444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The large molecule contract development and manufacturing organization (CDMO) market represents a critical segment of the pharmaceutical industry, focusing on the development and production of complex biological drugs including monoclonal antibodies, vaccines, gene therapies, and cell therapies. This specialized market has experienced remarkable growth driven by increasing demand for biologics, rising complexity of drug development, and the need for specialized manufacturing capabilities that many pharmaceutical companies prefer to outsource rather than develop in-house.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of approximately 8.2% over recent years. The growth trajectory reflects the pharmaceutical industry’s strategic shift toward outsourcing complex manufacturing processes to specialized providers who possess the technical expertise, regulatory compliance capabilities, and advanced infrastructure required for large molecule production.

Geographic distribution shows North America maintaining the largest market share at approximately 45% of global demand, followed by Europe at 32% and Asia-Pacific at 18%. This distribution reflects the concentration of major pharmaceutical companies and advanced biotechnology infrastructure in these regions, though emerging markets are showing increasing activity in biologics development and manufacturing.

The large molecule contract development and manufacturing organization market refers to the specialized sector comprising companies that provide comprehensive services for the development, testing, and commercial-scale manufacturing of biological drugs and complex therapeutic molecules on behalf of pharmaceutical and biotechnology companies. These organizations offer end-to-end solutions spanning from early-stage development through commercial production.

Large molecules in this context include proteins, antibodies, vaccines, gene therapies, cell therapies, and other complex biological entities that require sophisticated production systems, typically involving living cells or biological processes. Unlike small molecule drugs that can be chemically synthesized, large molecules demand specialized biomanufacturing capabilities including cell culture systems, purification technologies, and stringent quality control measures.

Contract development and manufacturing organizations serve as strategic partners to pharmaceutical companies, providing access to specialized expertise, advanced technologies, and regulatory compliance capabilities without requiring significant capital investment in dedicated facilities and equipment.

Strategic market positioning reveals the large molecule CDMO sector as an essential component of the modern pharmaceutical ecosystem, driven by the increasing complexity of biological drug development and the economic advantages of outsourcing specialized manufacturing processes. The market encompasses a diverse range of services including process development, analytical testing, regulatory support, and commercial manufacturing across multiple therapeutic areas.

Key growth drivers include the expanding pipeline of biological drugs, with biologics representing approximately 35% of new drug approvals in recent years, increasing regulatory complexity requiring specialized expertise, and the cost-effectiveness of outsourcing compared to building internal capabilities. The market benefits from technological advancements in biomanufacturing, including single-use systems, continuous manufacturing processes, and advanced analytics.

Competitive landscape features a mix of large multinational CDMOs with comprehensive capabilities and specialized providers focusing on specific technologies or therapeutic areas. Market consolidation continues through strategic acquisitions as companies seek to expand their service offerings and geographic reach while building scale advantages in an increasingly competitive environment.

Market segmentation analysis reveals several critical insights driving industry development and investment strategies:

Pharmaceutical industry evolution serves as the primary catalyst for large molecule CDMO market expansion, with several interconnected factors driving sustained demand growth. The increasing complexity of biological drug development requires specialized expertise and infrastructure that many pharmaceutical companies find more cost-effective to access through outsourcing arrangements rather than internal development.

Biologics pipeline growth represents a fundamental market driver, with biological drugs comprising an increasing percentage of pharmaceutical development pipelines. The success rate of biologics in clinical trials, combined with their potential for premium pricing and extended patent protection, encourages continued investment in biological drug development across multiple therapeutic areas.

Regulatory complexity drives demand for specialized CDMO services as companies seek partners with proven regulatory expertise and established relationships with global regulatory authorities. The stringent requirements for biological drug manufacturing, including complex quality systems and extensive documentation requirements, favor outsourcing to organizations with dedicated regulatory capabilities.

Cost optimization pressures encourage pharmaceutical companies to leverage CDMO partnerships to access advanced manufacturing capabilities without the significant capital investment required for internal facility development. This approach allows companies to focus resources on core competencies such as drug discovery and clinical development while accessing world-class manufacturing capabilities through strategic partnerships.

Supply chain complexity presents significant challenges for large molecule CDMO operations, particularly given the temperature-sensitive nature of biological products and the need for specialized handling throughout the manufacturing and distribution process. These complexities can create potential bottlenecks and increase operational costs, potentially limiting market growth in certain segments.

