444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The kids and nursery furniture market represents a dynamic and rapidly evolving sector within the global furniture industry, characterized by innovative designs, safety-focused manufacturing, and increasing consumer awareness regarding child development needs. This specialized market encompasses a comprehensive range of products including cribs, changing tables, dressers, toy storage solutions, children’s beds, study desks, and various nursery accessories designed specifically for infants, toddlers, and young children.

Market dynamics indicate substantial growth driven by rising birth rates in developing regions, increasing disposable income among young families, and growing emphasis on creating aesthetically pleasing and functional nursery spaces. The market demonstrates remarkable resilience with consistent demand patterns, experiencing growth at a CAGR of 6.2% over recent years, reflecting strong consumer confidence in specialized children’s furniture investments.

Contemporary trends show parents increasingly prioritizing multifunctional furniture pieces that adapt to children’s changing needs, sustainable materials, and smart furniture integration. The market benefits from evolving parenting philosophies that emphasize creating nurturing environments conducive to child development, learning, and creativity. Premium segment adoption has increased by 34% as parents seek high-quality, durable solutions that offer long-term value and safety assurance.

The kids and nursery furniture market refers to the specialized industry segment focused on designing, manufacturing, and distributing furniture products specifically created for children from infancy through early adolescence. This market encompasses all furniture categories tailored to meet the unique safety, developmental, and functional requirements of young users and their caregivers.

Core product categories include nursery essentials such as cribs, bassinets, changing stations, and rocking chairs, alongside children’s bedroom furniture including toddler beds, bunk beds, study desks, storage solutions, and play furniture. The market also encompasses specialized items like high chairs, booster seats, toy organizers, and decorative elements designed to create child-friendly living spaces.

Safety standards and regulatory compliance form fundamental aspects of this market, with products required to meet stringent safety certifications and quality benchmarks. The market emphasizes durability, non-toxic materials, rounded edges, secure construction, and age-appropriate design elements that support healthy child development while providing peace of mind for parents and caregivers.

Market performance demonstrates robust expansion across all major product segments, with particularly strong growth in convertible furniture solutions and eco-friendly product lines. The industry benefits from consistent demand drivers including population growth, urbanization trends, and increasing consumer spending on child-centric home furnishing solutions.

Key growth factors include rising awareness of child development principles, increasing dual-income households with higher purchasing power, and growing preference for premium, multifunctional furniture pieces. The market shows 42% adoption rate for convertible cribs that transform into toddler beds, reflecting consumer preference for long-term value investments.

Regional dynamics reveal strong performance across North America and Europe, with emerging markets in Asia-Pacific showing accelerated growth patterns. Online retail channels have captured 38% market share, driven by convenience, extensive product selection, and competitive pricing strategies. The market continues expanding through product innovation, strategic partnerships, and enhanced distribution networks targeting modern families’ evolving needs.

Strategic market insights reveal several critical trends shaping the kids and nursery furniture landscape:

Demographic trends serve as primary market drivers, with increasing birth rates in developing economies and delayed parenthood in developed markets creating sustained demand for quality nursery furniture. Rising disposable income levels enable families to invest in premium furniture solutions that prioritize safety, functionality, and aesthetic appeal.

Urbanization patterns drive demand for space-efficient, multifunctional furniture designs that maximize utility in smaller living spaces. Modern parents seek furniture pieces that serve multiple purposes, adapt to changing needs, and maintain visual appeal throughout extended use periods. This trend supports 28% growth in convertible furniture segment adoption.

Safety consciousness among parents creates strong demand for certified, high-quality furniture meeting or exceeding safety standards. Increased awareness of child development principles drives preference for ergonomically designed furniture that supports healthy growth, learning, and play activities. Consumer research indicates that 76% of parents prioritize safety certifications over price considerations when selecting nursery furniture.

E-commerce expansion facilitates market access, enabling consumers to research products thoroughly, compare options, and access extensive product ranges previously unavailable through traditional retail channels. Online platforms provide detailed product information, customer reviews, and convenient delivery options that appeal to busy parents.

