444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Krypton Market is a dynamic and rapidly evolving sector in the global economy. It encompasses a wide range of industries, including technology, finance, and commerce. The market is characterized by the exchange of digital assets, particularly cryptocurrencies, which are secured by advanced cryptographic techniques. Krypton Market provides a decentralized platform for individuals and businesses to trade, invest, and transact securely.

The term “Krypton Market” refers to the virtual marketplace where digital assets, such as cryptocurrencies, are bought, sold, and exchanged. It is an online platform that facilitates peer-to-peer transactions, eliminating the need for intermediaries like banks or financial institutions. The market is powered by blockchain technology, which ensures transparency, security, and immutability of transactions. Participants in the Krypton Market can engage in various activities, such as buying and holding digital assets, trading them for profit, or using them as a medium of exchange for goods and services.

Executive Summary

The Krypton Market has experienced significant growth over the past decade, driven by increasing adoption and recognition of cryptocurrencies as a legitimate asset class. The market has attracted a diverse range of participants, including individual investors, financial institutions, and even governments. The rising popularity of cryptocurrencies, such as Bitcoin and Ethereum, has propelled the market to new heights, with billions of dollars being traded daily.

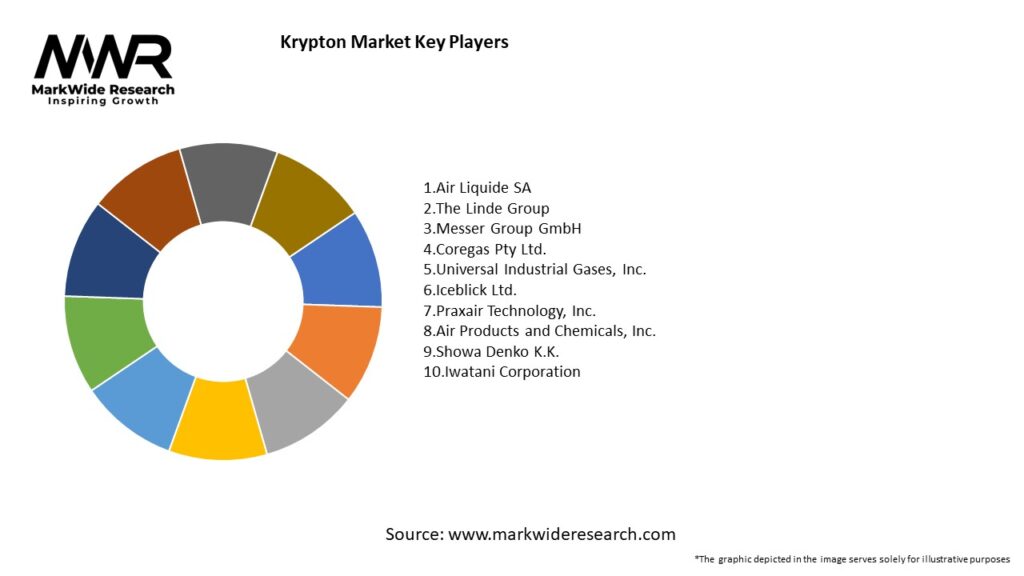

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Krypton Market is characterized by its decentralized nature, rapid technological advancements, and the interplay between market participants. The market dynamics are influenced by factors such as investor sentiment, regulatory developments, technological innovations, and macroeconomic conditions. Fluctuations in cryptocurrency prices, market trends, and shifts in investor behavior can create a dynamic and volatile environment.

Regional Analysis

The Krypton Market is global in nature, with participants and exchanges operating in various regions around the world. However, the regulatory landscape and adoption rates can vary significantly between regions. While some countries have embraced cryptocurrencies and fostered favorable environments for the Krypton Market, others have imposed restrictions or expressed skepticism. Understanding regional dynamics is crucial for market participants to navigate opportunities and challenges effectively.

Competitive Landscape

Leading companies in the Krypton Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

