444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America general aviation industry market represents a dynamic and rapidly evolving sector that encompasses private aircraft operations, charter services, flight training, and aircraft maintenance across the region. This comprehensive market includes business jets, turboprops, helicopters, and piston aircraft serving diverse applications from corporate transportation to emergency medical services. Market dynamics indicate robust growth potential driven by increasing business activities, tourism expansion, and infrastructure development throughout Latin American countries.

Regional characteristics of the Latin America general aviation market reflect unique geographical challenges and opportunities. The vast distances between major cities, challenging terrain, and limited commercial airline connectivity in remote areas create substantial demand for general aviation services. Countries such as Brazil, Mexico, Colombia, and Argentina lead market development, with Brazil accounting for approximately 45% of regional market share due to its extensive territory and robust economy.

Growth trajectories demonstrate the market’s resilience and expansion potential, with the sector experiencing a 6.2% compound annual growth rate over recent years. This growth stems from increasing corporate investments, expanding mining and oil exploration activities, and rising demand for specialized aviation services including aerial surveying, cargo transport, and passenger charter operations across the region’s diverse economic landscape.

The Latin America general aviation industry market refers to the comprehensive ecosystem of non-commercial aircraft operations, services, and supporting infrastructure across Central and South American countries, encompassing private and business aircraft ownership, charter services, maintenance operations, and specialized aviation applications.

Market definition includes various aircraft categories from single-engine piston aircraft to sophisticated business jets, helicopters for diverse applications, and turboprop aircraft serving regional connectivity needs. The industry encompasses manufacturing, sales, leasing, maintenance, repair, overhaul services, pilot training, and ground support operations that collectively support general aviation activities throughout the region.

Operational scope extends beyond traditional business aviation to include specialized services such as agricultural aviation, emergency medical transport, law enforcement support, tourism operations, and cargo transport to remote locations. This broad definition reflects the multifaceted nature of general aviation’s contribution to regional economic development and connectivity enhancement across Latin America’s diverse geographical and economic landscape.

Market positioning of the Latin America general aviation industry demonstrates significant growth momentum driven by expanding business activities, infrastructure development, and increasing recognition of aviation’s strategic importance for regional connectivity. The market benefits from favorable regulatory developments, foreign investment attraction, and technological advancement adoption across multiple countries in the region.

Key performance indicators reveal strong market fundamentals with fleet expansion rates reaching 8.1% annually in key segments, particularly business jets and helicopters serving corporate and specialized applications. Brazil continues dominating regional market dynamics, followed by Mexico and Colombia as secondary growth centers, while emerging markets including Peru, Chile, and Ecuador show increasing adoption rates.

Strategic developments include enhanced regulatory frameworks, improved airport infrastructure, and expanding maintenance capabilities that support market growth. According to MarkWide Research analysis, the integration of advanced avionics, sustainable aviation fuel adoption, and digital transformation initiatives position the market for continued expansion despite economic volatility challenges affecting the broader region.

Primary market drivers encompass several interconnected factors that collectively fuel industry expansion across Latin America:

Market segmentation reveals distinct growth patterns across different aircraft categories and applications. Business aviation shows the strongest growth trajectory with 12.3% annual expansion in high-end segments, while helicopter operations demonstrate steady growth driven by offshore oil operations, emergency services, and tourism applications throughout the region.

Economic expansion across Latin America creates fundamental demand for efficient business transportation solutions. Growing corporate activities, international trade relationships, and foreign direct investment require reliable aviation services that can navigate the region’s challenging geography and limited commercial airline schedules. Business efficiency demands drive corporate aircraft adoption as companies seek to optimize executive travel and operational connectivity.

Infrastructure limitations in many Latin American countries create substantial opportunities for general aviation services. Remote mining operations, oil exploration sites, and agricultural regions often lack adequate ground transportation or commercial airline access, making general aviation essential for personnel transport, equipment delivery, and emergency services. This connectivity gap represents a persistent market driver across the region.

Resource sector growth significantly impacts general aviation demand, particularly in countries with extensive mining, oil, and agricultural operations. Specialized aviation services support exploration activities, personnel transport to remote sites, and cargo delivery to locations inaccessible by other transportation modes. The expansion of renewable energy projects also creates new aviation service requirements for construction and maintenance activities.

