444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The KSA satellite communications market represents a rapidly evolving sector within Saudi Arabia’s ambitious digital transformation landscape. As the Kingdom continues to implement its Vision 2030 initiative, satellite communications infrastructure has emerged as a critical enabler for economic diversification and technological advancement. The market encompasses a comprehensive range of satellite-based communication services, including broadband internet, television broadcasting, military communications, and emerging applications in smart city development.

Market dynamics in the Kingdom are characterized by substantial government investment in space technology and telecommunications infrastructure. The Saudi Space Commission’s strategic initiatives have positioned the country as a regional leader in satellite communications, with growing emphasis on indigenous satellite manufacturing and launch capabilities. Current market trends indicate a 12.5% annual growth rate in satellite service adoption across various sectors, driven by increasing demand for high-speed connectivity in remote areas and expanding industrial applications.

Regional positioning within the Middle East and North Africa region has strengthened significantly, with Saudi Arabia accounting for approximately 35% of regional satellite communications revenue. The market benefits from strategic geographic location, substantial oil revenues funding technological infrastructure, and progressive regulatory frameworks supporting private sector participation in space-based communications services.

The KSA satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, infrastructure, and technologies operating within Saudi Arabia’s telecommunications landscape. This market encompasses satellite internet services, broadcasting systems, mobile satellite communications, and specialized applications for government, military, and commercial sectors.

Core components include geostationary and low Earth orbit satellite networks, ground station infrastructure, satellite phones and terminals, broadcasting equipment, and integrated communication solutions. The market serves diverse applications ranging from rural internet connectivity and oil field communications to smart city infrastructure and national security communications. Technological integration with 5G networks, Internet of Things applications, and artificial intelligence systems represents the evolving nature of satellite communications in the Kingdom’s digital ecosystem.

Strategic positioning of the KSA satellite communications market reflects the Kingdom’s commitment to technological leadership and economic diversification. The sector demonstrates robust growth momentum, supported by government initiatives, private sector investment, and increasing demand for reliable communication services across vast geographic territories. Market penetration has accelerated significantly, with satellite internet adoption growing by 18% annually in underserved regions.

Key market drivers include Vision 2030 implementation, NEOM smart city development, expanding oil and gas exploration activities, and growing demand for high-definition broadcasting services. The market benefits from strategic partnerships with international satellite operators, domestic manufacturing initiatives, and progressive regulatory frameworks encouraging innovation and competition.

Competitive landscape features a mix of international satellite service providers, domestic telecommunications companies, and emerging technology startups. Government support for indigenous space capabilities has fostered local industry development, while international partnerships provide access to advanced satellite technologies and global connectivity networks.

Market intelligence reveals several critical insights shaping the KSA satellite communications landscape:

Vision 2030 implementation serves as the primary catalyst for satellite communications market expansion in Saudi Arabia. The Kingdom’s ambitious economic transformation program emphasizes technological innovation, digital infrastructure development, and reduced dependence on oil revenues. Government commitment to space technology advancement has resulted in substantial investments in satellite manufacturing, launch capabilities, and communication infrastructure.

Geographic challenges within Saudi Arabia’s vast territory create natural demand for satellite-based communication solutions. Remote oil fields, mining operations, and rural communities require reliable connectivity that traditional terrestrial infrastructure cannot cost-effectively provide. Industrial expansion in sectors such as renewable energy, tourism, and manufacturing drives increasing demand for robust communication networks supporting operational efficiency and safety requirements.

Smart city development initiatives, particularly the NEOM project, require advanced satellite communication capabilities for Internet of Things applications, autonomous systems, and integrated urban management platforms. Digital transformation across government services, healthcare, education, and financial sectors creates growing demand for reliable, high-capacity satellite communication services supporting cloud computing, data analytics, and remote service delivery.

High capital requirements for satellite communication infrastructure development present significant barriers to market entry and expansion. Ground station construction, satellite terminal deployment, and network maintenance require substantial upfront investments that may limit participation by smaller companies and startups. Technical complexity associated with satellite system integration, frequency coordination, and regulatory compliance creates operational challenges for service providers.

Regulatory constraints related to spectrum allocation, licensing requirements, and national security considerations may limit market flexibility and innovation. International dependencies on foreign satellite manufacturers and technology providers create potential supply chain vulnerabilities and technology transfer limitations. Competition from terrestrial networks, particularly expanding 5G infrastructure and fiber optic networks, may reduce demand for satellite services in urban areas.

Weather-related service disruptions during sandstorms and extreme weather conditions can affect satellite signal quality and reliability. Skilled workforce shortages in satellite technology, space engineering, and related technical fields may constrain market growth and innovation capabilities.

