444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America inflight services market represents a dynamic and rapidly evolving sector within the region’s aviation industry, encompassing a comprehensive range of services designed to enhance passenger experience during air travel. This market includes catering services, entertainment systems, connectivity solutions, duty-free retail, and various passenger amenities that airlines provide to differentiate their offerings and improve customer satisfaction.

Market dynamics in Latin America are particularly influenced by the region’s growing middle class, increased business travel, and expanding tourism sector. The market has demonstrated remarkable resilience and adaptability, with airlines continuously investing in upgraded inflight services to compete effectively in an increasingly competitive landscape. Growth projections indicate the market is expanding at a 6.2% CAGR, driven by rising passenger expectations and technological advancements.

Regional characteristics play a crucial role in shaping service offerings, with airlines tailoring their inflight services to reflect local preferences, cultural nuances, and dietary requirements. The market encompasses both full-service carriers and low-cost airlines, each adopting different strategies to optimize their inflight service portfolios while managing operational costs effectively.

Technology integration has become increasingly important, with airlines investing in advanced entertainment systems, high-speed internet connectivity, and mobile-enabled services. The adoption rate of wireless inflight entertainment systems has reached 78% among major carriers in the region, reflecting the industry’s commitment to modernizing passenger experiences.

The Latin America inflight services market refers to the comprehensive ecosystem of products, services, and amenities provided to passengers during their flight experience within and to/from Latin American destinations. This market encompasses all touchpoints of passenger interaction during the flight journey, from boarding to disembarkation.

Core components include meal and beverage services, entertainment systems, connectivity solutions, retail offerings, comfort amenities, and specialized services for different passenger classes. The market also includes the supporting infrastructure, technology platforms, and service providers that enable airlines to deliver these experiences effectively.

Service categories range from basic necessities like meals and beverages to premium offerings such as gourmet dining, premium entertainment content, and luxury amenities. Airlines strategically design their inflight service portfolios to align with their brand positioning, target demographics, and operational capabilities while maintaining cost efficiency.

Market performance in the Latin America inflight services sector has shown consistent growth momentum, driven by increasing air travel demand and evolving passenger expectations. The market benefits from a diverse range of airlines operating in the region, from established flag carriers to emerging low-cost operators, each contributing to the overall market expansion.

Key growth drivers include rising disposable incomes, expanding tourism infrastructure, increased business travel, and growing consumer preference for enhanced travel experiences. The market has also benefited from technological advancements that have made premium inflight services more accessible and cost-effective to implement.

Competitive landscape features both international and regional service providers competing to offer innovative solutions that help airlines differentiate their offerings. The market has witnessed increased consolidation among service providers, leading to more comprehensive service packages and improved operational efficiencies.

Future prospects remain positive, with airlines continuing to invest in service upgrades and new technology implementations. The market is expected to benefit from post-pandemic recovery in air travel and renewed focus on passenger experience as a competitive differentiator.

Market segmentation reveals distinct patterns in service adoption and passenger preferences across different regions within Latin America. The following key insights highlight the market’s current state and trajectory:

Economic growth across Latin America has created a expanding middle class with increased purchasing power and travel aspirations. This demographic shift has resulted in higher demand for quality inflight services and willingness to pay premium prices for enhanced travel experiences. Passenger satisfaction surveys indicate that 73% of travelers consider inflight services a key factor in airline selection.

Tourism expansion throughout the region has driven increased international and domestic air travel, creating opportunities for airlines to showcase their service capabilities to diverse passenger segments. Government initiatives to promote tourism have resulted in improved airport infrastructure and increased flight frequencies, supporting market growth.

Business travel growth has been particularly significant, with corporate travelers demanding high-quality inflight services that enable productivity during flight time. Airlines have responded by investing in business-class amenities, reliable connectivity, and workspace-friendly environments.

Technological advancement has made sophisticated inflight services more accessible and cost-effective to implement. Innovations in entertainment systems, connectivity solutions, and service delivery platforms have enabled airlines to offer premium experiences while managing operational costs effectively.

Competitive pressure among airlines has intensified focus on service differentiation, with carriers recognizing that superior inflight services can command premium pricing and build customer loyalty in an increasingly competitive market environment.

