444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA packaging automation market represents a transformative segment within the broader industrial automation landscape, encompassing advanced technologies that streamline packaging processes across diverse industries. This dynamic market has experienced remarkable growth momentum, driven by increasing demand for operational efficiency, cost reduction, and enhanced product quality in packaging operations. Manufacturing companies across Los Angeles and surrounding regions are increasingly adopting automated packaging solutions to maintain competitive advantages in today’s fast-paced business environment.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. The integration of cutting-edge technologies including artificial intelligence, machine learning, and Internet of Things (IoT) capabilities has revolutionized traditional packaging methodologies. Industry leaders are investing heavily in automated packaging systems to address labor shortages, improve consistency, and meet stringent quality standards demanded by consumers and regulatory bodies.

Regional factors contributing to market growth include LA’s strategic position as a major manufacturing hub, proximity to key shipping ports, and concentration of diverse industries ranging from food and beverage to pharmaceuticals and consumer goods. The market encompasses various automation levels, from semi-automated systems to fully integrated packaging lines that require minimal human intervention.

The LA packaging automation market refers to the comprehensive ecosystem of automated technologies, equipment, and systems designed to streamline, optimize, and enhance packaging processes within the Los Angeles metropolitan area and surrounding regions. This market encompasses sophisticated machinery, software solutions, and integrated systems that reduce manual labor requirements while improving packaging speed, accuracy, and consistency across various industrial applications.

Packaging automation involves the implementation of advanced technologies including robotic systems, conveyor networks, sorting mechanisms, filling equipment, sealing devices, labeling systems, and quality control sensors. These integrated solutions work cohesively to transform raw materials and products into finished, packaged goods ready for distribution and retail sale.

Key components of packaging automation include primary packaging (direct product contact), secondary packaging (grouping and protection), and tertiary packaging (transportation and storage). The market serves diverse sectors including food processing, pharmaceutical manufacturing, consumer electronics, automotive parts, and e-commerce fulfillment operations throughout the LA region.

Market expansion in the LA packaging automation sector reflects broader industrial transformation trends, with companies increasingly prioritizing efficiency, sustainability, and technological advancement. The market demonstrates strong growth potential driven by evolving consumer preferences, regulatory requirements, and competitive pressures that demand higher packaging standards and faster turnaround times.

Technology adoption rates have accelerated significantly, with approximately 73% of manufacturers in the region implementing some form of packaging automation within their operations. This widespread adoption stems from proven benefits including reduced labor costs, improved product quality, enhanced safety protocols, and increased production throughput capabilities.

Investment patterns show sustained commitment to automation technologies, with companies allocating substantial resources toward upgrading existing packaging infrastructure and implementing next-generation solutions. The market benefits from strong venture capital interest, government incentives for manufacturing modernization, and collaborative partnerships between technology providers and end-users.

Future projections indicate continued expansion as emerging technologies mature and become more accessible to small and medium-sized enterprises. The integration of artificial intelligence, predictive maintenance capabilities, and sustainable packaging materials represents significant growth opportunities for market participants.

Market intelligence reveals several critical insights that shape the LA packaging automation landscape:

Primary drivers propelling the LA packaging automation market include escalating labor costs, increasing demand for consistent product quality, and growing pressure to improve operational efficiency. Manufacturing companies face mounting challenges related to workforce availability, particularly skilled packaging personnel, creating strong incentives for automation adoption.

Consumer expectations continue evolving toward higher quality standards, faster delivery times, and enhanced product presentation. These demands necessitate packaging processes that deliver consistent results while maintaining cost-effectiveness. Automation technologies enable companies to meet these expectations while reducing human error and improving overall product reliability.

Regulatory requirements across industries such as pharmaceuticals, food and beverage, and medical devices mandate strict quality control and traceability standards. Automated packaging systems provide comprehensive documentation, real-time monitoring, and consistent compliance with regulatory guidelines that would be challenging to maintain through manual processes.

Competitive pressures within the LA market drive companies to seek operational advantages through technology adoption. Organizations implementing packaging automation gain significant competitive benefits including faster time-to-market, improved product quality, and enhanced customer satisfaction levels.

Implementation challenges present significant barriers to packaging automation adoption, particularly for small and medium-sized enterprises with limited capital resources. Initial investment costs for comprehensive automation systems can be substantial, requiring careful financial planning and often multi-year implementation strategies.

Technical complexity associated with modern packaging automation systems demands specialized expertise for installation, operation, and maintenance. Many companies struggle to find qualified personnel capable of managing sophisticated automated packaging equipment, creating operational challenges and potential system downtime risks.

