444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America electronics security market represents a rapidly evolving landscape driven by increasing urbanization, rising crime rates, and growing awareness of security threats across the region. This dynamic market encompasses a comprehensive range of security solutions including video surveillance systems, access control technologies, intrusion detection systems, and integrated security platforms designed to protect residential, commercial, and industrial properties throughout Latin American countries.

Market expansion is particularly pronounced in major economies such as Brazil, Mexico, Argentina, and Colombia, where government initiatives and private sector investments are accelerating the adoption of advanced security technologies. The region is experiencing a 12.8% annual growth rate in electronics security deployments, with smart city projects and infrastructure development serving as primary catalysts for market development.

Technological advancement in artificial intelligence, cloud computing, and Internet of Things (IoT) integration is transforming traditional security approaches into sophisticated, interconnected systems. Latin American businesses and institutions are increasingly recognizing the value of proactive security measures, leading to substantial investments in modern electronics security infrastructure that can provide real-time monitoring, automated threat detection, and comprehensive incident response capabilities.

The Latin America electronics security market refers to the comprehensive ecosystem of electronic devices, systems, and services designed to protect people, property, and assets across residential, commercial, and industrial sectors throughout Latin American countries. This market encompasses advanced surveillance cameras, access control systems, alarm systems, perimeter protection solutions, and integrated security management platforms that utilize cutting-edge technologies to deliver comprehensive protection against various security threats.

Electronics security systems in Latin America integrate multiple technologies including video analytics, biometric authentication, wireless communication, cloud-based storage, and artificial intelligence to create robust security infrastructures. These solutions range from basic residential alarm systems to sophisticated enterprise-level security platforms that can monitor multiple locations simultaneously while providing real-time alerts and automated response capabilities.

Market definition extends beyond traditional hardware components to include software applications, professional services, system integration, maintenance support, and managed security services that ensure optimal performance and continuous protection. The sector serves diverse end-users including government agencies, financial institutions, retail establishments, manufacturing facilities, educational institutions, healthcare organizations, and residential communities seeking reliable security solutions.

Latin America’s electronics security market is experiencing unprecedented growth driven by escalating security concerns, technological innovations, and increasing investment in smart infrastructure projects. The region’s unique security challenges, combined with rapid urbanization and economic development, are creating substantial opportunities for advanced security solution providers to establish strong market presence and deliver comprehensive protection services.

Key market drivers include rising crime rates in urban areas, government initiatives promoting public safety, growing adoption of smart city technologies, and increasing awareness among businesses regarding the importance of comprehensive security measures. The market benefits from a 68% adoption rate of IP-based surveillance systems, reflecting the region’s transition toward more sophisticated and scalable security technologies.

Competitive landscape features both international technology leaders and regional solution providers working to address specific Latin American market requirements. Companies are focusing on developing cost-effective solutions that can operate reliably in challenging environmental conditions while providing advanced features such as remote monitoring, mobile accessibility, and integration with existing infrastructure systems.

Future prospects indicate continued expansion as Latin American countries invest in modernizing their security infrastructure, implementing smart city initiatives, and addressing evolving security threats through advanced technology adoption. The market is positioned for sustained growth with increasing demand for integrated security platforms that can deliver comprehensive protection across multiple sectors and applications.

Strategic market analysis reveals several critical insights that define the current state and future direction of Latin America’s electronics security market:

Primary market drivers propelling growth in Latin America’s electronics security market stem from a combination of security challenges, technological advancement, and economic development factors that create compelling demand for advanced security solutions across multiple sectors.

Rising crime rates in major Latin American cities are compelling businesses, government agencies, and residential communities to invest in comprehensive security systems. Urban areas experiencing rapid population growth face increased security challenges that traditional security measures cannot adequately address, driving adoption of sophisticated electronics security technologies that provide enhanced monitoring, detection, and response capabilities.

Government initiatives promoting public safety and smart city development are creating substantial market opportunities. National and municipal governments are implementing large-scale security projects that require advanced surveillance systems, integrated command centers, and comprehensive monitoring networks. These initiatives often include significant budget allocations for modernizing public security infrastructure and implementing technology-driven crime prevention strategies.