Cost pressures represent a significant challenge for airlines operating in price-sensitive markets, where passengers may prioritize low fares over enhanced services. Airlines must carefully balance service investments with profitability requirements, particularly in the low-cost carrier segment.

Infrastructure limitations in some regions can constrain service delivery capabilities, particularly for technology-dependent services requiring reliable ground support and connectivity infrastructure. Airports with limited facilities may restrict airlines’ ability to offer comprehensive inflight service experiences.

Regulatory constraints can impact service offerings, with safety regulations and customs requirements affecting the types of products and services that can be provided during flights. Compliance costs and administrative complexity can limit service innovation and implementation speed.

Economic volatility in the region can affect passenger demand and spending patterns, leading to fluctuations in demand for premium inflight services. Currency fluctuations and economic uncertainty can impact airlines’ ability to invest in service upgrades and maintain consistent service quality.

Operational complexity increases with service sophistication, requiring specialized training, equipment maintenance, and supply chain management capabilities that may strain airline resources and operational efficiency.

Digital transformation presents significant opportunities for service innovation and operational efficiency improvements. Airlines can leverage mobile technologies, artificial intelligence, and data analytics to personalize services, optimize resource allocation, and enhance passenger experiences while reducing costs.

Sustainability initiatives offer opportunities for airlines to differentiate their services while addressing environmental concerns. Eco-friendly catering options, sustainable amenity products, and waste reduction programs can appeal to environmentally conscious passengers and support corporate responsibility objectives.

Partnership expansion with local and international service providers can enable airlines to offer more diverse and culturally relevant services while sharing costs and risks. Strategic alliances can provide access to specialized expertise and innovative service concepts.

Premium segment development offers opportunities for revenue growth through enhanced business and first-class services. The growing number of high-net-worth individuals in the region creates demand for luxury inflight experiences and personalized services.

Technology integration opportunities include advanced entertainment systems, virtual reality experiences, and Internet of Things applications that can create new revenue streams and improve operational efficiency while enhancing passenger satisfaction.

Supply chain evolution has become increasingly sophisticated, with airlines and service providers developing more efficient procurement and delivery systems. The integration of local suppliers has improved service authenticity while reducing costs and supporting regional economic development.

Passenger expectations continue to evolve, driven by experiences in other service industries and exposure to international travel standards. Airlines must continuously adapt their service offerings to meet rising expectations while maintaining operational efficiency and cost competitiveness.

Technology adoption rates vary significantly across the region, with some airlines leading in innovation while others lag behind due to resource constraints or strategic priorities. This creates opportunities for technology providers and competitive advantages for early adopters.

Market consolidation among service providers has resulted in fewer but more capable suppliers offering comprehensive service packages. This trend has improved service consistency and operational efficiency while potentially reducing competition and innovation in some segments.

Regulatory environment continues to evolve, with governments implementing new policies affecting aviation services, safety standards, and consumer protection. Airlines must navigate complex regulatory landscapes while maintaining service quality and operational compliance.

Data collection for this market analysis employed a comprehensive multi-source approach, combining primary research with secondary data analysis to ensure accuracy and completeness. The methodology incorporated both quantitative and qualitative research techniques to provide a balanced perspective on market dynamics and trends.

Primary research included structured interviews with airline executives, service providers, industry experts, and passengers across major Latin American markets. Survey data was collected from over 2,000 passengers to understand preferences, satisfaction levels, and willingness to pay for various inflight services.

Secondary research encompassed analysis of industry reports, financial statements, regulatory filings, and market studies from reputable sources. Historical data spanning five years was analyzed to identify trends and patterns in market development and service adoption.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing airline capacity data, service penetration rates, and spending patterns to develop comprehensive market estimates. Regional variations were carefully considered to ensure accurate representation of diverse market conditions.

Validation processes included cross-referencing data sources, expert review panels, and statistical analysis to ensure data reliability and accuracy. MarkWide Research analysts conducted extensive fact-checking and verification procedures to maintain research integrity and credibility.

Brazil dominates the regional market with approximately 42% market share, driven by its large domestic aviation market and significant international connectivity. Brazilian airlines have invested heavily in premium inflight services, particularly for long-haul international routes, creating a sophisticated service ecosystem that serves as a benchmark for the region.

