444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America cloud computing market represents one of the most dynamic and rapidly evolving technology sectors in the region, experiencing unprecedented growth driven by digital transformation initiatives across multiple industries. Cloud adoption in Latin America has accelerated significantly, with organizations increasingly recognizing the strategic value of cloud-based solutions for enhancing operational efficiency, reducing infrastructure costs, and enabling scalable business operations. The market encompasses a comprehensive range of cloud services including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), each contributing to the region’s technological advancement.

Market dynamics indicate robust expansion across key countries including Brazil, Mexico, Argentina, Colombia, and Chile, with enterprises of all sizes embracing cloud technologies to remain competitive in an increasingly digital economy. The region’s cloud computing landscape is characterized by growing investments in data center infrastructure, improved internet connectivity, and supportive government policies promoting digital innovation. Growth rates in the Latin American cloud market consistently outpace global averages, with the sector experiencing a compound annual growth rate of approximately 18.5%, reflecting the region’s commitment to technological modernization and digital transformation.

Industry verticals driving cloud adoption include financial services, healthcare, retail, manufacturing, and government sectors, each leveraging cloud technologies to enhance service delivery, improve customer experiences, and optimize operational processes. The market’s expansion is further supported by increasing smartphone penetration, improved broadband infrastructure, and growing awareness of cloud computing benefits among small and medium enterprises (SMEs) throughout the region.

The Latin America cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions deployed across countries in Central and South America, encompassing public, private, and hybrid cloud deployment models that enable organizations to access computing resources, applications, and data storage capabilities through internet-connected networks rather than traditional on-premises infrastructure.

Cloud computing in the Latin American context represents a fundamental shift from traditional IT infrastructure models toward flexible, scalable, and cost-effective technology solutions that support business agility and innovation. This market includes various service models such as Infrastructure as a Service (IaaS), which provides virtualized computing resources; Platform as a Service (PaaS), offering development and deployment environments; and Software as a Service (SaaS), delivering ready-to-use applications accessible through web browsers or mobile applications.

Regional characteristics of the Latin American cloud market include diverse regulatory environments, varying levels of digital maturity across countries, and unique challenges related to data sovereignty, internet connectivity, and cybersecurity concerns. The market encompasses both international cloud service providers establishing regional presence and local providers developing solutions tailored to specific regional requirements and compliance standards.

Strategic analysis of the Latin America cloud computing market reveals a sector experiencing transformational growth, driven by accelerating digital transformation initiatives, increasing enterprise mobility requirements, and growing demand for cost-effective IT solutions. The market demonstrates strong momentum across all major service categories, with SaaS solutions leading adoption rates due to their accessibility and immediate business value proposition for organizations of all sizes.

Key market drivers include the region’s improving telecommunications infrastructure, supportive government digitalization policies, and increasing awareness of cloud computing benefits among traditional industries. The market benefits from approximately 72% of enterprises in major Latin American markets now utilizing some form of cloud services, representing significant growth from previous years and indicating widespread acceptance of cloud technologies across the business community.

Competitive dynamics feature a mix of global technology leaders and regional specialists, with international providers like Amazon Web Services, Microsoft Azure, and Google Cloud Platform establishing strong regional presence alongside local providers offering specialized solutions for specific market segments. The market’s evolution is characterized by increasing focus on hybrid and multi-cloud strategies, edge computing capabilities, and industry-specific cloud solutions tailored to regional business requirements.

Future prospects indicate continued robust growth driven by emerging technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) applications, all requiring scalable cloud infrastructure to support their implementation and operation across Latin American markets.

Market penetration analysis reveals significant opportunities for continued expansion, with cloud adoption rates varying considerably across different countries and industry sectors within Latin America. The following key insights characterize the current market landscape:

Digital transformation initiatives across Latin American organizations represent the primary catalyst driving cloud computing adoption, with enterprises recognizing cloud technologies as essential enablers of business modernization and competitive advantage. Organizations are increasingly implementing comprehensive digital strategies that require scalable, flexible IT infrastructure capable of supporting rapid business growth and changing market demands.

Cost optimization pressures continue to motivate cloud adoption, as organizations seek to reduce capital expenditures associated with traditional IT infrastructure while achieving improved operational efficiency. Cloud computing enables businesses to transform fixed IT costs into variable expenses, allowing for better resource allocation and improved financial flexibility during economic uncertainties.

