444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA biomedical sensors market represents a rapidly evolving sector within the broader healthcare technology landscape, encompassing advanced sensing devices designed for medical diagnostics, patient monitoring, and therapeutic applications. Los Angeles has emerged as a significant hub for biomedical sensor innovation, driven by its concentration of leading medical institutions, research universities, and technology companies. The region’s biomedical sensors market demonstrates robust growth potential with an estimated compound annual growth rate (CAGR) of 12.8% over the forecast period.

Market dynamics in the LA region are characterized by strong collaboration between academic institutions such as UCLA, USC, and Caltech, alongside established medical device manufacturers and emerging startups. The market encompasses various sensor technologies including biosensors, implantable sensors, wearable monitoring devices, and point-of-care diagnostic systems. Regional advantages include access to world-class healthcare facilities, a skilled workforce, and substantial venture capital investment in healthcare technology.

Innovation clusters throughout Los Angeles County have fostered the development of next-generation biomedical sensing technologies, with particular strength in areas such as continuous glucose monitoring, cardiac rhythm detection, and neurological monitoring systems. The market benefits from strategic partnerships between technology companies and major healthcare systems including Cedars-Sinai, UCLA Health, and Kaiser Permanente, facilitating rapid clinical validation and market adoption.

The LA biomedical sensors market refers to the regional ecosystem of companies, research institutions, and healthcare organizations involved in the development, manufacturing, and commercialization of sensor-based medical devices within the Los Angeles metropolitan area. Biomedical sensors are sophisticated devices that detect and measure biological, chemical, or physical parameters in the human body, converting these measurements into electrical signals for analysis and interpretation.

These sensors serve critical functions in modern healthcare delivery, enabling continuous patient monitoring, early disease detection, personalized treatment optimization, and remote healthcare management. The LA market specifically encompasses both established medical device companies and innovative startups leveraging the region’s technological expertise and clinical resources. Key applications include glucose monitoring for diabetes management, cardiac monitoring for heart disease, neurological sensors for brain activity measurement, and environmental sensors for air quality and exposure monitoring.

Market participants range from multinational corporations with significant LA operations to university spin-offs commercializing breakthrough research. The ecosystem benefits from the region’s unique combination of entertainment industry innovation, aerospace engineering expertise, and world-renowned medical institutions, creating a distinctive environment for biomedical sensor development and commercialization.

The LA biomedical sensors market demonstrates exceptional growth momentum, driven by increasing demand for personalized healthcare solutions, aging population demographics, and technological advancement in miniaturization and wireless connectivity. Market expansion is supported by substantial investment in healthcare infrastructure and growing adoption of digital health technologies across the region’s healthcare systems.

Key growth drivers include the rising prevalence of chronic diseases requiring continuous monitoring, with diabetes management representing approximately 28% of the regional sensor market demand. The market benefits from strong regulatory support, with the FDA’s Los Angeles office facilitating streamlined approval processes for innovative medical devices. Technological convergence between artificial intelligence, Internet of Things (IoT), and biomedical sensing is creating new opportunities for advanced diagnostic and monitoring solutions.

Competitive landscape features a mix of established players and emerging companies, with venture capital investment in LA-based biomedical sensor startups reaching significant levels. The market shows particular strength in wearable sensors, implantable devices, and point-of-care diagnostic systems. Future growth is expected to be driven by expanding applications in telemedicine, remote patient monitoring, and precision medicine initiatives across the region’s healthcare networks.

Strategic market insights reveal several critical trends shaping the LA biomedical sensors landscape. The following key insights demonstrate the market’s evolution and growth potential:

Market maturation is evident in the increasing sophistication of sensor technologies and the growing emphasis on data security and privacy protection. The regional ecosystem demonstrates strong innovation capacity with numerous patents filed annually by LA-based companies and research institutions.

