444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America commercial HVAC equipment market represents a dynamic and rapidly evolving sector driven by urbanization, industrial expansion, and increasing demand for energy-efficient climate control solutions. This comprehensive market encompasses a wide range of heating, ventilation, and air conditioning systems specifically designed for commercial applications across diverse industries including retail, hospitality, healthcare, manufacturing, and office buildings throughout the region.

Market dynamics in Latin America are characterized by significant growth potential, with the commercial HVAC sector experiencing robust expansion at a compound annual growth rate (CAGR) of 6.2% over the forecast period. The region’s tropical and subtropical climate conditions, combined with rising commercial construction activities, create substantial demand for advanced HVAC solutions that can deliver optimal indoor air quality and temperature control.

Key market drivers include rapid urbanization across major Latin American cities, increasing awareness of energy efficiency standards, and growing investments in commercial infrastructure development. Countries such as Brazil, Mexico, Argentina, and Colombia are leading the market expansion, with Brazil accounting for approximately 35% of regional market share due to its large commercial sector and ongoing modernization initiatives.

The market landscape features a diverse mix of international and regional players, with technology innovation focusing on smart HVAC systems, IoT integration, and sustainable refrigerants. Energy efficiency improvements of up to 25% are driving adoption of advanced commercial HVAC equipment, particularly in sectors where operational costs and environmental compliance are critical considerations.

The Latin America commercial HVAC equipment market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems, components, and services specifically designed for non-residential applications across Latin American countries. This market encompasses equipment ranging from small commercial units serving retail spaces to large-scale industrial HVAC systems for manufacturing facilities, data centers, and commercial complexes.

Commercial HVAC equipment in this context includes chillers, rooftop units, air handling units, heat pumps, ventilation fans, ductwork systems, and associated control technologies. The market also encompasses installation, maintenance, and retrofit services that support the lifecycle management of these systems across various commercial sectors.

Regional characteristics define this market through unique climate challenges, regulatory frameworks, and economic conditions specific to Latin America. The market addresses diverse cooling and heating requirements across different geographical zones, from tropical coastal areas requiring intensive cooling solutions to highland regions needing balanced climate control systems.

Technology integration within this market includes smart building automation, energy management systems, and advanced refrigeration technologies that comply with international environmental standards while meeting the specific operational requirements of Latin American commercial enterprises.

Strategic market positioning reveals the Latin America commercial HVAC equipment market as a high-growth sector benefiting from sustained economic development, infrastructure modernization, and increasing emphasis on energy-efficient building operations. The market demonstrates strong resilience and adaptation capabilities, with manufacturers and service providers continuously evolving their offerings to meet regional demands.

Growth trajectory analysis indicates robust expansion driven by multiple factors including commercial construction boom, replacement of aging HVAC infrastructure, and adoption of smart building technologies. The market benefits from government incentives promoting energy efficiency, with several countries implementing regulations that favor high-performance HVAC systems.

Competitive landscape features a balanced mix of global HVAC manufacturers and regional specialists, creating a dynamic environment that fosters innovation and competitive pricing. Market leaders are investing heavily in local manufacturing capabilities and distribution networks to better serve the diverse needs of Latin American commercial customers.

Technology trends are reshaping market dynamics through integration of artificial intelligence, predictive maintenance capabilities, and sustainable refrigerant technologies. These innovations are driving operational efficiency improvements of 20-30% while reducing environmental impact and operational costs for commercial building owners.

Future outlook remains highly positive, with market expansion supported by continued urbanization, industrial growth, and increasing awareness of indoor air quality importance, particularly following global health considerations that have elevated the role of proper ventilation in commercial spaces.

Market segmentation analysis reveals distinct patterns across different commercial applications, with the following key insights driving strategic decision-making:

Technology adoption patterns show increasing preference for integrated systems that combine heating, cooling, and ventilation functions with smart controls and energy management capabilities. Variable refrigerant flow (VRF) systems are gaining significant traction due to their energy efficiency and flexible installation options.

Regional variations in market demand reflect diverse climate conditions, with coastal areas showing higher demand for cooling-focused solutions while inland regions require more balanced heating and cooling capabilities.

Urbanization acceleration stands as the primary driver of commercial HVAC equipment demand across Latin America. Rapid city growth and commercial district development create continuous demand for new HVAC installations, with urban areas experiencing population growth rates of 1.8% annually, directly correlating with commercial construction activities.

