444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America food cans market represents a dynamic and rapidly evolving sector within the region’s packaging industry, driven by changing consumer preferences, urbanization trends, and growing demand for convenient food storage solutions. This comprehensive market encompasses various types of food canning products, including metal containers for processed foods, beverages, and preserved goods across multiple Latin American countries.

Market dynamics in Latin America reflect a unique blend of traditional food preservation methods and modern packaging technologies. The region’s food cans market has experienced significant transformation over the past decade, with manufacturers adapting to local preferences while incorporating international quality standards. Growth patterns indicate a steady expansion at approximately 6.2% CAGR, positioning Latin America as an emerging hub for food packaging innovation.

Regional characteristics play a crucial role in shaping market development, with countries like Brazil, Mexico, Argentina, and Colombia leading consumption patterns. The market benefits from abundant raw material availability, growing middle-class populations, and increasing adoption of processed and convenience foods. Consumer behavior shifts toward ready-to-eat meals and extended shelf-life products have created substantial opportunities for food can manufacturers throughout the region.

Technological advancements in can manufacturing processes, including improved coating technologies and enhanced preservation methods, have significantly boosted product quality and consumer acceptance. The integration of sustainable packaging solutions and recyclable materials has become increasingly important, with approximately 78% of consumers expressing preference for environmentally friendly packaging options.

The Latin America food cans market refers to the comprehensive ecosystem of metal container manufacturing, distribution, and consumption specifically designed for food preservation and storage across Latin American countries. This market encompasses the production, supply chain management, and retail distribution of various types of food cans, including aluminum and tinplate containers used for packaging processed foods, beverages, fruits, vegetables, and other consumable products.

Market definition extends beyond simple container manufacturing to include the entire value chain from raw material procurement to end-consumer delivery. The sector involves multiple stakeholders including can manufacturers, food processors, distributors, retailers, and consumers, each contributing to the market’s overall dynamics and growth trajectory.

Scope and boundaries of this market include both domestic production and international trade activities, covering import and export operations that influence regional supply and demand patterns. The market encompasses various can sizes, materials, and specialized applications tailored to local food preferences and regulatory requirements across different Latin American nations.

Strategic market positioning reveals that the Latin America food cans market has emerged as a significant growth driver within the broader packaging industry, supported by robust economic development and evolving consumer lifestyles. The market demonstrates strong resilience and adaptability, with manufacturers successfully navigating challenges while capitalizing on emerging opportunities.

Key performance indicators highlight impressive market expansion, with regional consumption growing at approximately 5.8% annually over the recent period. This growth trajectory reflects increased urbanization, rising disposable incomes, and growing preference for convenient food storage solutions among Latin American consumers.

Market segmentation analysis reveals diverse applications across food categories, with processed foods and beverages representing the largest consumption segments. The market benefits from strong domestic production capabilities, strategic geographic positioning, and increasing integration with global supply chains.

Competitive landscape features a mix of international corporations and regional players, creating a dynamic environment that fosters innovation and competitive pricing. Market leaders have established strong distribution networks and manufacturing facilities throughout key Latin American countries, ensuring efficient market coverage and customer service.

Primary market drivers include accelerating urbanization rates, changing dietary patterns, and increasing demand for processed and convenience foods across Latin American populations. These fundamental shifts create sustained demand for reliable food packaging solutions that extend shelf life and maintain product quality.

Consumer behavior analysis indicates several critical trends shaping market development:

Technology integration has become increasingly important, with smart packaging solutions and improved preservation technologies gaining traction. Manufacturers are investing in advanced coating systems, enhanced sealing technologies, and innovative design features that improve functionality and consumer appeal.

Supply chain optimization represents a critical success factor, with companies focusing on efficient distribution networks, inventory management, and logistics coordination to serve diverse Latin American markets effectively.

Urbanization acceleration stands as the primary catalyst driving food cans market expansion throughout Latin America. Rapid urban population growth, currently increasing at approximately 2.3% annually, creates substantial demand for convenient food storage and preservation solutions that align with fast-paced urban lifestyles.

Economic development across the region has resulted in rising disposable incomes and changing consumption patterns. Middle-class expansion has created new market segments with increased purchasing power and willingness to invest in quality food packaging solutions that offer convenience and reliability.