Primary market drivers propelling the LA biomedical sensors market include demographic shifts, technological advancement, and evolving healthcare delivery models. The aging population in Los Angeles County creates sustained demand for continuous health monitoring solutions, with seniors representing a rapidly growing segment requiring chronic disease management.

Healthcare cost containment initiatives drive adoption of preventive monitoring technologies that can detect health issues early and reduce expensive emergency interventions. The shift toward value-based care models incentivizes healthcare providers to invest in technologies that improve patient outcomes while controlling costs. Telemedicine expansion, accelerated by recent healthcare delivery changes, creates new opportunities for remote monitoring sensors.

Technological convergence between consumer electronics and medical devices enables more sophisticated and user-friendly biomedical sensors. The region’s strength in entertainment technology and user experience design translates into more engaging and effective medical monitoring devices. Regulatory support from the FDA’s Digital Health Center of Excellence, with significant LA-area engagement, facilitates faster approval pathways for innovative sensor technologies.

Investment capital availability from venture capital firms and corporate venture arms provides funding for sensor technology development and commercialization. The presence of major technology companies with healthcare initiatives, including Google Health and Amazon Health Services, creates partnership opportunities and market validation for emerging sensor technologies.

Significant market restraints challenge the growth trajectory of the LA biomedical sensors market, despite its overall positive outlook. Regulatory complexity remains a primary constraint, with FDA approval processes for medical devices requiring extensive clinical validation and documentation, creating lengthy development timelines and substantial costs for sensor manufacturers.

Reimbursement challenges limit market adoption, as many innovative sensor technologies lack established reimbursement codes from Medicare, Medicaid, and private insurance providers. Healthcare systems often hesitate to adopt new technologies without clear reimbursement pathways, creating a barrier to market penetration. Data privacy concerns and cybersecurity requirements add complexity and cost to sensor development, particularly for connected devices that transmit patient health information.

Technical limitations in sensor accuracy, battery life, and biocompatibility continue to constrain certain applications. The need for frequent calibration and maintenance of some sensor types creates user experience challenges and limits adoption in home-care settings. Market fragmentation across different healthcare systems and provider networks complicates standardization and interoperability efforts.

Competition from established medical device companies with significant resources and market presence creates challenges for smaller LA-based startups seeking market share. The high cost of clinical trials and regulatory compliance can strain the resources of emerging companies, potentially limiting innovation and market entry for breakthrough technologies.

Substantial market opportunities exist within the LA biomedical sensors landscape, driven by emerging applications and technological advancement. Precision medicine initiatives create demand for highly specific sensors capable of monitoring individual patient biomarkers and therapeutic responses, opening new market segments for specialized sensing technologies.

Mental health monitoring represents an underserved market opportunity, with growing recognition of the need for objective measurement tools for psychological and neurological conditions. The integration of biomedical sensors with digital therapeutics platforms creates opportunities for comprehensive treatment monitoring and optimization. Environmental health sensing gains importance as air quality concerns in Los Angeles drive demand for personal exposure monitoring devices.

Pediatric applications offer significant growth potential, with specialized sensors designed for children’s unique physiological characteristics and monitoring needs. The development of non-invasive and child-friendly sensor technologies addresses an underserved market segment. Sports medicine and performance monitoring leverage LA’s entertainment and sports industry presence to create high-value applications for professional and consumer markets.

International expansion opportunities emerge as LA-based companies leverage their technological expertise to enter global markets, particularly in emerging economies with growing healthcare infrastructure investment. Platform integration with electronic health records and healthcare information systems creates opportunities for comprehensive patient monitoring solutions that provide actionable insights to healthcare providers.

Complex market dynamics shape the LA biomedical sensors ecosystem through the interplay of technological innovation, regulatory evolution, and healthcare industry transformation. Innovation cycles in the region demonstrate accelerating pace, with breakthrough technologies moving from research laboratories to clinical applications more rapidly than historical patterns suggest.

