444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The large-scale LNG terminal market is expected to experience significant growth during the period from 2023 to 2028. This market is projected to expand at a healthy CAGR due to the increasing demand for natural gas as an alternative to fossil fuels, particularly in power generation and transportation. LNG is a reliable, cleaner, and more efficient source of energy, and it is being embraced by an increasing number of countries worldwide. The market for large-scale LNG terminals is expected to grow as a result of these factors, with more countries investing in infrastructure to import, store, and distribute LNG.

LNG stands for liquefied natural gas, which is a clear, odorless liquid that is formed by cooling natural gas to around -162°C. It takes up about 1/600th of the space of natural gas in its gaseous state, making it easier to transport and store. Large-scale LNG terminals are facilities that are built to import, store, and distribute LNG. These terminals are typically located near ports or other bodies of water, where LNG can be shipped in large quantities. The LNG is then stored in large tanks before being distributed through pipelines or by truck to its final destination.

Executive Summary:

The large-scale LNG terminal market is expected to experience significant growth during the period from 2023 to 2028. The market is being driven by the increasing demand for natural gas as an alternative to fossil fuels, particularly in power generation and transportation. The growth of the market is expected to be supported by an increasing number of countries worldwide investing in infrastructure to import, store, and distribute LNG. The market is also being driven by technological advancements in LNG transportation and storage. The market is, however, facing some challenges, such as the high capital costs associated with building LNG terminals and the lack of adequate infrastructure in some regions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Large Scale LNG Terminal Market:

Increased Global Demand for Natural Gas: As global energy consumption rises, natural gas is becoming a preferred energy source due to its lower emissions compared to coal and oil, driving the need for more LNG terminals to meet growing demand.

Energy Security and Diversification: Countries are increasingly investing in LNG terminals to secure a stable and diverse supply of natural gas, reducing dependency on domestic production and enhancing energy security.

Shift Toward Cleaner Energy: The push to reduce carbon emissions has led to a shift from coal and oil to cleaner energy sources such as LNG, supporting the demand for large-scale LNG terminals to accommodate growing natural gas trade.

Technological Advancements: Innovations in LNG terminal technologies, such as Floating LNG (FLNG) terminals and advanced liquefaction processes, are expanding the feasibility and capabilities of LNG infrastructure, allowing for more flexible operations and location options.

Government Policies and Regulations: Governments worldwide are supporting LNG infrastructure through favorable policies and investments, which include energy security incentives, environmental regulations, and the promotion of LNG as a cleaner fuel option.

Market Restraints

Despite its growth prospects, the Large Scale LNG Terminal Market faces several challenges:

High Capital Investment: Building and maintaining large-scale LNG terminals requires substantial capital investment, which can deter smaller players from entering the market. The high upfront costs and long-term nature of these projects can delay project development and expansion.

Environmental Concerns: While LNG is considered a cleaner alternative to coal and oil, environmental concerns related to the development of large infrastructure projects, including their impact on local ecosystems, can hinder the approval and development of LNG terminal projects.

Supply Chain Constraints: The LNG supply chain, including the transportation of LNG via ships, pipelines, and storage facilities, can face bottlenecks, especially during periods of high demand or geopolitical instability. These supply chain issues can impact the timely operation of LNG terminals.

Geopolitical and Regulatory Uncertainty: Political and regulatory uncertainties in certain regions can pose risks to the development and operation of LNG terminals, especially in regions where natural gas trade is subject to fluctuating tariffs and import/export restrictions.

Market Opportunities

The Large Scale LNG Terminal Market presents various opportunities for growth:

Expansion in Emerging Markets: As countries like India, China, and Southeast Asian nations continue to urbanize and industrialize, there is a significant opportunity for the construction of new LNG terminals to support the growing demand for natural gas.

Floating LNG (FLNG) Technology: The development of FLNG terminals offers an opportunity to extract and liquefy natural gas offshore, reducing the need for large onshore terminal facilities and enabling gas extraction in remote areas.

