444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kingdom of Saudi Arabia (KSA) cloud computing market represents one of the most dynamic and rapidly evolving technology sectors in the Middle East region. Digital transformation initiatives driven by Saudi Vision 2030 have positioned cloud computing as a fundamental enabler of economic diversification and technological advancement. The market encompasses various cloud service models including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), serving diverse sectors from government and healthcare to finance and manufacturing.

Market expansion is characterized by increasing adoption rates across both public and private sectors, with organizations recognizing cloud computing as essential for operational efficiency and competitive advantage. The Saudi government’s commitment to establishing the kingdom as a regional technology hub has accelerated cloud infrastructure development and regulatory frameworks supporting digital innovation. Growth trajectory indicates sustained expansion at a compound annual growth rate of 12.5%, reflecting strong demand for scalable computing solutions and data management capabilities.

Strategic investments in data centers, fiber optic networks, and digital infrastructure have created a robust foundation for cloud service delivery. Major international cloud providers have established local presence through partnerships and direct investments, while domestic technology companies are developing specialized cloud solutions tailored to regional requirements. The market demonstrates significant potential for continued growth driven by increasing digital literacy, smartphone penetration, and government digitization initiatives.

The KSA cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions available within the Kingdom of Saudi Arabia, encompassing public, private, and hybrid cloud deployments that enable organizations to access computing resources, applications, and data storage through internet-connected networks rather than traditional on-premises hardware systems.

Cloud computing fundamentally transforms how Saudi organizations manage their IT infrastructure by providing on-demand access to computing power, storage capacity, and software applications through remote servers hosted in data centers. This paradigm shift eliminates the need for substantial upfront capital investments in physical hardware while offering unprecedented scalability, flexibility, and cost-effectiveness. Service delivery models include Infrastructure as a Service providing virtualized computing resources, Platform as a Service offering development environments, and Software as a Service delivering ready-to-use applications.

Market significance extends beyond mere technology adoption to encompass strategic enablement of Saudi Arabia’s economic transformation goals. Cloud computing serves as the technological backbone supporting smart city initiatives, e-government services, digital healthcare systems, and Industry 4.0 manufacturing processes. The market represents a critical component of the kingdom’s broader digital economy strategy, facilitating innovation, entrepreneurship, and knowledge-based economic activities aligned with Vision 2030 objectives.

The KSA cloud computing market demonstrates exceptional growth momentum driven by comprehensive digital transformation initiatives and substantial government investment in technology infrastructure. Market dynamics reflect a maturing ecosystem where traditional IT spending is increasingly shifting toward cloud-based solutions, with organizations across all sectors recognizing the strategic value of cloud adoption for operational efficiency and competitive positioning.

Key market characteristics include strong government support through regulatory frameworks and investment incentives, growing private sector adoption across industries, and increasing availability of localized cloud services meeting data sovereignty requirements. The market benefits from rising digital adoption rates of 78% among Saudi businesses, indicating widespread acceptance of cloud technologies as essential business tools rather than optional enhancements.

Competitive landscape features a mix of global cloud giants establishing regional presence and emerging local providers developing specialized solutions for Saudi market requirements. Strategic partnerships between international technology companies and domestic organizations are accelerating market development while ensuring compliance with local regulations and cultural considerations. Investment flows continue to strengthen market infrastructure, with data center capacity expansion and network connectivity improvements supporting sustained growth trajectories.

Strategic market insights reveal several critical factors shaping the KSA cloud computing landscape and driving sustained expansion across multiple dimensions:

Primary market drivers propelling KSA cloud computing growth encompass strategic government initiatives, technological advancement requirements, and evolving business operational needs. Saudi Vision 2030 serves as the overarching catalyst, establishing digital transformation as a national priority and creating substantial demand for cloud-based solutions across government agencies and private enterprises.