Competitive dynamics feature both collaboration and competition among market participants, with companies often partnering on complementary technologies while competing in core market segments. The presence of major research universities creates a continuous pipeline of new technologies and skilled workforce, supporting sustained innovation and market growth. According to MarkWide Research analysis, the regional market demonstrates resilience to economic fluctuations due to the essential nature of healthcare applications.

Supply chain dynamics benefit from LA’s proximity to Asian manufacturing centers and established logistics infrastructure, enabling efficient component sourcing and product distribution. However, recent global supply chain disruptions have highlighted the importance of supply chain diversification and local manufacturing capabilities. Customer adoption patterns show increasing acceptance of digital health technologies, with patient engagement rates improving by approximately 23% annually.

Regulatory dynamics continue to evolve, with the FDA implementing new frameworks for digital health technologies and software-based medical devices. These changes create both opportunities and challenges for LA-based sensor companies, requiring ongoing adaptation to regulatory requirements while enabling faster market entry for qualifying technologies.

Comprehensive research methodology employed for analyzing the LA biomedical sensors market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, healthcare providers, regulatory experts, and technology developers across the Los Angeles metropolitan area.

Secondary research encompasses analysis of patent filings, clinical trial databases, regulatory submissions, and published research from regional academic institutions. Market data collection includes tracking of venture capital investments, merger and acquisition activity, and partnership announcements within the biomedical sensor sector. Quantitative analysis utilizes statistical modeling to project market trends and growth patterns based on historical data and identified market drivers.

Qualitative assessment incorporates expert opinions, technology roadmaps, and regulatory trend analysis to understand market dynamics and future development directions. The methodology includes validation through multiple independent sources and cross-verification of key findings. Geographic focus ensures comprehensive coverage of the LA market while considering broader California and national market influences.

Technology assessment includes evaluation of emerging sensor technologies, manufacturing capabilities, and clinical validation status. The research methodology incorporates ongoing monitoring of market developments and regular updates to reflect changing market conditions and new technology introductions.

Regional market analysis reveals distinct characteristics and competitive advantages within different areas of Los Angeles County. West LA and Santa Monica concentrate on consumer-focused wearable sensors and digital health applications, benefiting from proximity to technology companies and venture capital firms. This subregion accounts for approximately 35% of the regional market activity.

Downtown LA and USC area focus on clinical-grade sensors and hospital-based monitoring systems, leveraging the concentration of major medical centers and research institutions. The presence of LA BioMed and other research organizations creates a strong foundation for translational research and clinical validation. Pasadena and San Gabriel Valley emphasize advanced sensor technologies and manufacturing, building on the aerospace and engineering expertise in the region.

Orange County integration extends the market reach into adjacent areas with significant medical device manufacturing and biotechnology presence. The broader regional ecosystem benefits from complementary capabilities and shared resources across county boundaries. Torrance and South Bay areas contribute manufacturing and supply chain capabilities, supporting the production scale-up of successful sensor technologies.

Market distribution shows 42% concentration in clinical applications, 31% in consumer health monitoring, and 27% in research and development applications. The regional analysis demonstrates strong interconnections between different geographic areas, creating a cohesive ecosystem that supports the entire product development and commercialization lifecycle.

The competitive landscape of the LA biomedical sensors market features a diverse ecosystem of established medical device companies, emerging startups, and research institutions. Major players maintain significant operations in the region while competing with innovative local companies developing breakthrough technologies.

Emerging companies demonstrate significant innovation potential, with many university spin-offs and startup companies developing next-generation sensor technologies. The competitive environment encourages both collaboration and competition, with companies often partnering on complementary technologies while maintaining competitive positions in core markets.

Market segmentation of the LA biomedical sensors market reveals distinct categories based on technology type, application area, and end-user segments. By Technology:

By Application:

By End User:

Diabetes management sensors represent the largest market category, driven by high prevalence of diabetes in Los Angeles County and strong clinical evidence supporting continuous glucose monitoring benefits. Technology advancement in this category focuses on extended sensor life, improved accuracy, and integration with automated insulin delivery systems. Market penetration continues to grow with expanding insurance coverage and clinical adoption.

