444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America, Middle East and Africa automated guided vehicles market represents a rapidly evolving landscape of industrial automation and material handling solutions. This dynamic market encompasses sophisticated robotic systems designed to transport materials, products, and equipment within manufacturing facilities, warehouses, and distribution centers without human intervention. The region’s growing emphasis on operational efficiency and technological advancement has positioned automated guided vehicles (AGVs) as critical components in modern supply chain operations.

Market dynamics across these diverse regions reflect varying levels of industrial maturity and automation adoption. Latin America demonstrates strong growth potential driven by expanding manufacturing sectors, while the Middle East leverages substantial infrastructure investments to modernize logistics operations. Africa’s emerging industrial base presents significant opportunities for AGV implementation as companies seek to enhance productivity and reduce operational costs.

Regional adoption patterns indicate that the market is experiencing robust expansion, with growth rates reaching approximately 12.5% CAGR across key segments. This acceleration stems from increasing labor costs, growing emphasis on workplace safety, and the need for consistent, reliable material handling solutions. The integration of advanced technologies such as artificial intelligence, machine learning, and IoT connectivity has further enhanced the appeal of automated guided vehicles in these markets.

The automated guided vehicles market refers to the comprehensive ecosystem of self-navigating robotic systems designed to transport materials and products within industrial and commercial environments without direct human control. These sophisticated machines utilize various guidance technologies including magnetic tape, laser navigation, vision systems, and natural feature recognition to move efficiently through predetermined routes while avoiding obstacles and ensuring operational safety.

AGV systems encompass a wide range of vehicle types, from simple tugger vehicles that pull carts to complex unit load carriers capable of handling heavy machinery and equipment. The technology integrates advanced sensors, control software, and communication systems to create seamless material handling solutions that operate continuously with minimal human intervention. Modern automated guided vehicles can adapt to changing environments, optimize routes in real-time, and integrate with existing warehouse management systems and enterprise resource planning platforms.

Strategic market positioning across Latin America, Middle East, and Africa reveals significant growth opportunities driven by industrial modernization initiatives and increasing automation adoption. The market demonstrates strong momentum as organizations recognize the transformative potential of automated guided vehicles in optimizing operational efficiency and reducing long-term costs.

Key growth drivers include expanding e-commerce operations, rising labor costs, and growing emphasis on workplace safety standards. Manufacturing sectors in Brazil, Mexico, UAE, and South Africa are leading adoption efforts, with automotive, food and beverage, and pharmaceutical industries showing particularly strong demand for AGV solutions. The market benefits from approximately 68% efficiency improvement in material handling operations compared to traditional manual methods.

Technology advancement continues to shape market evolution, with artificial intelligence and machine learning capabilities enabling more sophisticated navigation and decision-making processes. The integration of Industry 4.0 principles has accelerated demand for connected, intelligent automated guided vehicles that can seamlessly integrate with broader manufacturing execution systems and provide real-time operational insights.

Market penetration analysis reveals several critical insights that define the current landscape and future trajectory of automated guided vehicles across these regions:

Labor market dynamics serve as a primary catalyst for automated guided vehicles adoption across Latin America, Middle East, and Africa. Rising wage costs, particularly in skilled manufacturing positions, have made automation investments increasingly attractive. Organizations face challenges in recruiting and retaining qualified material handling personnel, making AGV systems a strategic solution for maintaining operational continuity.

Operational efficiency demands continue to drive market expansion as companies seek to optimize throughput and reduce operational bottlenecks. Automated guided vehicles provide consistent performance levels that eliminate variability associated with human operators, enabling organizations to achieve predictable production schedules and delivery commitments. The technology’s ability to operate continuously without breaks or shift changes provides significant competitive advantages.

Safety regulatory compliance requirements increasingly favor automation solutions that minimize human exposure to potentially hazardous environments. AGV implementation helps organizations meet stringent workplace safety standards while reducing insurance costs and liability exposure. The technology’s built-in safety features, including obstacle detection and emergency stop capabilities, provide comprehensive protection for both personnel and equipment.

