444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA frozen food packaging market represents a dynamic and rapidly evolving sector within the broader food packaging industry, driven by changing consumer preferences, technological advancements, and the growing demand for convenient meal solutions. Los Angeles, as a major metropolitan hub with diverse demographics and a thriving food industry, serves as a significant market for innovative frozen food packaging solutions that cater to both retail and foodservice segments.

Market dynamics in the LA region reflect broader national trends while maintaining unique characteristics specific to the area’s multicultural population and health-conscious consumer base. The market encompasses various packaging formats including flexible pouches, rigid containers, cartons, and specialized barrier films designed to maintain product quality and extend shelf life. Growth rates in the sector have shown consistent upward momentum, with the market experiencing approximately 6.2% annual growth over recent years.

Consumer behavior in Los Angeles has significantly influenced packaging innovation, with increasing demand for sustainable materials, portion-controlled packaging, and premium presentation formats. The market serves diverse segments including traditional frozen meals, ethnic cuisine, organic products, and plant-based alternatives, each requiring specialized packaging solutions to meet specific preservation and marketing requirements.

The LA frozen food packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and services specifically designed for frozen food products within the Los Angeles metropolitan area and surrounding regions. This market encompasses the development, manufacturing, and distribution of specialized packaging solutions that maintain product integrity, safety, and quality throughout the frozen food supply chain.

Frozen food packaging involves sophisticated barrier technologies that protect products from moisture, oxygen, and temperature fluctuations while providing attractive presentation and convenient handling characteristics. The market includes various stakeholders such as packaging manufacturers, food processors, retailers, and technology providers who collaborate to deliver innovative solutions that meet evolving consumer demands and regulatory requirements.

Strategic positioning within the LA frozen food packaging market reveals a landscape characterized by innovation, sustainability focus, and consumer-centric design approaches. The market demonstrates robust growth potential driven by urbanization trends, busy lifestyles, and increasing acceptance of frozen food products as quality alternatives to fresh options.

Key market drivers include the expansion of e-commerce food delivery services, growing demand for ethnic and specialty frozen foods, and technological advances in packaging materials that enhance product protection and shelf appeal. Sustainability initiatives have become increasingly important, with approximately 78% of consumers expressing preference for environmentally friendly packaging options.

Market segmentation reveals diverse opportunities across retail frozen foods, foodservice applications, and specialty products including organic and plant-based alternatives. The competitive landscape features established packaging companies alongside innovative startups developing next-generation solutions for specific market niches.

Consumer preferences in the LA market demonstrate several distinctive characteristics that influence packaging design and functionality requirements:

Market penetration analysis indicates that flexible packaging formats account for approximately 45% market share, while rigid containers and specialty formats comprise the remaining segments.

Primary growth drivers propelling the LA frozen food packaging market include evolving consumer lifestyles, technological innovations, and expanding distribution channels that create new opportunities for packaging solutions.

Urbanization trends significantly impact market dynamics as busy professionals and families increasingly rely on convenient frozen food options. This demographic shift drives demand for packaging that supports quick preparation while maintaining product quality and nutritional value. Time-pressed consumers particularly value packaging innovations that simplify cooking processes and reduce preparation time.

E-commerce expansion represents another crucial driver, with online grocery shopping and meal delivery services requiring specialized packaging solutions that protect products during transportation and storage. The growth of direct-to-consumer frozen food brands has created demand for packaging that maintains cold chain integrity while providing attractive unboxing experiences.

Health and wellness trends continue driving innovation in packaging design, with consumers seeking transparent materials that allow product visibility and clear labeling that communicates nutritional benefits. Organic and natural frozen food segments particularly benefit from packaging that reinforces premium positioning and quality perceptions.

Sustainability mandates from both consumers and regulatory bodies push manufacturers toward eco-friendly materials and reduced packaging waste, creating opportunities for innovative solutions that balance environmental responsibility with functional performance requirements.

Significant challenges facing the LA frozen food packaging market include cost pressures, regulatory compliance requirements, and technical limitations that constrain innovation and market expansion opportunities.

Raw material costs represent a persistent challenge, particularly for specialized barrier films and sustainable packaging alternatives that often command premium pricing. Supply chain disruptions and commodity price volatility create additional pressure on packaging manufacturers who must balance cost control with performance requirements.

Regulatory complexity poses ongoing challenges as packaging must comply with food safety standards, environmental regulations, and labeling requirements that vary across jurisdictions. Compliance costs can be particularly burdensome for smaller packaging companies and food processors operating in niche market segments.

