444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The LAMEA (Latin America, Middle East, and Africa) Retail Cash Management Market encompasses the management and processing of cash transactions within the retail sector across the regions of Latin America, the Middle East, and Africa. It involves the use of technologies, systems, and services to optimize cash handling processes, improve security, and enhance operational efficiency for retailers of various sizes and types. As cash remains a prevalent payment method in many LAMEA countries, efficient cash management solutions are essential for retailers to streamline operations and provide a seamless customer experience.

Meaning

The LAMEA Retail Cash Management Market refers to the industry segment focused on providing solutions and services for the efficient handling, processing, and management of cash transactions within the retail sector across Latin America, the Middle East, and Africa. These solutions encompass cash handling devices, such as cash recyclers, smart safes, and currency sorters, as well as software platforms and services that automate cash reconciliation, reporting, and forecasting processes. With cash remaining a dominant payment method in many LAMEA countries, retail cash management solutions play a critical role in optimizing cash flow, reducing shrinkage, and enhancing overall operational efficiency for retailers.

Executive Summary

The LAMEA Retail Cash Management Market is experiencing steady growth, driven by factors such as increasing retail sales, expansion of the retail sector, adoption of advanced cash management technologies, and growing concerns about cash security and accountability. Retailers across Latin America, the Middle East, and Africa are increasingly investing in cash management solutions to streamline cash handling processes, mitigate risks of theft and fraud, and improve overall operational efficiency. Understanding key market insights, trends, and opportunities is essential for stakeholders to capitalize on the growing demand for retail cash management solutions in the LAMEA region.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The LAMEA Retail Cash Management Market operates within a dynamic environment shaped by factors such as economic trends, technological advancements, regulatory changes, competitive pressures, and shifting consumer behaviors. Understanding market dynamics is essential for stakeholders to identify growth opportunities, address challenges, and formulate effective strategies to succeed in the rapidly evolving retail cash management landscape.

Regional Analysis

The LAMEA Retail Cash Management Market exhibits regional variations influenced by factors such as economic development, retail infrastructure, payment habits, regulatory environments, and cultural preferences. Key regions within LAMEA include Latin America (e.g., Brazil, Mexico), the Middle East (e.g., UAE, Saudi Arabia), and Africa (e.g., Nigeria, South Africa), each offering unique market dynamics and growth opportunities for retail cash management solutions.

Competitive Landscape

Leading Companies in LAMEA Retail Cash Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

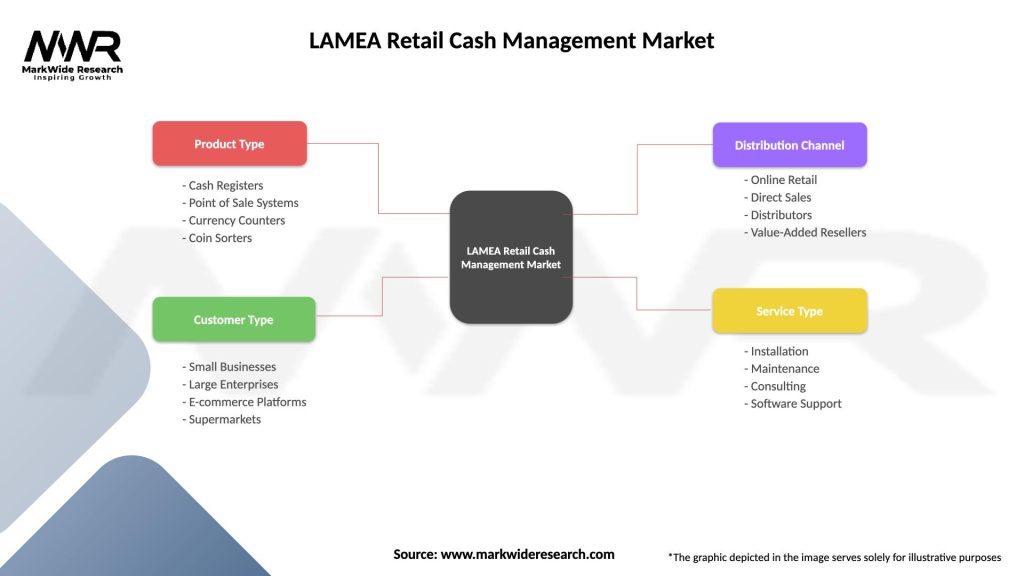

Segmentation

The LAMEA Retail Cash Management Market can be segmented based on various factors, including:

Segmentation enables a deeper understanding of market dynamics, customer needs, and competitive landscapes, facilitating targeted marketing, product development, and sales strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of retail cash management solutions in the LAMEA region by highlighting the importance of contactless payment methods, hygiene protocols, and cash security measures. Retailers have invested in cash recyclers, smart safes, and cash management software to minimize physical contact, reduce cash handling risks, and ensure business continuity amidst health and safety concerns.

Key Industry Developments

Analyst Suggestions

Future Outlook

The LAMEA Retail Cash Management Market is poised for robust growth in the coming years, driven by factors such as urbanization, digitalization, economic development, and regulatory reforms. Retailers across Latin America, the Middle East, and Africa are expected to continue investing in cash management solutions to optimize operations, enhance security, and improve customer experience. Strategic initiatives focusing on innovation, sustainability, customer value, and collaboration will shape the future trajectory of the market, unlocking new opportunities and driving sustainable growth.

Conclusion

The LAMEA Retail Cash Management Market presents lucrative opportunities for solution providers, retailers, and stakeholders to capitalize on the growing demand for efficient, secure, and integrated cash handling solutions across diverse industries and applications. By embracing technological innovations, regulatory compliance, sustainability initiatives, and customer-centric strategies, market players can navigate market dynamics, address evolving customer needs, and unlock the full potential of the LAMEA Retail Cash Management Market for sustainable business growth and success.

What is Retail Cash Management?

Retail Cash Management refers to the processes and systems used by retailers to handle cash transactions efficiently. This includes cash handling, cash flow management, and the use of technology to streamline operations and reduce risks associated with cash handling.

What are the key players in the LAMEA Retail Cash Management Market?

Key players in the LAMEA Retail Cash Management Market include companies like Diebold Nixdorf, NCR Corporation, and Glory Global Solutions, among others. These companies provide various cash management solutions tailored for retail environments.

What are the growth factors driving the LAMEA Retail Cash Management Market?

The growth of the LAMEA Retail Cash Management Market is driven by increasing retail transactions, the need for enhanced security in cash handling, and the adoption of automated cash management solutions. Additionally, the rise of e-commerce is influencing cash management strategies.

What challenges does the LAMEA Retail Cash Management Market face?

Challenges in the LAMEA Retail Cash Management Market include the high costs associated with implementing advanced cash management systems and the risk of cyber threats targeting cash handling technologies. Additionally, varying regulations across countries can complicate compliance.

What opportunities exist in the LAMEA Retail Cash Management Market?

Opportunities in the LAMEA Retail Cash Management Market include the growing trend of digital payments, which can complement cash management solutions, and the increasing demand for integrated cash management systems that enhance operational efficiency. Retailers are also looking for solutions that improve customer experience.

What trends are shaping the LAMEA Retail Cash Management Market?

Trends in the LAMEA Retail Cash Management Market include the rise of contactless payment methods, the integration of artificial intelligence in cash management systems, and the shift towards more sustainable cash handling practices. Retailers are increasingly focusing on technology to optimize cash flow and reduce waste.

LAMEA Retail Cash Management Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cash Registers, Point of Sale Systems, Currency Counters, Coin Sorters |

| Customer Type | Small Businesses, Large Enterprises, E-commerce Platforms, Supermarkets |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Value-Added Resellers |

| Service Type | Installation, Maintenance, Consulting, Software Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at