444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kenya ICT market represents one of Africa’s most dynamic and rapidly evolving technology landscapes, positioning itself as a regional hub for digital innovation and technological advancement. Kenya’s ICT sector has experienced remarkable transformation over the past decade, driven by government initiatives, private sector investments, and increasing digital adoption across various industries. The market encompasses telecommunications, software development, hardware distribution, digital services, and emerging technologies such as fintech, e-commerce, and cloud computing solutions.

Digital transformation initiatives have accelerated significantly, with the country achieving impressive connectivity rates and mobile penetration levels exceeding 95% of the population. The government’s commitment to establishing Kenya as a regional ICT hub has resulted in substantial infrastructure investments, including the development of technology parks, fiber optic networks, and digital literacy programs. Mobile money services have revolutionized financial inclusion, with Kenya leading globally in mobile payment adoption rates.

Innovation ecosystems continue to flourish across major urban centers, particularly in Nairobi’s Silicon Savannah, where startups, multinational corporations, and research institutions collaborate to drive technological advancement. The market demonstrates strong growth potential across multiple segments, including telecommunications infrastructure, software solutions, cybersecurity services, and digital financial services, supported by favorable regulatory frameworks and increasing investor confidence.

The Kenya ICT market refers to the comprehensive ecosystem of information and communication technology products, services, and solutions operating within Kenya’s economic landscape. This market encompasses telecommunications infrastructure, mobile and internet services, software development, hardware distribution, digital platforms, cybersecurity solutions, and emerging technology applications that support business operations, government services, and consumer needs across the country.

ICT market dynamics in Kenya include traditional telecommunications services, modern digital solutions, fintech innovations, e-commerce platforms, cloud computing services, and technology-enabled business processes. The market serves diverse stakeholders including government agencies, private enterprises, small and medium businesses, educational institutions, healthcare providers, and individual consumers seeking digital connectivity and technological solutions.

Market participants range from established telecommunications operators and multinational technology companies to local software developers, hardware distributors, digital service providers, and innovative startups creating solutions tailored to local market needs and regional expansion opportunities.

Kenya’s ICT market demonstrates exceptional resilience and growth momentum, establishing the country as East Africa’s leading technology destination. The market benefits from strong government support, robust telecommunications infrastructure, and a vibrant entrepreneurial ecosystem that continues to attract international investment and recognition. Digital adoption rates have accelerated significantly, with mobile internet penetration reaching approximately 87% of the population, creating substantial opportunities for technology-driven business models.

Key market drivers include increasing smartphone adoption, expanding fiber optic networks, growing demand for digital financial services, and rising awareness of cybersecurity needs. The government’s Digital Economy Blueprint and Vision 2030 initiatives provide strategic direction for sustainable ICT development, emphasizing innovation, skills development, and technology-enabled economic growth.

Market segments showing particular strength include mobile telecommunications, fintech solutions, e-commerce platforms, cloud services, and software development. The emergence of 5G technology deployment and Internet of Things applications presents new growth opportunities, while challenges related to digital skills gaps and cybersecurity threats require continued attention and investment.

Strategic market insights reveal several critical trends shaping Kenya’s ICT landscape and future development trajectory:

Government policy support serves as a fundamental driver for Kenya’s ICT market growth, with comprehensive strategies including the Digital Economy Blueprint, ICT Master Plan, and Vision 2030 providing clear direction for technology development and adoption. These initiatives emphasize digital infrastructure development, innovation promotion, and technology-enabled economic transformation across multiple sectors.

Mobile penetration growth continues to drive market expansion, with smartphone adoption rates increasing steadily and creating opportunities for mobile-based applications, services, and business models. The widespread availability of affordable mobile devices and competitive data pricing has democratized access to digital services and created new market opportunities for technology providers.

Digital financial inclusion initiatives have revolutionized banking and payment systems, with mobile money services achieving remarkable penetration rates and creating demand for related ICT infrastructure, security solutions, and complementary services. This success has attracted international attention and investment, further strengthening the market’s growth trajectory.