Regulatory compliance requirements are driving demand for cloud solutions that provide robust security, data governance, and audit capabilities. Financial services, healthcare, and government organizations particularly benefit from cloud platforms offering comprehensive compliance frameworks that address regional regulatory requirements while maintaining operational efficiency.

Workforce mobility trends accelerated by remote work adoption are creating sustained demand for cloud-based collaboration tools, virtual desktop infrastructure, and mobile-accessible business applications. Organizations require cloud solutions that enable seamless productivity regardless of employee location while maintaining security and data protection standards.

Technological innovation demands including artificial intelligence, machine learning, and advanced analytics require scalable computing resources that cloud platforms provide more effectively than traditional on-premises infrastructure. These emerging technologies are becoming competitive differentiators for businesses across various industries in Latin America.

Infrastructure limitations in certain regions of Latin America continue to challenge cloud adoption, particularly in areas with limited broadband connectivity or unreliable internet service. These connectivity constraints can impact cloud service performance and reliability, creating hesitation among potential adopters who require consistent access to cloud-based applications and data.

Data security concerns remain significant barriers for organizations considering cloud migration, particularly those handling sensitive customer information or proprietary business data. Many enterprises express concerns about data protection, privacy compliance, and potential security vulnerabilities associated with storing critical information in third-party cloud environments.

Regulatory complexity across different Latin American countries creates challenges for organizations operating in multiple markets, as varying data protection laws, industry regulations, and compliance requirements can complicate cloud deployment strategies. Organizations must navigate diverse regulatory landscapes while ensuring consistent cloud governance across their operations.

Skills shortage in cloud technologies represents a persistent challenge, with many organizations lacking internal expertise required for successful cloud implementation, management, and optimization. This skills gap can lead to increased implementation costs, longer deployment timelines, and suboptimal cloud utilization.

Legacy system integration complexities create technical and financial barriers for organizations with significant investments in existing IT infrastructure. The challenge of integrating legacy applications with cloud platforms while maintaining business continuity can deter organizations from pursuing comprehensive cloud strategies.

Emerging technology integration presents substantial opportunities for cloud service providers to develop innovative solutions incorporating artificial intelligence, machine learning, and Internet of Things capabilities. These advanced technologies require cloud infrastructure for optimal implementation, creating new revenue streams and market differentiation opportunities for providers offering comprehensive technology stacks.

Industry-specific solutions represent significant growth opportunities, particularly in sectors such as healthcare, education, and agriculture where cloud adoption remains relatively low compared to other industries. Developing specialized cloud offerings that address unique industry requirements, compliance standards, and operational challenges can capture substantial market share in these underserved segments.

Small and medium enterprise market expansion offers considerable potential, as many SMEs in Latin America have yet to fully embrace cloud technologies. Providing affordable, easy-to-implement cloud solutions with minimal technical complexity can unlock this large market segment and drive significant volume growth.

Edge computing deployment opportunities are emerging as organizations require low-latency processing capabilities for real-time applications, IoT implementations, and content delivery optimization. Cloud providers can expand their service offerings by developing edge computing solutions that complement traditional cloud services.

Government digitalization initiatives across Latin American countries create opportunities for cloud providers to support public sector modernization efforts. Government cloud adoption can drive broader market acceptance while providing stable, long-term revenue opportunities for qualified providers.

Competitive intensity in the Latin America cloud computing market continues to increase as both global technology leaders and regional specialists vie for market share across diverse industry segments. This competition drives innovation, service improvement, and pricing optimization, ultimately benefiting customers through enhanced value propositions and expanded service offerings.

Technology evolution remains a constant dynamic, with cloud platforms continuously incorporating new capabilities such as serverless computing, containerization, and advanced analytics tools. These technological advances enable organizations to achieve greater efficiency and innovation while cloud providers differentiate their offerings through cutting-edge features and performance improvements.

Customer expectations are evolving toward more sophisticated cloud solutions that provide seamless integration, enhanced security, and industry-specific functionality. Organizations increasingly demand cloud platforms that can support complex business requirements while maintaining simplicity in deployment and management.

Regulatory evolution across Latin American markets influences cloud adoption patterns, with governments developing new policies and frameworks that either facilitate or constrain cloud deployment strategies. According to MarkWide Research analysis, regulatory clarity is improving across major markets, with approximately 68% of organizations reporting increased confidence in cloud compliance capabilities.

Partnership ecosystems are becoming increasingly important, with cloud providers developing extensive networks of local partners, system integrators, and industry specialists to enhance market reach and service delivery capabilities throughout the region.

