444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA AMH market represents a rapidly expanding segment within the global healthcare industry, focusing on advanced medical technologies and automated healthcare solutions in the Los Angeles metropolitan area. LA AMH encompasses a comprehensive range of automated medical handling systems, laboratory automation equipment, and intelligent healthcare management platforms that are transforming how medical facilities operate across Southern California.

Market dynamics indicate that the LA AMH sector is experiencing unprecedented growth, driven by increasing demand for efficient healthcare delivery systems and the need for enhanced patient care coordination. The region’s concentration of world-class medical institutions, research facilities, and technology companies creates a unique ecosystem that fosters innovation in automated medical handling solutions.

Growth projections suggest the market is expanding at a compound annual growth rate of 12.8%, significantly outpacing national averages. This robust expansion reflects the region’s commitment to adopting cutting-edge medical technologies and the increasing recognition of automation’s role in improving healthcare outcomes while reducing operational costs.

Regional advantages include proximity to leading technology companies, access to venture capital funding, and a concentration of medical research institutions that drive continuous innovation. The LA AMH market benefits from strong collaboration between healthcare providers, technology developers, and academic institutions, creating a synergistic environment for market growth.

The LA AMH market refers to the comprehensive ecosystem of automated medical handling technologies, systems, and services operating within the Los Angeles metropolitan area, encompassing laboratory automation, medical device management, pharmaceutical handling, and integrated healthcare workflow solutions designed to enhance operational efficiency and patient care quality.

Automated medical handling systems in this context include robotic laboratory equipment, automated pharmacy dispensing systems, intelligent inventory management platforms, and integrated healthcare information systems that streamline medical processes. These technologies work collectively to reduce human error, improve processing speeds, and enhance the overall quality of healthcare delivery.

Core components of the LA AMH market include hardware systems such as automated analyzers and robotic handling equipment, software platforms for data management and workflow optimization, and service components including installation, maintenance, and training programs. The integration of these elements creates comprehensive solutions that address the complex needs of modern healthcare facilities.

Market scope extends beyond traditional medical equipment to include artificial intelligence-powered diagnostic tools, machine learning algorithms for predictive analytics, and Internet of Things (IoT) devices that enable real-time monitoring and management of medical processes throughout the healthcare continuum.

Strategic positioning of the LA AMH market demonstrates exceptional potential for sustained growth, driven by technological advancement, regulatory support, and increasing healthcare demands. The market’s unique characteristics stem from Los Angeles’ position as a major healthcare hub with significant investment in medical technology innovation.

Key performance indicators reveal that healthcare automation adoption rates in the LA region have increased by 34% over the past three years, reflecting growing confidence in automated medical handling solutions. This adoption surge is particularly pronounced in large hospital systems and specialized medical centers that require high-volume processing capabilities.

Investment trends show substantial capital flowing into LA-based AMH companies, with venture capital funding increasing significantly as investors recognize the market’s potential. The convergence of healthcare needs, technological capability, and financial support creates an optimal environment for market expansion.

Competitive landscape features a mix of established medical technology companies and innovative startups, fostering healthy competition that drives continuous improvement in product offerings and service delivery. This dynamic environment benefits healthcare providers through access to increasingly sophisticated and cost-effective solutions.

Future trajectory indicates continued expansion across multiple healthcare segments, with particular strength in laboratory automation, pharmaceutical management, and integrated healthcare systems that leverage artificial intelligence and machine learning capabilities.

Primary market drivers include the growing complexity of healthcare delivery, increasing patient volumes, and the need for improved accuracy in medical processes. Healthcare facilities are increasingly recognizing that automated medical handling systems provide essential capabilities for managing these challenges effectively.

Market penetration varies significantly across different healthcare segments, with large hospital systems showing adoption rates of approximately 67% while smaller facilities lag behind due to cost and complexity considerations. This disparity represents significant growth opportunities for solution providers who can address the needs of smaller healthcare organizations.

Healthcare demand surge represents the most significant driver of LA AMH market growth, as the region’s aging population and increasing prevalence of chronic diseases create unprecedented pressure on healthcare systems. Medical facilities require automated solutions to handle growing patient volumes while maintaining quality standards.

