444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LATAM animation, VFX and post production market represents one of the most dynamic and rapidly evolving entertainment technology sectors in Latin America. This comprehensive market encompasses a diverse range of creative services including 2D and 3D animation, visual effects production, motion graphics, color correction, sound design, and digital compositing. The region has experienced remarkable growth in recent years, driven by increasing demand from streaming platforms, international film productions, and the expanding gaming industry.

Market dynamics indicate that the LATAM region is becoming increasingly attractive to global entertainment companies seeking cost-effective yet high-quality production services. Countries like Mexico, Brazil, Argentina, and Colombia have emerged as key hubs for animation and VFX services, offering skilled talent pools and competitive production costs. The market is characterized by a growing number of local studios, increased foreign investment, and rising adoption of cutting-edge technologies such as real-time rendering and cloud-based production workflows.

Regional growth has been particularly strong, with the market expanding at a compound annual growth rate (CAGR) of 12.8% over the past five years. This growth trajectory reflects the increasing sophistication of local production capabilities and the region’s growing reputation as a reliable outsourcing destination for international projects. The market benefits from government incentives, educational initiatives, and the establishment of specialized training programs that are developing the next generation of creative professionals.

The LATAM animation, VFX and post production market refers to the comprehensive ecosystem of creative and technical services involved in the creation, enhancement, and finishing of visual content across Latin American countries. This market encompasses all stages of digital content production, from initial concept development and pre-visualization to final delivery and distribution.

Animation services within this market include traditional 2D animation, computer-generated 3D animation, stop-motion animation, and motion graphics for various applications including feature films, television series, commercials, educational content, and digital marketing materials. The VFX component covers visual effects creation, digital compositing, matte painting, character animation, and environment creation for live-action productions.

Post production services encompass video editing, color grading, audio post-production, sound design, music composition, and final delivery preparation. This integrated approach allows LATAM studios to offer comprehensive solutions to clients ranging from local broadcasters to major international streaming platforms and film studios.

The LATAM animation, VFX and post production market has emerged as a significant force in the global entertainment industry, leveraging the region’s creative talent, competitive costs, and improving technological infrastructure. The market serves both domestic and international clients, with approximately 68% of revenue generated from export services to North American and European markets.

Key market drivers include the explosive growth of streaming content demand, increasing investment in original Latin American productions, and the region’s strategic time zone advantages for serving North American clients. Major streaming platforms have significantly increased their investment in LATAM original content, creating substantial opportunities for local animation and VFX studios.

Technology adoption has accelerated rapidly, with studios investing in advanced software, cloud-based workflows, and remote collaboration tools. The COVID-19 pandemic actually accelerated market growth as remote production capabilities became essential, and many studios successfully adapted to distributed workflows while maintaining high production standards.

Market challenges include talent retention, competition from other global outsourcing destinations, and the need for continued investment in technology and training. However, the overall outlook remains highly positive, with industry experts projecting continued strong growth driven by increasing content demand and the region’s growing reputation for quality and reliability.

Strategic positioning within the global entertainment ecosystem has become increasingly important for LATAM studios. The following key insights highlight the market’s current dynamics and future potential:

Content demand explosion represents the primary driver of market growth, with streaming platforms requiring unprecedented volumes of original content to satisfy diverse audience preferences. The shift toward localized content has particularly benefited LATAM studios, as international platforms seek authentic regional stories and culturally relevant productions.

Cost competitiveness continues to be a significant advantage for LATAM studios, offering production costs that are typically 30-50% lower than comparable services in North America or Europe, while maintaining high quality standards. This cost advantage, combined with improving quality and reliability, has made the region increasingly attractive to international clients.

Technological advancement has democratized access to professional-grade tools and workflows. Cloud-based rendering, real-time collaboration platforms, and subscription-based software models have enabled smaller studios to compete with larger facilities while reducing capital investment requirements.