Economic development and increasing foreign investment are driving demand for advanced security solutions in commercial and industrial sectors. International companies establishing operations in Latin America require security systems that meet global standards while addressing local security challenges. This trend is particularly evident in manufacturing, logistics, retail, and financial services sectors where asset protection and operational continuity are critical business requirements.

Technological accessibility and decreasing costs of advanced security technologies are making sophisticated systems more accessible to smaller organizations and residential users. The availability of scalable solutions that can grow with user requirements is expanding the addressable market beyond traditional large enterprise customers to include small businesses, educational institutions, and residential communities.

Economic constraints represent the most significant challenge facing Latin America’s electronics security market, as currency volatility, inflation, and limited capital availability can restrict investment in advanced security technologies. Many potential customers face budget limitations that delay or reduce the scope of security system implementations, particularly affecting small and medium-sized businesses that could benefit substantially from modern security solutions.

Technical infrastructure limitations in certain regions create deployment challenges for advanced security systems that require reliable internet connectivity, stable power supply, and adequate telecommunications infrastructure. Rural areas and developing regions may lack the necessary infrastructure to support sophisticated IP-based security systems, limiting market expansion and requiring alternative technology approaches.

Skills shortage in security system installation, maintenance, and operation creates barriers to market growth. The complexity of modern security technologies requires specialized technical expertise that may not be readily available in all markets. This challenge affects both system deployment timelines and ongoing operational effectiveness, potentially deterring some customers from adopting advanced security solutions.

Regulatory complexity and varying compliance requirements across different Latin American countries can complicate market entry and product standardization efforts. Companies must navigate diverse regulatory environments, data protection laws, and certification requirements that can increase costs and complexity of serving multiple markets within the region.

Integration challenges with existing infrastructure and legacy systems can create technical and financial barriers to adoption. Organizations with established security systems may face significant costs and operational disruption when upgrading to modern electronics security platforms, leading to delayed adoption decisions or reduced system scope.

Smart city initiatives across Latin America present substantial opportunities for electronics security market expansion. Governments are investing heavily in urban technology infrastructure that includes comprehensive security systems, traffic monitoring, emergency response coordination, and public safety enhancement. These projects require integrated security platforms that can support multiple applications while providing centralized management and real-time situational awareness capabilities.

Digital transformation in traditional industries is creating new demand for advanced security solutions that can protect both physical and digital assets. Manufacturing companies, financial institutions, healthcare organizations, and retail businesses are implementing comprehensive security strategies that integrate physical security with cybersecurity measures, creating opportunities for solution providers that can deliver unified security platforms.

Residential market expansion represents a significant growth opportunity as middle-class populations in Latin America increasingly invest in home security systems. Rising disposable income, growing security awareness, and availability of affordable smart home security solutions are driving residential market growth. This segment particularly benefits from wireless technologies and mobile-accessible systems that provide convenience and flexibility.

Cross-border collaboration and regional integration initiatives are creating opportunities for standardized security solutions that can operate across multiple Latin American countries. Companies that can develop scalable platforms supporting multiple languages, currencies, and regulatory requirements are well-positioned to capture regional market share and establish strong competitive positions.

Emerging technologies such as artificial intelligence, machine learning, and advanced analytics are creating opportunities for innovative security solutions that can provide enhanced threat detection, predictive analytics, and automated response capabilities. Early adopters of these technologies can establish competitive advantages while addressing evolving security challenges that traditional systems cannot adequately handle.

Market dynamics in Latin America’s electronics security sector are characterized by rapid technological evolution, changing customer expectations, and increasing competition among solution providers seeking to establish strong regional presence. The interplay between these factors creates a complex but opportunity-rich environment for companies that can effectively navigate local market conditions while delivering advanced security capabilities.

Competitive intensity is increasing as both international technology leaders and regional specialists compete for market share. This competition is driving innovation, improving solution quality, and creating more favorable pricing for customers. Companies are differentiating themselves through specialized applications, superior service support, and ability to address specific regional requirements that generic solutions cannot adequately meet.

