444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America gear market represents a dynamic and rapidly evolving industrial landscape characterized by substantial growth opportunities and increasing technological sophistication. This comprehensive market encompasses various gear types including spur gears, helical gears, bevel gears, worm gears, and planetary gears, serving diverse industries across the region. Market dynamics indicate robust expansion driven by industrial modernization, infrastructure development, and growing manufacturing capabilities throughout Latin American countries.

Regional growth patterns demonstrate significant momentum, with the market experiencing a projected compound annual growth rate of 6.2% CAGR over the forecast period. Brazil and Mexico emerge as dominant markets, collectively accounting for approximately 68% of regional demand, while countries like Argentina, Chile, and Colombia contribute substantially to market expansion. The automotive sector represents the largest application segment, capturing nearly 35% market share, followed by industrial machinery and construction equipment applications.

Technological advancement plays a crucial role in market evolution, with manufacturers increasingly adopting precision manufacturing techniques, advanced materials, and computer-aided design systems. The integration of Industry 4.0 technologies and smart manufacturing processes enhances production efficiency by approximately 25-30%, positioning Latin American gear manufacturers competitively in global markets. Supply chain optimization and local manufacturing capabilities continue strengthening, reducing dependency on imports and fostering regional industrial growth.

The Latin America gear market refers to the comprehensive ecosystem of mechanical gear production, distribution, and application across Latin American countries, encompassing all types of gear systems used in industrial, automotive, aerospace, and consumer applications. This market includes traditional gear manufacturing, precision gear cutting, gear assembly systems, and related services supporting various industrial sectors throughout the region.

Gear systems function as fundamental mechanical components that transmit power and motion between machine elements, enabling speed reduction, torque multiplication, and directional changes in mechanical systems. The Latin American market specifically addresses regional manufacturing capabilities, local demand patterns, export opportunities, and the integration of global gear technologies with regional industrial requirements and economic conditions.

Market expansion across Latin America demonstrates remarkable resilience and growth potential, driven by increasing industrialization, automotive production growth, and infrastructure development initiatives. The region’s gear market benefits from strategic geographical positioning, abundant natural resources, and growing manufacturing expertise that positions it as an emerging hub for gear production and export activities.

Key growth drivers include automotive industry expansion, mining equipment modernization, renewable energy infrastructure development, and increasing adoption of automation technologies across manufacturing sectors. The market experiences particularly strong demand from Brazil’s automotive sector, Mexico’s manufacturing base, and Argentina’s agricultural machinery industry, collectively representing 78% of total regional consumption.

Competitive dynamics reveal a mix of international gear manufacturers establishing regional operations alongside growing local companies developing specialized expertise. Technology transfer, joint ventures, and strategic partnerships facilitate knowledge sharing and capability development, enhancing overall market sophistication and competitiveness in global markets.

Strategic market insights reveal several critical trends shaping the Latin America gear market landscape:

Automotive industry expansion serves as the primary market driver, with Latin American countries experiencing significant growth in vehicle production and assembly operations. Brazil and Mexico lead regional automotive manufacturing, with production volumes increasing by approximately 8.5% annually, creating substantial demand for transmission gears, differential gears, and engine components. Electric vehicle adoption introduces new gear requirements for electric drivetrains and charging infrastructure systems.

Infrastructure development initiatives across the region generate substantial demand for construction equipment, mining machinery, and industrial systems requiring various gear applications. Government investment in transportation infrastructure, energy projects, and industrial facilities creates long-term growth opportunities for gear manufacturers and suppliers throughout Latin America.

Industrial automation adoption drives demand for precision gears used in robotics, conveyor systems, and automated manufacturing equipment. Companies investing in modernization and efficiency improvements require high-quality gear systems that enhance operational performance and reduce maintenance requirements. Manufacturing competitiveness initiatives encourage local production capabilities and technology advancement.

