444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kuwait vegetables and fruits market represents a dynamic and rapidly evolving sector within the Gulf Cooperation Council region, characterized by increasing consumer demand for fresh produce and growing emphasis on food security initiatives. Kuwait’s strategic position as a major oil-producing nation has facilitated significant investments in agricultural infrastructure and import capabilities, creating a robust marketplace for both domestic and international produce suppliers.

Market dynamics in Kuwait’s fresh produce sector are primarily driven by the country’s limited arable land, which accounts for less than 1% of total land area, necessitating heavy reliance on imports to meet domestic consumption needs. The market demonstrates remarkable resilience and growth potential, with import volumes increasing by 8.5% annually over recent years, reflecting both population growth and evolving dietary preferences toward healthier food options.

Consumer behavior patterns indicate a strong preference for premium quality produce, with Kuwaiti consumers increasingly willing to pay premium prices for organic and sustainably sourced fruits and vegetables. The market benefits from high per capita income levels and sophisticated retail infrastructure, including modern hypermarkets, specialty stores, and emerging e-commerce platforms that facilitate efficient distribution of fresh produce throughout the country.

The Kuwait vegetables and fruits market refers to the comprehensive ecosystem encompassing the production, import, distribution, and retail of fresh produce within Kuwait’s borders, serving both residential consumers and commercial food service establishments. This market represents a critical component of the nation’s food security strategy and encompasses various supply chain elements from international sourcing to final consumer delivery.

Market definition includes all categories of fresh vegetables, fruits, and related produce products available through traditional markets, modern retail outlets, wholesale distribution centers, and digital commerce platforms. The sector encompasses both conventional and organic produce varieties, catering to diverse consumer preferences and dietary requirements across Kuwait’s multicultural population base.

Stakeholder participation involves international exporters, local importers, wholesale distributors, retail chains, traditional souks, restaurants, hotels, and institutional buyers including schools, hospitals, and corporate catering services. The market operates within Kuwait’s regulatory framework governing food safety, import standards, and quality assurance protocols established by relevant government authorities.

Kuwait’s vegetables and fruits market demonstrates exceptional growth momentum driven by increasing health consciousness, population expansion, and government initiatives promoting food security and agricultural diversification. The market benefits from Kuwait’s strategic geographic location, enabling efficient access to produce from multiple international sources including neighboring Arab countries, South Asia, Europe, and North America.

Key market characteristics include heavy import dependence, premium quality preferences, and sophisticated distribution networks serving both traditional and modern retail channels. The sector shows particular strength in tropical fruits, leafy vegetables, and specialty organic produce categories, with organic segment growth reaching 12% annually as consumers increasingly prioritize health and sustainability considerations.

Strategic developments include investments in cold chain infrastructure, expansion of hydroponic farming facilities, and integration of digital technologies for supply chain optimization. The market demonstrates resilience against external shocks through diversified sourcing strategies and robust inventory management systems maintained by major retail operators and wholesale distributors.

Consumer preferences in Kuwait’s produce market reflect sophisticated tastes and quality expectations, with particular emphasis on freshness, appearance, and nutritional value. The following insights characterize current market dynamics:

Population growth serves as a fundamental driver for Kuwait’s vegetables and fruits market, with the country’s population expanding steadily and creating increased demand for fresh produce across all demographic segments. The diverse expatriate population, representing various cultural backgrounds, contributes to demand for specialty fruits and vegetables from different regions worldwide.

Health and wellness trends significantly influence market dynamics as Kuwaiti consumers become increasingly conscious of dietary choices and nutritional benefits associated with fresh produce consumption. Government health initiatives promoting balanced diets and reduced consumption of processed foods further support market growth across all produce categories.

Economic prosperity enables consumers to prioritize quality over price considerations, driving demand for premium imported produce and organic alternatives. High disposable income levels support willingness to experiment with exotic fruits and specialty vegetables, creating opportunities for niche market segments and premium product positioning.

Infrastructure development including modern retail facilities, cold storage capabilities, and efficient logistics networks facilitates market expansion and improves product availability throughout Kuwait. Investments in port facilities and transportation systems enhance import capabilities and reduce supply chain costs for international produce suppliers.

Climate limitations pose significant challenges for domestic agricultural production in Kuwait, with extreme temperatures, limited water resources, and poor soil conditions restricting local farming capabilities. These environmental constraints necessitate continued reliance on imports and limit opportunities for agricultural self-sufficiency initiatives.

