444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA temperature sensors market represents a rapidly expanding segment within the broader industrial automation and measurement technology landscape. Temperature sensors have become indispensable components across diverse industries, from automotive and aerospace to healthcare and consumer electronics. The market demonstrates robust growth driven by increasing demand for precision measurement, industrial automation, and smart technology integration.

Market dynamics indicate significant expansion opportunities as industries increasingly adopt advanced sensing technologies. The growing emphasis on process optimization and quality control has positioned temperature sensors as critical components in modern manufacturing and monitoring systems. With technological advancements enabling higher accuracy and reliability, the market continues to attract substantial investment and innovation.

Regional distribution shows strong growth across North America, Europe, and Asia-Pacific, with emerging markets demonstrating particularly impressive adoption rates. The market benefits from increasing industrial automation, growing automotive production, and expanding healthcare infrastructure. MarkWide Research analysis indicates that the temperature sensors market is experiencing accelerated growth, with adoption rates reaching 78% across major industrial sectors.

Technology evolution continues to drive market expansion, with wireless sensors, IoT integration, and smart monitoring systems creating new application opportunities. The convergence of artificial intelligence and sensor technology is opening unprecedented possibilities for predictive maintenance and automated control systems.

The LA temperature sensors market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and application of temperature measurement devices across various industries and geographic regions. Temperature sensors are electronic devices designed to detect and measure thermal variations, converting temperature changes into readable electrical signals for monitoring, control, and data analysis purposes.

These sophisticated devices operate through various technological principles, including thermocouples, resistance temperature detectors (RTDs), thermistors, and infrared sensors. Each technology offers distinct advantages for specific applications, ranging from high-temperature industrial processes to precision medical monitoring systems.

Market scope encompasses both traditional analog sensors and advanced digital solutions featuring wireless connectivity, data logging capabilities, and integration with industrial Internet of Things (IoT) platforms. The market includes various form factors, from miniature sensors for consumer electronics to robust industrial-grade devices capable of operating in extreme environments.

Application diversity spans multiple sectors including automotive engine management, HVAC systems, food processing, pharmaceutical manufacturing, and environmental monitoring. The market’s evolution reflects the growing need for accurate temperature measurement in increasingly complex and automated industrial processes.

The LA temperature sensors market demonstrates exceptional growth momentum driven by industrial automation trends, technological advancement, and expanding application domains. Key market drivers include increasing demand for process optimization, quality control requirements, and the growing adoption of smart manufacturing technologies.

Market segmentation reveals diverse opportunities across technology types, with RTD sensors showing particularly strong growth at 12.4% annual adoption rate due to their superior accuracy and stability. The automotive sector represents the largest application segment, accounting for significant market share driven by electric vehicle development and advanced driver assistance systems.

Competitive landscape features established players alongside innovative startups, creating a dynamic environment for technological advancement and market expansion. Leading companies are investing heavily in research and development, focusing on wireless connectivity, miniaturization, and enhanced accuracy capabilities.

Regional analysis indicates strong growth across all major markets, with Asia-Pacific demonstrating the highest growth rates due to rapid industrialization and manufacturing expansion. North America and Europe maintain strong positions through technological innovation and high-value applications in aerospace, healthcare, and precision manufacturing.

Future outlook remains highly positive, with emerging technologies such as artificial intelligence integration, edge computing capabilities, and advanced materials science driving continued innovation and market expansion opportunities.

Strategic market analysis reveals several critical insights shaping the temperature sensors landscape. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating supply chain challenges while maintaining innovation momentum.

Market maturity varies significantly across different technology segments, with traditional thermocouples maintaining steady demand while digital sensors experience rapid growth. The convergence of multiple sensing technologies within single devices creates new opportunities for comprehensive monitoring solutions.

Industrial automation expansion serves as the primary catalyst for temperature sensor market growth. Manufacturing facilities worldwide are implementing comprehensive automation systems requiring precise temperature monitoring for process control, quality assurance, and equipment protection. This trend accelerates across industries seeking operational efficiency and cost reduction.