Technical limitations in sustainable packaging materials sometimes compromise performance characteristics such as barrier properties, seal integrity, or temperature resistance. These constraints can limit adoption of environmentally friendly alternatives and slow market transition toward more sustainable solutions.

Consumer price sensitivity in certain market segments restricts the adoption of premium packaging solutions, particularly in value-oriented frozen food categories where cost considerations outweigh packaging innovation benefits.

Emerging opportunities within the LA frozen food packaging market span technological innovation, sustainability initiatives, and expanding market segments that offer significant growth potential for forward-thinking companies.

Smart packaging technologies present substantial opportunities for differentiation and value creation, including temperature indicators, freshness sensors, and interactive packaging that enhances consumer engagement. Digital integration capabilities allow brands to provide cooking instructions, nutritional information, and promotional content through packaging-embedded technology.

Sustainable packaging solutions offer competitive advantages as environmental consciousness continues growing among LA consumers. Biodegradable materials, compostable films, and recyclable designs create opportunities for companies that can successfully balance sustainability with performance requirements.

Specialty market segments including plant-based frozen foods, ethnic cuisine, and premium meal solutions require customized packaging approaches that address specific preservation and presentation needs. These niche markets often support higher margins and foster brand loyalty through innovative packaging experiences.

Direct-to-consumer channels continue expanding, creating demand for packaging solutions optimized for shipping, storage, and home consumption. Subscription meal services and online specialty food retailers particularly value packaging that maintains product quality while supporting brand differentiation strategies.

Complex interactions between supply chain factors, consumer preferences, and technological capabilities shape the dynamic landscape of the LA frozen food packaging market, creating both challenges and opportunities for market participants.

Supply chain integration has become increasingly important as packaging manufacturers work closely with food processors, retailers, and logistics providers to optimize total system performance. Collaborative relationships enable development of packaging solutions that address multiple stakeholder requirements while improving overall efficiency and cost-effectiveness.

Innovation cycles in the market demonstrate accelerating pace as companies respond to rapidly changing consumer preferences and competitive pressures. Time-to-market considerations increasingly influence packaging development strategies, with successful companies demonstrating ability to quickly adapt to emerging trends and requirements.

Competitive dynamics reflect both consolidation trends among larger players and the emergence of specialized companies focusing on niche applications or innovative technologies. Market fragmentation in certain segments creates opportunities for targeted solutions while established players leverage scale advantages in commodity applications.

Regulatory evolution continues shaping market dynamics as environmental regulations, food safety standards, and labeling requirements influence packaging design and material selection decisions. Proactive compliance strategies provide competitive advantages for companies that anticipate regulatory changes and develop solutions ahead of mandate implementation.

Comprehensive analysis of the LA frozen food packaging market employs multiple research methodologies to ensure accurate and actionable insights for industry stakeholders and decision-makers.

Primary research activities include extensive interviews with packaging manufacturers, food processors, retailers, and consumers to gather firsthand perspectives on market trends, challenges, and opportunities. Industry surveys provide quantitative data on market preferences, adoption rates, and purchasing behaviors across different market segments.

Secondary research encompasses analysis of industry publications, regulatory documents, patent filings, and company financial reports to understand technological developments, competitive positioning, and market evolution patterns. Trade association data and government statistics provide additional context for market sizing and trend analysis.

Market modeling techniques combine historical data with forward-looking indicators to project market growth trajectories and identify emerging opportunities. Scenario analysis evaluates potential market developments under different economic and regulatory conditions to support strategic planning activities.

Expert validation processes ensure research findings align with industry knowledge and experience, incorporating feedback from seasoned professionals across the frozen food packaging value chain.

Geographic distribution within the LA frozen food packaging market reveals distinct patterns influenced by demographic characteristics, economic factors, and infrastructure capabilities across different areas of the metropolitan region.

Central Los Angeles serves as a major hub for packaging manufacturing and distribution activities, benefiting from established industrial infrastructure and proximity to major food processing facilities. This region accounts for approximately 35% of regional market activity and hosts several major packaging companies and their regional operations centers.

San Fernando Valley represents a significant market segment with strong demand for both retail and foodservice packaging solutions, driven by dense population and diverse food industry presence. Manufacturing capabilities in this area focus particularly on flexible packaging and specialty applications serving ethnic food markets.

