444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America blood glucose test strip packaging market represents a critical segment within the broader diabetes management ecosystem, serving millions of diabetic patients across the region. This specialized packaging market encompasses the protective containers, individual wrapping, and bulk packaging solutions designed specifically for blood glucose test strips used in diabetes monitoring devices. Market dynamics in Latin America are characterized by increasing diabetes prevalence, growing healthcare awareness, and evolving regulatory requirements that demand sophisticated packaging solutions.

Regional growth patterns indicate significant expansion opportunities, with the market experiencing robust development driven by rising diabetes incidence rates and improved healthcare infrastructure. The packaging solutions must maintain strict moisture control, ensure sterility, and provide tamper-evident features while remaining cost-effective for widespread distribution. Brazil and Mexico emerge as the dominant markets, collectively accounting for approximately 68% of regional demand, while countries like Argentina, Colombia, and Chile contribute substantially to market growth.

Technological advancement in packaging materials and design continues to reshape market offerings, with manufacturers focusing on enhanced barrier properties, extended shelf life, and user-friendly designs. The integration of smart packaging technologies and sustainability initiatives further influences market development, as healthcare providers and patients increasingly demand environmentally responsible solutions without compromising product integrity.

The Latin America blood glucose test strip packaging market refers to the specialized industry segment focused on developing, manufacturing, and distributing protective packaging solutions specifically designed for blood glucose test strips used in diabetes monitoring across Latin American countries. This market encompasses various packaging formats including individual strip pouches, multi-strip vials, bulk containers, and secondary packaging systems that ensure product integrity, sterility, and usability throughout the distribution chain.

Packaging requirements in this market are particularly stringent due to the sensitive nature of glucose test strips, which contain enzymes and chemicals that can degrade when exposed to moisture, light, or temperature fluctuations. The packaging must provide exceptional barrier properties while maintaining cost-effectiveness for widespread accessibility across diverse economic conditions prevalent in Latin American markets.

Market scope includes primary packaging that directly contacts the test strips, secondary packaging for retail distribution, and tertiary packaging for bulk transportation. The industry serves multiple stakeholders including test strip manufacturers, healthcare providers, pharmacies, and ultimately, diabetic patients who rely on these products for daily glucose monitoring and diabetes management.

Market expansion in the Latin America blood glucose test strip packaging sector reflects the region’s growing diabetes burden and increasing healthcare investments. The market demonstrates strong growth potential driven by demographic trends, urbanization, and lifestyle changes that contribute to rising diabetes prevalence across the region. Key growth drivers include expanding healthcare coverage, increasing awareness of diabetes management, and technological improvements in packaging materials and design.

Competitive landscape features a mix of international packaging giants and regional specialists, with companies focusing on innovation in barrier materials, sustainable packaging solutions, and cost-effective manufacturing processes. The market benefits from increasing healthcare expenditure and government initiatives promoting diabetes awareness and management programs throughout Latin American countries.

Regional variations in market development reflect differences in healthcare infrastructure, regulatory environments, and economic conditions. While larger markets like Brazil and Mexico drive volume growth, emerging markets present significant opportunities for expansion as healthcare systems develop and diabetes awareness increases. The market growth rate demonstrates consistent upward trajectory, with projections indicating sustained expansion driven by demographic and healthcare trends.

Market segmentation reveals distinct patterns in packaging preferences and requirements across different Latin American countries, with variations in regulatory standards, climate conditions, and distribution channels influencing packaging design and material selection. The following key insights shape market development:

Diabetes prevalence continues to rise across Latin America, creating sustained demand for blood glucose monitoring products and their associated packaging solutions. The International Diabetes Federation reports significant increases in diabetes cases throughout the region, with urbanization, dietary changes, and sedentary lifestyles contributing to this health challenge. This epidemiological trend directly translates to increased demand for glucose test strips and their specialized packaging.

Healthcare infrastructure development across Latin American countries supports market growth through improved distribution networks, expanded pharmacy coverage, and enhanced healthcare provider capabilities. Government initiatives promoting diabetes awareness and management create favorable conditions for market expansion, while increasing healthcare expenditure enables broader access to diabetes monitoring products.

