444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

Inertial systems have become an integral part of modern navigation and positioning technologies. These systems provide accurate real-time information about an object’s position, orientation, and velocity. The Latin America inertial systems market has witnessed significant growth in recent years, driven by the increasing demand for precise navigation systems across various industries. This article provides a comprehensive analysis of the market, including key insights, drivers, restraints, opportunities, and future outlook.

Meaning

Inertial systems, also known as inertial navigation systems (INS), rely on a combination of accelerometers, gyroscopes, and other sensors to calculate the movement and orientation of an object relative to a known starting point. These systems do not depend on external references such as GPS signals, making them ideal for applications in areas with limited or no satellite coverage, like underground or underwater environments

Executive Summary

The Latin America inertial systems market is experiencing robust growth due to the increasing adoption of precise navigation systems in various sectors. The market offers a wide range of inertial systems, including inertial measurement units (IMUs), attitude and heading reference systems (AHRS), and inertial navigation systems (INS). These systems find applications in aerospace and defense, marine, automotive, and robotics industries, among others. The market is highly competitive, with both local and international players striving to offer advanced solutions to cater to evolving customer demands.

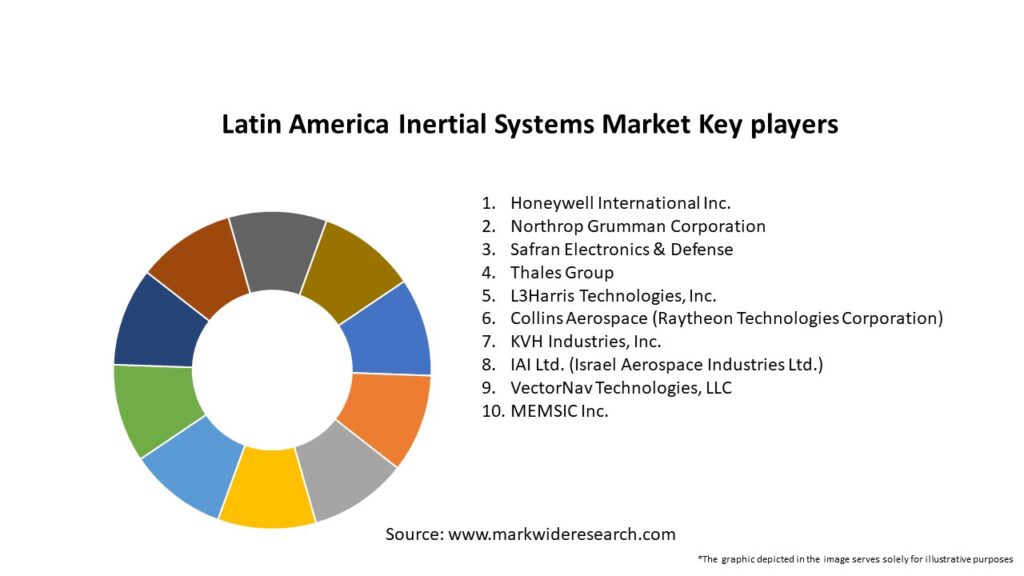

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

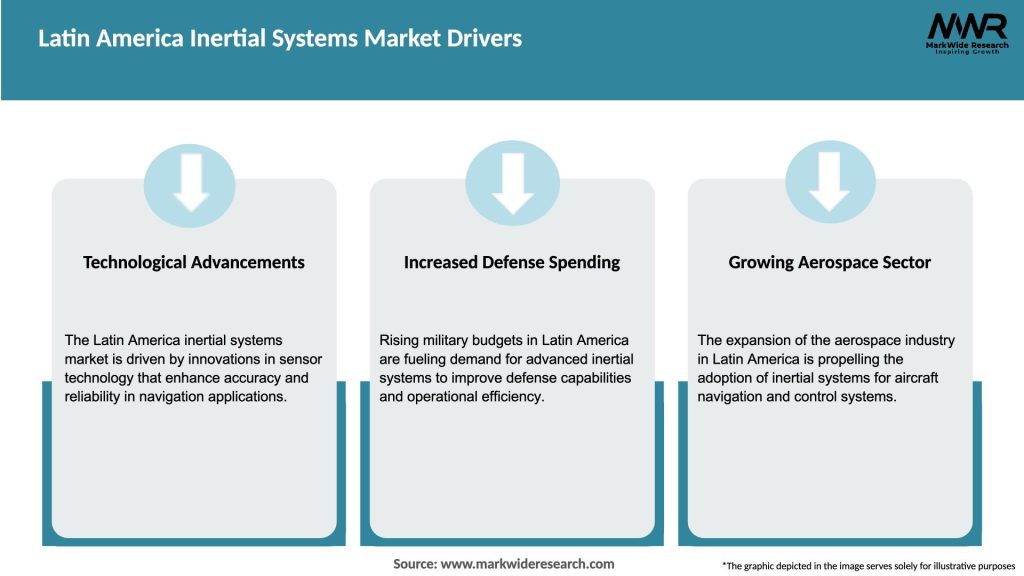

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Latin America inertial systems market is driven by a combination of technological advancements, industry-specific demands, and government initiatives. The market is highly dynamic, with continuous innovations aimed at improving accuracy, reliability, and affordability. Key market dynamics include increasing competition, evolving customer requirements, and the impact of regulatory policies on the adoption of inertial systems.

Regional Analysis

Latin America can be divided into key regions, including Brazil, Mexico, Argentina, and Chile. Brazil dominates the market due to its strong aerospace and defense industry. Mexico and Argentina are also significant contributors, driven by their growing automotive and manufacturing sectors. The market in Chile is expanding due to increased investments in mining and offshore activities. The regional analysis helps understand the market trends, opportunities, and challenges specific to each country.

Competitive Landscape

Leading Companies in the Latin America Inertial Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on product type, application, and end-user industry. Product types include IMUs, AHRS, and INS. Applications range from aerospace and defense to marine, automotive, robotics, and others. The end-user industries include military, commercial aviation, transportation, and oil and gas, among others. Segment-wise analysis helps identify specific growth areas and tailor strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Latin America inertial systems market. While the market experienced disruptions due to supply chain challenges and reduced investments during the initial phases of the pandemic, the growing need for autonomous technologies and remote operations boosted the demand for inertial systems in industries such as healthcare, logistics, and agriculture.