Digital transformation initiatives across industries have created demand for connected, intelligent material handling solutions. Automated guided vehicles equipped with IoT sensors and data analytics capabilities provide valuable operational insights that support continuous improvement efforts and predictive maintenance strategies.

Capital investment requirements represent a significant barrier to automated guided vehicles adoption, particularly for small and medium-sized enterprises across these regions. The initial costs associated with AGV systems, including vehicles, infrastructure modifications, and integration services, can be substantial. Organizations must carefully evaluate return on investment calculations and may require extended payback periods to justify automation investments.

Technical complexity challenges associated with AGV implementation can deter organizations lacking internal technical expertise. The integration of automated systems with existing warehouse management systems, enterprise resource planning platforms, and manufacturing execution systems requires specialized knowledge and careful planning. Organizations may need to invest in additional training or external consulting services to ensure successful deployment.

Infrastructure limitations in certain regional markets can constrain automated guided vehicles adoption. Facilities may require significant modifications to accommodate AGV operations, including floor surface improvements, pathway marking, and charging station installation. Older industrial facilities may face particular challenges in adapting their layouts for optimal AGV performance.

Cultural resistance to automation technologies can slow adoption rates in markets where traditional material handling methods remain prevalent. Organizations may encounter workforce concerns about job displacement and require comprehensive change management strategies to ensure successful AGV integration.

E-commerce expansion across Latin America, Middle East, and Africa presents substantial opportunities for automated guided vehicles deployment in fulfillment centers and distribution facilities. The rapid growth of online retail operations requires sophisticated material handling solutions capable of managing high-volume, variable demand patterns. AGV systems provide the flexibility and scalability necessary to support dynamic e-commerce operations.

Manufacturing sector modernization initiatives create significant demand for advanced automation technologies. Governments across these regions are implementing policies to encourage industrial upgrading and competitiveness enhancement. Automated guided vehicles align with these objectives by improving productivity, quality, and operational efficiency in manufacturing environments.

Pharmaceutical and healthcare logistics represent emerging application areas with stringent requirements for precision, traceability, and contamination control. AGV systems can provide the controlled environments and documented processes necessary for pharmaceutical manufacturing and distribution operations. The growing healthcare infrastructure across these regions supports expanded adoption opportunities.

Technology partnerships between international AGV manufacturers and regional system integrators create opportunities for market expansion and localized support services. These collaborations can address specific regional requirements while providing access to advanced technologies and global best practices.

Competitive landscape evolution reflects increasing participation from both international technology providers and regional solution integrators. Global automated guided vehicles manufacturers are establishing local partnerships and service capabilities to better serve regional markets. This trend has intensified competition while improving customer access to advanced technologies and support services.

Technology convergence with artificial intelligence, machine learning, and advanced sensor technologies is reshaping AGV capabilities and market expectations. Modern systems offer enhanced navigation accuracy, predictive maintenance capabilities, and seamless integration with broader industrial IoT ecosystems. These technological advances are expanding the range of applications and improving the business case for automation investments.

Supply chain resilience considerations have elevated the strategic importance of automated guided vehicles in maintaining operational continuity during disruptions. Organizations recognize that automation technologies can provide greater flexibility and reliability compared to labor-dependent processes, particularly during periods of workforce availability challenges or health-related restrictions.

Regulatory environment changes across these regions increasingly support automation adoption through favorable policies, tax incentives, and infrastructure development programs. Government initiatives promoting industrial modernization and competitiveness enhancement create supportive conditions for AGV market expansion.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the automated guided vehicles market across Latin America, Middle East, and Africa. Primary research activities include structured interviews with industry executives, technology providers, end-users, and system integrators to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass extensive analysis of industry publications, company financial reports, government statistics, and trade association data. This approach provides comprehensive coverage of market dynamics, competitive positioning, and regulatory developments affecting AGV adoption across diverse regional markets.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Market sizing and growth projections utilize established analytical frameworks while accounting for regional variations in industrial development, automation maturity, and economic conditions. MarkWide Research methodology incorporates both quantitative analysis and qualitative insights to provide balanced market perspectives.

