comprehensive understanding of regional security priorities and procurement processes. Companies should focus on developing long-term partnerships that include technology transfer and local production components. Investment strategies should prioritize countries with stable defense budgets and clear modernization programs.

Technology positioning should emphasize dual-use capabilities that provide value beyond military applications, enhancing the return on investment for government stakeholders. Companies should develop modular solutions that can be customized for specific regional requirements while maintaining cost-effectiveness. Service capabilities including training, maintenance, and upgrade services are becoming increasingly important differentiators.

Market entry strategies should consider regional cooperation opportunities and joint venture possibilities with local partners. Understanding regulatory requirements and compliance frameworks is essential for successful market penetration. Long-term success depends on building sustainable relationships with military organizations and supporting their operational capability development objectives.

Market expansion is projected to continue at a robust pace, with military surveillance drone adoption expected to grow by 9.2% annually over the next five years. The increasing sophistication of regional security threats will drive demand for more advanced surveillance capabilities. Technology evolution will focus on autonomous operations, artificial intelligence integration, and enhanced sensor capabilities.

Indigenous development programs are expected to mature, creating regional manufacturing hubs and reducing dependence on foreign suppliers. The establishment of comprehensive supply chains will support sustainable market growth and technology advancement. Regional cooperation initiatives will expand, creating larger market opportunities and shared development costs.

MWR projections indicate that the market will become increasingly sophisticated, with emphasis on multi-mission platforms and integrated surveillance systems. The convergence of military and civilian applications will create new market segments and revenue opportunities. Investment patterns will shift toward comprehensive capability packages that include training, maintenance, and long-term support services alongside hardware procurement.

The Latin America military surveillance drone market represents a dynamic and rapidly evolving sector within the region’s defense modernization landscape. Strong growth drivers including security imperatives, technological advancement, and government support for indigenous development create substantial opportunities for market participants. The market’s evolution from experimental technology adoption to strategic integration within military operations demonstrates its maturity and long-term viability.

Regional diversity in security challenges and operational requirements creates multiple market segments and opportunities for specialized solutions. The emphasis on technology transfer and local production capabilities positions the market for sustainable growth while reducing foreign dependence. Competitive dynamics favor companies that can provide comprehensive solutions including training, maintenance, and long-term support services.

Future success in this market will depend on understanding regional priorities, building sustainable partnerships, and delivering cost-effective solutions that address specific operational requirements. The continued evolution of drone technology and increasing sophistication of military applications ensure ongoing market growth and innovation opportunities throughout the forecast period.

What is Military Surveillance Drone?

Military Surveillance Drones are unmanned aerial vehicles (UAVs) designed for reconnaissance and intelligence-gathering purposes in military operations. They are equipped with advanced sensors and cameras to monitor and collect data over vast areas.

What are the key players in the Latin America Military Surveillance Drone Market?

Key players in the Latin America Military Surveillance Drone Market include companies like Boeing, Northrop Grumman, and Elbit Systems, which are known for their advanced drone technologies and military applications, among others.

What are the growth factors driving the Latin America Military Surveillance Drone Market?

The growth of the Latin America Military Surveillance Drone Market is driven by increasing defense budgets, the need for enhanced surveillance capabilities, and the rising demand for border security and anti-terrorism operations.

What challenges does the Latin America Military Surveillance Drone Market face?

Challenges in the Latin America Military Surveillance Drone Market include regulatory hurdles, high development costs, and concerns regarding privacy and ethical implications of drone surveillance.

What opportunities exist in the Latin America Military Surveillance Drone Market?

Opportunities in the Latin America Military Surveillance Drone Market include advancements in drone technology, increasing partnerships between governments and private companies, and the potential for expanding applications in disaster management and environmental monitoring.

What trends are shaping the Latin America Military Surveillance Drone Market?

Trends in the Latin America Military Surveillance Drone Market include the integration of artificial intelligence for data analysis, the development of smaller and more efficient drones, and the growing use of drones for multi-domain operations.

Latin America Military Surveillance Drone Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Wing, Rotary-Wing, Hybrid, Nano |

| Technology | Electro-Optical, Infrared, Radar, Communication |

| End User | Defense Forces, Law Enforcement, Border Security, Private Contractors |

| Deployment | On-Premise, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Military Surveillance Drone Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at