444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The laboratory robotic arm market represents a transformative segment within the broader laboratory automation industry, experiencing unprecedented growth as research facilities worldwide embrace advanced automation technologies. Laboratory robotic arms have emerged as essential tools for enhancing precision, efficiency, and reproducibility in various scientific applications, from pharmaceutical research to clinical diagnostics. The market demonstrates robust expansion driven by increasing demand for high-throughput screening, growing emphasis on laboratory safety, and the need to reduce human error in critical research processes.

Market dynamics indicate substantial growth potential, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory reflects the increasing adoption of automation technologies across pharmaceutical companies, biotechnology firms, academic research institutions, and clinical laboratories. The integration of artificial intelligence and machine learning capabilities into robotic systems has further accelerated market expansion, enabling more sophisticated and autonomous laboratory operations.

Regional distribution shows North America maintaining the largest market share at approximately 42% of global adoption, followed by Europe and Asia-Pacific regions. The market’s evolution is characterized by continuous technological advancements, strategic partnerships between robotics manufacturers and laboratory equipment providers, and increasing investment in research and development activities across multiple industries.

The laboratory robotic arm market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and implementation of automated robotic systems specifically engineered for laboratory applications. These sophisticated mechanical devices are programmed to perform precise, repetitive tasks traditionally carried out by human technicians, including sample handling, liquid dispensing, plate manipulation, and analytical testing procedures.

Laboratory robotic arms integrate advanced sensors, actuators, and control systems to execute complex workflows with exceptional accuracy and consistency. These systems typically feature multiple degrees of freedom, allowing them to navigate three-dimensional laboratory environments while maintaining sterile conditions and adhering to strict safety protocols. The technology encompasses various configurations, from simple pick-and-place units to sophisticated multi-axis systems capable of performing intricate analytical procedures.

Modern robotic arms incorporate cutting-edge technologies such as computer vision, force feedback sensors, and adaptive learning algorithms, enabling them to handle delicate samples, adjust to varying experimental conditions, and optimize performance based on historical data. The market includes both standalone robotic systems and integrated automation platforms that combine multiple robotic components with complementary laboratory equipment.

Market expansion in the laboratory robotic arm sector reflects the fundamental shift toward automation-driven research methodologies across multiple scientific disciplines. The industry has witnessed remarkable growth as organizations recognize the strategic advantages of implementing robotic solutions, including enhanced productivity, improved data quality, and reduced operational costs. Key market drivers include the increasing complexity of research protocols, growing demand for personalized medicine, and the need for scalable laboratory operations.

Technological innovations continue to reshape the competitive landscape, with manufacturers introducing increasingly sophisticated systems that offer greater flexibility, improved user interfaces, and enhanced integration capabilities. The market benefits from strong demand across pharmaceutical research, clinical diagnostics, food safety testing, and environmental analysis applications. Industry adoption rates have accelerated significantly, with laboratory automation penetration reaching 68% among major research institutions.

Investment patterns demonstrate sustained confidence in the sector’s long-term prospects, with venture capital funding and strategic acquisitions driving innovation and market consolidation. The competitive environment features established robotics manufacturers, specialized laboratory automation companies, and emerging technology providers, creating a dynamic ecosystem that fosters continuous advancement and market expansion.

Market intelligence reveals several critical insights that define the current state and future trajectory of the laboratory robotic arm industry:

Primary growth drivers propelling the laboratory robotic arm market forward encompass technological, economic, and regulatory factors that collectively create favorable conditions for sustained expansion. The increasing complexity of modern research protocols demands higher levels of precision and consistency than traditional manual methods can reliably provide, driving laboratories to adopt automated solutions.

Pharmaceutical research intensification represents a major catalyst, as drug discovery processes require extensive high-throughput screening, compound synthesis, and analytical testing procedures. The growing emphasis on personalized medicine and precision therapeutics further amplifies demand for sophisticated laboratory automation capable of handling diverse sample types and complex analytical workflows. Research productivity pressures compel organizations to maximize output while maintaining rigorous quality standards.