Automotive industry transformation significantly impacts market demand, particularly with electric vehicle development requiring sophisticated thermal management systems. Battery temperature monitoring, motor control, and charging system optimization create substantial opportunities for advanced sensor technologies. The shift toward autonomous vehicles further amplifies sensor requirements for environmental monitoring and system reliability.

Healthcare sector growth drives demand for precision temperature sensors in medical devices, pharmaceutical manufacturing, and patient monitoring systems. Regulatory compliance requirements and patient safety considerations necessitate highly accurate and reliable temperature measurement solutions across healthcare applications.

Environmental monitoring initiatives create expanding opportunities as governments and organizations implement comprehensive climate monitoring programs. Smart city developments, agricultural optimization, and industrial emissions monitoring require extensive sensor networks for data collection and analysis.

Consumer electronics evolution continues driving miniaturization and cost reduction efforts while maintaining performance standards. Smartphones, wearable devices, and smart home systems integrate temperature sensors for user experience enhancement and device protection.

High implementation costs present significant challenges for smaller organizations seeking to adopt advanced temperature sensing technologies. Initial investment requirements for comprehensive monitoring systems, including sensors, infrastructure, and software integration, can be substantial barriers to market entry.

Technical complexity associated with sensor integration and calibration creates obstacles for organizations lacking specialized expertise. Proper installation, configuration, and maintenance of advanced temperature sensing systems require skilled personnel and ongoing training investments.

Calibration requirements impose ongoing operational costs and complexity, particularly for applications demanding high accuracy. Regular calibration schedules, specialized equipment, and certified procedures add to the total cost of ownership for temperature sensing systems.

Environmental limitations restrict sensor performance in extreme conditions, limiting application possibilities in harsh industrial environments. Temperature extremes, corrosive atmospheres, and electromagnetic interference can compromise sensor reliability and accuracy.

Standardization challenges across different industries and regions create compatibility issues and increase development costs. Varying regulatory requirements and technical specifications complicate product development and market entry strategies for sensor manufacturers.

Internet of Things integration presents unprecedented opportunities for temperature sensor market expansion. The growing IoT ecosystem creates demand for connected sensors capable of wireless communication, remote monitoring, and integration with cloud-based analytics platforms. This convergence enables new business models and service opportunities.

Artificial intelligence applications open new frontiers for intelligent temperature monitoring systems. Machine learning algorithms can analyze sensor data patterns to predict equipment failures, optimize processes, and automate control decisions, creating significant value for end users.

Emerging market expansion offers substantial growth potential as developing economies invest in industrial infrastructure, healthcare systems, and environmental monitoring capabilities. These markets present opportunities for both established players and innovative newcomers.

Renewable energy sector growth creates demand for specialized temperature sensors in solar panels, wind turbines, and energy storage systems. Thermal management becomes critical for optimizing renewable energy system performance and longevity.

Food safety regulations drive increasing demand for temperature monitoring throughout the food supply chain. Cold chain management, processing facility monitoring, and retail temperature control create expanding market opportunities for sensor manufacturers.

Supply chain evolution significantly impacts market dynamics as manufacturers adapt to global disruptions and seek supply chain resilience. Companies are diversifying supplier networks, investing in local manufacturing capabilities, and implementing flexible production strategies to maintain market competitiveness.

Technological convergence creates both opportunities and challenges as traditional sensor boundaries blur. The integration of multiple sensing capabilities within single devices requires new design approaches and manufacturing processes while offering enhanced value propositions for customers.

Customer expectations continue evolving toward more sophisticated solutions offering greater functionality, reliability, and ease of use. End users increasingly demand plug-and-play installation, wireless connectivity, and comprehensive data analytics capabilities from temperature sensing systems.

Competitive intensity increases as new entrants leverage advanced technologies to challenge established players. Innovation cycles accelerate, requiring continuous investment in research and development to maintain market position and customer relevance.