Tourism industry development drives demand for charter services, scenic flights, and recreational aviation activities. Countries investing in tourism infrastructure recognize general aviation’s role in accessing remote destinations and providing unique travel experiences. Luxury tourism segments particularly value private aircraft access to exclusive locations throughout the region.

Economic volatility represents a significant challenge for the Latin America general aviation market, with currency fluctuations, inflation pressures, and political instability affecting investment decisions and operational costs. Financial constraints limit aircraft acquisition capabilities for many potential operators, while economic uncertainty reduces discretionary spending on aviation services across various market segments.

Regulatory complexity creates operational challenges as aviation regulations vary significantly between countries, complicating cross-border operations and fleet management. Bureaucratic processes for aircraft registration, import procedures, and operational approvals can delay market entry and increase compliance costs for operators seeking regional expansion opportunities.

Infrastructure limitations constrain market growth despite creating demand opportunities. Many airports lack adequate general aviation facilities, fuel availability, or maintenance services, limiting operational flexibility and increasing costs. Ground infrastructure deficiencies including navigation aids, weather services, and air traffic control capabilities affect safety and operational efficiency across the region.

Skilled personnel shortages impact market development as the region faces challenges in pilot training, maintenance technician availability, and aviation management expertise. Training infrastructure limitations and high education costs create barriers to workforce development, while experienced personnel often migrate to higher-paying markets outside the region.

Fleet modernization presents substantial opportunities as aging aircraft throughout Latin America require replacement or significant upgrades. This replacement cycle creates demand for new aircraft sales, retrofit services, and advanced avionics installations. Modern aircraft offer improved fuel efficiency, reduced maintenance costs, and enhanced safety features that appeal to cost-conscious operators.

Emerging market penetration offers growth potential in countries with developing general aviation sectors. Secondary markets including Paraguay, Uruguay, Bolivia, and Central American countries show increasing interest in general aviation services as their economies develop and business activities expand. These markets present opportunities for aircraft sales, service establishment, and operational expansion.

Service diversification creates new revenue streams through specialized applications including emergency medical services, law enforcement support, environmental monitoring, and cargo transport. Niche markets such as aerial surveying, pipeline patrol, and disaster response services offer stable revenue opportunities with less economic sensitivity than traditional business aviation segments.

Technology integration opportunities include advanced avionics systems, satellite communications, flight tracking technologies, and maintenance management systems. Digital transformation initiatives can improve operational efficiency, reduce costs, and enhance safety standards while creating competitive advantages for early adopters in the regional market.

Supply chain dynamics in the Latin America general aviation market reflect complex interactions between aircraft manufacturers, service providers, and end users. Market forces include fluctuating aircraft values, varying demand cycles, and evolving customer requirements that collectively shape industry structure and competitive positioning across different market segments.

Competitive pressures intensify as international operators expand regional presence while local companies develop capabilities and market share. Market consolidation trends emerge in certain segments as larger operators acquire smaller companies to achieve economies of scale and expand service offerings across multiple countries and applications.

Regulatory evolution continues shaping market dynamics as governments modernize aviation regulations, implement safety management systems, and harmonize standards with international practices. Policy changes regarding aircraft imports, taxation, and operational requirements significantly impact market accessibility and growth potential for various operator categories.

Technology disruption influences market dynamics through advanced aircraft systems, digital maintenance platforms, and operational efficiency improvements. Innovation adoption rates vary across the region, with larger operators and developed markets leading technology integration while smaller operators and emerging markets follow adoption trends.

Data collection for Latin America general aviation market analysis employs comprehensive methodologies including primary research through industry interviews, operator surveys, and regulatory authority consultations. Primary sources include aircraft operators, maintenance providers, aviation authorities, and industry associations across major Latin American countries to ensure accurate market representation and trend identification.

Secondary research incorporates aviation industry reports, government statistics, trade publications, and regulatory filings to validate primary findings and establish historical market trends. Data validation processes ensure accuracy through cross-referencing multiple sources and applying statistical analysis techniques to identify consistent patterns and reliable projections.

Market segmentation analysis utilizes aircraft registration databases, operator classifications, and service category definitions to provide detailed market structure insights. Quantitative analysis includes fleet composition studies, utilization rate calculations, and growth trend projections based on historical data and forward-looking indicators.