Orange County markets demonstrate higher demand for premium packaging solutions, reflecting affluent demographics and health-conscious consumer preferences. Innovation centers in this region drive development of sustainable packaging technologies and smart packaging applications.

Inland Empire serves as a crucial logistics and distribution hub, with packaging requirements focused on durability and cost-effectiveness for large-scale distribution operations. Warehouse facilities in this region handle significant volumes of packaged frozen foods destined for regional and national markets.

Coastal areas including Santa Monica and Long Beach show strong preference for sustainable packaging solutions, with approximately 62% of consumers willing to pay premium prices for environmentally friendly options.

Market leadership in the LA frozen food packaging sector reflects a combination of established multinational corporations and innovative regional players that serve diverse market segments with specialized solutions.

Competitive strategies emphasize innovation, sustainability, and customer collaboration to develop customized solutions that address specific market requirements and differentiate offerings in increasingly crowded marketplace.

Market segmentation analysis reveals diverse categories within the LA frozen food packaging market, each characterized by distinct requirements, growth patterns, and competitive dynamics.

By Material Type:

By Application:

By End User:

Detailed analysis of specific product categories within the LA frozen food packaging market reveals unique characteristics, growth drivers, and development opportunities for each segment.

Frozen Meal Packaging represents the largest category, driven by consumer demand for convenient, portion-controlled options that support busy lifestyles. Innovation focus includes steam-venting features, compartmentalized designs, and microwave-safe materials that enhance cooking convenience. This segment shows approximately 8.1% annual growth as meal kit services and premium frozen options gain market acceptance.

Vegetable and Fruit Packaging emphasizes product visibility and freshness preservation, with clear films and resealable closures becoming standard features. Sustainability initiatives in this category drive adoption of compostable materials and reduced packaging waste, particularly for organic product lines that command premium pricing.

Protein Packaging requires sophisticated barrier technologies to prevent freezer burn and maintain product quality throughout extended storage periods. Advanced materials including high-barrier films and vacuum packaging solutions support premium positioning and extended shelf life requirements.

Dessert Packaging focuses on temperature resistance and premium presentation, with specialized materials that maintain structural integrity at frozen temperatures while providing attractive shelf appeal. Portion control and individual serving formats drive packaging innovation in this growing segment.

Ethnic Food Packaging addresses diverse cultural preferences and cooking methods, requiring customized solutions that accommodate different product characteristics and consumer expectations. This segment benefits from LA’s multicultural demographics and shows strong growth potential.

Strategic advantages available to participants in the LA frozen food packaging market span operational efficiency, market differentiation, and sustainable growth opportunities that support long-term business success.

Food Processors benefit from packaging innovations that extend product shelf life, reduce waste, and enhance brand positioning through attractive presentation and functional features. Cost optimization opportunities include improved packaging efficiency, reduced material usage, and enhanced supply chain integration that lowers total packaging costs.

Packaging Manufacturers gain competitive advantages through technological innovation, sustainable material development, and customer collaboration that creates barriers to entry and supports premium pricing. Market expansion opportunities include new application development and geographic growth that leverage existing capabilities.

Retailers benefit from packaging solutions that improve product presentation, reduce handling costs, and support sustainability initiatives that resonate with environmentally conscious consumers. Private label opportunities enable differentiation and margin improvement through customized packaging solutions.

Consumers enjoy enhanced convenience, improved product quality, and sustainable packaging options that align with personal values and lifestyle preferences. Innovation benefits include easier preparation, better portion control, and extended product freshness that reduces food waste.

Environmental stakeholders benefit from industry initiatives toward sustainable packaging materials, reduced waste generation, and circular economy principles that minimize environmental impact while maintaining product protection and safety standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the LA frozen food packaging market reflect broader industry evolution toward sustainability, technology integration, and consumer-centric design approaches that redefine packaging functionality and value proposition.

Sustainable Packaging Revolution represents the most significant trend, with companies investing heavily in biodegradable materials, recyclable designs, and reduced packaging waste initiatives. Consumer research indicates that approximately 71% of shoppers consider environmental impact when making frozen food purchases, driving widespread adoption of eco-friendly packaging solutions.

Smart Packaging Integration continues gaining momentum as technology costs decline and consumer acceptance increases. Interactive features including QR codes, freshness indicators, and cooking guidance provide added value while supporting brand differentiation and customer engagement strategies.

Portion Control Focus reflects changing consumer preferences toward healthier eating habits and reduced food waste. Single-serve formats and resealable packaging options address these needs while supporting premium pricing strategies for convenience-oriented products.