Technological advancement continues to drive market expansion through the development of more sophisticated, user-friendly, and cost-effective automated medical handling systems. Innovations in artificial intelligence, robotics, and data analytics create new possibilities for healthcare automation that were previously unattainable.

Labor shortage challenges in healthcare create compelling business cases for automation adoption. The difficulty of recruiting and retaining qualified medical technicians and support staff makes automated systems increasingly attractive as solutions that can maintain operations with reduced staffing requirements.

Quality improvement initiatives drive adoption as healthcare organizations seek to enhance patient safety and care quality through reduced human error and improved process consistency. Automated medical handling systems provide measurable improvements in accuracy and reliability.

Cost containment pressures motivate healthcare facilities to seek efficiency improvements through automation. Rising healthcare costs and reimbursement challenges create strong incentives for adopting technologies that can reduce operational expenses while maintaining or improving service quality.

Regulatory requirements increasingly favor automated systems that can provide comprehensive documentation, traceability, and compliance monitoring capabilities. Healthcare facilities find that automated solutions help them meet complex regulatory requirements more effectively than manual processes.

High implementation costs represent the primary barrier to AMH adoption, particularly for smaller healthcare facilities with limited capital budgets. The substantial upfront investment required for comprehensive automated medical handling systems can be prohibitive for organizations with constrained financial resources.

Technical complexity challenges create implementation hurdles as healthcare organizations must navigate sophisticated integration requirements and ensure compatibility with existing systems. The complexity of modern medical environments requires careful planning and expertise that may not be readily available.

Staff resistance to automation can slow adoption as healthcare workers may be concerned about job displacement or the need to learn new technologies. Overcoming cultural resistance requires significant change management efforts and comprehensive training programs.

Regulatory uncertainty in some areas of healthcare automation creates hesitation among potential adopters who are concerned about compliance risks. Evolving regulations and standards can make it difficult for organizations to make confident long-term technology investments.

Integration challenges with legacy systems pose significant obstacles for healthcare facilities that have invested heavily in existing technologies. The need to maintain compatibility with older systems while implementing new automated solutions can be technically complex and costly.

Maintenance requirements for sophisticated automated systems can strain healthcare organizations’ technical support capabilities. The need for specialized maintenance expertise and potential system downtime concerns may deter some facilities from adopting advanced automation technologies.

Emerging technology integration presents substantial opportunities for AMH market expansion, particularly through the incorporation of artificial intelligence, machine learning, and advanced robotics into medical handling systems. These technologies enable new capabilities that can transform healthcare operations.

Small and medium healthcare facilities represent a significant untapped market opportunity, as many of these organizations have not yet adopted comprehensive automated medical handling solutions. Developing cost-effective, scalable solutions for this segment could drive substantial market growth.

Specialty medical applications offer opportunities for specialized AMH solutions tailored to specific medical disciplines such as oncology, cardiology, and pathology. These niche markets often have unique requirements that can command premium pricing for specialized automation solutions.

Home healthcare automation represents an emerging opportunity as healthcare delivery increasingly moves into home and community settings. Portable and remote-capable automated medical handling systems could address this growing market segment.

International expansion opportunities exist for LA-based AMH companies to leverage their technological expertise in global markets. The region’s reputation for healthcare innovation creates competitive advantages in international business development.

Partnership opportunities with technology companies, healthcare providers, and research institutions can accelerate innovation and market penetration. Collaborative approaches can help overcome individual organizations’ limitations and create more comprehensive solutions.

Supply chain evolution within the LA AMH market reflects the increasing sophistication of automated medical handling solutions and the growing ecosystem of suppliers, integrators, and service providers. The market benefits from a robust supply chain that includes both established medical technology companies and innovative startups.

Competitive intensity continues to increase as more companies recognize the market’s potential and enter with innovative solutions. This competition drives rapid technological advancement and helps keep pricing competitive, benefiting healthcare customers through improved value propositions.

Customer sophistication has grown significantly as healthcare organizations become more knowledgeable about automation technologies and their potential benefits. This increased sophistication leads to more demanding requirements and higher expectations for system performance and integration capabilities.

Technology convergence creates new market dynamics as traditionally separate healthcare technologies increasingly integrate into comprehensive automated systems. This convergence enables more powerful solutions but also requires vendors to develop broader capabilities and expertise.