Integration difficulties arise when attempting to incorporate new automation technologies with existing production infrastructure. Legacy systems may require significant modifications or complete replacement to accommodate modern packaging automation solutions, adding complexity and cost to implementation projects.

Customization requirements for specific packaging applications can limit the availability of standardized solutions, necessitating custom engineering and development work that increases project timelines and costs. This challenge particularly affects companies with unique packaging requirements or specialized product characteristics.

Emerging technologies present substantial growth opportunities within the LA packaging automation market, particularly in areas such as artificial intelligence, machine learning, and advanced robotics. These technologies enable more sophisticated packaging solutions with enhanced flexibility, adaptability, and performance capabilities.

E-commerce expansion creates significant demand for automated packaging solutions capable of handling diverse product types, varying order sizes, and rapid fulfillment requirements. The growing online retail sector requires packaging automation systems that can efficiently process high volumes while maintaining product protection and presentation standards.

Sustainability initiatives drive demand for packaging automation systems that support environmentally friendly materials and processes. Companies increasingly seek solutions that reduce waste, optimize material usage, and support recyclable or biodegradable packaging options while maintaining operational efficiency.

Small business adoption represents an underserved market segment with significant growth potential. As automation technologies become more affordable and accessible, smaller manufacturers gain opportunities to implement packaging automation solutions that were previously available only to large enterprises.

Supply chain evolution significantly influences packaging automation market dynamics, with companies seeking integrated solutions that seamlessly connect packaging operations with broader manufacturing and distribution processes. Digital transformation initiatives drive demand for smart packaging systems capable of real-time data collection, analysis, and optimization.

Labor market conditions continue shaping automation adoption patterns, with persistent workforce shortages in manufacturing sectors accelerating the transition toward automated packaging solutions. Companies report productivity improvements of up to 40% following packaging automation implementation, demonstrating clear operational benefits.

Technology convergence creates new possibilities for packaging automation, as advances in robotics, sensors, artificial intelligence, and connectivity enable more sophisticated and capable systems. These technological developments expand the range of packaging applications suitable for automation while improving system performance and reliability.

Market consolidation trends among packaging automation providers result in more comprehensive solution offerings and enhanced service capabilities. Strategic partnerships and acquisitions enable companies to deliver integrated systems that address complete packaging workflows rather than individual components.

Comprehensive analysis of the LA packaging automation market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research includes extensive interviews with industry executives, technology providers, end-users, and market experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses thorough analysis of industry publications, company reports, government data, trade association statistics, and academic studies related to packaging automation technologies and market developments. This approach provides historical context and validates primary research findings through multiple data sources.

Market modeling techniques incorporate quantitative analysis of market drivers, restraints, and growth factors to develop accurate projections and trend assessments. Statistical analysis of adoption rates, investment patterns, and technology deployment data supports comprehensive market understanding.

Expert validation processes ensure research accuracy through peer review and industry expert consultation. MarkWide Research employs rigorous quality control measures to verify data accuracy and maintain research integrity throughout the analysis process.

Los Angeles County dominates the regional packaging automation market, accounting for approximately 45% of total market activity due to its concentration of manufacturing facilities, distribution centers, and technology companies. The region benefits from excellent transportation infrastructure, skilled workforce availability, and proximity to major ports facilitating international trade.

Orange County represents a significant market segment with strong growth in pharmaceutical and medical device packaging automation. The area’s concentration of life sciences companies drives demand for specialized packaging solutions that meet stringent regulatory requirements and quality standards.

Riverside and San Bernardino Counties show rapid growth in packaging automation adoption, particularly in logistics and e-commerce fulfillment operations. These inland regions offer cost advantages for large-scale distribution facilities while maintaining access to LA’s transportation networks.

Ventura County demonstrates steady growth in food and beverage packaging automation, supported by the region’s agricultural processing industry and proximity to major consumer markets. The area’s focus on sustainable packaging solutions aligns with broader environmental initiatives throughout California.

Market leadership in the LA packaging automation sector includes both established industrial automation companies and specialized packaging technology providers. The competitive environment features diverse players ranging from global corporations to regional specialists offering customized solutions.

Competitive strategies focus on technology innovation, customer service excellence, and comprehensive solution offerings that address complete packaging workflows rather than individual components.

Technology-based segmentation reveals distinct market categories based on automation sophistication and application requirements:

Application-based segmentation addresses specific industry requirements:

Primary packaging automation focuses on direct product contact applications including filling, sealing, and immediate product protection. This category demonstrates strong growth driven by quality consistency requirements and contamination prevention needs. Technology advancement in this segment emphasizes precision, speed, and material compatibility across diverse product types.