Regulatory landscape evolution affects market dynamics through changing safety standards, environmental requirements, and industry-specific regulations. Companies must adapt products and processes to meet evolving compliance requirements while maintaining cost competitiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technology experts, and end users across various application segments and geographic regions.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market trends, competitive positioning, and technological developments. This approach provides historical context and validates primary research findings.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth, segment performance, and regional trends. Data validation through multiple sources ensures reliability and accuracy of numerical projections and market sizing estimates.

Qualitative assessment focuses on understanding market dynamics, competitive strategies, and emerging trends through expert interviews and industry observation. This methodology provides insights into factors driving market evolution and future opportunities.

Technology assessment involves detailed evaluation of emerging technologies, patent landscapes, and innovation trends to identify potential market disruptors and growth opportunities. This analysis helps stakeholders understand the technological trajectory and investment priorities.

North America maintains a leading position in the temperature sensors market, driven by advanced manufacturing capabilities, strong automotive industry presence, and significant healthcare sector investments. The region demonstrates 65% adoption rate of advanced sensor technologies across major industrial applications. United States leads regional growth through aerospace, defense, and technology sector demand.

Europe shows robust market performance with particular strength in automotive applications and industrial automation. Germany and France lead regional development through automotive manufacturing and industrial equipment production. The region’s emphasis on environmental monitoring and energy efficiency creates substantial opportunities for temperature sensor applications.

Asia-Pacific demonstrates the highest growth rates globally, with China, Japan, and South Korea driving market expansion through manufacturing growth and technology adoption. The region accounts for approximately 45% of global sensor production and shows increasing domestic demand across multiple application sectors.

Latin America presents emerging opportunities through industrial development and infrastructure investment. Brazil and Mexico lead regional growth, particularly in automotive and manufacturing applications. The region shows increasing adoption of advanced sensor technologies for process optimization and quality control.

Middle East and Africa demonstrate growing market potential through oil and gas industry applications, renewable energy projects, and industrial development initiatives. The region’s harsh environmental conditions create demand for specialized sensor solutions capable of reliable operation in extreme temperatures.

Market leadership features a diverse mix of established multinational corporations and innovative technology companies. The competitive environment encourages continuous innovation and strategic partnerships to address evolving customer requirements and market opportunities.

Strategic initiatives include mergers and acquisitions, technology partnerships, and research collaborations to enhance product capabilities and market reach. Companies invest heavily in developing next-generation sensor technologies incorporating wireless connectivity, artificial intelligence, and advanced materials.

Innovation focus centers on miniaturization, accuracy improvement, and cost reduction while maintaining reliability and performance standards. Leading companies establish dedicated research facilities and collaborate with universities to advance sensor technology development.

Technology-based segmentation reveals distinct market characteristics and growth patterns across different sensor types. Each technology offers unique advantages for specific applications, creating diverse market opportunities and competitive dynamics.

By Technology:

By Application:

By End-User Industry:

Automotive category demonstrates exceptional growth driven by electric vehicle development and advanced driver assistance systems. Temperature sensors play critical roles in battery management, motor control, and cabin climate systems. The category shows 15.2% annual growth in sensor integration across vehicle platforms.

Industrial automation segment maintains steady expansion through manufacturing digitization and Industry 4.0 initiatives. Temperature monitoring becomes essential for predictive maintenance, quality control, and process optimization. Smart factory implementations drive demand for connected sensor solutions with advanced analytics capabilities.

Healthcare applications show increasing sophistication with precision requirements and regulatory compliance driving technology advancement. Medical device integration, pharmaceutical cold chain management, and patient monitoring create diverse opportunities for specialized sensor solutions.

Consumer electronics category emphasizes miniaturization and cost optimization while maintaining performance standards. Smartphone thermal management, wearable device integration, and smart home applications drive volume growth and technology innovation.

Energy sector applications expand through renewable energy adoption and grid modernization initiatives. Solar panel optimization, wind turbine monitoring, and energy storage thermal management create new market segments with specialized requirements.