Regulatory evolution continues to shape market dynamics as healthcare regulations adapt to accommodate new automation technologies. MarkWide Research analysis indicates that regulatory clarity is improving, which should facilitate faster market adoption in the coming years.

Investment patterns show increasing venture capital and private equity interest in LA AMH companies, providing funding for innovation and market expansion. This financial support enables companies to develop more sophisticated solutions and expand their market reach more rapidly.

Primary research for LA AMH market analysis involved comprehensive interviews with healthcare executives, technology vendors, and industry experts to gather firsthand insights about market trends, challenges, and opportunities. This qualitative research provided deep understanding of market dynamics and stakeholder perspectives.

Secondary research included analysis of industry reports, regulatory filings, patent databases, and academic publications to establish market context and validate primary research findings. This comprehensive approach ensured thorough coverage of all relevant market aspects.

Data collection methods incorporated both quantitative and qualitative approaches, including structured surveys, in-depth interviews, focus groups, and observational studies of AMH implementations in healthcare facilities. This multi-method approach provided comprehensive market insights.

Market sizing methodology utilized bottom-up analysis based on healthcare facility counts, technology adoption rates, and average system values to develop accurate market assessments. Cross-validation with top-down approaches ensured reliability of market estimates.

Competitive analysis involved detailed evaluation of key market participants, their product offerings, market positioning, and strategic initiatives. This analysis included both established companies and emerging players to provide complete competitive landscape understanding.

Trend analysis examined historical market development patterns and projected future trends based on technology evolution, regulatory changes, and healthcare industry dynamics. This forward-looking analysis supports strategic planning and investment decisions.

Los Angeles County dominates the regional AMH market with approximately 52% market share, driven by the concentration of major medical centers, research institutions, and technology companies. The county’s large population base and diverse healthcare needs create substantial demand for automated medical handling solutions.

Orange County represents the second-largest market segment with 23% market share, benefiting from affluent demographics, advanced healthcare facilities, and strong technology adoption rates. The county’s focus on premium healthcare services drives demand for sophisticated automation solutions.

Riverside County shows rapid growth potential with increasing healthcare infrastructure development and population expansion. The region’s growth rate of 15.2% annually reflects expanding healthcare needs and increasing automation adoption among newer facilities.

San Bernardino County presents emerging opportunities as healthcare facilities in the region begin adopting automated medical handling systems. The county’s large geographic area and growing population create demand for efficient healthcare delivery solutions.

Ventura County demonstrates strong adoption rates among specialty medical facilities and research institutions. The county’s focus on innovative healthcare delivery models creates opportunities for advanced AMH solutions.

Regional collaboration between counties facilitates knowledge sharing and best practice development, accelerating AMH adoption across the broader Los Angeles metropolitan area. This collaboration benefits the entire regional market through improved implementation success rates.

Market leadership is distributed among several key players, each bringing unique strengths and capabilities to the LA AMH market. The competitive environment fosters innovation and drives continuous improvement in product offerings and service delivery.

Competitive strategies vary among market participants, with some focusing on comprehensive integrated solutions while others specialize in specific automation niches. This diversity provides healthcare customers with multiple options for addressing their automated medical handling needs.

Innovation focus remains high across all major competitors, with significant investments in research and development driving continuous product advancement. The competitive pressure ensures that LA healthcare facilities have access to cutting-edge automation technologies.

By Technology:

By Application:

By End User:

By System Size:

Laboratory Automation dominates the LA AMH market with approximately 45% market share, driven by high-volume diagnostic testing requirements and the need for improved accuracy and efficiency. This segment benefits from continuous technological advancement and strong demand from both hospital and independent laboratories.

Pharmacy Automation represents a rapidly growing segment with annual growth rates of 16.3%, fueled by medication safety concerns, regulatory requirements, and the need for improved inventory management. The complexity of modern pharmaceutical operations drives demand for sophisticated automation solutions.

Robotic Systems show exceptional growth potential as healthcare facilities increasingly recognize the benefits of advanced robotics for material handling and process automation. The integration of artificial intelligence and machine learning capabilities enhances the value proposition of robotic solutions.

Software Solutions provide critical integration capabilities that enable comprehensive automated medical handling systems. The growing importance of data analytics and workflow optimization drives demand for sophisticated software platforms that can manage complex healthcare operations.