Secondary packaging automation addresses product grouping, bundling, and protective packaging applications. This category shows robust expansion as companies seek to optimize case packing, shrink wrapping, and multi-product packaging operations. Integration capabilities with primary packaging systems create comprehensive automation solutions.

Tertiary packaging automation encompasses palletizing, stretch wrapping, and shipping preparation systems. This segment experiences significant growth due to e-commerce expansion and distribution efficiency requirements. Advanced robotics and artificial intelligence enable flexible palletizing patterns and optimized load configurations.

Quality control automation represents a rapidly growing category incorporating vision systems, weight checking, and defect detection technologies. Companies increasingly recognize the value of automated quality assurance in maintaining brand reputation and regulatory compliance.

Manufacturers gain substantial advantages through packaging automation implementation, including reduced labor costs, improved product quality, enhanced safety conditions, and increased production capacity. Operational efficiency improvements typically result in cost reductions of 25-35% while simultaneously improving output quality and consistency.

Technology providers benefit from sustained market demand, opportunities for innovation, and long-term customer relationships through service and support contracts. The market offers substantial revenue potential through equipment sales, system integration services, and ongoing maintenance agreements.

End consumers receive improved product quality, enhanced safety, and more consistent packaging presentation through automated processes. Supply chain efficiency improvements often translate to better product availability and competitive pricing in retail markets.

Regional economic development benefits from packaging automation adoption through job creation in technical fields, increased manufacturing competitiveness, and attraction of new businesses seeking advanced packaging capabilities. The technology sector expansion supports broader economic diversification and growth initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend in packaging automation, enabling predictive maintenance, quality optimization, and adaptive system performance. Machine learning algorithms analyze packaging operations in real-time, identifying opportunities for efficiency improvements and preventing potential system failures.

Sustainability focus drives development of packaging automation systems that support environmentally friendly materials and processes. Companies increasingly seek solutions that reduce waste, optimize material usage, and accommodate biodegradable or recyclable packaging options while maintaining operational efficiency.

Flexible automation systems gain popularity as manufacturers require packaging solutions capable of handling diverse product types and varying production volumes. Modular designs enable rapid reconfiguration for different packaging requirements without extensive system modifications.

Digital connectivity and Internet of Things (IoT) integration create smart packaging systems that provide real-time monitoring, remote diagnostics, and comprehensive data analytics. These capabilities enable proactive maintenance, performance optimization, and integration with broader manufacturing execution systems.

Technology partnerships between packaging automation providers and software companies create integrated solutions that combine hardware capabilities with advanced analytics and control systems. These collaborations result in more sophisticated packaging platforms that deliver enhanced performance and operational insights.

Investment expansion by major automation companies in LA region facilities demonstrates confidence in long-term market growth. MarkWide Research analysis indicates increased capital commitment to local manufacturing and service capabilities to support growing customer demand.

Regulatory developments in California environmental and safety standards influence packaging automation design and implementation requirements. Companies must ensure their systems comply with evolving regulations while maintaining operational efficiency and cost-effectiveness.

Workforce development initiatives between industry associations, educational institutions, and technology providers address skill gaps in packaging automation. These programs focus on training technical personnel capable of operating and maintaining sophisticated automated packaging systems.

Strategic planning for packaging automation implementation should emphasize comprehensive needs assessment, technology evaluation, and phased deployment approaches that minimize operational disruption. Companies should prioritize solutions that offer scalability and flexibility to accommodate future growth and changing requirements.

Investment decisions should consider total cost of ownership including initial capital, installation, training, and ongoing maintenance expenses. Return on investment analysis should account for both direct cost savings and indirect benefits such as improved quality, reduced waste, and enhanced customer satisfaction.

Technology selection should prioritize systems that offer integration capabilities with existing infrastructure and future expansion possibilities. Companies should evaluate vendors based on technical expertise, service capabilities, and long-term viability rather than solely on initial equipment costs.

Workforce preparation requires proactive training and development programs to ensure personnel can effectively operate and maintain automated packaging systems. Organizations should invest in technical education and establish relationships with equipment suppliers for ongoing support and training.

Market expansion projections indicate sustained growth in the LA packaging automation sector, driven by continued technology advancement, increasing labor costs, and growing demand for operational efficiency. MWR analysis suggests the market will experience accelerated adoption rates of 12-15% annually as automation technologies become more accessible and cost-effective.

Technology evolution will focus on artificial intelligence integration, enhanced flexibility, and improved sustainability features. Next-generation packaging automation systems will offer greater adaptability, reduced environmental impact, and seamless integration with digital manufacturing platforms.