Digital government initiatives are generating significant cloud adoption momentum as public sector organizations modernize service delivery mechanisms and citizen engagement platforms. The National Digital Transformation Program mandates cloud-first approaches for government IT projects, creating a substantial and sustained demand base for cloud services. Regulatory support through favorable policies and investment incentives further accelerates market development by reducing adoption barriers and encouraging innovation.

Economic diversification efforts drive cloud adoption as organizations across non-oil sectors seek technological advantages to compete in global markets. Small and medium enterprises particularly benefit from cloud computing’s ability to provide enterprise-grade capabilities without substantial capital investments. Cost efficiency requirements motivate organizations to replace expensive on-premises infrastructure with flexible, pay-as-you-use cloud models that align expenses with actual business needs and growth patterns.

Technological advancement needs in areas like artificial intelligence, machine learning, and big data analytics require computing resources and specialized platforms that cloud providers can deliver more effectively than traditional IT infrastructure. The growing importance of data-driven decision making across industries creates sustained demand for cloud-based analytics and business intelligence solutions.

Market restraints affecting KSA cloud computing adoption include regulatory compliance complexities, cybersecurity concerns, and organizational change management challenges that can slow implementation timelines and limit market expansion in certain segments.

Data sovereignty requirements create constraints for organizations handling sensitive information, particularly in government, healthcare, and financial services sectors. Compliance with local data protection regulations and industry-specific standards requires careful vendor selection and deployment planning, potentially limiting cloud adoption options and increasing implementation complexity. Regulatory uncertainty in emerging technology areas can cause organizations to delay cloud migration decisions pending clearer guidance from authorities.

Cybersecurity concerns remain significant adoption barriers, particularly for organizations handling confidential or mission-critical data. Despite cloud providers’ advanced security capabilities, perceived risks related to data breaches, unauthorized access, and cyber attacks can slow adoption decisions. Skills shortage in cloud computing expertise limits organizations’ ability to effectively plan, implement, and manage cloud deployments, creating dependency on external consultants and potentially increasing project costs.

Legacy system integration challenges present technical and financial obstacles for organizations with substantial investments in existing IT infrastructure. The complexity and cost of migrating legacy applications to cloud environments can deter adoption, particularly for organizations with highly customized or industry-specific systems. Cultural resistance to change within traditional organizations can slow cloud adoption as employees and management teams require education and support to embrace new technology paradigms.

Significant market opportunities exist within the KSA cloud computing sector, driven by emerging technology trends, underserved market segments, and evolving business requirements that create substantial growth potential for innovative service providers and solution developers.

Artificial intelligence integration presents substantial opportunities as organizations seek cloud-based AI and machine learning capabilities to enhance operations, customer service, and decision-making processes. The convergence of cloud computing with AI technologies creates new service categories and revenue streams for providers capable of delivering sophisticated, industry-specific AI solutions. Edge computing development offers opportunities to extend cloud capabilities closer to end-users and IoT devices, supporting applications requiring low latency and real-time processing.

Industry-specific cloud solutions represent significant growth opportunities, particularly in sectors like Islamic finance, oil and gas, and healthcare where specialized compliance and functionality requirements create demand for tailored cloud offerings. Small business market penetration remains largely untapped, with substantial potential for cloud providers offering simplified, cost-effective solutions designed for SME requirements and budget constraints.

Smart city initiatives across Saudi Arabia create opportunities for cloud providers to support IoT platforms, data analytics, and citizen services applications. The integration of cloud computing with emerging technologies like blockchain, 5G networks, and augmented reality opens new market segments and application areas. Cross-border expansion opportunities exist for Saudi cloud providers to serve regional markets, leveraging local expertise and cultural understanding to compete with global providers.

Market dynamics within the KSA cloud computing sector reflect complex interactions between technological advancement, regulatory evolution, competitive pressures, and changing customer expectations that collectively shape market development trajectories and strategic positioning requirements.

Competitive intensity is increasing as global cloud giants establish local presence while domestic providers develop specialized offerings to compete for market share. This competition drives innovation, service quality improvements, and pricing optimization that benefits customers while challenging providers to differentiate their offerings. Partnership strategies are becoming increasingly important as organizations seek to combine global expertise with local market knowledge and regulatory compliance capabilities.

