444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The LAMEA (Latin America, Middle East, and Africa) region is witnessing a surge in the adoption of bank kiosks, revolutionizing the banking landscape with self-service solutions. Bank kiosks offer a convenient and efficient way for customers to perform various banking transactions, such as withdrawals, deposits, transfers, and account inquiries. With the digitization of financial services and the growing preference for self-service options, the LAMEA bank kiosk market presents significant growth opportunities for banks, financial institutions, and technology providers.

Meaning: Bank kiosks are self-service terminals deployed by banks and financial institutions to offer a wide range of banking services to customers. These kiosks are equipped with touchscreens, card readers, cash dispensers, and other peripherals, allowing users to conduct routine banking transactions without the need for human assistance. Bank kiosks enhance operational efficiency, reduce wait times, and improve customer satisfaction by providing convenient access to banking services 24/7.

Executive Summary: The LAMEA bank kiosk market is experiencing rapid growth driven by factors such as increasing customer demand for self-service banking solutions, rising adoption of digital banking channels, and efforts by banks to enhance operational efficiency and reduce costs. Bank kiosks empower customers to perform transactions conveniently and securely, driving customer engagement and loyalty. With advancements in technology and evolving customer expectations, the LAMEA bank kiosk market is poised for further expansion and innovation.

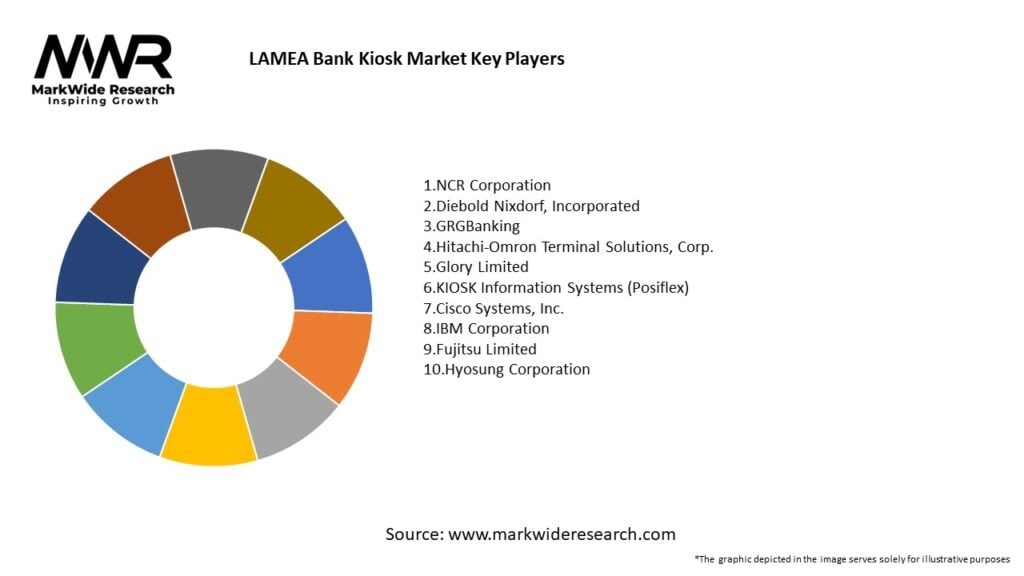

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The LAMEA bank kiosk market operates in a dynamic environment shaped by evolving consumer behavior, technological advancements, regulatory changes, and competitive pressures. Key drivers such as convenience, cost reduction, and market expansion propel market growth, while restraints such as security concerns and regulatory compliance pose challenges to adoption. Understanding market dynamics and trends is essential for banks and technology providers to capitalize on growth opportunities and navigate industry challenges effectively.

Regional Analysis: The LAMEA bank kiosk market exhibits regional variations in adoption rates, market maturity, regulatory frameworks, and consumer preferences. While certain countries in Latin America, the Middle East, and Africa demonstrate strong demand and market potential for bank kiosks, others may face infrastructure constraints or regulatory barriers that impact deployment and uptake.

Competitive Landscape:

Leading Companies in LAMEA Bank Kiosk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The LAMEA bank kiosk market can be segmented based on various factors, including kiosk type, functionality, deployment location, and end-user industry. Segmentation allows for targeted marketing, customization, and strategic positioning of kiosk solutions to address specific market segments and customer requirements in the region.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has accelerated the adoption of bank kiosks in the LAMEA region, driven by social distancing measures, hygiene concerns, and the shift towards contactless banking solutions. Banks are deploying kiosks equipped with safety features, such as antimicrobial surfaces, touchless interfaces, and sanitation stations, to reassure customers and maintain service continuity amid the pandemic.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the LAMEA bank kiosk market is optimistic, with continued growth expected driven by factors such as digital transformation, urbanization, financial inclusion initiatives, and evolving consumer preferences for self-service banking solutions. As banks embrace innovation, leverage technology, and expand their kiosk networks, the market will witness further advancements in kiosk design, functionality, and service offerings, driving increased adoption and market penetration across the LAMEA region.

Conclusion: In conclusion, the LAMEA bank kiosk market presents lucrative opportunities for banks, financial institutions, and technology providers to capitalize on the growing demand for self-service banking solutions. By offering convenient, accessible, and innovative kiosk services, banks can enhance customer experience, drive operational efficiency, and expand their market reach in the dynamic and competitive banking landscape of the LAMEA region. Embracing technology, prioritizing security, and delivering personalized experiences are essential for success in the evolving bank kiosk market, positioning industry players for long-term growth and success.

What is Bank Kiosk?

Bank kiosks are self-service machines that allow customers to perform various banking transactions, such as cash withdrawals, deposits, and account inquiries, without the need for human assistance. They are designed to enhance customer convenience and streamline banking operations.

What are the key players in the LAMEA Bank Kiosk Market?

Key players in the LAMEA Bank Kiosk Market include NCR Corporation, Diebold Nixdorf, GRG Banking, and KIOSK Information Systems, among others. These companies are known for their innovative solutions and extensive product offerings in the banking kiosk sector.

What are the growth factors driving the LAMEA Bank Kiosk Market?

The growth of the LAMEA Bank Kiosk Market is driven by increasing demand for self-service banking solutions, the rise in cashless transactions, and the need for enhanced customer experience. Additionally, the expansion of banking services in remote areas is contributing to market growth.

What challenges does the LAMEA Bank Kiosk Market face?

The LAMEA Bank Kiosk Market faces challenges such as high initial setup costs, security concerns related to fraud and data breaches, and the need for regular maintenance and updates. These factors can hinder the widespread adoption of bank kiosks.

What opportunities exist in the LAMEA Bank Kiosk Market?

Opportunities in the LAMEA Bank Kiosk Market include the integration of advanced technologies like AI and biometrics, which can enhance security and user experience. Additionally, the growing trend of digital banking presents a significant opportunity for kiosk deployment in various banking environments.

What trends are shaping the LAMEA Bank Kiosk Market?

Trends shaping the LAMEA Bank Kiosk Market include the increasing adoption of contactless payment solutions, the rise of mobile banking applications, and the demand for multi-functional kiosks that offer a range of services beyond traditional banking. These trends are influencing how banks approach customer service and technology integration.

LAMEA Bank Kiosk Market

| Segmentation Details | Description |

|---|---|

| Product Type | Self-Service Kiosks, Interactive Kiosks, Cash Deposit Kiosks, Bill Payment Kiosks |

| End User | Retail Banks, Credit Unions, Investment Firms, Insurance Companies |

| Technology | Touchscreen, Biometric Authentication, NFC, Cloud-Based Solutions |

| Installation | Indoor, Outdoor, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at