High initial costs associated with quality nursery furniture present significant barriers for price-sensitive consumers, particularly in emerging markets where disposable income levels remain constrained. Premium furniture pieces often require substantial upfront investments that may deter budget-conscious families despite long-term value propositions.

Safety regulations and compliance requirements increase manufacturing costs and complexity, potentially limiting product innovation and market entry for smaller manufacturers. Stringent testing procedures, certification processes, and ongoing compliance monitoring create operational challenges that impact pricing strategies and market accessibility.

Limited usage periods for certain furniture categories, particularly infant-specific items like cribs and changing tables, create concerns about cost-effectiveness among consumers. Parents may hesitate to invest in specialized furniture pieces with relatively short functional lifespans, preferring more versatile alternatives.

Space constraints in urban environments limit demand for larger furniture pieces, requiring manufacturers to balance functionality with compact design requirements. Storage and transportation challenges associated with bulky furniture items create logistical complexities that impact distribution efficiency and cost structures.

Emerging markets present substantial growth opportunities as rising middle-class populations in Asia-Pacific, Latin America, and Africa develop increased purchasing power and awareness of specialized children’s furniture benefits. These regions show 45% annual growth potential in premium furniture segment adoption.

Technology integration offers innovative opportunities for smart furniture development, including IoT-enabled monitoring systems, adjustable components, and interactive features that enhance functionality and appeal to tech-savvy parents. Smart nursery solutions represent an emerging segment with significant growth potential.

Sustainability focus creates opportunities for eco-friendly product lines using recycled materials, sustainable manufacturing processes, and biodegradable components. Environmental consciousness among millennial parents drives demand for responsible furniture options that align with family values and environmental commitments.

Customization services enable manufacturers to differentiate products through personalized designs, custom sizing, and unique aesthetic options. Made-to-order furniture solutions command premium pricing while meeting specific consumer requirements and space constraints.

Supply chain dynamics within the kids and nursery furniture market demonstrate increasing complexity as manufacturers balance cost efficiency with quality requirements and safety compliance. Global sourcing strategies enable access to specialized materials and components while managing production costs, though supply chain disruptions can impact availability and pricing stability.

Consumer behavior patterns show evolving preferences toward research-intensive purchasing decisions, with parents extensively comparing safety ratings, user reviews, and product specifications before making furniture investments. Digital influence accounts for 67% of purchase decisions, with social media, parenting blogs, and online reviews significantly impacting brand perception and product selection.

Competitive dynamics intensify as traditional furniture manufacturers expand into children’s segments while specialized nursery brands enhance product portfolios and market reach. Innovation cycles accelerate as companies invest in research and development to create differentiated products that address evolving consumer needs and regulatory requirements.

Retail evolution transforms market dynamics through omnichannel strategies that integrate online and offline experiences. Showroom concepts allow hands-on product evaluation while e-commerce platforms provide extensive selection and convenient purchasing options, creating hybrid retail models that optimize customer engagement and satisfaction.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the kids and nursery furniture market landscape. Primary research initiatives include extensive consumer surveys, industry expert interviews, and manufacturer consultations to gather firsthand market intelligence and trend identification.

Secondary research encompasses analysis of industry reports, trade publications, regulatory documentation, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure information accuracy and reliability across multiple sources and research approaches.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth patterns, segment performance, and regional dynamics. Market sizing methodologies incorporate production data, import/export statistics, and retail sales information to establish comprehensive market parameters.

Qualitative research includes focus group discussions with parents, retailer interviews, and industry stakeholder consultations to understand market nuances, consumer motivations, and emerging trends that quantitative data alone cannot capture. This mixed-method approach provides holistic market understanding and strategic insights.

North America maintains market leadership with mature consumer base characterized by high disposable income, strong safety awareness, and preference for premium furniture solutions. The region demonstrates 32% market share globally, driven by established retail infrastructure, brand loyalty, and consistent replacement demand patterns.

