444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA package testing market represents a critical segment within the semiconductor testing industry, focusing on the comprehensive evaluation of packaged integrated circuits and electronic components. This specialized market encompasses various testing methodologies designed to ensure the reliability, functionality, and performance of packaged semiconductors before they reach end-user applications. Market dynamics indicate robust growth driven by increasing demand for electronic devices, automotive electronics, and advanced packaging technologies.

Industry expansion is characterized by technological advancements in testing equipment, growing complexity of semiconductor packages, and stringent quality requirements across multiple sectors. The market demonstrates significant momentum with a projected CAGR of 8.2% over the forecast period, reflecting the essential role of package testing in maintaining product quality and reliability standards.

Regional distribution shows concentrated activity in Asia-Pacific, North America, and Europe, with emerging markets contributing to accelerated growth. The integration of artificial intelligence and machine learning technologies in testing processes has revolutionized traditional approaches, enabling more efficient and accurate testing protocols. Market penetration continues to expand as manufacturers recognize the critical importance of comprehensive package testing in reducing field failures and ensuring customer satisfaction.

The LA package testing market refers to the specialized industry segment dedicated to evaluating and validating the performance, reliability, and functionality of packaged semiconductor devices and electronic components through comprehensive testing methodologies and advanced equipment solutions.

Package testing encompasses multiple evaluation processes including electrical testing, thermal analysis, mechanical stress testing, and environmental conditioning to ensure packaged components meet specified performance criteria. This testing occurs after the semiconductor die has been assembled into its final package form, representing the final quality assurance step before market distribution.

Testing methodologies involve sophisticated equipment and protocols designed to simulate real-world operating conditions, identify potential failure modes, and verify compliance with industry standards. The process includes both functional testing to confirm operational parameters and reliability testing to predict long-term performance under various environmental and operational stresses.

Market fundamentals demonstrate strong growth trajectory driven by increasing semiconductor complexity, expanding electronic device markets, and heightened quality requirements across industries. The LA package testing market benefits from technological innovations in testing equipment, growing adoption of advanced packaging technologies, and increasing emphasis on reliability assurance in critical applications.

Key growth drivers include the proliferation of Internet of Things devices, automotive electronics expansion, and 5G technology deployment, all requiring rigorous package testing to ensure optimal performance. Market adoption rates show 72% of manufacturers implementing advanced package testing protocols to meet evolving quality standards and customer expectations.

Competitive landscape features established testing equipment manufacturers, specialized service providers, and emerging technology companies developing innovative testing solutions. The market demonstrates resilience through economic cycles due to the essential nature of quality assurance in semiconductor manufacturing and the continuous demand for reliable electronic components across diverse applications.

Strategic insights reveal several critical factors shaping the LA package testing market landscape:

Primary growth catalysts propelling the LA package testing market include the exponential increase in electronic device complexity and the corresponding need for comprehensive quality assurance. The automotive industry’s transition toward electric vehicles and autonomous driving systems creates substantial demand for reliable semiconductor packages that can withstand harsh operating environments.

Technological advancement in packaging technologies, including advanced substrates, multi-chip modules, and heterogeneous integration, necessitates sophisticated testing methodologies to validate performance and reliability. The growing adoption of artificial intelligence and machine learning in testing processes enables more accurate defect detection and predictive analysis, driving market expansion.

Consumer electronics proliferation continues to fuel demand for package testing services, with manufacturers requiring assurance that components will perform reliably across diverse applications. The Internet of Things ecosystem expansion creates additional testing requirements as devices must operate reliably in various environmental conditions with minimal maintenance requirements.

Regulatory compliance requirements across industries, particularly in automotive, aerospace, and medical applications, mandate comprehensive testing protocols to ensure safety and reliability standards. Quality assurance initiatives show 89% of manufacturers implementing enhanced testing procedures to meet evolving regulatory requirements and customer expectations.

Cost considerations represent a significant challenge for the LA package testing market, as comprehensive testing protocols require substantial investment in equipment, facilities, and skilled personnel. Small and medium-sized manufacturers often face budget constraints that limit their ability to implement advanced testing capabilities, potentially impacting market penetration in certain segments.

Technical complexity associated with testing advanced packaging formats creates barriers for organizations lacking specialized expertise and equipment. The rapid evolution of packaging technologies often outpaces the development of corresponding testing methodologies, creating gaps in testing capabilities for emerging package types.