Mining sector growth throughout Latin America creates substantial opportunities for heavy-duty gear applications in extraction equipment, processing machinery, and transportation systems. The region’s abundant mineral resources and expanding mining operations require reliable, high-performance gear systems capable of operating in challenging environments and demanding applications.

Economic volatility across Latin American countries creates challenges for gear market growth, with currency fluctuations, inflation pressures, and political uncertainties affecting investment decisions and long-term planning. Capital constraints limit companies’ ability to invest in advanced manufacturing equipment and technology upgrades necessary for competitive gear production.

Skills shortages in precision manufacturing and gear cutting technologies pose significant challenges for market development. The specialized nature of gear manufacturing requires highly trained technicians and engineers, while educational systems and training programs struggle to meet industry demands for qualified personnel with advanced technical capabilities.

Import competition from established gear manufacturing regions, particularly Asia and Europe, creates pricing pressures and market share challenges for local manufacturers. International competitors often benefit from economies of scale, advanced technology, and established distribution networks that provide competitive advantages in Latin American markets.

Infrastructure limitations in some regions affect manufacturing capabilities, logistics efficiency, and market access. Inadequate transportation networks, power supply issues, and limited industrial infrastructure constrain manufacturing operations and increase operational costs for gear producers and end-users throughout the region.

Export market development presents substantial opportunities for Latin American gear manufacturers to expand beyond regional markets and compete internationally. Growing manufacturing capabilities, competitive labor costs, and strategic geographical positioning enable companies to serve North American and European markets effectively while developing specialized expertise in niche applications.

Technology partnerships with international gear manufacturers create opportunities for knowledge transfer, capability development, and market expansion. Joint ventures, licensing agreements, and strategic alliances facilitate access to advanced technologies, manufacturing processes, and global distribution networks that enhance competitive positioning.

Renewable energy sector growth generates significant opportunities for specialized gear applications in wind turbines, solar tracking systems, and energy storage solutions. Latin America’s abundant renewable energy resources and government support for clean energy development create long-term demand for precision gear systems and related components.

Aftermarket services expansion offers opportunities for gear manufacturers to develop comprehensive service offerings including maintenance, repair, and upgrade services. The growing installed base of industrial equipment and machinery creates ongoing demand for replacement parts, refurbishment services, and performance enhancement solutions.

Supply chain evolution demonstrates increasing localization and regional integration, with manufacturers developing comprehensive supplier networks and distribution systems throughout Latin America. MarkWide Research analysis indicates that regional sourcing has increased by approximately 42% over recent years, reducing dependency on imports and improving supply chain resilience during global disruptions.

Technological advancement accelerates across the region, with companies investing in computer numerical control (CNC) machining, precision measurement systems, and quality control technologies. These investments enhance manufacturing capabilities, improve product quality, and enable production of complex gear systems that meet international standards and specifications.

Market consolidation trends emerge as larger companies acquire smaller manufacturers to expand capabilities, geographic reach, and market share. Strategic acquisitions enable companies to integrate complementary technologies, access new customer segments, and achieve economies of scale necessary for competitive positioning in global markets.

Customer requirements evolution drives demand for customized gear solutions, shorter delivery times, and comprehensive technical support services. End-users increasingly seek suppliers capable of providing complete solutions including design assistance, prototype development, and ongoing technical support throughout product lifecycles.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across major Latin American markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial information to validate primary findings and provide comprehensive market context. Data triangulation techniques ensure accuracy and reliability of market estimates and projections throughout the research process.

Market modeling utilizes advanced analytical techniques including regression analysis, time series forecasting, and scenario planning to develop robust market projections and identify key growth drivers. Statistical validation ensures model accuracy and reliability for strategic decision-making purposes.

Industry expert validation provides additional verification of research findings through consultation with recognized industry authorities, technical specialists, and market analysts. Expert insights enhance understanding of market dynamics, technology trends, and competitive positioning factors affecting market development.

