444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA ampoules packaging market represents a critical segment within the global pharmaceutical packaging industry, experiencing unprecedented growth driven by increasing demand for sterile injectable medications and advanced drug delivery systems. LA ampoules, specifically designed for pharmaceutical applications, provide superior protection for sensitive liquid medications while ensuring optimal sterility and product integrity throughout the supply chain.

Market dynamics indicate robust expansion across multiple therapeutic areas, with the packaging solutions demonstrating exceptional performance in maintaining drug stability and preventing contamination. The market encompasses various ampoule sizes, materials, and specialized coating technologies designed to meet stringent regulatory requirements and enhance patient safety outcomes.

Growth trajectories show significant momentum, with the market expanding at a compound annual growth rate of 8.2% driven by increasing pharmaceutical production, rising demand for biologics, and growing emphasis on advanced packaging technologies. Regional markets demonstrate varying adoption patterns, with developed economies leading in premium packaging solutions while emerging markets show rapid uptake of cost-effective alternatives.

Industry stakeholders benefit from technological innovations including enhanced barrier properties, improved break resistance, and advanced labeling capabilities that support pharmaceutical traceability and patient compliance initiatives. The market’s evolution reflects broader trends toward personalized medicine, specialty pharmaceuticals, and sophisticated drug delivery mechanisms requiring specialized packaging solutions.

The LA ampoules packaging market refers to the specialized segment focused on manufacturing, distributing, and utilizing sealed glass or plastic containers designed specifically for storing and delivering liquid pharmaceutical products. These ampoules provide hermetic sealing capabilities that protect sensitive medications from environmental contamination, oxidation, and microbial infiltration while maintaining product efficacy throughout extended storage periods.

Technical specifications encompass various container volumes ranging from small-dose presentations to larger therapeutic applications, with materials engineered to meet pharmaceutical-grade standards for chemical compatibility, thermal stability, and mechanical durability. The packaging solutions incorporate advanced manufacturing processes including flame-sealing, nitrogen flushing, and specialized surface treatments that enhance product protection and extend shelf life.

Regulatory compliance represents a fundamental aspect of LA ampoules packaging, with products designed to meet international pharmaceutical standards including USP, EP, and JP requirements for container closure systems. These specifications ensure consistent quality, safety, and performance across global markets while supporting pharmaceutical companies’ regulatory approval processes.

Application scope extends across multiple therapeutic categories including vaccines, biologics, oncology treatments, and specialty pharmaceuticals requiring sterile packaging solutions. The market serves diverse end-users from large pharmaceutical manufacturers to specialty drug companies and contract packaging organizations seeking reliable, cost-effective packaging alternatives.

Market positioning reveals the LA ampoules packaging sector as a dynamic and rapidly evolving component of the broader pharmaceutical packaging ecosystem, characterized by continuous innovation and expanding application opportunities. The market demonstrates strong fundamentals supported by increasing pharmaceutical production, growing demand for injectable medications, and rising emphasis on product safety and quality assurance.

Key performance indicators highlight sustained growth momentum, with market penetration increasing by 12.5% annually across major pharmaceutical manufacturing regions. This expansion reflects growing recognition of LA ampoules’ superior protective properties and their ability to support complex drug formulations requiring specialized packaging solutions.

Competitive landscape features established packaging manufacturers alongside emerging technology providers, creating a diverse ecosystem of solutions ranging from standard ampoule designs to highly specialized custom packaging systems. Market leaders focus on innovation, quality excellence, and comprehensive service capabilities to maintain competitive advantages in this demanding sector.

Strategic implications indicate continued market expansion driven by pharmaceutical industry growth, increasing regulatory requirements, and evolving drug delivery technologies. Companies investing in advanced manufacturing capabilities, sustainable packaging solutions, and digital integration technologies position themselves favorably for long-term market success and customer partnership opportunities.

Market intelligence reveals several critical insights shaping the LA ampoules packaging landscape and influencing strategic decision-making across the pharmaceutical supply chain:

Pharmaceutical industry expansion serves as the primary catalyst driving LA ampoules packaging market growth, with increasing global drug development activities, rising healthcare expenditures, and expanding access to advanced medical treatments creating sustained demand for specialized packaging solutions. The market benefits from growing pharmaceutical production volumes and increasing complexity of drug formulations requiring sophisticated packaging technologies.