Regulatory compliance burden represents a substantial constraint, as CDMOs must maintain compliance with multiple regulatory frameworks across different geographic markets. The cost and complexity of maintaining current good manufacturing practices (cGMP) standards, conducting regular audits, and managing regulatory submissions can create barriers to entry for smaller organizations and increase operational costs for established players.

Technical expertise requirements create challenges in recruiting and retaining qualified personnel with the specialized knowledge required for large molecule manufacturing. The limited pool of experienced professionals in areas such as cell culture, purification technologies, and regulatory affairs can constrain capacity expansion and increase labor costs across the industry.

Capital intensity of large molecule manufacturing facilities requires substantial upfront investment in specialized equipment, clean room facilities, and quality systems. This capital requirement can limit the ability of CDMOs to rapidly expand capacity in response to market demand and may create barriers to entry for new market participants.

Emerging therapeutic modalities present substantial growth opportunities for CDMOs willing to invest in specialized capabilities for cell therapy, gene therapy, and advanced biologics manufacturing. These cutting-edge treatments require highly specialized manufacturing processes and regulatory expertise, creating opportunities for CDMOs to develop differentiated service offerings and command premium pricing.

Geographic expansion opportunities exist in emerging markets where pharmaceutical companies are increasingly conducting clinical trials and seeking local manufacturing capabilities to serve regional markets. CDMOs that establish early presence in these markets can capture significant market share as local pharmaceutical industries develop and regulatory frameworks mature.

Technology advancement creates opportunities for CDMOs to differentiate their services through adoption of innovative manufacturing technologies such as continuous processing, advanced analytics, and automation systems. These technologies can improve efficiency, reduce costs, and enhance quality while providing competitive advantages in client acquisition and retention.

Strategic partnerships with pharmaceutical companies offer opportunities to develop long-term relationships that provide stable revenue streams and collaborative development opportunities. These partnerships can include risk-sharing arrangements, exclusive manufacturing agreements, and joint investment in specialized capabilities that benefit both parties.

Competitive intensity continues to increase as the market attracts new entrants and existing players expand their capabilities through organic growth and strategic acquisitions. This competition drives innovation in service offerings, technology adoption, and operational efficiency while potentially pressuring margins in certain market segments.

Client relationship evolution shows a trend toward longer-term strategic partnerships rather than transactional relationships, with pharmaceutical companies seeking CDMOs that can provide comprehensive support throughout the product lifecycle. This shift requires CDMOs to develop broader capabilities and invest in relationship management to maintain competitive positioning.

Technology disruption influences market dynamics through the introduction of new manufacturing technologies, analytical methods, and digital systems that can improve efficiency and quality while reducing costs. CDMOs must continuously evaluate and invest in new technologies to maintain competitive advantages and meet evolving client expectations.

Regulatory evolution impacts market dynamics as regulatory authorities update requirements for biological drug manufacturing, quality systems, and supply chain management. CDMOs must adapt their operations and invest in compliance capabilities to maintain regulatory standing and serve global markets effectively.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the large molecule CDMO market. Primary research includes extensive interviews with industry executives, regulatory experts, and key stakeholders across the pharmaceutical and biotechnology sectors to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of public company financial reports, regulatory filings, industry publications, and academic research to validate primary findings and provide comprehensive market context. This approach ensures that market analysis reflects both current conditions and emerging trends that may impact future market development.

Data validation processes include cross-referencing multiple sources, conducting expert interviews to verify findings, and employing statistical analysis to ensure data accuracy and reliability. Market projections are based on historical trends, current market conditions, and expert assessments of future market drivers and constraints.

Industry segmentation analysis examines market dynamics across different service categories, therapeutic areas, and geographic regions to provide detailed insights into market structure and growth opportunities. This segmentation approach enables identification of high-growth market segments and emerging opportunities for market participants.

North American market maintains its position as the largest regional market, accounting for approximately 45% of global demand, driven by the presence of major pharmaceutical companies, advanced biotechnology infrastructure, and supportive regulatory environment. The region benefits from significant investment in biologics research and development, with many leading CDMOs headquartered in the United States and Canada.

European market represents approximately 32% of global market share, with strong growth driven by established pharmaceutical industries in countries such as Germany, Switzerland, and the United Kingdom. The region’s emphasis on high-quality manufacturing standards and regulatory harmonization through the European Medicines Agency creates favorable conditions for CDMO operations.