Technological advancement in packaging materials drives market innovation, with new barrier films, smart packaging technologies, and sustainable materials offering improved product protection and user experience. The development of cost-effective advanced materials makes sophisticated packaging solutions accessible to price-sensitive Latin American markets while maintaining necessary protection standards.

Regulatory harmonization efforts across the region facilitate market development by reducing compliance complexity and enabling more efficient product distribution. Standardized quality requirements and safety standards create opportunities for economies of scale while ensuring consistent product quality across different countries.

Economic volatility in several Latin American countries creates challenges for market growth, with currency fluctuations, inflation, and economic uncertainty affecting healthcare spending and product accessibility. These economic factors can limit market expansion and create pricing pressures that impact packaging innovation and quality investments.

Regulatory complexity across different countries requires significant compliance investments and can delay product launches or market entry. Varying national standards for medical device packaging, labeling requirements, and import regulations create barriers for manufacturers seeking regional market penetration.

Infrastructure limitations in certain regions affect distribution efficiency and product integrity maintenance throughout the supply chain. Poor transportation networks, inadequate cold chain facilities, and limited warehouse capabilities can compromise packaging effectiveness and increase costs.

Cost sensitivity among healthcare systems and patients limits adoption of premium packaging solutions, creating pressure to balance protection requirements with affordability constraints. This challenge is particularly acute in markets with limited healthcare coverage or high out-of-pocket expenses for diabetes management products.

Emerging markets within Latin America present significant growth opportunities as healthcare systems develop and diabetes awareness increases. Countries with expanding middle classes and improving healthcare infrastructure offer substantial potential for market penetration and volume growth.

Sustainability initiatives create opportunities for innovative packaging solutions that address environmental concerns while maintaining product protection. The development of biodegradable materials, recyclable packaging designs, and reduced material usage can differentiate products and appeal to environmentally conscious consumers and healthcare providers.

Digital integration opportunities include smart packaging technologies that enhance patient engagement, improve medication adherence, and provide valuable data for healthcare providers. Integration with mobile health applications and telemedicine platforms can create additional value propositions for packaging solutions.

Partnership opportunities with local manufacturers, healthcare providers, and government agencies can facilitate market entry and expansion while addressing specific regional needs and preferences. Collaborative approaches can help overcome regulatory barriers and build sustainable market presence.

Supply chain evolution significantly impacts market dynamics, with manufacturers adapting to changing distribution patterns, e-commerce growth, and direct-to-patient delivery models. These shifts require packaging solutions that can withstand varied handling conditions while maintaining cost-effectiveness across different distribution channels.

Competitive pressure drives continuous innovation in packaging design, materials, and manufacturing processes. Companies compete on factors including protection effectiveness, cost efficiency, sustainability credentials, and user experience, leading to rapid technological advancement and market differentiation strategies.

Regulatory evolution shapes market dynamics through changing requirements for medical device packaging, environmental regulations, and quality standards. Companies must maintain flexibility to adapt to regulatory changes while investing in compliance capabilities and quality systems.

Technology convergence between packaging, medical devices, and digital health creates new market dynamics and opportunities for value creation. The integration of packaging with monitoring systems, data collection, and patient management platforms represents a significant market evolution trend.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with key stakeholders across the value chain, including packaging manufacturers, test strip producers, healthcare providers, and regulatory officials throughout Latin America.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications related to diabetes management, medical device packaging, and Latin American healthcare markets. This approach provides comprehensive market context and validates primary research findings.

Data triangulation methods ensure research accuracy by cross-referencing information from multiple sources and validating findings through different analytical approaches. Quantitative analysis includes market sizing, growth projections, and trend analysis, while qualitative research provides insights into market dynamics, competitive strategies, and future opportunities.

Regional analysis methodology incorporates country-specific research to account for variations in market conditions, regulatory environments, and healthcare systems across Latin America. This approach ensures accurate representation of market diversity and enables targeted strategic recommendations for different regional markets.

Brazil dominates the Latin America blood glucose test strip packaging market, accounting for approximately 42% of regional demand due to its large population, established healthcare infrastructure, and significant diabetes prevalence. The Brazilian market benefits from local manufacturing capabilities, supportive regulatory environment, and growing healthcare investments that drive packaging innovation and adoption.

Mexico represents the second-largest market with roughly 26% market share, characterized by rapid healthcare system modernization and increasing diabetes awareness programs. The proximity to North American markets facilitates technology transfer and supply chain efficiency, while government health initiatives support market growth through expanded access to diabetes management products.