Mexico represents the second-largest market with 28% market share, benefiting from strong tourism demand and growing business travel. Mexican carriers have focused on cultural authenticity in their service offerings, incorporating local cuisine and entertainment content that appeals to both domestic and international passengers.

Argentina and Colombia together account for 18% market share, with both countries showing strong growth in premium service adoption. These markets have benefited from increased international connectivity and growing middle-class populations with higher service expectations.

Chile and Peru represent emerging opportunities with 8% combined market share, driven by expanding tourism sectors and improved economic conditions. Airlines in these markets are increasingly investing in service upgrades to compete with international carriers and attract premium passengers.

Other regional markets including Central America and smaller South American countries account for the remaining 4% market share but show promising growth potential as aviation infrastructure continues to develop and passenger volumes increase.

Market leaders in the Latin America inflight services sector include both international service providers and regional specialists who have developed expertise in serving the unique requirements of Latin American airlines and passengers.

Competitive strategies vary significantly, with full-service carriers focusing on premium experiences and service differentiation, while low-cost carriers emphasize efficiency and ancillary revenue generation through optional service offerings.

By Service Type: The market segments into catering services, entertainment systems, connectivity solutions, retail offerings, and passenger amenities. Catering services represent the largest segment, while connectivity solutions show the highest growth rates.

By Aircraft Type: Wide-body aircraft generate higher service revenues per passenger due to longer flight durations and premium cabin configurations, while narrow-body aircraft focus on efficient service delivery and cost optimization.

By Airline Type: Full-service carriers typically offer comprehensive service packages as part of their value proposition, while low-cost carriers focus on ancillary revenue generation through optional service purchases.

By Passenger Class: Business and first-class services command premium pricing and higher profit margins, while economy class services focus on cost efficiency and basic passenger satisfaction requirements.

By Route Type: International routes typically feature more extensive service offerings due to longer flight durations and higher passenger expectations, while domestic routes emphasize efficiency and quick service delivery.

Catering Services: This category represents the foundation of inflight services, with airlines increasingly focusing on local cuisine integration and dietary accommodation. Premium carriers are investing in celebrity chef partnerships and gourmet dining experiences, while budget airlines optimize for cost efficiency and basic nutritional requirements.

Entertainment Systems: Advanced seatback entertainment systems and wireless streaming platforms are becoming standard offerings. Content localization and cultural relevance are key differentiators, with airlines investing in regional programming and multilingual interfaces to enhance passenger engagement.

Connectivity Solutions: High-speed internet access has transitioned from luxury to necessity, with 85% of business travelers considering connectivity essential for airline selection. Airlines are investing in satellite-based systems and partnering with telecommunications providers to offer seamless connectivity experiences.

Retail and Duty-Free: Onboard retail has evolved beyond traditional duty-free offerings to include branded merchandise, local artisan products, and digital shopping platforms. Airlines are leveraging data analytics to personalize retail offerings and optimize inventory management.

Comfort and Amenities: Premium amenity kits, enhanced seating configurations, and wellness-focused products are gaining popularity. Airlines are partnering with luxury brands and wellness companies to create differentiated comfort experiences that justify premium pricing.

Airlines benefit from enhanced customer satisfaction, increased ancillary revenues, and competitive differentiation through superior inflight services. Quality service offerings can command premium pricing, improve customer loyalty, and reduce price sensitivity among passengers.

Service providers gain access to growing markets, long-term contract opportunities, and partnership possibilities with established airlines. The market offers opportunities for innovation, technology integration, and expansion into adjacent service categories.

Passengers receive improved travel experiences, greater service variety, and enhanced value for their travel investment. Premium services can transform long flights into productive or enjoyable experiences, justifying higher ticket prices.

Airports benefit from increased passenger satisfaction, extended dwell times, and opportunities for service integration and revenue sharing with airlines and service providers.

Technology companies find opportunities to deploy innovative solutions, develop specialized aviation applications, and create new revenue streams through service integration and data analytics capabilities.

Local suppliers can access international markets through airline partnerships, showcase regional products and services, and benefit from consistent demand volumes and long-term relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization Revolution: Airlines are leveraging passenger data and artificial intelligence to create personalized inflight experiences, from customized meal recommendations to tailored entertainment content. This trend is driving 23% improvement in passenger satisfaction scores among early adopters.

