444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LATAM agricultural machinery market represents a dynamic and rapidly evolving sector that serves as the backbone of Latin America’s agricultural transformation. This comprehensive market encompasses a diverse range of equipment including tractors, harvesters, planting equipment, irrigation systems, and precision farming technologies that are revolutionizing agricultural practices across the region. Market dynamics indicate robust growth driven by increasing mechanization needs, rising agricultural productivity demands, and government initiatives supporting modern farming practices.

Regional characteristics of the LATAM agricultural machinery market reflect the diverse agricultural landscapes spanning from Brazil’s vast soybean fields to Argentina’s wheat production zones and Mexico’s varied crop cultivation areas. The market demonstrates significant growth potential with agricultural mechanization rates increasing by approximately 12% annually across major Latin American countries. Technology adoption patterns show accelerating integration of smart farming solutions, GPS-guided equipment, and automated machinery systems.

Market penetration varies considerably across different countries, with Brazil leading in terms of advanced machinery adoption while smaller economies focus on basic mechanization improvements. The sector benefits from favorable agricultural policies, increasing farm sizes, and growing export demands that necessitate higher productivity and efficiency levels.

The LATAM agricultural machinery market refers to the comprehensive ecosystem of mechanical equipment, tools, and technology solutions designed to enhance agricultural productivity, efficiency, and sustainability across Latin American countries. This market encompasses traditional farming equipment such as tractors and harvesters, as well as modern precision agriculture technologies including GPS-guided systems, automated planters, and smart irrigation solutions.

Market scope includes manufacturing, distribution, sales, and after-sales services of agricultural machinery across key Latin American nations including Brazil, Argentina, Mexico, Colombia, Chile, and other regional markets. The definition extends to both domestically produced equipment and imported machinery that serves the diverse agricultural needs of the region’s farming communities.

Technological integration within this market definition includes traditional mechanical systems, hydraulic equipment, electronic control systems, and emerging digital agriculture solutions that collectively support the modernization of Latin American farming practices.

Strategic market analysis reveals the LATAM agricultural machinery market as a cornerstone of regional agricultural development, experiencing substantial growth driven by mechanization needs and technological advancement. Key market drivers include increasing agricultural production demands, government support for mechanization, and the need for enhanced productivity to meet global food security challenges.

Market segmentation demonstrates strong performance across multiple categories, with tractors maintaining the largest market share at approximately 35% of total equipment sales, followed by harvesting equipment and planting machinery. Regional distribution shows Brazil commanding the dominant position with over 45% market share, while Argentina and Mexico represent significant secondary markets.

Competitive landscape features a mix of international manufacturers and regional players, with companies focusing on localized solutions, financing options, and comprehensive service networks. Technology trends indicate accelerating adoption of precision agriculture solutions, with smart farming technologies experiencing growth rates of approximately 18% annually across the region.

Future projections suggest continued market expansion supported by agricultural modernization initiatives, increasing farm consolidation, and growing emphasis on sustainable farming practices that require advanced machinery solutions.

Market intelligence reveals several critical insights that define the LATAM agricultural machinery landscape and its growth trajectory:

Market maturity varies significantly across countries, with advanced markets like Brazil showing sophisticated equipment preferences while emerging markets focus on basic mechanization needs. Investment patterns indicate increasing private sector participation and international partnerships driving market development.

Primary growth drivers propelling the LATAM agricultural machinery market encompass both economic and technological factors that create sustained demand for advanced farming equipment. Agricultural productivity requirements represent the fundamental driver, as farmers seek to maximize yields while optimizing resource utilization across diverse crop production systems.

Government initiatives across Latin American countries provide substantial support through subsidies, tax incentives, and modernization programs that make advanced machinery more accessible to farmers. Policy frameworks in countries like Brazil and Argentina specifically target agricultural mechanization as a pathway to enhanced competitiveness in global markets.

Labor shortage challenges increasingly drive mechanization adoption as rural populations migrate to urban areas, creating demand for automated and semi-automated farming solutions. Demographic shifts necessitate equipment that can compensate for reduced manual labor availability while maintaining or increasing production levels.

Export market demands require higher quality standards and increased production volumes that can only be achieved through modern machinery and precision farming techniques. Global food security concerns further amplify the need for efficient agricultural production systems throughout the region.

Climate change adaptation drives demand for specialized equipment capable of operating under varying weather conditions and supporting sustainable farming practices that preserve soil health and optimize water usage.