Supply chain vulnerabilities create potential disruptions in produce availability, particularly during geopolitical tensions, transportation strikes, or global supply chain disruptions. The market’s heavy dependence on imports makes it susceptible to external factors beyond local control, including weather conditions in source countries and international trade policies.

Storage and preservation challenges in Kuwait’s harsh climate require significant investments in cold chain infrastructure and climate-controlled facilities. High energy costs associated with maintaining optimal storage conditions impact overall supply chain economics and may influence pricing strategies for temperature-sensitive produce categories.

Regulatory compliance requirements for imported produce include extensive documentation, quality certifications, and inspection procedures that may create delays and additional costs for importers. Stringent food safety standards, while ensuring quality, can limit sourcing options and increase administrative burdens for market participants.

Organic produce expansion presents substantial growth opportunities as consumer awareness of health benefits and environmental sustainability increases. The premium pricing potential for certified organic fruits and vegetables aligns with Kuwait’s affluent consumer base and growing health consciousness trends.

Hydroponic and controlled environment agriculture offer promising avenues for reducing import dependence while ensuring year-round production of high-quality vegetables. Government support for agricultural innovation and technology adoption creates favorable conditions for investment in modern farming techniques and greenhouse facilities.

E-commerce integration provides significant opportunities for market expansion, particularly among younger consumers and busy professionals seeking convenience in grocery shopping. Digital platforms enable direct-to-consumer sales models and subscription-based delivery services that can capture growing market segments.

Value-added processing including pre-cut vegetables, fruit salads, and ready-to-eat products addresses consumer demand for convenience while creating higher margin opportunities for retailers and processors. The food service sector’s growth creates additional demand for processed and semi-prepared produce items.

Supply chain efficiency remains a critical factor in Kuwait’s vegetables and fruits market, with successful operators investing heavily in logistics optimization, inventory management, and cold chain maintenance. The market rewards companies that can consistently deliver fresh, high-quality produce while minimizing waste and maintaining competitive pricing structures.

Seasonal demand patterns create dynamic market conditions requiring sophisticated forecasting and inventory planning capabilities. Peak consumption periods during Ramadan and cooler months generate significant volume increases, while summer months typically see reduced demand for certain produce categories due to climate considerations and travel patterns.

Competition intensity varies across different market segments, with premium imported produce facing less price competition compared to commodity vegetables and fruits. Market participants differentiate through quality consistency, brand reputation, customer service, and specialized product offerings targeting specific consumer preferences.

Technology adoption increasingly influences market dynamics through improved supply chain visibility, demand forecasting, and customer engagement platforms. MarkWide Research indicates that companies leveraging advanced analytics and digital technologies achieve 15% better inventory turnover rates compared to traditional operators.

Primary research activities encompassed comprehensive interviews with key market stakeholders including importers, distributors, retailers, and consumers across Kuwait’s major population centers. Field research included visits to traditional souks, modern hypermarkets, wholesale markets, and emerging e-commerce fulfillment centers to gather firsthand insights into market operations and consumer behavior patterns.

Secondary research sources included government statistical databases, trade association reports, customs import data, and industry publications providing quantitative market information and trend analysis. Academic research papers and international agricultural reports contributed additional context regarding regional market dynamics and global produce trade patterns.

Data validation processes involved cross-referencing multiple information sources and conducting follow-up interviews with industry experts to ensure accuracy and reliability of market insights. Statistical analysis techniques were applied to identify significant trends and correlations within the collected data sets.

Market segmentation analysis utilized both demographic and psychographic variables to understand consumer preferences and purchasing behaviors across different market segments. Geographic analysis considered regional variations within Kuwait and proximity factors affecting distribution efficiency and market accessibility.

Kuwait City metropolitan area represents the largest market concentration, accounting for approximately 45% of total produce consumption due to high population density and concentration of retail infrastructure. The capital region features the most sophisticated distribution networks, premium retail outlets, and diverse consumer base with varying cultural preferences and purchasing power levels.

Hawalli Governorate demonstrates strong market potential with growing residential communities and expanding retail presence. The region shows particular strength in family-oriented shopping patterns and traditional market preferences, creating opportunities for both modern retail formats and conventional produce vendors.

Farwaniya region exhibits significant growth in produce consumption driven by population expansion and infrastructure development. The area benefits from strategic location advantages for wholesale distribution and shows increasing adoption of modern retail formats alongside traditional shopping preferences.

