Market Overview

The Juniper Berry Market plays a pivotal role in the global flavor, fragrance, and botanical extract industries. Juniper berries—the cone-like, aromatic seed cones of the Juniperus communis plant—are best known for their key role in gin production. Beyond spirits, they are valued in culinary, cosmetic, pharmaceutical, and aromatherapy applications. The market’s growth is driven by rising consumer interest in natural ingredients, craft spirits, functional botanicals, and premium fragrances. Additionally, increasing awareness of the health benefits attributed to juniper’s essential oils—such as digestive support, antioxidant properties, and anti-inflammatory effects—has broadened demand across nutraceutical and wellness sectors.

As supply chains evolve and craft distillation gains momentum, the juniper berry market is experiencing diversification in product forms (whole berries, extracts, essential oils) and end‑use applications. Sustainability concerns, climate change impacts on wild populations, and regulatory frameworks around foraged botanicals are shaping market dynamics, encouraging cultivation initiatives and traceable sourcing models.

Meaning

Juniper berries are the seed cones harvested primarily from Juniperus communis and related species. Their distinctive, piney‑citrus flavor profile and rich terpene content—dominated by α‑pinene, myrcene, and limonene—make them a versatile botanical:

-

Culinary & Beverage Use: Infusing spirits (notably gin), flavoring meats, sauces, and condiments.

-

Cosmetics & Fragrances: As a top or middle note in perfumes, soaps, and skincare, offering a fresh, woody character.

-

Pharmaceutical & Nutraceutical: Employed in traditional medicine and modern supplements for diuretic, digestive, and antioxidant properties.

-

Aromatherapy & Wellness: Juniper essential oil is used for stress relief, respiratory support, and massage blends.

The market segments juniper products into three primary forms: whole dried berries, solvent or CO₂ extracts, and steam‑distilled essential oils. Each form commands specific quality parameters—aroma intensity, purity (absence of pesticides, heavy metals), and consistent terpene profiles—that influence their suitability for different industries.

Executive Summary

The global juniper berry market, valued at approximately USD 200 million in 2024, is projected to grow at a CAGR of 5–6% through 2030. The craft spirits revolution—especially premium gin—remains the market’s single largest driver, accounting for over 60% of global juniper demand. Concurrently, the rise of functional foods, natural cosmetics, and holistic wellness trends has spurred demand for juniper extracts and essential oils.

Key trends include:

-

Craft & Artisanal Spirits Expansion: New distilleries seeking unique regional juniper varietals to differentiate products.

-

Cultivation vs. Wild Harvesting: Shift toward managed cultivation in Europe and North America to ensure sustainable supply.

-

Cold‑Pressed & CO₂ Extraction: Premium extraction methods gaining traction for higher terpene retention and purity.

-

Geographical Indications & Traceability: Emphasis on provenance (e.g., Carpathian juniper, Macedonian juniper) to command premium pricing.

Challenges such as climate variability, regulatory scrutiny on wild foraging, and competition from synthetic flavor alternatives underscore the need for sustainable cultivation, quality standardization, and value addition.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Gin Renaissance: The global gin market is forecast to grow at an 8% CAGR from 2024–2030, driving upstream juniper demand. Small‑batch and flavored gins increasingly use region‑specific juniper to highlight terroir.

-

Diversified End‑Use: While beverages dominate, nutraceuticals and cosmetics sectors are experiencing double‑digit growth in juniper extract/oil use due to consumer preference for plant‑based actives.

-

Value‑Added Processing: CO₂‑extracted juniper oil fetches 2–3× higher prices than steam‑distilled oil owing to superior aromatic profiles and absence of solvent residues.

-

Geography Matters: Eastern Europe (e.g., Serbia, Macedonia) and Scandinavia supply the bulk of wild juniper berries, whereas France, Germany, and the U.S. are leading cultivation regions.

-

Sustainability & Certification: Organic, FairWild, and ISO‑certified juniper products are commanding price premiums of 10–20%, as buyers prioritize ethically sourced botanicals.

Market Drivers

-

Craft Beverage Boom: Proliferation of gin brands and botanical cocktails requiring high‑quality juniper berries.