Manufacturers benefit from expanding market opportunities across diverse application segments and geographic regions. The growing demand for temperature sensors enables revenue growth, technology advancement, and market share expansion through innovation and strategic positioning.

Technology suppliers gain from increasing integration requirements and demand for advanced sensor capabilities. Component manufacturers, software developers, and system integrators find expanding opportunities in the evolving sensor ecosystem.

End users achieve operational improvements through enhanced process control, quality assurance, and equipment reliability. Temperature monitoring systems enable cost reduction, efficiency gains, and regulatory compliance across various industries and applications.

System integrators benefit from growing demand for comprehensive monitoring solutions combining multiple sensor types with analytics and control capabilities. The market evolution toward integrated systems creates opportunities for value-added services and long-term customer relationships.

Research institutions find expanding collaboration opportunities with industry partners seeking advanced sensor technologies and innovative applications. Academic research contributes to technology advancement while benefiting from industry funding and practical application insights.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless connectivity adoption accelerates across all application segments as users seek installation flexibility and remote monitoring capabilities. MWR analysis indicates that wireless sensor adoption rates reach 82% in new installations, driven by reduced installation costs and enhanced functionality.

Artificial intelligence integration transforms temperature sensors from simple measurement devices into intelligent monitoring systems capable of predictive analysis and automated decision-making. Machine learning algorithms analyze sensor data patterns to optimize processes and prevent equipment failures.

Miniaturization continues as manufacturers develop smaller sensors without compromising accuracy or reliability. Advanced packaging technologies and materials science enable sensor integration into space-constrained applications while maintaining performance standards.

Energy efficiency focus drives development of low-power sensor solutions suitable for battery-operated and energy-harvesting applications. Ultra-low-power designs enable long-term deployment without maintenance while supporting sustainability objectives.

Multi-parameter sensing becomes increasingly common as single devices integrate temperature measurement with humidity, pressure, and other environmental parameters. This trend reduces system complexity and installation costs while providing comprehensive monitoring capabilities.

Edge computing capabilities enable sensors to perform local data processing and analysis, reducing network bandwidth requirements and enabling real-time decision-making. This trend supports autonomous system development and reduces dependence on cloud connectivity.

Strategic partnerships between sensor manufacturers and technology companies accelerate innovation and market expansion. Collaborations focus on developing integrated solutions combining sensors with analytics software, connectivity platforms, and artificial intelligence capabilities.

Manufacturing capacity expansion occurs globally as companies invest in production facilities to meet growing demand. New facilities incorporate advanced manufacturing technologies to improve quality, reduce costs, and enhance production flexibility.

Technology acquisitions enable companies to expand capabilities and enter new market segments. Strategic acquisitions focus on specialized sensor technologies, software platforms, and market access opportunities.

Research investments increase as companies and institutions develop next-generation sensor technologies. Focus areas include advanced materials, nanotechnology applications, and novel sensing principles for enhanced performance and new applications.

Standardization efforts advance through industry collaboration to establish common protocols for sensor communication, data formats, and interoperability. These initiatives reduce integration complexity and accelerate market adoption.

Sustainability initiatives drive development of environmentally friendly sensor solutions using recyclable materials and energy-efficient designs. Companies implement circular economy principles in product development and manufacturing processes.

Investment prioritization should focus on wireless sensor technologies and IoT integration capabilities as these represent the highest growth potential segments. Companies should allocate resources toward developing connected sensor solutions with advanced analytics capabilities.

Market entry strategies for new participants should emphasize niche applications and specialized requirements where established players may have limited presence. Focus on emerging applications in renewable energy, smart cities, and healthcare technology offers opportunities for market penetration.

Technology development should prioritize artificial intelligence integration, edge computing capabilities, and multi-parameter sensing to address evolving customer requirements. Investment in these areas positions companies for long-term competitive advantage.

Geographic expansion opportunities exist in emerging markets where industrial development and infrastructure investment create growing demand for temperature sensing solutions. Strategic partnerships with local distributors and system integrators facilitate market entry.