Brazil dominates the Latin American gear market, accounting for approximately 38% of regional demand, driven by its substantial automotive industry, mining operations, and manufacturing base. The country’s gear manufacturers benefit from established industrial infrastructure, skilled workforce, and government support for manufacturing development. São Paulo serves as the primary manufacturing hub, hosting numerous gear producers and automotive suppliers.

Mexico represents the second-largest market with approximately 30% market share, benefiting from its strategic location, NAFTA trade advantages, and growing automotive production. Mexican gear manufacturers serve both domestic and export markets, with particular strength in automotive applications and industrial machinery components. Manufacturing clusters in Bajío and northern regions drive market growth and development.

Argentina contributes significantly to regional market growth, particularly in agricultural machinery and industrial equipment applications. The country’s gear manufacturers specialize in heavy-duty applications for mining, agriculture, and industrial sectors. Economic challenges create both obstacles and opportunities for market development and international competitiveness.

Chile and Colombia represent emerging markets with growing industrial bases and increasing gear demand. These countries benefit from mining sector growth, infrastructure development, and expanding manufacturing capabilities that create opportunities for gear manufacturers and suppliers throughout the region.

Market competition features a diverse mix of international corporations, regional manufacturers, and specialized local companies serving various market segments and applications. The competitive environment encourages innovation, quality improvement, and customer service excellence throughout the industry.

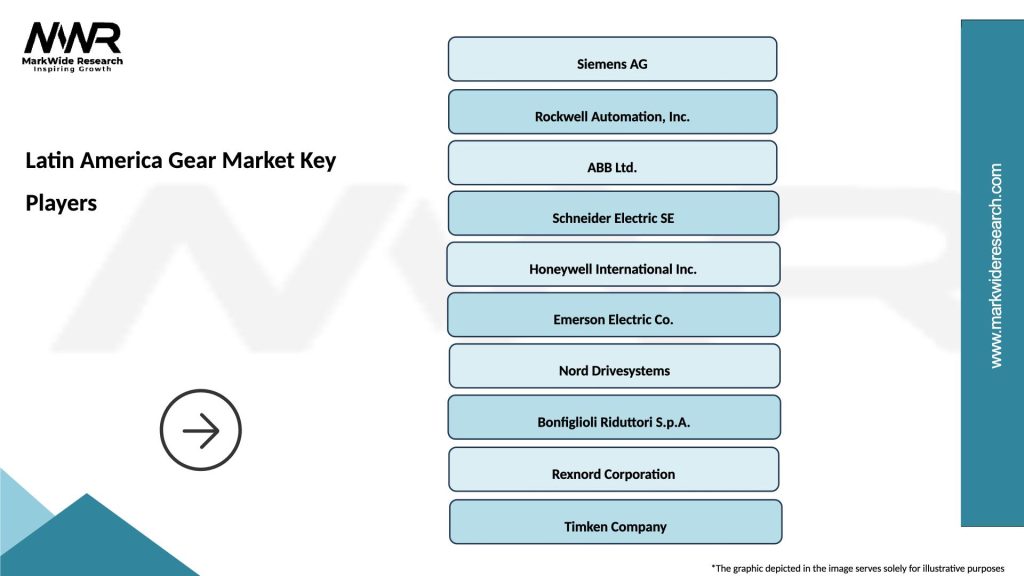

Leading market participants include:

Competitive strategies emphasize technology development, local manufacturing capabilities, customer service excellence, and strategic partnerships. Companies invest in research and development, manufacturing facility expansion, and workforce development to enhance competitive positioning and market share growth.

By Gear Type:

By Application:

By Material:

Automotive segment leadership reflects the substantial vehicle production throughout Latin America, with gear demand driven by transmission systems, differential assemblies, and engine components. Electric vehicle adoption creates new opportunities for specialized gear systems in electric drivetrains and charging infrastructure applications.