Demographic shifts contribute significantly to market growth, with younger populations embracing processed and convenience foods more readily than previous generations. These demographic changes drive demand for innovative packaging solutions that meet evolving lifestyle requirements and food preferences.

Food safety regulations have become increasingly stringent across Latin American countries, creating opportunities for high-quality food can manufacturers who can meet enhanced safety standards and certification requirements. Regulatory compliance drives demand for advanced packaging technologies and quality assurance systems.

Retail sector expansion throughout the region has improved product accessibility and availability, creating new distribution channels and market opportunities. Modern retail formats, including supermarkets and convenience stores, have increased consumer exposure to canned food products and driven adoption rates.

Raw material price volatility presents significant challenges for food can manufacturers, with aluminum and steel price fluctuations directly impacting production costs and profit margins. These material cost variations create uncertainty in pricing strategies and long-term planning initiatives.

Environmental concerns regarding metal packaging waste and recycling infrastructure limitations pose ongoing challenges for market growth. Consumer awareness of environmental issues has increased pressure on manufacturers to develop more sustainable packaging solutions and improve recycling programs.

Competition from alternative packaging formats, including flexible packaging, glass containers, and plastic alternatives, creates market pressure and requires continuous innovation to maintain competitive positioning. These alternative solutions often offer cost advantages or specific functional benefits that challenge traditional food cans.

Economic instability in certain Latin American countries affects consumer purchasing power and market demand patterns. Currency fluctuations, inflation rates, and economic uncertainty can impact both production costs and consumer spending on packaged food products.

Infrastructure limitations in some regions affect distribution efficiency and market penetration capabilities. Transportation challenges, storage facility limitations, and logistics constraints can restrict market access and increase operational costs for manufacturers and distributors.

Sustainable packaging innovation represents a tremendous growth opportunity, with increasing consumer demand for environmentally responsible packaging solutions. Manufacturers who invest in recyclable materials, reduced environmental impact, and circular economy principles can capture significant market share and premium pricing opportunities.

Premium product segments offer substantial growth potential, particularly in urban markets where consumers demonstrate willingness to pay higher prices for superior quality, innovative features, and enhanced convenience. Specialty food cans with advanced preservation technologies and unique design elements can command premium market positions.

Export market expansion provides opportunities for Latin American manufacturers to leverage competitive production costs and strategic geographic positioning to serve international markets. Regional trade agreements and improved logistics infrastructure support export growth initiatives.

Technology integration opportunities include smart packaging solutions, improved coating technologies, and enhanced preservation systems that extend shelf life and improve food quality. These technological advances can differentiate products and create competitive advantages in the marketplace.

E-commerce growth creates new distribution channels and market access opportunities, particularly for specialty and premium food can products. Online retail platforms enable manufacturers to reach consumers directly and expand market coverage beyond traditional retail networks.

Supply and demand equilibrium in the Latin America food cans market reflects complex interactions between production capacity, consumer demand, and economic factors. Market dynamics are influenced by seasonal consumption patterns, economic cycles, and changing consumer preferences that create both challenges and opportunities for market participants.

Competitive intensity has increased significantly as both international and regional players compete for market share. This competition drives innovation, improves product quality, and creates pricing pressures that benefit consumers while challenging manufacturers to optimize operational efficiency.

Value chain integration has become increasingly important, with successful companies developing comprehensive strategies that encompass raw material sourcing, manufacturing efficiency, distribution optimization, and customer relationship management. Integrated approaches enable better cost control and market responsiveness.

Regulatory environment evolution continues to shape market dynamics, with governments implementing new food safety standards, environmental regulations, and trade policies that affect market operations. Companies must adapt to changing regulatory requirements while maintaining competitive positioning.

Consumer preference shifts toward health-conscious and environmentally sustainable products are reshaping market dynamics. Manufacturers must balance traditional market demands with emerging consumer expectations for responsible packaging and healthy food options.

Comprehensive market analysis employed multiple research approaches to ensure accurate and reliable market insights. The methodology combined quantitative data collection with qualitative analysis to provide a complete understanding of market dynamics, trends, and growth opportunities within the Latin America food cans market.

Primary research activities included extensive interviews with industry executives, manufacturers, distributors, and key stakeholders across major Latin American markets. These interviews provided valuable insights into market challenges, opportunities, and strategic priorities that shape industry development.

Secondary research components involved comprehensive analysis of industry reports, government statistics, trade publications, and company financial data. This research foundation ensured accurate market sizing, trend identification, and competitive landscape assessment.