Comprehensive market analysis for the Latin America cloud computing market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate, reliable, and actionable market insights. The research framework incorporates quantitative data analysis, qualitative assessments, and industry expert consultations to provide a complete market perspective.

Primary research activities include extensive surveys of cloud service providers, enterprise customers, and technology decision-makers across major Latin American markets. These surveys capture current adoption patterns, future investment plans, technology preferences, and market challenges directly from market participants, providing real-time insights into market dynamics and trends.

Secondary research components encompass analysis of industry reports, government publications, technology vendor announcements, and financial disclosures from publicly traded companies operating in the cloud computing sector. This secondary research provides historical context, market sizing validation, and competitive landscape analysis.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Market projections and trend analysis incorporate both quantitative modeling and qualitative expert assessments to provide balanced, realistic market forecasts.

Regional coverage includes detailed analysis of major Latin American markets including Brazil, Mexico, Argentina, Colombia, Chile, and Peru, with additional coverage of smaller markets where cloud adoption is emerging. This comprehensive geographic scope ensures complete regional market representation and identifies country-specific opportunities and challenges.

Brazil represents the largest cloud computing market in Latin America, accounting for approximately 42% of regional cloud adoption, driven by its large enterprise base, advanced telecommunications infrastructure, and supportive government digitalization policies. The Brazilian market demonstrates strong growth across all cloud service categories, with particular strength in financial services, retail, and manufacturing sectors.

Mexico emerges as the second-largest market, benefiting from its proximity to North American technology providers and strong manufacturing sector digitalization initiatives. Mexican organizations are increasingly adopting hybrid cloud strategies to support cross-border business operations while maintaining data sovereignty compliance.

Argentina shows significant potential despite economic challenges, with organizations leveraging cloud computing to achieve cost optimization and operational efficiency. The Argentine market demonstrates particular strength in SaaS adoption among small and medium enterprises seeking affordable technology solutions.

Colombia represents a rapidly growing market driven by government digitalization initiatives and increasing foreign investment in technology infrastructure. Colombian organizations are particularly focused on cloud solutions that support business continuity and disaster recovery capabilities.

Chile demonstrates advanced cloud adoption rates relative to its market size, with organizations across mining, financial services, and technology sectors implementing sophisticated cloud strategies. The Chilean market shows strong preference for hybrid cloud deployments that balance scalability with data control requirements.

Regional trends indicate increasing cross-border cloud adoption, with organizations implementing multi-country cloud strategies to support regional business expansion and operational standardization across Latin American markets.

Market leadership in the Latin America cloud computing sector features a dynamic mix of global technology giants and regional specialists, each contributing unique value propositions and market expertise. The competitive environment continues to evolve as providers expand their regional presence and develop localized service offerings.

Competitive strategies focus on local data center expansion, partnership development with regional system integrators, and creation of industry-specific cloud solutions that address unique Latin American market requirements and regulatory compliance needs.

Service Model Segmentation:

Deployment Model Segmentation:

Organization Size Segmentation:

By Industry Vertical:

By Technology Focus:

For Enterprises:

For Cloud Service Providers:

For Technology Partners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid and Multi-Cloud Strategies are becoming increasingly prevalent as organizations seek to optimize workload placement, avoid vendor lock-in, and maintain flexibility in their cloud deployments. This trend reflects growing cloud maturity among Latin American enterprises and their desire to leverage best-of-breed solutions from multiple providers.

Edge Computing Integration represents an emerging trend driven by requirements for low-latency processing, real-time analytics, and improved application performance. Organizations are implementing edge computing solutions to complement their cloud strategies, particularly in manufacturing, retail, and telecommunications sectors.

Industry-Specific Cloud Solutions are gaining traction as providers develop specialized offerings addressing unique requirements of healthcare, financial services, government, and other regulated industries. These solutions incorporate industry-specific compliance, security, and functionality requirements while maintaining cloud scalability benefits.

Artificial Intelligence and Machine Learning Integration is accelerating across cloud platforms, with MWR data indicating that approximately 45% of cloud adopters are now utilizing AI-enabled services for business analytics, automation, and customer experience enhancement applications.

Sustainability Focus is emerging as organizations increasingly consider environmental impact in their technology decisions. Cloud providers are responding with renewable energy commitments, carbon-neutral services, and sustainability reporting capabilities that appeal to environmentally conscious enterprises.

Zero Trust Security Models are being integrated into cloud architectures as organizations prioritize comprehensive security frameworks that verify all users and devices regardless of location or network connection, reflecting growing cybersecurity awareness and regulatory requirements.