Injectable medication trends significantly influence market dynamics, as healthcare providers increasingly adopt injectable therapies for their rapid onset, precise dosing, and enhanced bioavailability characteristics. This trend drives demand for high-quality ampoule packaging that ensures sterility, prevents contamination, and maintains drug stability throughout the distribution chain.

Biologics and biosimilars growth creates substantial opportunities for LA ampoules packaging, as these complex therapeutic products require specialized packaging solutions capable of maintaining protein stability, preventing aggregation, and protecting against environmental degradation. The market benefits from increasing biologics development and commercialization activities across multiple therapeutic areas.

Regulatory compliance requirements drive adoption of advanced packaging solutions that meet stringent quality standards, documentation requirements, and validation protocols. Pharmaceutical companies increasingly seek packaging partners capable of supporting regulatory submissions, providing comprehensive testing data, and ensuring consistent compliance across global markets.

Emerging market expansion contributes to market growth as developing economies invest in healthcare infrastructure, expand pharmaceutical manufacturing capabilities, and increase access to modern medical treatments. These markets demonstrate growing demand for cost-effective yet high-quality packaging solutions that support local pharmaceutical production and distribution networks.

High capital requirements present significant barriers to market entry, as establishing pharmaceutical-grade manufacturing facilities requires substantial investments in specialized equipment, clean room environments, and quality control systems. These financial constraints limit the number of qualified suppliers and may impact pricing dynamics across the market.

Regulatory complexity creates challenges for market participants, as navigating diverse international standards, validation requirements, and documentation protocols demands significant expertise and resources. Companies must maintain compliance across multiple jurisdictions while adapting to evolving regulatory frameworks and changing quality expectations.

Technical manufacturing challenges include maintaining consistent quality standards, minimizing defect rates, and ensuring reliable production processes under stringent pharmaceutical manufacturing conditions. These challenges require continuous investment in technology upgrades, process optimization, and workforce training to maintain competitive performance levels.

Supply chain vulnerabilities affect market stability, as disruptions in raw material availability, transportation networks, or manufacturing operations can impact product delivery and customer satisfaction. The market’s dependence on specialized materials and components creates potential bottlenecks that require careful supply chain management and risk mitigation strategies.

Competition from alternative packaging formats including pre-filled syringes, vials, and cartridge systems presents ongoing challenges for ampoule packaging adoption. These alternatives may offer advantages in specific applications, requiring ampoule manufacturers to continuously innovate and demonstrate superior value propositions to maintain market share.

Personalized medicine growth creates significant opportunities for LA ampoules packaging, as individualized therapies often require specialized packaging solutions capable of supporting small batch production, custom labeling, and flexible manufacturing processes. This trend enables packaging companies to develop niche expertise and premium service offerings for high-value therapeutic applications.

Emerging therapeutic areas including gene therapy, cell therapy, and advanced biologics present substantial growth opportunities for specialized packaging solutions. These innovative treatments require sophisticated packaging technologies capable of maintaining product integrity under challenging storage and transportation conditions while supporting complex regulatory requirements.

Digital integration possibilities enable development of smart packaging solutions incorporating sensors, indicators, and connectivity features that enhance supply chain visibility, patient compliance, and product authentication capabilities. These technologies create opportunities for value-added services and differentiated product offerings in competitive markets.

Sustainability initiatives drive demand for environmentally responsible packaging solutions including recyclable materials, reduced packaging waste, and energy-efficient manufacturing processes. Companies developing sustainable packaging alternatives position themselves favorably for partnerships with environmentally conscious pharmaceutical manufacturers and healthcare organizations.

Geographic expansion opportunities exist in emerging markets where healthcare infrastructure development, pharmaceutical manufacturing growth, and increasing medical access create demand for high-quality packaging solutions. These markets offer potential for establishing local manufacturing capabilities, distribution networks, and customer relationships supporting long-term growth strategies.

Supply and demand equilibrium in the LA ampoules packaging market reflects complex interactions between pharmaceutical production cycles, regulatory requirements, and technological innovation trends. Market dynamics demonstrate increasing demand stability as pharmaceutical companies recognize the strategic importance of reliable packaging partnerships for supporting product commercialization and market success.

Pricing mechanisms incorporate multiple factors including raw material costs, manufacturing complexity, regulatory compliance requirements, and value-added services. The market shows pricing optimization of 15.3% through improved manufacturing efficiency, economies of scale, and strategic sourcing initiatives that benefit both suppliers and customers.