Regional market segmentation analysis considers country-specific factors including industrial base composition, infrastructure development levels, regulatory environments, and economic growth patterns. This granular approach enables accurate assessment of market opportunities and challenges across diverse geographic markets within the broader regional scope.

Latin America market dynamics demonstrate strong growth potential driven by expanding manufacturing sectors and increasing automation adoption. Brazil leads regional demand with approximately 40% market share, supported by robust automotive and food processing industries. Mexico follows as a significant market, benefiting from its strategic position in North American supply chains and growing manufacturing base.

Middle East market development reflects substantial infrastructure investments and economic diversification initiatives. The United Arab Emirates and Saudi Arabia represent the largest markets, with government-led modernization programs supporting automated guided vehicles adoption in logistics, manufacturing, and port operations. These countries’ strategic focus on becoming regional logistics hubs creates favorable conditions for AGV market expansion.

Africa market emergence shows promising growth prospects despite varying levels of industrial development across countries. South Africa maintains the most mature market, with established manufacturing sectors and advanced logistics infrastructure supporting AGV implementation. Nigeria and Kenya represent emerging opportunities as their industrial bases expand and modernization efforts accelerate.

Regional growth patterns indicate that the Middle East currently demonstrates the highest adoption rates, with approximately 15% annual growth in AGV installations. Latin America follows with steady expansion driven by manufacturing sector investments, while Africa shows the highest growth potential as industrial development accelerates across key markets.

Market leadership in the automated guided vehicles sector reflects a combination of international technology providers and specialized regional integrators. The competitive environment continues to evolve as companies expand their geographic presence and develop market-specific solutions.

Strategic partnerships between international manufacturers and regional distributors have become increasingly important for market success. These collaborations enable global companies to leverage local market knowledge while providing regional partners access to advanced technologies and established product portfolios.

Technology-based segmentation reveals distinct preferences across different application environments and operational requirements:

By Navigation Technology:

By Vehicle Type:

By Application Sector:

Manufacturing applications dominate the automated guided vehicles market across Latin America, Middle East, and Africa, representing the largest category by deployment volume and revenue generation. Automotive manufacturing facilities lead adoption efforts, utilizing AGV systems for just-in-time material delivery, work-in-process transport, and finished goods handling. These applications demonstrate clear return on investment through reduced labor costs and improved production efficiency.

Warehouse and distribution operations represent the fastest-growing application category, driven by e-commerce expansion and supply chain optimization initiatives. Automated guided vehicles in these environments handle order picking support, inventory replenishment, and cross-docking operations. The technology’s ability to operate continuously and adapt to varying demand patterns makes it particularly valuable for modern distribution centers.

Healthcare and pharmaceutical applications show strong growth potential as organizations seek to improve operational efficiency while maintaining strict quality and safety standards. AGV systems in hospitals transport medications, supplies, and equipment while reducing human contact and contamination risks. Pharmaceutical manufacturing facilities utilize automated systems for raw material handling and finished product distribution.

Airport and logistics applications benefit from the region’s growing air cargo operations and passenger traffic. Automated guided vehicles handle baggage transport, cargo movement, and ground support equipment positioning. These applications require robust systems capable of operating in challenging outdoor environments while maintaining high reliability standards.

Operational efficiency improvements represent the most significant benefit for organizations implementing automated guided vehicles. Companies typically experience productivity gains exceeding 35% through consistent material handling performance, reduced cycle times, and elimination of human error factors. The technology enables 24/7 operations without breaks or shift changes, maximizing facility utilization and throughput capacity.

Cost reduction opportunities extend beyond direct labor savings to include reduced product damage, lower insurance premiums, and decreased facility maintenance requirements. AGV systems operate with precision and consistency that minimizes product handling damage while reducing wear on facility floors and infrastructure. Organizations also benefit from predictable operating costs and reduced exposure to labor market fluctuations.