Argentina, Colombia, and Chile collectively contribute approximately 22% of market demand, with each country presenting unique opportunities and challenges. Argentina offers significant market potential despite economic volatility, while Colombia benefits from healthcare system reforms and Chile demonstrates strong regulatory frameworks that support quality packaging adoption.

Emerging markets including Peru, Ecuador, and Central American countries represent the remaining 10% of current demand but show strong growth potential as healthcare infrastructure develops and diabetes awareness increases. These markets present opportunities for cost-effective packaging solutions tailored to local needs and economic conditions.

Market leadership is distributed among several key players, each bringing distinct capabilities and market approaches to the Latin America blood glucose test strip packaging sector. The competitive environment features both global packaging companies and regional specialists focused on medical device packaging solutions.

Competitive strategies focus on technological innovation, cost optimization, sustainability initiatives, and regional market penetration. Companies invest in local manufacturing capabilities, regulatory compliance, and customer relationships to build sustainable competitive advantages in the diverse Latin American market.

By Packaging Type:

By Material Type:

By End User:

Individual strip pouches represent the fastest-growing segment, driven by increasing preference for single-use packaging that ensures maximum product integrity and user convenience. This category benefits from growing awareness of contamination risks and the need for precise dosing in diabetes management. Market adoption is particularly strong in urban areas where patients prioritize convenience and product reliability.

Multi-strip vials maintain significant market share due to cost advantages and established distribution patterns. This category serves price-sensitive markets effectively while providing adequate protection through desiccant integration and robust container design. Healthcare institutions particularly favor this format for bulk purchasing and inventory management efficiency.

Aluminum foil laminates dominate the material segment due to superior barrier properties essential for tropical and subtropical climates prevalent across Latin America. These materials provide excellent moisture protection, light blocking, and tamper evidence, making them ideal for demanding environmental conditions. Innovation focus includes sustainable alternatives that maintain barrier performance while addressing environmental concerns.

Hospital and clinic segments drive demand for institutional packaging formats that prioritize protection, efficiency, and cost-effectiveness. These end users require packaging solutions that integrate with existing workflows while maintaining strict quality standards. Procurement patterns in this segment emphasize long-term supplier relationships and consistent quality delivery.

Manufacturers benefit from growing market demand driven by increasing diabetes prevalence and healthcare infrastructure development across Latin America. The market offers opportunities for product differentiation through innovative packaging solutions, sustainable materials, and smart packaging technologies that create competitive advantages and premium pricing opportunities.

Healthcare providers gain from improved packaging solutions that enhance product integrity, reduce waste, and improve patient outcomes through better medication adherence and monitoring accuracy. Advanced packaging features including tamper evidence, expiration date tracking, and user-friendly designs support clinical objectives and operational efficiency.

Patients receive significant benefits from packaging innovations that improve product reliability, ease of use, and storage convenience. Better packaging design reduces the risk of test strip degradation, ensures accurate glucose readings, and supports effective diabetes management through improved user experience and medication adherence.

Regulatory bodies benefit from industry adoption of advanced packaging standards that enhance product safety, traceability, and quality assurance. Improved packaging solutions support regulatory objectives for medical device safety while facilitating market oversight and compliance monitoring.

Environmental stakeholders gain from industry initiatives toward sustainable packaging materials and reduced environmental impact. The development of recyclable, biodegradable, and reduced-material packaging solutions supports environmental protection goals while maintaining necessary product protection standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with manufacturers increasingly focusing on environmentally responsible packaging solutions that maintain product protection while reducing environmental impact. This trend includes development of biodegradable materials, recyclable packaging designs, and reduced material usage without compromising barrier properties or user functionality.

Smart packaging adoption accelerates across the market, with integration of QR codes, NFC chips, temperature indicators, and other digital technologies that enhance patient engagement and provide valuable data for healthcare management. These technologies support medication adherence, product authentication, and supply chain traceability while creating new value propositions for stakeholders.

Customization demand increases as different market segments require tailored packaging solutions that address specific regional needs, climate conditions, and user preferences. This trend drives development of flexible manufacturing capabilities and modular packaging designs that can be adapted for different markets while maintaining cost efficiency.