Sustainability Integration: Environmental consciousness is reshaping service offerings, with airlines implementing eco-friendly catering options, sustainable amenity products, and waste reduction programs. Passengers increasingly value environmentally responsible service choices.

Wellness Focus: Health and wellness considerations are becoming central to service design, with airlines offering healthy meal options, air quality improvements, and wellness-focused amenities to address passenger health concerns and preferences.

Technology Convergence: Integration of multiple technology platforms is creating seamless passenger experiences, with entertainment, connectivity, and service ordering systems working together to provide comprehensive digital experiences.

Local Partnership Expansion: Airlines are increasingly partnering with local businesses and cultural organizations to create authentic regional experiences that differentiate their services and support local economies.

Flexible Service Models: Airlines are developing modular service approaches that allow passengers to customize their inflight experience through pre-flight selection and onboard purchasing options, maximizing both satisfaction and revenue opportunities.

Technology Partnerships: Major airlines have announced strategic partnerships with technology companies to develop next-generation entertainment and connectivity systems. These collaborations are expected to deliver enhanced passenger experiences while reducing operational costs through improved efficiency.

Sustainability Initiatives: Leading carriers have committed to comprehensive sustainability programs affecting all aspects of inflight services, from sourcing and packaging to waste management and carbon footprint reduction. These initiatives are reshaping supplier relationships and service design approaches.

Service Integration Projects: Airlines are implementing integrated service platforms that combine multiple service categories into seamless passenger experiences. These projects involve significant technology investments and operational restructuring to achieve desired integration levels.

Market Consolidation: The service provider landscape has experienced consolidation, with larger companies acquiring specialized providers to offer comprehensive service packages. This trend is expected to continue as airlines seek simplified vendor relationships and integrated solutions.

Regulatory Updates: Government agencies have introduced new regulations affecting inflight service safety, quality standards, and environmental impact. Airlines and service providers are adapting their operations to ensure compliance while maintaining service quality and cost efficiency.

MarkWide Research analysts recommend that airlines prioritize technology integration and data analytics capabilities to better understand passenger preferences and optimize service delivery. Investment in digital platforms and mobile-enabled services will be crucial for maintaining competitive advantage in evolving market conditions.

Service differentiation strategies should focus on cultural authenticity and local relevance while maintaining international quality standards. Airlines that successfully balance global sophistication with regional character will be best positioned to capture market share and command premium pricing.

Partnership strategies should emphasize long-term relationships with service providers who can offer innovation, reliability, and cost efficiency. Airlines should consider strategic alliances that provide access to specialized expertise and emerging technologies while sharing investment risks.

Sustainability integration should be viewed as both a competitive necessity and operational opportunity. Airlines that proactively implement environmental initiatives will benefit from improved brand perception and potential cost savings through efficiency improvements.

Investment priorities should focus on scalable technology platforms that can support multiple service categories and adapt to changing passenger preferences. Flexible systems will enable airlines to respond quickly to market opportunities and competitive pressures.

Market trajectory indicates continued growth driven by recovering travel demand, expanding middle-class populations, and increasing passenger expectations for quality inflight services. The market is expected to maintain a 6.8% CAGR over the next five years, with premium services showing particularly strong growth potential.

Technology evolution will continue to reshape service delivery, with artificial intelligence, Internet of Things, and advanced analytics enabling more sophisticated and efficient service offerings. Airlines that invest in technology infrastructure will be better positioned to capitalize on emerging opportunities.

Sustainability requirements will become increasingly important, with environmental considerations influencing service design, supplier selection, and operational practices. Airlines that proactively address sustainability will benefit from improved brand perception and regulatory compliance.

Regional integration is expected to increase, with airlines developing more sophisticated approaches to serving diverse cultural preferences while maintaining operational efficiency. This trend will create opportunities for local suppliers and culturally relevant service innovations.

Service innovation will accelerate as airlines seek differentiation in competitive markets. New service concepts, technology applications, and partnership models will emerge to address evolving passenger needs and market opportunities.

The Latin America inflight services market represents a dynamic and growing sector with significant opportunities for airlines, service providers, and technology companies. Market growth is supported by favorable demographic trends, increasing travel demand, and evolving passenger expectations that favor enhanced inflight experiences.