Safety enhancement benefits provide both tangible and intangible value through reduced workplace accidents and improved employee morale. Automated guided vehicles eliminate many common material handling injuries while creating safer work environments for remaining personnel. This improvement supports regulatory compliance efforts and reduces liability exposure for organizations.

Scalability advantages enable organizations to adapt their material handling capabilities to changing business requirements without major infrastructure investments. Modular AGV systems can be expanded or reconfigured as operations grow or change, providing flexibility that traditional fixed automation systems cannot match.

Data and analytics capabilities provide valuable operational insights that support continuous improvement initiatives. Modern automated guided vehicles generate comprehensive performance data that helps organizations optimize routes, predict maintenance requirements, and identify operational bottlenecks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend reshaping automated guided vehicles capabilities and market expectations. Modern AGV systems incorporate machine learning algorithms that enable adaptive behavior, route optimization, and predictive maintenance capabilities. This evolution allows vehicles to learn from operational patterns and continuously improve performance while reducing maintenance requirements and operational disruptions.

Fleet management sophistication has emerged as organizations deploy larger numbers of automated guided vehicles and require centralized control and optimization capabilities. Advanced fleet management systems provide real-time visibility into vehicle status, performance metrics, and operational efficiency indicators. These platforms enable dynamic route planning, load balancing, and resource allocation optimization across entire AGV fleets.

Collaborative robotics integration reflects the growing trend toward human-robot collaboration in industrial environments. Modern AGV systems incorporate advanced safety features and interaction capabilities that enable safe operation alongside human workers. This approach maximizes the benefits of automation while maintaining flexibility for tasks requiring human judgment and dexterity.

Cloud connectivity expansion enables remote monitoring, diagnostics, and software updates for automated guided vehicles deployed across multiple facilities. Cloud-based platforms provide centralized management capabilities while enabling predictive analytics and performance benchmarking across different sites and applications.

Sustainability focus drives demand for energy-efficient AGV systems with reduced environmental impact. Electric vehicles with advanced battery technologies and energy recovery systems align with corporate sustainability objectives while reducing operating costs through improved energy efficiency.

Technology advancement initiatives continue to drive innovation in automated guided vehicles across navigation, control, and integration capabilities. Leading manufacturers are investing heavily in research and development to enhance system performance, reliability, and ease of implementation. Recent developments include improved sensor technologies, more sophisticated control algorithms, and enhanced integration capabilities with existing enterprise systems.

Strategic partnerships between international AGV manufacturers and regional system integrators have accelerated market development across Latin America, Middle East, and Africa. These collaborations combine global technology expertise with local market knowledge and service capabilities, enabling more effective market penetration and customer support.

Manufacturing facility expansions by major AGV providers reflect growing confidence in regional market potential. Several international companies have established local assembly and service facilities to better serve regional customers while reducing delivery times and support costs. These investments demonstrate long-term commitment to market development and customer satisfaction.

Government policy support for industrial automation and modernization has created favorable conditions for automated guided vehicles adoption. Various countries across these regions have implemented incentive programs, tax benefits, and infrastructure development initiatives that support automation investments and technology adoption.

Industry standardization efforts are improving interoperability and reducing implementation complexity for AGV systems. Development of common communication protocols, safety standards, and integration frameworks enables more seamless deployment and reduces technical barriers to adoption.

Market entry strategies for automated guided vehicles providers should prioritize partnership development with established regional distributors and system integrators. MarkWide Research analysis indicates that successful market penetration requires local presence and support capabilities to address customer concerns about service availability and technical support. Organizations should invest in building comprehensive partner networks before attempting direct market entry.

Technology positioning should emphasize flexibility, scalability, and ease of integration rather than purely focusing on advanced features. Regional markets often prioritize practical benefits and proven reliability over cutting-edge capabilities. Providers should develop clear value propositions that demonstrate tangible return on investment and address specific regional challenges such as infrastructure limitations or skills availability.