Energy efficiency mandates are increasingly influencing purchasing decisions as governments implement stricter building codes and energy performance standards. Commercial building owners are motivated by potential energy cost savings and regulatory compliance requirements, driving adoption of high-efficiency HVAC systems that can reduce energy consumption significantly.

Climate change impacts are intensifying cooling requirements across the region, with rising temperatures and more frequent extreme weather events creating greater demand for reliable commercial HVAC systems. This environmental pressure is particularly pronounced in urban heat islands where commercial buildings require enhanced cooling capacity.

Economic development across key Latin American markets is fueling commercial sector expansion, with increased foreign investment, tourism growth, and industrial development creating substantial demand for modern HVAC infrastructure. Commercial construction activity has increased by notable percentages in major metropolitan areas.

Health and safety awareness has elevated the importance of proper ventilation and air quality control in commercial spaces. Post-pandemic considerations have made indoor air quality a critical factor in HVAC system selection, driving demand for advanced filtration and ventilation capabilities.

Technology advancement in HVAC equipment is making modern systems more attractive through improved efficiency, reduced maintenance requirements, and enhanced user control capabilities. Smart building integration and IoT connectivity are becoming standard expectations rather than premium features.

High initial capital investment requirements present a significant barrier for many commercial building owners, particularly small and medium-sized enterprises. The substantial upfront costs associated with modern HVAC systems, including equipment, installation, and infrastructure modifications, can delay adoption decisions and limit market penetration in price-sensitive segments.

Economic volatility characteristic of several Latin American markets creates uncertainty in commercial investment decisions. Currency fluctuations, inflation pressures, and political instability can impact both equipment pricing and customer purchasing power, leading to delayed or reduced HVAC investments.

Skilled technician shortage poses operational challenges for both installation and maintenance of advanced HVAC systems. The complexity of modern commercial HVAC equipment requires specialized training and certification, but the region faces a shortage of qualified technicians capable of properly installing and servicing sophisticated systems.

Infrastructure limitations in some areas restrict the deployment of advanced HVAC solutions. Unreliable electrical supply, inadequate building infrastructure, and limited access to specialized components can complicate installation and operation of commercial HVAC systems.

Import dependency for advanced HVAC components and systems creates cost and availability challenges. Many sophisticated commercial HVAC products are manufactured outside the region, making them subject to import duties, shipping delays, and currency exchange impacts that can affect overall project economics.

Regulatory complexity across different countries creates compliance challenges for manufacturers and installers. Varying standards, certification requirements, and environmental regulations can complicate market entry and increase operational costs for HVAC equipment providers.

Retrofit and replacement market presents substantial opportunities as aging commercial HVAC systems across Latin America reach end-of-life status. Many commercial buildings installed basic HVAC systems during previous decades and now require modern, energy-efficient replacements that offer improved performance and reduced operational costs.

Smart building integration creates new market segments as commercial property owners seek to modernize their facilities with intelligent HVAC systems. The convergence of HVAC technology with building automation, energy management, and IoT platforms opens opportunities for comprehensive solutions that optimize building performance.

Sustainable technology adoption offers growth potential as environmental regulations tighten and corporate sustainability commitments increase. Commercial customers are increasingly interested in HVAC solutions that use eco-friendly refrigerants, reduce energy consumption, and support green building certifications.

Service sector expansion provides recurring revenue opportunities through maintenance contracts, system optimization services, and performance monitoring. As commercial HVAC systems become more sophisticated, the demand for specialized service capabilities increases, creating stable long-term business relationships.

Industrial sector growth in manufacturing, food processing, and pharmaceutical industries creates demand for specialized commercial HVAC solutions. These sectors require precise climate control for both product quality and worker safety, driving demand for advanced HVAC technologies.

Government infrastructure projects across the region include hospitals, schools, and public buildings that require modern HVAC systems. Public sector investments in infrastructure modernization create substantial market opportunities for commercial HVAC equipment providers.

Supply chain evolution is reshaping the commercial HVAC equipment market as manufacturers establish regional production facilities and distribution networks. This localization trend is improving product availability, reducing costs, and enabling better customer service across Latin American markets.

Technology convergence between HVAC systems and digital technologies is creating new market dynamics. The integration of artificial intelligence, machine learning, and predictive analytics into commercial HVAC systems is enabling maintenance cost reductions of up to 15% while improving system reliability and performance.