Ahmadi and Mubarak Al-Kabeer governorates represent emerging market opportunities with developing residential areas and increasing retail investment. These regions demonstrate growing demand for convenience-oriented produce offerings and premium quality imports, reflecting rising income levels and changing lifestyle patterns.

Market leadership in Kuwait’s vegetables and fruits sector is characterized by a mix of large-scale importers, established retail chains, and specialized produce distributors. The competitive environment rewards companies that can maintain consistent quality standards, efficient supply chain operations, and strong customer relationships across diverse market segments.

Competitive strategies include vertical integration, exclusive supplier relationships, private label development, and customer loyalty programs. Market leaders invest significantly in cold chain infrastructure, quality assurance systems, and staff training to maintain competitive advantages in this quality-sensitive market.

By Product Category:

By Distribution Channel:

By Consumer Segment:

Vegetable categories demonstrate varying growth patterns and consumer preferences across Kuwait’s diverse market. Leafy greens including lettuce, spinach, and herbs show consistent demand throughout the year, while seasonal vegetables like squash and root vegetables experience cyclical consumption patterns aligned with traditional cooking preferences and cultural celebrations.

Fruit segments exhibit strong performance in tropical varieties including mangoes, pineapples, and exotic Asian fruits that appeal to both local and expatriate consumers. Citrus fruits maintain steady demand year-round, while berry categories command premium prices and show growing popularity among health-conscious consumers seeking antioxidant-rich options.

Organic produce categories experience rapid growth across both fruits and vegetables, with organic sales increasing by 18% annually as consumers become more aware of health benefits and environmental considerations. Premium positioning and limited availability create opportunities for specialized retailers and importers focusing on certified organic products.

Processed and value-added produce segments including pre-cut vegetables, fruit salads, and packaged herbs show strong growth potential driven by convenience trends and busy lifestyles. These categories offer higher margins for retailers while addressing consumer demand for time-saving food preparation solutions.

Importers and distributors benefit from Kuwait’s stable economic environment, high consumer purchasing power, and efficient port infrastructure that facilitates international trade operations. The market’s premium positioning allows for healthy profit margins on quality produce while diversified sourcing opportunities reduce supply chain risks.

Retail operators enjoy strong consumer loyalty and repeat purchase patterns in the fresh produce category, creating predictable revenue streams and opportunities for cross-selling complementary products. Modern retail formats benefit from growing consumer preference for one-stop shopping experiences and quality assurance.

Technology providers find significant opportunities in supply chain optimization, inventory management systems, and e-commerce platforms as market participants seek efficiency improvements and digital transformation solutions. Cold chain technology and preservation systems represent particularly attractive market segments.

Consumers benefit from year-round availability of diverse, high-quality produce options at competitive prices relative to regional markets. The sophisticated retail infrastructure ensures food safety standards while providing convenient shopping experiences across multiple channels and formats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as a dominant trend with consumers increasingly considering environmental impact in their purchasing decisions. Retailers respond by expanding organic offerings, reducing packaging waste, and partnering with suppliers committed to sustainable farming practices and carbon footprint reduction initiatives.

Digital transformation accelerates across all market segments with online grocery platforms, mobile applications, and contactless payment systems becoming standard offerings. MWR analysis indicates that digital channel adoption rates increased by 35% over the past two years, fundamentally changing consumer shopping behaviors and expectations.

Health and wellness positioning influences product selection, marketing strategies, and retail merchandising approaches as consumers seek produce with specific nutritional benefits. Superfoods, antioxidant-rich fruits, and functional vegetables gain prominence in product assortments and promotional activities.

Convenience enhancement drives innovation in packaging, preparation, and delivery services with retailers offering pre-cut vegetables, meal kits, and subscription-based delivery programs. Time-pressed consumers increasingly value solutions that simplify meal preparation while maintaining nutritional quality and freshness standards.

Infrastructure investments include major expansions of cold storage facilities, automated distribution centers, and temperature-controlled transportation fleets to support growing market demand and improve supply chain efficiency. These developments enhance product quality maintenance and reduce waste throughout the distribution process.

Technology adoption encompasses implementation of blockchain systems for traceability, artificial intelligence for demand forecasting, and IoT sensors for cold chain monitoring. These technological advances improve operational efficiency while providing transparency and quality assurance to increasingly sophisticated consumers.

Partnership formations between international suppliers and local distributors create more stable supply relationships and enable better market penetration for specialty produce categories. Strategic alliances facilitate knowledge transfer, quality standardization, and market development initiatives.

