444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The lamps and lighting market represents a dynamic and rapidly evolving industry that encompasses a wide range of illumination solutions for residential, commercial, and industrial applications. Market dynamics indicate substantial growth driven by technological advancements, energy efficiency mandates, and increasing urbanization worldwide. The transition from traditional incandescent and fluorescent lighting to LED technology has fundamentally transformed the industry landscape, creating new opportunities for innovation and market expansion.

Smart lighting systems are experiencing unprecedented adoption rates, with connected lighting solutions growing at approximately 22% annually across major markets. The integration of Internet of Things (IoT) capabilities, wireless connectivity, and advanced control systems has positioned the lighting industry at the forefront of the smart home and smart city revolution. Energy efficiency regulations continue to drive market transformation, with LED adoption rates reaching 78% in commercial applications and 65% in residential settings globally.

Regional market dynamics show significant variation, with North America and Europe leading in premium lighting solutions adoption, while Asia-Pacific demonstrates the highest growth rates due to rapid infrastructure development and urbanization. The market encompasses diverse product categories including general lighting, decorative lighting, architectural lighting, and specialized industrial lighting solutions, each serving distinct customer needs and applications.

The lamps and lighting market refers to the comprehensive industry ecosystem encompassing the design, manufacture, distribution, and installation of artificial lighting solutions for various applications. This market includes traditional lighting products such as incandescent bulbs, fluorescent tubes, and halogen lamps, as well as modern technologies including LED fixtures, smart lighting systems, and connected illumination solutions.

Market scope extends beyond simple illumination devices to include sophisticated lighting control systems, dimming technologies, color-changing capabilities, and integrated sensor networks. The industry serves multiple end-user segments including residential consumers, commercial enterprises, industrial facilities, outdoor infrastructure, and specialized applications such as automotive lighting, horticultural lighting, and entertainment venues.

Value chain participants include component manufacturers, lighting fixture producers, technology integrators, distribution channels, and installation service providers. The market has evolved from a commodity-based industry focused primarily on basic illumination to a technology-driven sector emphasizing energy efficiency, connectivity, user experience, and environmental sustainability.

Market transformation in the lamps and lighting industry reflects a fundamental shift toward intelligent, energy-efficient, and connected lighting solutions. The widespread adoption of LED technology has created new market opportunities while disrupting traditional business models and competitive dynamics. Industry leaders are investing heavily in research and development to create innovative products that combine superior performance with enhanced user experiences.

Key growth drivers include increasing energy costs, stringent environmental regulations, rapid urbanization, and growing consumer awareness of sustainability issues. The commercial and industrial segments demonstrate particularly strong demand for smart lighting solutions, with adoption rates increasing by approximately 35% annually in major metropolitan areas. Residential market penetration continues to expand as product costs decline and consumer familiarity with smart home technologies increases.

Competitive landscape features both established lighting manufacturers and emerging technology companies, creating a dynamic environment characterized by innovation, strategic partnerships, and market consolidation. The integration of artificial intelligence, machine learning, and advanced analytics into lighting systems represents the next frontier of market evolution, promising enhanced functionality and operational efficiency.

Technology adoption patterns reveal significant market shifts that are reshaping the entire lighting industry. The following key insights demonstrate the market’s evolution:

Energy efficiency mandates serve as the primary catalyst for market transformation, with governments worldwide implementing regulations that phase out inefficient lighting technologies. These regulatory frameworks create mandatory adoption timelines for LED technology and other energy-efficient solutions, driving consistent market demand across all segments. Utility incentive programs further accelerate adoption by reducing the initial cost barriers associated with upgrading to modern lighting systems.

Urbanization trends create substantial demand for comprehensive lighting solutions in new construction projects, infrastructure development, and urban renewal initiatives. Smart city initiatives particularly emphasize intelligent lighting systems that can adapt to usage patterns, reduce energy consumption, and provide enhanced safety and security. The integration of lighting with other urban systems creates opportunities for comprehensive smart infrastructure solutions.