Government initiatives across the region have provided crucial support through tax incentives, grants, and infrastructure development. Countries like Colombia, Mexico, and Brazil have implemented specific programs to attract international productions and support local industry development.

Educational development has created a growing pool of skilled professionals. Universities and specialized training centers have expanded their programs, often in partnership with industry leaders, ensuring graduates have relevant skills for current market demands.

Talent retention challenges pose a significant constraint as skilled professionals are increasingly recruited by international companies or choose to work as freelancers for higher compensation. This brain drain effect can limit the growth potential of local studios and increase operational costs.

Infrastructure limitations in some regions continue to impact productivity and competitiveness. Inconsistent internet connectivity, power supply issues, and limited access to high-end hardware can create operational challenges for studios attempting to serve international clients with demanding technical requirements.

Currency volatility affects pricing strategies and profitability, particularly for studios serving international clients. Fluctuating exchange rates can impact competitiveness and make long-term project planning challenging.

Competition from established markets such as India, Eastern Europe, and Southeast Asia continues to pressure LATAM studios. These regions often have more mature industries, established client relationships, and proven track records in serving international markets.

Technology investment requirements can be substantial, particularly for smaller studios seeking to compete for high-end projects. The rapid pace of technological change requires continuous investment in software, hardware, and training to remain competitive.

Streaming platform expansion presents enormous opportunities as major services continue to invest heavily in original LATAM content. The success of regional productions on global platforms has demonstrated the commercial viability of Latin American stories, encouraging further investment.

Gaming industry growth offers substantial potential, with the LATAM gaming market experiencing rapid expansion. Local studios can leverage their animation and VFX capabilities to serve both domestic and international gaming companies requiring high-quality visual content.

Virtual production technologies represent a significant opportunity for studios willing to invest in LED volumes, real-time rendering, and virtual production workflows. These technologies can attract high-value international projects and differentiate studios in the competitive marketplace.

Educational and corporate content markets are expanding rapidly, driven by digital transformation initiatives and remote learning trends. Studios can diversify their revenue streams by serving these growing market segments with specialized content solutions.

Cross-border collaboration opportunities continue to expand as international studios seek reliable partners for overflow work, specialized services, or cost-effective production solutions. Strategic partnerships can provide access to larger projects and advanced technical knowledge.

Supply and demand dynamics in the LATAM animation, VFX and post production market are characterized by rapidly increasing demand that often outpaces the available skilled workforce. This imbalance has led to wage inflation in key markets and increased competition for experienced professionals.

Technology evolution continues to reshape market dynamics, with cloud-based workflows enabling smaller studios to compete for international projects while reducing infrastructure costs. The adoption of artificial intelligence and machine learning tools is beginning to impact production efficiency, with early adopters gaining competitive advantages.

Client relationship patterns show a trend toward longer-term partnerships rather than project-based engagements. International clients increasingly prefer to work with trusted LATAM partners who understand their requirements and can deliver consistent quality across multiple projects.

Pricing pressures vary by market segment, with high-end VFX work maintaining premium pricing while commodity animation services face increasing price competition. Studios are responding by specializing in specific niches or developing unique capabilities that command higher rates.

Geographic concentration remains significant, with major production hubs in Mexico City, São Paulo, Buenos Aires, and Bogotá accounting for approximately 75% of regional production capacity. However, emerging centers in smaller cities are beginning to develop as remote work capabilities expand.

Primary research for this market analysis involved comprehensive interviews with industry executives, studio owners, creative professionals, and technology vendors across the LATAM region. Over 150 stakeholders participated in structured interviews and surveys designed to capture current market conditions, growth projections, and industry challenges.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and financial filings from publicly traded companies operating in the region. This research provided quantitative data on market size, growth rates, and competitive positioning.

Market validation was conducted through multiple data triangulation methods, comparing primary research findings with secondary sources and industry expert opinions. MarkWide Research analysts conducted follow-up interviews with key stakeholders to verify findings and ensure accuracy of market projections.