-

Natural & Functional Ingredient Trends: Surge in demand for plant‑derived extracts in supplements, digestive aids, and sports nutrition.

-

Premium Fragrance & Cosmetic Products: Juniper’s fresh, woody aroma is increasingly incorporated into high‑end personal care formulations.

-

Health & Wellness Movement: Recognition of juniper’s antioxidant and anti‑inflammatory properties spurs innovation in aromatherapy and topical applications.

-

Traceability & Origin Marketing: Consumer interest in provenance bolsters demand for regionally distinct juniper varieties.

Market Restraints

-

Climate Change & Yield Variability: Unpredictable weather patterns affect wild berry yields, causing price spikes and supply shortages.

-

Regulatory Complexities: Restrictions on wild harvesting in protected areas and stringent import/export phytosanitary rules can impede trade.

-

Quality Inconsistency: Variations in terpene content and potential contamination (molds, heavy metals) require rigorous quality control, raising processing costs.

-

Competition from Synthetic Alternatives: Lower‑cost synthetic juniper flavor compounds threaten natural berry demand in cost‑sensitive segments.

-

Harvesting Labor Shortages: Reliance on seasonal, manual harvesting operations faces challenges due to labor scarcity and rising wages.

Market Opportunities

-

Cultivated Juniper Plantations: Expanding agroforestry programs targeting J. communis to stabilize supply and improve berry uniformity.

-

High‑Value Extracts: Development of ultra‑purified, standardized juniper flavonoid and terpene fractions for pharmaceuticals and cosmeceuticals.

-

Exotic Varietal Profiling: Marketing lesser‑known juniper species (e.g., J. drupacea, J. phoenicea) with unique flavor/health profiles to niche distillers and perfumers.

-

Digital Traceability Platforms: Blockchain‑based origin tracking to bolster consumer trust and justify premium pricing.

-

Collaborations with Distillers: Co‑branding and limited‑edition spirits to showcase unique juniper sources, enhancing brand loyalty.

Market Dynamics

-

Supply Side: Wild harvesting accounts for 70% of global supply; increasing tilt toward cultivation to mitigate climate risks. Key producers invest in nursery propagation and orchard development.

-

Demand Side: The confluence of craft spirits, botanical supplements, and natural cosmetics diversifies demand, shifting volume from bulk dried berries toward value‑added extracts and oils.

-

Economic Factors: Rising consumer spending on premium beverages and wellness products supports sustained price growth for high‑quality juniper products, despite occasional commodity price volatility.

Regional Analysis

-

Europe: Largest producer and consumer region. The UK, Spain, and Germany are top importers, driven by gin production hubs. Wild‑harvested berries from Balkan and Scandinavian wildlands command premium.

-

North America: Rapidly growing craft distillery scene in the U.S. and Canada fuels local cultivation efforts, with Oregon and British Columbia leading plantation projects.

-

Asia‑Pacific: Emerging interest in gin and functional botanicals in China, Japan, and Australia drives imports. Local cultivation trials underway in Australia’s temperate zones.

-

Latin America: Craft spirit movement expanding in Mexico and Brazil; niche demand for juniper‑flavored liqueurs stimulates imports.

-

Middle East & Africa: Early stage; boutique distilleries and premium cosmetics producers beginning to source juniper extracts, albeit volumes remain small.

Competitive Landscape

Leading Companies in the Juniper Berry Market:

- Florihana Distillerie

- Jiangxi Baicao Pharmaceutical

- Inovia International

- Biolandes

- Eden Botanicals

- Young Living Essential Oils

- Kanta Enterprises

- Thracian Oils

- Alba Grups Ltd

- Amazon Forest Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

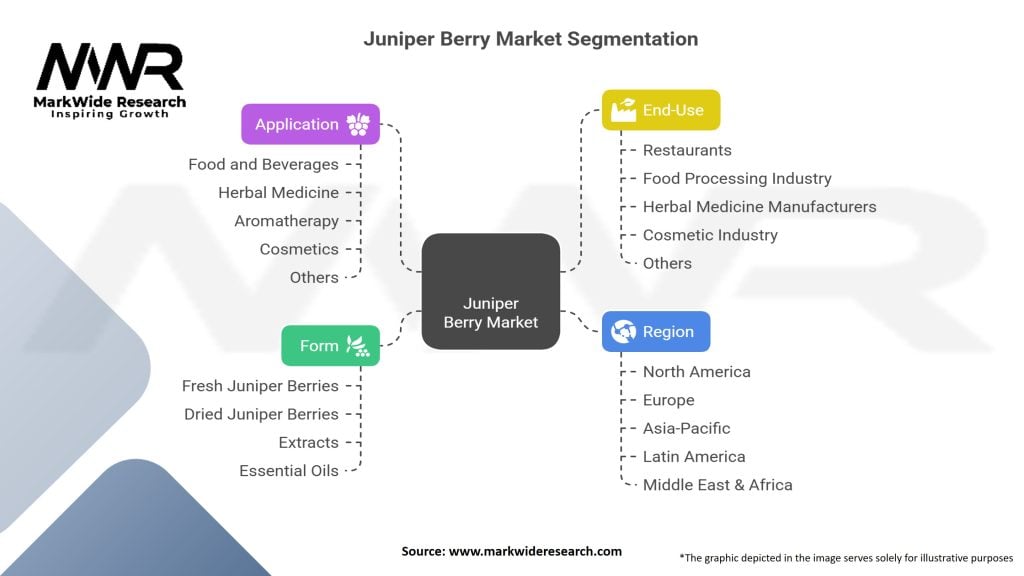

Segmentation

-

By Product Form:

-

Whole Dried Berries

-

Powdered Extracts

-

CO₂‑Extracts & Tinctures

-

Steam‑Distilled Essential Oils

-

-

By Application:

-

Beverages (Gin, Liqueurs, Botanical Infusions)

-

Food Flavoring (Marinades, Sauces, Meat Seasonings)

-

Cosmetics & Personal Care (Perfumes, Soaps, Skincare)

-

Pharmaceutical & Nutraceutical (Digestive Aids, Diuretics, Antioxidants)

-

Aromatherapy & Wellness Products

-

-

By Source:

-

Wild‑Harvested Sourcings (Balkans, Scandinavia, Iberia)

-

Cultivated Plantations (France, USA, Germany)

-

-

By Distribution Channel:

-

Direct Sales to Distilleries & Manufacturers

-

Spice, Botanical, & Essential Oil Distributors

-

Online B2B Marketplaces

-

Category‑Wise Insights

-

Whole Berries: Bulk volumes at lower price points; primarily sold to large gin distillers and food processors.

-

Extracts & Powders: Value‑added segments commanding 20–50% higher margins; popular with nutraceutical, cosmetic, and flavor companies seeking consistency.

-

Essential Oils: Highest‑value products (up to 10× whole berry price), used in premium perfumery and aromatherapy. Quality driven by distillation method and terroir.

Key Benefits for Industry Participants and Stakeholders

-

Value Addition & Margin Expansion: Extracts and oils offer significant upside compared to bulk berries.

-

Brand Differentiation: Unique regional juniper sources enable product storytelling and premium positioning.

-

Supply Chain Control: Cultivation initiatives reduce reliance on unpredictable wild harvests, improving forecast accuracy.

-

Regulatory Compliance: Standardized extracts facilitate labeling and safety compliance in food, pharma, and cosmetics.

-

Sustainability Leadership: Ethical sourcing and certification can unlock new markets and price premiums.

SWOT Analysis

-

Strengths:

-

Established demand in spirits and botanical industries.

-

High-value downstream derivatives (extracts, oils).

-

Growing consumer preference for natural, premium ingredients.

-

-

Weaknesses:

-

Supply volatility due to climate and wild‑harvest dependency.

-

High labor intensity in harvesting and processing.

-

Fragmented producer base lacking large‑scale cultivation.

-

-

Opportunities:

-

Expansion of dedicated juniper plantations.

-

New product development in nutraceuticals and cosmeceuticals.

-

Digital traceability systems to validate sustainable sourcing.

-

-

Threats:

-

Synthetic flavor/aroma substitutes undercutting natural juniper prices.

