444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America LDPE market represents a dynamic and rapidly evolving segment within the regional petrochemical industry, characterized by robust demand across diverse applications and significant growth potential. Low-density polyethylene (LDPE) has established itself as a cornerstone material in packaging, agriculture, construction, and consumer goods manufacturing throughout Latin American countries. The market demonstrates remarkable resilience and adaptability, driven by expanding industrial sectors, growing consumer markets, and increasing infrastructure development across the region.

Market dynamics indicate substantial growth momentum, with the Latin America LDPE market experiencing a compound annual growth rate (CAGR) of 4.2% over the forecast period. This growth trajectory reflects the region’s expanding manufacturing capabilities, rising disposable incomes, and increasing adoption of flexible packaging solutions across various industries. Brazil, Mexico, and Argentina emerge as the primary consumption centers, collectively accounting for approximately 78% of regional LDPE demand.

Industrial applications continue to drive market expansion, with packaging applications representing the largest consumption segment at 65% market share. The agricultural sector’s growing adoption of greenhouse films, mulch films, and irrigation systems contributes significantly to demand growth. Construction applications including vapor barriers, geomembranes, and insulation materials further strengthen market foundations, supported by ongoing infrastructure development initiatives across Latin American countries.

The Latin America LDPE market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of low-density polyethylene across Latin American countries, including manufacturing facilities, supply chain networks, end-user industries, and regulatory frameworks governing market operations.

LDPE characteristics make it particularly valuable for Latin American applications, offering excellent flexibility, chemical resistance, and processability. The polymer’s unique branched molecular structure provides superior clarity, impact resistance, and sealability properties essential for packaging applications. Market participants include petrochemical producers, converters, distributors, and end-users spanning packaging, agriculture, construction, and consumer goods sectors.

Regional market dynamics encompass local production capabilities, import dependencies, export opportunities, and cross-border trade patterns. The market’s significance extends beyond economic considerations, supporting employment generation, technology transfer, and industrial development across participating countries. Sustainability initiatives increasingly influence market direction, with growing emphasis on recycling programs, bio-based alternatives, and circular economy principles.

Strategic market analysis reveals the Latin America LDPE market’s position as a critical component of the regional petrochemical value chain, demonstrating consistent growth patterns and expanding application portfolios. The market benefits from favorable demographic trends, urbanization processes, and industrial diversification initiatives across key Latin American economies.

Key growth drivers include expanding e-commerce activities driving flexible packaging demand, agricultural modernization requiring advanced film solutions, and construction sector growth necessitating specialized LDPE applications. Market consolidation trends show increasing integration between producers and converters, creating more efficient supply chain structures and enhanced customer service capabilities.

Competitive landscape features both international petrochemical giants and regional players, fostering innovation and market development. Technology advancement initiatives focus on improving production efficiency, developing specialized grades, and enhancing sustainability profiles. Regulatory environment evolution supports market growth while addressing environmental concerns through improved recycling infrastructure and waste management systems.

Future prospects indicate continued market expansion driven by economic recovery, industrial growth, and increasing consumer sophistication. The market’s resilience during economic uncertainties demonstrates its fundamental importance to regional economic development and industrial competitiveness.

Market intelligence reveals several critical insights shaping the Latin America LDPE market landscape and future development trajectory:

Primary growth drivers propelling the Latin America LDPE market forward encompass both macroeconomic factors and industry-specific developments that create sustained demand growth across multiple application segments.

Economic expansion across key Latin American countries drives increased consumer spending, industrial activity, and infrastructure development, directly translating into higher LDPE consumption. Rising disposable incomes support packaging industry growth as consumers demand convenient, attractive, and functional packaging solutions for food, beverages, and consumer goods.

E-commerce growth represents a transformative driver, with online retail expansion requiring sophisticated packaging solutions that protect products during shipping while maintaining cost efficiency. The flexible packaging segment benefits significantly from this trend, as LDPE films provide excellent barrier properties, printability, and consumer convenience features.

Agricultural modernization initiatives across Latin America drive substantial LDPE demand for greenhouse films, mulch films, and irrigation systems. Government programs supporting agricultural productivity improvements and sustainable farming practices create consistent demand growth for specialized LDPE applications.

Construction sector expansion fueled by urbanization, infrastructure development, and housing programs generates increasing demand for LDPE applications including vapor barriers, geomembranes, and insulation materials. Infrastructure investments in transportation, utilities, and commercial development further strengthen market foundations.

