444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The laboratory-grown diamonds (LGDs) market is experiencing rapid growth, driven by factors such as increasing consumer awareness of ethical and sustainable jewelry options, advancements in diamond-growing technology, and shifting preferences towards environmentally responsible products. Laboratory-grown diamonds, also known as synthetic or cultured diamonds, are chemically and optically identical to natural diamonds but are created in controlled laboratory environments rather than mined from the earth. With the rising demand for eco-friendly and affordable luxury goods, the LGDs market is poised for continued expansion in the jewelry industry.

Meaning

Laboratory-grown diamonds are diamonds produced through a process known as chemical vapor deposition (CVD) or high-pressure high-temperature (HPHT) synthesis in specialized laboratory settings. These diamonds have the same chemical composition, crystal structure, and physical properties as natural diamonds formed over millions of years beneath the earth’s surface. However, laboratory-grown diamonds are created within weeks or months using advanced technology that replicates the natural conditions required for diamond formation. LGDs offer consumers an ethical, sustainable, and cost-effective alternative to mined diamonds, without compromising on quality or beauty.

Executive Summary

The laboratory-grown diamonds market is witnessing significant growth, fueled by factors such as the increasing demand for ethical and sustainable jewelry options, advancements in diamond-growing technology, and changing consumer preferences towards eco-friendly luxury goods. Key market players are focusing on product innovation, branding, and marketing strategies to capitalize on emerging opportunities and gain a competitive edge in the market. Additionally, the expansion of online retail channels, the rise of custom jewelry design, and the growing influence of social media on consumer purchasing decisions are expected to further fuel market growth in the foreseeable future.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The laboratory-grown diamonds market is characterized by dynamic consumer preferences, evolving industry standards, and technological advancements in diamond-growing technology. Key market players are continuously innovating to stay ahead of the competition and meet the changing needs of consumers worldwide. Additionally, the rise of online jewelry platforms, customizable jewelry design tools, and social media influencers has facilitated greater product visibility, consumer engagement, and brand loyalty within the market.

Regional Analysis

The laboratory-grown diamonds market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are significant markets for laboratory-grown diamonds, driven by consumer awareness of ethical and sustainable jewelry options, regulatory initiatives promoting responsible sourcing, and the presence of leading diamond-growing companies. Asia Pacific is witnessing rapid market growth, fueled by emerging consumer markets, increasing disposable incomes, and the popularity of lab-grown diamonds among younger demographics. Latin America and the Middle East and Africa regions are also emerging markets with growing demand for ethical and sustainable luxury goods.

Competitive Landscape

Leading Companies in the Laboratory-grown Diamonds (LGDs) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The laboratory-grown diamonds market can be segmented based on diamond type, color, clarity, carat weight, and end-use application. Diamond types include white diamonds, fancy colored diamonds, and melee diamonds for use in jewelry, watches, and industrial applications. Color grades range from colorless (D-F) to near colorless (G-J) and faint yellow (K-M), with varying degrees of saturation and intensity. Clarity grades range from internally flawless (IF) to included (I3), reflecting the presence of internal and external blemishes and inclusions. Carat weights vary from small sizes (0.01-0.25 carats) to large sizes (1.00 carat and above), catering to different budget ranges and aesthetic preferences. End-use applications encompass engagement rings, wedding bands, earrings, necklaces, bracelets, and other fine jewelry pieces.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has led to changes in consumer behavior and shopping habits, including increased demand for online jewelry purchases, contactless transactions, and virtual consultations. With disruptions in supply chains and temporary closures of brick-and-mortar stores, consumers have turned to e-commerce platforms, digital channels, and social media for purchasing jewelry, including laboratory-grown diamonds. Additionally, the rise of virtual events, online auctions, and virtual try-on experiences has facilitated greater product discovery, consumer engagement, and brand loyalty within the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The laboratory-grown diamonds market is expected to continue its rapid growth in the coming years, driven by factors such as increasing consumer awareness of ethical and sustainable jewelry options, advancements in diamond-growing technology, and changing preferences towards eco-friendly luxury goods. Key market players are likely to invest in product innovation, branding, and marketing initiatives to capitalize on emerging opportunities and maintain their competitive edge in the market. Additionally, the expansion of online retail channels, the rise of custom jewelry design, and the growing influence of social media on consumer purchasing decisions are expected to further fuel market growth and enhance brand visibility and accessibility for consumers worldwide.

Conclusion

In conclusion, the laboratory-grown diamonds market is experiencing rapid growth, driven by increasing consumer awareness of ethical and sustainable jewelry options, advancements in diamond-growing technology, and changing preferences towards eco-friendly luxury goods. Despite challenges such as perception issues, competition from natural diamonds, and regulatory uncertainty, the market is expected to continue its upward trajectory in the foreseeable future. With the expansion of online retail channels, investment in digital marketing, and collaboration with jewelry designers and influencers, laboratory-grown diamonds are poised to become increasingly popular among consumers seeking ethical, sustainable, and affordable luxury goods, contributing to the growth and vibrancy of the jewelry industry globally.