Innovation cycles drive continuous market evolution as companies invest in research and development activities focused on enhanced materials, improved manufacturing processes, and advanced packaging technologies. These innovation efforts create competitive advantages while supporting pharmaceutical industry requirements for superior product protection and regulatory compliance.

Customer relationship dynamics emphasize long-term partnerships, collaborative development programs, and comprehensive service offerings that extend beyond basic packaging supply to include technical support, regulatory assistance, and supply chain optimization services. These relationships create mutual value and support sustained market growth.

Market maturation patterns indicate evolution from commodity-based competition toward value-added service differentiation, with successful companies focusing on technical expertise, quality excellence, and customer-centric solutions that address specific pharmaceutical industry challenges and opportunities.

Data collection approaches for LA ampoules packaging market analysis incorporate multiple primary and secondary research methodologies designed to provide comprehensive market intelligence and strategic insights. The research framework combines quantitative analysis with qualitative assessments to deliver actionable market understanding for industry stakeholders.

Primary research activities include structured interviews with industry executives, technical specialists, and key decision-makers across the pharmaceutical packaging value chain. These interactions provide firsthand insights into market trends, competitive dynamics, technological developments, and strategic priorities influencing market evolution and growth trajectories.

Secondary research components encompass analysis of industry publications, regulatory documents, patent filings, and company financial reports to establish comprehensive market baselines and identify emerging trends. This research foundation supports quantitative modeling and forecasting activities that inform strategic recommendations and market projections.

Market validation processes ensure data accuracy and reliability through cross-referencing multiple sources, expert review panels, and statistical validation techniques. MarkWide Research employs rigorous quality control measures to verify findings and ensure research conclusions accurately reflect market realities and future prospects.

Analytical frameworks incorporate advanced statistical modeling, trend analysis, and scenario planning techniques to develop robust market forecasts and strategic insights. These methodologies enable comprehensive assessment of market opportunities, competitive positioning, and risk factors affecting industry participants and investment decisions.

North American markets demonstrate strong performance in LA ampoules packaging adoption, with the region accounting for 35.7% of global market share driven by advanced pharmaceutical manufacturing infrastructure, stringent regulatory standards, and significant investment in biotechnology development. The market benefits from established supply chains, technical expertise, and customer relationships supporting sustained growth momentum.

European market dynamics reflect sophisticated regulatory frameworks, emphasis on quality excellence, and growing demand for specialized packaging solutions supporting the region’s pharmaceutical and biotechnology industries. European markets show particular strength in biologics packaging, sustainability initiatives, and advanced manufacturing technologies that enhance product quality and operational efficiency.

Asia-Pacific expansion represents the fastest-growing regional market, with annual growth rates exceeding 11.8% driven by pharmaceutical manufacturing expansion, healthcare infrastructure development, and increasing access to modern medical treatments. The region offers significant opportunities for market penetration, local manufacturing establishment, and strategic partnerships with emerging pharmaceutical companies.

Latin American markets show increasing adoption of advanced packaging solutions as healthcare systems modernize and pharmaceutical manufacturing capabilities expand. These markets demonstrate growing demand for cost-effective yet high-quality packaging alternatives that support local production and distribution requirements while meeting international quality standards.

Middle East and Africa present emerging opportunities as healthcare infrastructure investments, pharmaceutical manufacturing development, and increasing medical access create demand for specialized packaging solutions. These markets require tailored approaches considering local regulatory requirements, economic conditions, and healthcare delivery systems.