LNG as a Transportation Fuel: The increasing use of LNG as a fuel for transportation, particularly in shipping and heavy-duty vehicles, is creating new opportunities for LNG terminal operators to support this growing sector.

Energy Transition and Decarbonization: As countries aim for carbon neutrality, the role of LNG in reducing emissions makes LNG terminal infrastructure increasingly important in global energy transition plans.

Market Dynamics

The North America Large Scale LNG Terminal Market is influenced by several key dynamics:

Energy Transition: The increasing focus on reducing greenhouse gas emissions and transitioning to cleaner energy sources is pushing governments and companies to invest in LNG infrastructure to support the broader adoption of LNG as a low-carbon energy alternative.

Technological Innovations: Continuous advancements in LNG liquefaction, storage, and regasification technologies are improving the efficiency and flexibility of LNG terminals, allowing operators to meet changing market needs.

Changing Trade Routes: Global shifts in natural gas production and trade routes, driven by geopolitical factors, are influencing the demand for LNG terminal infrastructure to support new trade flows.

Supply and Demand Balances: The balance between LNG supply and demand continues to shift as more countries invest in LNG terminal infrastructure, and as new natural gas reserves are discovered globally, influencing the market’s dynamics.

Regional Analysis

The North America Large Scale LNG Terminal Market shows significant activity across key regions:

United States: The U.S. is a leader in LNG exports, and its LNG terminals, especially along the Gulf Coast, play a significant role in global LNG supply. The development of new LNG terminals and expansion of existing facilities are expected to continue driving market growth.

Canada: With increasing investments in LNG infrastructure, particularly in British Columbia and other export hubs, Canada is positioning itself as a major player in the global LNG market, particularly for Asia-Pacific demand.

Mexico: As a growing energy consumer and an exporter of natural gas to the U.S., Mexico is investing in LNG terminals to support domestic energy needs and strengthen its role in the global LNG market.

Competitive Landscape

Leading companies in the Large Scale LNG Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

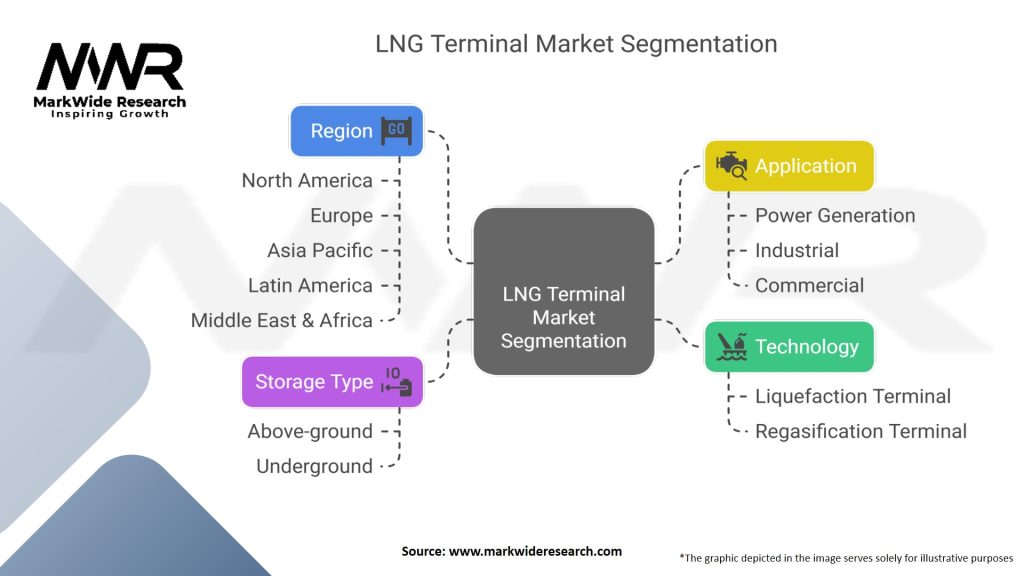

Segmentation

The North America Large Scale LNG Terminal Market can be segmented based on various factors:

Type: Import Terminals, Export Terminals, Liquefaction Terminals, Regasification Terminals.

End-User Industry: Power Generation, Industrial, Transport, Residential.