Geographic coverage included detailed analysis of major markets including Brazil, Mexico, Argentina, Colombia, Chile, and Peru, with additional coverage of emerging markets throughout Central America and the Caribbean region.

Temporal analysis examined market trends over the past five years while projecting future growth scenarios based on current industry dynamics, planned investments, and emerging technology adoption patterns.

Brazil represents the largest market within the LATAM region, accounting for approximately 35% of total regional production capacity. The country benefits from a large domestic market, established production infrastructure, and significant government support for the creative industries. São Paulo and Rio de Janeiro serve as primary production hubs, with emerging centers in other major cities.

Mexico holds the second-largest market share at roughly 28% of regional capacity, driven by its proximity to the US market and established relationships with Hollywood studios. The country has successfully attracted international productions through competitive tax incentives and a skilled workforce with strong English language capabilities.

Argentina maintains a strong position with approximately 18% market share, leveraging its reputation for creative excellence and technical innovation. Buenos Aires has become a recognized center for high-quality animation and VFX work, particularly serving European and North American clients.

Colombia has emerged as a rapidly growing market, capturing about 12% of regional production. Government initiatives and strategic investments in education and infrastructure have positioned the country as an attractive destination for international productions and outsourcing services.

Other markets including Chile, Peru, and Central American countries collectively represent the remaining 7% of market share, with several showing strong growth potential as infrastructure and capabilities continue to develop.

Market leadership in the LATAM animation, VFX and post production sector is distributed among several key players, ranging from large integrated studios to specialized boutique facilities. The competitive landscape is characterized by both regional champions and international companies with local operations.

Competitive strategies vary significantly across the market, with some companies focusing on cost leadership while others pursue differentiation through specialized capabilities or premium service offerings. Strategic partnerships and international collaborations have become increasingly important for accessing larger projects and advanced technologies.

By Service Type: The market segments into distinct service categories, each with unique characteristics and growth patterns. Animation services represent the largest segment, followed by VFX and post-production services.

By End-User Industry: The market serves diverse industry segments with varying requirements and budget considerations.

By Technology: Different technological approaches serve various market needs and budget requirements.

Animation Services represent the largest and fastest-growing category within the LATAM market. The segment benefits from strong demand for original animated content from streaming platforms and the growing popularity of Latin American stories in international markets. Studios are increasingly investing in original IP development to capture higher value and longer-term revenue streams.

Visual Effects Services have experienced rapid growth as international productions seek cost-effective alternatives to traditional VFX hubs. LATAM studios have successfully competed for mid-budget Hollywood productions and high-end streaming content, demonstrating their ability to deliver complex VFX work at competitive prices.

Post-Production Services remain a stable and profitable segment, with many studios using post-production as an entry point for client relationships that expand into animation and VFX work. The segment benefits from relatively lower technology barriers and the ability to serve both domestic and international clients effectively.

Gaming Content Creation represents an emerging high-growth category as the Latin American gaming industry expands rapidly. Studios are developing specialized capabilities for game cinematics, character animation, and promotional content, often leveraging their existing animation expertise.

Corporate and Educational Content has grown significantly, particularly following the COVID-19 pandemic. Organizations across the region have increased their investment in digital content for training, marketing, and communication purposes, creating new revenue opportunities for production studios.

Cost Advantages remain a primary benefit for international clients working with LATAM studios. Production costs are typically 40-60% lower than comparable services in developed markets, while quality standards continue to improve through technology adoption and workforce development.

Cultural Authenticity provides unique value for productions targeting Latin American audiences or featuring regional stories. Local studios bring deep cultural understanding and authentic perspectives that enhance the quality and market appeal of content.

Time Zone Benefits offer significant advantages for North American clients, enabling real-time collaboration and faster project turnaround times. This proximity advantage has become increasingly valuable as remote work capabilities have expanded.