Technology convergence is reshaping market boundaries as traditional security systems integrate with IT infrastructure, telecommunications networks, and business management platforms. This convergence creates opportunities for comprehensive solution providers while challenging companies that focus on narrow technology segments. The trend toward integrated platforms requires vendors to develop broader capabilities or establish strategic partnerships.

Customer expectations are evolving toward more sophisticated, user-friendly, and cost-effective solutions that can deliver immediate value while scaling to meet future requirements. According to MarkWide Research analysis, customers increasingly prioritize systems that offer remote accessibility, mobile integration, and automated features that reduce operational complexity while enhancing security effectiveness.

Regulatory evolution is influencing market dynamics as governments implement new security standards, data protection requirements, and technology certification processes. These regulatory changes create both challenges and opportunities, as companies must adapt their solutions while potentially benefiting from increased demand for compliant security systems.

Comprehensive market research methodology employed for analyzing Latin America’s electronics security market incorporates multiple data collection approaches, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. The research framework combines quantitative analysis with qualitative assessment to provide a complete understanding of market conditions, trends, and future prospects.

Primary research activities include extensive interviews with industry executives, technology vendors, system integrators, end-users, and government officials across major Latin American markets. These interviews provide firsthand insights into market conditions, customer requirements, competitive dynamics, and emerging trends that shape the electronics security landscape. Survey data collection from diverse stakeholder groups ensures comprehensive representation of market perspectives.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, technology specifications, and regulatory documentation. This research provides historical context, market sizing data, competitive intelligence, and regulatory framework understanding that supports primary research findings and enables comprehensive market analysis.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. The methodology incorporates economic indicators, demographic trends, technology adoption patterns, and regulatory developments to create robust market projections that account for various influencing factors.

Data validation processes include cross-referencing multiple sources, expert review panels, and market participant feedback to ensure research accuracy and reliability. The methodology emphasizes transparency and objectivity while providing actionable insights that support strategic decision-making for market participants and stakeholders.

Brazil dominates the Latin American electronics security market with approximately 42% market share, driven by its large economy, significant urban population, and substantial investment in security infrastructure. The country’s major cities face considerable security challenges that drive demand for advanced surveillance systems, access control technologies, and integrated security platforms. Government initiatives promoting public safety and smart city development create additional market opportunities for security solution providers.

Mexico represents the second-largest market with 28% regional market share, benefiting from its proximity to North American markets, growing manufacturing sector, and increasing foreign investment. The country’s border security requirements, industrial facility protection needs, and expanding retail sector create diverse demand for electronics security solutions. Mexico’s participation in international trade agreements also drives adoption of security standards that meet global requirements.

Argentina and Colombia collectively account for 18% of the regional market, with both countries experiencing growing demand for modern security technologies. Argentina’s financial sector and urban centers drive sophisticated security system adoption, while Colombia’s improving security situation and economic development create opportunities for comprehensive security infrastructure investments.

Smaller markets including Chile, Peru, Venezuela, and Central American countries represent the remaining 12% market share but offer significant growth potential. These markets are characterized by increasing urbanization, growing middle-class populations, and government initiatives promoting public safety and economic development. Mining, agriculture, and tourism industries in these regions create specialized security requirements that drive demand for tailored solutions.

Regional integration trends are creating opportunities for standardized security platforms that can operate across multiple countries while addressing local requirements. Companies that can navigate diverse regulatory environments and cultural preferences while delivering consistent quality and support are well-positioned for regional expansion success.