Market challenges facing the Latin America LDPE market include both structural limitations and external factors that may constrain growth potential and market development across the region.

Raw material price volatility represents a significant constraint, as LDPE production costs are directly linked to crude oil and natural gas prices. Price fluctuations create uncertainty for both producers and consumers, affecting investment decisions and long-term planning capabilities. Currency fluctuations further complicate cost management, particularly for countries with import dependencies.

Environmental regulations increasingly restrict single-use plastic applications, potentially limiting LDPE demand in certain segments. Growing environmental awareness among consumers and governments drives demand for alternative materials and enhanced recycling programs, requiring significant investment in new technologies and infrastructure.

Competition from alternatives including biodegradable polymers, paper-based packaging, and other plastic resins challenges LDPE market share in specific applications. Technology advancement in alternative materials may accelerate substitution trends, particularly in environmentally sensitive applications.

Infrastructure limitations in some Latin American countries constrain market development, including inadequate transportation networks, limited recycling facilities, and insufficient waste management systems. These factors affect both market efficiency and sustainability initiatives.

Emerging opportunities within the Latin America LDPE market present significant potential for growth, innovation, and market expansion across diverse application segments and geographic regions.

Sustainability initiatives create opportunities for developing recycled LDPE products, bio-based alternatives, and circular economy solutions. Companies investing in advanced recycling technologies and sustainable production processes can capture growing demand from environmentally conscious consumers and regulatory requirements.

Specialty applications offer high-value growth opportunities, including medical packaging, food safety films, and industrial applications requiring specialized properties. These segments typically command premium pricing and demonstrate strong growth potential as industries become more sophisticated.

Export market development presents opportunities for Latin American producers to serve international markets, leveraging competitive production costs and improving quality standards. Regional trade agreements facilitate market access and create competitive advantages for local producers.

Technology partnerships with international companies can accelerate innovation, improve production efficiency, and develop new product grades. These collaborations enable access to advanced technologies and global market knowledge while maintaining regional manufacturing capabilities.

Infrastructure development programs across Latin America create demand for specialized LDPE applications in construction, agriculture, and industrial sectors. Government initiatives supporting economic development and modernization drive sustained market growth opportunities.

Market dynamics within the Latin America LDPE market reflect complex interactions between supply and demand factors, competitive forces, and external influences shaping market evolution and strategic direction.

Supply chain dynamics demonstrate increasing integration and efficiency improvements as market participants optimize production, distribution, and customer service capabilities. Regional producers are expanding capacity while improving operational efficiency, reducing dependence on imports and enhancing market competitiveness.

Demand patterns show diversification across application segments, with traditional packaging applications maintaining dominance while specialty segments demonstrate accelerated growth. Seasonal variations in agricultural applications create cyclical demand patterns that market participants must manage through inventory optimization and production planning.

Competitive dynamics feature both collaboration and competition among market participants, with strategic partnerships enabling technology sharing and market development while maintaining competitive differentiation. Price competition remains significant, particularly in commodity grades, driving efficiency improvements and cost optimization initiatives.

Innovation dynamics focus on developing specialized grades, improving sustainability profiles, and enhancing processing capabilities. MarkWide Research analysis indicates that companies investing in research and development achieve 15% higher profit margins compared to those focusing solely on commodity production.

Comprehensive research methodology employed for analyzing the Latin America LDPE market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for market participants and stakeholders.

Primary research activities include extensive interviews with industry executives, market participants, and subject matter experts across the LDPE value chain. These interactions provide insights into market trends, competitive dynamics, and future outlook perspectives that complement quantitative data analysis.

Secondary research encompasses analysis of industry publications, company reports, government statistics, and trade association data to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Market modeling approaches utilize econometric analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. These models incorporate macroeconomic factors, industry-specific variables, and regional considerations affecting market development.

Validation processes include expert review panels, market participant feedback, and cross-reference analysis to ensure research findings accurately reflect market realities and provide actionable intelligence for strategic decision-making.

Regional market analysis reveals distinct patterns and characteristics across Latin American countries, reflecting varying levels of industrial development, market maturity, and growth potential within the LDPE market landscape.

Brazil dominates the regional market with approximately 45% market share, driven by its large manufacturing base, extensive agricultural sector, and sophisticated packaging industry. The country’s domestic production capabilities and growing export potential position it as the regional market leader. São Paulo and Rio de Janeiro serve as primary consumption centers, while expanding production facilities in other regions support market growth.