Talent Pool Expansion allows international clients to access skilled professionals who may not be available in their domestic markets. The growing pool of trained animators, VFX artists, and technical specialists provides flexibility and scalability for large projects.

Technology Access through partnerships with LATAM studios can provide clients with access to specialized tools, techniques, and workflows that may not be available in their local markets. Many studios have invested in cutting-edge technology to differentiate their services.

Risk Mitigation through geographic diversification helps international clients reduce operational risks and maintain production continuity. LATAM studios provide alternative production capacity during peak demand periods or unexpected disruptions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Remote Production Workflows have become permanently established following the pandemic, with studios investing heavily in cloud-based tools and distributed production capabilities. This trend has enabled access to global talent pools while reducing facility overhead costs.

Real-Time Rendering Technology adoption is accelerating as studios seek to differentiate their services and attract high-value projects. Early adopters are successfully competing for virtual production work and interactive content creation.

Original IP Development has emerged as a key strategy for studios seeking to capture higher value and reduce dependence on service work. Successful original properties can generate long-term revenue through licensing and merchandising.

Artificial Intelligence Integration is beginning to impact production workflows, with studios experimenting with AI-powered tools for tasks such as rotoscoping, motion capture cleanup, and automated compositing. Early adoption is providing efficiency gains of 25-35% in specific workflow areas.

Sustainability Initiatives are becoming increasingly important as international clients prioritize environmental responsibility. Studios are implementing green production practices and carbon offset programs to meet client requirements.

Cross-Platform Content Creation is driving demand for content that can be adapted across multiple distribution channels and formats. Studios are developing capabilities to create content packages that serve streaming, broadcast, social media, and interactive platforms simultaneously.

Major streaming platforms have announced significant increases in LATAM content investment, with several committing to double their regional production budgets over the next three years. This investment is driving demand for local animation and VFX services while encouraging studios to expand their capabilities.

Government initiatives across the region have introduced new tax incentive programs specifically targeting the creative industries. Colombia’s recent legislation offers up to 40% tax credits for qualifying productions, while Mexico has expanded its existing incentive program to include animation and VFX services.

Educational partnerships between major studios and universities have expanded significantly, with several international companies establishing training centers in key markets. These partnerships are helping to address skill gaps while ensuring graduates have relevant industry experience.

Technology investments by leading studios have accelerated, with several facilities implementing virtual production capabilities and real-time rendering workflows. MarkWide Research analysis indicates that studios investing in advanced technology are achieving 20-30% higher project margins compared to traditional facilities.

International acquisitions and partnerships have increased as global companies seek to establish or expand their LATAM presence. These transactions are bringing additional capital and technical expertise to the region while providing local studios with access to international clients and projects.

Investment in advanced technology should be a priority for studios seeking to compete for high-value international projects. Virtual production capabilities, real-time rendering, and cloud-based workflows are becoming essential for attracting premium clients and commanding higher rates.

Talent development and retention strategies must be strengthened to address the growing skills shortage. Studios should consider implementing comprehensive training programs, competitive compensation packages, and career development opportunities to retain key personnel.

Specialization and differentiation are becoming increasingly important as the market matures. Studios should identify specific niches or capabilities where they can establish competitive advantages rather than competing solely on cost.

Strategic partnerships with international studios, technology vendors, and educational institutions can provide access to advanced capabilities, larger projects, and skilled talent. These relationships are essential for scaling operations and accessing global markets.

Original IP development represents a significant opportunity for studios to capture higher value and reduce dependence on service work. Successful original properties can generate substantial long-term revenue through multiple monetization channels.

Geographic diversification within the region can help studios access different market opportunities and reduce concentration risk. Establishing operations in multiple countries can provide access to various incentive programs and client bases.

Market growth is projected to continue at a robust pace, with industry analysts forecasting a compound annual growth rate of 14.2% over the next five years. This growth will be driven by continued streaming platform investment, expanding gaming industry demand, and increasing adoption of advanced production technologies.

