444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kuwait cybersecurity market represents a rapidly evolving landscape driven by increasing digital transformation initiatives and growing cyber threat awareness across both public and private sectors. Kuwait’s strategic position as a regional financial hub and its ambitious Vision 2035 development plan have accelerated the adoption of comprehensive cybersecurity solutions throughout the country. The market demonstrates robust growth potential with organizations increasingly recognizing the critical importance of protecting digital assets against sophisticated cyber attacks.

Government initiatives have played a pivotal role in shaping the cybersecurity landscape, with the establishment of the National Cybersecurity Strategy and the Kuwait National Computer Emergency Response Team (KW-CERT). These developments have created a favorable environment for cybersecurity investments, driving demand for advanced threat detection, incident response, and compliance management solutions. The market experiences significant growth momentum with a projected compound annual growth rate of 12.5% over the forecast period.

Digital transformation acceleration across key sectors including banking, oil and gas, telecommunications, and government services has expanded the attack surface, necessitating comprehensive cybersecurity frameworks. Organizations are increasingly adopting multi-layered security approaches that encompass network security, endpoint protection, cloud security, and identity management solutions. The market benefits from strong government support and regulatory frameworks that mandate cybersecurity compliance across critical infrastructure sectors.

The Kuwait cybersecurity market refers to the comprehensive ecosystem of security technologies, services, and solutions designed to protect digital infrastructure, data, and systems from cyber threats within Kuwait’s borders. This market encompasses a wide range of cybersecurity offerings including network security appliances, endpoint protection platforms, security information and event management (SIEM) systems, threat intelligence services, and managed security services.

Market participants include international cybersecurity vendors, local system integrators, managed security service providers, and consulting firms that deliver specialized cybersecurity expertise to Kuwaiti organizations. The market serves diverse sectors including government agencies, financial institutions, energy companies, telecommunications providers, healthcare organizations, and educational institutions, each with unique security requirements and compliance obligations.

Strategic importance of cybersecurity in Kuwait extends beyond traditional IT protection to encompass critical national infrastructure security, economic stability, and digital sovereignty. The market reflects Kuwait’s commitment to building resilient digital infrastructure capable of supporting its economic diversification goals while maintaining robust defense against evolving cyber threats.

Kuwait’s cybersecurity market demonstrates exceptional growth trajectory driven by accelerating digital transformation, increasing cyber threat sophistication, and strong regulatory support. The market benefits from government-led initiatives that prioritize cybersecurity as a national strategic priority, creating sustained demand for advanced security solutions across all economic sectors. Organizations are transitioning from reactive security approaches to proactive, intelligence-driven cybersecurity strategies.

Key market drivers include the rapid adoption of cloud technologies, increasing mobile device usage, growing e-commerce activities, and the expansion of Internet of Things (IoT) deployments across smart city initiatives. The banking and financial services sector represents the largest market segment, accounting for approximately 35% of total cybersecurity investments, followed by government and public sector organizations at 28% market share.

Emerging trends shaping the market include the adoption of artificial intelligence and machine learning for threat detection, zero-trust security architectures, and integrated security operations centers (SOCs). The market experiences strong demand for managed security services as organizations seek to address cybersecurity skills shortages while maintaining cost-effective security operations. MarkWide Research analysis indicates that managed security services represent the fastest-growing segment with 15.2% annual growth rate.

Strategic market insights reveal several critical factors driving cybersecurity adoption in Kuwait:

Digital transformation acceleration serves as the primary catalyst for cybersecurity market growth in Kuwait. Organizations across all sectors are modernizing their IT infrastructure, adopting cloud technologies, and implementing digital services that expand their cyber risk exposure. This transformation creates unprecedented demand for comprehensive cybersecurity solutions that can protect hybrid IT environments and support business continuity objectives.

Regulatory compliance requirements continue to drive significant cybersecurity investments, particularly in the financial services and critical infrastructure sectors. The Central Bank of Kuwait’s cybersecurity framework, along with sector-specific regulations, mandate stringent security controls that require organizations to implement advanced threat detection, data protection, and incident response capabilities. These regulatory drivers ensure sustained market demand regardless of economic fluctuations.

Increasing cyber threat sophistication compels organizations to upgrade their security postures continuously. The rise of advanced persistent threats, ransomware attacks, and nation-state sponsored cyber activities creates urgent need for next-generation security technologies. Organizations are investing in artificial intelligence-powered threat detection, behavioral analytics, and automated incident response systems to combat evolving threats effectively.