Technological advancement continues to drive market evolution through improved performance, reduced costs, and enhanced functionality. Developments in semiconductor technology, wireless communication protocols, and sensor integration enable increasingly sophisticated lighting solutions that deliver superior user experiences. Cost reduction trends make advanced lighting technologies accessible to broader market segments, accelerating adoption rates across residential and commercial applications.

Consumer awareness of environmental impact and energy costs motivates purchasing decisions toward sustainable lighting solutions. The growing emphasis on corporate sustainability initiatives drives commercial and industrial customers to invest in energy-efficient lighting systems that support their environmental goals while reducing operational expenses.

High initial costs associated with advanced lighting systems continue to present barriers to adoption, particularly in price-sensitive market segments. While LED technology costs have declined significantly, comprehensive smart lighting installations still require substantial upfront investments that may deter some customers despite long-term operational savings. The complexity of calculating total cost of ownership can complicate purchasing decisions for budget-conscious consumers and organizations.

Technical complexity in modern lighting systems creates challenges for installation, configuration, and maintenance. The integration of smart lighting solutions with existing building systems often requires specialized expertise and can result in compatibility issues. Customers may hesitate to adopt advanced technologies due to concerns about technical support requirements and system reliability over extended operational periods.

Market fragmentation across different technology standards, communication protocols, and product ecosystems creates confusion for customers and limits interoperability between systems from different manufacturers. The lack of universal standards for smart lighting integration can result in vendor lock-in situations that concern customers about future flexibility and upgrade paths.

Economic uncertainties and fluctuating construction activity can impact demand for lighting products, particularly in commercial and industrial segments where capital expenditure decisions are closely tied to broader economic conditions. Supply chain disruptions and raw material cost volatility also create pricing pressures that can affect market growth rates.

Smart city development presents unprecedented opportunities for comprehensive lighting solutions that integrate with broader urban infrastructure systems. The convergence of lighting with IoT platforms, environmental monitoring, traffic management, and public safety systems creates substantial market potential for technology-forward lighting companies. Municipal governments increasingly view intelligent lighting as foundational infrastructure for digital city initiatives.

Retrofit market expansion offers significant growth potential as existing buildings upgrade from traditional lighting to modern LED systems and smart controls. The large installed base of inefficient lighting creates a substantial addressable market for replacement products and upgrade services. Energy service companies and financing solutions are emerging to facilitate these upgrade projects through performance-based contracts.

Emerging applications in sectors such as horticulture, healthcare, and entertainment create new market segments with specialized requirements and premium pricing opportunities. Horticultural lighting for indoor farming and greenhouse applications represents a rapidly growing niche with unique spectral requirements and control needs. Healthcare applications emphasize human-centric lighting that supports patient recovery and staff productivity.

International market expansion in developing regions offers substantial growth opportunities as infrastructure development accelerates and living standards improve. The adoption of modern lighting technologies in these markets can leapfrog traditional solutions, creating opportunities for advanced products and systems that might have evolved more gradually in mature markets.

Competitive dynamics in the lamps and lighting market reflect ongoing consolidation among traditional manufacturers while new technology companies enter specific market segments. Established lighting companies are acquiring technology startups to enhance their smart lighting capabilities, while technology companies are partnering with lighting manufacturers to access distribution channels and manufacturing expertise.

Supply chain evolution demonstrates increasing vertical integration as companies seek to control critical components and technologies. The importance of semiconductor components in modern lighting has led many companies to develop closer relationships with chip manufacturers or establish in-house capabilities. Global supply chain challenges have emphasized the importance of diversified sourcing strategies and regional manufacturing capabilities.

Customer expectations continue to evolve toward more sophisticated functionality, seamless integration, and enhanced user experiences. The consumerization of technology has raised expectations for intuitive interfaces, mobile app control, and voice integration in lighting systems. Commercial customers increasingly demand comprehensive analytics, energy reporting, and integration with building management systems.

Regulatory environment remains a significant influence on market dynamics, with energy efficiency standards becoming more stringent and new requirements emerging for smart grid integration and demand response capabilities. Environmental regulations regarding product lifecycle, recyclability, and hazardous materials continue to shape product development priorities and manufacturing processes.