Technology evolution will continue to reshape the industry, with artificial intelligence, machine learning, and automated production tools becoming increasingly prevalent. Studios that successfully integrate these technologies while maintaining creative quality will gain significant competitive advantages.

International recognition of LATAM creative capabilities is expected to increase, leading to more high-profile project opportunities and strategic partnerships. The region’s reputation for quality and reliability continues to improve, opening doors to premium market segments.

Workforce development initiatives are expected to address current skill shortages, with government and industry collaboration expanding educational programs and training opportunities. MWR projects that the skilled workforce will grow by approximately 18% annually over the next three years.

Market consolidation may accelerate as successful studios seek to scale their operations and compete for larger projects. Strategic acquisitions and mergers could create regional champions with enhanced capabilities and international reach.

Emerging technologies such as virtual reality, augmented reality, and interactive media will create new market opportunities for studios willing to invest in developing these capabilities. Early movers in these segments are likely to capture significant market share as demand develops.

The LATAM animation, VFX and post production market stands at a pivotal moment in its development, with unprecedented opportunities for growth and international recognition. The combination of cost advantages, improving quality standards, and increasing demand from global streaming platforms has positioned the region as a significant force in the global entertainment industry.

Success factors for market participants will increasingly center on technology adoption, talent development, and strategic positioning rather than cost competition alone. Studios that invest in advanced capabilities, develop specialized expertise, and build strong international relationships will be best positioned to capitalize on the market’s growth potential.

Long-term prospects remain highly positive, with fundamental market drivers including streaming content demand, gaming industry growth, and digital transformation initiatives expected to sustain robust growth rates. The region’s strategic advantages in time zones, cultural diversity, and cost competitiveness provide a strong foundation for continued expansion and international success in the dynamic global entertainment marketplace.

What is LATAM Animation, VFX And Post Production?

LATAM Animation, VFX And Post Production refers to the creative processes involved in producing animated content, visual effects, and post-production services in the Latin American region. This includes various applications such as film, television, advertising, and video games.

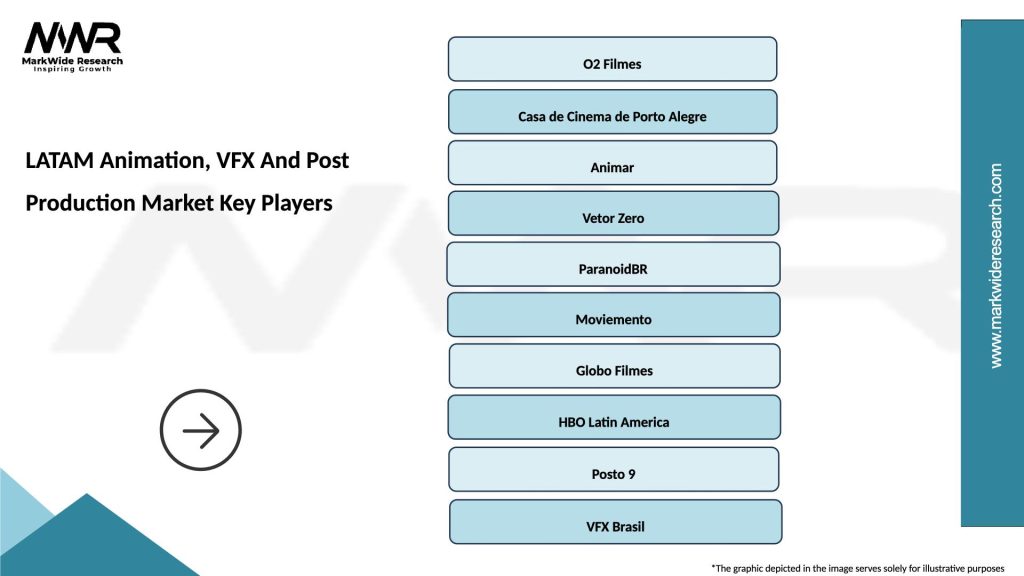

Who are the key players in the LATAM Animation, VFX And Post Production Market?