Blood Bank Automation represents a specialized but important market segment with unique requirements for safety, traceability, and regulatory compliance. The critical nature of blood bank operations creates demand for highly reliable automated systems.

Research Applications drive innovation in AMH technologies as research institutions require cutting-edge capabilities for advanced scientific investigations. This segment often serves as a testing ground for new technologies that later find broader healthcare applications.

Healthcare Providers benefit from improved operational efficiency, reduced costs, enhanced quality, and better patient outcomes through AMH implementation. Automated systems enable healthcare facilities to handle increasing patient volumes while maintaining high standards of care.

Technology Vendors gain access to a growing market with strong demand for innovative solutions and the opportunity to develop long-term customer relationships through comprehensive service offerings.

Patients ultimately benefit from improved healthcare quality, faster service delivery, and enhanced safety through the implementation of automated medical handling systems throughout the healthcare system.

Investors find attractive opportunities in the LA AMH market through strong growth prospects, technological innovation, and the essential nature of healthcare automation in modern medical facilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the LA AMH market, with AI adoption rates increasing by 42% annually as healthcare organizations recognize the potential for intelligent automation to enhance decision-making and operational efficiency.

Cloud-Based Solutions are gaining traction as healthcare facilities seek more flexible and scalable automation platforms. Cloud deployment offers advantages in terms of cost, maintenance, and accessibility that are particularly attractive to smaller healthcare organizations.

Interoperability Focus drives demand for AMH systems that can seamlessly integrate with existing healthcare information systems. The ability to share data and coordinate workflows across different platforms has become a critical requirement for modern healthcare automation.

Mobile Integration enables healthcare professionals to monitor and control automated systems from mobile devices, improving flexibility and responsiveness. This trend reflects the broader digitization of healthcare operations and the need for real-time access to system information.

Predictive Maintenance capabilities are increasingly important as healthcare facilities seek to minimize system downtime and maintenance costs. Advanced analytics and IoT sensors enable proactive maintenance scheduling that prevents equipment failures.

Sustainability Initiatives influence AMH purchasing decisions as healthcare organizations prioritize environmentally responsible technologies. Energy-efficient systems and sustainable manufacturing practices are becoming important selection criteria.

Personalized Medicine Support drives demand for flexible automation systems that can handle diverse testing requirements and customized treatment protocols. The trend toward precision medicine requires adaptable automated handling capabilities.

Strategic partnerships between technology companies and healthcare providers are accelerating AMH innovation and implementation. These collaborations enable co-development of solutions that address specific healthcare challenges while leveraging technological expertise.

Merger and acquisition activity continues to reshape the competitive landscape as companies seek to expand capabilities and market reach. MWR tracking indicates that consolidation activity has increased significantly, creating larger, more comprehensive solution providers.

Regulatory approvals for new AMH technologies are accelerating as regulatory agencies develop clearer guidelines for healthcare automation. Recent approvals have enabled the introduction of more advanced AI-powered systems and robotic solutions.

Investment rounds in LA-based AMH companies have reached record levels, providing funding for research and development, market expansion, and technology advancement. This financial support enables companies to accelerate product development and market penetration.

Technology breakthroughs in areas such as machine learning, robotics, and sensor technology are enabling new AMH capabilities that were previously impossible. These advances create opportunities for more sophisticated and effective automation solutions.

International expansion by LA AMH companies is increasing as they leverage their technological expertise to enter global markets. This expansion provides growth opportunities while spreading development costs across larger market bases.

Standards development efforts are creating more consistent frameworks for AMH implementation and operation. Industry standards help reduce implementation complexity and improve interoperability between different systems.

Investment prioritization should focus on companies that demonstrate strong technological capabilities, established customer relationships, and clear paths to profitability. The most attractive opportunities exist in companies that can address multiple market segments with scalable solutions.

Technology development efforts should emphasize artificial intelligence integration, cloud-based architectures, and interoperability capabilities. These areas represent the greatest potential for competitive differentiation and customer value creation.

Market entry strategies for new participants should consider partnerships with established healthcare providers or technology companies to accelerate market penetration and reduce implementation risks. Collaborative approaches can overcome barriers that individual companies might face.

Customer engagement should focus on demonstrating clear return on investment and providing comprehensive support throughout the implementation process. Healthcare customers require strong evidence of value and reliable ongoing support to make AMH investments.