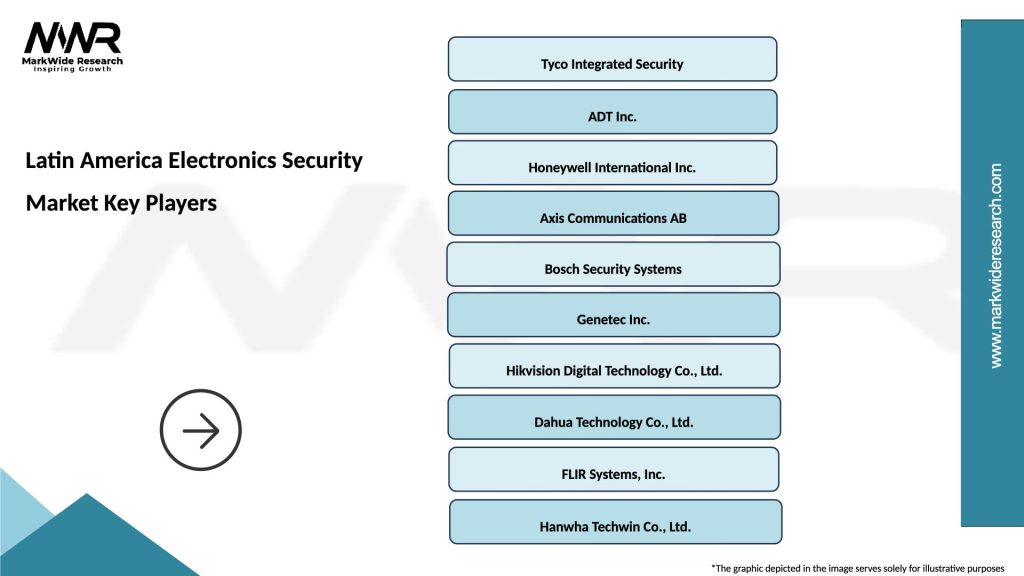

Market leadership in Latin America’s electronics security sector is distributed among international technology companies, regional specialists, and local system integrators that collectively serve diverse customer requirements across multiple market segments. The competitive environment emphasizes technological innovation, local market knowledge, and comprehensive service capabilities.

Regional competitors and local system integrators play crucial roles in market development by providing specialized services, local support, and customized solutions that address specific regional requirements. These companies often establish partnerships with international technology providers to deliver comprehensive solutions while maintaining competitive pricing and superior customer service.

Competitive strategies focus on technological differentiation, local market adaptation, comprehensive service offerings, and strategic partnerships that enable companies to address diverse customer requirements while maintaining sustainable competitive advantages in the dynamic Latin American market environment.

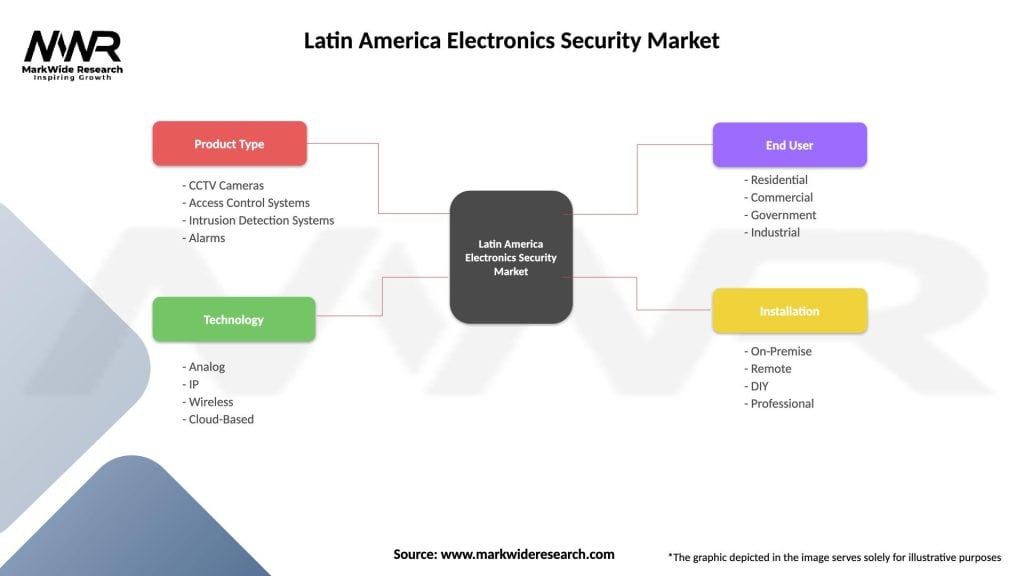

Technology segmentation reveals distinct market categories that serve different security requirements and customer preferences across Latin America’s diverse electronics security landscape:

By Technology:

By Application:

By End-User:

Video surveillance systems dominate the Latin American electronics security market with 58% category share, driven by their versatility, declining costs, and advanced analytics capabilities. IP-based cameras are rapidly replacing analog systems as customers seek higher image quality, remote accessibility, and integration with other security technologies. The segment benefits from artificial intelligence integration that enables automated threat detection, facial recognition, and behavioral analysis capabilities.

Access control systems represent a rapidly growing category with 23% market share, fueled by increasing security awareness and adoption of biometric technologies. Organizations are implementing sophisticated access control solutions that integrate with time and attendance systems, visitor management platforms, and overall security infrastructure. Mobile credentials and cloud-based access control are gaining popularity due to their convenience and scalability.

Intrusion detection systems maintain steady demand with 12% market share, particularly in residential and small commercial applications. Wireless technologies and smart home integration are driving innovation in this category, making intrusion detection systems more accessible and user-friendly. Integration with mobile devices and professional monitoring services enhances the value proposition for end-users.

Integrated security platforms represent the fastest-growing category with 7% current market share but significant growth potential. These comprehensive solutions appeal to organizations seeking unified security management, reduced complexity, and improved operational efficiency. The category benefits from increasing demand for centralized security operations centers and comprehensive threat management capabilities.

Category convergence is creating new opportunities as traditional boundaries between security technologies blur. Customers increasingly prefer solutions that combine multiple security functions while providing unified management interfaces and comprehensive reporting capabilities. This trend favors vendors that can deliver integrated platforms over those focusing on individual technology categories.

Technology vendors benefit from expanding market opportunities driven by increasing security awareness, government investment in public safety, and growing adoption of advanced security technologies across multiple sectors. The Latin American market offers substantial growth potential for companies that can adapt their solutions to local requirements while maintaining competitive pricing and comprehensive support capabilities.

System integrators and service providers gain from increasing demand for professional installation, maintenance, and managed security services. The complexity of modern security systems creates opportunities for specialized service providers that can deliver expertise in system design, integration, and ongoing support. Local integrators particularly benefit from their understanding of regional requirements and ability to provide responsive customer service.

End-users across all sectors benefit from improved security effectiveness, reduced operational costs, and enhanced situational awareness provided by modern electronics security systems. Advanced technologies enable proactive threat detection, automated response capabilities, and comprehensive incident documentation that supports both security operations and business continuity requirements.

Government agencies benefit from enhanced public safety capabilities, improved emergency response coordination, and more effective crime prevention through deployment of comprehensive security infrastructure. Smart city initiatives and integrated security platforms enable more efficient resource utilization while providing better protection for citizens and public assets.

Economic development benefits include job creation in technology sectors, increased foreign investment attraction, and improved business confidence resulting from enhanced security infrastructure. The electronics security market contributes to overall economic growth while supporting the development of local technical expertise and service capabilities.

Society benefits from reduced crime rates, improved public safety, and enhanced quality of life resulting from comprehensive security infrastructure deployment. Advanced security technologies contribute to creating safer communities while supporting economic development and social progress throughout the Latin American region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming Latin America’s electronics security market by enabling advanced analytics, automated threat detection, and predictive security capabilities. AI-powered systems can analyze video footage in real-time, identify suspicious behavior, and generate automated alerts that enable faster response times. This trend is particularly valuable in large-scale deployments where human monitoring of multiple camera feeds would be impractical or cost-prohibitive.

Cloud-based security platforms are gaining significant traction as organizations seek scalable, cost-effective solutions that can be accessed remotely and managed centrally. Cloud deployment eliminates the need for extensive on-premises infrastructure while providing automatic software updates, data backup, and multi-site management capabilities. This trend particularly benefits small and medium-sized businesses that lack dedicated IT resources for security system management.