Regulatory compliance requirements increasingly favor automated systems that provide comprehensive documentation, traceability, and reproducibility features essential for meeting stringent industry standards. The need to minimize human error in critical research applications drives adoption of robotic systems that eliminate variability associated with manual procedures. Labor shortage challenges in skilled laboratory technicians create additional incentives for automation adoption, as robotic arms can operate continuously without fatigue or performance degradation.

Cost optimization initiatives motivate laboratories to implement automation solutions that reduce long-term operational expenses through improved efficiency, reduced waste, and enhanced resource utilization. The integration of artificial intelligence and machine learning capabilities enables predictive maintenance and adaptive optimization, further enhancing the value proposition of modern robotic systems.

Implementation challenges present significant barriers to market expansion, particularly regarding the substantial initial capital investment required for advanced robotic systems. Many smaller research facilities and academic institutions face budget constraints that limit their ability to adopt sophisticated automation technologies, creating market segmentation based on organizational size and financial resources.

Technical complexity associated with robotic arm integration poses challenges for laboratories lacking specialized technical expertise. The need for comprehensive staff training, system validation, and ongoing maintenance requirements can create operational disruptions during implementation phases. Compatibility issues with existing laboratory infrastructure and equipment may necessitate additional investments in supporting technologies and facility modifications.

Regulatory hurdles in certain applications, particularly clinical diagnostics and pharmaceutical manufacturing, require extensive validation and approval processes that can delay implementation timelines and increase overall project costs. The conservative nature of some research environments creates resistance to adopting new technologies, particularly when existing manual processes have established track records of reliability.

Customization limitations of standardized robotic systems may not fully address the unique requirements of specialized research applications, necessitating expensive custom engineering solutions. The rapid pace of technological advancement can create concerns about system obsolescence, making some organizations hesitant to commit to long-term automation investments.

Emerging applications in fields such as synthetic biology, gene therapy research, and advanced materials development present substantial growth opportunities for laboratory robotic arm manufacturers. The expanding scope of personalized medicine initiatives creates demand for flexible automation platforms capable of handling diverse sample types and complex analytical protocols with minimal reconfiguration requirements.

Geographic expansion opportunities exist in developing markets where research infrastructure investment is accelerating, particularly in Asia-Pacific and Latin American regions. The growing emphasis on food safety testing, environmental monitoring, and quality control applications opens new market segments beyond traditional pharmaceutical and biotechnology applications.

Technology convergence opportunities arise from integrating robotic arms with complementary technologies such as artificial intelligence, computer vision, and advanced sensors to create more capable and autonomous laboratory systems. The development of cloud-based control platforms and remote monitoring capabilities enables new service models and recurring revenue opportunities.

Collaborative robotics represents an emerging opportunity segment, with systems designed to work alongside human technicians rather than replacing them entirely. This approach addresses concerns about job displacement while providing enhanced capabilities and safety benefits. Modular system architectures create opportunities for scalable solutions that can grow with laboratory needs, appealing to budget-conscious organizations seeking phased implementation approaches.

Competitive dynamics within the laboratory robotic arm market reflect the interplay between established industrial robotics manufacturers expanding into laboratory applications and specialized laboratory automation companies developing purpose-built solutions. This convergence creates a diverse competitive landscape characterized by continuous innovation, strategic partnerships, and market consolidation activities.

Technology evolution drives market dynamics through the introduction of increasingly sophisticated systems that offer enhanced precision, improved user interfaces, and greater integration capabilities. The incorporation of artificial intelligence and machine learning technologies enables adaptive optimization and predictive maintenance features that enhance system reliability and performance. Market maturation in developed regions is driving manufacturers to focus on emerging markets and specialized applications to maintain growth trajectories.

Customer requirements continue to evolve toward more flexible, user-friendly systems that can adapt to changing research needs without extensive reprogramming or reconfiguration. The demand for comprehensive support services, including training, validation, and ongoing maintenance, influences vendor selection criteria and shapes competitive strategies. Regulatory considerations increasingly impact product development priorities, with manufacturers investing in features that facilitate compliance with evolving industry standards.