Cardiovascular monitoring demonstrates rapid growth potential, particularly in remote monitoring applications for heart failure and arrhythmia management. MWR data indicates that cardiac sensor adoption rates are increasing by 18% annually among LA-area healthcare providers. Innovation focuses on miniaturization and long-term biocompatibility for implantable devices.

Neurological sensors represent an emerging high-value category, with applications in epilepsy monitoring, brain-computer interfaces, and neurodegenerative disease management. The presence of leading neuroscience research institutions in LA supports continued innovation and clinical validation in this segment. Wearable sensors show strong consumer adoption, particularly among health-conscious demographics and fitness enthusiasts.

Point-of-care diagnostics benefit from the need for rapid testing capabilities, especially in urgent care and emergency department settings. The COVID-19 pandemic has accelerated adoption of rapid diagnostic sensors, creating sustained demand for infectious disease detection capabilities. Environmental health sensors gain importance due to air quality concerns in the LA basin, creating opportunities for personal exposure monitoring devices.

Healthcare providers benefit from improved patient outcomes through continuous monitoring capabilities that enable early intervention and personalized treatment optimization. Cost reduction results from decreased hospital readmissions and more efficient resource utilization through remote monitoring programs. Enhanced patient engagement and compliance improve treatment effectiveness and long-term health outcomes.

Patients and consumers gain access to real-time health information, enabling proactive health management and improved quality of life. Convenience factors include reduced need for frequent clinical visits and laboratory testing, while maintaining or improving monitoring accuracy. Personalized health insights support better lifestyle decisions and treatment adherence.

Technology companies access growing market opportunities with strong revenue potential and opportunities for platform expansion. Innovation partnerships with healthcare institutions provide clinical validation pathways and market credibility. The regional ecosystem supports technology transfer and commercialization through established networks and resources.

Investors and stakeholders benefit from the market’s growth potential and the region’s track record of successful healthcare technology companies. Risk mitigation results from diversified application areas and strong regulatory support for innovative medical technologies. The presence of major healthcare systems provides clear pathways to market adoption and revenue generation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the LA biomedical sensors market, with machine learning algorithms enhancing sensor data interpretation and predictive capabilities. Edge computing enables real-time data processing within sensor devices, reducing latency and improving privacy protection while enabling more sophisticated analysis capabilities.

Miniaturization advancement continues to drive new applications, with sensors becoming smaller, more power-efficient, and less invasive. Nanotechnology applications enable molecular-level sensing capabilities for early disease detection and therapeutic monitoring. Wireless connectivity evolution includes 5G integration for high-bandwidth, low-latency communication and improved remote monitoring capabilities.

Personalization trends focus on developing sensors that adapt to individual patient characteristics and provide customized monitoring protocols. Multi-parameter sensing combines multiple biomarkers and physiological signals into comprehensive health assessment platforms. Integration with electronic health records and clinical decision support systems creates seamless workflows for healthcare providers.

Sustainability considerations drive development of environmentally friendly sensor technologies with reduced waste and improved recyclability. User experience enhancement emphasizes intuitive interfaces and seamless integration with daily life activities. The trend toward preventive healthcare creates demand for sensors capable of detecting health risks before symptoms appear.

Recent industry developments highlight the dynamic nature of the LA biomedical sensors market and ongoing innovation activities. FDA breakthrough device designations have been awarded to several LA-based companies developing innovative sensor technologies, accelerating their path to market approval and clinical adoption.

Strategic partnerships between technology companies and healthcare systems continue to expand, with major announcements including collaborations between UCLA Health and sensor manufacturers for clinical validation studies. Venture capital investment in LA-based biomedical sensor companies has reached record levels, supporting continued innovation and market expansion.