Regional analysis methodology incorporates country-specific factors including economic conditions, regulatory environments, and infrastructure capabilities to provide accurate market assessments. Comparative analysis between countries and regions enables identification of growth opportunities and market development patterns across the Latin American aviation landscape.

Brazil dominates the Latin America general aviation market with the largest fleet size, most developed infrastructure, and highest activity levels. The country accounts for approximately 45% of regional market share with strong presence across all aircraft categories from business jets to helicopters. Brazilian market benefits from extensive territory, robust economy, and well-established aviation industry supporting both domestic and international operations.

Mexico represents the second-largest market with significant growth in business aviation and cross-border operations. Mexican operators benefit from proximity to the United States market, strong manufacturing sector presence, and growing tourism industry that drives charter and recreational aviation demand. The market shows 7.4% annual growth in business jet operations reflecting economic expansion and increased corporate activities.

Colombia emerges as a key growth market with expanding oil sector activities, improving security conditions, and government infrastructure investments. Colombian aviation serves diverse applications including resource exploration, cargo transport, and passenger services to remote regions with limited ground transportation access.

Argentina maintains significant market presence despite economic challenges, with established aviation traditions and extensive agricultural aviation operations. Regional markets including Chile, Peru, and Ecuador show increasing general aviation adoption driven by mining activities, tourism development, and business expansion across diverse economic sectors.

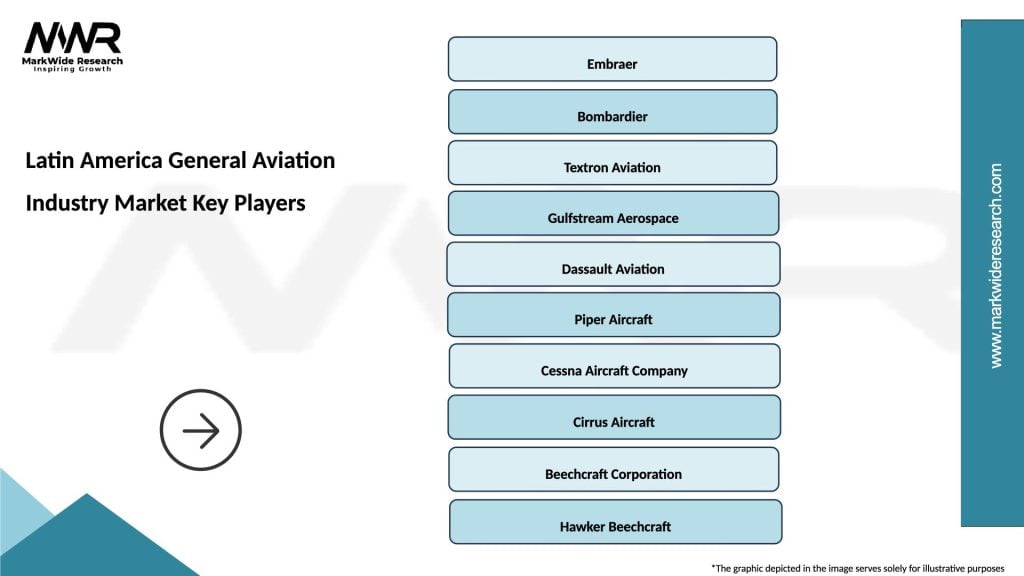

Market leaders in the Latin America general aviation industry include both international manufacturers and regional service providers that collectively shape competitive dynamics:

Service providers include major maintenance organizations, charter operators, and flight training facilities that support market development. Regional competitors often focus on specialized services or specific geographic markets, creating diverse competitive landscapes across different countries and application segments.

Competitive strategies emphasize local partnerships, service network expansion, and customer support capabilities tailored to regional requirements. Market differentiation occurs through specialized services, competitive pricing, and operational expertise adapted to Latin American operating conditions and regulatory environments.

By Aircraft Type:

By Application:

By Country:

Business jets represent the highest-value segment with strong growth driven by corporate expansion and international business activities. Market preferences favor mid-size and super-mid-size aircraft offering transcontinental range capabilities essential for regional business operations. Growth rates in this segment reach 12.3% annually reflecting increasing corporate aviation adoption across major Latin American economies.