Time-to-market pressures in the semiconductor industry can conflict with comprehensive testing requirements, as manufacturers balance thorough quality assurance with competitive product launch schedules. This tension sometimes results in abbreviated testing protocols that may not fully validate long-term reliability characteristics.

Equipment obsolescence concerns arise as testing technologies evolve rapidly, requiring continuous investment in new equipment and training to maintain testing capabilities. The specialized nature of package testing equipment limits supplier options and can result in higher costs and longer lead times for equipment acquisition and maintenance.

Emerging technologies present substantial opportunities for LA package testing market expansion, particularly in areas such as 5G communications, artificial intelligence processors, and advanced automotive electronics. These applications require specialized testing approaches that create new market segments and revenue opportunities for testing service providers.

Geographic expansion opportunities exist in developing markets where semiconductor manufacturing is growing rapidly. Establishing testing capabilities in these regions can provide competitive advantages and access to new customer bases while supporting local manufacturing ecosystems.

Service diversification enables testing providers to expand their offerings beyond traditional package testing to include design validation, failure analysis, and consulting services. This comprehensive approach creates additional value for customers and strengthens long-term business relationships.

Technology integration opportunities include incorporating advanced analytics, machine learning, and automation technologies to enhance testing efficiency and accuracy. Market research indicates 76% of testing facilities planning to implement AI-driven testing solutions within the next three years, representing significant growth potential for technology providers.

Supply chain integration continues to reshape the LA package testing market as manufacturers seek closer collaboration with testing providers to optimize quality assurance processes. This trend toward partnership-based relationships creates opportunities for testing companies to become integral parts of the semiconductor development and manufacturing ecosystem.

Technology convergence between testing equipment manufacturers and software developers results in more sophisticated testing platforms that combine hardware capabilities with advanced analytics and reporting features. This integration enables more comprehensive testing approaches and better data utilization for continuous improvement initiatives.

Market consolidation trends show larger testing service providers acquiring specialized companies to expand their capabilities and geographic reach. According to MarkWide Research analysis, this consolidation activity has increased by 34% over the past two years, indicating a maturing market with established players seeking competitive advantages through strategic acquisitions.

Customer expectations continue to evolve toward more comprehensive testing services that include not only validation but also optimization recommendations and predictive analysis. This shift requires testing providers to develop broader expertise and invest in advanced analytical capabilities to meet changing market demands.

Comprehensive analysis of the LA package testing market employs multiple research approaches including primary interviews with industry experts, secondary data analysis from reputable sources, and quantitative modeling to project market trends and growth patterns.

Primary research involves structured interviews with key stakeholders including testing equipment manufacturers, service providers, semiconductor companies, and end-user organizations across various industries. This approach provides insights into current market conditions, emerging trends, and future requirements that shape market development.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive dynamics, and technological developments. This comprehensive approach ensures accurate representation of market conditions and reliable forecasting.

Data validation processes include cross-referencing information from multiple sources, expert review of findings, and statistical analysis to ensure accuracy and reliability of market assessments. The methodology incorporates both quantitative metrics and qualitative insights to provide a complete market perspective.

Asia-Pacific dominance characterizes the LA package testing market with the region accounting for approximately 58% market share due to concentrated semiconductor manufacturing activities in countries like China, Taiwan, South Korea, and Japan. The region benefits from established manufacturing infrastructure, skilled workforce availability, and proximity to major electronics manufacturers.

North American market demonstrates strong growth driven by advanced technology development, particularly in automotive electronics, aerospace applications, and emerging technologies like artificial intelligence and 5G communications. The region’s emphasis on innovation and quality standards creates demand for sophisticated testing capabilities.

European market shows steady expansion supported by automotive industry requirements, industrial automation applications, and stringent quality standards. The region’s focus on environmental compliance and sustainability drives demand for comprehensive testing protocols that validate long-term reliability and environmental performance.

Emerging markets in Latin America, Middle East, and Africa present growth opportunities as local electronics manufacturing develops and quality requirements increase. These regions show 15% annual growth in testing service adoption as manufacturers recognize the importance of comprehensive quality assurance in competitive markets.

Market leadership is distributed among several key categories of participants in the LA package testing market:

Competitive strategies focus on technological innovation, service expansion, and strategic partnerships to enhance market position and customer value proposition. Companies invest heavily in research and development to maintain technological leadership and address evolving testing requirements.