Clinical trial initiatives demonstrate growing evidence base for sensor-based healthcare interventions, with multiple large-scale studies underway at LA medical centers. Manufacturing expansion includes new facilities and production capabilities to support growing demand for biomedical sensors. Technology licensing agreements between universities and commercial entities facilitate technology transfer and commercialization.

Regulatory milestone achievements include FDA approvals for next-generation sensor technologies developed by LA-based companies. International expansion activities show LA companies successfully entering global markets with their sensor technologies. Acquisition activity demonstrates market consolidation trends and strategic positioning by major medical device companies.

Strategic recommendations for market participants focus on leveraging LA’s unique advantages while addressing key challenges. Companies should prioritize clinical validation partnerships with the region’s leading medical institutions to build evidence base and market credibility. Establishing strong regulatory expertise and FDA relationships early in product development can significantly reduce time-to-market and approval risks.

Investment in talent acquisition and retention remains critical, given the competitive landscape for skilled engineers and healthcare professionals. Collaboration strategies with academic institutions can provide access to cutting-edge research and emerging technologies while supporting workforce development. Companies should consider platform approaches that enable multiple applications and market segments rather than single-purpose devices.

Market entry strategies should focus on specific clinical applications with clear value propositions and established reimbursement pathways. International expansion planning should begin early in product development to ensure regulatory compliance across target markets. Supply chain diversification and local manufacturing capabilities can provide competitive advantages and risk mitigation.

Technology roadmap development should anticipate future trends including AI integration, 5G connectivity, and personalized medicine requirements. MarkWide Research suggests that companies maintaining focus on user experience and clinical workflow integration will achieve higher adoption rates and market success.

The future outlook for the LA biomedical sensors market remains highly positive, with sustained growth expected across all major market segments. Technology convergence between artificial intelligence, advanced materials, and wireless communications will create new capabilities and applications previously not feasible. The market is projected to maintain strong growth momentum with an estimated CAGR of 14.2% over the next five years.

Emerging applications in mental health monitoring, environmental health sensing, and precision medicine will drive market expansion beyond traditional clinical monitoring. Consumer adoption of health monitoring technologies is expected to accelerate, creating new market opportunities for sensor manufacturers. Integration with telemedicine platforms and digital therapeutics will expand the addressable market and create new revenue models.

Regulatory evolution toward more streamlined approval processes for digital health technologies will reduce barriers to market entry and accelerate innovation cycles. Healthcare system transformation toward value-based care models will increase demand for monitoring technologies that demonstrate improved outcomes and cost effectiveness. The aging population demographic will create sustained demand for chronic disease monitoring solutions.

Global market opportunities will expand as LA-developed technologies gain international recognition and regulatory approval. Investment capital availability is expected to remain strong, supporting continued innovation and market development. The convergence of healthcare, technology, and consumer electronics industries will create new partnership opportunities and market segments for biomedical sensor technologies.

The LA biomedical sensors market represents a dynamic and rapidly growing sector with exceptional potential for continued expansion and innovation. Regional advantages including world-class research institutions, skilled workforce, abundant investment capital, and strong healthcare infrastructure create a uniquely favorable environment for biomedical sensor development and commercialization.

Market fundamentals remain strong, driven by aging demographics, increasing prevalence of chronic diseases, and growing acceptance of digital health technologies. The combination of technological advancement and clinical validation capabilities positions LA-based companies for continued success in both domestic and international markets. Innovation momentum shows no signs of slowing, with breakthrough technologies in development across multiple application areas.

Strategic positioning of the LA market within the broader healthcare technology ecosystem provides sustainable competitive advantages and growth opportunities. While challenges exist in regulatory complexity and market competition, the overall trajectory remains highly positive. Future success will depend on continued collaboration between technology companies, healthcare providers, and research institutions, leveraging the region’s unique strengths to advance biomedical sensor technologies and improve patient outcomes worldwide.

What is Biomedical Sensors?