Europe shows steady growth with emphasis on sustainable manufacturing, innovative design, and strict safety regulations that drive quality standards across the industry. Scandinavian countries lead in eco-friendly furniture adoption, while Western European markets focus on multifunctional and space-saving solutions for urban environments.

Asia-Pacific represents the fastest-growing regional market with 8.4% CAGR, fueled by rising birth rates, increasing urbanization, and expanding middle-class populations. China and India drive regional growth through domestic manufacturing capabilities and growing consumer awareness of specialized children’s furniture benefits.

Latin America demonstrates emerging market potential with increasing disposable income and changing lifestyle patterns among urban families. Brazil and Mexico lead regional development through improved retail infrastructure and growing preference for quality children’s furniture solutions.

Middle East and Africa show developing market characteristics with growth concentrated in urban centers and affluent consumer segments. The region benefits from increasing expatriate populations and rising awareness of international furniture standards and safety requirements.

Market leadership is distributed among several key players who have established strong brand recognition and comprehensive product portfolios:

Competitive strategies focus on product differentiation through safety innovations, design aesthetics, and multifunctional capabilities. Companies invest heavily in research and development to create unique features that address specific consumer needs while maintaining competitive pricing structures.

By Product Type:

By Age Group:

By Material:

Cribs and Sleep Solutions represent the largest market segment, driven by essential nature and safety requirements. Convertible cribs show particularly strong growth with 52% adoption rate among new parents, offering long-term value through transformation into toddler beds and daybeds. Premium materials and innovative safety features command higher price points in this category.

Storage and Organization furniture demonstrates consistent demand as parents seek solutions for managing children’s belongings efficiently. Modular storage systems gain popularity for their adaptability and space optimization capabilities, particularly in urban environments where space efficiency is paramount.

Study and Activity Furniture shows accelerated growth as parents invest in dedicated learning spaces for children. Height-adjustable desks and ergonomic seating solutions reflect growing awareness of proper posture and learning environment importance for child development.

Specialty Seating including nursing chairs and gliders maintains steady demand driven by comfort requirements during feeding and bonding activities. Premium upholstery options and ergonomic designs differentiate products in this competitive segment.

Decorative and Themed Furniture appeals to parents seeking to create engaging, personalized spaces for children. Character-themed furniture and customizable options enable creative expression while maintaining functional utility.

Manufacturers benefit from consistent demand patterns and opportunities for product differentiation through innovation, safety enhancements, and design aesthetics. The market offers premium pricing potential for high-quality, certified products that meet evolving consumer expectations and regulatory requirements.

Retailers enjoy stable inventory turnover and customer loyalty development through specialized expertise in children’s furniture. Omnichannel strategies enable expanded market reach while showroom experiences facilitate customer confidence in safety and quality assessments.

Consumers gain access to specialized products designed specifically for children’s needs, safety requirements, and developmental stages. Quality furniture investments provide long-term value through durability, safety assurance, and adaptability to changing family needs.

Suppliers benefit from consistent raw material demand and opportunities for specialized component development. Safety hardware, non-toxic finishes, and sustainable materials represent growing supply categories with premium pricing potential.

Investors find attractive opportunities in a market characterized by consistent demand, innovation potential, and expansion possibilities in emerging markets. The sector demonstrates resilience during economic fluctuations due to essential nature of children’s furniture needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Manufacturing emerges as a dominant trend with consumers increasingly prioritizing eco-friendly furniture options. Manufacturers adopt responsibly sourced materials, low-emission finishes, and recyclable components to meet environmental expectations while maintaining safety and quality standards.

Convertible and Multifunctional Designs gain momentum as parents seek furniture pieces that adapt to children’s changing needs and space constraints. Cribs that convert to toddler beds, storage ottomans, and adjustable desks represent growing segments within this trend category.

Gender-Neutral Aesthetics reflect changing parenting philosophies and practical considerations for families with multiple children. Neutral color palettes, universal designs, and timeless aesthetics appeal to modern parents seeking versatile furniture solutions.

Smart Furniture Integration introduces technology-enabled features including built-in monitors, LED lighting systems, and connectivity options that enhance functionality and appeal to tech-savvy millennial parents. This trend shows 23% annual growth in premium market segments.