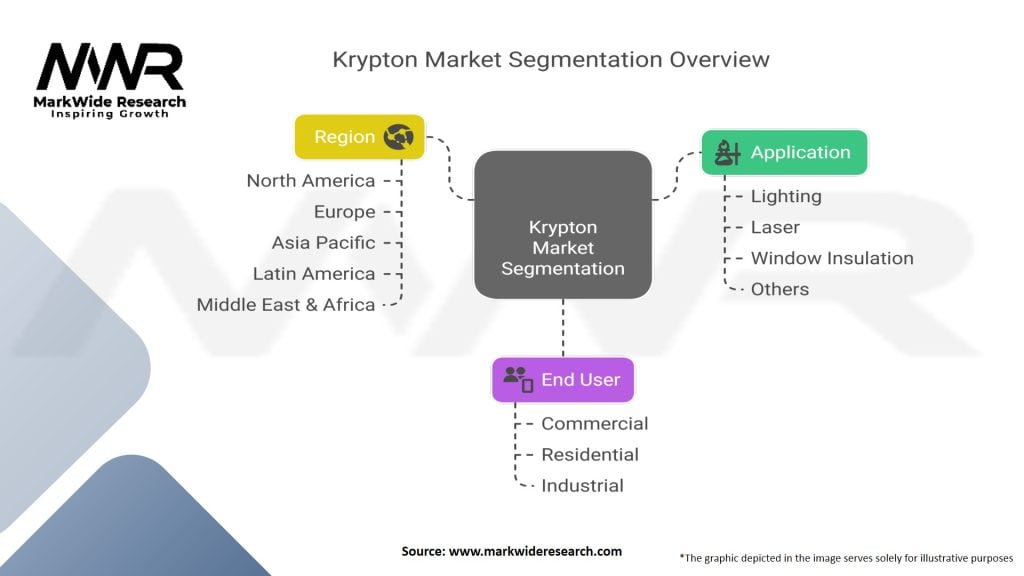

Segmentation

The Krypton Market can be segmented based on various factors, including the type of digital assets traded, user demographics, and geographical regions. Some common segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Krypton Market. While it initially led to market volatility and a temporary decline in cryptocurrency prices, it also highlighted the potential of digital assets as a hedge against traditional financial uncertainties. The pandemic accelerated the adoption of digital payment systems and drove interest in decentralized finance (DeFi) applications.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Krypton Market is optimistic, driven by ongoing technological advancements, increasing institutional adoption, and the growing acceptance of cryptocurrencies as a mainstream financial asset class. However, challenges such as regulatory uncertainties, market volatility, and security concerns will continue to shape the market’s trajectory. The integration of blockchain technology into various industries and the development of scalable solutions will contribute to the long-term growth and maturation of the Krypton Market.

Conclusion

The Krypton Market represents a vibrant and evolving ecosystem that offers opportunities for investors, businesses, and innovators. With its decentralized nature, potential for high returns, and technological advancements, the market has gained recognition as a significant disruptor in the global financial landscape. However, participants must navigate regulatory challenges, security risks, and market volatility while capitalizing on the market’s benefits. As the Krypton Market continues to mature, collaboration between industry stakeholders, regulatory clarity, and ongoing education will play key roles in shaping its future success.

What is Krypton?

Krypton is a colorless, odorless noble gas that is used in various applications, including lighting, photography, and as a component in certain types of lasers. It is known for its high efficiency in producing bright white light and is often utilized in high-performance light bulbs.

Who are the key players in the Krypton Market?

Key players in the Krypton Market include Air Products and Chemicals, Inc., Linde plc, and Praxair Technology, Inc., among others. These companies are involved in the production and supply of krypton gas for various industrial applications.

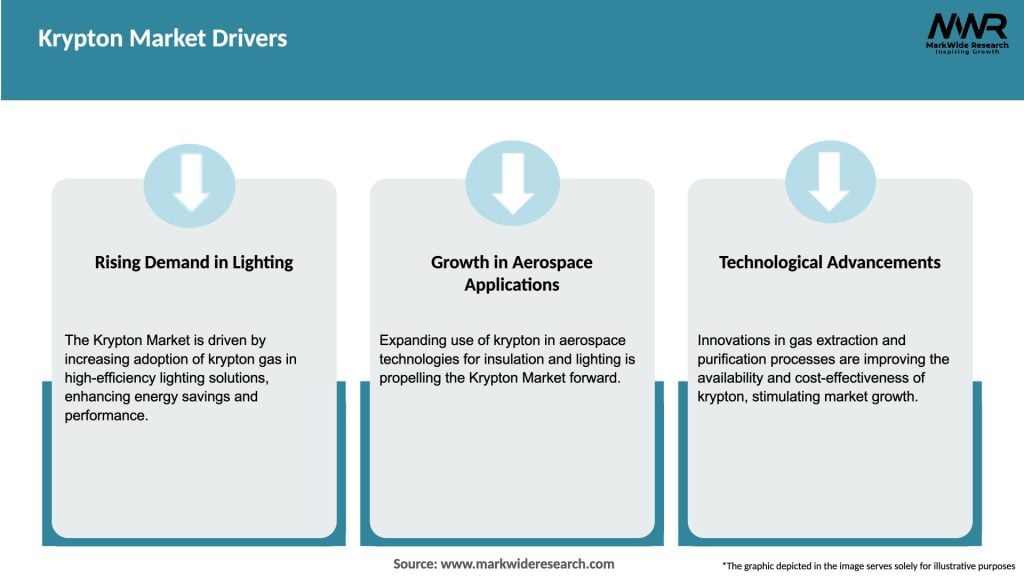

What are the growth factors driving the Krypton Market?

The growth of the Krypton Market is driven by the increasing demand for energy-efficient lighting solutions and advancements in laser technology. Additionally, the expansion of the electronics industry is contributing to the rising use of krypton in specialized applications.

What challenges does the Krypton Market face?

The Krypton Market faces challenges such as the high cost of production and the limited availability of natural krypton gas. Furthermore, competition from alternative gases and technologies can hinder market growth.

What opportunities exist in the Krypton Market?

Opportunities in the Krypton Market include the development of new applications in the aerospace and medical sectors, as well as the potential for increased use in high-efficiency lighting systems. The growing focus on sustainable technologies also presents avenues for market expansion.

What trends are shaping the Krypton Market?

Trends in the Krypton Market include the rising adoption of LED lighting technologies that incorporate krypton for enhanced performance and the exploration of krypton in advanced imaging systems. Additionally, there is a growing interest in the environmental impact of gas production and usage.

Krypton Market

| Segmentation | Details |

|---|---|

| Application | Lighting, Laser, Window Insulation, Others |

| End User | Commercial, Residential, Industrial |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Krypton Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at