Mexico represents the second-largest market with 22% regional share, benefiting from proximity to North American markets, strong manufacturing sector, and growing consumer market. The country’s strategic location enables both domestic consumption and export opportunities, particularly to the United States market.

Argentina accounts for 11% of regional consumption, with strong agricultural applications driving demand for LDPE films and specialized products. The country’s agricultural modernization initiatives and expanding food processing industry create sustained growth opportunities.

Colombia, Chile, and Peru collectively represent 15% market share, demonstrating significant growth potential as their economies develop and industrial sectors expand. These markets show increasing sophistication in LDPE applications and growing demand for specialty products.

Central American countries comprise the remaining 7% market share, with growth driven by agricultural applications, packaging industry development, and increasing consumer market sophistication.

Competitive landscape within the Latin America LDPE market features a diverse mix of international petrochemical companies, regional producers, and specialized converters, creating a dynamic environment characterized by both collaboration and competition.

Leading market participants include:

Competitive strategies focus on capacity expansion, technology advancement, sustainability initiatives, and customer service enhancement. Market leaders invest heavily in research and development to create differentiated products and maintain competitive advantages.

Market consolidation trends show increasing integration between producers and converters, creating more efficient value chains and enhanced customer relationships. Strategic partnerships enable technology sharing, market development, and risk mitigation across the competitive landscape.

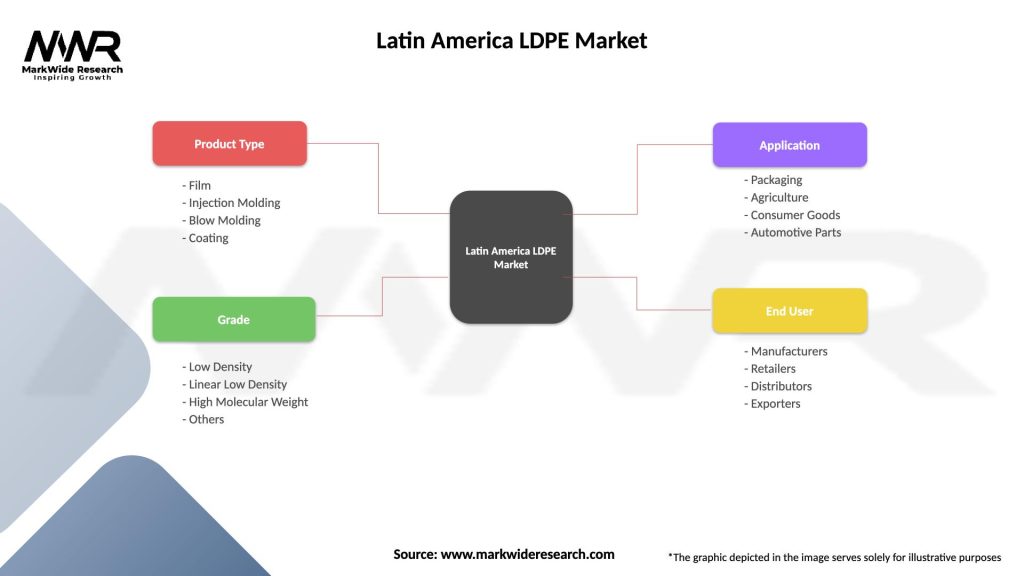

Market segmentation analysis provides detailed insights into the Latin America LDPE market structure, revealing distinct characteristics and growth patterns across various categorization frameworks that guide strategic decision-making and market development initiatives.

By Application:

By End-User Industry:

By Production Technology:

Category analysis reveals distinct market dynamics, growth patterns, and competitive characteristics across different LDPE application segments, providing strategic insights for market participants and stakeholders.

Packaging Applications dominate market consumption with sophisticated requirements for barrier properties, printability, and processing efficiency. This segment benefits from e-commerce growth, consumer convenience trends, and food safety regulations. Innovation focus includes developing high-performance films, improving sustainability profiles, and enhancing processing capabilities.

Agricultural Films demonstrate strong growth potential driven by agricultural modernization, government support programs, and increasing focus on crop productivity. This segment requires specialized properties including UV resistance, mechanical strength, and environmental durability. Market opportunities include greenhouse expansion, precision agriculture adoption, and sustainable farming practices.

Construction Applications show steady growth supported by infrastructure development, urbanization trends, and building code requirements. These applications demand specific performance characteristics including chemical resistance, dimensional stability, and long-term durability. Growth drivers include green building initiatives, energy efficiency requirements, and infrastructure modernization programs.