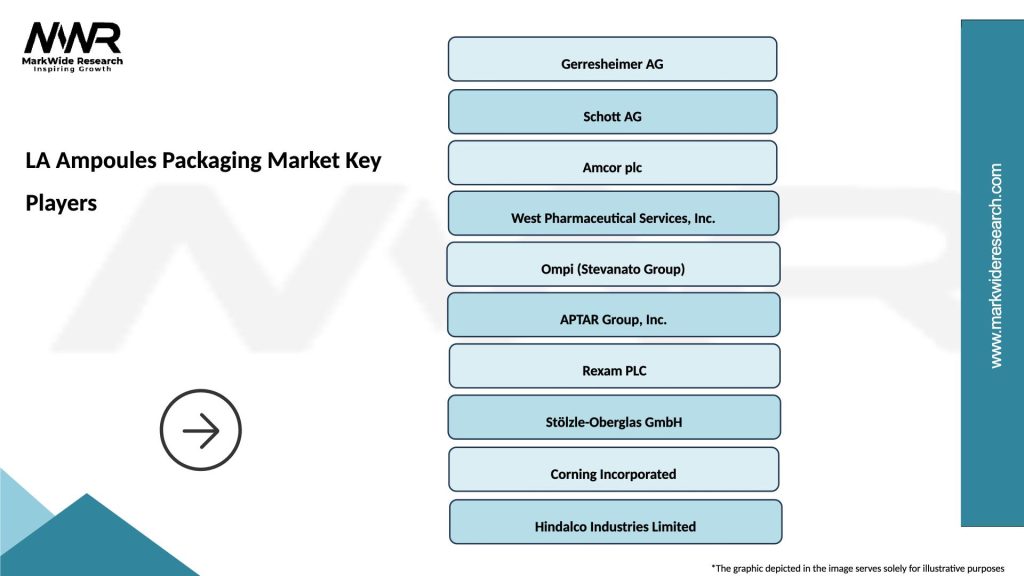

Market leadership in the LA ampoules packaging sector features established pharmaceutical packaging companies with comprehensive manufacturing capabilities, global distribution networks, and extensive technical expertise. The competitive environment emphasizes innovation, quality excellence, and customer service capabilities that support long-term partnership development.

Key market participants include:

Competitive strategies emphasize technological innovation, manufacturing excellence, and comprehensive customer support services that address evolving pharmaceutical industry requirements. Market leaders invest significantly in research and development, capacity expansion, and strategic partnerships to maintain competitive advantages and support customer growth initiatives.

Market differentiation occurs through specialized product offerings, technical expertise, regulatory compliance capabilities, and value-added services that extend beyond basic packaging supply to include development support, validation assistance, and supply chain optimization solutions.

By Material Type:

By Volume Capacity:

By Application:

Borosilicate glass ampoules represent the premium segment of the LA ampoules packaging market, offering superior performance characteristics including exceptional chemical resistance, minimal extractables, and excellent thermal stability. This category demonstrates market growth of 9.4% annually driven by increasing demand for high-quality packaging solutions supporting sensitive pharmaceutical formulations and biologics applications.

Small volume ampoules show significant growth potential as pharmaceutical companies develop more potent medications requiring precise dosing and specialized packaging solutions. This segment benefits from trends toward personalized medicine, targeted therapies, and high-value pharmaceutical products that justify premium packaging investments and advanced protection capabilities.

Vaccine packaging applications demonstrate exceptional growth momentum driven by global immunization programs, pandemic preparedness initiatives, and expanding vaccine development activities. This category requires specialized packaging solutions capable of maintaining cold chain integrity, preventing contamination, and supporting global distribution networks under challenging logistics conditions.

Biologics packaging solutions represent a high-growth category characterized by complex technical requirements, stringent regulatory standards, and premium pricing structures. The segment benefits from increasing biologics development, biosimilar competition, and growing recognition of biologics’ therapeutic advantages across multiple disease areas and patient populations.

Emerging market segments including gene therapy, cell therapy, and advanced drug delivery systems create opportunities for specialized packaging solutions with unique performance characteristics and regulatory requirements. These applications drive innovation in packaging materials, manufacturing processes, and quality assurance systems supporting next-generation therapeutic development.

Pharmaceutical manufacturers benefit from LA ampoules packaging through enhanced product protection, extended shelf life, and reliable sterility assurance that supports successful product commercialization and market penetration. The packaging solutions enable companies to maintain product quality throughout global distribution networks while meeting diverse regulatory requirements and customer expectations.

Healthcare providers gain advantages through improved medication safety, reduced contamination risks, and enhanced patient outcomes supported by high-quality packaging systems. LA ampoules provide reliable dose accuracy, easy handling characteristics, and clear product identification that supports clinical workflow efficiency and patient safety protocols.

Patients and consumers benefit from enhanced medication safety, improved product stability, and reduced risk of adverse events associated with packaging-related contamination or degradation. The packaging solutions support better therapeutic outcomes through maintained drug efficacy and reduced potential for medication errors or quality issues.

Packaging manufacturers realize opportunities for sustainable business growth, technical innovation, and strategic partnerships with pharmaceutical companies seeking reliable packaging solutions. The market provides platforms for developing specialized expertise, expanding geographic presence, and creating value-added services that differentiate companies in competitive markets.