Customer engagement strategies should emphasize value-added services, technical support, and application expertise to differentiate from commodity suppliers. Building long-term customer relationships through comprehensive solutions creates competitive advantages.

Supply chain resilience requires diversification of supplier networks and investment in local manufacturing capabilities to mitigate disruption risks. Companies should develop flexible production strategies and maintain strategic inventory levels.

Market trajectory remains strongly positive with continued growth expected across all major segments and geographic regions. The convergence of multiple technology trends creates unprecedented opportunities for sensor manufacturers and system integrators.

Technology evolution will accelerate with artificial intelligence, edge computing, and advanced materials driving next-generation sensor capabilities. These developments enable new applications and business models while improving performance and reducing costs.

Application expansion continues as industries discover new uses for temperature sensing technology. Emerging applications in autonomous vehicles, smart infrastructure, and environmental monitoring create substantial growth opportunities.

Market consolidation may occur as larger companies acquire specialized technology providers and smaller players to expand capabilities and market reach. This trend could accelerate innovation while creating more comprehensive solution offerings.

Regulatory evolution will influence market development through new safety standards, environmental requirements, and industry-specific regulations. Companies must adapt products and processes to meet evolving compliance requirements while maintaining competitiveness.

Sustainability focus will increasingly influence product development and manufacturing processes as customers and regulators emphasize environmental responsibility. Companies investing in sustainable practices gain competitive advantages and market access opportunities.

The LA temperature sensors market demonstrates exceptional growth potential driven by technological advancement, expanding applications, and increasing industrial automation adoption. Market dynamics favor companies investing in innovation, customer relationships, and strategic positioning across diverse application segments.

Success factors include technology leadership, market diversification, and customer-centric solution development. Companies must balance innovation investment with operational efficiency while maintaining quality standards and competitive pricing.

Future opportunities emerge from IoT integration, artificial intelligence applications, and expanding global markets. Organizations positioning themselves at the intersection of these trends will capture the greatest market opportunities and achieve sustainable competitive advantages in the evolving temperature sensors landscape.

What is LA Temperature Sensors?

LA Temperature Sensors are devices used to measure temperature in various applications, including industrial processes, HVAC systems, and environmental monitoring. They provide accurate temperature readings and are essential for maintaining optimal conditions in numerous settings.

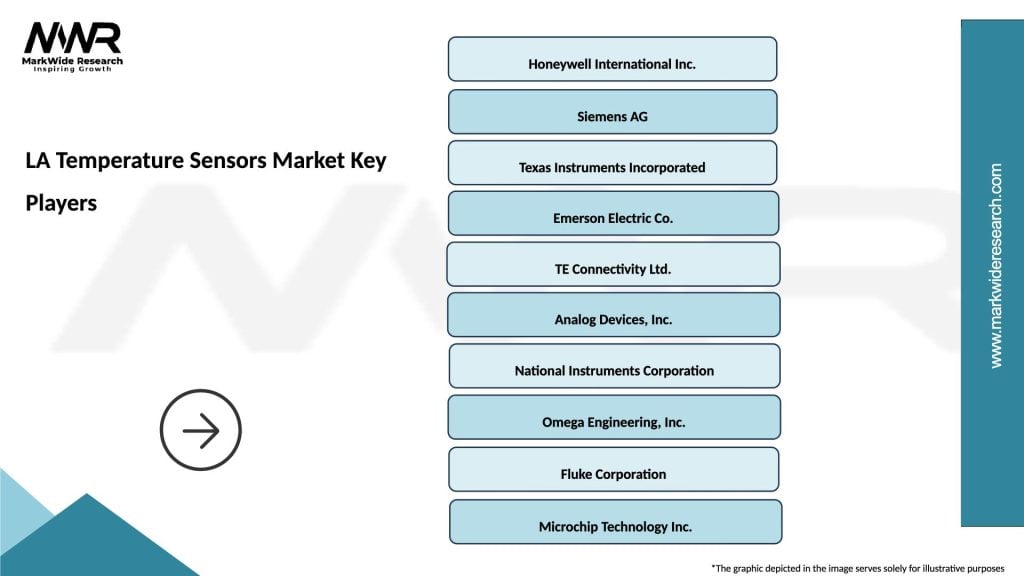

What are the key players in the LA Temperature Sensors Market?