Financing solutions represent a critical success factor for expanding AGV adoption among small and medium-sized enterprises. Organizations should consider developing flexible financing options, leasing programs, or phased implementation approaches that reduce initial capital requirements. These strategies can significantly expand the addressable market and accelerate adoption rates.

Service capability development should receive equal priority with product development efforts. Regional customers place high value on local service availability, rapid response times, and technical support in local languages. Establishing comprehensive service networks and training programs will be essential for long-term market success.

Application-specific solutions may provide competitive advantages in markets with distinct industry requirements. Developing specialized AGV systems for specific sectors such as food processing, pharmaceuticals, or mining can create differentiation opportunities and command premium pricing.

Market growth trajectory for automated guided vehicles across Latin America, Middle East, and Africa remains strongly positive, with expansion expected to accelerate as industrial modernization efforts intensify. The convergence of favorable economic conditions, government support policies, and technological advancement creates an environment conducive to sustained market development. Regional growth rates are projected to maintain momentum above 10% annually through the forecast period.

Technology evolution will continue reshaping market dynamics as artificial intelligence, machine learning, and advanced sensor technologies become standard features in AGV systems. These capabilities will enable more sophisticated applications and expand the range of environments where automated vehicles can operate effectively. Integration with broader Industry 4.0 ecosystems will create new value propositions and competitive advantages.

Geographic expansion within these regions will extend beyond current leading markets to include emerging economies with developing industrial bases. Countries such as Colombia, Peru, Nigeria, and Kenya represent significant growth opportunities as their manufacturing sectors mature and automation adoption accelerates. This expansion will require adapted solutions and business models suited to different economic conditions and infrastructure capabilities.

Application diversification will drive market growth as automated guided vehicles find new uses beyond traditional manufacturing and warehousing environments. Healthcare facilities, retail operations, airports, and port facilities represent emerging application areas with substantial growth potential. Each sector will require specialized solutions and create opportunities for market differentiation.

Competitive landscape evolution will likely include increased participation from regional technology providers and new market entrants. This development will intensify competition while potentially reducing costs and improving service availability for end customers. Successful companies will need to continuously innovate while building strong local market presence and customer relationships.

The Latin America, Middle East and Africa automated guided vehicles market represents a dynamic and rapidly expanding opportunity driven by industrial modernization, operational efficiency demands, and technological advancement. The convergence of favorable market conditions, government support initiatives, and proven technology benefits creates a compelling environment for sustained growth and development across these diverse regions.

Market fundamentals remain strong as organizations increasingly recognize the strategic value of automation in maintaining competitive advantages and operational resilience. The technology’s proven ability to deliver measurable improvements in productivity, safety, and cost efficiency provides a solid foundation for continued adoption across diverse industrial sectors and applications.

Regional diversity within the market creates multiple growth vectors and opportunities for specialized solutions. While Latin America leverages its expanding manufacturing base, the Middle East capitalizes on infrastructure investments and logistics modernization. Africa’s emerging industrial development presents significant long-term potential as economic growth accelerates and industrial capabilities mature.

Future success in this market will require balanced approaches that combine advanced technology capabilities with practical implementation strategies suited to regional conditions. Organizations that can effectively address local market requirements while delivering proven value propositions will be best positioned to capitalize on the substantial opportunities ahead. The automated guided vehicles market across these regions is poised for continued expansion as automation becomes increasingly essential for industrial competitiveness and operational excellence.

What is Automated Guided Vehicles?

Automated Guided Vehicles (AGVs) are mobile robots used to transport materials within a facility or production environment. They are equipped with various navigation technologies to move autonomously, enhancing efficiency in industries such as manufacturing, warehousing, and logistics.