Government strategic initiatives including Kuwait Vision 2035 and the National Cybersecurity Strategy provide strong institutional support for cybersecurity market development. These initiatives allocate substantial resources for cybersecurity infrastructure development, skills training, and public-private collaboration programs that stimulate market growth across multiple sectors.

Cybersecurity skills shortage represents a significant constraint limiting market growth potential in Kuwait. The lack of qualified cybersecurity professionals creates implementation challenges for organizations seeking to deploy advanced security solutions effectively. This skills gap increases reliance on expensive foreign expertise and extends project timelines, potentially slowing market adoption rates.

High implementation costs associated with comprehensive cybersecurity solutions can limit adoption among small and medium-sized enterprises. The initial investment required for enterprise-grade security infrastructure, combined with ongoing operational expenses, creates budget constraints that may delay cybersecurity initiatives. Organizations often struggle to justify cybersecurity investments without clear return on investment metrics.

Legacy system integration challenges pose significant obstacles for organizations with established IT infrastructure. Many Kuwaiti organizations operate complex hybrid environments that combine modern cloud services with legacy systems, creating integration difficulties for comprehensive security solutions. These technical challenges can extend implementation timelines and increase project costs.

Vendor selection complexity in the fragmented cybersecurity market can overwhelm organizations lacking specialized expertise. The proliferation of cybersecurity vendors and solutions creates decision paralysis that may delay procurement processes and implementation schedules. Organizations require significant time and resources to evaluate and select appropriate cybersecurity technologies.

Artificial intelligence integration presents substantial opportunities for cybersecurity market expansion in Kuwait. Organizations are increasingly interested in AI-powered security solutions that can automate threat detection, reduce false positives, and accelerate incident response times. This trend creates opportunities for vendors offering machine learning-based security analytics and automated security orchestration platforms.

Managed security services growth offers significant market expansion potential as organizations seek to address cybersecurity skills shortages while maintaining cost-effective security operations. The demand for 24/7 security monitoring, threat hunting, and incident response services creates opportunities for both international and local managed security service providers to establish operations in Kuwait.

Cloud security solutions represent a rapidly expanding market segment as organizations accelerate cloud adoption. The need for cloud-native security tools, multi-cloud security management platforms, and hybrid security architectures creates substantial opportunities for vendors specializing in cloud security technologies. This trend aligns with Kuwait’s digital transformation objectives.

Critical infrastructure protection initiatives in the oil and gas sector present specialized market opportunities for industrial cybersecurity solutions. The need to protect operational technology environments, industrial control systems, and SCADA networks creates demand for specialized cybersecurity solutions designed for industrial environments.

Market dynamics in Kuwait’s cybersecurity sector reflect the interplay between accelerating digital transformation, evolving threat landscapes, and regulatory requirements. The market experiences strong growth momentum driven by government initiatives, private sector investments, and increasing cyber threat awareness across all organizational levels. These dynamics create a favorable environment for both established cybersecurity vendors and emerging technology providers.

Competitive intensity continues to increase as international cybersecurity vendors establish local presence to capture market opportunities. This competition drives innovation acceleration and price optimization, benefiting end-users through improved solution quality and competitive pricing. Local system integrators and service providers are forming strategic partnerships with global vendors to enhance their cybersecurity capabilities.

Technology evolution significantly influences market dynamics, with organizations seeking solutions that can adapt to emerging threats and support evolving business requirements. The shift toward integrated security platforms that combine multiple security functions creates opportunities for vendors offering comprehensive security suites while challenging point solution providers.

Customer expectations are evolving toward solutions that provide measurable security outcomes, simplified management interfaces, and seamless integration capabilities. Organizations increasingly demand proof of value from cybersecurity investments, driving vendors to develop solutions with clear metrics and business impact measurement capabilities.

Comprehensive market research methodology employed for analyzing Kuwait’s cybersecurity market incorporates multiple data collection and analysis approaches to ensure accuracy and reliability. The research framework combines primary research activities including structured interviews with cybersecurity executives, technology vendors, and government officials, along with secondary research encompassing industry reports, regulatory documents, and market intelligence databases.

Primary research components include in-depth interviews with chief information security officers, IT directors, and cybersecurity managers across key sectors including banking, oil and gas, telecommunications, and government agencies. These interviews provide qualitative insights into market trends, technology adoption patterns, budget allocation priorities, and vendor selection criteria that shape purchasing decisions.