Market analysis approach combines quantitative data collection with qualitative insights from industry participants, technology experts, and end-user organizations. Primary research methodologies include structured interviews with key market participants, customer surveys, and detailed analysis of product specifications and pricing trends. Secondary research encompasses industry publications, regulatory filings, patent analysis, and technology trend monitoring.

Data validation processes ensure accuracy and reliability through multiple source verification, statistical analysis, and expert review. Market sizing methodologies incorporate bottom-up analysis based on product categories and applications, combined with top-down validation using industry benchmarks and historical growth patterns. Forecasting models integrate multiple variables including technological adoption curves, regulatory timelines, and economic indicators.

Industry expert consultation provides critical insights into technology trends, competitive dynamics, and market evolution patterns. Regular engagement with manufacturers, distributors, installers, and end-users ensures comprehensive understanding of market forces and emerging opportunities. Technology assessment includes evaluation of patent landscapes, research and development investments, and emerging product capabilities.

Regional analysis methodology accounts for local market conditions, regulatory environments, and cultural preferences that influence lighting adoption patterns. Cross-regional comparison identifies best practices and successful market development strategies that can be applied in different geographic contexts.

North American market demonstrates strong adoption of premium lighting solutions, with the United States leading in smart lighting integration across both residential and commercial segments. The region benefits from favorable regulatory environments, established distribution channels, and high consumer awareness of energy efficiency benefits. Canada’s market shows particular strength in outdoor and industrial lighting applications, driven by harsh climate requirements and energy cost considerations.

European markets exhibit the highest penetration rates for energy-efficient lighting technologies, supported by stringent environmental regulations and strong government incentives. Germany and the Netherlands lead in smart lighting adoption, with approximately 45% market penetration in commercial applications. The region’s emphasis on sustainability and circular economy principles drives demand for environmentally responsible lighting solutions.

Asia-Pacific region represents the fastest-growing market globally, with China and India driving substantial demand through rapid urbanization and infrastructure development. The region accounts for approximately 55% of global lighting production and demonstrates increasing domestic consumption of advanced lighting technologies. Japan and South Korea lead in technology innovation and premium product adoption.

Latin American markets show growing adoption of modern lighting technologies, with Brazil and Mexico leading regional demand. Government initiatives promoting energy efficiency and urban development create opportunities for comprehensive lighting solutions. The region’s focus on sustainable development aligns with advanced lighting technology benefits.

Middle East and Africa present emerging opportunities driven by large-scale infrastructure projects and urban development initiatives. The region’s extreme climate conditions create demand for specialized lighting solutions with enhanced durability and performance characteristics.

Market leadership in the lamps and lighting industry reflects a combination of traditional lighting manufacturers and emerging technology companies. The competitive environment demonstrates ongoing consolidation and strategic partnerships as companies position themselves for the smart lighting revolution.

Competitive strategies emphasize technology innovation, market expansion, and strategic acquisitions to build comprehensive smart lighting capabilities. Companies are investing heavily in research and development to create differentiated products that combine superior performance with enhanced connectivity and control features.

Technology-based segmentation reveals distinct market dynamics across different lighting technologies, each serving specific applications and customer requirements:

By Technology:

By Application:

By End-User:

LED lighting category dominates market growth with superior performance characteristics and declining costs making it the preferred choice across most applications. Smart LED systems represent the highest growth subcategory, with connected features enabling remote control, energy monitoring, and integration with building automation systems. The category benefits from continuous technological improvements in efficiency, color quality, and lifespan.

Residential lighting segment shows strong adoption of decorative and architectural lighting solutions that combine aesthetic appeal with energy efficiency. Smart home integration drives demand for connected lighting systems that can be controlled through mobile apps, voice assistants, and home automation platforms. Consumer preferences increasingly favor products that offer both functional and aesthetic benefits.