Customer expectations are evolving toward comprehensive solutions that include equipment, installation, commissioning, and ongoing service support. Commercial customers increasingly prefer single-source providers who can deliver complete HVAC solutions rather than managing multiple vendors and contractors.

Competitive intensity is increasing as both global manufacturers and regional players compete for market share. This competition is driving innovation, improving product quality, and creating more favorable pricing for commercial customers while pushing companies to differentiate through service quality and technical expertise.

Regulatory harmonization efforts across Latin American countries are gradually creating more consistent standards and requirements for commercial HVAC equipment. This trend is simplifying market entry for manufacturers and reducing compliance complexity for customers operating across multiple countries.

Financing innovation is emerging as equipment manufacturers and financial institutions develop new funding models for commercial HVAC projects. Energy service company (ESCO) models and performance-based contracts are making advanced HVAC systems more accessible to cost-conscious commercial customers.

Comprehensive market analysis for the Latin America commercial HVAC equipment market employed a multi-faceted research approach combining primary and secondary research methodologies. The research framework was designed to capture both quantitative market data and qualitative insights from industry stakeholders across the region.

Primary research activities included structured interviews with key market participants including HVAC equipment manufacturers, distributors, installation contractors, and end-user customers across major Latin American markets. These interviews provided firsthand insights into market trends, challenges, and opportunities from multiple perspectives within the value chain.

Secondary research sources encompassed industry reports, government statistics, trade association data, and company financial disclosures to establish market size parameters, growth trends, and competitive landscape analysis. This research included examination of building permit data, construction industry statistics, and energy consumption patterns across commercial sectors.

Market segmentation analysis utilized both top-down and bottom-up approaches to validate market size estimates and growth projections. The methodology included analysis of commercial building stock, replacement cycles, and new construction trends to develop accurate market forecasts.

Regional analysis methodology involved country-specific research to understand local market conditions, regulatory environments, and competitive dynamics. This approach ensured that regional variations in climate, economic conditions, and market maturity were properly reflected in the overall market assessment.

Data validation processes included cross-referencing multiple sources, conducting expert interviews for verification, and applying statistical analysis to ensure research accuracy and reliability. The methodology incorporated feedback loops to refine estimates and projections based on market participant input.

Brazil market leadership positions the country as the dominant force in Latin America’s commercial HVAC equipment sector, driven by its large economy, extensive commercial infrastructure, and ongoing urbanization. The Brazilian market benefits from local manufacturing capabilities, established distribution networks, and strong demand across retail, industrial, and office building segments.

Mexico’s strategic importance stems from its proximity to North American markets, manufacturing sector growth, and increasing commercial construction activity. The Mexican market shows particular strength in industrial HVAC applications, with manufacturing sector demand representing 22% of total market volume. Cross-border trade relationships also facilitate access to advanced HVAC technologies.

Argentina’s market characteristics reflect a mature commercial sector with significant replacement and retrofit opportunities. The country’s diverse climate zones create demand for both heating and cooling solutions, while economic challenges have increased focus on energy-efficient systems that can reduce operational costs.

Colombia’s emerging potential is driven by economic growth, infrastructure development, and increasing foreign investment. The Colombian market shows strong growth in hospitality and retail sectors, supported by tourism expansion and urban development projects in major cities.

Chile’s market sophistication demonstrates advanced adoption of energy-efficient HVAC technologies, supported by strong environmental regulations and corporate sustainability initiatives. The Chilean market serves as a testing ground for innovative HVAC solutions before broader regional deployment.

Regional market distribution shows Brazil commanding 35% market share, followed by Mexico at 25%, with Argentina, Colombia, and Chile collectively representing 30% of regional demand. The remaining 10% is distributed among smaller Central American and Caribbean markets.

Market leadership structure in the Latin America commercial HVAC equipment market features a competitive environment with both global manufacturers and regional specialists competing across different market segments and price points.

Competitive strategies focus on local manufacturing capabilities, comprehensive service networks, and technology innovation. Leading companies are investing in regional production facilities to reduce costs and improve market responsiveness while developing partnerships with local distributors and contractors.

Market differentiation occurs through product innovation, energy efficiency performance, and integrated solutions that combine HVAC equipment with building automation and energy management systems. Companies are also competing on service capabilities, offering comprehensive maintenance and optimization services.

Regional players maintain competitive positions through specialized applications, local market knowledge, and competitive pricing strategies. These companies often focus on specific market segments or geographical areas where they can leverage regional advantages.