Technology evolution continues to reshape market dynamics as new cloud services, deployment models, and integration capabilities emerge. The shift toward multi-cloud and hybrid cloud strategies requires providers to offer interoperability and management tools that support complex, distributed IT environments. Customer sophistication is growing as organizations develop cloud expertise and become more demanding regarding service quality, security, and cost-effectiveness.

Regulatory evolution influences market dynamics through changing compliance requirements, data protection standards, and government procurement policies that affect vendor selection criteria and service delivery models. Economic factors including oil price fluctuations and economic diversification efforts impact IT spending patterns and cloud adoption priorities across different industry sectors. According to MarkWide Research analysis, these dynamic factors contribute to a market adoption rate of 68% among large enterprises, indicating strong momentum despite various challenges.

Comprehensive research methodology employed for analyzing the KSA cloud computing market incorporates multiple data collection approaches, analytical frameworks, and validation processes to ensure accuracy, reliability, and relevance of market insights and projections.

Primary research activities include structured interviews with cloud service providers, enterprise customers, government officials, and industry experts to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies target IT decision-makers across various industry sectors to quantify adoption patterns, spending priorities, and technology preferences. Focus group discussions with end-users provide qualitative insights into user experience, satisfaction levels, and future requirements that inform market analysis and forecasting.

Secondary research encompasses analysis of government publications, industry reports, financial statements, and regulatory documents to understand market context, policy implications, and competitive dynamics. Technology trend analysis examines emerging cloud computing innovations, global best practices, and regional adaptation patterns that influence local market development. Data triangulation processes validate findings across multiple sources to ensure consistency and reliability of market intelligence.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, and scenario planning techniques that support strategic insights and future projections. Statistical modeling approaches examine relationships between market drivers, adoption patterns, and growth trajectories to identify key success factors and potential risks affecting market development.

Regional analysis of the KSA cloud computing market reveals significant variations in adoption patterns, infrastructure development, and growth potential across different geographic areas within the kingdom, reflecting diverse economic activities, population densities, and technological readiness levels.

Riyadh region dominates market activity with approximately 45% market share, driven by concentration of government agencies, large enterprises, and technology companies that generate substantial demand for cloud services. The capital’s role as the administrative and business center creates a dense ecosystem of cloud providers, system integrators, and specialized service companies. Infrastructure investments in data centers and fiber optic networks support high-capacity cloud service delivery and position Riyadh as the primary cloud computing hub.

Eastern Province represents the second-largest market segment with 28% regional share, primarily driven by oil and gas industry requirements for cloud-based analytics, IoT platforms, and industrial automation solutions. The region’s industrial base creates demand for specialized cloud applications supporting manufacturing, petrochemicals, and logistics operations. Jeddah and Western Province account for 18% market share, with growth driven by port operations, trade facilitation, and tourism sector digitization initiatives.

Northern and Southern regions represent emerging markets with substantial growth potential as infrastructure development and economic diversification efforts expand cloud computing accessibility and adoption. Smart city projects in NEOM and other mega-developments are expected to significantly increase cloud computing demand in previously underserved regions, creating new market opportunities and competitive dynamics.

The competitive landscape of the KSA cloud computing market features a diverse mix of global technology giants, regional providers, and emerging local companies competing across different service categories and customer segments through varied strategic approaches and value propositions.

Competitive strategies include local partnership development, data center investments, regulatory compliance enhancement, and industry-specific solution development. Market differentiation occurs through pricing models, service quality, security capabilities, and customer support excellence that address specific Saudi market requirements and preferences.

Market segmentation analysis reveals distinct customer categories, service types, and deployment models that characterize the KSA cloud computing market structure and inform strategic positioning and service development decisions.

By Service Model:

By Deployment Model:

By Organization Size:

Category-wise analysis provides detailed insights into specific market segments, revealing unique characteristics, growth patterns, and strategic considerations that influence competitive positioning and service development priorities within the KSA cloud computing ecosystem.