Asia-Pacific region shows the fastest growth rate with approximately 18% market share and expanding rapidly due to increasing pharmaceutical investment, growing biotechnology sectors, and cost advantages in manufacturing operations. Countries such as China, India, and Singapore are emerging as important CDMO hubs, attracting both domestic and international pharmaceutical companies.

Rest of World markets including Latin America, Middle East, and Africa represent emerging opportunities with approximately 5% current market share but showing increasing activity as pharmaceutical companies expand global operations and seek regional manufacturing capabilities to serve local markets and reduce supply chain complexity.

Market leadership is characterized by a mix of large multinational CDMOs with comprehensive capabilities and specialized providers focusing on specific technologies or therapeutic areas. The competitive landscape continues to evolve through strategic acquisitions, capacity expansions, and technology investments.

By Service Type:

By Molecule Type:

By End User:

Monoclonal antibody manufacturing represents the largest category within the large molecule CDMO market, accounting for approximately 55% of total demand. This dominance reflects the commercial success of antibody-based therapeutics across multiple therapeutic areas including oncology, autoimmune diseases, and inflammatory conditions. CDMOs serving this segment require sophisticated cell culture capabilities, advanced purification systems, and extensive regulatory expertise.

Cell and gene therapy manufacturing emerges as the fastest-growing category with growth rates exceeding 15% annually, driven by breakthrough approvals and expanding clinical pipelines. This segment requires highly specialized manufacturing capabilities including viral vector production, cell processing systems, and stringent quality control measures that create barriers to entry and support premium pricing for qualified CDMOs.

Vaccine manufacturing has gained increased attention following recent global health events, with CDMOs investing in flexible manufacturing platforms capable of rapid response to emerging health threats. This category benefits from government support for pandemic preparedness and growing emphasis on preventive healthcare across global markets.

Biosimilar manufacturing represents an emerging opportunity as patent expiration of major biological drugs creates demand for cost-effective manufacturing solutions. CDMOs with demonstrated regulatory expertise and cost-efficient operations are well-positioned to capture market share in this growing segment.

Pharmaceutical companies benefit from CDMO partnerships through access to specialized expertise, reduced capital requirements, and improved operational flexibility. These partnerships enable companies to focus resources on core competencies such as drug discovery and clinical development while accessing world-class manufacturing capabilities through strategic relationships.

Cost optimization represents a significant benefit as CDMOs can achieve economies of scale through serving multiple clients and spreading fixed costs across larger production volumes. This approach often results in lower per-unit manufacturing costs compared to internal production, particularly for companies with limited biologics manufacturing experience.

Risk mitigation benefits include reduced regulatory compliance burden, access to proven manufacturing processes, and diversified supply chain capabilities that can improve product availability and reduce supply disruptions. CDMOs with multiple manufacturing sites can provide backup production capabilities and geographic diversification.

Speed to market advantages result from CDMOs’ established infrastructure, regulatory relationships, and operational expertise that can accelerate product development timelines and reduce time to commercial launch. This speed advantage can be particularly valuable in competitive therapeutic areas where first-to-market advantages are significant.

Strengths:

Weaknesses:

Opportunities:

Threats:

Consolidation acceleration continues as larger CDMOs acquire specialized providers to expand service offerings and geographic reach. This trend reflects the industry’s evolution toward comprehensive service providers capable of supporting clients throughout the product lifecycle, from early development through commercial manufacturing.

Technology integration drives adoption of advanced manufacturing systems including continuous processing, single-use technologies, and automated systems that improve efficiency and reduce contamination risks. MarkWide Research analysis indicates that approximately 70% of new facility investments incorporate these advanced technologies.

Therapeutic specialization emerges as CDMOs develop focused expertise in high-growth areas such as cell and gene therapy, oncology biologics, and rare disease treatments. This specialization allows CDMOs to command premium pricing and develop deeper client relationships in specific therapeutic areas.

Digital transformation encompasses implementation of advanced data analytics, process monitoring systems, and supply chain management technologies that improve operational visibility and decision-making capabilities. These digital investments support quality improvement, cost reduction, and enhanced client service.

Sustainability focus drives investment in environmentally responsible manufacturing processes, waste reduction initiatives, and energy-efficient operations that align with pharmaceutical industry sustainability goals and regulatory expectations for environmental stewardship.