Mobile accessibility has become a standard requirement as users expect to monitor and control their security systems from smartphones and tablets. Mobile applications provide real-time alerts, live video viewing, remote system control, and incident management capabilities that enhance security effectiveness while providing convenience for system operators. This trend is driving development of user-friendly interfaces and responsive system designs.

Integration convergence is creating comprehensive security ecosystems that combine physical security with cybersecurity, building automation, and business intelligence systems. Organizations increasingly prefer unified platforms that can manage multiple security functions while providing consolidated reporting and centralized control capabilities. This trend requires vendors to develop broader solution portfolios or establish strategic partnerships.

Biometric authentication adoption is accelerating as organizations seek more secure and convenient access control solutions. Fingerprint, facial recognition, and iris scanning technologies are becoming more affordable and reliable, making them accessible to a broader range of applications. The 35% annual growth in biometric system deployments reflects increasing acceptance and technological maturity in this segment.

Strategic partnerships between international technology providers and local system integrators are reshaping the competitive landscape by combining global expertise with regional market knowledge. These collaborations enable faster market entry, better customer support, and more competitive pricing while helping local companies access advanced technologies and training resources.

Government initiatives promoting smart city development and public safety enhancement are creating large-scale deployment opportunities across major Latin American cities. These projects often include comprehensive security infrastructure that integrates surveillance systems, emergency response coordination, traffic management, and public communication networks into unified platforms.

Technology standardization efforts are improving interoperability between different security system components while reducing integration complexity and costs. Industry organizations and government agencies are promoting open standards that enable customers to select best-of-breed solutions from multiple vendors while maintaining system compatibility and future upgrade flexibility.

Cybersecurity integration is becoming increasingly important as security systems become more connected and data-driven. Vendors are implementing enhanced encryption, secure communication protocols, and cyber threat protection measures to address growing concerns about system vulnerability and data protection. This development is particularly relevant for government and critical infrastructure applications.

Service model evolution toward managed security services and subscription-based offerings is changing how customers acquire and operate security systems. These models reduce upfront capital requirements while providing ongoing support, maintenance, and system updates that ensure optimal performance and security effectiveness throughout the system lifecycle.

Market entry strategies for Latin America should emphasize local partnerships, cultural adaptation, and flexible financing options that address regional economic conditions and customer preferences. MWR analysis indicates that successful companies typically establish strong local presence through partnerships with established system integrators and service providers who understand regional market dynamics and customer requirements.

Technology positioning should focus on solutions that deliver immediate value while providing scalability for future expansion. Customers in Latin American markets particularly value systems that can start with basic functionality and grow to include advanced features as requirements and budgets evolve. This approach reduces initial investment barriers while creating long-term customer relationships.

Service capabilities development is crucial for sustained success in Latin American markets where ongoing support and maintenance are highly valued. Companies should invest in local technical expertise, training programs, and service infrastructure that can provide responsive support throughout the customer lifecycle. Remote diagnostic and support capabilities can help reduce service costs while improving response times.

Pricing strategies must account for economic volatility and currency fluctuations that affect customer purchasing power. Flexible payment terms, local currency pricing, and value-based pricing models can help maintain competitiveness while protecting profit margins. Leasing and managed service options may be particularly attractive in markets with limited capital availability.

Regulatory compliance preparation should begin early in market entry planning as requirements vary significantly between countries and continue evolving. Companies should establish relationships with local legal and regulatory experts while designing solutions that can adapt to changing compliance requirements without major system modifications.

Market expansion in Latin America’s electronics security sector is projected to continue at a robust pace driven by ongoing urbanization, increasing security awareness, and government investment in public safety infrastructure. The market is expected to maintain strong growth momentum with annual expansion rates exceeding 11% as economic development and technological advancement create favorable conditions for security system adoption across multiple sectors.

Technology evolution will continue transforming the security landscape through artificial intelligence, machine learning, and advanced analytics capabilities that enable more proactive and effective security operations. Future systems will provide predictive threat assessment, automated incident response, and comprehensive situational awareness that significantly enhances security effectiveness while reducing operational complexity and costs.