Government Sector: Represents the largest and most stable customer category, driven by digital transformation mandates and substantial IT modernization budgets. Procurement processes favor providers with strong security credentials, local presence, and compliance capabilities. Growth is sustained through e-government initiatives, smart city projects, and citizen service digitization programs that require scalable cloud infrastructure and applications.

Financial Services: Demonstrates high cloud adoption rates despite stringent regulatory requirements, with digital banking transformation driving demand for secure, compliant cloud solutions. Islamic banking institutions require specialized cloud applications supporting Sharia-compliant financial products and services. Fintech innovation creates opportunities for cloud providers offering development platforms and financial technology integration capabilities.

Healthcare Sector: Experiencing rapid cloud adoption driven by telemedicine expansion, electronic health records implementation, and medical research requirements. Data privacy concerns and regulatory compliance needs favor providers with healthcare-specific security and compliance capabilities. The COVID-19 pandemic accelerated digital health initiatives, creating sustained demand for cloud-based healthcare solutions.

Education Sector: Significant growth potential driven by online learning adoption, research computing requirements, and administrative system modernization. University partnerships with cloud providers support research activities while educational technology companies leverage cloud platforms for content delivery and student management systems.

Industry participants and stakeholders across the KSA cloud computing ecosystem realize substantial benefits through market participation, ranging from operational efficiencies and cost optimization to strategic advantages and innovation enablement that support long-term business success.

For Cloud Service Providers:

For Enterprise Customers:

For Government Stakeholders:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the KSA cloud computing landscape reflect technological evolution, changing customer preferences, and strategic market developments that influence competitive dynamics and growth trajectories across different service categories and customer segments.

Multi-Cloud Strategy Adoption represents a significant trend as organizations seek to avoid vendor lock-in while optimizing service delivery through best-of-breed cloud solutions. Enterprise customers increasingly deploy workloads across multiple cloud platforms to enhance resilience, negotiate better pricing, and access specialized capabilities from different providers. This trend creates opportunities for cloud management and integration service providers while challenging individual cloud vendors to demonstrate unique value propositions.

Edge Computing Integration is gaining momentum as organizations require low-latency processing for IoT applications, real-time analytics, and mobile services. 5G network deployment accelerates edge computing adoption by enabling high-speed, low-latency connectivity between edge devices and cloud infrastructure. Cloud providers are investing in edge computing capabilities to support applications requiring real-time processing and reduced data transmission costs.

Industry-Specific Cloud Solutions are becoming increasingly important as organizations seek specialized capabilities addressing unique sector requirements. Islamic finance institutions require Sharia-compliant cloud applications, while oil and gas companies need specialized analytics and simulation capabilities. Healthcare organizations demand HIPAA-equivalent compliance features, and government agencies require enhanced security and data sovereignty controls.

Artificial Intelligence Integration is transforming cloud service offerings as providers embed AI and machine learning capabilities into their platforms. Automated cloud management, predictive analytics, and intelligent resource optimization are becoming standard features that enhance service quality while reducing operational complexity for customers.

Recent industry developments demonstrate the dynamic nature of the KSA cloud computing market, with significant investments, partnerships, and technological advancements reshaping competitive dynamics and market opportunities across multiple dimensions.

Major Infrastructure Investments include substantial data center construction projects by leading cloud providers establishing local presence to meet data sovereignty requirements and improve service delivery performance. Amazon Web Services announced plans for multiple availability zones within Saudi Arabia, while Microsoft established Azure regions to support government and enterprise customers with enhanced security and compliance capabilities.

Strategic Partnership Formations between international cloud providers and local telecommunications companies are accelerating market development through combined expertise and infrastructure capabilities. STC Group partnerships with global technology companies enable integrated cloud and connectivity solutions, while Mobily collaborations focus on enterprise customer segments requiring comprehensive digital transformation support.