Infrastructure investments in fiber optic networks, data centers, and telecommunications facilities provide the foundation for advanced ICT services and applications. The National Optic Fibre Backbone Infrastructure and county connectivity projects have significantly improved internet access and quality, supporting business growth and innovation across the country.

Digital skills gaps represent a significant challenge for Kenya’s ICT market development, with limited availability of qualified technical professionals constraining growth in certain segments. The shortage of specialized skills in areas such as cybersecurity, software development, and data analytics affects both local companies and international organizations seeking to establish operations in Kenya.

Infrastructure limitations in rural and remote areas continue to restrict market reach and digital inclusion efforts. While urban centers enjoy robust connectivity, rural communities often face challenges related to network coverage, electricity supply, and affordable access to ICT services, limiting overall market potential.

Cybersecurity threats pose increasing risks to market participants and end users, with growing incidents of cyber attacks, data breaches, and online fraud affecting confidence in digital services. The need for comprehensive cybersecurity frameworks and awareness programs requires significant investment and coordination across multiple stakeholders.

Regulatory complexities and compliance requirements can create barriers for market entry and expansion, particularly for smaller companies and startups. Navigating multiple regulatory frameworks, licensing requirements, and compliance obligations requires substantial resources and expertise that may not be readily available to all market participants.

5G technology deployment presents substantial opportunities for Kenya’s ICT market, with potential applications spanning smart cities, industrial automation, healthcare delivery, and agricultural technology. Early adoption of 5G infrastructure could strengthen Kenya’s position as a regional technology leader and create new business opportunities across multiple sectors.

Digital agriculture solutions offer significant growth potential, with opportunities to develop technology platforms that support farmers, agricultural cooperatives, and agribusiness companies. Solutions including weather monitoring, crop management, market access platforms, and financial services tailored to agricultural needs represent substantial market opportunities.

E-government services expansion creates opportunities for ICT companies to support public sector digital transformation initiatives. Projects including digital identity systems, online service delivery platforms, tax administration systems, and citizen engagement tools require comprehensive technology solutions and ongoing support services.

Regional market expansion opportunities allow Kenyan ICT companies to leverage their local success and expertise to serve broader East African markets. The country’s established technology ecosystem, skilled workforce, and proven solutions create competitive advantages for regional expansion initiatives.

Competitive dynamics in Kenya’s ICT market reflect a healthy balance between established multinational corporations, successful local companies, and innovative startups. This diversity creates opportunities for collaboration, partnership, and knowledge transfer while maintaining competitive pressure that drives innovation and service improvement across all market segments.

Technology adoption patterns demonstrate Kenya’s unique approach to digital transformation, with mobile-first strategies and leapfrog technologies enabling rapid advancement without requiring extensive legacy infrastructure investments. This approach has created opportunities for innovative solutions that address local needs while maintaining global competitiveness.

Investment flows into Kenya’s ICT sector continue to strengthen, with both local and international investors recognizing the market’s potential and supporting growth across multiple segments. Venture capital, private equity, and development finance institutions provide funding for startups, infrastructure projects, and expansion initiatives.

Partnership ecosystems between government agencies, private companies, educational institutions, and development organizations create synergies that accelerate market development and innovation. These collaborations support skills development, infrastructure investment, and technology transfer initiatives that benefit the entire ICT ecosystem.

Comprehensive market analysis for Kenya’s ICT sector employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes structured interviews with industry executives, government officials, technology entrepreneurs, and end users across various market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government publications, industry reports, regulatory documents, financial statements, and academic studies to provide comprehensive market context and historical perspective. Data sources include telecommunications regulators, government statistics offices, industry associations, and international development organizations.

Market surveys and questionnaires target specific stakeholder groups including businesses, consumers, and technology providers to gather quantitative data on adoption rates, spending patterns, and future requirements. These surveys provide statistical validation for qualitative insights and help identify emerging trends and market opportunities.

Expert consultations with industry specialists, academic researchers, and policy makers provide additional validation and context for market analysis. These consultations help ensure that research findings accurately reflect current market conditions and future development prospects.