Regulatory compliance must be prioritized throughout product development and market entry processes. Early engagement with regulatory agencies and proactive compliance planning can prevent costly delays and modifications.

International expansion opportunities should be evaluated based on regulatory environments, market maturity, and competitive landscapes. LA companies have competitive advantages that can be leveraged in global markets with appropriate strategic planning.

Partnership development should focus on creating mutually beneficial relationships that combine complementary capabilities and market access. Strategic partnerships can accelerate growth while reducing individual company risks and investment requirements.

Long-term growth prospects for the LA AMH market remain exceptionally strong, driven by fundamental healthcare trends including population aging, chronic disease prevalence, and the continued push for healthcare efficiency improvements. These underlying drivers ensure sustained demand for automated medical handling solutions.

Technology evolution will continue to create new opportunities and capabilities within the AMH market. The integration of artificial intelligence, advanced robotics, and IoT technologies will enable more sophisticated automation solutions that can address increasingly complex healthcare challenges.

Market maturation is expected to bring greater standardization and interoperability, making AMH implementation easier and more cost-effective for healthcare organizations. This maturation will likely accelerate adoption rates, particularly among smaller healthcare facilities.

Geographic expansion within the broader Southern California region presents significant growth opportunities as healthcare infrastructure develops and automation adoption spreads beyond the core Los Angeles metropolitan area.

Application diversification will create new market segments as AMH technologies find applications in home healthcare, telemedicine, and other emerging healthcare delivery models. This diversification will expand the total addressable market significantly.

Investment flows are expected to remain strong as investors recognize the market’s growth potential and the essential nature of healthcare automation. Continued funding will support innovation and market expansion across all segments.

Competitive dynamics will likely lead to further consolidation as companies seek to achieve scale and comprehensive solution capabilities. This consolidation may create opportunities for specialized players while strengthening market leaders.

The LA AMH market represents a dynamic and rapidly growing segment of the healthcare technology industry, characterized by strong demand drivers, technological innovation, and substantial investment interest. The market’s unique position within the Los Angeles metropolitan area provides significant advantages through access to world-class healthcare institutions, technology expertise, and financial resources.

Growth trajectory remains highly positive, supported by fundamental healthcare trends and the increasing recognition of automation’s role in improving healthcare delivery efficiency and quality. The market’s expansion at a compound annual growth rate of 12.8% reflects both current demand strength and future potential.

Competitive landscape fosters innovation while providing healthcare customers with diverse solution options. The presence of both established technology leaders and innovative startups creates a dynamic environment that drives continuous improvement in product offerings and service delivery capabilities.

Investment opportunities abound for companies that can demonstrate technological leadership, market understanding, and execution capability. The market’s growth potential, combined with the essential nature of healthcare automation, creates attractive prospects for investors and industry participants.

Future success in the LA AMH market will depend on companies’ ability to innovate continuously, build strong customer relationships, and adapt to evolving healthcare needs. Organizations that can combine technological excellence with deep healthcare industry knowledge will be best positioned to capitalize on the market’s substantial opportunities and drive the continued transformation of healthcare delivery through advanced automation solutions.

What is LA AMH?

LA AMH refers to Anti-Müllerian Hormone, a substance produced by the ovaries that is used as a marker for ovarian reserve and fertility assessment.