Government Initiative Launches include the National Cloud Computing Strategy establishing frameworks for public sector cloud adoption and digital service delivery enhancement. CITC regulations provide clarity on data protection, cybersecurity, and cloud service provider requirements, creating a more predictable regulatory environment for market participants.

Technology Innovation Developments encompass AI-powered cloud management platforms, blockchain integration capabilities, and IoT-specific cloud services addressing emerging market requirements. Local technology companies are developing specialized solutions for Saudi market needs while international providers adapt global offerings to meet regional preferences and compliance requirements.

Strategic analyst recommendations for KSA cloud computing market participants emphasize the importance of localization, partnership development, and specialized service offerings that address unique market characteristics and customer requirements while building sustainable competitive advantages.

For Cloud Service Providers: Focus on establishing local data center presence and obtaining relevant compliance certifications to address data sovereignty concerns and regulatory requirements. Partnership strategies with local systems integrators and telecommunications companies can accelerate market entry and customer acquisition while providing cultural and regulatory expertise. Investment in Arabic language support and local customer service capabilities enhances market acceptance and customer satisfaction levels.

For Enterprise Customers: Develop comprehensive cloud strategies that align with business objectives while addressing security, compliance, and integration requirements. Pilot project approaches enable organizations to gain cloud experience and build internal expertise before undertaking large-scale migrations. Multi-cloud strategies should be considered to avoid vendor lock-in while accessing best-of-breed capabilities from different providers.

For Government Agencies: Establish clear cloud adoption policies and procurement frameworks that balance security requirements with innovation objectives. Skills development programs should be prioritized to build internal cloud expertise and reduce dependency on external consultants. Collaboration with private sector organizations can accelerate digital transformation while sharing implementation costs and risks.

For Investment Stakeholders: Focus on companies developing industry-specific cloud solutions and those with strong local market presence and regulatory compliance capabilities. MWR analysis suggests that organizations with hybrid cloud expertise and edge computing capabilities represent attractive investment opportunities given growing market demand for these specialized services.

Future outlook for the KSA cloud computing market indicates sustained growth driven by continued digital transformation initiatives, emerging technology adoption, and expanding market penetration across previously underserved sectors and geographic regions within the kingdom.

Growth projections suggest the market will maintain robust expansion momentum with a projected CAGR of 14.2% over the next five years, driven by increasing enterprise adoption, government digitization programs, and emerging technology integration requirements. Market maturation will likely result in more sophisticated customer requirements, increased competition among providers, and greater emphasis on specialized service offerings addressing specific industry needs.

Technology evolution will continue reshaping market dynamics as artificial intelligence, edge computing, and quantum computing capabilities become integrated into cloud platforms. 5G network deployment will enable new cloud service categories and applications requiring ultra-low latency and high-bandwidth connectivity. The convergence of cloud computing with IoT, blockchain, and augmented reality technologies will create new market opportunities and revenue streams.

Regional expansion opportunities exist for Saudi cloud providers to leverage local expertise and cultural understanding to serve broader Middle East and North Africa markets. Cross-border data flows and regional integration initiatives may create demand for cloud services supporting international business operations and trade facilitation activities.

Market consolidation trends may emerge as smaller providers seek partnerships or acquisition opportunities to compete with global cloud giants, while specialized niche providers focus on specific industry verticals or technology capabilities. Regulatory evolution will continue influencing market dynamics through data protection standards, cybersecurity requirements, and digital economy policies that affect competitive positioning and service delivery models.

The KSA cloud computing market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by comprehensive digital transformation initiatives, strong government support, and increasing recognition of cloud computing as essential infrastructure for economic diversification and technological advancement. Market fundamentals remain robust with substantial investment in infrastructure, regulatory frameworks supporting innovation, and growing customer sophistication driving demand for advanced cloud services and specialized solutions.

Strategic opportunities exist across multiple dimensions including industry-specific solution development, emerging technology integration, and regional market expansion that can benefit both international providers and domestic companies with appropriate positioning and capabilities. The convergence of cloud computing with artificial intelligence, edge computing, and 5G networks creates new service categories and revenue potential while addressing evolving customer requirements for performance, security, and compliance.