Nairobi metropolitan area dominates Kenya’s ICT market, accounting for approximately 70% of technology sector activity and serving as the primary hub for multinational corporations, startups, and innovation centers. The capital city benefits from superior infrastructure, skilled workforce availability, and proximity to government agencies and financial institutions that support ICT development.

Mombasa coastal region represents the second-largest ICT market concentration, with growing emphasis on port automation, logistics technology, and tourism-related digital services. The region’s strategic location and economic importance create opportunities for specialized ICT solutions and regional connectivity projects.

Central Kenya counties including Kiambu, Nakuru, and Nyeri demonstrate increasing ICT adoption driven by agricultural technology, manufacturing automation, and small business digitization. These areas benefit from proximity to Nairobi while offering lower operational costs and access to specific industry clusters.

Western and Northern regions show emerging ICT development potential, with government initiatives and development programs supporting infrastructure expansion and digital inclusion efforts. While currently representing smaller market shares, these regions offer growth opportunities for companies focused on rural market development and inclusive technology solutions.

Major market participants in Kenya’s ICT sector include a diverse mix of established telecommunications operators, multinational technology companies, and innovative local firms:

Competitive strategies focus on innovation, customer service excellence, strategic partnerships, and market expansion initiatives. Companies compete on technology capabilities, service quality, pricing, and ability to address specific local market needs while maintaining international standards.

By Service Type:

By End User:

Telecommunications infrastructure continues to serve as the foundation for Kenya’s ICT market growth, with ongoing investments in network expansion, capacity upgrades, and new technology deployment. The segment benefits from strong demand for mobile services and increasing data consumption, with operators focusing on network quality improvements and service diversification.

Software development represents a rapidly growing category, with local companies creating solutions for banking, agriculture, healthcare, and government applications. The segment benefits from increasing demand for custom applications, mobile solutions, and integration services that address specific local market needs while maintaining international quality standards.

Cybersecurity services show accelerating growth as organizations recognize the importance of protecting digital assets and maintaining customer trust. The category includes security consulting, managed security services, security software, and training programs that help organizations address evolving cyber threats.

Cloud computing adoption continues to expand across all market segments, with organizations seeking scalable, cost-effective technology solutions that support business growth and digital transformation initiatives. The category includes infrastructure as a service, software as a service, and platform as a service offerings.

Technology companies operating in Kenya’s ICT market benefit from access to a large and growing customer base, supportive government policies, and opportunities for regional expansion. The market offers diverse revenue streams, partnership opportunities, and potential for innovation-driven growth across multiple sectors and applications.

Government agencies gain access to advanced technology solutions that improve service delivery, operational efficiency, and citizen engagement. ICT adoption supports transparency, accountability, and cost-effectiveness in public sector operations while enabling new service delivery models and citizen interaction channels.

Private enterprises benefit from improved operational efficiency, competitive advantages, and new business opportunities enabled by ICT adoption. Technology solutions support process automation, customer engagement, market expansion, and innovation initiatives that drive business growth and profitability.

Educational institutions leverage ICT solutions to enhance learning outcomes, expand access to education, and improve administrative efficiency. Technology enables distance learning, digital content delivery, and administrative automation that support institutional goals and student success.

Healthcare providers utilize ICT solutions to improve patient care, operational efficiency, and health outcomes. Digital health platforms, electronic medical records, and telemedicine solutions support better healthcare delivery and access across urban and rural communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration is gaining momentum across Kenya’s ICT market, with companies exploring AI applications in customer service, fraud detection, agricultural monitoring, and business process automation. Local startups and established companies are developing AI-powered solutions tailored to local market needs and challenges.

Internet of Things deployment shows increasing adoption in agriculture, manufacturing, and smart city applications. IoT solutions for crop monitoring, equipment tracking, and environmental sensing are creating new market opportunities and supporting digital transformation across traditional industries.

Blockchain technology adoption is emerging in financial services, supply chain management, and identity verification applications. Local companies are exploring blockchain solutions for improving transparency, security, and efficiency in various business processes and government services.