Industrial machinery applications demonstrate steady growth driven by manufacturing modernization and automation adoption. Companies invest in advanced manufacturing equipment requiring precision gear systems for optimal performance and reliability. Maintenance requirements create ongoing demand for replacement parts and upgrade services.

Mining equipment segment benefits from Latin America’s abundant mineral resources and expanding extraction operations. Heavy-duty gear applications require specialized designs capable of operating in challenging environments with high reliability and minimal maintenance requirements. Equipment modernization drives demand for advanced gear systems.

Construction equipment applications grow with infrastructure development and urbanization throughout the region. Gear systems for excavators, cranes, and construction machinery require durability, reliability, and performance under demanding operating conditions. Equipment rental markets create additional demand for replacement parts and services.

Manufacturers benefit from expanding market opportunities, technology advancement, and growing regional demand across multiple application segments. Investment in advanced manufacturing capabilities, quality systems, and customer service excellence creates competitive advantages and market share growth opportunities throughout Latin America.

End-users gain access to improved gear technologies, enhanced performance characteristics, and comprehensive technical support services. Local manufacturing development reduces lead times, improves supply chain reliability, and provides cost-effective solutions for various industrial applications and requirements.

Suppliers and distributors benefit from market expansion, product diversification opportunities, and growing demand for technical services. Regional market development creates opportunities for specialized distribution networks, technical support services, and value-added solutions that enhance customer relationships and business growth.

Government and economic development benefit from industrial growth, employment creation, and technology transfer associated with gear manufacturing development. Investment in manufacturing capabilities, skills development, and export growth contributes to economic diversification and competitiveness enhancement throughout the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates throughout the gear manufacturing industry, with companies adopting Industry 4.0 technologies, IoT integration, and smart manufacturing systems. These technologies enhance production efficiency by approximately 28% while improving quality control and predictive maintenance capabilities. Data analytics and machine learning applications optimize manufacturing processes and customer service delivery.

Sustainability initiatives gain prominence as manufacturers focus on environmental responsibility, energy efficiency, and circular economy principles. Companies invest in cleaner production technologies, waste reduction programs, and sustainable material sourcing to meet environmental regulations and customer expectations for responsible manufacturing practices.

Customization demand increases as end-users seek specialized gear solutions tailored to specific applications and operating requirements. Manufacturers develop flexible production capabilities, rapid prototyping services, and engineering support to meet growing demand for customized gear systems and technical solutions.

Service integration becomes increasingly important as manufacturers expand beyond product sales to offer comprehensive solutions including design assistance, installation support, maintenance services, and performance optimization. MWR research indicates that service revenues now represent approximately 23% of total industry revenues.

Manufacturing facility expansion continues throughout Latin America as companies invest in production capacity, technology upgrades, and geographic expansion. Recent investments include new manufacturing plants in Mexico, Brazil, and Colombia, enhancing regional production capabilities and market access for gear manufacturers and suppliers.

Technology partnerships between international and regional companies facilitate knowledge transfer, capability development, and market expansion. Strategic alliances enable local manufacturers to access advanced technologies, manufacturing processes, and global distribution networks while providing international companies with regional market access and manufacturing capabilities.

Workforce development initiatives address skills shortages through technical education programs, apprenticeship opportunities, and specialized training centers. Industry collaboration with educational institutions creates pathways for developing skilled technicians and engineers necessary for advanced gear manufacturing and quality control operations.

Export market development gains momentum as Latin American manufacturers achieve international quality certifications, develop export capabilities, and establish distribution partnerships in North American and European markets. Government support programs facilitate export development and international competitiveness enhancement.

Investment prioritization should focus on advanced manufacturing technologies, quality control systems, and workforce development to enhance competitive positioning and market share growth. Companies investing in precision manufacturing capabilities and technical expertise will benefit from growing demand for high-quality gear systems and specialized applications.

Market diversification strategies should emphasize export development, application expansion, and service integration to reduce dependency on domestic markets and create multiple revenue streams. Successful companies will develop comprehensive solutions combining products, services, and technical support to meet evolving customer requirements.