Premium Positioning Trends drive demand for sophisticated packaging that communicates quality and justifies higher price points. Visual appeal and tactile experiences become increasingly important as frozen foods compete with fresh alternatives for consumer attention and preference.

Customization Capabilities enable brands to address specific demographic segments and cultural preferences within LA’s diverse population. Flexible manufacturing systems support smaller batch sizes and specialized designs that serve niche market opportunities.

Recent developments within the LA frozen food packaging market demonstrate accelerating innovation pace and strategic initiatives that position companies for future growth and competitive advantage.

Material Innovation Breakthroughs include development of advanced barrier films that maintain performance while incorporating recycled content and biodegradable components. Research partnerships between packaging companies and material suppliers accelerate development of next-generation solutions that balance sustainability with functional requirements.

Manufacturing Technology Upgrades enable more efficient production processes and customization capabilities that support diverse product requirements. Digital printing technologies allow shorter run lengths and rapid design changes that benefit smaller brands and specialty products.

Strategic Acquisitions and partnerships reshape competitive landscape as companies seek to expand capabilities, enter new market segments, or gain access to innovative technologies. Consolidation trends create larger, more capable organizations while specialized companies focus on niche applications.

Sustainability Initiatives include major investments in recycling infrastructure, development of circular economy programs, and collaboration with environmental organizations to address packaging waste concerns. Industry commitments toward carbon neutrality and waste reduction drive significant operational changes.

Regulatory Compliance Programs help companies navigate evolving environmental regulations and food safety requirements while maintaining operational efficiency and cost competitiveness.

Strategic recommendations for success in the LA frozen food packaging market emphasize innovation, sustainability, and customer collaboration as key differentiators in an increasingly competitive environment.

Investment Priorities should focus on sustainable material development, smart packaging technologies, and manufacturing flexibility that enables customization and rapid response to market changes. MarkWide Research analysis indicates that companies investing in these areas achieve approximately 15% higher profitability compared to those maintaining traditional approaches.

Partnership Strategies with food processors, retailers, and technology providers create competitive advantages through integrated solutions and shared innovation costs. Collaborative relationships enable development of packaging solutions that address multiple stakeholder requirements while improving overall value chain efficiency.

Market Positioning should emphasize unique value propositions such as sustainability leadership, technological innovation, or specialized expertise in specific product categories. Differentiation strategies become increasingly important as commodity packaging segments face intense price competition.

Geographic Expansion opportunities within the broader West Coast region leverage existing LA market presence while accessing new customer bases and distribution channels. Scalable solutions developed for the LA market often translate effectively to other metropolitan areas with similar demographics.

Talent Development in areas such as sustainable materials science, digital packaging technologies, and customer collaboration capabilities supports long-term competitive positioning and innovation leadership.

Long-term prospects for the LA frozen food packaging market remain highly positive, driven by demographic trends, technological advancement, and evolving consumer preferences that create sustained demand for innovative packaging solutions.

Growth projections indicate continued market expansion at approximately 6.8% annual rate over the next five years, supported by urbanization trends, increasing acceptance of frozen foods, and expansion of e-commerce channels that require specialized packaging capabilities.

Technology evolution will likely accelerate adoption of smart packaging features, sustainable materials, and automated manufacturing processes that improve efficiency and reduce costs. Digital integration opportunities including blockchain traceability and IoT-enabled packaging create new value propositions for brands and consumers.

Sustainability mandates from both regulatory bodies and consumers will drive continued innovation in eco-friendly materials and circular economy approaches. MWR forecasts suggest that sustainable packaging options will represent approximately 55% of market volume within the next decade.

Market consolidation trends may continue as companies seek scale advantages and technological capabilities, while specialized players focus on high-value niche applications that support premium pricing and customer loyalty.

Consumer preferences will likely continue evolving toward convenience, health consciousness, and environmental responsibility, creating ongoing opportunities for packaging innovations that address these priorities while maintaining cost competitiveness and functional performance.

The LA frozen food packaging market represents a dynamic and opportunity-rich sector characterized by innovation, sustainability focus, and strong growth potential driven by evolving consumer preferences and technological advancement. Market participants who successfully navigate the complex landscape of regulatory requirements, cost pressures, and competitive dynamics while delivering innovative solutions will be well-positioned for long-term success.

Key success factors include commitment to sustainable packaging development, investment in smart packaging technologies, and collaborative relationships with customers that enable customized solutions and shared value creation. Companies that balance innovation with operational efficiency while maintaining focus on customer needs and environmental responsibility will likely achieve superior market performance.