Key players in the LATAM Animation, VFX And Post Production Market include companies like O2 Filmes, Casablanca, and Lobo, which are known for their innovative work in animation and visual effects, among others.

What are the growth factors driving the LATAM Animation, VFX And Post Production Market?

The growth of the LATAM Animation, VFX And Post Production Market is driven by increasing demand for high-quality content in streaming services, the rise of local productions, and advancements in technology that enhance visual storytelling.

What challenges does the LATAM Animation, VFX And Post Production Market face?

Challenges in the LATAM Animation, VFX And Post Production Market include limited funding for projects, competition from international studios, and the need for skilled professionals in the industry.

What opportunities exist in the LATAM Animation, VFX And Post Production Market?

Opportunities in the LATAM Animation, VFX And Post Production Market include the potential for collaboration with global platforms, the growth of mobile content consumption, and the increasing interest in diverse storytelling that reflects local cultures.

What trends are shaping the LATAM Animation, VFX And Post Production Market?

Trends in the LATAM Animation, VFX And Post Production Market include the integration of augmented reality and virtual reality in projects, the use of artificial intelligence for animation processes, and a focus on sustainability in production practices.

LATAM Animation, VFX And Post Production Market

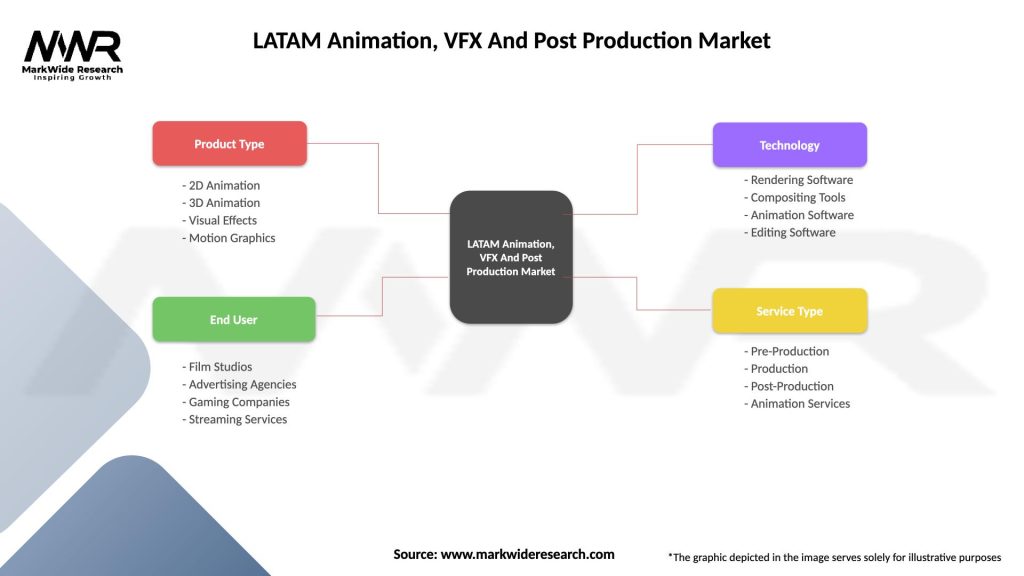

| Segmentation Details | Description |

|---|---|

| Product Type | 2D Animation, 3D Animation, Visual Effects, Motion Graphics |

| End User | Film Studios, Advertising Agencies, Gaming Companies, Streaming Services |

| Technology | Rendering Software, Compositing Tools, Animation Software, Editing Software |

| Service Type | Pre-Production, Production, Post-Production, Animation Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LATAM Animation, VFX And Post Production Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at