Supply chain stakeholders including distributors, logistics providers, and regulatory agencies benefit from standardized packaging solutions that support efficient handling, transportation, and quality assurance processes. LA ampoules packaging enables streamlined supply chain operations while maintaining product integrity and regulatory compliance throughout distribution networks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping the LA ampoules packaging market, with manufacturers increasingly focusing on recyclable materials, reduced environmental impact, and energy-efficient production processes. This trend reflects growing environmental consciousness among pharmaceutical companies and healthcare organizations seeking to minimize their ecological footprint while maintaining product quality standards.

Digital transformation initiatives drive adoption of smart packaging technologies, serialization capabilities, and track-and-trace systems that enhance supply chain transparency and support anti-counterfeiting efforts. The market shows digital adoption rates of 23.6% as companies recognize the value of connected packaging solutions for improving operational efficiency and customer service capabilities.

Customization and personalization trends influence packaging design and manufacturing approaches, with pharmaceutical companies seeking tailored solutions that support specific therapeutic applications, branding requirements, and patient populations. This trend creates opportunities for specialized packaging providers capable of delivering flexible manufacturing and custom design services.

Quality assurance enhancement represents a critical trend as regulatory requirements become more stringent and pharmaceutical companies demand higher levels of documentation, validation, and process control. The market responds through implementation of advanced testing protocols, statistical process control, and comprehensive quality management systems.

Supply chain optimization drives adoption of integrated packaging solutions that support efficient manufacturing, distribution, and inventory management processes. Companies increasingly seek packaging partners capable of providing comprehensive supply chain services including forecasting, logistics support, and inventory optimization capabilities.

Manufacturing technology advances include implementation of automated production systems, enhanced quality control processes, and improved manufacturing efficiency that reduce costs while maintaining superior product quality. These developments enable packaging manufacturers to better serve pharmaceutical industry requirements while improving competitive positioning and profitability.

Material science innovations drive development of enhanced glass compositions, specialized coatings, and alternative materials that provide improved performance characteristics for demanding pharmaceutical applications. Recent developments focus on reducing extractables, enhancing chemical compatibility, and improving mechanical properties supporting diverse therapeutic requirements.

Regulatory framework evolution influences industry practices through updated standards, enhanced documentation requirements, and increased emphasis on supply chain transparency and product traceability. MarkWide Research analysis indicates these developments create both challenges and opportunities for market participants seeking to maintain compliance while supporting customer growth initiatives.

Strategic partnerships and acquisitions reshape competitive dynamics as companies seek to expand capabilities, geographic reach, and market presence through collaborative arrangements and corporate transactions. These developments enable participants to better serve global pharmaceutical customers while achieving operational synergies and cost efficiencies.

Sustainability initiatives gain momentum as companies invest in environmentally responsible manufacturing processes, recyclable packaging materials, and energy-efficient operations that support corporate social responsibility objectives while meeting customer sustainability requirements and regulatory expectations.

Investment priorities should focus on advanced manufacturing technologies, quality assurance systems, and customer service capabilities that support long-term competitive advantages in the evolving pharmaceutical packaging market. Companies achieving success will demonstrate technical excellence, regulatory compliance, and comprehensive service offerings that address diverse customer requirements and market opportunities.

Market entry strategies for new participants should emphasize niche specialization, technical differentiation, and strategic partnerships that enable rapid market penetration while minimizing capital requirements and competitive risks. Success requires deep understanding of pharmaceutical industry requirements, regulatory standards, and customer decision-making processes.

Geographic expansion approaches should consider local market characteristics, regulatory requirements, and competitive dynamics when developing international growth strategies. Companies should evaluate opportunities for establishing local manufacturing capabilities, distribution partnerships, and customer relationships that support sustainable market presence and growth momentum.

Technology investment decisions should prioritize innovations that enhance product quality, manufacturing efficiency, and customer value while supporting regulatory compliance and sustainability objectives. Strategic technology investments enable companies to maintain competitive advantages while adapting to evolving market requirements and customer expectations.

Partnership development strategies should focus on creating mutually beneficial relationships with pharmaceutical companies, regulatory agencies, and supply chain partners that support long-term business growth and market success. Effective partnerships provide access to market intelligence, technical expertise, and customer relationships that accelerate business development and competitive positioning.

Market evolution indicates continued expansion of the LA ampoules packaging sector driven by pharmaceutical industry growth, increasing regulatory requirements, and technological innovation trends. The market demonstrates strong fundamentals supporting sustained growth momentum with projected expansion rates of 8.7% annually over the next five years, reflecting robust demand across multiple therapeutic categories and geographic regions.