By Testing Type:

By Package Type:

By Application:

Electrical testing segment represents the largest category within the LA package testing market, accounting for approximately 45% of testing activities due to the fundamental requirement for functional verification of all packaged devices. This category includes both basic continuity testing and sophisticated parametric measurements that validate device performance across specified operating conditions.

Thermal testing applications show rapid growth driven by increasing power densities in modern semiconductor packages and the need for reliable operation across extended temperature ranges. Advanced thermal testing methodologies include thermal cycling, thermal shock, and steady-state temperature testing to validate package integrity under thermal stress.

Automotive electronics segment demonstrates the highest growth rate within application categories, reflecting the industry’s stringent reliability requirements and increasing electronic content in vehicles. This segment requires specialized testing protocols that address automotive-specific environmental conditions and safety standards.

System-in-Package testing emerges as a high-growth category due to increasing adoption of integrated packaging solutions that combine multiple functions in single packages. These complex packages require comprehensive testing approaches that validate both individual component performance and system-level functionality.

Manufacturers benefit from comprehensive package testing through reduced field failure rates, improved customer satisfaction, and enhanced brand reputation. Testing protocols help identify potential issues before product shipment, reducing warranty costs and maintaining market competitiveness through reliable product performance.

End users gain confidence in product reliability and performance consistency through rigorous package testing validation. This assurance is particularly valuable in critical applications where component failure could result in safety risks or significant operational disruptions.

Testing service providers benefit from growing market demand and opportunities for service expansion into emerging technologies and applications. The specialized nature of package testing creates competitive barriers that protect established providers while offering growth opportunities for innovative companies.

Equipment manufacturers experience sustained demand for advanced testing equipment as package complexity increases and testing requirements become more sophisticated. This creates opportunities for technology development and market expansion through innovative testing solutions.

Supply chain stakeholders benefit from improved quality assurance throughout the semiconductor manufacturing process, resulting in more predictable product performance and reduced supply chain disruptions due to quality issues.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend in the LA package testing market, with MWR data indicating 67% of testing facilities implementing AI-driven analysis tools to improve defect detection accuracy and reduce testing time. Machine learning algorithms enable predictive analysis that can identify potential failure modes before they manifest in traditional testing protocols.

Automation advancement continues to reshape testing operations through sophisticated robotic handling systems, automated test equipment, and integrated data management platforms. This trend reduces human error, improves testing consistency, and enables 24/7 testing operations that enhance overall efficiency and throughput.

Environmental sustainability becomes increasingly important as testing facilities implement energy-efficient equipment, reduce waste generation, and adopt environmentally responsible testing practices. This trend responds to both regulatory requirements and customer expectations for sustainable manufacturing processes.

Real-time monitoring capabilities enable continuous assessment of testing equipment performance and immediate identification of potential issues that could affect testing accuracy. This proactive approach minimizes downtime and ensures consistent testing quality across all operations.

Collaborative testing approaches involve closer integration between package testing providers and semiconductor manufacturers to optimize testing protocols and improve overall product quality. This trend toward partnership-based relationships creates more effective testing strategies and better alignment with manufacturing objectives.

Technology partnerships between testing equipment manufacturers and software developers have resulted in more sophisticated testing platforms that combine hardware capabilities with advanced analytics and reporting features. These collaborations enable more comprehensive testing approaches and better utilization of testing data for continuous improvement initiatives.

Facility expansions by major testing service providers reflect growing market demand and the need for increased testing capacity to support expanding semiconductor production. These investments demonstrate confidence in long-term market growth and commitment to serving evolving customer requirements.

Standards development activities focus on establishing comprehensive testing protocols for emerging package technologies and applications. Industry organizations work collaboratively to develop standards that ensure consistent testing approaches and reliable quality assurance across the supply chain.

Acquisition activity among testing companies continues as larger organizations seek to expand their capabilities and geographic reach through strategic acquisitions. This consolidation trend creates more comprehensive service offerings and stronger competitive positions in the global market.

Research initiatives focus on developing next-generation testing methodologies for advanced packaging technologies including 3D packages, heterogeneous integration, and flexible electronics. These efforts ensure that testing capabilities keep pace with rapidly evolving packaging technologies.