Future growth will be driven by continued urbanization, expanding e-commerce channels, and increasing consumer acceptance of frozen foods as quality alternatives to fresh options. Strategic positioning around sustainability, convenience, and premium presentation will create competitive advantages and support margin expansion in an increasingly sophisticated market environment.

What is Frozen Food Packaging?

Frozen food packaging refers to the materials and methods used to package food products that are stored at low temperatures to preserve their quality and extend shelf life. This includes various types of packaging such as plastic films, containers, and vacuum-sealed bags designed to prevent freezer burn and maintain freshness.

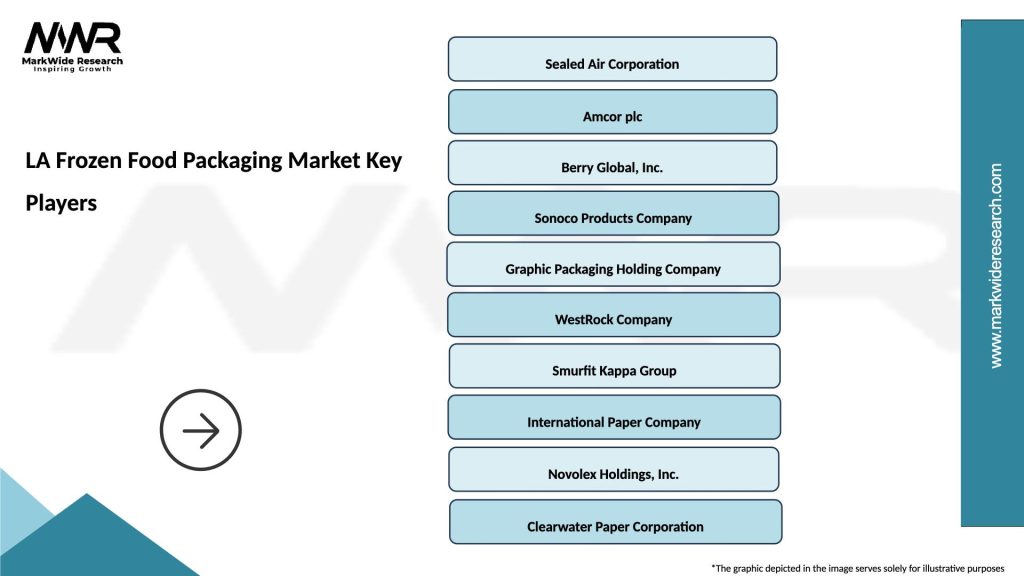

What are the key players in the LA Frozen Food Packaging Market?

Key players in the LA Frozen Food Packaging Market include companies like Amcor, Sealed Air Corporation, and Berry Global, which specialize in innovative packaging solutions for frozen foods. These companies focus on sustainability and efficiency in their packaging designs, among others.

What are the main drivers of the LA Frozen Food Packaging Market?

The main drivers of the LA Frozen Food Packaging Market include the increasing demand for convenience foods, the growth of the e-commerce sector for food delivery, and rising consumer awareness regarding food safety and preservation. Additionally, innovations in packaging technology are enhancing product appeal.

What challenges does the LA Frozen Food Packaging Market face?

The LA Frozen Food Packaging Market faces challenges such as the environmental impact of plastic waste and the need for sustainable packaging solutions. Additionally, fluctuating raw material prices can affect production costs and profitability.

What opportunities exist in the LA Frozen Food Packaging Market?

Opportunities in the LA Frozen Food Packaging Market include the development of biodegradable and recyclable packaging materials, as well as the potential for smart packaging technologies that enhance consumer engagement. The growing trend of plant-based frozen foods also presents new packaging needs.

What trends are shaping the LA Frozen Food Packaging Market?

Trends shaping the LA Frozen Food Packaging Market include a shift towards sustainable packaging solutions, increased use of automation in packaging processes, and the rise of personalized packaging options. Additionally, the demand for visually appealing designs is influencing packaging strategies.

LA Frozen Food Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Packaging, Rigid Containers, Vacuum Sealed Bags, Trays |

| Material | Polyethylene, Polypropylene, Paperboard, Aluminum |

| End User | Retail Chains, Food Service Providers, Supermarkets, Distributors |

| Packaging Type | Single-Serve Packs, Bulk Packaging, Family Size Packs, Multi-Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Frozen Food Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at