By Product Type:

By Application:

By Technology:

By End-User Size:

Chiller systems category represents the premium segment of the commercial HVAC market, with water-cooled and air-cooled chillers serving large commercial buildings, hospitals, and industrial facilities. This category shows steady growth driven by replacement of aging systems and new large-scale construction projects. Energy efficiency improvements of 30% in modern chillers compared to older systems are driving replacement decisions.

Rooftop units segment dominates the light commercial market due to ease of installation, lower initial costs, and suitability for single-story commercial buildings. This category benefits from the growth of retail construction and warehouse facilities across Latin America. Packaged rooftop units offer integrated heating and cooling solutions that simplify installation and maintenance.

VRF systems category is experiencing the fastest growth rate due to energy efficiency advantages and flexible zoning capabilities. These systems are particularly popular in office buildings, hotels, and mixed-use developments where different zones require individual climate control. The ability to provide simultaneous heating and cooling to different zones makes VRF systems highly attractive for commercial applications.

Air handling units serve as critical components in large commercial HVAC systems, providing centralized air distribution and treatment. This category benefits from increasing emphasis on indoor air quality and ventilation requirements, particularly in healthcare and educational facilities where air quality standards are stringent.

Heat pump technology is gaining traction in regions with moderate climates where both heating and cooling are required. Modern heat pumps offer high efficiency in both heating and cooling modes, making them attractive for year-round climate control in commercial applications.

Smart HVAC systems represent the fastest-growing technology category, with adoption rates increasing by 18% annually as commercial building owners seek to optimize energy consumption and improve operational efficiency through advanced controls and monitoring capabilities.

Equipment manufacturers benefit from expanding market opportunities driven by commercial construction growth, replacement demand, and increasing adoption of energy-efficient technologies. The Latin American market offers substantial growth potential with relatively lower market penetration compared to developed regions, creating opportunities for market share expansion.

Distributors and dealers gain from increasing product complexity and service requirements that create higher value-added opportunities. The trend toward integrated solutions and smart technologies enables distributors to offer comprehensive packages that include equipment, installation, and ongoing service support.

Installation contractors benefit from growing demand for specialized HVAC installation and commissioning services. As systems become more sophisticated, the value of professional installation and system optimization increases, creating opportunities for contractors to differentiate through technical expertise.

Service providers gain from the increasing complexity of commercial HVAC systems that require specialized maintenance and optimization services. Predictive maintenance capabilities and remote monitoring technologies create new service revenue streams while improving customer relationships.

Building owners and operators benefit from improved energy efficiency, reduced operational costs, and enhanced occupant comfort through modern HVAC systems. Energy cost savings of 20-25% are achievable through upgrades to high-efficiency equipment and smart controls.

End users and occupants experience improved indoor air quality, better temperature control, and enhanced comfort levels through advanced HVAC systems. Modern systems provide more consistent climate control while reducing noise levels and improving overall building environments.

Financial institutions benefit from growing opportunities to finance commercial HVAC projects through equipment financing, energy service contracts, and performance-based funding models that align financing with energy savings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart HVAC integration is transforming the commercial market through IoT connectivity, artificial intelligence, and predictive analytics. These technologies enable real-time monitoring, automated optimization, and predictive maintenance capabilities that improve system efficiency while reducing operational costs. Smart system adoption rates are increasing significantly as building owners recognize the operational benefits.

Energy efficiency focus continues to drive product development and customer purchasing decisions. Commercial building owners are increasingly prioritizing HVAC systems that can deliver substantial energy savings, driven by both cost considerations and environmental sustainability goals. High-efficiency systems are becoming standard rather than premium options.

Sustainable refrigerant adoption is accelerating as environmental regulations phase out high global warming potential refrigerants. Manufacturers are transitioning to low-GWP alternatives and natural refrigerants, creating opportunities for system upgrades and replacements across the commercial sector.

Modular and scalable solutions are gaining popularity as commercial customers seek HVAC systems that can adapt to changing space requirements and usage patterns. Modular systems allow for phased installation and future expansion, making them attractive for growing businesses and flexible commercial spaces.

Indoor air quality emphasis has elevated the importance of ventilation and filtration capabilities in commercial HVAC systems. Enhanced filtration, UV sterilization, and improved ventilation rates are becoming standard features rather than optional upgrades.

Service-oriented business models are emerging as manufacturers and contractors develop comprehensive service offerings that include equipment, installation, maintenance, and performance optimization. These models create recurring revenue streams while providing customers with predictable operational costs.