Industry transformation will see packaging automation become standard practice across manufacturing sectors, with manual packaging operations becoming increasingly rare. This shift will create new job categories focused on system operation, maintenance, and optimization rather than manual packaging tasks.

Regional competitiveness will depend on continued investment in technology infrastructure, workforce development, and business-friendly policies that support manufacturing operations. The LA region’s success in maintaining packaging automation leadership will influence broader economic development and industrial competitiveness.

The LA packaging automation market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, operational efficiency requirements, and changing market demands. Companies across diverse industries are recognizing the strategic importance of packaging automation in maintaining competitive advantages and meeting customer expectations.

Market fundamentals remain strong, supported by robust demand drivers including labor cost pressures, quality consistency requirements, and regulatory compliance needs. The region’s technological infrastructure, skilled workforce, and diverse industrial base create favorable conditions for continued packaging automation expansion.

Future success in this market will depend on strategic technology adoption, comprehensive workforce development, and continued innovation in automation capabilities. Organizations that proactively embrace packaging automation technologies will be well-positioned to capitalize on emerging opportunities and navigate evolving market challenges in the years ahead.

What is LA Packaging Automation?

LA Packaging Automation refers to the use of technology and machinery to automate the packaging process in various industries, enhancing efficiency, reducing labor costs, and improving product safety.

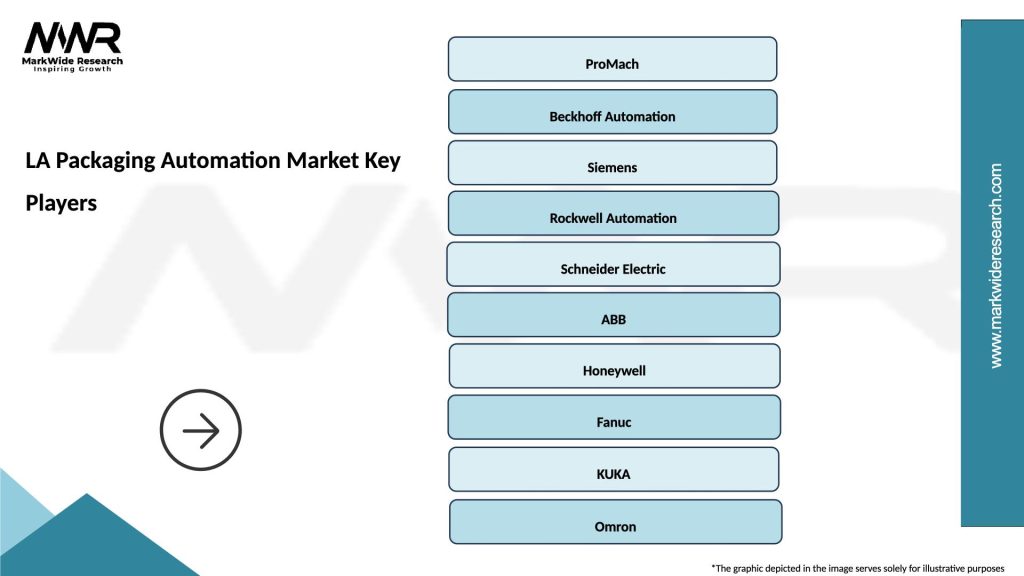

What are the key players in the LA Packaging Automation Market?

Key players in the LA Packaging Automation Market include companies like Siemens, Rockwell Automation, and ABB, which provide innovative solutions for packaging processes, among others.

What are the main drivers of growth in the LA Packaging Automation Market?

The main drivers of growth in the LA Packaging Automation Market include the increasing demand for efficient packaging solutions, the rise of e-commerce requiring faster packaging, and advancements in automation technology.

What challenges does the LA Packaging Automation Market face?

Challenges in the LA Packaging Automation Market include high initial investment costs, the need for skilled labor to operate advanced systems, and the integration of new technologies with existing processes.

What opportunities exist in the LA Packaging Automation Market?

Opportunities in the LA Packaging Automation Market include the expansion of smart packaging technologies, the growing trend of sustainable packaging solutions, and the increasing adoption of automation in emerging markets.

What trends are shaping the LA Packaging Automation Market?

Trends shaping the LA Packaging Automation Market include the rise of Industry Four Point Zero, the integration of IoT in packaging systems, and the focus on reducing waste through more efficient packaging processes.

LA Packaging Automation Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robotic Systems, Conveyor Systems, Automated Guided Vehicles, Packaging Machines |

| Technology | IoT Solutions, Machine Learning, Vision Systems, Sensor Technologies |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Packaging Type | Flexible Packaging, Rigid Packaging, Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Packaging Automation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at