Supply chain dynamics affect component availability and pricing, particularly for specialized sensors, actuators, and control systems essential for laboratory-grade precision. The trend toward modular system architectures enables more flexible manufacturing approaches and customization capabilities while maintaining cost efficiency.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary data sources to provide accurate insights into laboratory robotic arm market trends, competitive dynamics, and growth prospects. The methodology incorporates quantitative and qualitative research techniques to ensure robust data validation and comprehensive market understanding.

Primary research activities include structured interviews with key industry stakeholders, including laboratory automation manufacturers, end-user organizations, technology integrators, and industry experts. Survey methodologies capture quantitative data regarding adoption rates, investment priorities, and performance metrics across diverse market segments. Secondary research encompasses analysis of industry publications, patent filings, regulatory documents, and financial reports to identify market trends and competitive positioning.

Data validation processes employ triangulation techniques to verify findings across multiple sources and ensure accuracy of market projections. Statistical analysis methods include regression modeling, trend analysis, and correlation studies to identify key market drivers and forecast future growth patterns. Market segmentation analysis utilizes clustering techniques to identify distinct customer groups and application categories with unique characteristics and requirements.

Expert consultation with industry thought leaders and technical specialists provides qualitative insights into emerging technologies, regulatory developments, and market evolution patterns. The research methodology adheres to established market research standards and incorporates feedback from peer review processes to ensure analytical rigor and reliability.

North American dominance in the laboratory robotic arm market reflects the region’s concentration of pharmaceutical companies, biotechnology firms, and advanced research institutions. The United States leads regional adoption with approximately 38% of North American market share, driven by substantial research and development investments, favorable regulatory environment, and strong venture capital funding for laboratory automation initiatives.

European markets demonstrate steady growth across key countries including Germany, United Kingdom, France, and Switzerland, with particular strength in pharmaceutical research and clinical diagnostics applications. The region’s emphasis on regulatory compliance and quality assurance creates favorable conditions for automated laboratory systems that provide comprehensive documentation and traceability features. European adoption rates show consistent year-over-year growth of approximately 7.5% across major market segments.

Asia-Pacific emergence represents the fastest-growing regional market, with countries such as China, Japan, South Korea, and India investing heavily in research infrastructure and laboratory automation capabilities. The region benefits from expanding pharmaceutical manufacturing, growing biotechnology sectors, and increasing government support for scientific research initiatives. Market penetration in Asia-Pacific is expected to reach 28% of global adoption within the forecast period.

Emerging markets in Latin America, Middle East, and Africa show promising growth potential as research infrastructure development accelerates and international pharmaceutical companies establish regional operations. These markets present opportunities for cost-effective automation solutions tailored to local requirements and budget constraints.

Market leadership is distributed among several key players that have established strong positions through technological innovation, strategic partnerships, and comprehensive product portfolios. The competitive environment features both global industrial robotics manufacturers and specialized laboratory automation companies, creating diverse approaches to market development and customer engagement.

Strategic initiatives among leading companies include research and development investments, acquisition activities, and partnership agreements to enhance technological capabilities and market reach. The competitive landscape continues to evolve through innovation in artificial intelligence integration, user interface design, and system modularity.