Minimalist Design Philosophy influences product development with emphasis on clean lines, simple forms, and uncluttered aesthetics that complement contemporary home décor while maintaining child-friendly functionality and safety features.

Safety Innovation Advances include development of anti-tip mechanisms, improved corner protection, and enhanced stability features that exceed current regulatory requirements. Manufacturers invest in research and development to create safer products that provide competitive advantages and consumer confidence.

Material Technology Progress encompasses introduction of new composite materials, improved finishes, and sustainable alternatives that maintain durability while reducing environmental impact. Advanced manufacturing techniques enable more precise construction and consistent quality control.

Digital Integration Expansion sees furniture manufacturers partnering with technology companies to develop smart features, mobile app connectivity, and IoT integration that enhance product functionality and user experience for modern families.

Retail Channel Evolution includes expansion of omnichannel strategies, virtual showroom experiences, and augmented reality tools that help consumers visualize furniture in their homes before purchase. MarkWide Research indicates that digital retail channels now account for significant market share growth.

Customization Platform Development enables consumers to personalize furniture designs, select materials, and modify dimensions to meet specific requirements. These platforms combine manufacturing efficiency with individual customization capabilities.

Market participants should prioritize safety innovation and compliance excellence to maintain consumer trust and regulatory approval. Investment in advanced testing capabilities and quality assurance systems provides competitive advantages while ensuring product reliability and brand reputation protection.

Product development strategies should emphasize multifunctional designs that maximize utility and value for consumers. Convertible furniture solutions that adapt to children’s growth stages offer compelling value propositions and differentiation opportunities in competitive markets.

Sustainability initiatives represent essential investments for long-term market success as environmental consciousness continues growing among target consumers. Manufacturers should develop comprehensive sustainability programs encompassing materials, manufacturing processes, and product lifecycle management.

Digital transformation requires strategic investment in e-commerce capabilities, digital marketing, and technology integration to meet evolving consumer expectations and shopping behaviors. Omnichannel strategies that seamlessly integrate online and offline experiences provide competitive advantages.

Emerging market expansion offers significant growth opportunities for companies willing to adapt products and strategies to local preferences, regulatory requirements, and economic conditions. Strategic partnerships with local distributors and retailers facilitate market entry and expansion success.

Market trajectory indicates continued expansion driven by demographic trends, increasing consumer awareness, and ongoing product innovation. The industry is projected to maintain robust growth with CAGR of 6.8% over the next five years, supported by emerging market development and premium segment expansion.

Technology integration will accelerate with smart furniture features becoming standard rather than premium options. IoT connectivity, mobile app integration, and automated functionality will transform traditional furniture into intelligent home ecosystem components that enhance child safety and parental convenience.

Sustainability requirements will intensify as regulatory frameworks evolve and consumer expectations increase. Manufacturers must develop comprehensive environmental strategies encompassing sustainable sourcing, manufacturing processes, and end-of-life product management to maintain market competitiveness.

Customization capabilities will expand through advanced manufacturing technologies including 3D printing, automated production systems, and flexible supply chains that enable mass customization without significant cost penalties. MWR analysis suggests that customization options will become key differentiators in mature markets.

Global market integration will continue as manufacturers develop standardized products that meet multiple regional safety requirements while maintaining local aesthetic preferences. Cross-border e-commerce will facilitate market access and consumer choice expansion across geographic boundaries.

The kids and nursery furniture market demonstrates remarkable resilience and growth potential, driven by fundamental demographic trends, evolving consumer preferences, and continuous innovation in safety, functionality, and design. Market participants who prioritize quality, safety, and consumer-centric product development are well-positioned to capitalize on expanding opportunities across global markets.

Strategic success factors include maintaining rigorous safety standards, embracing sustainable manufacturing practices, and developing multifunctional products that provide long-term value for families. The integration of technology, customization capabilities, and omnichannel retail strategies will differentiate market leaders from competitors in increasingly competitive environments.