Data validation processes included cross-referencing multiple information sources, statistical analysis verification, and expert review to ensure research accuracy and reliability. Quality control measures were implemented throughout the research process to maintain high standards of data integrity.

Market modeling techniques utilized advanced analytical methods to project future market trends, growth patterns, and opportunity assessment. These models incorporated economic indicators, demographic trends, and industry-specific factors to provide robust market forecasts and strategic insights.

Brazil dominates the Latin America food cans market, accounting for approximately 42% of regional consumption, driven by its large population, developed food processing industry, and strong manufacturing capabilities. The Brazilian market benefits from established supply chains, diverse food preferences, and growing urban consumer base that supports sustained market growth.

Mexico represents the second-largest market segment, with approximately 28% market share, supported by proximity to North American markets, strong manufacturing infrastructure, and growing middle-class population. Mexican food can manufacturers benefit from competitive production costs and strategic trade relationships that facilitate both domestic and export market development.

Argentina and Colombia together account for approximately 18% of regional market share, with both countries demonstrating strong growth potential driven by economic development, urbanization trends, and increasing adoption of processed foods. These markets offer opportunities for both domestic production and international investment.

Smaller regional markets including Chile, Peru, Venezuela, and Central American countries collectively represent the remaining 12% market share but demonstrate significant growth potential. These markets benefit from improving economic conditions, growing consumer awareness, and increasing integration with regional supply chains.

Regional trade dynamics facilitate market integration and cross-border commerce, with trade agreements and improved logistics infrastructure supporting market expansion and efficiency improvements. Regional cooperation enhances competitiveness and market access for Latin American food can manufacturers.

Market leadership is characterized by a diverse mix of international corporations and regional specialists who compete across different market segments and geographic regions. The competitive environment fosters innovation, quality improvements, and strategic partnerships that benefit overall market development.

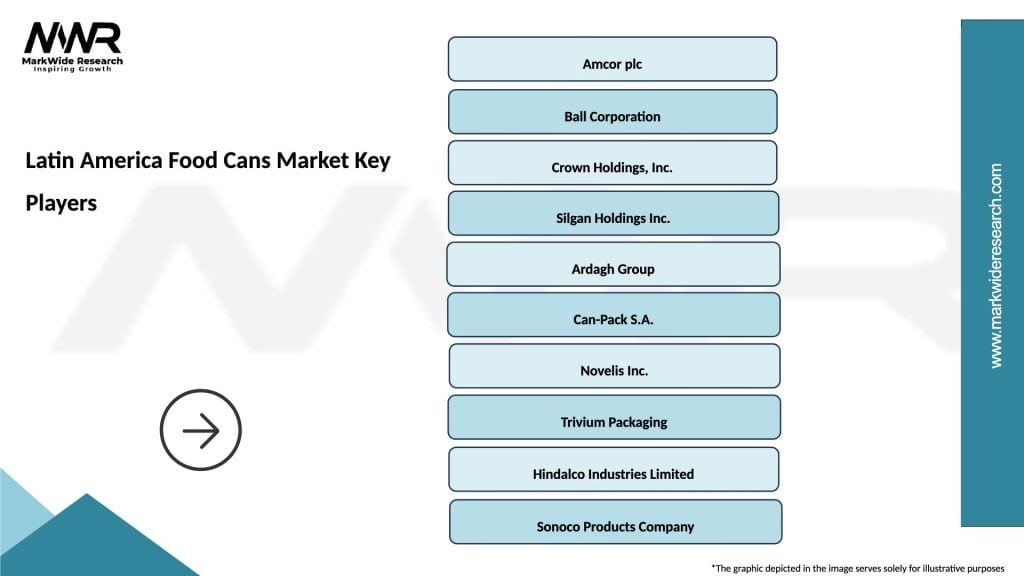

Key market participants include:

Competitive strategies focus on operational efficiency, product innovation, customer service excellence, and strategic market positioning. Leading companies invest in advanced manufacturing technologies, quality assurance systems, and distribution network optimization to maintain competitive advantages.

Strategic partnerships and joint ventures have become increasingly common as companies seek to leverage complementary strengths, share market risks, and accelerate growth initiatives. These collaborative approaches enable market expansion and technology sharing that benefits overall industry development.