Commercial lighting applications emphasize energy efficiency, maintenance reduction, and operational cost savings. Office lighting systems increasingly incorporate human-centric lighting principles that support employee productivity and well-being. Retail lighting focuses on creating engaging customer experiences while minimizing energy consumption and maintenance requirements.

Industrial lighting solutions prioritize durability, reliability, and safety in demanding operational environments. High-bay LED fixtures have largely replaced traditional technologies in warehouse and manufacturing applications, delivering superior light quality and significant energy savings. Specialized applications such as hazardous location lighting require certified products meeting stringent safety standards.

Outdoor lighting infrastructure represents substantial growth opportunities as municipalities upgrade street lighting systems to smart LED solutions. These systems offer energy savings, improved light quality, and the potential for additional smart city functionality such as environmental monitoring and wireless connectivity.

Manufacturers benefit from expanding market opportunities driven by technology innovation and regulatory support for energy-efficient lighting solutions. The transition to LED technology and smart lighting systems creates opportunities for premium pricing and differentiated product offerings. Companies that successfully integrate advanced technologies can establish competitive advantages and build stronger customer relationships.

Distributors and retailers gain from increased product complexity and higher average selling prices associated with advanced lighting solutions. The need for technical expertise and customer education creates opportunities for value-added services and stronger customer relationships. Smart lighting systems often require ongoing support and maintenance, creating recurring revenue opportunities.

End-users realize substantial benefits through reduced energy consumption, lower maintenance costs, and improved lighting quality. Commercial customers can achieve significant operational cost savings while enhancing employee productivity and customer experiences. Residential consumers benefit from convenience, energy savings, and enhanced home automation capabilities.

Energy utilities benefit from reduced peak demand and improved grid stability through smart lighting systems that can participate in demand response programs. LED adoption reduces overall electricity consumption, helping utilities meet environmental goals and regulatory requirements while potentially deferring infrastructure investments.

Environmental stakeholders benefit from reduced energy consumption, lower carbon emissions, and improved product recyclability associated with modern lighting technologies. The longer lifespan of LED products reduces waste generation and resource consumption compared to traditional lighting technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Human-centric lighting emerges as a significant trend, with products designed to support natural circadian rhythms and enhance human well-being. These systems automatically adjust color temperature and intensity throughout the day to optimize alertness, productivity, and sleep quality. Healthcare applications particularly benefit from lighting that supports patient recovery and staff performance.

Wireless connectivity becomes standard in commercial and premium residential lighting products, enabling remote control, monitoring, and integration with broader building systems. Mesh networking protocols allow lighting fixtures to communicate with each other and central control systems, creating robust and scalable smart lighting networks.

Sustainability focus drives demand for products with minimal environmental impact throughout their lifecycle. Manufacturers increasingly emphasize recyclable materials, reduced packaging, and carbon-neutral manufacturing processes. Circular economy principles influence product design to facilitate repair, refurbishment, and material recovery.

Artificial intelligence integration enables lighting systems to learn from usage patterns and automatically optimize performance for energy efficiency and user preferences. Machine learning algorithms can predict maintenance needs, optimize energy consumption, and enhance user experiences through personalized lighting scenarios.

Miniaturization trends allow lighting integration into previously impossible applications, creating new market opportunities in automotive, wearable, and architectural applications. Advanced LED chip technology enables smaller, more efficient lighting solutions with enhanced design flexibility.

Strategic acquisitions continue to reshape the competitive landscape as traditional lighting companies acquire technology startups to enhance their smart lighting capabilities. Recent transactions demonstrate the industry’s focus on building comprehensive IoT platforms and advanced control systems. Vertical integration strategies help companies control critical components and technologies while reducing supply chain dependencies.

Technology partnerships between lighting manufacturers and technology companies accelerate innovation and market adoption of smart lighting solutions. Collaborations with semiconductor companies, software developers, and telecommunications providers enable comprehensive smart building solutions. Platform integration with major technology ecosystems enhances product compatibility and market reach.

Regulatory developments continue to drive market evolution, with new energy efficiency standards and smart grid integration requirements creating opportunities for advanced products. Government incentive programs support adoption of energy-efficient lighting in both commercial and residential applications, accelerating market transformation.