Edge computing development supports the growing demand for low-latency applications and local data processing capabilities. This trend is particularly relevant for applications requiring real-time processing and reduced dependence on centralized cloud infrastructure.

Digital payment innovation continues to evolve beyond traditional mobile money services, with new solutions for merchant payments, international transfers, and integration with e-commerce platforms. According to MarkWide Research analysis, digital payment adoption rates continue to expand across all demographic segments.

5G network rollout initiatives by major telecommunications operators represent significant infrastructure investments that will enable new applications and services. These deployments support smart city initiatives, industrial automation, and enhanced mobile broadband services that create opportunities for technology providers and application developers.

Data center investments by local and international companies are expanding Kenya’s cloud computing capabilities and supporting digital transformation initiatives. New data centers provide improved performance, security, and compliance capabilities for organizations adopting cloud-based solutions.

Fintech partnerships between traditional financial institutions and technology companies are creating innovative solutions that combine banking expertise with technological innovation. These collaborations are expanding financial inclusion and creating new revenue opportunities for all participants.

Government digitization projects including the Huduma Namba digital identity system, eCitizen platform expansion, and various e-government initiatives are creating substantial demand for ICT solutions and services while improving public sector efficiency and citizen satisfaction.

International technology partnerships and investments continue to strengthen Kenya’s ICT ecosystem, with global companies establishing local operations, research centers, and innovation labs that support knowledge transfer and skills development.

Skills development investment should be prioritized by both government and private sector stakeholders to address the growing demand for qualified ICT professionals. Comprehensive training programs, university partnerships, and certification initiatives can help build the workforce needed to support continued market growth and innovation.

Cybersecurity capabilities require immediate attention and investment to protect the growing digital economy and maintain stakeholder confidence. Organizations should implement comprehensive security frameworks, invest in security technologies, and develop incident response capabilities to address evolving cyber threats.

Rural market development presents significant opportunities for companies willing to invest in infrastructure and solutions tailored to underserved communities. Innovative business models, partnerships with local organizations, and government support can help expand ICT access and adoption in rural areas.

Regional expansion strategies should leverage Kenya’s established ICT capabilities and market success to serve broader East African markets. Companies should consider partnerships, local presence, and solution adaptation to address specific regional market needs and regulatory requirements.

Innovation ecosystem support through continued investment in startups, research and development, and technology transfer initiatives will help maintain Kenya’s competitive position and drive future market growth. Collaboration between established companies, startups, and research institutions can accelerate innovation and market development.

Kenya’s ICT market is positioned for continued strong growth over the next decade, driven by ongoing digital transformation initiatives, infrastructure investments, and innovation ecosystem development. MWR projects that the market will maintain robust expansion across all major segments, with particular strength in mobile services, software solutions, and digital platforms.

Technology adoption rates are expected to accelerate, with 5G deployment, artificial intelligence integration, and Internet of Things applications creating new market opportunities and business models. The convergence of these technologies will enable innovative solutions that address local challenges while maintaining global competitiveness.

Government support for digital transformation and ICT development is expected to continue, with new initiatives focused on digital skills development, cybersecurity enhancement, and inclusive technology access. These efforts will support market growth while addressing key challenges and ensuring sustainable development.

Regional integration opportunities will expand as Kenya’s ICT companies leverage their local success to serve broader African markets. Cross-border partnerships, technology transfer, and regional infrastructure projects will create new growth opportunities and strengthen Kenya’s position as a continental technology leader.

Investment flows into Kenya’s ICT sector are projected to increase, with both local and international investors recognizing the market’s potential and supporting expansion across multiple segments. This investment will support infrastructure development, innovation initiatives, and market expansion efforts that drive long-term growth.

Kenya’s ICT market represents one of Africa’s most promising technology landscapes, characterized by strong government support, innovative solutions, and robust growth across multiple segments. The market’s success in mobile money services, digital innovation, and regional leadership demonstrates the potential for continued expansion and development in emerging technology areas.