Investment priorities should focus on developing automated testing capabilities that can handle increasing package complexity while maintaining cost-effectiveness. Companies should prioritize technologies that enable faster testing cycles without compromising accuracy or reliability validation.

Strategic partnerships with semiconductor manufacturers can provide competitive advantages through closer collaboration on testing protocol development and optimization. These relationships enable testing providers to better understand evolving requirements and develop more effective testing solutions.

Technology adoption strategies should emphasize artificial intelligence and machine learning integration to improve testing efficiency and accuracy. Early adopters of these technologies can gain competitive advantages through superior testing capabilities and reduced operational costs.

Geographic expansion opportunities exist in emerging markets where semiconductor manufacturing is growing rapidly. Establishing testing capabilities in these regions can provide access to new customer bases and support local manufacturing ecosystem development.

Service diversification beyond traditional package testing can create additional revenue opportunities and strengthen customer relationships. Companies should consider expanding into related areas such as design validation, failure analysis, and consulting services to provide more comprehensive value propositions.

Market evolution indicates continued strong growth for the LA package testing market driven by increasing semiconductor complexity, expanding electronic device markets, and heightened quality requirements across industries. MarkWide Research projects sustained expansion with testing service adoption reaching 85% penetration among semiconductor manufacturers by 2028.

Technology advancement will continue to drive market development through innovations in testing equipment, methodologies, and analytical capabilities. The integration of artificial intelligence, machine learning, and advanced automation will enable more sophisticated testing approaches that can address the challenges of next-generation packaging technologies.

Application expansion into emerging areas such as flexible electronics, wearable devices, and Internet of Things applications will create new testing requirements and market opportunities. These applications often require specialized testing approaches that address unique environmental and operational conditions.

Industry consolidation trends are expected to continue as larger testing service providers seek to expand their capabilities and geographic reach through strategic acquisitions. This consolidation will create more comprehensive service offerings and stronger competitive positions in the global market.

Regulatory evolution will likely result in more stringent testing requirements, particularly in automotive, aerospace, and medical applications where component reliability is critical for safety and performance. These requirements will drive demand for more comprehensive testing protocols and advanced testing capabilities.

The LA package testing market represents a critical and growing segment of the semiconductor industry, driven by increasing device complexity, expanding applications, and heightened quality requirements. Market fundamentals demonstrate strong growth potential supported by technological advancement, geographic expansion opportunities, and evolving customer needs across diverse industries.

Strategic positioning in this market requires investment in advanced testing capabilities, development of comprehensive service offerings, and establishment of strong customer relationships through collaborative approaches. Companies that successfully integrate emerging technologies such as artificial intelligence and automation while maintaining focus on quality and reliability will be best positioned for long-term success.

Future success will depend on the ability to adapt to rapidly evolving packaging technologies, meet increasingly stringent quality requirements, and provide cost-effective testing solutions that support customer competitiveness. The market outlook remains positive with sustained growth expected across all major segments and geographic regions, creating opportunities for both established players and innovative new entrants in the LA package testing market.

What is LA Package Testing?

LA Package Testing refers to the evaluation and assessment of packaging materials and systems to ensure they meet safety, quality, and regulatory standards. This process is crucial for various industries, including food and beverage, pharmaceuticals, and consumer goods.