Financial constraints represent the most significant barrier to agricultural machinery adoption, particularly for small and medium-sized farms that struggle with high capital investment requirements. Credit accessibility remains limited in many rural areas, restricting farmers’ ability to purchase advanced equipment despite clear productivity benefits.

Infrastructure limitations across rural Latin America create challenges for machinery deployment and maintenance, with inadequate transportation networks and limited service facilities hindering market expansion. Technical expertise shortages further complicate equipment adoption, as many farmers lack the skills necessary to operate and maintain sophisticated machinery.

Economic volatility in several Latin American countries creates uncertainty that affects long-term investment decisions in agricultural equipment. Currency fluctuations particularly impact imported machinery costs, making budget planning challenging for agricultural enterprises.

Land tenure issues in some regions discourage mechanization investments, as uncertain property rights reduce incentives for long-term agricultural improvements. Fragmented farm structures in certain areas make large-scale machinery economically unfeasible, limiting market penetration opportunities.

Environmental regulations increasingly require compliance with emission standards and sustainability criteria that may increase equipment costs and complexity, potentially slowing adoption rates among price-sensitive farmers.

Precision agriculture presents the most significant growth opportunity, with smart farming technologies offering substantial productivity improvements and resource optimization benefits. Digital transformation initiatives across the agricultural sector create demand for IoT-enabled equipment, GPS-guided systems, and data analytics platforms that enhance farming efficiency.

Sustainable farming practices drive opportunities for specialized equipment that supports conservation agriculture, reduced tillage systems, and integrated pest management approaches. Environmental compliance requirements create markets for machinery that meets stringent emission standards while delivering superior performance.

Small farm mechanization represents an underserved market segment with substantial growth potential, particularly through innovative financing solutions and equipment sharing models. Cooperative farming initiatives enable smaller producers to access advanced machinery through shared ownership arrangements.

After-sales services and maintenance solutions offer recurring revenue opportunities for manufacturers and dealers, with comprehensive service networks becoming increasingly valuable to farmers. Training programs and technical support services create additional value propositions that differentiate market participants.

Regional manufacturing opportunities exist for companies willing to establish local production facilities, reducing costs and improving supply chain efficiency while supporting economic development initiatives.

Supply chain dynamics in the LATAM agricultural machinery market reflect complex interactions between international manufacturers, regional distributors, and local service providers. Market equilibrium is influenced by seasonal demand patterns, with peak sales periods coinciding with planting and harvesting seasons across different agricultural zones.

Competitive dynamics show increasing consolidation among dealers and distributors, while manufacturers focus on developing region-specific solutions that address local farming conditions and preferences. Price competition remains intense, particularly in commodity equipment segments, driving innovation in value-added services and financing options.

Technology dynamics demonstrate accelerating integration of digital solutions, with traditional mechanical systems increasingly incorporating electronic controls and connectivity features. Innovation cycles are shortening as manufacturers respond to rapidly evolving farmer needs and regulatory requirements.

Demand dynamics reflect growing sophistication among farmers who increasingly seek comprehensive solutions rather than individual equipment pieces. Market maturation in advanced regions drives replacement demand, while emerging areas focus on initial mechanization needs.

Regulatory dynamics continue evolving with stricter environmental standards and safety requirements influencing product development and market access strategies across different countries.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the LATAM agricultural machinery market. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, farmers, and agricultural experts across key Latin American markets.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and academic publications to validate primary findings and provide historical context. Data triangulation methods ensure consistency and accuracy across different information sources.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing production data, import/export statistics, and sales figures from multiple sources. Forecasting models incorporate economic indicators, agricultural trends, and policy developments to project future market trajectories.

Regional analysis employs country-specific research approaches that account for local market conditions, regulatory environments, and agricultural practices. Segmentation analysis utilizes detailed categorization of equipment types, applications, and end-user segments to provide granular market insights.

Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to ensure research accuracy and relevance throughout the analysis period.

Brazil dominates the LATAM agricultural machinery market with approximately 45% regional market share, driven by its vast agricultural lands, advanced farming practices, and strong government support for mechanization. Brazilian market characteristics include high adoption of precision agriculture technologies, substantial domestic manufacturing capabilities, and sophisticated financing mechanisms that support equipment purchases.