By Material Type:

By Application:

By End-User:

Aluminum cans segment demonstrates the strongest growth trajectory, driven by consumer preference for lightweight, recyclable packaging and premium product positioning. This category benefits from technological advances in aluminum processing and growing environmental consciousness among consumers.

Beverage applications represent the most dynamic market segment, with approximately 35% of total market consumption, supported by growing soft drink consumption, energy drink popularity, and alcoholic beverage market expansion. Innovation in can design and functionality drives continued growth in this segment.

Processed food packaging maintains steady growth supported by urbanization trends and changing dietary patterns. This category benefits from extended shelf life requirements, convenience factors, and growing acceptance of processed foods across Latin American markets.

Premium and specialty segments show exceptional growth potential, with consumers increasingly willing to pay premium prices for high-quality packaging that preserves product integrity and enhances brand perception. These segments offer higher profit margins and differentiation opportunities.

Export-oriented production has gained momentum as Latin American manufacturers leverage competitive advantages to serve international markets. This category benefits from favorable exchange rates, competitive production costs, and strategic geographic positioning.

Manufacturers benefit from growing market demand, technological advancement opportunities, and expanding distribution channels that support revenue growth and market share expansion. The market offers opportunities for operational efficiency improvements and product innovation that enhance competitive positioning.

Food processors gain access to reliable packaging solutions that extend product shelf life, maintain quality standards, and support brand differentiation strategies. Advanced food can technologies enable processors to explore new product categories and market opportunities.

Retailers advantage from improved inventory management, reduced spoilage rates, and enhanced product presentation that drives consumer purchases. Food cans offer consistent quality, extended shelf life, and efficient storage characteristics that benefit retail operations.

Consumers receive convenient, safe, and reliable food storage solutions that fit modern lifestyle requirements. Food cans provide extended shelf life, portion control, and easy preparation options that meet diverse consumer needs and preferences.

Environmental stakeholders benefit from increasing focus on recyclable materials, sustainable production processes, and circular economy principles that reduce environmental impact and promote responsible resource utilization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has emerged as the dominant trend shaping market development, with manufacturers investing in recyclable materials, reduced environmental impact, and circular economy principles. This trend reflects growing consumer awareness and regulatory pressure for responsible packaging solutions.

Smart packaging technologies are gaining traction, including QR codes, freshness indicators, and interactive features that enhance consumer engagement and provide additional value beyond basic packaging functions. These innovations create differentiation opportunities and premium positioning possibilities.

Lightweight design optimization continues to drive product development, with manufacturers focusing on material reduction while maintaining structural integrity and performance characteristics. This trend supports cost reduction, environmental benefits, and improved logistics efficiency.

Customization and personalization have become increasingly important, with brands seeking unique packaging solutions that support marketing objectives and consumer engagement strategies. Custom printing, special finishes, and limited edition designs drive market differentiation.

Health and wellness positioning influences packaging design and marketing strategies, with emphasis on BPA-free coatings, organic certifications, and health-conscious messaging that appeals to increasingly health-aware consumers.

Manufacturing capacity expansion has accelerated across the region, with major players investing in new production facilities and equipment upgrades to meet growing demand. These investments demonstrate confidence in long-term market growth and regional development potential.

Technology partnerships between international corporations and regional manufacturers have facilitated knowledge transfer, quality improvements, and innovation acceleration. These collaborations enhance competitive capabilities and market positioning for Latin American companies.

Sustainability initiatives have gained momentum, with companies implementing comprehensive recycling programs, sustainable sourcing practices, and environmental impact reduction strategies. According to MarkWide Research analysis, approximately 68% of manufacturers have implemented formal sustainability programs.

Regulatory harmonization efforts across Latin American countries are improving market efficiency and reducing compliance complexity. Standardized regulations facilitate trade, reduce costs, and improve market access for manufacturers and distributors.

Digital transformation initiatives are reshaping operations, with companies investing in automation, data analytics, and digital supply chain management systems that improve efficiency and customer service capabilities.

Strategic focus recommendations emphasize the importance of sustainability integration, technology adoption, and market diversification strategies that position companies for long-term success. Companies should prioritize environmental responsibility while maintaining competitive cost structures and operational efficiency.

Investment priorities should include manufacturing technology upgrades, quality assurance systems, and distribution network optimization that enhance competitive capabilities. Strategic investments in research and development can drive innovation and market differentiation.