Technology: Floating LNG (FLNG), Onshore LNG, Hybrid LNG Terminals.

Category-wise Insights

Each category of LNG terminals offers unique features and benefits:

Key Benefits for Industry Participants and Stakeholders

The North America Large Scale LNG Terminal Market offers several benefits:

Energy Security: LNG terminals provide countries with access to a stable, diversified energy supply, reducing dependency on domestic or regional sources.

Sustainability: LNG is a cleaner alternative to coal and oil, contributing to reduced carbon emissions and supporting sustainability goals.

Economic Growth: The development of LNG terminals creates jobs, boosts infrastructure, and promotes economic growth, particularly in export-driven regions.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the North America Large Scale LNG Terminal Market include:

Green LNG Solutions: Growing focus on sustainable and eco-friendly LNG terminal operations.

Floating LNG Technology: Increased adoption of FLNG technology for offshore LNG production and export.

Covid-19 Impact:

The Covid-19 pandemic had a significant impact on the large-scale LNG terminal market, with disruptions to supply chains and delays in the construction of new terminals. However, the pandemic also highlighted the importance of diversifying energy supplies and increasing resilience to supply chain disruptions, which could drive investment in LNG infrastructure in the future.

Key Industry Developments:

Analyst Suggestions

Future Outlook:

The future outlook for the large-scale LNG terminal market is positive, with significant growth expected during the period from 2023 to 2028. The market is being driven by the increasing demand for natural gas as an alternative to fossil fuels, particularly in power generation and transportation. The growth of the market will be supported by an increasing number of countries worldwide investing in infrastructure to import, store, and distribute LNG, as well as by technological advancements in LNG transportation and storage.

Conclusion:

In conclusion, the large-scale LNG terminal market is expected to experience significant growth during the period from 2023 to 2028. The market is being driven by the increasing demand for natural gas as an alternative to fossil fuels, particularly in power generation and transportation. The growth of the market will be supported by an increasing number of countries worldwide investing in infrastructure to import, store, and distribute LNG, as well as by technological advancements in LNG transportation and storage. The market does, however, face some challenges, including the high capital costs associated with building LNG terminals and the lack of adequate infrastructure in some regions. Nevertheless, there are several opportunities for growth in the market, including the growing demand for natural gas in developing countries and the increasing use of natural gas in transportation. Overall, the large-scale LNG terminal market presents significant opportunities for companies operating in the energy sector, as well as for engineering and construction firms involved in the development of LNG infrastructure.

What is a large scale LNG terminal?

A large scale LNG terminal is a facility designed for the import, export, and storage of liquefied natural gas. These terminals play a crucial role in the global energy supply chain, enabling the transportation of natural gas across long distances in a liquid state.

Who are the key players in the large scale LNG terminal market?

Key players in the large scale LNG terminal market include companies such as Cheniere Energy, Royal Dutch Shell, and TotalEnergies, which are involved in the development and operation of LNG terminals, among others.

What are the main drivers of growth in the large scale LNG terminal market?

The growth of the large scale LNG terminal market is driven by increasing global energy demand, the shift towards cleaner energy sources, and the expansion of natural gas infrastructure in emerging economies.

What challenges does the large scale LNG terminal market face?

Challenges in the large scale LNG terminal market include regulatory hurdles, high capital investment requirements, and competition from alternative energy sources such as renewables.

What opportunities exist in the large scale LNG terminal market?

Opportunities in the large scale LNG terminal market include the potential for technological advancements in LNG processing and storage, as well as the increasing demand for LNG in maritime and industrial applications.

What trends are shaping the large scale LNG terminal market?

Trends in the large scale LNG terminal market include the rise of floating LNG terminals, increased investment in LNG infrastructure, and a growing focus on sustainability and reducing carbon emissions in terminal operations.

Large Scale LNG Terminal Market

| Segmentation | Details |

|---|---|

| Technology | Liquefaction Terminal, Regasification Terminal |

| Storage Type | Above-ground, Underground |

| Application | Power Generation, Industrial, Commercial |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Large Scale LNG Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at