Argentina represents the second-largest market with significant focus on grain production equipment, particularly harvesters and tractors suited for large-scale operations. Argentine farmers demonstrate strong preference for high-capacity equipment that can handle extensive farming operations efficiently.

Mexico shows diverse market characteristics with varying needs across different agricultural regions, from small-scale vegetable production to large commercial grain operations. Mexican market growth is supported by NAFTA trade benefits and increasing agricultural exports that require enhanced productivity.

Colombia and Chile represent emerging markets with growing mechanization needs, particularly in specialty crops and export-oriented agriculture. Market development in these countries focuses on appropriate-scale equipment that matches local farming conditions and economic capabilities.

Regional integration initiatives facilitate cross-border trade and technology transfer, with market share distribution showing Brazil at 45%, Argentina at 25%, Mexico at 18%, and other countries collectively representing 12% of the regional market.

Market leadership in the LATAM agricultural machinery sector is characterized by a mix of global manufacturers and regional specialists who compete across different equipment categories and market segments. Competitive positioning strategies focus on localization, service networks, and financing solutions that address specific regional needs.

Competitive strategies increasingly emphasize digital integration, sustainability features, and comprehensive service offerings that differentiate products beyond basic functionality. Market consolidation trends show ongoing merger and acquisition activity as companies seek to strengthen regional positions and expand product portfolios.

Equipment type segmentation reveals distinct market dynamics across different machinery categories, with each segment addressing specific agricultural needs and operational requirements throughout the LATAM region.

By Equipment Type:

By Application:

By Farm Size:

Tractor category maintains market dominance through diverse applications ranging from basic field operations to sophisticated precision farming tasks. Technology integration in modern tractors includes GPS guidance, automated steering, and implement control systems that enhance operational efficiency and reduce operator fatigue.

Harvesting equipment shows strong growth driven by increasing grain production and the need for timely harvest operations that minimize crop losses. Combine harvesters with advanced cleaning systems and yield monitoring capabilities are particularly popular among large-scale grain producers.

Precision planting equipment represents the fastest-growing category with adoption rates increasing by approximately 20% annually as farmers recognize the productivity benefits of accurate seed placement and variable rate applications. Smart planters with real-time monitoring and adjustment capabilities are transforming planting operations across the region.

Spraying equipment evolution focuses on precision application technologies that reduce chemical usage while maintaining effective pest and disease control. Self-propelled sprayers with boom stability systems and variable rate capabilities are gaining market share among professional applicators.

Irrigation systems category benefits from water scarcity concerns and the need for efficient water management in agricultural operations. Smart irrigation technologies incorporating soil moisture sensors and weather data are increasingly adopted by progressive farmers.

Manufacturers benefit from expanding market opportunities driven by agricultural modernization needs and government support for mechanization initiatives. Revenue growth potential exists across multiple equipment categories, with particular opportunities in precision agriculture and sustainable farming solutions.

Dealers and distributors gain from increasing demand for comprehensive solutions that combine equipment sales with financing, training, and after-sales support services. Service revenue streams provide stable income sources that complement equipment sales cycles.

Farmers realize substantial benefits through improved productivity, reduced labor requirements, and enhanced operational efficiency that directly impact profitability. Technology adoption enables better resource management and environmental stewardship while maintaining competitive production costs.

Financial institutions find opportunities in agricultural equipment financing that supports rural economic development while generating attractive returns through secured lending arrangements. Risk mitigation strategies include equipment-backed loans and partnership arrangements with manufacturers.

Government stakeholders achieve agricultural policy objectives through mechanization support that enhances food security, rural employment, and export competitiveness. Economic development benefits include technology transfer, skill development, and industrial growth in agricultural equipment sectors.

Technology providers benefit from increasing demand for digital agriculture solutions, IoT integration, and data analytics platforms that enhance farming operations and decision-making processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the LATAM agricultural machinery market, with IoT integration, GPS guidance, and data analytics becoming standard features across equipment categories. Smart farming adoption rates continue accelerating as farmers recognize the value of data-driven decision making and precision agriculture techniques.

Sustainability focus drives demand for equipment that supports conservation agriculture practices, reduced chemical usage, and improved fuel efficiency. Environmental compliance requirements increasingly influence purchasing decisions as farmers seek machinery that meets evolving regulatory standards.

Autonomous equipment development shows promising progress with semi-autonomous tractors and implements gaining market acceptance among progressive farmers. Automation benefits include reduced labor requirements, improved operational precision, and enhanced safety in agricultural operations.