Market expansion strategies should consider both domestic market penetration and international export opportunities. Companies should evaluate market entry strategies, partnership opportunities, and competitive positioning approaches that maximize growth potential.

Risk management approaches must address raw material price volatility, economic uncertainty, and regulatory changes that could impact market operations. Diversification strategies and flexible operational models can help mitigate these risks.

Customer relationship development should focus on understanding evolving consumer preferences, building brand loyalty, and creating value-added services that differentiate offerings in competitive markets. Strong customer relationships provide sustainable competitive advantages.

Long-term growth prospects remain positive for the Latin America food cans market, supported by continued urbanization, economic development, and evolving consumer preferences. MWR projections indicate sustained growth at approximately 6.5% CAGR over the next five years, driven by fundamental market drivers and emerging opportunities.

Technology evolution will continue to reshape market dynamics, with advanced materials, smart packaging solutions, and sustainable technologies becoming increasingly important. Companies that successfully integrate these technologies will gain competitive advantages and market leadership positions.

Market consolidation trends may accelerate as companies seek scale advantages, operational efficiencies, and enhanced market coverage. Strategic mergers and acquisitions could reshape competitive dynamics and create new market leaders.

Sustainability requirements will become increasingly stringent, driving innovation in recyclable materials, environmental impact reduction, and circular economy implementation. Companies that proactively address sustainability challenges will benefit from regulatory compliance and consumer preference alignment.

Export market development offers significant growth potential as Latin American manufacturers leverage competitive advantages to serve international markets. Strategic positioning and quality improvements can capture global market opportunities and drive revenue expansion.

The Latin America food cans market presents compelling growth opportunities supported by strong fundamental drivers, evolving consumer preferences, and favorable market dynamics. The market’s resilience and adaptability position it well for continued expansion despite economic challenges and competitive pressures.

Strategic success factors include sustainability integration, technology adoption, operational efficiency, and customer-focused innovation that address evolving market requirements. Companies that successfully navigate these priorities will capture market leadership positions and sustainable competitive advantages.

Future market development will be shaped by environmental consciousness, technological advancement, and changing consumer lifestyles that create both challenges and opportunities for market participants. Proactive adaptation to these trends will determine long-term success in this dynamic and growing market.

Investment attractiveness remains strong for the Latin America food cans market, with multiple growth drivers, expanding applications, and improving market infrastructure supporting positive long-term prospects. The market offers attractive opportunities for both domestic and international investors seeking exposure to growing Latin American consumer markets.

What is Food Cans?

Food cans are containers made of metal, glass, or plastic used for preserving food products. They are designed to extend the shelf life of food items by preventing exposure to air and light, making them a popular choice for various food categories such as vegetables, fruits, and meats.

What are the key players in the Latin America Food Cans Market?

Key players in the Latin America Food Cans Market include Crown Holdings, Ball Corporation, and Ardagh Group, among others. These companies are known for their innovative packaging solutions and extensive distribution networks across the region.

What are the growth factors driving the Latin America Food Cans Market?

The Latin America Food Cans Market is driven by increasing consumer demand for convenient and long-lasting food products. Additionally, the rise in urbanization and busy lifestyles has led to a higher preference for ready-to-eat meals, further boosting the market.

What challenges does the Latin America Food Cans Market face?

The Latin America Food Cans Market faces challenges such as fluctuating raw material prices and environmental concerns regarding packaging waste. Additionally, competition from alternative packaging solutions can impact market growth.

What opportunities exist in the Latin America Food Cans Market?

Opportunities in the Latin America Food Cans Market include the growing trend of sustainable packaging and the increasing demand for organic and health-focused food products. Companies can leverage these trends to innovate and expand their product offerings.

What trends are shaping the Latin America Food Cans Market?

Trends shaping the Latin America Food Cans Market include the rise of eco-friendly packaging solutions and the integration of smart technology in food cans. These innovations aim to enhance consumer convenience and improve food preservation methods.

Latin America Food Cans Market

| Segmentation Details | Description |

|---|---|

| Product Type | Aluminum, Steel, Tinplate, Composite |

| End User | Food Manufacturers, Retailers, Distributors, Restaurants |

| Packaging Type | Easy-Open, Resealable, Standard, Specialty |

| Application | Vegetables, Fruits, Soups, Beverages |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Food Cans Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at