Regulatory updates include enhanced food safety requirements, streamlined import procedures for certified suppliers, and support programs for agricultural technology adoption. Government initiatives promote food security through diversified sourcing strategies and domestic production capability development.

Market participants should prioritize investment in cold chain infrastructure and quality assurance systems to maintain competitive advantages in Kuwait’s quality-sensitive produce market. Companies that consistently deliver superior product quality and freshness will capture premium market segments and build strong customer loyalty.

Diversification strategies across multiple product categories, sourcing regions, and distribution channels will help mitigate risks associated with supply chain disruptions and seasonal demand variations. Successful operators maintain flexible sourcing arrangements and robust inventory management systems.

Digital integration represents a critical success factor for future market participation, with companies needing to develop comprehensive online presence, mobile applications, and data analytics capabilities. Early adopters of digital technologies will gain significant competitive advantages in customer acquisition and retention.

Sustainability initiatives should be integrated into business strategies to align with growing consumer environmental consciousness and potential future regulatory requirements. Companies investing in sustainable practices and transparent supply chains will be better positioned for long-term market success.

Market growth prospects remain positive driven by continued population expansion, rising health consciousness, and increasing adoption of modern retail formats. The sector is expected to maintain steady growth with annual expansion rates of 6-8% across most produce categories, supported by strong consumer purchasing power and infrastructure development.

Technology integration will accelerate with artificial intelligence, automation, and blockchain technologies becoming standard components of successful supply chain operations. Companies that effectively leverage these technologies will achieve significant efficiency gains and competitive advantages in the evolving marketplace.

Domestic production initiatives may gradually reduce import dependence through controlled environment agriculture and hydroponic farming developments. Government support for agricultural innovation and food security initiatives will create opportunities for local production expansion, particularly in leafy vegetables and herbs categories.

Consumer preferences will continue evolving toward premium quality, organic options, and convenience-oriented products. MarkWide Research projects that organic produce consumption will grow by 20% annually over the next five years, while convenience products and value-added offerings will capture increasing market share across all demographic segments.

Kuwait’s vegetables and fruits market represents a dynamic and opportunity-rich sector characterized by strong consumer demand, sophisticated retail infrastructure, and favorable economic conditions. The market’s heavy reliance on imports creates both challenges and opportunities for international suppliers and local distributors seeking to serve this affluent and quality-conscious consumer base.

Success factors in this market include maintaining superior product quality, developing efficient cold chain operations, and adapting to evolving consumer preferences toward health, convenience, and sustainability. Companies that invest in technology integration, diversified sourcing strategies, and customer-centric service delivery will be best positioned to capture growing market opportunities.

Future market development will be shaped by continued digital transformation, sustainability initiatives, and potential domestic production expansion through controlled agriculture technologies. The sector’s strong fundamentals, supported by stable economic conditions and growing health consciousness, ensure continued growth and evolution in response to changing consumer needs and global market dynamics.

What is Vegetables and Fruits?

Vegetables and fruits refer to the edible parts of plants that are consumed for their nutritional value, flavor, and culinary uses. In Kuwait, these products are essential for a balanced diet and are widely used in various traditional dishes.