Equipment sharing models emerge as viable solutions for smaller farms, with cooperative ownership and rental services making advanced machinery more accessible. Collaborative farming initiatives enable resource sharing while maintaining individual farm operations.

Electrification trends begin influencing equipment design, particularly in smaller implements and specialty applications where electric power offers operational advantages. Battery technology improvements support longer operating periods and reduced maintenance requirements.

Customization demand increases as farmers seek equipment specifically designed for local crops, soil conditions, and operational requirements rather than generic solutions.

Manufacturing expansion initiatives by major equipment manufacturers include new production facilities and assembly operations across Latin America to serve regional markets more effectively. Local production strategies reduce costs, improve supply chain resilience, and support economic development objectives.

Technology partnerships between traditional machinery manufacturers and agricultural technology companies accelerate innovation in precision farming solutions and digital agriculture platforms. Collaborative development efforts focus on integrated systems that combine mechanical and digital capabilities.

Financing innovations include new credit mechanisms, leasing programs, and government-backed loan guarantees that improve equipment accessibility for farmers across different economic segments. Financial inclusion initiatives specifically target underserved agricultural communities.

Service network expansion by manufacturers and dealers emphasizes comprehensive support systems that include training, maintenance, and technical assistance. Digital service platforms enable remote diagnostics and predictive maintenance capabilities.

Regulatory developments include updated emission standards, safety requirements, and certification processes that influence equipment design and market access strategies. Harmonization efforts among Latin American countries aim to reduce regulatory complexity for manufacturers and importers.

Research initiatives by agricultural institutions and universities focus on developing region-specific solutions that address local farming challenges and opportunities.

Market entry strategies should prioritize local partnerships and comprehensive service networks that address the unique needs of Latin American farmers. MarkWide Research analysis indicates that successful market participants invest heavily in regional presence and customer support capabilities.

Product development recommendations emphasize creating equipment solutions that balance advanced technology with affordability and ease of use. Localization efforts should consider specific crop requirements, soil conditions, and operational practices prevalent in different regional markets.

Financing strategy development is crucial for market success, with companies advised to establish partnerships with financial institutions and explore innovative credit mechanisms. Payment flexibility and seasonal financing options align with agricultural cash flow patterns.

Technology integration should focus on practical applications that deliver measurable benefits to farmers rather than complex systems that may be difficult to implement or maintain. Training programs and technical support are essential components of technology adoption strategies.

Sustainability positioning becomes increasingly important as environmental regulations tighten and farmers seek equipment that supports sustainable farming practices. Compliance readiness for evolving environmental standards should guide product development priorities.

Market diversification across different countries and equipment segments reduces risk while maximizing growth opportunities in this dynamic regional market.

Long-term growth prospects for the LATAM agricultural machinery market remain highly positive, supported by fundamental drivers including population growth, increasing food demand, and ongoing agricultural modernization needs. Market expansion is expected to continue at robust rates, with precision agriculture and smart farming technologies leading growth initiatives.

Technology evolution will accelerate the integration of artificial intelligence, machine learning, and advanced automation systems that transform traditional farming operations. Digital agriculture adoption rates are projected to increase by approximately 25% annually over the next five years as farmers recognize competitive advantages.

Sustainability requirements will increasingly influence equipment design and market demand, with environmentally friendly technologies becoming standard rather than optional features. Carbon footprint reduction initiatives will drive innovation in fuel-efficient and electric-powered agricultural equipment.

Market consolidation trends may continue as manufacturers seek to strengthen regional positions and achieve economies of scale in production and distribution. Strategic partnerships between equipment manufacturers and technology companies will accelerate innovation cycles.

Government support for agricultural mechanization is expected to remain strong across Latin American countries, with policy initiatives focusing on productivity enhancement and rural development objectives. Investment incentives and modernization programs will continue supporting market growth.

MarkWide Research projections indicate sustained market expansion driven by these fundamental trends and the ongoing transformation of Latin American agriculture toward more efficient and sustainable production systems.

The LATAM agricultural machinery market stands at a pivotal juncture where traditional farming practices are rapidly evolving toward mechanized and technology-enhanced operations. Market dynamics reflect strong growth fundamentals supported by government initiatives, increasing agricultural productivity demands, and the ongoing modernization of farming practices across the region.