Data Center Expansion across Latin America continues accelerating, with major cloud providers investing significantly in regional infrastructure to improve service performance, reduce latency, and address data sovereignty requirements. These investments demonstrate long-term commitment to the regional market and enable enhanced service delivery capabilities.

Strategic Partnerships between global cloud providers and regional telecommunications companies are expanding, creating comprehensive service offerings that combine cloud capabilities with local connectivity and support services. These partnerships enhance market reach and provide customers with integrated solutions addressing their complete technology requirements.

Government Cloud Initiatives are expanding across multiple countries, with public sector organizations implementing cloud-first policies and developing frameworks for secure government cloud adoption. These initiatives drive broader market acceptance while creating substantial revenue opportunities for qualified providers.

Industry Consolidation activities include acquisitions of regional cloud providers by global technology companies, enabling rapid market expansion and integration of local expertise with global capabilities. This consolidation trend is reshaping competitive dynamics while providing customers with enhanced service offerings.

Regulatory Framework Development continues evolving, with governments implementing new data protection laws, cybersecurity requirements, and cloud governance frameworks that influence adoption patterns and provider strategies throughout the region.

Innovation Centers and research facilities are being established by major cloud providers to support local innovation, develop region-specific solutions, and collaborate with academic institutions and technology startups on emerging cloud technologies and applications.

Market Entry Strategies for cloud providers should prioritize local partnership development, regulatory compliance capabilities, and industry-specific solution development to effectively compete in the diverse Latin American market. Understanding regional business practices, cultural preferences, and regulatory requirements is essential for successful market penetration.

Investment Priorities should focus on infrastructure expansion, security enhancement, and skills development to address key market barriers and enable sustainable growth. Providers investing in local data centers, comprehensive security frameworks, and customer education programs are likely to achieve stronger market positions.

Customer Acquisition strategies should emphasize value demonstration, risk mitigation, and gradual adoption pathways that address common concerns about cloud migration. Successful providers offer proof-of-concept programs, comprehensive migration support, and flexible engagement models that reduce customer risk and accelerate adoption decisions.

Technology Development efforts should concentrate on emerging technologies such as artificial intelligence, edge computing, and industry-specific applications that provide competitive differentiation and address evolving customer requirements. Innovation in these areas can create significant market advantages and premium pricing opportunities.

Competitive Positioning requires clear value propositions that differentiate providers based on specific customer needs, whether focusing on cost optimization, security capabilities, industry expertise, or technological innovation. Generic positioning strategies are less effective in the increasingly competitive Latin American cloud market.

Long-term Success depends on building sustainable competitive advantages through local expertise, comprehensive service portfolios, and strong customer relationships that create switching costs and drive customer loyalty in a dynamic market environment.

Growth Trajectory for the Latin America cloud computing market remains strongly positive, with continued expansion expected across all service categories and geographic markets. The market is projected to maintain robust growth rates exceeding 15% annually over the next five years, driven by ongoing digital transformation initiatives and increasing cloud maturity among regional organizations.

Technology Evolution will continue driving market expansion as cloud platforms incorporate advanced capabilities such as quantum computing, advanced AI services, and next-generation security features. These technological advances will enable new use cases and applications that further expand cloud adoption across industries and organization sizes.

Market Maturation indicators suggest the Latin American cloud market is transitioning from early adoption to mainstream acceptance, with organizations increasingly viewing cloud computing as essential business infrastructure rather than optional technology enhancement. This maturation process will drive more sophisticated cloud strategies and higher per-customer spending.

Regulatory Environment evolution is expected to become more supportive of cloud adoption as governments recognize the economic and innovation benefits of cloud computing. MarkWide Research projects that approximately 78% of regional governments will implement cloud-friendly policies within the next three years, further accelerating market growth.

Competitive Landscape will continue evolving with new market entrants, strategic partnerships, and service innovation creating dynamic market conditions. Organizations will benefit from increased choice, improved service quality, and competitive pricing as the market becomes more mature and competitive.

Investment Opportunities remain substantial across infrastructure development, technology innovation, and market expansion initiatives, with the region representing one of the most attractive global markets for cloud computing investment and growth.

The Latin America cloud computing market represents a dynamic and rapidly expanding sector that offers significant opportunities for growth, innovation, and value creation across multiple stakeholder groups. The market’s evolution from early adoption to mainstream acceptance reflects the region’s commitment to digital transformation and technological modernization, creating a foundation for sustained long-term growth.