Secondary research analysis encompasses comprehensive review of government cybersecurity strategies, regulatory frameworks, industry association reports, and vendor market positioning materials. This analysis provides quantitative market data including market size estimates, growth projections, and competitive landscape mapping that supports primary research findings.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. The methodology incorporates market modeling approaches that account for economic factors, technology adoption curves, and regulatory impact assessments to generate reliable market forecasts and trend analysis.

Kuwait City metropolitan area dominates the cybersecurity market, accounting for approximately 65% of total market activity due to the concentration of government agencies, financial institutions, and major corporations. The capital region benefits from advanced telecommunications infrastructure, proximity to decision-makers, and availability of skilled cybersecurity professionals, creating favorable conditions for cybersecurity solution deployment and vendor operations.

Ahmadi Governorate represents a significant market segment driven by the concentration of oil and gas industry operations, including Kuwait Petroleum Corporation and its subsidiaries. This region demonstrates strong demand for industrial cybersecurity solutions, operational technology protection, and critical infrastructure security services. The governorate accounts for approximately 20% of cybersecurity market activity.

Hawalli and Farwaniya Governorates contribute to market growth through diverse economic activities including manufacturing, logistics, and service sectors. These regions show increasing adoption of cybersecurity solutions among small and medium-sized enterprises, driven by digital transformation initiatives and regulatory compliance requirements. Combined, these governorates represent approximately 15% of market activity.

Northern regions including Jahra and Mubarak Al-Kabeer demonstrate emerging market potential as infrastructure development and economic diversification initiatives expand. Government smart city projects and industrial development zones in these areas create new opportunities for cybersecurity solution providers, though current market share remains limited at approximately 10% of total market activity.

International cybersecurity vendors maintain strong market presence in Kuwait through direct operations and authorized partner networks:

Local system integrators and service providers play crucial roles in market development through solution implementation, customization, and ongoing support services. These organizations provide valuable local expertise and cultural understanding that enhances cybersecurity solution adoption across Kuwaiti organizations.

By Solution Type:

By Service Type:

By Deployment Model:

By Organization Size:

Banking and Financial Services sector leads cybersecurity adoption with sophisticated security requirements driven by regulatory compliance and high-value digital assets. Financial institutions invest heavily in fraud detection systems, transaction monitoring platforms, and advanced threat protection solutions. The sector demonstrates strong preference for proven enterprise-grade solutions with extensive compliance capabilities and 24/7 support services.

Government and Public Sector organizations prioritize cybersecurity solutions that protect citizen data and critical government services. This segment shows increasing adoption of cloud security solutions as government agencies migrate to cloud platforms. Security requirements focus on data sovereignty, privacy protection, and business continuity capabilities that ensure uninterrupted public service delivery.

Oil and Gas Industry demonstrates unique cybersecurity requirements combining traditional IT security with operational technology protection. Organizations in this sector invest in specialized solutions for industrial control system security, SCADA protection, and air-gapped network security. The segment shows growing interest in threat intelligence services focused on energy sector-specific threats.

Telecommunications Sector requires cybersecurity solutions that protect network infrastructure while supporting high-volume data processing and customer service delivery. Telecom operators invest in network security solutions, DDoS protection services, and subscriber data protection systems. The sector demonstrates strong interest in 5G security solutions as network modernization accelerates.

Healthcare Organizations show increasing cybersecurity adoption driven by patient data protection requirements and medical device security concerns. Healthcare providers seek specialized solutions for medical device security, patient data encryption, and HIPAA compliance management. The segment demonstrates growing interest in cloud security solutions as healthcare digitization accelerates.

Technology Vendors benefit from Kuwait’s expanding cybersecurity market through multiple value creation opportunities. The market offers substantial revenue potential for vendors with solutions addressing local requirements including Arabic language support, regional compliance frameworks, and integration with existing infrastructure. Vendors can establish long-term customer relationships through comprehensive support services and ongoing solution evolution.

System Integrators and service providers gain significant opportunities to develop specialized cybersecurity expertise and expand service portfolios. The market rewards organizations that can provide end-to-end implementation services, ongoing managed services, and local technical support. These capabilities create competitive advantages and sustainable revenue streams through long-term customer relationships.