Strategic opportunities abound for manufacturers, dealers, and service providers who can effectively address the diverse needs of Latin American farmers while navigating the complexities of regional markets. Success factors include comprehensive service networks, innovative financing solutions, and products that balance advanced technology with practical applicability.

Technology integration will continue driving market evolution, with precision agriculture, digital farming solutions, and sustainable equipment becoming increasingly important for competitive advantage. Market participants who invest in these technological capabilities while maintaining strong regional presence will be best positioned for long-term success.

The future trajectory of the LATAM agricultural machinery market promises continued expansion and innovation, making it an attractive sector for investment and development. Sustainable growth will depend on addressing key challenges including financing accessibility, infrastructure development, and skill building while capitalizing on the substantial opportunities presented by this dynamic and essential market.

What is Agricultural Machinery?

Agricultural machinery refers to the various tools and equipment used in farming and agriculture to enhance productivity and efficiency. This includes tractors, harvesters, plows, and irrigation systems, among others.

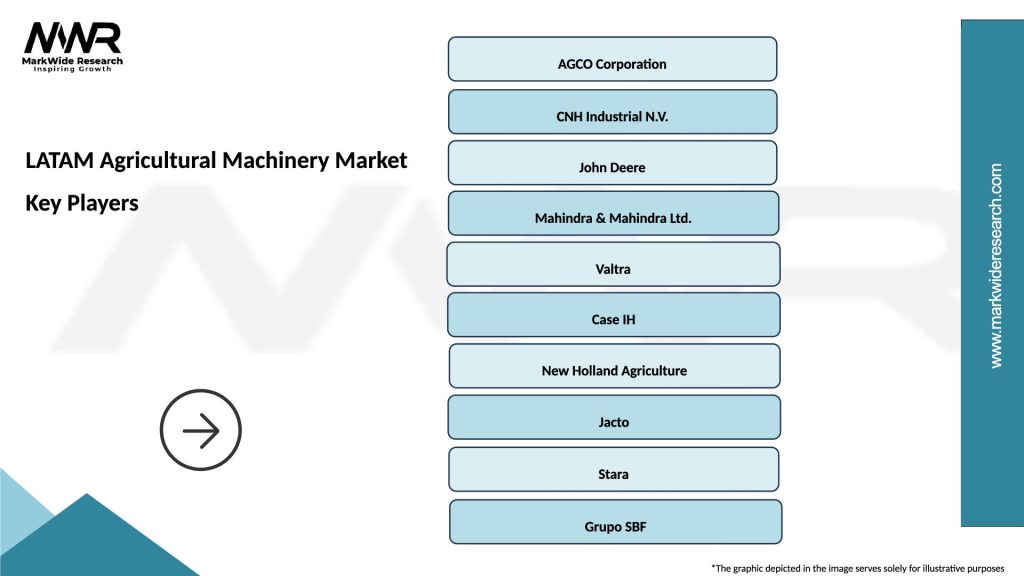

What are the key players in the LATAM Agricultural Machinery Market?

Key players in the LATAM Agricultural Machinery Market include John Deere, AGCO Corporation, and CNH Industrial, which provide a range of agricultural equipment and technology solutions, among others.

What are the main drivers of the LATAM Agricultural Machinery Market?

The main drivers of the LATAM Agricultural Machinery Market include the increasing demand for food production, advancements in agricultural technology, and the need for efficient farming practices to enhance crop yields.

What challenges does the LATAM Agricultural Machinery Market face?

Challenges in the LATAM Agricultural Machinery Market include high initial investment costs, limited access to financing for small farmers, and varying regulations across different countries that can impact market entry.

What opportunities exist in the LATAM Agricultural Machinery Market?

Opportunities in the LATAM Agricultural Machinery Market include the growing trend towards precision agriculture, the adoption of sustainable farming practices, and the increasing integration of digital technologies in farming operations.

What trends are shaping the LATAM Agricultural Machinery Market?

Trends shaping the LATAM Agricultural Machinery Market include the rise of automation in farming, the development of eco-friendly machinery, and the increasing use of data analytics to optimize agricultural processes.

LATAM Agricultural Machinery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tractors, Harvesters, Plows, Seeders |

| Technology | Precision Agriculture, Autonomous Machinery, IoT Integration, GPS Guidance |

| End User | Farmers, Cooperatives, Agribusinesses, Government Agencies |

| Application | Crop Production, Soil Preparation, Irrigation Management, Pest Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LATAM Agricultural Machinery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at