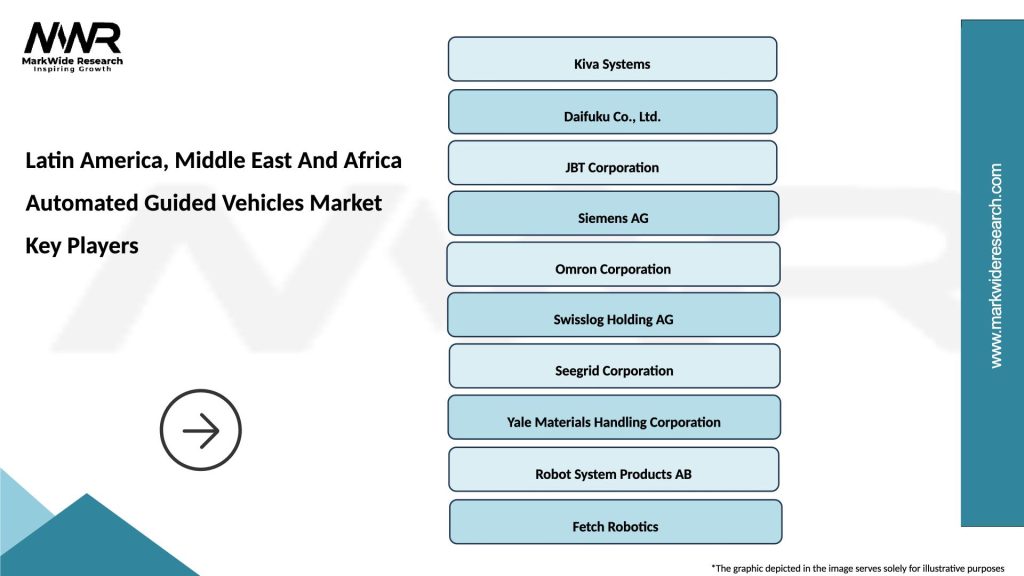

What are the key players in the Latin America, Middle East And Africa Automated Guided Vehicles Market?

Key players in the Latin America, Middle East And Africa Automated Guided Vehicles Market include Kiva Systems, Daifuku Co., Ltd., and Swisslog, among others. These companies are known for their innovative solutions and contributions to the AGV technology landscape.

What are the growth factors driving the Latin America, Middle East And Africa Automated Guided Vehicles Market?

The growth of the Latin America, Middle East And Africa Automated Guided Vehicles Market is driven by increasing demand for automation in warehouses, the need for efficient material handling, and advancements in robotics technology. Additionally, the rise of e-commerce is pushing companies to adopt AGVs for faster order fulfillment.

What challenges does the Latin America, Middle East And Africa Automated Guided Vehicles Market face?

Challenges in the Latin America, Middle East And Africa Automated Guided Vehicles Market include high initial investment costs, integration complexities with existing systems, and a shortage of skilled workforce to operate and maintain AGVs. These factors can hinder widespread adoption in various industries.

What opportunities exist in the Latin America, Middle East And Africa Automated Guided Vehicles Market?

Opportunities in the Latin America, Middle East And Africa Automated Guided Vehicles Market include the expansion of smart factories, increased investment in logistics automation, and the growing trend of Industry Four Point Zero. These factors are likely to create a favorable environment for AGV adoption.

What trends are shaping the Latin America, Middle East And Africa Automated Guided Vehicles Market?

Trends shaping the Latin America, Middle East And Africa Automated Guided Vehicles Market include the integration of artificial intelligence for improved navigation, the development of collaborative AGVs that work alongside human workers, and the increasing use of AGVs in healthcare and retail sectors for efficient operations.

Latin America, Middle East And Africa Automated Guided Vehicles Market

| Segmentation Details | Description |

|---|---|

| Product Type | Unit Load AGVs, Tow Tractors, Pallet Trucks, Forklift AGVs |

| Technology | Laser Guidance, Magnetic Guidance, Vision Guidance, Inductive Guidance |

| End User | Manufacturing, Warehousing, Healthcare, Retail |

| Deployment | On-Premise, Cloud-Based, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America, Middle East And Africa Automated Guided Vehicles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at