Biomedical sensors are devices that detect and measure biological signals, often used in medical diagnostics, monitoring, and treatment. They play a crucial role in applications such as glucose monitoring, heart rate detection, and wearable health technology.

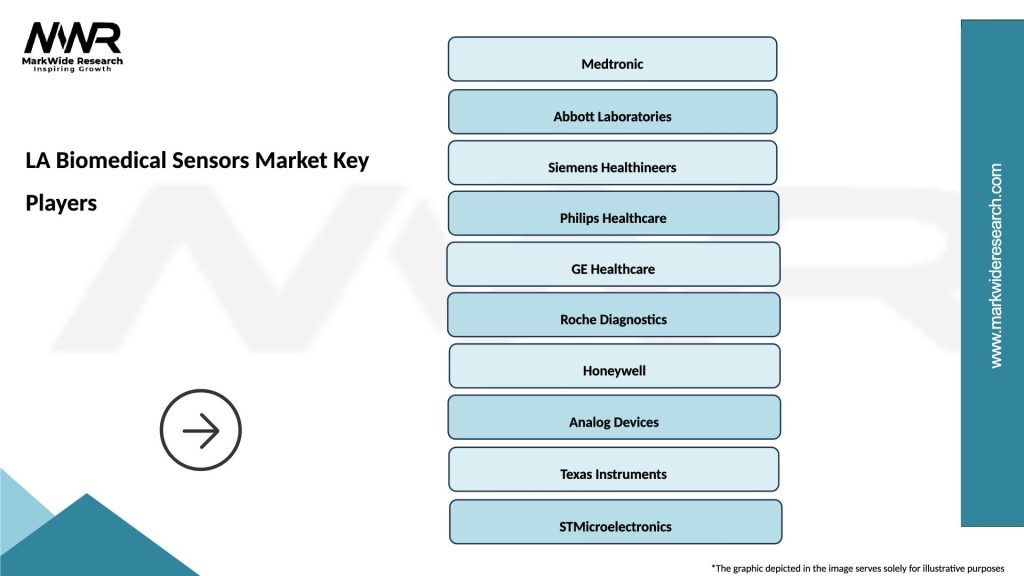

What are the key players in the LA Biomedical Sensors Market?

Key players in the LA Biomedical Sensors Market include Medtronic, Abbott Laboratories, and Philips Healthcare, among others. These companies are known for their innovative sensor technologies and contributions to healthcare solutions.

What are the main drivers of growth in the LA Biomedical Sensors Market?

The growth of the LA Biomedical Sensors Market is driven by the increasing prevalence of chronic diseases, the rising demand for home healthcare solutions, and advancements in sensor technology. These factors contribute to the expanding applications of biomedical sensors in various healthcare settings.

What challenges does the LA Biomedical Sensors Market face?

The LA Biomedical Sensors Market faces challenges such as regulatory hurdles, high development costs, and the need for continuous innovation. Additionally, ensuring data security and patient privacy remains a significant concern for manufacturers.

What opportunities exist in the LA Biomedical Sensors Market?

Opportunities in the LA Biomedical Sensors Market include the development of advanced wearable devices, integration of artificial intelligence for better data analysis, and expansion into emerging markets. These trends can enhance patient monitoring and improve healthcare outcomes.

What are the current trends in the LA Biomedical Sensors Market?

Current trends in the LA Biomedical Sensors Market include the rise of telemedicine, increased focus on personalized medicine, and the integration of IoT technology in health monitoring devices. These trends are shaping the future of healthcare delivery and patient engagement.

LA Biomedical Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Sensors, Implantable Sensors, Invasive Sensors, Non-invasive Sensors |

| Technology | Optical Sensors, Electrochemical Sensors, Thermal Sensors, Magnetic Sensors |

| End User | Hospitals, Homecare, Diagnostic Laboratories, Research Institutions |

| Application | Cardiac Monitoring, Glucose Monitoring, Respiratory Monitoring, Neurological Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Biomedical Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at