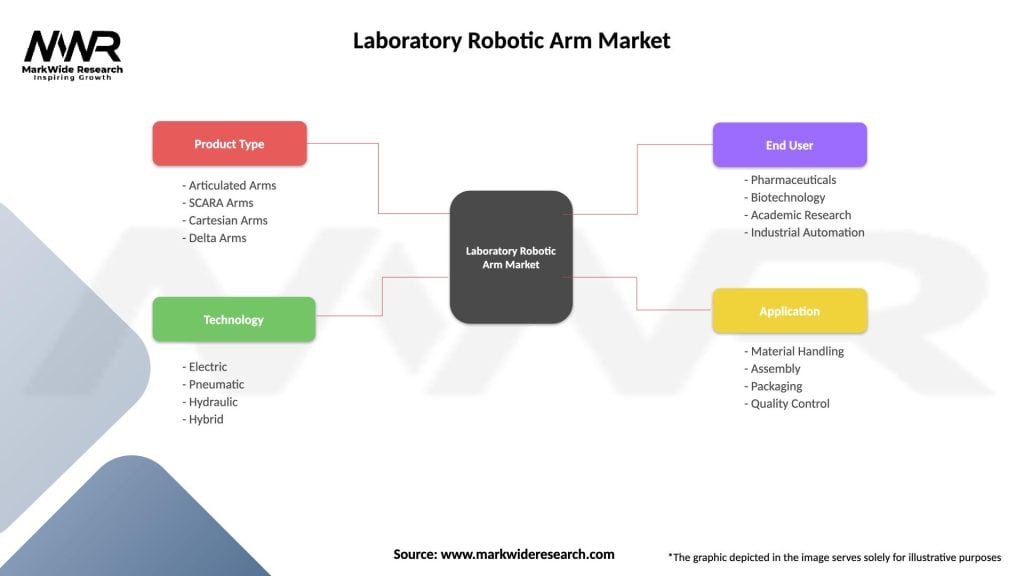

Market segmentation analysis reveals distinct categories based on technology type, application area, end-user industry, and geographic region, each exhibiting unique growth patterns and competitive dynamics.

By Technology:

By Application:

By End-User:

Pharmaceutical applications dominate the laboratory robotic arm market, representing the largest and most mature segment with established adoption patterns and proven return on investment metrics. This category benefits from stringent regulatory requirements that favor automated systems capable of providing comprehensive documentation and reproducible results. Drug discovery processes particularly benefit from robotic automation, with high-throughput screening applications showing adoption rates exceeding 75% among major pharmaceutical companies.

Biotechnology segment demonstrates rapid growth driven by expanding research activities in gene therapy, cell culture, and protein analysis applications. The category’s emphasis on precision and contamination control creates strong demand for advanced robotic systems with specialized capabilities. Clinical diagnostics represents an emerging high-growth category, with automated systems increasingly deployed for routine testing procedures and specialized assays.

Academic research institutions show growing adoption of robotic systems, particularly for multi-user facilities where automation can maximize equipment utilization and ensure consistent results across different research groups. This segment often requires flexible, modular systems that can adapt to diverse research requirements and budget constraints. Food safety testing and environmental analysis applications represent niche but growing categories with specific requirements for contamination prevention and regulatory compliance.

Technology categories show distinct adoption patterns, with articulated robotic arms maintaining the largest market share due to their versatility and precision capabilities. Collaborative robots represent the fastest-growing technology segment, with adoption rates increasing by approximately 12% annually as laboratories seek human-robot collaboration solutions.

Laboratory operators realize substantial benefits from robotic arm implementation, including enhanced productivity, improved data quality, and reduced operational costs. Automated systems enable 24/7 operation capabilities, significantly increasing throughput while maintaining consistent performance standards. Quality improvements result from elimination of human variability and enhanced precision in critical procedures.

Research organizations benefit from accelerated project timelines, improved resource utilization, and enhanced competitive positioning through advanced automation capabilities. The ability to handle hazardous materials safely and reduce exposure risks provides significant safety advantages for laboratory personnel. Regulatory compliance benefits include comprehensive data logging, traceability features, and standardized procedures that facilitate audit processes.

Equipment manufacturers gain opportunities for recurring revenue through service contracts, software updates, and consumable sales associated with robotic systems. The integration of advanced technologies creates differentiation opportunities and premium pricing potential. Technology providers benefit from expanding market opportunities as laboratory automation adoption accelerates across diverse application areas.

Investment stakeholders realize returns through market expansion, technological advancement, and increasing adoption rates across multiple industry segments. The sector’s growth trajectory and innovation potential create attractive investment opportunities in both established companies and emerging technology providers. Supply chain partners benefit from increased demand for specialized components, sensors, and control systems essential for laboratory-grade robotic applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping the laboratory robotic arm market, with manufacturers incorporating machine learning algorithms to enable adaptive optimization, predictive maintenance, and autonomous decision-making capabilities. These AI-enhanced systems can learn from historical data, optimize protocols automatically, and identify potential issues before they impact operations.