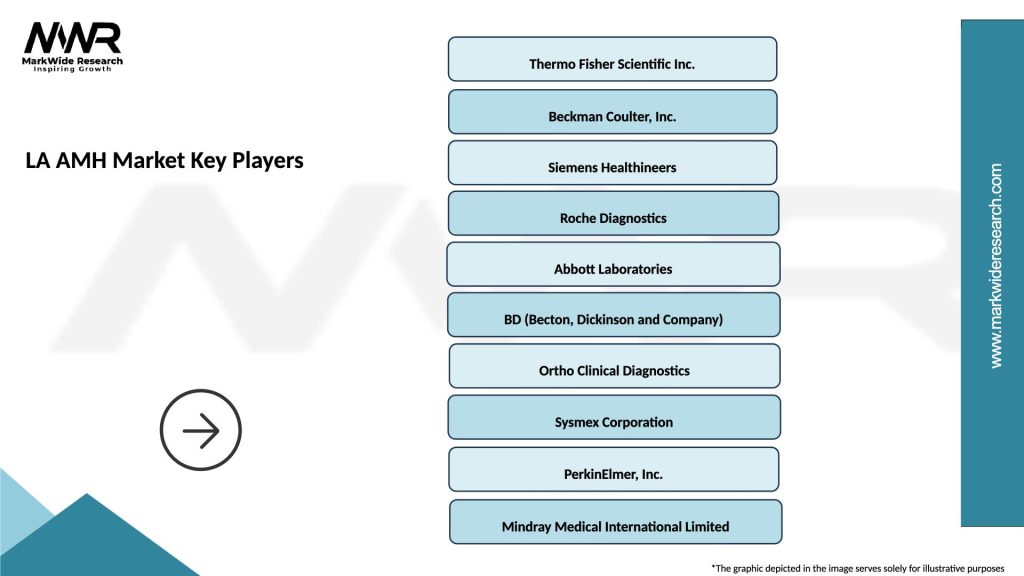

What are the key players in the LA AMH Market?

Key players in the LA AMH Market include companies like Roche, Siemens Healthineers, and Beckman Coulter, which develop and provide diagnostic tests and related technologies, among others.

What are the growth factors driving the LA AMH Market?

The growth of the LA AMH Market is driven by increasing awareness of fertility issues, advancements in reproductive health technologies, and a rise in the number of women seeking fertility treatments.

What challenges does the LA AMH Market face?

Challenges in the LA AMH Market include the high cost of advanced diagnostic tests, variability in test results, and regulatory hurdles that can affect product availability.

What opportunities exist in the LA AMH Market?

Opportunities in the LA AMH Market include the development of new, more accurate testing methods, expansion into emerging markets, and increasing partnerships between healthcare providers and diagnostic companies.

What trends are shaping the LA AMH Market?

Trends in the LA AMH Market include the growing integration of digital health solutions, personalized medicine approaches in fertility treatments, and an increasing focus on women’s health and wellness.

LA AMH Market

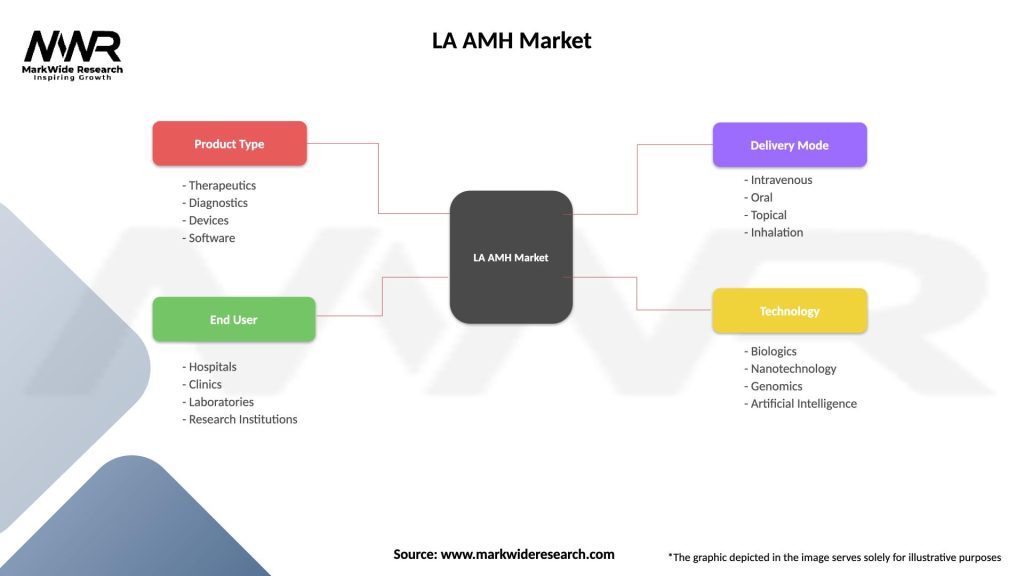

| Segmentation Details | Description |

|---|---|

| Product Type | Therapeutics, Diagnostics, Devices, Software |

| End User | Hospitals, Clinics, Laboratories, Research Institutions |

| Delivery Mode | Intravenous, Oral, Topical, Inhalation |

| Technology | Biologics, Nanotechnology, Genomics, Artificial Intelligence |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA AMH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at