Market maturation will lead to increased standardization, improved interoperability, and more sophisticated customer requirements that favor comprehensive solution providers over single-product vendors. This evolution will create opportunities for companies that can deliver integrated platforms while challenging those that focus on narrow technology segments without broader solution capabilities.

Regional integration trends will create opportunities for standardized security platforms that can operate across multiple Latin American countries while addressing local requirements and regulations. Companies that can navigate diverse regulatory environments and cultural preferences while maintaining consistent quality and support will be well-positioned for regional expansion success.

Emerging applications in smart cities, critical infrastructure protection, and integrated business security will drive demand for more sophisticated and comprehensive security solutions. These applications require advanced technologies, professional services, and ongoing support that create substantial value opportunities for qualified solution providers capable of delivering complex, mission-critical security systems.

Latin America’s electronics security market represents a dynamic and rapidly expanding opportunity driven by increasing security challenges, technological advancement, and growing investment in modern security infrastructure. The region’s unique combination of economic development, urbanization, and security requirements creates favorable conditions for sustained market growth and innovation in security technology solutions.

Market fundamentals remain strong with consistent demand drivers including rising crime rates, government initiatives promoting public safety, and increasing awareness of security technology benefits across residential, commercial, and industrial sectors. The transition toward IP-based systems, artificial intelligence integration, and cloud-based platforms is creating new opportunities while improving security effectiveness and operational efficiency.

Success factors for market participants include local market adaptation, comprehensive service capabilities, flexible financing options, and ability to deliver integrated solutions that address evolving customer requirements. Companies that can combine technological innovation with regional expertise and responsive customer support are best positioned to capture market opportunities and establish sustainable competitive advantages.

Future prospects indicate continued expansion as Latin American countries modernize their security infrastructure, implement smart city initiatives, and address evolving security threats through advanced technology adoption. The Latin America electronics security market is positioned for sustained growth with increasing demand for comprehensive security platforms that can deliver effective protection while supporting economic development and social progress throughout the region.

What is Electronics Security?

Electronics Security refers to the systems and technologies designed to protect electronic devices and data from unauthorized access, theft, and damage. This includes surveillance systems, access control, and alarm systems used across various sectors such as residential, commercial, and industrial applications.

What are the key players in the Latin America Electronics Security Market?

Key players in the Latin America Electronics Security Market include companies like Hikvision, Bosch Security Systems, and Axis Communications, which provide a range of security solutions such as video surveillance and intrusion detection systems, among others.

What are the main drivers of growth in the Latin America Electronics Security Market?

The main drivers of growth in the Latin America Electronics Security Market include increasing concerns over safety and security, the rise in crime rates, and the growing adoption of smart home technologies. Additionally, government initiatives to enhance public safety are also contributing to market expansion.

What challenges does the Latin America Electronics Security Market face?

Challenges in the Latin America Electronics Security Market include budget constraints faced by consumers and businesses, as well as the lack of awareness regarding advanced security technologies. Furthermore, regulatory hurdles can also impede market growth.

What opportunities exist in the Latin America Electronics Security Market?

Opportunities in the Latin America Electronics Security Market include the increasing demand for integrated security solutions and the potential for growth in the IoT sector. The expansion of e-commerce and smart city initiatives also presents new avenues for security technology adoption.

What trends are shaping the Latin America Electronics Security Market?

Trends shaping the Latin America Electronics Security Market include the integration of artificial intelligence in surveillance systems, the shift towards cloud-based security solutions, and the growing emphasis on cybersecurity measures. These trends are driving innovation and enhancing the effectiveness of security systems.

Latin America Electronics Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | CCTV Cameras, Access Control Systems, Intrusion Detection Systems, Alarms |

| Technology | Analog, IP, Wireless, Cloud-Based |

| End User | Residential, Commercial, Government, Industrial |

| Installation | On-Premise, Remote, DIY, Professional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Electronics Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at