Capacity expansion initiatives continue across major CDMOs as companies invest in new manufacturing facilities and upgrade existing capabilities to meet growing demand. Recent announcements include multi-billion dollar facility investments in North America, Europe, and Asia-Pacific regions, reflecting confidence in long-term market growth prospects.

Strategic acquisitions reshape the competitive landscape as leading CDMOs acquire specialized providers to expand service offerings and enter new therapeutic areas. Notable transactions include acquisitions of cell therapy specialists, gene therapy manufacturers, and regional CDMOs that provide geographic expansion opportunities.

Technology partnerships emerge between CDMOs and technology providers to develop and implement advanced manufacturing systems, analytical methods, and digital solutions that improve operational efficiency and quality outcomes. These partnerships accelerate technology adoption and create competitive advantages for participating organizations.

Regulatory milestone achievements include successful facility inspections, product approvals, and regulatory submissions that demonstrate CDMO capabilities and strengthen client relationships. These regulatory successes are critical for maintaining market position and attracting new clients in the highly regulated biologics manufacturing sector.

Strategic positioning recommendations emphasize the importance of developing differentiated capabilities in high-growth therapeutic areas while maintaining operational excellence in core manufacturing services. CDMOs should focus on building specialized expertise that creates barriers to entry and supports premium pricing strategies.

Investment priorities should emphasize technology advancement, capacity expansion in strategic markets, and talent development to support long-term growth objectives. MWR analysis suggests that companies investing in advanced manufacturing technologies achieve 20-30% higher operational efficiency compared to traditional approaches.

Partnership development strategies should focus on building long-term strategic relationships with pharmaceutical clients rather than pursuing purely transactional business models. These partnerships provide revenue stability, collaborative development opportunities, and insights into future market requirements.

Geographic diversification remains important for managing supply chain risks and accessing growing markets in Asia-Pacific and other emerging regions. CDMOs should evaluate market entry strategies that balance growth opportunities with operational complexity and regulatory requirements.

Talent acquisition and retention strategies are critical given the specialized expertise required for large molecule manufacturing. Companies should invest in training programs, competitive compensation packages, and career development opportunities to attract and retain qualified personnel.

Long-term growth prospects remain positive for the large molecule CDMO market, driven by continued expansion of biologics pipelines, increasing complexity of therapeutic modalities, and pharmaceutical industry preference for outsourcing specialized manufacturing processes. The market is expected to maintain robust growth rates with projected CAGR of 8-10% over the next five years.

Emerging therapeutic modalities including cell therapy, gene therapy, and personalized medicine approaches will create new growth opportunities for CDMOs willing to invest in specialized capabilities. These advanced therapies require highly sophisticated manufacturing processes and regulatory expertise that favor experienced CDMO providers.

Technology evolution will continue to transform manufacturing operations through automation, advanced analytics, and continuous processing systems that improve efficiency, quality, and cost-effectiveness. CDMOs that successfully implement these technologies will gain competitive advantages and improved profitability.

Market consolidation is expected to continue as larger CDMOs acquire specialized providers and smaller companies seek strategic partnerships to compete effectively. This consolidation will create larger, more capable organizations with comprehensive service offerings and global reach.

Regulatory harmonization efforts across major markets may reduce compliance complexity and facilitate global operations for CDMOs with multi-regional manufacturing capabilities. However, emerging regulatory requirements for advanced therapies will require continued investment in compliance capabilities and expertise.

Market evolution demonstrates the large molecule CDMO sector’s transformation into an essential component of the pharmaceutical industry ecosystem, driven by increasing biologics complexity, regulatory requirements, and economic advantages of specialized outsourcing. The market’s robust growth trajectory reflects fundamental industry trends that support long-term expansion prospects.

Strategic imperatives for market participants include continuous investment in advanced capabilities, technology adoption, and talent development to maintain competitive positioning in an evolving marketplace. Success requires balancing operational excellence with innovation while building strategic client relationships that provide sustainable competitive advantages.

Future success in the large molecule CDMO market will depend on organizations’ ability to adapt to changing client requirements, regulatory evolution, and technological advancement while maintaining the highest standards of quality and compliance. Companies that successfully navigate these challenges while investing in emerging opportunities will capture significant market share and achieve sustainable growth in this dynamic and expanding market.