Manufacturing localization initiatives are reshaping the competitive landscape as global HVAC manufacturers establish production facilities within Latin America. These investments improve product availability, reduce costs, and enable better customization for regional market requirements while creating local employment opportunities.

Technology partnerships between HVAC manufacturers and technology companies are accelerating the development of smart building solutions. These collaborations are creating integrated platforms that combine HVAC control with building automation, energy management, and occupancy optimization systems.

Regulatory developments across Latin American countries are establishing more stringent energy efficiency standards and environmental requirements for commercial HVAC systems. These regulations are driving market demand for high-performance equipment while creating compliance challenges for older systems.

Financing innovation is making advanced HVAC systems more accessible through energy service company (ESCO) models, equipment-as-a-service offerings, and performance-based contracts. These financing alternatives reduce upfront costs while aligning equipment performance with customer savings.

Distribution network expansion is improving market coverage as manufacturers and distributors invest in regional service centers, training facilities, and parts inventory. Enhanced distribution capabilities are reducing lead times and improving customer service across the region.

Sustainability initiatives are driving development of eco-friendly HVAC solutions including systems that use natural refrigerants, incorporate renewable energy sources, and achieve carbon-neutral operation. These developments align with corporate sustainability goals and environmental regulations.

MarkWide Research analysis indicates that commercial HVAC equipment manufacturers should prioritize local market presence through regional manufacturing, distribution partnerships, and service network development. This localization strategy will improve competitiveness while reducing costs and delivery times for customers across Latin America.

Technology investment in smart HVAC solutions and IoT integration should be a strategic priority for market participants. The convergence of HVAC systems with building automation and energy management platforms creates significant differentiation opportunities and higher value propositions for commercial customers.

Service capability development represents a critical success factor as commercial customers increasingly seek comprehensive solutions that include installation, commissioning, maintenance, and optimization services. Companies should invest in technician training, service infrastructure, and digital service platforms to capture this growing market segment.

Energy efficiency positioning should be central to product development and marketing strategies, as commercial customers prioritize systems that can deliver measurable energy savings and operational cost reductions. High-efficiency equipment commands premium pricing while meeting customer sustainability objectives.

Market segmentation strategies should recognize the diverse needs of different commercial applications, from retail and office buildings to healthcare and industrial facilities. Specialized solutions for specific market segments can create competitive advantages and customer loyalty.

Partnership development with local contractors, distributors, and system integrators is essential for market penetration and customer service delivery. Strong channel partnerships enable manufacturers to leverage local market knowledge and customer relationships while expanding market coverage.

Market expansion trajectory for the Latin America commercial HVAC equipment market remains highly positive, supported by continued urbanization, commercial construction growth, and increasing adoption of energy-efficient technologies. MWR projects sustained growth driven by both new construction demand and replacement of aging HVAC infrastructure across the region.

Technology evolution will continue to reshape the market through advancement in smart controls, artificial intelligence, and predictive maintenance capabilities. These technologies will become standard features rather than premium options, driving system upgrades and creating new service opportunities for market participants.

Sustainability requirements will increasingly influence purchasing decisions as environmental regulations tighten and corporate sustainability commitments expand. Commercial customers will prioritize HVAC systems that support green building certifications and carbon reduction goals, creating opportunities for eco-friendly technologies.

Market consolidation may occur as smaller regional players seek partnerships or acquisition opportunities with larger manufacturers to access advanced technologies and broader distribution networks. This consolidation could improve market efficiency while maintaining competitive dynamics.

Service market growth will outpace equipment sales as the installed base of sophisticated commercial HVAC systems expands. Recurring service revenue from maintenance, optimization, and system upgrades will become increasingly important for market participants’ long-term success.

Regional integration efforts may create more harmonized standards and regulations across Latin American countries, simplifying market entry and reducing compliance complexity for manufacturers while facilitating cross-border trade and service delivery.

The Latin America commercial HVAC equipment market represents a dynamic and rapidly evolving sector with substantial growth potential driven by urbanization, commercial construction expansion, and increasing emphasis on energy efficiency. Market participants who can successfully navigate regional complexities while delivering innovative, efficient solutions will capture significant opportunities in this expanding market.

Strategic success factors include local market presence, comprehensive service capabilities, technology innovation, and strong distribution partnerships. The market rewards companies that can combine global expertise with regional market knowledge to deliver solutions that meet the specific needs of Latin American commercial customers.

