444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The LAMEA (Latin America, Middle East, and Africa) currency management market is a critical component of the financial ecosystem, playing a pivotal role in handling, processing, and safeguarding currencies within the region. This market is characterized by a complex interplay of technological advancements, regulatory frameworks, and the evolving needs of financial institutions and businesses. As the LAMEA region witnesses economic growth, expanding trade relationships, and increasing financial transactions, the currency management market becomes instrumental in ensuring the efficient flow of money.

Meaning:

Currency management involves the comprehensive handling of physical currency, encompassing processes such as sorting, counting, authentication, and disposal. In the LAMEA context, where diverse currencies and economic structures coexist, currency management extends to currency logistics, supply chain security, and compliance with regional financial regulations. The significance of currency management is underscored by its role in maintaining the integrity of cash transactions and supporting the overall stability of financial systems.

Executive Summary:

The LAMEA currency management market reflects the region’s economic vibrancy, marked by a surge in financial activities, cross-border transactions, and the need for robust currency handling solutions. This market presents a spectrum of opportunities for industry players, but it is not without challenges. Understanding key market insights, technological trends, and regulatory nuances is essential for stakeholders to navigate this dynamic landscape successfully.

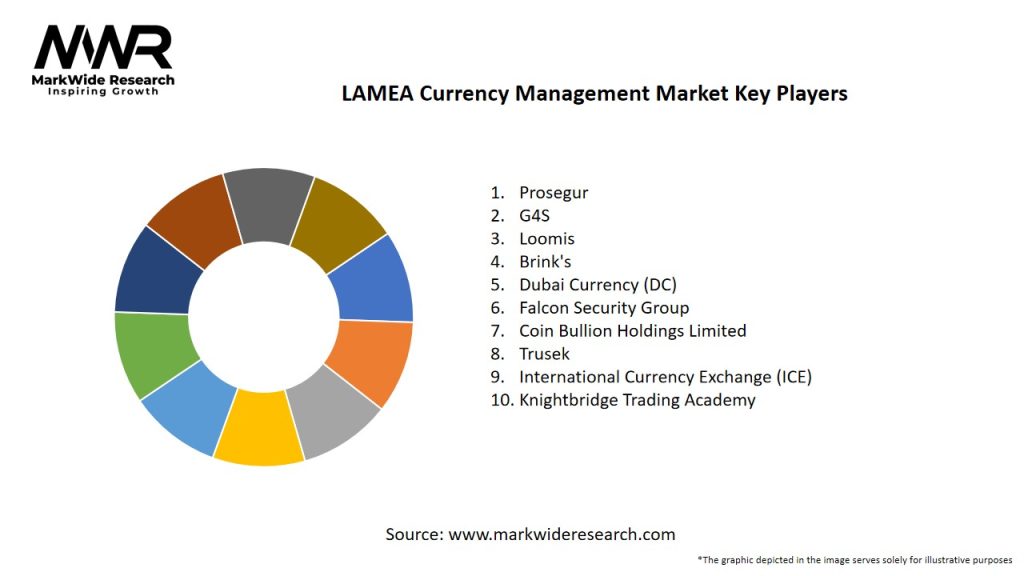

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The LAMEA currency management market operates in a dynamic environment shaped by economic policies, technological advancements, and evolving consumer behaviors. These dynamics require industry participants to stay agile, adapt to changing market trends, and innovate to meet the evolving needs of financial institutions and businesses.

Regional Analysis:

The currency management market in the LAMEA region exhibits variations influenced by economic conditions, technological adoption rates, and regulatory frameworks. Let’s explore key insights from different sub-regions:

Competitive Landscape:

Leading Companies in the LAMEA Currency Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The LAMEA currency management market can be segmented based on various factors:

Segmentation provides a detailed understanding of market dynamics, allowing businesses to tailor their currency management strategies to specific regional needs and industry requirements.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has accelerated certain trends in the LAMEA currency management market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The LAMEA currency management market is poised for growth, driven by technological advancements, increased demand for efficient currency handling, and the region’s economic expansion. The future outlook suggests a continued focus on security, adaptability to digital transformations, and sustainable currency management practices. Industry players that align with these trends and address emerging challenges are likely to thrive in the evolving landscape.

Conclusion:

In conclusion, the LAMEA currency management market serves as a critical pillar in the region’s financial infrastructure. As economies grow and financial transactions become more intricate, the demand for efficient and secure currency management solutions rises. Navigating the dynamics of this market requires a keen understanding of technological trends, regulatory landscapes, and the evolving needs of diverse economies within the LAMEA region. By embracing innovation, ensuring security, and adapting to changing market dynamics, the currency management industry can contribute significantly to the financial stability and growth of the LAMEA region.

What is Currency Management?

Currency management refers to the strategies and processes used by businesses to manage their foreign exchange risks and optimize their currency transactions. This includes activities such as hedging, currency conversion, and monitoring exchange rates to minimize financial exposure.

What are the key players in the LAMEA Currency Management Market?

Key players in the LAMEA Currency Management Market include companies like FIS, Oracle, and SAP, which provide software solutions for currency management and financial services. These companies offer tools that help businesses manage their currency exposure and streamline their financial operations, among others.

What are the main drivers of growth in the LAMEA Currency Management Market?

The main drivers of growth in the LAMEA Currency Management Market include the increasing globalization of businesses, the need for effective risk management strategies, and the rising demand for automated currency management solutions. Additionally, the expansion of e-commerce and cross-border transactions contributes to this growth.

What challenges does the LAMEA Currency Management Market face?

Challenges in the LAMEA Currency Management Market include fluctuating exchange rates, regulatory compliance issues, and the complexity of managing multiple currencies. Companies must navigate these challenges to effectively manage their currency risks and ensure financial stability.

What opportunities exist in the LAMEA Currency Management Market?

Opportunities in the LAMEA Currency Management Market include the adoption of advanced technologies such as blockchain and artificial intelligence, which can enhance currency management processes. Additionally, the growing trend of digital payments and fintech innovations presents new avenues for growth.

What trends are shaping the LAMEA Currency Management Market?

Trends shaping the LAMEA Currency Management Market include the increasing use of cloud-based solutions for currency management, the rise of real-time currency tracking tools, and a focus on sustainability in financial practices. These trends are driving innovation and efficiency in currency management strategies.

LAMEA Currency Management Market

| Segmentation Details | Description |

|---|---|

| Product Type | Software Solutions, Consulting Services, Managed Services, Integration Services |

| End User | Corporates, Financial Institutions, Government Agencies, Non-Profit Organizations |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

| Service Type | Transaction Management, Risk Management, Compliance Management, Reporting Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the LAMEA Currency Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at