Key players in the LA Temperature Sensors Market include companies like Honeywell, Siemens, and Texas Instruments, which are known for their innovative temperature sensing technologies. These companies focus on developing advanced sensors for various applications, including automotive and industrial sectors, among others.

What are the growth factors driving the LA Temperature Sensors Market?

The LA Temperature Sensors Market is driven by the increasing demand for automation in industries, the growth of smart home technologies, and the rising need for accurate temperature monitoring in healthcare. These factors contribute to the expanding applications of temperature sensors across various sectors.

What challenges does the LA Temperature Sensors Market face?

The LA Temperature Sensors Market faces challenges such as the high cost of advanced sensors and the need for regular calibration to maintain accuracy. Additionally, competition from alternative temperature measurement technologies can hinder market growth.

What opportunities exist in the LA Temperature Sensors Market?

Opportunities in the LA Temperature Sensors Market include the development of wireless temperature sensors and the integration of IoT technology for real-time monitoring. These advancements can enhance efficiency in sectors like agriculture and food safety.

What trends are shaping the LA Temperature Sensors Market?

Trends in the LA Temperature Sensors Market include the increasing adoption of smart sensors and the focus on miniaturization for compact applications. Additionally, there is a growing emphasis on sustainability, leading to the development of eco-friendly sensor materials.

LA Temperature Sensors Market

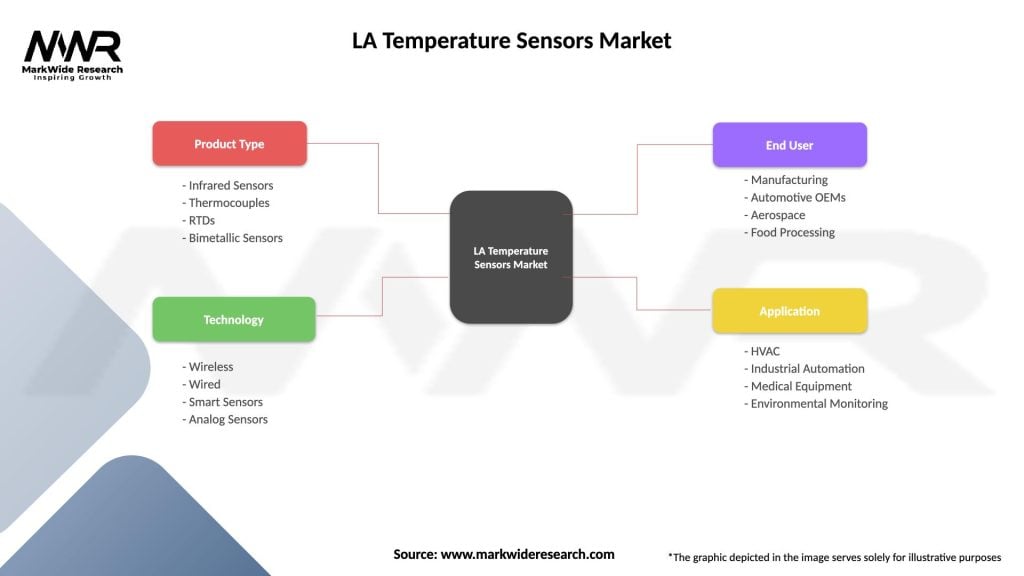

| Segmentation Details | Description |

|---|---|

| Product Type | Infrared Sensors, Thermocouples, RTDs, Bimetallic Sensors |

| Technology | Wireless, Wired, Smart Sensors, Analog Sensors |

| End User | Manufacturing, Automotive OEMs, Aerospace, Food Processing |

| Application | HVAC, Industrial Automation, Medical Equipment, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Temperature Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at