-

Regulatory restrictions on wild harvesting and botanical imports.

-

Potential over‑exploitation of wild juniper leading to biodiversity concerns.

-

Market Key Trends

-

Craft Terroir: Distillers emphasizing single‑origin juniper to create signature gin expressions.

-

Premiumization: Shift toward high‑purity CO₂ extracts in luxury cosmetics and aromatherapy.

-

Sustainably Sourced Botanicals: Certification programs (Organic, FairWild) gaining mainstream acceptance.

-

Functional Ingredients: Juniper flavonoids incorporated into digestive health supplements and sports nutrition.

-

Vertical Integration: Distilleries establishing or partnering on juniper plantations to secure supply and quality control.

Covid‑19 Impact

-

Supply Chain Disruptions: Travel and border closures impeded wild harvesting expeditions in 2020–21, but digital trade platforms mitigated delays.

-

Gin & Home‑Mixing Boom: Lockdowns spurred home cocktail culture, temporarily boosting bulk juniper sales to microdistilleries.

-

Wellness Surge: Increased consumer focus on immune‑supporting botanicals broadened interest in juniper extracts.

-

Shift to E‑Commerce: Suppliers enhanced online B2B and D2C channels, improving global reach.

Key Industry Developments

-

Cultivation Initiatives: New juniper orchards established in France’s Massif Central and Oregon’s Willamette Valley.

-

Extraction Technology Advances: Supercritical CO₂ processes enabling solvent‑free, high‑purity juniper oils.

-

Certification Roll‑Outs: FairWild and EU organic certifications adopted by key Balkan cooperatives.

-

Collaborations: Gin brands co‑developing proprietary juniper varietals with botanical growers to secure exclusivity.

-

Digital Traceability: Blockchain pilots launched to authenticate juniper origin and harvest practices.

Analyst Suggestions

-

Invest in Cultivation: Develop dedicated juniper plantations to stabilize supply, improve berry uniformity, and reduce environmental pressures on wild populations.

-

Enhance Value‑Added Processing: Focus on high‑margin extracts and essential oils, leveraging premium extraction technologies and customized terpene profiles.

-

Pursue Certifications & Traceability: Obtain organic, FairWild, and Geo‑Origin certifications, and implement digital tracking to build consumer trust and justify price premiums.

-

Forge Strategic Partnerships: Collaborate with craft distillers, cosmeceutical brands, and nutritional supplement companies on co‑branding and custom product development.

-

Expand Emerging Market Footprint: Target growth in Asia‑Pacific and Latin America by educating local spirits producers, cosmetic formulators, and wellness brands on juniper’s unique benefits.

Future Outlook

The Juniper Berry Market is poised for sustained growth as it capitalizes on the convergence of craft beverage innovation, natural wellness trends, and premium fragrance demand. Key factors shaping the future include:

-

Terroir‑Driven Differentiation: Growing consumer interest in regional authenticity will drive demand for distinct juniper varietals.

-

Health & Wellness Cross‑Over: Juniper’s traditional medicinal uses are being reframed through modern clinical research, opening new nutraceutical opportunities.

-

Technology & Traceability: Digital platforms ensuring provenance, quality, and sustainability will become critical to commanding premium pricing.

-

Sustainable Cultivation: Expansion of climate‑resilient juniper orchards will mitigate wild supply risks and support biodiversity goals.

-

Innovative Product Formats: New delivery forms—microencapsulated oils, liposomal extracts, flavor‑infused botanicals—will cater to diverse end‑use markets.

Conclusion

The Juniper Berry Market stands at the intersection of tradition and innovation. Established demand from the spirits industry continues to underpin volumes, while burgeoning applications in cosmetics, pharmaceuticals, and wellness are diversifying revenue streams. To capitalize on these trends, stakeholders must balance sustainable sourcing, product innovation, and strategic market positioning. Investments in cultivation, advanced extraction, certification, and digital traceability will be essential to meet evolving consumer expectations for authenticity, quality, and environmental responsibility. By embracing these strategies, juniper producers, processors, and end‑users can navigate market complexities and unlock long‑term growth in a competitive global landscape.