Technology integration will increasingly influence market dynamics as companies adopt digital solutions, advanced materials, and automated manufacturing processes that enhance operational efficiency while improving product quality and customer service capabilities. These technological advances create competitive advantages for companies investing in innovation and modernization initiatives.

Regulatory landscape evolution will continue shaping market requirements through enhanced standards, increased documentation needs, and greater emphasis on supply chain transparency and product traceability. Companies maintaining proactive compliance strategies and robust quality management systems will be better positioned for long-term success in this regulated environment.

Geographic expansion opportunities will emerge in developing markets as healthcare infrastructure investments, pharmaceutical manufacturing growth, and increasing medical access create demand for high-quality packaging solutions. These markets offer significant potential for companies capable of adapting their offerings to local requirements while maintaining international quality standards.

Innovation trajectories will focus on sustainability, functionality enhancement, and customer value creation through development of environmentally responsible packaging solutions, smart packaging technologies, and comprehensive service offerings. MWR projections indicate these innovation areas will drive market differentiation and competitive advantage development throughout the forecast period.

The LA ampoules packaging market represents a dynamic and rapidly evolving sector within the global pharmaceutical packaging industry, characterized by strong growth fundamentals, continuous innovation, and expanding application opportunities. Market analysis reveals sustained demand growth driven by pharmaceutical industry expansion, increasing regulatory requirements, and technological advancement trends that create favorable conditions for industry participants and stakeholders.

Strategic positioning in this market requires comprehensive understanding of pharmaceutical industry requirements, regulatory compliance standards, and customer service expectations that influence purchasing decisions and partnership development. Companies achieving long-term success demonstrate technical excellence, quality leadership, and customer-centric approaches that support mutually beneficial business relationships and sustainable competitive advantages.

Future market prospects indicate continued expansion opportunities across multiple dimensions including geographic markets, therapeutic applications, and technology integration possibilities. The market’s evolution toward more sophisticated packaging solutions, enhanced functionality, and comprehensive service offerings creates platforms for innovation, differentiation, and value creation that benefit all stakeholders throughout the pharmaceutical supply chain.

Investment implications suggest favorable conditions for companies seeking to establish or expand presence in the LA ampoules packaging market, with particular opportunities in emerging markets, specialized applications, and technology-enhanced solutions. Success requires strategic focus on quality excellence, customer service, and continuous innovation that addresses evolving pharmaceutical industry requirements and market dynamics while supporting sustainable business growth and stakeholder value creation.

What is LA Ampoules Packaging?

LA Ampoules Packaging refers to the specialized packaging solutions designed for ampoules, which are sealed vials used to contain and preserve pharmaceuticals, chemicals, and other sensitive products. This type of packaging ensures product integrity and safety during storage and transportation.

What are the key players in the LA Ampoules Packaging Market?

Key players in the LA Ampoules Packaging Market include Gerresheimer AG, Schott AG, and AptarGroup, Inc. These companies are known for their innovative packaging solutions and extensive product portfolios, catering to various industries such as pharmaceuticals and cosmetics, among others.

What are the growth factors driving the LA Ampoules Packaging Market?

The growth of the LA Ampoules Packaging Market is driven by the increasing demand for safe and reliable packaging in the pharmaceutical industry, the rise in biologics and injectable drugs, and the growing focus on sustainability in packaging materials.

What challenges does the LA Ampoules Packaging Market face?

The LA Ampoules Packaging Market faces challenges such as stringent regulatory requirements, high production costs, and the need for continuous innovation to meet evolving consumer preferences and safety standards.

What opportunities exist in the LA Ampoules Packaging Market?

Opportunities in the LA Ampoules Packaging Market include the development of eco-friendly packaging solutions, advancements in smart packaging technologies, and the expansion of the market in emerging economies where healthcare infrastructure is improving.

What trends are shaping the LA Ampoules Packaging Market?

Trends shaping the LA Ampoules Packaging Market include the increasing adoption of automation in packaging processes, the shift towards sustainable materials, and the growing demand for customized packaging solutions tailored to specific product needs.

LA Ampoules Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Glass, Plastic, Biodegradable, Aluminum |

| Packaging Type | Single Dose, Multi Dose, Tamper Evident, Child Resistant |

| End User | Pharmaceuticals, Cosmetics, Nutraceuticals, Veterinary |

| Distribution Channel | Online, Retail, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA Ampoules Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at