Market fundamentals remain strong, supported by improving infrastructure, supportive government policies, growing enterprise awareness of cloud benefits, and increasing availability of industry-specific solutions that address unique regional requirements. The combination of these factors creates a favorable environment for continued cloud adoption acceleration across diverse industry sectors and organization sizes.

Strategic implications for market participants include the importance of local market understanding, comprehensive service portfolios, and strong partnership ecosystems that enable effective competition in this diverse and evolving market. Success requires balancing global capabilities with regional expertise and customer-specific requirements.

Future prospects indicate that the Latin America cloud computing market will continue serving as a key driver of regional economic development, business innovation, and technological advancement. Organizations that effectively leverage cloud technologies will be well-positioned to compete in an increasingly digital economy, while cloud providers that successfully address regional market needs will capture substantial growth opportunities in this expanding market.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing power, and applications. It allows businesses and individuals to access and manage data remotely, enhancing flexibility and scalability.

What are the key players in the Latin America Cloud Computing Market?

Key players in the Latin America Cloud Computing Market include Amazon Web Services, Microsoft Azure, Google Cloud, and IBM Cloud, among others. These companies provide a range of cloud services tailored to various industries and business needs.

What are the main drivers of growth in the Latin America Cloud Computing Market?

The main drivers of growth in the Latin America Cloud Computing Market include the increasing demand for digital transformation, the rise of remote work, and the need for scalable IT solutions. Additionally, businesses are adopting cloud services to enhance operational efficiency and reduce costs.

What challenges does the Latin America Cloud Computing Market face?

The Latin America Cloud Computing Market faces challenges such as data security concerns, regulatory compliance issues, and a lack of skilled workforce. These factors can hinder the adoption and growth of cloud services in the region.

What opportunities exist in the Latin America Cloud Computing Market?

Opportunities in the Latin America Cloud Computing Market include the expansion of internet connectivity, the growth of small and medium-sized enterprises adopting cloud solutions, and the increasing focus on artificial intelligence and machine learning applications. These trends are likely to drive further investment in cloud technologies.

What trends are shaping the Latin America Cloud Computing Market?

Trends shaping the Latin America Cloud Computing Market include the rise of hybrid cloud solutions, increased emphasis on data analytics, and the growing adoption of cloud-native applications. These trends reflect the evolving needs of businesses seeking agility and innovation.

Latin America Cloud Computing Market

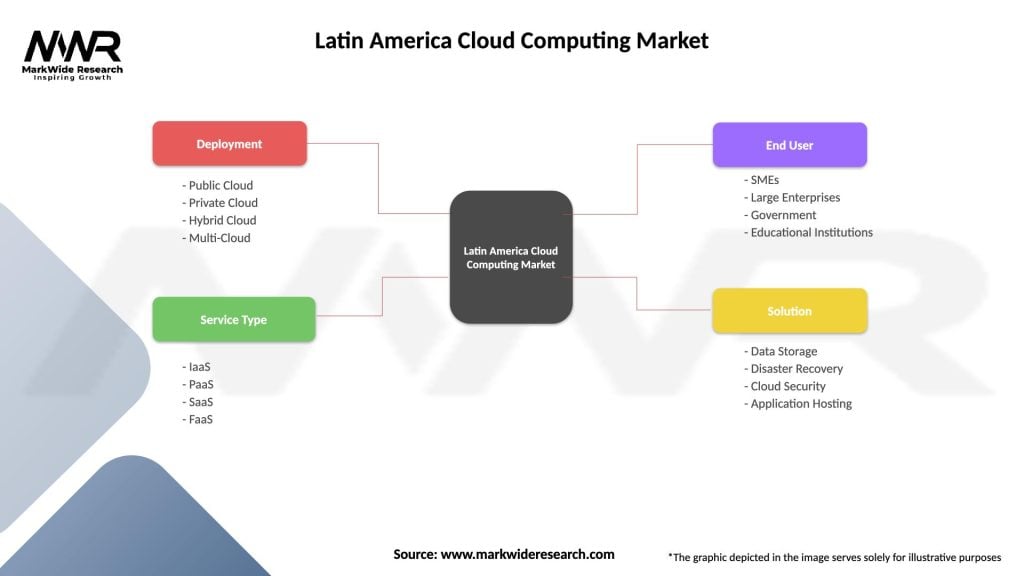

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Service Type | IaaS, PaaS, SaaS, FaaS |

| End User | SMEs, Large Enterprises, Government, Educational Institutions |

| Solution | Data Storage, Disaster Recovery, Cloud Security, Application Hosting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at