Helicopter operations serve diverse applications from offshore oil support to emergency medical services, with market growth supported by resource sector expansion and government service requirements. Operational diversity includes tourism, law enforcement, and cargo transport applications that provide stable revenue streams less sensitive to economic fluctuations affecting other aviation segments.

Turboprop aircraft fill important regional connectivity gaps while serving specialized applications including cargo transport, passenger charter, and government operations. Market appeal stems from operational flexibility, lower operating costs compared to jets, and capability to access shorter runways common throughout Latin America’s diverse airport infrastructure.

Training and recreational aviation segments show steady growth supported by increasing pilot training requirements and expanding recreational flying activities. Market development benefits from growing middle-class populations, increased leisure spending, and recognition of aviation career opportunities across the region’s developing economies.

Aircraft manufacturers benefit from expanding market opportunities across diverse aircraft categories and applications. Market expansion provides revenue growth potential through new aircraft sales, parts and service support, and technology upgrade programs tailored to regional operator requirements and operating conditions.

Service providers gain opportunities for business expansion through maintenance services, charter operations, and specialized aviation applications. Revenue diversification through multiple service offerings reduces dependence on single market segments while providing stable income streams across economic cycles.

Operators achieve improved business efficiency, expanded market reach, and enhanced operational capabilities through general aviation services. Competitive advantages include reduced travel time, access to remote locations, and flexible scheduling that supports business development and operational effectiveness across challenging geographical conditions.

Regional economies benefit from improved connectivity, business development support, and specialized services that contribute to economic growth. Economic impact includes job creation, infrastructure development, and enhanced access to remote regions that support resource development and tourism expansion throughout Latin America.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives gain momentum across the Latin America general aviation market as operators and manufacturers focus on environmental responsibility. Sustainable aviation fuel adoption increases gradually while aircraft manufacturers develop more fuel-efficient designs and operators implement carbon offset programs to address environmental concerns and regulatory requirements.

Digital transformation accelerates throughout the industry with advanced flight planning systems, predictive maintenance technologies, and operational management platforms. Technology adoption improves operational efficiency, reduces costs, and enhances safety standards while providing competitive advantages for forward-thinking operators across the region.

Market consolidation trends emerge as larger operators acquire smaller companies to achieve economies of scale and expand service offerings. Strategic partnerships between manufacturers, service providers, and operators create integrated service networks that better serve customer requirements across multiple countries and applications.

Regulatory harmonization efforts continue as Latin American countries work toward standardized aviation regulations and improved cross-border operational procedures. MarkWide Research indicates that regulatory improvements facilitate market growth by reducing compliance complexity and enabling more efficient regional operations for multi-country operators.

Infrastructure investments across the region include airport improvements, navigation system upgrades, and maintenance facility expansions that support general aviation growth. Government initiatives in several countries recognize aviation’s economic importance and implement policies to encourage industry development through tax incentives and regulatory improvements.

Fleet expansion activities include significant aircraft orders and delivery schedules that reflect market confidence and growth expectations. Operator investments in new aircraft, facility upgrades, and service expansion demonstrate commitment to market development despite economic challenges affecting the broader region.

Training program developments address skilled personnel shortages through expanded pilot training facilities, maintenance technician programs, and aviation management education. Educational partnerships between international organizations and local institutions improve training quality and accessibility across multiple countries.

Technology partnerships between aircraft manufacturers, avionics suppliers, and service providers accelerate innovation adoption and improve operational capabilities. Collaborative initiatives focus on safety improvements, efficiency enhancements, and cost reduction strategies that benefit the entire industry ecosystem.

Market entry strategies should emphasize local partnerships, regulatory compliance expertise, and service network development to succeed in Latin America’s complex aviation environment. Strategic recommendations include focusing on specific geographic markets or application segments where competitive advantages can be established and maintained over time.

Investment priorities should target infrastructure development, technology adoption, and personnel training to support sustainable market growth. Capital allocation strategies should balance growth opportunities with risk management considering economic volatility and regulatory uncertainty affecting the region.

Operational excellence requires emphasis on safety standards, customer service quality, and cost management to maintain competitiveness in price-sensitive markets. Service differentiation through specialized capabilities, geographic coverage, or technology integration can provide sustainable competitive advantages.