Future market evolution will be shaped by emerging market expansion, technological advancement, and sustainability requirements that transform traditional furniture into intelligent, environmentally responsible solutions. Companies that anticipate and adapt to these trends while maintaining focus on core safety and quality principles will achieve sustained success in this dynamic and rewarding market segment.

What is Kids And Nursery Furniture?

Kids and nursery furniture refers to a range of furniture designed specifically for children, including cribs, changing tables, dressers, and playroom furniture. This type of furniture is often characterized by safety features, vibrant colors, and child-friendly designs.

What are the key players in the Kids And Nursery Furniture Market?

Key players in the Kids And Nursery Furniture Market include companies like IKEA, Delta Children, and Graco. These companies are known for their innovative designs and commitment to safety, among others.

What are the growth factors driving the Kids And Nursery Furniture Market?

The Kids And Nursery Furniture Market is driven by factors such as increasing birth rates, rising disposable incomes, and a growing focus on child safety and comfort. Additionally, the trend towards eco-friendly materials is influencing consumer choices.

What challenges does the Kids And Nursery Furniture Market face?

Challenges in the Kids And Nursery Furniture Market include stringent safety regulations, fluctuating raw material costs, and competition from unbranded or low-cost alternatives. These factors can impact pricing and market accessibility.

What opportunities exist in the Kids And Nursery Furniture Market?

Opportunities in the Kids And Nursery Furniture Market include the growing demand for multifunctional furniture and the rise of online retailing. Additionally, increasing awareness of sustainable and non-toxic materials presents new avenues for growth.

What trends are shaping the Kids And Nursery Furniture Market?

Trends in the Kids And Nursery Furniture Market include a shift towards customizable furniture solutions, the incorporation of technology in designs, and a focus on space-saving furniture for smaller living environments. These trends reflect changing consumer lifestyles and preferences.

Kids And Nursery Furniture Market

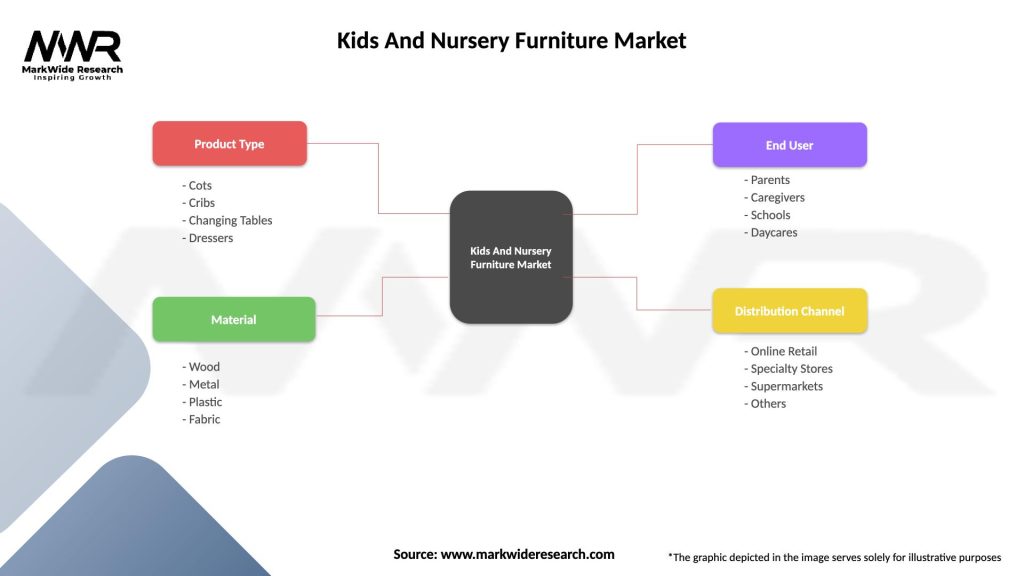

| Segmentation Details | Description |

|---|---|

| Product Type | Cots, Cribs, Changing Tables, Dressers |

| Material | Wood, Metal, Plastic, Fabric |

| End User | Parents, Caregivers, Schools, Daycares |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kids And Nursery Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at