Consumer Products reflect economic development and rising living standards across Latin America. This segment emphasizes product safety, aesthetic appeal, and cost efficiency. Market trends include increasing quality expectations, brand differentiation, and regulatory compliance requirements.

Industrial Applications represent specialized, high-value segments requiring customized solutions and technical expertise. These applications often command premium pricing and demonstrate strong customer loyalty. Development opportunities include advanced manufacturing processes, specialized equipment applications, and emerging industrial technologies.

Industry participants and stakeholders within the Latin America LDPE market realize substantial benefits through strategic positioning, operational excellence, and market development initiatives that create value across the entire value chain.

For Producers:

For Converters and Processors:

For End Users:

SWOT analysis provides comprehensive evaluation of the Latin America LDPE market’s strategic position, identifying internal capabilities and external factors that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Latin America LDPE market reflect evolving customer requirements, technological advancement, and regulatory developments that influence strategic direction and competitive positioning across the industry.

Sustainability Integration emerges as a dominant trend, with market participants investing in recycling technologies, circular economy initiatives, and bio-based alternatives. MarkWide Research indicates that 68% of major producers have implemented sustainability programs, demonstrating industry commitment to environmental responsibility.

Digital Transformation initiatives are revolutionizing operations, supply chain management, and customer engagement across the LDPE value chain. Advanced analytics, automation technologies, and digital platforms enhance efficiency, reduce costs, and improve customer service capabilities.

Specialty Product Development focuses on creating high-performance LDPE grades for demanding applications including medical packaging, food safety films, and industrial components. These specialized products command premium pricing and demonstrate strong growth potential.

Supply Chain Optimization trends emphasize regional integration, logistics efficiency, and inventory management improvements. Companies are developing more responsive and flexible supply chain structures to serve diverse customer requirements effectively.

Customer Partnership approaches are evolving toward collaborative relationships that enable joint product development, technical support, and market development initiatives. These partnerships create competitive advantages and enhance customer loyalty.

Regulatory Compliance requirements are driving innovation in production processes, product formulations, and waste management systems. Companies proactively address regulatory changes to maintain market access and competitive positioning.

Industry developments within the Latin America LDPE market demonstrate dynamic evolution, strategic investments, and technological advancement that reshape competitive dynamics and market opportunities.

Capacity Expansion Projects across the region include significant investments by major producers to meet growing demand and reduce import dependency. These projects incorporate advanced technologies and sustainability features that enhance competitive positioning.

Technology Partnerships between regional producers and international technology providers accelerate innovation and capability development. These collaborations enable access to advanced production processes, specialized product grades, and global market expertise.

Sustainability Initiatives include major investments in recycling infrastructure, circular economy programs, and bio-based product development. Industry leaders are establishing comprehensive sustainability strategies that address environmental concerns while maintaining economic viability.

Market Consolidation activities feature strategic acquisitions, joint ventures, and partnership agreements that create synergies and enhance market coverage. These developments strengthen competitive positions and improve operational efficiency.

Regulatory Developments include new environmental standards, packaging regulations, and trade policies that influence market dynamics. Industry participants actively engage with regulatory authorities to ensure compliance and influence policy development.

Innovation Programs focus on developing next-generation LDPE products with enhanced performance characteristics, improved sustainability profiles, and specialized application capabilities. These initiatives drive market differentiation and competitive advantage.

Strategic recommendations for Latin America LDPE market participants emphasize positioning for sustainable growth, operational excellence, and competitive differentiation in an evolving market environment.

Investment Priorities should focus on capacity expansion in high-growth regions, technology advancement for specialized products, and sustainability infrastructure development. Companies should evaluate opportunities for vertical integration and supply chain optimization to enhance competitiveness.

Product Development initiatives should emphasize specialty grades, sustainable alternatives, and application-specific solutions that command premium pricing. MWR analysis suggests that companies focusing on innovation achieve 12% higher revenue growth compared to commodity-focused competitors.

Market Expansion strategies should consider both geographic diversification within Latin America and export market development. Companies should leverage regional production advantages and improving quality standards to access international markets.

Partnership Development opportunities include technology licensing agreements, joint ventures with regional players, and customer collaboration programs. These partnerships enable risk sharing, market access, and capability enhancement.

Sustainability Leadership positions companies advantageously for future market requirements and regulatory compliance. Early investment in recycling technologies and circular economy initiatives creates competitive differentiation and market positioning.