Risk management strategies should address currency exposure, political risks, and operational challenges through diversification, insurance coverage, and contingency planning. Financial planning must account for economic volatility while maintaining investment capabilities for growth opportunities as they emerge across different market segments.

Growth projections for the Latin America general aviation market indicate continued expansion driven by economic development, infrastructure improvements, and increasing aviation adoption across diverse applications. Market forecasts suggest sustained growth rates of 6.8% annually over the next decade, with business aviation and specialized services leading expansion trends.

Technology evolution will significantly impact market development through advanced aircraft systems, digital operational platforms, and sustainable aviation solutions. Innovation adoption rates are expected to accelerate as operators recognize competitive advantages and regulatory requirements drive technology integration across the industry.

Market maturation in developed countries will be balanced by emerging market growth as secondary cities and developing economies increase general aviation adoption. Regional expansion opportunities include Central American countries, smaller South American markets, and specialized application segments that currently show limited development.

Regulatory improvements will continue supporting market growth through harmonized standards, simplified procedures, and enhanced safety frameworks. According to MWR analysis, regulatory evolution combined with infrastructure development creates favorable conditions for sustained industry expansion despite periodic economic challenges affecting the broader Latin American region.

The Latin America general aviation industry market demonstrates significant growth potential driven by economic expansion, infrastructure development, and increasing recognition of aviation’s strategic importance for regional connectivity. Despite challenges including economic volatility, regulatory complexity, and infrastructure limitations, the market benefits from fundamental demand drivers that support long-term expansion across diverse aircraft categories and applications.

Market opportunities encompass fleet modernization, service diversification, technology integration, and emerging market penetration that collectively create substantial growth potential. The region’s unique geographical characteristics, resource wealth, and developing economies provide natural demand for general aviation services while creating competitive advantages for operators who successfully navigate local market conditions.

Strategic success in this market requires comprehensive understanding of regional dynamics, regulatory environments, and customer requirements combined with operational excellence and risk management capabilities. Companies that invest in local partnerships, infrastructure development, and technology adoption while maintaining financial flexibility will be best positioned to capitalize on the Latin America general aviation industry market’s continued evolution and expansion opportunities.

What is General Aviation?

General Aviation refers to all civil aviation operations other than scheduled air services and non-scheduled air transport operations for remuneration or hire. It encompasses a wide range of activities, including private flying, flight training, agricultural aviation, and air ambulance services.

What are the key players in the Latin America General Aviation Industry Market?

Key players in the Latin America General Aviation Industry Market include Embraer, Textron Aviation, Bombardier, and Piper Aircraft, among others. These companies are involved in manufacturing aircraft, providing maintenance services, and offering flight training programs.

What are the growth factors driving the Latin America General Aviation Industry Market?

The growth of the Latin America General Aviation Industry Market is driven by increasing demand for private air travel, the expansion of flight training schools, and the rise in air ambulance services. Additionally, the region’s economic development is contributing to a greater interest in general aviation.

What challenges does the Latin America General Aviation Industry Market face?

The Latin America General Aviation Industry Market faces challenges such as regulatory hurdles, high operational costs, and limited infrastructure in certain areas. These factors can hinder the growth and accessibility of general aviation services in the region.

What opportunities exist in the Latin America General Aviation Industry Market?

Opportunities in the Latin America General Aviation Industry Market include the potential for increased investment in aviation infrastructure, the development of new flight training programs, and the growing interest in sustainable aviation practices. These factors could enhance the overall market landscape.

What trends are shaping the Latin America General Aviation Industry Market?

Trends shaping the Latin America General Aviation Industry Market include advancements in aircraft technology, a shift towards more environmentally friendly aviation solutions, and the increasing use of digital platforms for flight operations and management. These trends are influencing how general aviation is conducted in the region.

Latin America General Aviation Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Wing Aircraft, Rotorcraft, UAVs, Light Sport Aircraft |

| End User | Private Owners, Flight Schools, Charter Services, Government Agencies |

| Technology | Avionics, Propulsion Systems, Navigation Systems, Safety Equipment |

| Service Type | Maintenance, Training, Leasing, Repair |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America General Aviation Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at