Future market leadership will belong to organizations that embrace smart technology integration, sustainability initiatives, and service-oriented business models while maintaining competitive pricing and reliable product performance. The convergence of HVAC systems with building automation and energy management platforms creates new opportunities for differentiation and value creation.

As the market continues to mature and evolve, the Latin America commercial HVAC equipment market will remain an attractive growth opportunity for manufacturers, distributors, contractors, and service providers who can adapt to changing customer needs while delivering measurable value through improved energy efficiency, operational reliability, and occupant comfort.

What is Commercial HVAC Equipment?

Commercial HVAC Equipment refers to heating, ventilation, and air conditioning systems designed for use in commercial buildings such as offices, retail spaces, and industrial facilities. These systems are essential for maintaining indoor air quality and comfort in large spaces.

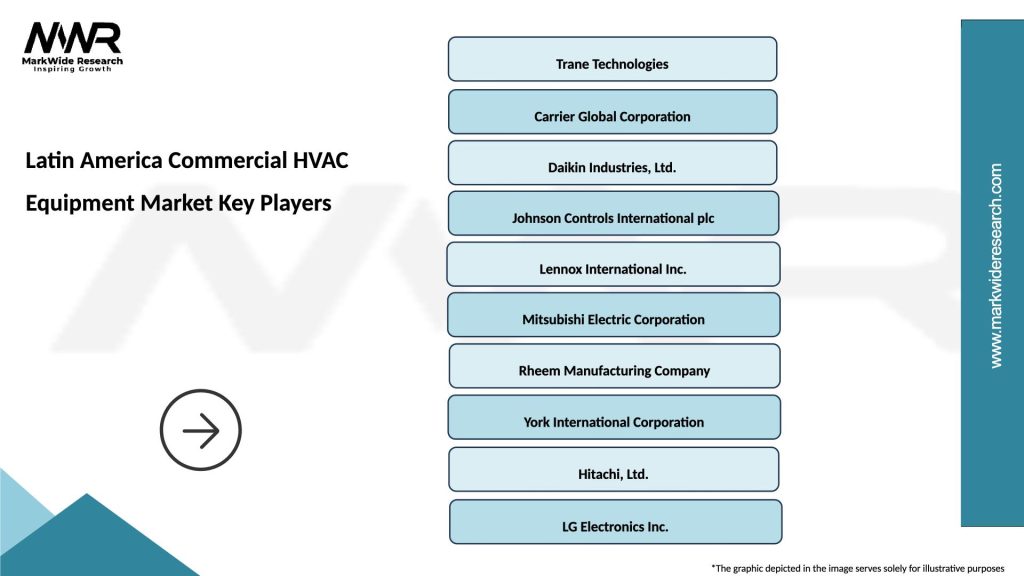

What are the key players in the Latin America Commercial HVAC Equipment Market?

Key players in the Latin America Commercial HVAC Equipment Market include Trane Technologies, Carrier Global Corporation, Daikin Industries, and Johnson Controls, among others. These companies are known for their innovative solutions and extensive product offerings in the HVAC sector.

What are the main drivers of the Latin America Commercial HVAC Equipment Market?

The main drivers of the Latin America Commercial HVAC Equipment Market include the growing demand for energy-efficient systems, increasing urbanization, and the expansion of commercial infrastructure. Additionally, rising awareness of indoor air quality is propelling market growth.

What challenges does the Latin America Commercial HVAC Equipment Market face?

The Latin America Commercial HVAC Equipment Market faces challenges such as high installation and maintenance costs, regulatory compliance issues, and competition from alternative cooling solutions. These factors can hinder market growth and adoption rates.

What opportunities exist in the Latin America Commercial HVAC Equipment Market?

Opportunities in the Latin America Commercial HVAC Equipment Market include advancements in smart HVAC technologies, the integration of IoT for better energy management, and the increasing focus on sustainable building practices. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the Latin America Commercial HVAC Equipment Market?

Trends shaping the Latin America Commercial HVAC Equipment Market include the shift towards eco-friendly refrigerants, the rise of smart HVAC systems, and the growing emphasis on energy efficiency. These trends reflect a broader commitment to sustainability and improved operational performance in commercial buildings.

Latin America Commercial HVAC Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Rooftop Units, Split Systems |

| Technology | Variable Refrigerant Flow, Geothermal, Ductless, Smart Thermostats |

| End User | Commercial Buildings, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Commercial HVAC Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at