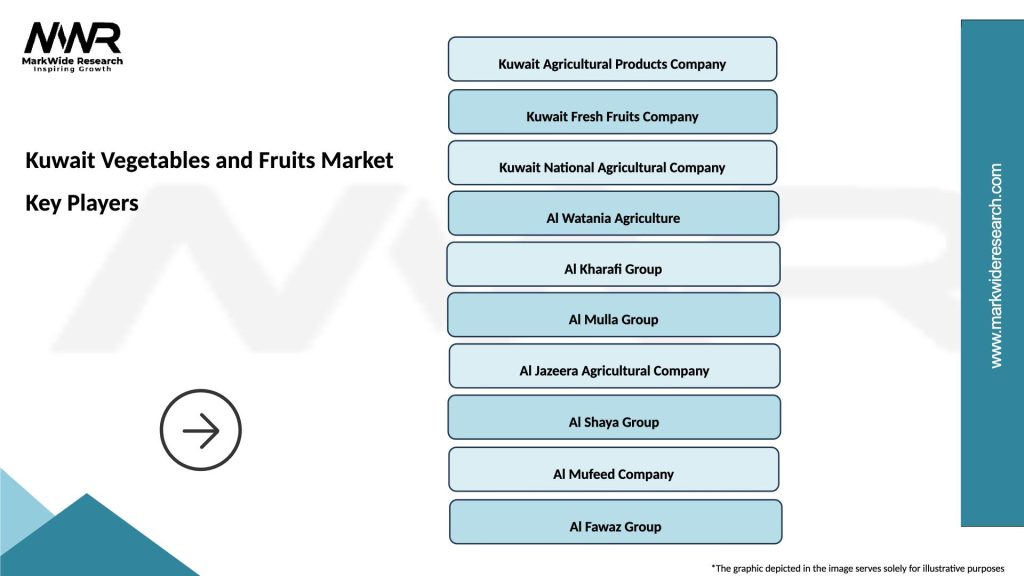

What are the key players in the Kuwait Vegetables and Fruits Market?

Key players in the Kuwait Vegetables and Fruits Market include Al Watania Agriculture, Kuwait Fresh Fruits Company, and Al-Ahli Group, among others. These companies are involved in the production, distribution, and retail of fresh produce.

What are the growth factors driving the Kuwait Vegetables and Fruits Market?

The growth of the Kuwait Vegetables and Fruits Market is driven by increasing health consciousness among consumers, a rising demand for organic produce, and the expansion of retail channels such as supermarkets and online grocery stores.

What challenges does the Kuwait Vegetables and Fruits Market face?

The Kuwait Vegetables and Fruits Market faces challenges such as harsh climatic conditions affecting local agriculture, reliance on imports for certain products, and fluctuating prices due to supply chain disruptions.

What opportunities exist in the Kuwait Vegetables and Fruits Market?

Opportunities in the Kuwait Vegetables and Fruits Market include the potential for vertical farming, increased investment in local agriculture, and the growing trend of health-focused diets that favor fresh produce.

What trends are shaping the Kuwait Vegetables and Fruits Market?

Trends shaping the Kuwait Vegetables and Fruits Market include the rise of organic farming, the popularity of farm-to-table dining experiences, and the increasing use of technology in agriculture, such as hydroponics and smart farming solutions.

Kuwait Vegetables and Fruits Market

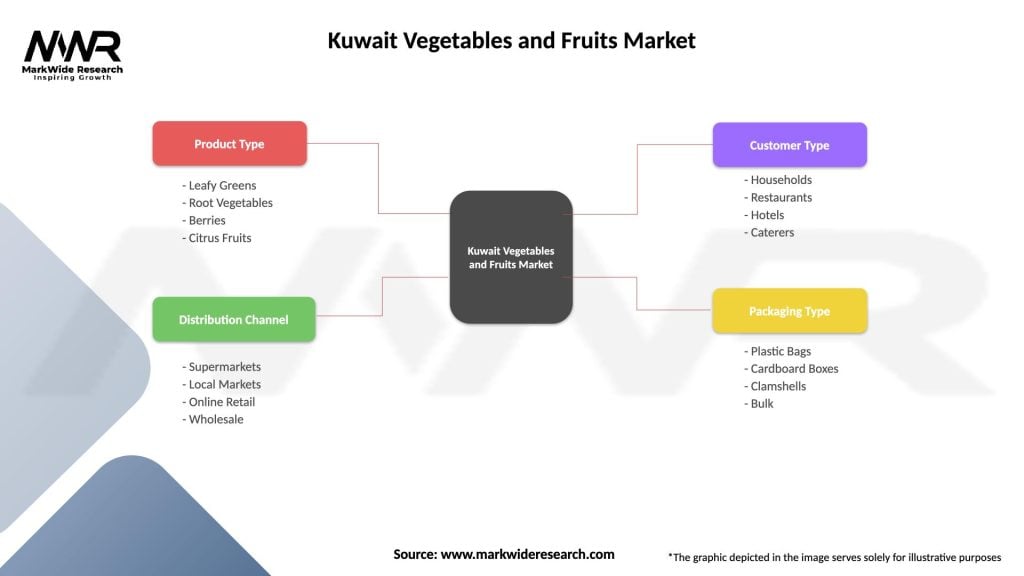

| Segmentation Details | Description |

|---|---|

| Product Type | Leafy Greens, Root Vegetables, Berries, Citrus Fruits |

| Distribution Channel | Supermarkets, Local Markets, Online Retail, Wholesale |

| Customer Type | Households, Restaurants, Hotels, Caterers |

| Packaging Type | Plastic Bags, Cardboard Boxes, Clamshells, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kuwait Vegetables and Fruits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at