Collaborative robotics adoption continues to accelerate as laboratories seek solutions that enhance human capabilities rather than replacing personnel entirely. These systems feature advanced safety mechanisms, intuitive programming interfaces, and the ability to work alongside human technicians in shared workspace environments. User interface evolution toward more intuitive, touchscreen-based control systems reduces training requirements and improves operational efficiency.

Modular system architectures gain popularity as laboratories demand flexible solutions that can adapt to changing research requirements without complete system replacement. This trend enables phased implementation approaches and reduces initial capital investment barriers. Cloud connectivity and remote monitoring capabilities allow for centralized system management, predictive maintenance, and performance optimization across multiple laboratory locations.

Miniaturization trends drive development of compact robotic systems suitable for smaller laboratory spaces and specialized applications. The integration of advanced sensors and computer vision technologies enables more sophisticated sample recognition and handling capabilities. Sustainability considerations increasingly influence product development, with manufacturers focusing on energy efficiency, recyclable materials, and reduced waste generation.

Strategic acquisitions continue to reshape the competitive landscape as established companies acquire specialized technology providers to enhance their automation portfolios. Recent consolidation activities have created more comprehensive solution providers capable of addressing diverse laboratory automation requirements through integrated platforms.

Technology partnerships between robotics manufacturers and software developers have accelerated the integration of advanced control systems, artificial intelligence capabilities, and laboratory information management systems. These collaborations enable more sophisticated automation solutions that provide seamless integration with existing laboratory workflows.

Regulatory developments in pharmaceutical and clinical diagnostics sectors have created new requirements for automated systems, driving demand for enhanced documentation, traceability, and validation capabilities. MarkWide Research analysis indicates that regulatory compliance features now influence purchasing decisions in approximately 85% of automation projects.

Innovation investments in collaborative robotics, artificial intelligence, and advanced sensor technologies have resulted in next-generation systems with enhanced capabilities and improved user experiences. The development of standardized interfaces and communication protocols facilitates easier integration and interoperability between different automation components.

Market expansion initiatives by leading manufacturers include establishment of regional service centers, local partnerships, and customized solutions for emerging market requirements. These developments support global market growth and improve customer support capabilities in diverse geographic regions.

Investment priorities should focus on companies demonstrating strong technological innovation capabilities, particularly in artificial intelligence integration and collaborative robotics development. Organizations with comprehensive service offerings and established customer relationships are positioned for sustained growth in the evolving market landscape.

Market entry strategies for new participants should emphasize specialized applications or underserved market segments where established players have limited presence. Focusing on cost-effective solutions for smaller laboratories or emerging market requirements can provide differentiation opportunities and competitive advantages.

Technology development recommendations include continued investment in user interface improvements, system modularity, and integration capabilities that address evolving customer requirements. The incorporation of predictive analytics and autonomous optimization features will become increasingly important for maintaining competitive positioning.

Partnership opportunities exist between robotics manufacturers and software developers, laboratory equipment providers, and system integrators to create comprehensive automation solutions. These collaborations can accelerate market penetration and enhance value propositions for end-user customers.

Geographic expansion strategies should prioritize Asia-Pacific and Latin American markets where research infrastructure investment is accelerating. Establishing local partnerships and service capabilities will be essential for success in these emerging regions. Customer education initiatives can help overcome adoption barriers and demonstrate the value proposition of advanced laboratory automation solutions.

Market trajectory indicates sustained growth driven by continued technological advancement, expanding application areas, and increasing adoption across diverse industry segments. The integration of artificial intelligence, machine learning, and advanced sensor technologies will create more capable and autonomous laboratory systems that can adapt to changing research requirements.