Manufacturing innovations focus on improving production efficiency, reducing costs, and enhancing product quality. Advanced manufacturing techniques enable mass customization of lighting products while maintaining competitive pricing. Supply chain optimization strategies help companies manage component shortages and cost volatility.

Market expansion initiatives target emerging geographic markets and new application segments. Companies are establishing local manufacturing and distribution capabilities to serve growing markets in Asia-Pacific, Latin America, and Africa. Product localization strategies address regional preferences and regulatory requirements.

MarkWide Research analysis indicates that companies should prioritize investment in smart lighting technologies and IoT integration capabilities to remain competitive in the evolving market landscape. The convergence of lighting with broader building automation and smart city systems creates substantial opportunities for companies that can deliver comprehensive solutions rather than standalone products.

Technology differentiation becomes increasingly important as basic LED products become commoditized. Companies should focus on developing unique value propositions through advanced features such as human-centric lighting, AI-powered optimization, and seamless integration with popular smart home and building platforms. Software capabilities may become as important as hardware performance in determining market success.

Market expansion strategies should emphasize emerging geographic markets where infrastructure development creates demand for modern lighting solutions. Companies can potentially leapfrog traditional technology adoption patterns in these markets by introducing advanced products that might have evolved more gradually in mature markets. Local partnerships and manufacturing capabilities can provide competitive advantages in these regions.

Customer education initiatives remain critical for driving adoption of advanced lighting technologies. Many potential customers lack awareness of the benefits and capabilities of modern lighting systems, creating opportunities for companies that can effectively communicate value propositions and provide comprehensive support throughout the customer journey.

Sustainability positioning should be integrated into all aspects of business strategy, from product development to marketing and customer engagement. Environmental considerations increasingly influence purchasing decisions across all market segments, creating competitive advantages for companies that can demonstrate genuine commitment to sustainability principles.

Market evolution toward intelligent, connected lighting systems will accelerate over the next decade, driven by advancing technology capabilities and increasing customer sophistication. The integration of artificial intelligence and machine learning will enable lighting systems to become truly autonomous, automatically optimizing performance based on usage patterns, environmental conditions, and user preferences.

Technology convergence will blur traditional boundaries between lighting, building automation, and smart city infrastructure. Future lighting systems will serve multiple functions beyond illumination, including environmental monitoring, wireless connectivity, and data collection. This evolution will create new business models and revenue opportunities for forward-thinking companies.

Market growth projections indicate continued expansion driven by urbanization, infrastructure development, and technology adoption. MWR forecasts suggest that smart lighting penetration will reach 85% in commercial applications and 60% in residential settings by 2030, representing substantial market opportunities for companies positioned to serve this demand.

Regulatory environment will continue to support market growth through increasingly stringent energy efficiency requirements and smart grid integration mandates. Government initiatives promoting smart city development and sustainable infrastructure will create substantial demand for advanced lighting solutions that can contribute to broader urban optimization goals.

Innovation focus will shift toward enhancing user experiences, improving system intelligence, and developing new applications for lighting technology. The emergence of quantum dot LEDs, advanced sensor integration, and edge computing capabilities will enable lighting systems with unprecedented functionality and performance characteristics.

The lamps and lighting market stands at a transformative juncture, with traditional illumination products rapidly giving way to intelligent, connected systems that serve multiple functions beyond basic lighting. The widespread adoption of LED technology has fundamentally altered industry dynamics, creating opportunities for innovation while challenging established business models and competitive positions.

Market drivers including energy efficiency regulations, urbanization trends, and technological advancement continue to fuel growth across all segments. The emergence of smart lighting systems represents the next phase of industry evolution, offering enhanced functionality, energy savings, and integration capabilities that create substantial value for end-users while opening new revenue streams for industry participants.