Supply chain optimization becomes increasingly important as companies seek to improve efficiency, reduce costs, and enhance product availability across diverse Latin American markets. This includes investment in regional manufacturing, distribution network optimization, and inventory management systems that support reliable product supply.

Regulatory harmonization efforts across Latin America create opportunities for standardized packaging solutions that can serve multiple markets efficiently. This trend supports economies of scale while reducing compliance complexity and facilitating regional market expansion strategies.

Manufacturing expansion initiatives by major packaging companies include establishment of new production facilities and capacity increases across Latin America to serve growing market demand. These investments support local supply chain development while reducing costs and improving market responsiveness.

Technology partnerships between packaging manufacturers and test strip producers drive innovation in integrated solutions that optimize product protection, user experience, and manufacturing efficiency. These collaborations result in specialized packaging designs tailored to specific product requirements and market conditions.

Regulatory approvals for new packaging materials and designs expand market opportunities while ensuring compliance with evolving safety and quality standards. Recent approvals include advanced barrier films, sustainable materials, and smart packaging technologies that meet stringent medical device packaging requirements.

Sustainability initiatives across the industry include development of recyclable packaging materials, reduced plastic usage, and circular economy approaches that address environmental concerns while maintaining product protection standards. These initiatives respond to growing environmental awareness and regulatory pressure for sustainable packaging solutions.

Market consolidation activities include strategic acquisitions and partnerships that strengthen market positions, expand geographic coverage, and enhance technological capabilities. These developments reshape competitive dynamics while creating opportunities for improved market service and innovation acceleration.

MarkWide Research recommends that companies focus on developing cost-effective packaging solutions that balance protection requirements with affordability constraints prevalent in Latin American markets. This approach should emphasize value engineering, material optimization, and manufacturing efficiency to achieve competitive pricing while maintaining quality standards.

Regional market entry strategies should prioritize partnerships with local distributors, healthcare providers, and regulatory consultants to navigate complex market conditions and build sustainable market presence. Companies should invest in understanding local market dynamics, regulatory requirements, and customer preferences to develop effective market penetration strategies.

Innovation investment should focus on sustainability initiatives, smart packaging technologies, and user experience improvements that create competitive differentiation while addressing market needs. Companies should balance innovation investments with market realities to ensure commercial viability and customer adoption.

Supply chain optimization initiatives should emphasize regional manufacturing capabilities, distribution network efficiency, and inventory management systems that support reliable product availability across diverse market conditions. This includes investment in local partnerships and infrastructure development that enhance market service capabilities.

Regulatory compliance strategies should emphasize proactive engagement with regulatory authorities, investment in quality systems, and development of flexible product designs that can accommodate varying national requirements. Companies should build regulatory expertise and compliance capabilities that support efficient market entry and expansion.

Market growth prospects remain positive, with continued expansion expected driven by increasing diabetes prevalence, healthcare infrastructure development, and growing awareness of diabetes management importance across Latin America. The market is projected to maintain steady growth rates, with emerging markets contributing significantly to overall expansion.

Technology evolution will continue shaping market development through advances in barrier materials, smart packaging capabilities, and sustainable packaging solutions. MWR analysis indicates that companies investing in technological innovation while maintaining cost competitiveness will achieve the strongest market positions and growth opportunities.

Regulatory environment evolution is expected to support market growth through harmonization efforts, quality standard improvements, and supportive policies for diabetes management. These developments will facilitate market expansion while ensuring product safety and quality standards that benefit all stakeholders.

Sustainability focus will intensify, with environmental considerations becoming increasingly important in packaging design, material selection, and manufacturing processes. Companies that successfully integrate sustainability initiatives while maintaining product protection and cost competitiveness will gain significant competitive advantages.

Market maturation in established markets will drive focus toward innovation, premium solutions, and value-added services, while emerging markets will continue offering volume growth opportunities. This dual market dynamic will require flexible strategies that address different market development stages and customer needs across the region.

The Latin America blood glucose test strip packaging market represents a dynamic and growing sector driven by increasing diabetes prevalence, healthcare infrastructure development, and evolving patient needs across the region. Market opportunities are substantial, with diverse country markets offering different growth potential and requiring tailored approaches that address local conditions, regulatory requirements, and economic factors.