Emerging technologies present substantial opportunities for market expansion and innovation. Low Earth orbit satellite constellations offer improved latency and coverage capabilities, creating new possibilities for real-time applications and enhanced user experiences. Integration opportunities with 5G networks, edge computing, and artificial intelligence systems enable development of hybrid communication solutions addressing diverse market needs.

Export potential for Saudi-manufactured satellite communication equipment and services to regional and international markets represents significant revenue opportunities. Public-private partnerships in space technology development, satellite manufacturing, and service delivery create collaborative opportunities for domestic and international companies. Vertical market expansion into sectors such as agriculture, logistics, healthcare, and education offers diversification opportunities beyond traditional applications.

Research and development initiatives supported by government funding and international partnerships enable innovation in satellite technology, ground systems, and application development. Regional hub development positioning Saudi Arabia as a satellite communications center for the Middle East and Africa regions creates opportunities for service expansion and technology leadership.

Supply chain dynamics in the KSA satellite communications market reflect a complex interplay between international technology providers, domestic manufacturing initiatives, and government procurement policies. Demand patterns show increasing sophistication, with customers requiring integrated solutions combining satellite connectivity, terrestrial networks, and value-added services. Pricing dynamics demonstrate gradual cost reduction as technology matures and competition intensifies.

Technology evolution drives continuous market transformation, with software-defined satellites, artificial intelligence integration, and quantum communication technologies reshaping service capabilities and market opportunities. Regulatory evolution reflects government efforts to balance market liberalization with national security requirements and strategic technology development objectives.

Partnership dynamics between domestic and international companies facilitate technology transfer, market access, and capability development. Investment flows from both public and private sources support infrastructure development, research initiatives, and market expansion activities. Customer behavior evolution shows increasing demand for customized solutions, service reliability, and integrated communication platforms.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, government officials, technology providers, and end-users across various sectors utilizing satellite communication services. Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and company financial statements.

Data collection methods include quantitative surveys measuring market adoption rates, service utilization patterns, and customer satisfaction levels. Qualitative research explores market trends, competitive dynamics, and emerging opportunities through focus groups and expert consultations. Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to project future market developments and growth trajectories.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert review, and consistency checks. MarkWide Research methodology emphasizes objective analysis, comprehensive coverage, and actionable insights supporting strategic decision-making by market participants and stakeholders.

Central region dynamics centered around Riyadh demonstrate the highest concentration of satellite communication infrastructure and service demand. Government agencies, financial institutions, and corporate headquarters drive sophisticated communication requirements supporting business operations and administrative functions. Market share distribution shows the central region accounting for approximately 40% of total satellite communication services revenue.

Eastern province characteristics reflect heavy industrial demand driven by oil and gas operations, petrochemical facilities, and port activities. Satellite communication adoption in industrial applications has reached 85% penetration among major facilities requiring reliable connectivity for operational safety and efficiency. Western region development focuses on tourism, religious pilgrimage services, and Red Sea development projects creating diverse communication requirements.

Northern and southern regions demonstrate growing demand for satellite internet services addressing rural connectivity needs and supporting agricultural development initiatives. Border area communications require specialized satellite solutions for security, customs, and cross-border trade facilitation. Regional infrastructure development varies significantly, with urban areas receiving priority for advanced satellite communication capabilities while rural areas rely on basic connectivity services.

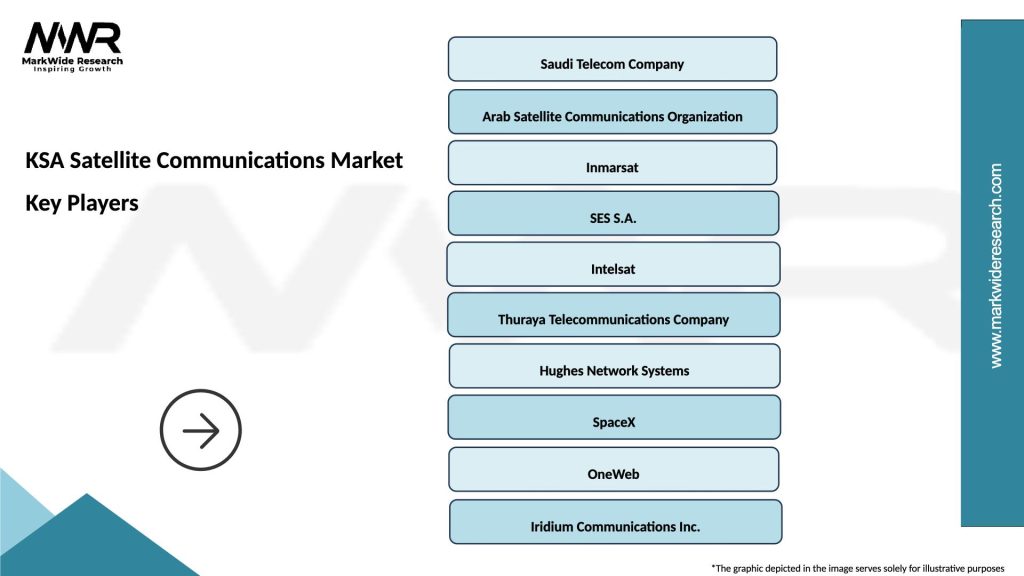

Market leadership in the KSA satellite communications sector reflects a diverse ecosystem of international and domestic players:

Competitive strategies emphasize service differentiation, technology innovation, and strategic partnerships with local companies and government agencies. Market positioning varies from comprehensive service providers to specialized niche players focusing on specific applications or customer segments.

By Technology:

By Application:

By End-User:

Broadband internet services represent the fastest-growing segment, driven by increasing demand for high-speed connectivity in underserved areas and growing adoption of cloud-based applications. Service quality improvements through advanced satellite technologies have enhanced user experience and market acceptance. Pricing competitiveness with terrestrial alternatives has improved significantly, expanding market accessibility.

Broadcasting applications maintain strong market position despite competition from streaming services and terrestrial broadcasting. High-definition content delivery and specialized programming create continued demand for satellite broadcasting services. Government broadcasting initiatives support cultural and educational content distribution across the Kingdom.

Enterprise solutions demonstrate sophisticated requirements for integrated communication platforms combining voice, data, and video services. Customization capabilities enable service providers to address specific industry needs and operational requirements. Reliability standards in enterprise applications drive demand for redundant systems and service level guarantees.

Military and defense applications require specialized secure communication capabilities with stringent performance and reliability requirements. Technology sovereignty considerations influence procurement decisions and technology development priorities. Interoperability requirements with allied nations create opportunities for standardized communication solutions.

Service providers benefit from expanding market opportunities, government support for infrastructure development, and growing demand across multiple sectors. Revenue diversification through multiple service offerings and customer segments reduces market risk and enhances financial stability. Technology partnerships with international companies provide access to advanced capabilities and global market opportunities.

End-users gain access to reliable communication services in previously underserved areas, enhanced connectivity options, and integrated solutions supporting business operations and personal communications. Cost efficiencies through satellite communication services enable business expansion and operational optimization in remote locations.

Government stakeholders achieve strategic objectives including economic diversification, technological advancement, and national security enhancement. Infrastructure development supports Vision 2030 implementation and creates employment opportunities in high-technology sectors. Regional leadership in satellite communications enhances Saudi Arabia’s position as a technology hub and innovation center.

Technology suppliers access growing market opportunities, participate in government-supported development programs, and establish long-term partnerships with domestic companies. Local manufacturing initiatives create opportunities for technology transfer and capability development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Low Earth Orbit constellation deployment represents a transformative trend reshaping satellite communication capabilities and market dynamics. Service integration combining satellite and terrestrial networks creates hybrid solutions addressing diverse customer requirements. Artificial intelligence integration enhances network optimization, predictive maintenance, and service quality management.

Edge computing integration with satellite networks enables real-time data processing and reduced latency for critical applications. Software-defined satellite technology provides flexibility and adaptability for changing market requirements and service configurations. Quantum communication research explores next-generation secure communication capabilities.

Sustainability initiatives focus on environmentally responsible satellite design, launch practices, and end-of-life management. Standardization efforts promote interoperability and reduce costs through common technical specifications and protocols. Customer experience enhancement through improved user interfaces, service reliability, and technical support capabilities.

Saudi Space Commission establishment has provided strategic leadership and coordination for national space activities including satellite communications development. NEOM smart city project creates demand for advanced satellite communication capabilities supporting Internet of Things applications and autonomous systems. International partnership agreements with leading space agencies and technology companies facilitate knowledge transfer and capability development.

Domestic satellite manufacturing initiatives aim to develop indigenous production capabilities and reduce dependence on foreign suppliers. Regulatory framework modernization streamlines licensing processes and encourages private sector participation in satellite communications markets. Research and development investments in universities and research institutions support innovation and workforce development.

Ground station infrastructure expansion enhances satellite communication coverage and service quality across the Kingdom. Frequency spectrum allocation optimization ensures efficient utilization of radio spectrum resources for satellite communications. MarkWide Research analysis indicates that these developments collectively strengthen Saudi Arabia’s position in the global satellite communications market.