End-User Organizations benefit from improved security postures that protect business operations, customer data, and intellectual property. Effective cybersecurity implementations provide measurable business value through reduced security incident costs, improved operational efficiency, and enhanced customer trust. Organizations gain competitive advantages through robust security capabilities that support digital transformation initiatives.

Government Agencies achieve strategic objectives including national security protection, economic stability, and citizen service delivery through comprehensive cybersecurity frameworks. Government cybersecurity investments create positive economic impacts through job creation, skills development, and technology sector growth that supports economic diversification goals.

Investment Community benefits from cybersecurity market growth through investment opportunities in both international vendors and local service providers. The market demonstrates sustainable growth characteristics supported by regulatory requirements, digital transformation trends, and government strategic initiatives that ensure long-term demand stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Zero Trust Architecture Adoption represents a fundamental shift in cybersecurity approach, with organizations moving away from perimeter-based security models toward comprehensive identity verification and least-privilege access controls. This trend drives demand for integrated security platforms that can implement zero trust principles across hybrid IT environments while maintaining user experience and operational efficiency.

Artificial Intelligence Integration continues accelerating across cybersecurity solutions, with organizations seeking AI-powered threat detection, automated incident response, and predictive security analytics. This trend creates opportunities for next-generation security solutions that can process large volumes of security data and identify sophisticated threats that traditional rule-based systems might miss.

Cloud Security Transformation reflects the ongoing migration to cloud platforms, driving demand for cloud-native security solutions, multi-cloud security management, and hybrid security architectures. Organizations require comprehensive cloud security strategies that protect data and applications across multiple cloud environments while maintaining compliance with local regulations.

Managed Security Services Growth addresses cybersecurity skills shortages and cost optimization requirements through outsourced security operations. Organizations increasingly adopt managed detection and response services, security operations center services, and threat hunting capabilities to enhance their security postures without significant internal resource investments.

Regulatory Compliance Automation emerges as organizations seek to streamline compliance processes while reducing manual effort and human error risks. This trend drives adoption of compliance management platforms that can automate regulatory reporting, policy enforcement, and audit preparation activities across multiple regulatory frameworks.

Government Cybersecurity Initiatives continue expanding with the establishment of new regulatory frameworks, cybersecurity awareness programs, and public-private collaboration platforms. Recent developments include enhanced cybersecurity requirements for critical infrastructure sectors and expanded mandate for the Kuwait National Computer Emergency Response Team. These initiatives create sustained market demand for cybersecurity solutions and services.

Banking Sector Modernization drives significant cybersecurity investments as financial institutions implement digital banking platforms, mobile payment systems, and open banking initiatives. Major banks are establishing dedicated cybersecurity operations centers and implementing advanced fraud detection systems to protect against sophisticated financial crimes and maintain customer trust.

Critical Infrastructure Protection programs in the energy sector focus on protecting operational technology environments and industrial control systems from cyber threats. Kuwait Petroleum Corporation and its subsidiaries are implementing comprehensive cybersecurity frameworks that address both IT and OT security requirements while maintaining operational efficiency.

Skills Development Programs launched by government agencies and educational institutions aim to develop local cybersecurity expertise and reduce dependence on foreign specialists. These programs include cybersecurity certification courses, university degree programs, and professional development initiatives that support long-term market growth and sustainability.

Vendor Market Entry activities continue as international cybersecurity companies establish local presence through direct operations, authorized partnerships, and acquisition strategies. Recent market entries include cloud security specialists and managed security service providers seeking to capitalize on growing market opportunities.

MarkWide Research analysis suggests that organizations should prioritize integrated cybersecurity platforms that can address multiple security requirements through unified management interfaces. This approach provides operational efficiency benefits while reducing complexity and total cost of ownership compared to multiple point solutions. Organizations should evaluate vendors based on integration capabilities, local support availability, and long-term technology roadmaps.

Investment prioritization should focus on solutions that provide measurable security outcomes and business value rather than technology features alone. Organizations should implement security metrics frameworks that can demonstrate return on investment and support ongoing budget justification for cybersecurity initiatives. This approach ensures sustainable cybersecurity program funding and organizational support.

Skills development strategies should combine internal training programs with strategic partnerships with managed security service providers to address cybersecurity expertise gaps. Organizations should invest in continuous education programs that keep internal teams current with evolving threats and technologies while leveraging external expertise for specialized requirements.