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Latin America inertial systems market is poised for significant growth in the coming years. Advancements in sensor technologies, increasing demand for autonomous systems, and emerging applications in various industries will drive market expansion. Companies that can offer accurate, reliable, and cost-effective solutions while adapting to evolving customer needs and regulatory requirements will be well-positioned to capitalize on the opportunities presented by the market.

Conclusion

The Latin America inertial systems market is witnessing steady growth, driven by the demand for precise navigation and positioning solutions across industries. Advancements in sensor technologies, integration with other sensors, and the rising adoption of autonomous systems present numerous opportunities for market players. With a focus on innovation, collaboration, and customer-centric approaches, companies can thrive in this dynamic market, catering to the evolving needs of industries in Latin America.

What is Inertial Systems?

Inertial systems are devices that measure the specific force, angular rate, and sometimes the magnetic field surrounding the device. They are commonly used in navigation, guidance, and control applications across various industries, including aerospace, automotive, and robotics.

What are the key players in the Latin America Inertial Systems Market?

Key players in the Latin America Inertial Systems Market include Honeywell International Inc., Northrop Grumman Corporation, and Thales Group, among others. These companies are involved in the development and supply of advanced inertial systems for various applications.

What are the growth factors driving the Latin America Inertial Systems Market?

The Latin America Inertial Systems Market is driven by the increasing demand for advanced navigation systems in aerospace and defense, the growth of the automotive sector, and the rising adoption of automation in industrial applications.

What challenges does the Latin America Inertial Systems Market face?

Challenges in the Latin America Inertial Systems Market include high development costs, the complexity of integrating inertial systems with existing technologies, and competition from alternative navigation technologies such as GPS.

What opportunities exist in the Latin America Inertial Systems Market?

Opportunities in the Latin America Inertial Systems Market include the expansion of smart transportation systems, advancements in miniaturization of inertial sensors, and increasing investments in defense and aerospace sectors.

What trends are shaping the Latin America Inertial Systems Market?

Trends in the Latin America Inertial Systems Market include the integration of artificial intelligence for enhanced data processing, the development of MEMS-based inertial sensors, and a growing focus on autonomous vehicles and drones.

Latin America Inertial Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gyroscopes, Accelerometers, Inertial Measurement Units, Navigation Systems |

| End User | Aerospace, Defense, Automotive, Consumer Electronics |

| Technology | Micro-Electro-Mechanical Systems, Fiber Optic, Ring Laser, Quantum |

| Application | Guidance Systems, Motion Tracking, Robotics, Virtual Reality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Latin America Inertial Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at