What is Large Molecule Contract Development And Manufacturing Organization?

Large Molecule Contract Development And Manufacturing Organization refers to companies that provide specialized services for the development and manufacturing of large molecule therapeutics, such as biologics and monoclonal antibodies. These organizations support pharmaceutical and biotechnology companies in bringing complex drugs to market efficiently.

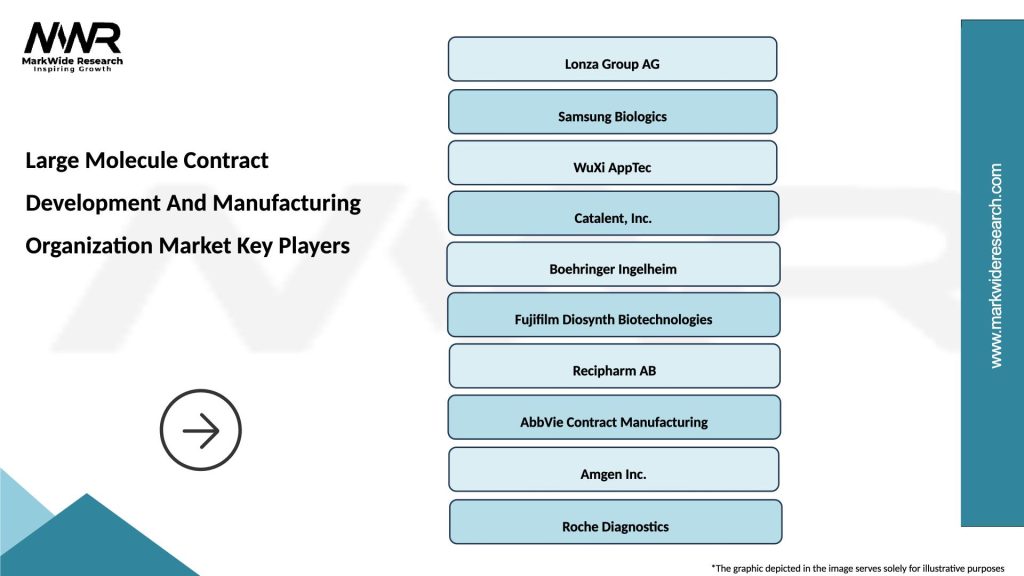

What are the key players in the Large Molecule Contract Development And Manufacturing Organization Market?

Key players in the Large Molecule Contract Development And Manufacturing Organization Market include companies like Lonza, Catalent, and Samsung Biologics. These firms are known for their expertise in biologics manufacturing and development, providing essential services to the pharmaceutical industry, among others.

What are the growth factors driving the Large Molecule Contract Development And Manufacturing Organization Market?

The growth of the Large Molecule Contract Development And Manufacturing Organization Market is driven by the increasing demand for biologics, advancements in biomanufacturing technologies, and the rising number of clinical trials for large molecule drugs. Additionally, the shift towards outsourcing manufacturing processes is also a significant factor.

What challenges does the Large Molecule Contract Development And Manufacturing Organization Market face?

Challenges in the Large Molecule Contract Development And Manufacturing Organization Market include regulatory compliance complexities, high operational costs, and the need for specialized expertise in large molecule production. These factors can hinder the efficiency and scalability of manufacturing processes.

What opportunities exist in the Large Molecule Contract Development And Manufacturing Organization Market?

Opportunities in the Large Molecule Contract Development And Manufacturing Organization Market include the expansion of personalized medicine, the development of novel biologics, and increased collaboration between biotech firms and CDMOs. These trends are expected to enhance innovation and growth in the sector.

What trends are shaping the Large Molecule Contract Development And Manufacturing Organization Market?

Trends shaping the Large Molecule Contract Development And Manufacturing Organization Market include the adoption of continuous manufacturing processes, advancements in cell line development, and the integration of automation and digital technologies. These innovations are aimed at improving efficiency and reducing time-to-market for large molecule therapeutics.

Large Molecule Contract Development And Manufacturing Organization Market

| Segmentation Details | Description |

|---|---|

| Product Type | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Gene Therapies |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Technology | Cell Culture, Fermentation, Purification, Formulation |

| Application | Oncology, Autoimmune Disorders, Infectious Diseases, Rare Diseases |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Large Molecule Contract Development And Manufacturing Organization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at