Future success in the lamps and lighting market will depend on companies’ ability to navigate technological complexity, deliver comprehensive solutions, and build sustainable competitive advantages through innovation and customer focus. The industry’s evolution toward intelligent, connected lighting systems presents both challenges and opportunities that will reshape the competitive landscape over the coming decade. Companies that successfully integrate advanced technologies while maintaining focus on customer needs and market dynamics will be best positioned to capitalize on the substantial growth opportunities ahead.

What is Lamps And Lighting?

Lamps and lighting refer to various devices that produce artificial light for illumination purposes. This includes a wide range of products such as table lamps, floor lamps, ceiling fixtures, and decorative lighting used in residential, commercial, and industrial settings.

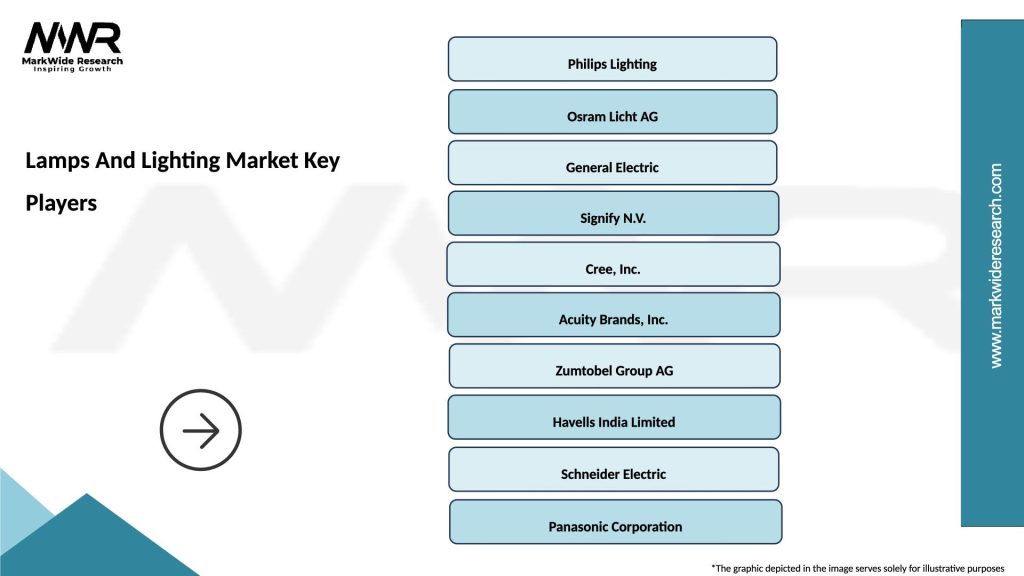

What are the key companies in the Lamps And Lighting Market?

Key companies in the Lamps And Lighting Market include Philips Lighting, Osram, General Electric, and Cree, among others. These companies are known for their innovative lighting solutions and extensive product ranges.

What are the growth factors driving the Lamps And Lighting Market?

The growth of the Lamps And Lighting Market is driven by increasing urbanization, the demand for energy-efficient lighting solutions, and advancements in smart lighting technologies. Additionally, the rise in home automation and the popularity of LED lighting contribute to market expansion.

What challenges does the Lamps And Lighting Market face?

The Lamps And Lighting Market faces challenges such as the high initial cost of advanced lighting technologies and competition from alternative light sources. Additionally, regulatory changes regarding energy efficiency standards can impact product offerings.

What opportunities exist in the future for the Lamps And Lighting Market?

Opportunities in the Lamps And Lighting Market include the growing demand for smart lighting solutions and the integration of IoT technology. Furthermore, the increasing focus on sustainable lighting options presents avenues for innovation and market growth.

What are the current trends in the Lamps And Lighting Market?

Current trends in the Lamps And Lighting Market include the shift towards LED technology, the rise of smart lighting systems, and the increasing popularity of decorative and ambient lighting. These trends reflect consumer preferences for energy efficiency and aesthetic appeal.

Lamps And Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, Incandescent, Fluorescent, Halogen |

| Technology | Smart Lighting, Solar Lighting, Traditional Lighting, Emergency Lighting |

| End User | Residential, Commercial, Industrial, Hospitality |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Lamps And Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at