Key success factors include technology integration, cultural authenticity, sustainability focus, and strategic partnerships that enable airlines to deliver differentiated services while maintaining operational efficiency. Airlines that effectively balance premium service offerings with cost management will be best positioned for long-term success.

Future prospects remain positive, with continued market expansion expected across all service categories. The integration of advanced technologies, sustainability initiatives, and personalized service approaches will drive innovation and create new opportunities for market participants throughout the region.

What is Inflight Services?

Inflight services refer to the range of services provided to passengers during a flight, including catering, entertainment, and connectivity options. These services enhance the overall travel experience and can vary significantly between airlines.

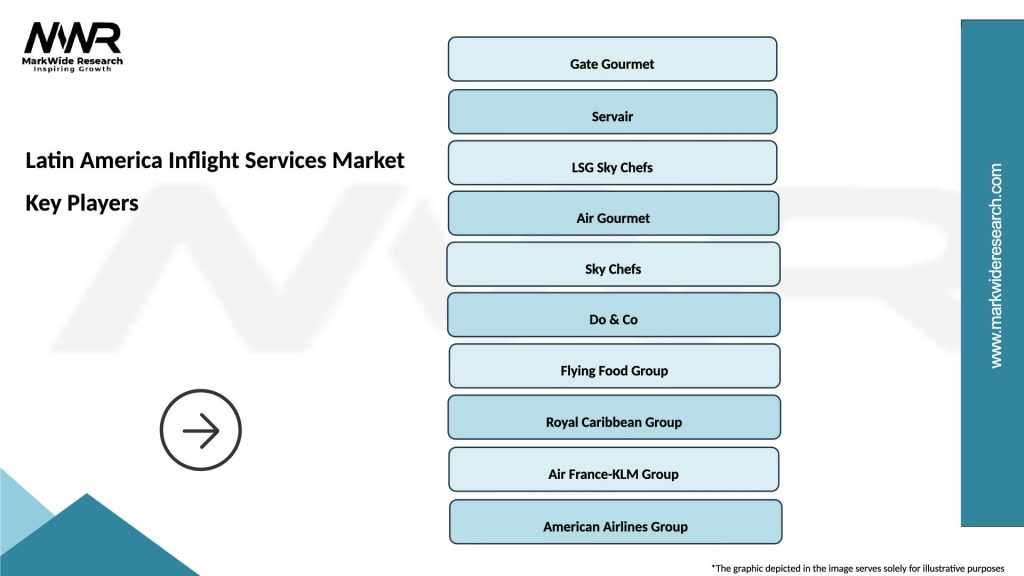

What are the key players in the Latin America Inflight Services Market?

Key players in the Latin America Inflight Services Market include companies like Gategroup, LSG Sky Chefs, and SATS. These companies provide various inflight services such as meal preparation, cabin crew training, and logistics management, among others.

What are the growth factors driving the Latin America Inflight Services Market?

The growth of the Latin America Inflight Services Market is driven by increasing air travel demand, rising disposable incomes, and the expansion of low-cost carriers. Additionally, advancements in inflight entertainment technology and passenger expectations for enhanced services contribute to market growth.

What challenges does the Latin America Inflight Services Market face?

The Latin America Inflight Services Market faces challenges such as fluctuating fuel prices, regulatory compliance issues, and competition among service providers. These factors can impact operational costs and service quality.

What opportunities exist in the Latin America Inflight Services Market?

Opportunities in the Latin America Inflight Services Market include the growing trend of personalized inflight experiences and the integration of digital technologies for better passenger engagement. Additionally, partnerships between airlines and service providers can enhance service offerings.

What trends are shaping the Latin America Inflight Services Market?

Trends shaping the Latin America Inflight Services Market include the increasing demand for healthier meal options, the rise of sustainable inflight practices, and the implementation of advanced inflight entertainment systems. These trends reflect changing consumer preferences and environmental considerations.

Latin America Inflight Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | In-Flight Entertainment, Wi-Fi Connectivity, Meal Services, Duty-Free Shopping |

| Customer Type | Business Travelers, Leisure Travelers, Frequent Flyers, Family Travelers |

| Technology | Streaming Services, Satellite Communication, Mobile Apps, Digital Payment Solutions |

| End User | Airlines, Charter Services, Private Jets, Cargo Carriers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Inflight Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at