Strategic recommendations for market participants emphasize the importance of long-term planning and sustainable growth strategies. Technology investment in next-generation satellite systems and ground infrastructure should prioritize flexibility and scalability to accommodate evolving market requirements. Partnership development with international technology providers and domestic companies creates opportunities for knowledge sharing and market expansion.

Market positioning strategies should focus on differentiation through service quality, customer support, and specialized applications addressing specific industry needs. Regulatory engagement with government agencies ensures compliance and influences policy development supporting market growth. Workforce development through training programs and educational partnerships addresses skills shortages and supports industry expansion.

Risk management strategies should address technology obsolescence, competitive pressures, and regulatory changes through diversification and contingency planning. Customer relationship management emphasizing long-term partnerships and service excellence creates competitive advantages and market stability. Innovation investment in research and development ensures technological leadership and market competitiveness.

Market trajectory for the KSA satellite communications sector indicates sustained growth driven by government initiatives, technological advancement, and expanding applications across multiple industries. Growth projections suggest continued expansion at 14.2% annually over the next five years, supported by infrastructure investment and service demand growth. Technology evolution will likely focus on low Earth orbit constellations, artificial intelligence integration, and hybrid network solutions.

Market maturation is expected to bring increased competition, service standardization, and cost optimization benefiting end-users and expanding market accessibility. Regional leadership positioning will likely strengthen through continued investment in indigenous capabilities and strategic partnerships with international technology providers. Application diversification into emerging sectors such as autonomous vehicles, smart agriculture, and telemedicine creates new growth opportunities.

Regulatory development will likely emphasize market liberalization while maintaining national security considerations and strategic technology development objectives. MWR forecasts indicate that successful market participants will be those investing in technology innovation, customer service excellence, and strategic partnerships supporting long-term growth and competitiveness in the evolving satellite communications landscape.

The KSA satellite communications market represents a dynamic and rapidly evolving sector positioned for substantial growth and technological advancement. Government commitment through Vision 2030 implementation, substantial investment in space technology, and progressive regulatory frameworks creates a supportive environment for market development and innovation. Market fundamentals including geographic requirements, industrial demand, and digital transformation initiatives provide strong foundations for sustained growth.

Competitive dynamics reflect a healthy mix of international expertise and domestic capability development, creating opportunities for technology transfer, innovation, and market expansion. Technology trends toward low Earth orbit systems, artificial intelligence integration, and hybrid network solutions position the market for enhanced service capabilities and expanded applications. Strategic positioning as a regional satellite communications hub creates opportunities for service export and technological leadership in the Middle East and Africa regions.

Future success in the KSA satellite communications market will depend on continued investment in technology innovation, workforce development, and strategic partnerships supporting sustainable growth and competitive advantage. The market’s evolution reflects Saudi Arabia’s broader transformation toward a knowledge-based economy and technological leadership, making satellite communications a critical enabler for national development objectives and economic diversification goals.

What is Satellite Communications?

Satellite communications involve the use of satellite technology to transmit data, voice, and video across long distances. This technology is crucial for various applications, including broadcasting, internet services, and military communications.

What are the key players in the KSA Satellite Communications Market?

Key players in the KSA Satellite Communications Market include Saudi Telecom Company (STC), Arabsat, and Intelsat, among others. These companies provide a range of services, including satellite internet, broadcasting, and telecommunications.

What are the growth factors driving the KSA Satellite Communications Market?

The KSA Satellite Communications Market is driven by increasing demand for high-speed internet, the expansion of telecommunications infrastructure, and the growing need for reliable communication in remote areas. Additionally, advancements in satellite technology are enhancing service delivery.

What challenges does the KSA Satellite Communications Market face?

Challenges in the KSA Satellite Communications Market include regulatory hurdles, high operational costs, and competition from terrestrial communication networks. These factors can impact the growth and profitability of satellite service providers.

What opportunities exist in the KSA Satellite Communications Market?

Opportunities in the KSA Satellite Communications Market include the potential for expanding services to underserved regions, the integration of satellite technology with IoT applications, and the increasing demand for secure communication solutions in various sectors.

What trends are shaping the KSA Satellite Communications Market?

Trends in the KSA Satellite Communications Market include the rise of low Earth orbit (LEO) satellite constellations, advancements in satellite manufacturing, and the growing focus on sustainability in satellite operations. These trends are expected to enhance service capabilities and reduce costs.

KSA Satellite Communications Market

| Segmentation Details | Description |

|---|---|

| Product Type | Satellite Phones, Ground Stations, Satellite Modems, Antennas |

| Technology | Geostationary, Low Earth Orbit, Medium Earth Orbit, Hybrid |

| End User | Government, Military, Maritime, Aviation |

| Service Type | Data Services, Voice Services, Broadcasting, Internet Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the KSA Satellite Communications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at