Regulatory compliance planning should anticipate future regulatory requirements and implement flexible security architectures that can adapt to changing compliance obligations. Organizations should engage with regulatory bodies proactively to understand upcoming requirements and influence policy development through industry association participation.

Vendor selection processes should emphasize local support capabilities, regional compliance expertise, and long-term partnership potential rather than focusing solely on technology capabilities. Organizations should evaluate vendors based on total value proposition including implementation services, ongoing support, and strategic consulting capabilities that support long-term cybersecurity objectives.

Market growth trajectory remains strongly positive with sustained demand drivers including digital transformation acceleration, regulatory compliance requirements, and evolving threat landscapes. The market is expected to maintain double-digit growth rates over the forecast period, supported by government strategic initiatives and private sector cybersecurity investments across all major economic sectors.

Technology evolution will continue driving market transformation through artificial intelligence integration, automation capabilities, and cloud-native security solutions. Organizations will increasingly adopt integrated security platforms that combine multiple security functions while providing simplified management and improved threat detection capabilities. This trend favors vendors with comprehensive security portfolios and strong integration capabilities.

Skills development initiatives will gradually address cybersecurity expertise shortages through expanded education programs, professional certification courses, and government-sponsored training initiatives. The development of local cybersecurity expertise will support market sustainability while reducing costs and improving solution effectiveness through better cultural and regulatory understanding.

Regional market expansion opportunities will emerge as Kuwait-based cybersecurity providers develop capabilities to serve broader GCC markets. This expansion potential creates significant growth opportunities for both international vendors and local service providers that can leverage Kuwait as a regional hub for cybersecurity operations and expertise.

Regulatory framework evolution will continue shaping market requirements through enhanced compliance obligations, sector-specific security standards, and cross-border data protection requirements. Organizations must prepare for increasing regulatory complexity while maintaining operational efficiency and cost-effectiveness in their cybersecurity programs. MWR projects that regulatory-driven cybersecurity investments will account for approximately 40% of total market growth over the next five years.

Kuwait’s cybersecurity market presents exceptional growth opportunities driven by digital transformation acceleration, strong government support, and increasing cyber threat awareness across all economic sectors. The market benefits from favorable regulatory frameworks, substantial government investments, and growing private sector recognition of cybersecurity as a strategic business enabler rather than merely a compliance requirement.

Key success factors for market participants include developing comprehensive solution portfolios, establishing strong local partnerships, and investing in skills development programs that address market-specific requirements. Organizations that can provide integrated security platforms with measurable business outcomes will capture the greatest market opportunities while building sustainable competitive advantages.

Future market development will be shaped by continued technology evolution, regulatory framework expansion, and the gradual development of local cybersecurity expertise. The market demonstrates strong fundamentals for sustained growth, supported by Kuwait’s strategic position as a regional hub and its commitment to building resilient digital infrastructure that supports economic diversification objectives and national security requirements.

What is Kuwait Cybersecurity?

Kuwait Cybersecurity refers to the practices, technologies, and processes designed to protect computer systems, networks, and data from cyber threats and attacks within Kuwait. It encompasses various measures to ensure the confidentiality, integrity, and availability of information.