What is Laboratory-grown Diamonds (LGDs)?

Laboratory-grown diamonds (LGDs) are diamonds that are created in controlled environments using advanced technological processes that replicate the natural conditions under which diamonds form. They possess the same physical, chemical, and optical properties as natural diamonds, making them indistinguishable to the naked eye.

What are the key players in the Laboratory-grown Diamonds (LGDs) Market?

Key players in the Laboratory-grown Diamonds (LGDs) Market include companies like Diamond Foundry, Brilliant Earth, and De Beers Group, which are known for their innovative approaches to diamond production and marketing. These companies are competing to capture market share by offering a range of products and services, including engagement rings and other jewelry, among others.

What are the growth factors driving the Laboratory-grown Diamonds (LGDs) Market?

The Laboratory-grown Diamonds (LGDs) Market is driven by factors such as increasing consumer awareness of ethical sourcing, the growing demand for sustainable products, and advancements in technology that enhance the quality of LGDs. Additionally, the affordability of LGDs compared to natural diamonds is attracting a broader customer base.

What challenges does the Laboratory-grown Diamonds (LGDs) Market face?

The Laboratory-grown Diamonds (LGDs) Market faces challenges such as consumer perception issues regarding the value of LGDs compared to natural diamonds and potential regulatory hurdles related to labeling and marketing. Additionally, competition from natural diamond producers can impact market growth.

What opportunities exist in the Laboratory-grown Diamonds (LGDs) Market?

Opportunities in the Laboratory-grown Diamonds (LGDs) Market include expanding into new geographic regions, developing innovative marketing strategies to educate consumers, and creating partnerships with retailers to enhance distribution channels. The rising trend of customization in jewelry also presents significant growth potential.

What trends are shaping the Laboratory-grown Diamonds (LGDs) Market?

Trends shaping the Laboratory-grown Diamonds (LGDs) Market include the increasing popularity of online jewelry sales, the rise of eco-conscious consumerism, and advancements in production technology that allow for larger and higher-quality diamonds. Additionally, collaborations with fashion brands are becoming more common, influencing consumer preferences.

Laboratory-grown Diamonds (LGDs) Market

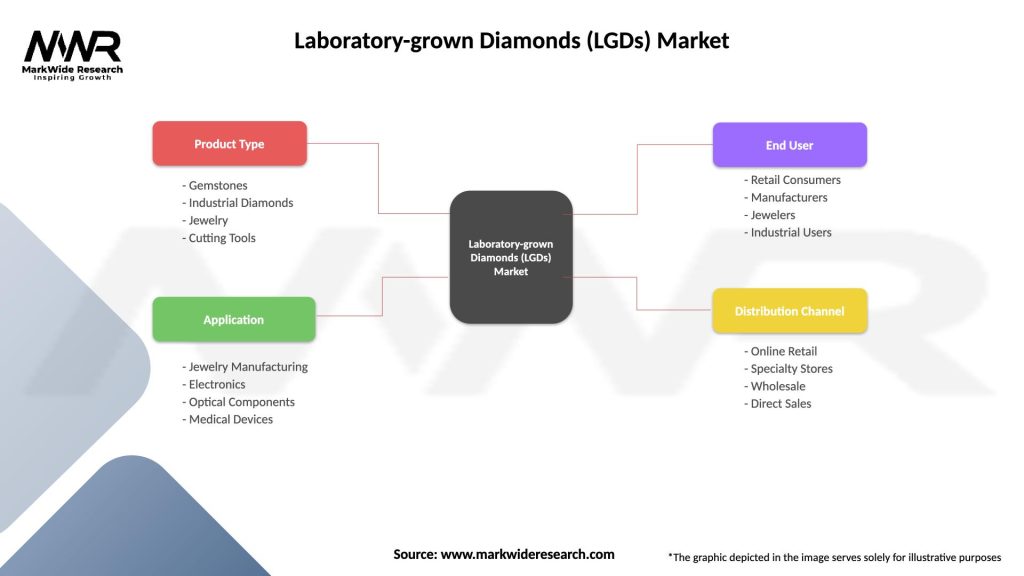

| Segmentation Details | Description |

|---|---|

| Product Type | Gemstones, Industrial Diamonds, Jewelry, Cutting Tools |

| Application | Jewelry Manufacturing, Electronics, Optical Components, Medical Devices |

| End User | Retail Consumers, Manufacturers, Jewelers, Industrial Users |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Laboratory-grown Diamonds (LGDs) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at