Technology evolution will focus on enhanced human-robot collaboration, improved user interfaces, and greater system intelligence that reduces programming complexity and maintenance requirements. The development of standardized platforms and modular architectures will facilitate easier customization and scalability for diverse laboratory applications.

Market expansion is expected to accelerate in emerging regions as research infrastructure development continues and international pharmaceutical companies establish regional operations. The growing emphasis on personalized medicine, precision therapeutics, and advanced materials research will create new application opportunities for laboratory robotic systems.

Industry consolidation trends will likely continue as companies seek to create comprehensive automation platforms through strategic acquisitions and partnerships. This consolidation will result in more integrated solutions and improved customer support capabilities across global markets. MWR projections indicate that market penetration rates will reach 78% among major research institutions within the next five years, reflecting the technology’s transition from early adoption to mainstream implementation.

Innovation focus will shift toward autonomous laboratory operations, predictive maintenance capabilities, and seamless integration with digital laboratory ecosystems. The convergence of robotics, artificial intelligence, and cloud computing technologies will enable new service models and recurring revenue opportunities for market participants.

The laboratory robotic arm market represents a dynamic and rapidly evolving sector that continues to transform scientific research methodologies across multiple industries. The convergence of advanced robotics, artificial intelligence, and laboratory automation technologies has created unprecedented opportunities for enhancing research productivity, improving data quality, and reducing operational costs.

Market fundamentals remain strong, supported by increasing demand for high-throughput research capabilities, growing emphasis on regulatory compliance, and the need for enhanced laboratory safety. The sector’s growth trajectory reflects the successful demonstration of return on investment metrics and the proven benefits of automation in diverse laboratory applications.

Future success in this market will depend on continued technological innovation, strategic partnerships, and the ability to address evolving customer requirements through flexible, user-friendly solutions. The integration of collaborative robotics, artificial intelligence, and cloud-based management platforms will define the next generation of laboratory automation systems, creating new opportunities for market participants and stakeholders throughout the value chain.

What is Laboratory Robotic Arm?

Laboratory robotic arms are automated devices designed to perform precise tasks in laboratory settings, such as sample handling, liquid dispensing, and repetitive testing. They enhance efficiency and accuracy in various scientific and research applications.

What are the key players in the Laboratory Robotic Arm Market?

Key players in the Laboratory Robotic Arm Market include companies like ABB, KUKA, and Yaskawa Electric Corporation, which are known for their innovative robotic solutions. These companies focus on enhancing automation in laboratories and research facilities, among others.

What are the growth factors driving the Laboratory Robotic Arm Market?

The Laboratory Robotic Arm Market is driven by factors such as the increasing demand for automation in laboratories, the need for high precision in experiments, and the growing focus on reducing human error in scientific research. Additionally, advancements in robotics technology contribute to market growth.

What challenges does the Laboratory Robotic Arm Market face?

Challenges in the Laboratory Robotic Arm Market include high initial investment costs, the complexity of integration with existing laboratory systems, and the need for skilled personnel to operate and maintain these robotic systems. These factors can hinder widespread adoption.

What opportunities exist in the Laboratory Robotic Arm Market?

Opportunities in the Laboratory Robotic Arm Market include the development of more affordable and user-friendly robotic solutions, the expansion of applications in fields like pharmaceuticals and biotechnology, and the potential for collaboration with artificial intelligence technologies to enhance functionality.

What trends are shaping the Laboratory Robotic Arm Market?

Trends in the Laboratory Robotic Arm Market include the increasing use of collaborative robots (cobots) that work alongside human operators, advancements in machine learning for improved automation, and a growing emphasis on sustainability in robotic design and operation.

Laboratory Robotic Arm Market

| Segmentation Details | Description |

|---|---|

| Product Type | Articulated Arms, SCARA Arms, Cartesian Arms, Delta Arms |

| Technology | Electric, Pneumatic, Hydraulic, Hybrid |

| End User | Pharmaceuticals, Biotechnology, Academic Research, Industrial Automation |

| Application | Material Handling, Assembly, Packaging, Quality Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Laboratory Robotic Arm Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at