Success factors in this market include technological innovation, cost optimization, regulatory compliance, and sustainable packaging development that meets both market needs and environmental responsibilities. Companies that effectively balance these requirements while building strong regional partnerships and distribution capabilities will achieve sustainable competitive advantages and market growth.

Future market development will be shaped by continued diabetes prevalence growth, healthcare system evolution, and technological advancement in packaging materials and design. The integration of sustainability initiatives, smart packaging technologies, and user-centered design approaches will create new opportunities for market differentiation and value creation across the diverse Latin American market landscape.

What is Blood Glucose Test Strip Packaging?

Blood Glucose Test Strip Packaging refers to the materials and methods used to package test strips that measure glucose levels in the blood, ensuring their safety, stability, and usability for diabetic patients.

What are the key players in the Latin America Blood Glucose Test Strip Packaging Market?

Key players in the Latin America Blood Glucose Test Strip Packaging Market include Abbott Laboratories, Roche Diagnostics, and Ascensia Diabetes Care, among others.

What are the growth factors driving the Latin America Blood Glucose Test Strip Packaging Market?

The growth of the Latin America Blood Glucose Test Strip Packaging Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in packaging technologies that enhance product shelf life.

What challenges does the Latin America Blood Glucose Test Strip Packaging Market face?

Challenges in the Latin America Blood Glucose Test Strip Packaging Market include regulatory hurdles, competition from alternative glucose monitoring technologies, and the need for cost-effective packaging solutions.

What opportunities exist in the Latin America Blood Glucose Test Strip Packaging Market?

Opportunities in the Latin America Blood Glucose Test Strip Packaging Market include the development of eco-friendly packaging materials, innovations in smart packaging technologies, and expanding distribution channels to reach underserved populations.

What trends are shaping the Latin America Blood Glucose Test Strip Packaging Market?

Trends in the Latin America Blood Glucose Test Strip Packaging Market include the shift towards sustainable packaging solutions, the integration of digital technologies for better user experience, and the increasing demand for personalized diabetes management products.

Latin America Blood Glucose Test Strip Packaging Market

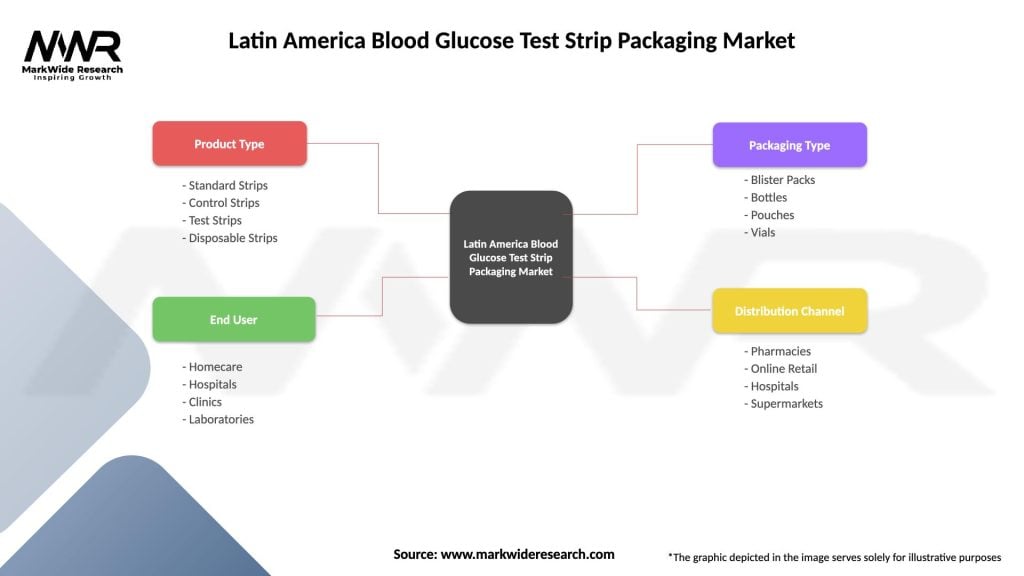

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Strips, Control Strips, Test Strips, Disposable Strips |

| End User | Homecare, Hospitals, Clinics, Laboratories |

| Packaging Type | Blister Packs, Bottles, Pouches, Vials |

| Distribution Channel | Pharmacies, Online Retail, Hospitals, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Blood Glucose Test Strip Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at