444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The family floater health insurance market in the LAMEA region (Latin America, Middle East, and Africa) is a burgeoning sector that addresses the diverse healthcare needs of families across different continents. Family floater plans play a crucial role in providing financial security and access to quality healthcare services, making them integral to the overall insurance landscape in the region.

Meaning:

Family floater health insurance in the LAMEA region refers to insurance policies that extend coverage to the entire family under a single plan. This inclusive approach ensures that all family members, irrespective of age or health status, are protected against medical expenses, aligning with the cultural significance placed on familial well-being.

Executive Summary:

The LAMEA family floater health insurance market is witnessing significant growth, driven by factors such as rising healthcare costs, evolving family structures, and increasing awareness about the importance of health insurance. This market presents both opportunities and challenges for insurers, emphasizing the need for tailored solutions to meet the unique needs of families in the region.

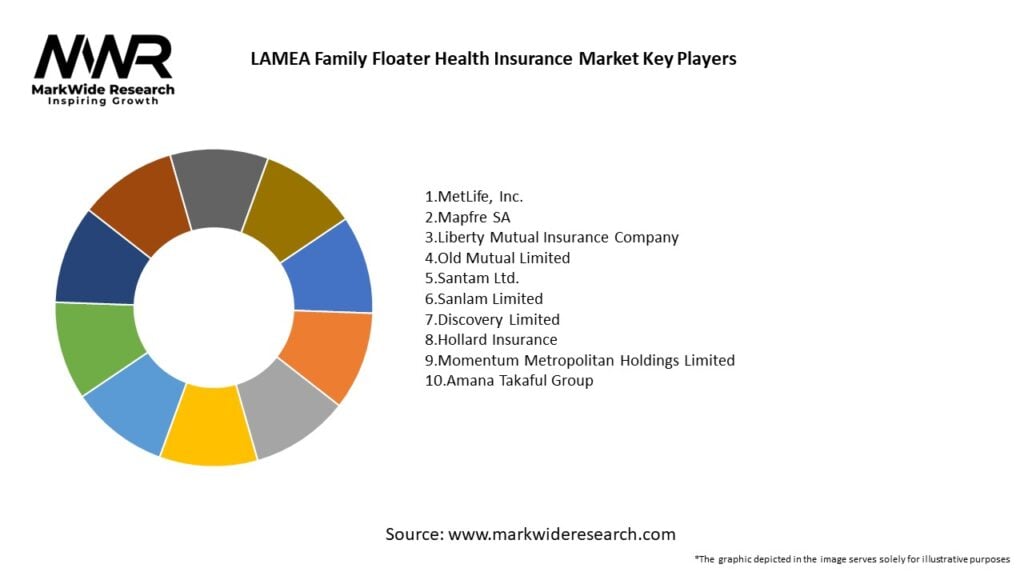

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The family floater health insurance market in the LAMEA region operates in a dynamic environment shaped by factors such as cultural nuances, regulatory changes, technological advancements, and evolving consumer expectations. Insurers must stay attuned to these dynamics to remain agile and responsive to emerging trends.

Regional Analysis:

Competitive Landscape:

Leading Companies in LAMEA Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The family floater health insurance market in the LAMEA region can be segmented based on:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has accelerated the adoption of family floater health insurance in the LAMEA region. Insurers adapted by introducing specific COVID-19 coverage, telehealth services, and digital solutions, addressing the evolving healthcare landscape.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The LAMEA family floater health insurance market is poised for substantial growth as the region undergoes economic development and demographic changes. Insurers that adapt to local dynamics, offer innovative solutions, and prioritize customer-centricity will be well-positioned to capitalize on the expanding opportunities in this vibrant market.

Conclusion:

The LAMEA family floater health insurance market reflects the unique interplay of cultural diversity, evolving healthcare needs, and economic dynamics. As insurers navigate this dynamic landscape, a strategic focus on customization, digital transformation, and cultural alignment will be pivotal in establishing a strong and lasting presence in this rapidly growing market.

What is Family Floater Health Insurance?

Family Floater Health Insurance is a type of health insurance policy that covers the medical expenses of an entire family under a single sum insured. It typically includes coverage for hospitalization, surgeries, and other medical treatments for all family members, making it a cost-effective option for families.

What are the key players in the LAMEA Family Floater Health Insurance Market?

Key players in the LAMEA Family Floater Health Insurance Market include companies like Allianz, Aetna, and Sanlam, which offer a variety of health insurance products tailored to family needs, among others.

What are the growth factors driving the LAMEA Family Floater Health Insurance Market?

The growth of the LAMEA Family Floater Health Insurance Market is driven by increasing healthcare costs, rising awareness of health insurance benefits, and a growing middle-class population seeking comprehensive health coverage for families.

What challenges does the LAMEA Family Floater Health Insurance Market face?

Challenges in the LAMEA Family Floater Health Insurance Market include regulatory hurdles, lack of awareness about insurance products, and varying healthcare standards across different countries, which can affect policy uptake.

What opportunities exist in the LAMEA Family Floater Health Insurance Market?

Opportunities in the LAMEA Family Floater Health Insurance Market include the potential for digital transformation in policy distribution, increasing demand for customized health plans, and the expansion of telemedicine services that can enhance insurance offerings.

What trends are shaping the LAMEA Family Floater Health Insurance Market?

Trends in the LAMEA Family Floater Health Insurance Market include the rise of wellness programs, integration of technology in health insurance services, and a shift towards preventive healthcare, which are all influencing consumer choices and policy designs.

LAMEA Family Floater Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Group Plans, Family Plans, Comprehensive Coverage |

| End User | Families, Individuals, Employers, Organizations |

| Distribution Channel | Online Platforms, Insurance Brokers, Direct Sales, Agents |

| Coverage Type | Inpatient Care, Outpatient Care, Preventive Services, Emergency Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in LAMEA Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at