Partnership development with international technology providers, regional distributors, and end-user industries creates opportunities for capability enhancement, market access, and competitive advantage development. Strategic alliances facilitate knowledge transfer and resource sharing necessary for sustainable growth and market leadership.

Sustainability integration becomes increasingly important for long-term competitiveness and regulatory compliance. Companies should invest in environmental management systems, energy efficiency improvements, and sustainable manufacturing practices to meet evolving market expectations and regulatory requirements.

Market growth prospects remain positive throughout the forecast period, with continued expansion expected across all major application segments and geographic markets. MarkWide Research projections indicate sustained growth driven by industrial modernization, automotive sector development, and infrastructure investment throughout Latin America.

Technology advancement will continue reshaping the industry landscape, with digital manufacturing, automation integration, and advanced materials creating new opportunities and competitive requirements. Companies embracing technological innovation and digital transformation will achieve competitive advantages and market leadership positions.

Regional integration will strengthen as manufacturers develop comprehensive supply chains, distribution networks, and service capabilities throughout Latin America. Cross-border collaboration and trade facilitation will enhance market efficiency and competitive positioning in global markets.

Sustainability requirements will become increasingly important as environmental regulations, customer expectations, and corporate responsibility initiatives drive demand for sustainable manufacturing practices and environmentally responsible products. Companies prioritizing sustainability will benefit from competitive advantages and market opportunities.

The Latin America gear market demonstrates substantial growth potential and increasing sophistication, driven by industrial modernization, automotive sector expansion, and infrastructure development throughout the region. Market dynamics favor companies investing in advanced manufacturing capabilities, technology development, and comprehensive customer solutions that address evolving market requirements and competitive challenges.

Strategic opportunities exist for manufacturers, suppliers, and service providers willing to invest in capability development, market expansion, and technology advancement. Success factors include manufacturing excellence, customer service quality, technical expertise, and strategic partnerships that enhance competitive positioning and market share growth throughout Latin America and international markets.

Future success will depend on companies’ ability to adapt to changing market conditions, embrace technological innovation, and develop sustainable business practices that meet evolving customer expectations and regulatory requirements. The Latin America gear market offers substantial opportunities for growth, development, and competitive advantage creation for industry participants committed to excellence and continuous improvement.

What is Gear?

Gear refers to mechanical components used to transmit power and motion between machines. They are essential in various applications, including automotive, industrial machinery, and consumer electronics.

What are the key players in the Latin America Gear Market?

Key players in the Latin America Gear Market include Siemens AG, Bosch Rexroth AG, and Timken Company, among others. These companies are known for their innovative gear solutions and extensive product portfolios.

What are the main drivers of growth in the Latin America Gear Market?

The growth of the Latin America Gear Market is driven by increasing industrialization, the expansion of the automotive sector, and rising demand for automation in manufacturing processes.

What challenges does the Latin America Gear Market face?

Challenges in the Latin America Gear Market include fluctuating raw material prices, competition from low-cost manufacturers, and the need for technological advancements to meet evolving industry standards.

What opportunities exist in the Latin America Gear Market?

Opportunities in the Latin America Gear Market include the growing demand for renewable energy solutions, advancements in smart manufacturing technologies, and the increasing adoption of electric vehicles.

What trends are shaping the Latin America Gear Market?

Trends in the Latin America Gear Market include the integration of IoT technologies in gear systems, a shift towards lightweight materials for improved efficiency, and a focus on sustainability in manufacturing processes.

Latin America Gear Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mechanical Gears, Planetary Gears, Bevel Gears, Worm Gears |

| Technology | 3D Printing, CNC Machining, Injection Molding, Casting |

| End User | Aerospace, Marine, Construction, Agriculture |

| Application | Power Transmission, Robotics, Automotive, Industrial Machinery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Gear Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at