Success factors for market participants include establishing local presence, developing strategic partnerships, obtaining relevant certifications, and investing in specialized capabilities that address unique Saudi market requirements. MarkWide Research analysis indicates that organizations focusing on hybrid cloud solutions, industry-specific applications, and comprehensive security capabilities are best positioned to capitalize on market growth opportunities while building sustainable competitive advantages in this dynamic and promising market environment.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing, and software. It enables businesses to access technology resources on-demand without the need for physical infrastructure.

What are the key players in the KSA Cloud Computing Market?

Key players in the KSA Cloud Computing Market include STC Cloud, Mobily, and Oracle, which provide various cloud services such as infrastructure as a service (IaaS) and software as a service (SaaS), among others.

What are the main drivers of growth in the KSA Cloud Computing Market?

The main drivers of growth in the KSA Cloud Computing Market include the increasing demand for digital transformation, the rise of remote work, and government initiatives promoting cloud adoption across various sectors.

What challenges does the KSA Cloud Computing Market face?

Challenges in the KSA Cloud Computing Market include concerns over data security and privacy, regulatory compliance issues, and the need for skilled professionals to manage cloud technologies effectively.

What opportunities exist in the KSA Cloud Computing Market?

Opportunities in the KSA Cloud Computing Market include the expansion of cloud services in sectors like healthcare and education, as well as the potential for innovation in artificial intelligence and big data analytics.

What trends are shaping the KSA Cloud Computing Market?

Trends shaping the KSA Cloud Computing Market include the growing adoption of hybrid cloud solutions, increased focus on sustainability in cloud operations, and the integration of advanced technologies like machine learning and IoT.

KSA Cloud Computing Market

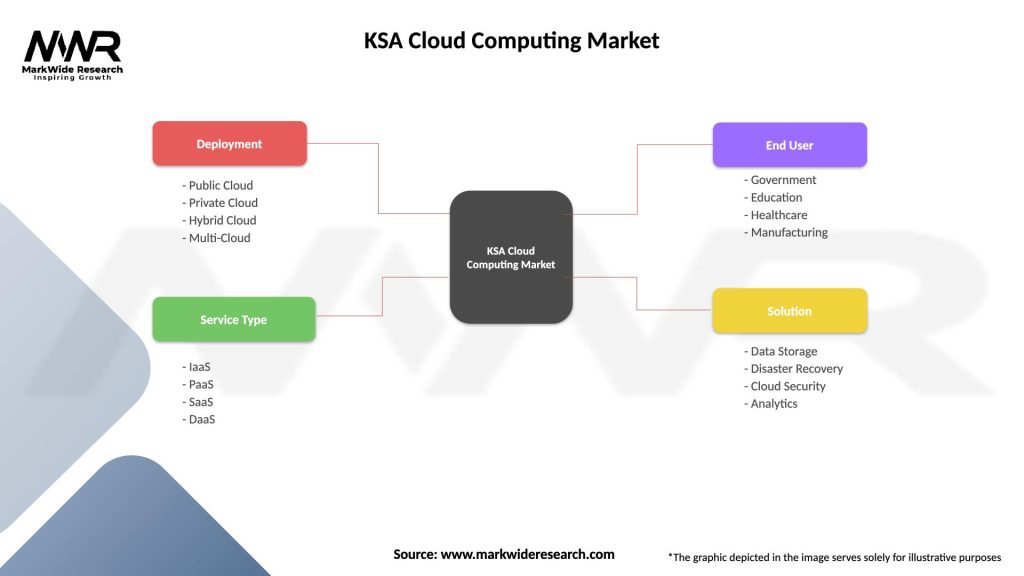

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Service Type | IaaS, PaaS, SaaS, DaaS |

| End User | Government, Education, Healthcare, Manufacturing |

| Solution | Data Storage, Disaster Recovery, Cloud Security, Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the KSA Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at