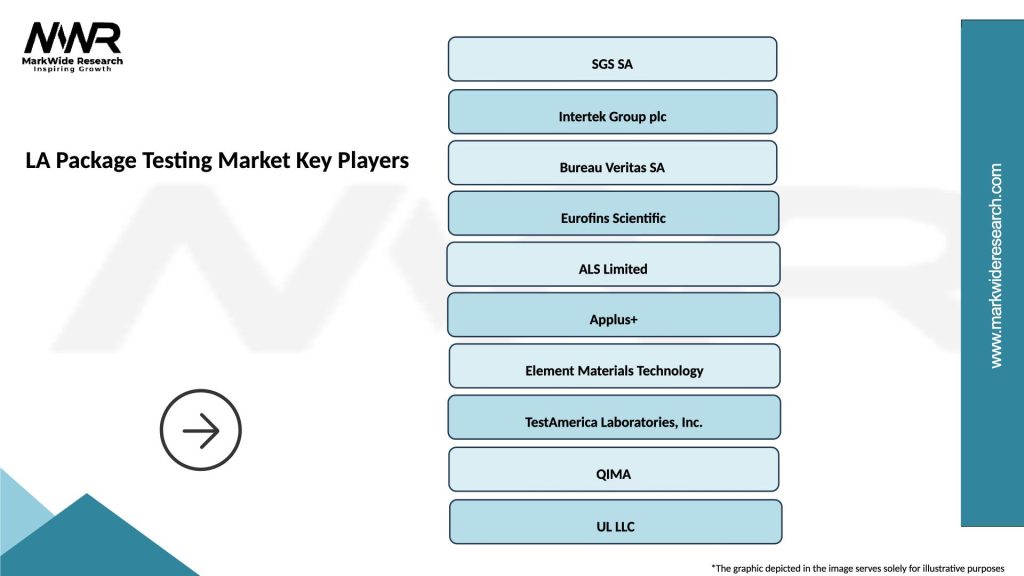

What are the key players in the LA Package Testing Market?

Key players in the LA Package Testing Market include SGS SA, Intertek Group plc, and Eurofins Scientific, among others. These companies provide a range of testing services to ensure packaging compliance and performance across different sectors.

What are the main drivers of growth in the LA Package Testing Market?

The main drivers of growth in the LA Package Testing Market include increasing consumer awareness regarding product safety, stringent regulatory requirements, and the rising demand for sustainable packaging solutions. Additionally, innovations in packaging materials are also contributing to market expansion.

What challenges does the LA Package Testing Market face?

The LA Package Testing Market faces challenges such as the high costs associated with advanced testing technologies and the complexity of regulatory compliance across different regions. Furthermore, the rapid pace of innovation in packaging materials can make it difficult to keep testing methods up to date.

What opportunities exist in the LA Package Testing Market?

Opportunities in the LA Package Testing Market include the growing trend towards e-commerce, which requires robust packaging solutions, and the increasing focus on sustainability, prompting the development of eco-friendly packaging materials. Additionally, advancements in testing technologies present new avenues for growth.

What trends are shaping the LA Package Testing Market?

Trends shaping the LA Package Testing Market include the integration of digital technologies for more efficient testing processes and the rise of smart packaging solutions that enhance product safety and traceability. Moreover, there is a growing emphasis on circular economy practices within the packaging industry.

LA Package Testing Market

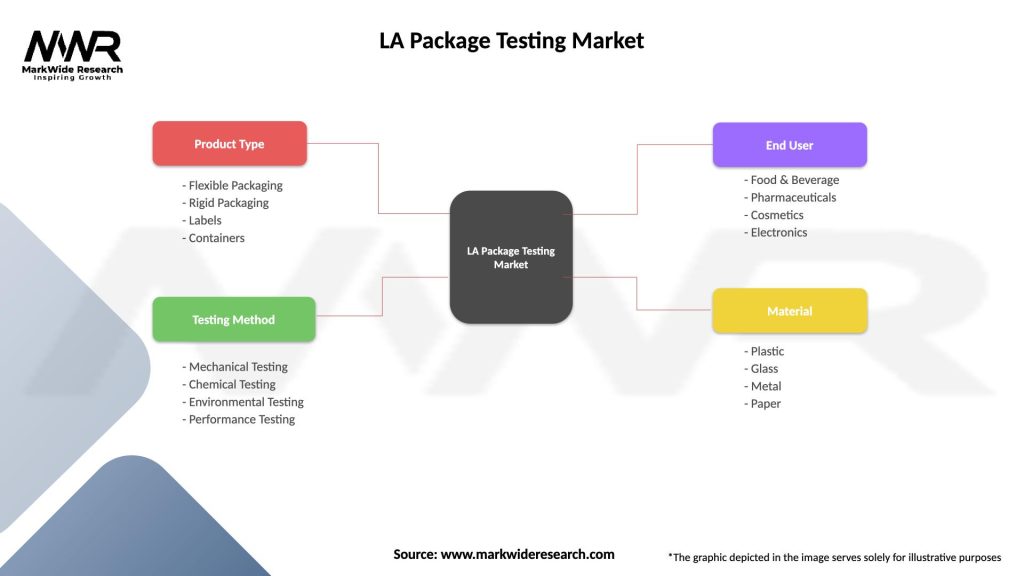

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Packaging, Rigid Packaging, Labels, Containers |

| Testing Method | Mechanical Testing, Chemical Testing, Environmental Testing, Performance Testing |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Material | Plastic, Glass, Metal, Paper |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Package Testing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at