Strategic opportunities in 5G deployment, artificial intelligence, digital agriculture, and regional expansion provide clear pathways for market participants to achieve sustainable growth while contributing to Kenya’s economic development and digital transformation objectives. The combination of supportive policies, infrastructure investments, and entrepreneurial energy creates a favorable environment for technology innovation and adoption.

Market challenges related to skills development, cybersecurity, and rural connectivity require continued attention and investment from all stakeholders. Addressing these challenges through collaborative efforts, strategic partnerships, and targeted initiatives will ensure that Kenya’s ICT market continues to thrive and serve as a model for other emerging markets seeking to leverage technology for economic development and social progress.

What is ICT?

ICT stands for Information and Communication Technology, encompassing technologies that provide access to information through telecommunications, the internet, and other means. It includes various applications such as mobile communications, software development, and digital services.

What are the key players in the Kenya ICT Market?

The Kenya ICT Market features several prominent companies, including Safaricom, Airtel Kenya, and Telkom Kenya, which are significant in telecommunications and mobile services. Additionally, firms like IBM and Microsoft are influential in software and technology solutions, among others.

What are the growth factors driving the Kenya ICT Market?

Key growth factors for the Kenya ICT Market include the increasing smartphone penetration, the expansion of internet connectivity, and the rising demand for digital services across various sectors such as education, finance, and healthcare.

What challenges does the Kenya ICT Market face?

The Kenya ICT Market faces challenges such as inadequate infrastructure in rural areas, cybersecurity threats, and regulatory hurdles that can hinder innovation and investment in technology.

What opportunities exist in the Kenya ICT Market?

Opportunities in the Kenya ICT Market include the potential for growth in e-commerce, the development of fintech solutions, and the expansion of cloud computing services, which can enhance business operations and consumer access.

What trends are shaping the Kenya ICT Market?

Trends in the Kenya ICT Market include the rise of mobile money services, increased adoption of artificial intelligence in various applications, and a growing focus on digital transformation among businesses and government entities.

Kenya ICT Market

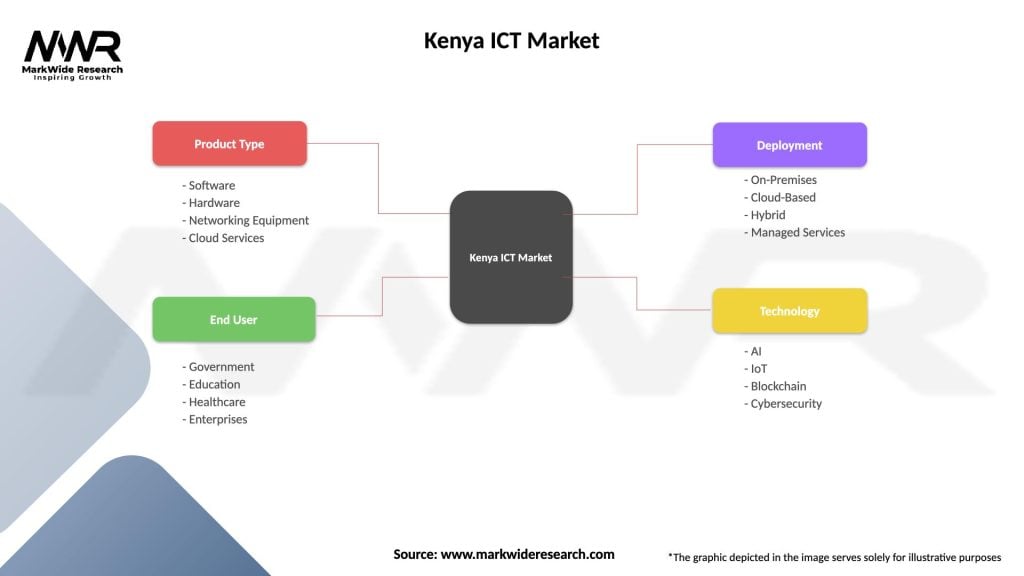

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Networking Equipment, Cloud Services |

| End User | Government, Education, Healthcare, Enterprises |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | AI, IoT, Blockchain, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Kenya ICT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at