Operational Excellence programs should focus on cost optimization, quality improvement, and customer service enhancement. Digital transformation initiatives can significantly improve operational efficiency and market responsiveness.

Future market outlook for the Latin America LDPE market indicates continued growth, structural evolution, and increasing sophistication as the region’s economies develop and industrial sectors mature.

Growth Trajectory projections suggest sustained market expansion driven by economic development, population growth, and increasing consumer sophistication. The market is expected to maintain its positive growth momentum with expanding applications and improving production capabilities supporting long-term development.

Technology Evolution will drive significant improvements in production efficiency, product performance, and sustainability characteristics. Advanced manufacturing processes, digital integration, and innovative product development will reshape competitive dynamics and market opportunities.

Sustainability Transformation will accelerate as environmental awareness increases and regulatory requirements evolve. The market will see growing adoption of recycled content, bio-based alternatives, and circular economy principles that redefine industry standards.

Market Maturation processes will create more sophisticated customer requirements, specialized applications, and premium product segments. This evolution will reward companies with strong technical capabilities, innovation programs, and customer partnership approaches.

Regional Integration trends will strengthen trade relationships, optimize supply chains, and create economies of scale that benefit market participants. Cross-border collaboration and investment will enhance market efficiency and competitive positioning.

Export Potential will expand as regional production capabilities improve and quality standards advance. Latin American producers will increasingly compete in global markets, leveraging cost advantages and strategic positioning.

The Latin America LDPE market represents a dynamic and promising segment within the global petrochemical industry, characterized by robust growth potential, evolving applications, and increasing strategic importance for regional economic development. Market analysis reveals a complex ecosystem driven by expanding industrial sectors, growing consumer markets, and advancing technological capabilities across key Latin American countries.

Market fundamentals remain strong, supported by favorable demographic trends, economic development initiatives, and increasing sophistication in end-user applications. The packaging industry’s continued expansion, agricultural modernization programs, and construction sector growth create sustained demand for LDPE products across diverse application segments. Regional production capabilities are expanding to meet growing demand while reducing import dependency and enhancing supply chain security.

Strategic opportunities abound for market participants willing to invest in capacity expansion, technology advancement, and sustainability initiatives. The market’s evolution toward specialty applications, premium products, and environmentally responsible solutions creates differentiation opportunities and competitive advantages for forward-thinking companies. Partnership development, innovation programs, and customer collaboration initiatives will be critical success factors in the evolving market landscape.

Future success in the Latin America LDPE market will depend on companies’ ability to balance growth ambitions with sustainability requirements, operational excellence with innovation capabilities, and regional focus with global competitiveness. The market’s continued development will contribute significantly to regional economic growth, industrial advancement, and technological progress across Latin America.

What is LDPE?

LDPE, or Low-Density Polyethylene, is a thermoplastic made from the polymerization of ethylene. It is known for its flexibility, low-density structure, and is commonly used in packaging, plastic bags, and containers.

What are the key players in the Latin America LDPE Market?

Key players in the Latin America LDPE Market include Braskem, LyondellBasell, and ExxonMobil, among others. These companies are involved in the production and distribution of LDPE for various applications such as packaging and consumer goods.

What are the growth factors driving the Latin America LDPE Market?

The growth of the Latin America LDPE Market is driven by increasing demand for flexible packaging solutions, the rise in consumer goods production, and advancements in manufacturing technologies. Additionally, the expansion of the e-commerce sector is contributing to the demand for LDPE packaging.

What challenges does the Latin America LDPE Market face?

The Latin America LDPE Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable materials, and competition from alternative packaging solutions. These factors can hinder market growth and innovation.

What opportunities exist in the Latin America LDPE Market?

Opportunities in the Latin America LDPE Market include the development of biodegradable LDPE alternatives, increasing investments in recycling technologies, and the growing trend of sustainable packaging. These factors can enhance market prospects and attract new investments.

What trends are shaping the Latin America LDPE Market?

Trends shaping the Latin America LDPE Market include the shift towards eco-friendly packaging solutions, innovations in polymer technology, and the increasing use of LDPE in various industries such as agriculture and construction. These trends are influencing production and consumption patterns.

Latin America LDPE Market

| Segmentation Details | Description |

|---|---|

| Product Type | Film, Injection Molding, Blow Molding, Coating |

| Grade | Low Density, Linear Low Density, High Molecular Weight, Others |

| Application | Packaging, Agriculture, Consumer Goods, Automotive Parts |

| End User | Manufacturers, Retailers, Distributors, Exporters |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America LDPE Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at