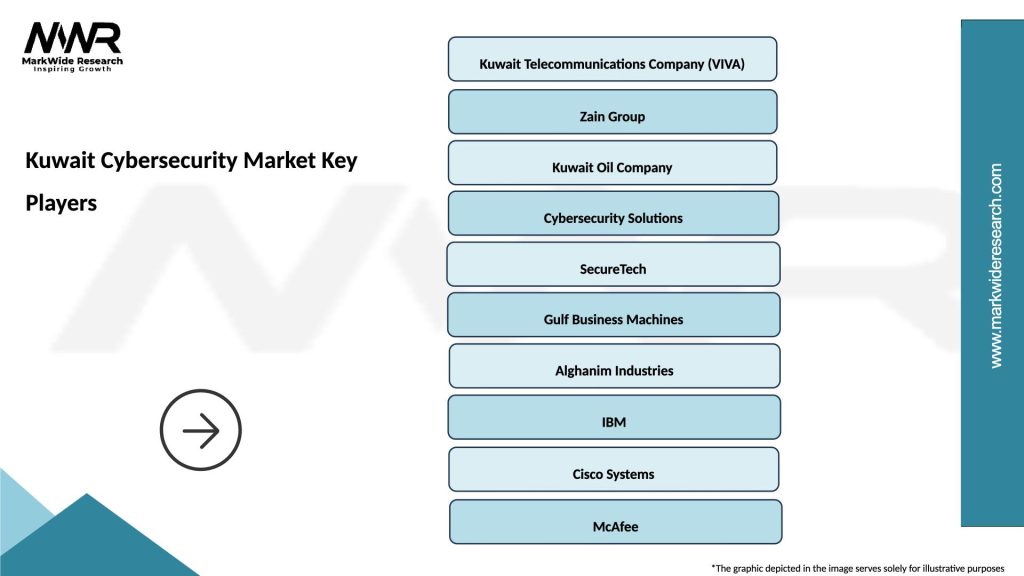

What are the key players in the Kuwait Cybersecurity Market?

Key players in the Kuwait Cybersecurity Market include companies like Kaspersky, Cisco, and Palo Alto Networks, which provide a range of cybersecurity solutions. These companies focus on areas such as threat detection, network security, and data protection, among others.

What are the main drivers of growth in the Kuwait Cybersecurity Market?

The main drivers of growth in the Kuwait Cybersecurity Market include the increasing frequency of cyberattacks, the rising adoption of digital transformation initiatives, and the growing awareness of data privacy regulations. Organizations are investing in cybersecurity to protect sensitive information and maintain customer trust.

What challenges does the Kuwait Cybersecurity Market face?

The Kuwait Cybersecurity Market faces challenges such as a shortage of skilled cybersecurity professionals, the evolving nature of cyber threats, and the high costs associated with implementing comprehensive security measures. These factors can hinder the effectiveness of cybersecurity strategies.

What opportunities exist in the Kuwait Cybersecurity Market?

Opportunities in the Kuwait Cybersecurity Market include the growing demand for cloud security solutions, the rise of IoT devices requiring protection, and the increasing focus on regulatory compliance. Companies can leverage these trends to develop innovative cybersecurity products and services.

What trends are shaping the Kuwait Cybersecurity Market?

Trends shaping the Kuwait Cybersecurity Market include the integration of artificial intelligence in threat detection, the shift towards managed security services, and the emphasis on zero-trust security models. These trends are driving advancements in how organizations approach cybersecurity.

Kuwait Cybersecurity Market

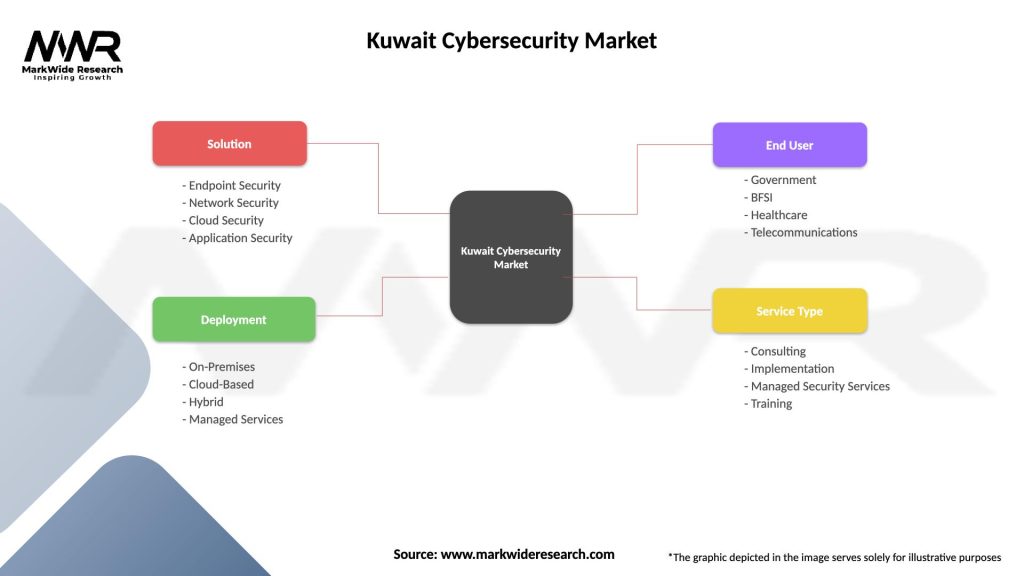

| Segmentation Details | Description |

|---|---|

| Solution | Endpoint Security, Network Security, Cloud Security, Application Security |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Telecommunications |

| Service Type | Consulting, Implementation, Managed Security Services, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kuwait Cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at