444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Japan Thermal Power Plant Market serves as a cornerstone of the nation’s energy landscape, providing a significant portion of its electricity needs. This market is characterized by a blend of cutting-edge technology, environmental concerns, and the nation’s commitment to energy security.

Meaning

Thermal power plants are electricity generation facilities that utilize the heat energy produced by burning fossil fuels or other heat sources to produce steam, which, in turn, drives turbines to generate electricity. These plants play a crucial role in Japan’s energy mix, contributing to baseload power generation.

Executive Summary

Amidst the technological advancements and environmental challenges, the Japan Thermal Power Plant Market stands as a key pillar of the nation’s energy infrastructure. This executive summary offers a concise overview of the Japan Thermal Power Plant Market, highlighting its significance, growth potential, and key trends.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Japan’s mature thermal fleet includes many aging plants requiring refurbishment rather than replacement.

Gas-fired thermal plants are favored for flexibility and lower emissions, supporting renewables integration.

Coal plants face increasing regulatory pressure and social opposition, pushing toward decommissioning or retrofits.

Demonstration projects for hydrogen co-firing and carbon capture are progressing but still limited in scale.

Digital performance optimization, predictive maintenance, and thermal efficiency improvements are high-leverage retrofit strategies.

Market Drivers

Grid Stability & Flexibility Needs: Thermal plants supply baseload and peaking support, helping manage variable renewable output.

Emission Regulations & Policy Targets: Stricter CO₂, NOx, SOx, and particulate limits force upgrades or replacement of older plants.

Aging Infrastructure: Many thermal plants were built decades ago and need life-extension, replacement, or modernization.

Energy Security & Fuel Diversity: Japan’s reliance on fuel imports makes flexible, efficient plants and alternate fuels (e.g., hydrogen, biomass) more attractive.

Technological Advances: Developments in high-efficiency turbines, carbon capture, and hybrid systems spur retrofit investment.

Market Restraints

High Capital Costs: Building new plants or retrofits, especially with carbon capture or hydrogen readiness, demands significant investment.

Fuel Price Volatility: Dependence on imported gas, coal or hydrogen subjects operating economics to global price fluctuations.

Public Resistance & Environmental Concerns: Local opposition to thermal plants and emissions may delay permitting.

Regulatory Uncertainty: Policies on carbon pricing, renewable mandates, and coal use evolve, creating investment risk.

Competition from Renewables & Storage: Solar, wind, and battery systems lower operating costs and threaten the role of thermal generation in some markets.

Market Opportunities

Hydrogen Co‑firing & Fuel Conversion: Retrofitting existing gas or coal plants to co-fire hydrogen or transition entirely.

Carbon Capture & Storage (CCS): Installing capture systems to reduce CO₂ emissions, especially at large baseload plants.

Biomass & Waste Co-firing: Integrating local biomass or waste feedstocks to reduce carbon footprint.

Flexible & Hybrid Plants: Enhancing ramp rates, load-following capability, and coupling with battery storage.

Digital & Efficiency Retrofits: Upgrading turbines, boilers, controls, and asset management with AI-driven optimization.

Market Dynamics

Supply-Side Factors:

Major equipment providers (turbine, boiler, emissions systems) offer retrofit kits and hybrid upgrade options.

EPC (Engineering, Procurement, Construction) firms bid for modernization and conversion projects.

Grid operators and utility companies manage capacity mix and dispatch rules influencing plant utilization.

Demand-Side Factors:

Utilities and independent power producers (IPPs) require dependable, flexible plants to meet peak demands and reserve margins.

Industrial clusters require stable power supply for heavy and continuous loads.

Policy & Economic Context:

National energy and climate strategy influences incentives, carbon pricing, and subsidy frameworks.

Fuel import, tax regimes, and emission trading schemes affect operational costs and investment returns.

Regional Analysis

Kanto / Tokyo Region: High power demand and grid density necessitate nearby thermal capacity, sometimes with district heating integration.

Kansai / Osaka Region: Industrial and population centers require mid-sized plants or grid tie-ins for stability.

Hokkaido & Northern Japan: Seasonal demand spikes and grid isolation make thermal peaks critical.

Chubu / Nagoya Axis: Industrial-heavy region with manufacturing plants reliant on grid stability from thermal backup.

Kyushu & Southern Islands: Power supply constraints and integration with renewable generation demand flexible plant operations.

Competitive Landscape

Leading Companies in Japan Thermal Power Plant Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Fuel Type:

Natural Gas (combined cycle, open cycle)

Coal (supercritical, ultrasupercritical)

Oil / Heavy Fuel Oil

Biomass / Waste / Co-firing

Hydrogen‑ready / Hybrid systems

By Plant Size:

Large Baseload Plants (hundreds to over a thousand megawatts)

Mid-size Grid Plants

Peaking / Peaking Thermal Units of smaller capacity

By Service Type:

New Build Projects

Retrofit & Modernization

Operations & Maintenance (O&M)

Fuel Conversion / Hybrid Transition

Emission Control / Carbon Capture Projects

By Region:

Eastern (Kanto, Chiba, Tokyo)

Western (Kansai, Osaka)

Northern (Hokkaido)

Southern / Insular Regions (Shikoku, Kyushu)

Central (Chubu, Nagoya area)

Category-wise Insights

Natural Gas Plants: Favored for lower emissions and flexibility; many investments are in CCGT upgrades or gas-to-power expansions.

Coal Plants: Facing pressure for conversion, retirement, or major retrofits; interest in partial biomass blending or CCS to extend life.

Oil-Fired Units: Often reserved as backup or peaking; maintenance and fuel costs limit utilization.

Biomass / Co-firing Units: Attractive for emission reductions, though feedstock supply logistics and cost remain challenges.

Hydrogen / Hybrid Systems: Emerging projects to retrofit existing thermal plants to handle hydrogen blends with future full hydrogen readiness.

Key Benefits for Industry Participants and Stakeholders

Grid Stability & Reliability: Thermal plants ensure continuous supply, serve as fallback resources, and support renewable integration.

Asset Value Preservation: Retrofit and modernization investments extend plant life while maintaining competitiveness.

Carbon Emissions Mitigation: Co-firing, CCS, or hydrogen capabilities support regulatory compliance and climate goals.

Economic Leverage: Efficient, modern thermal assets reduce fuel use, maintenance costs, and increase dispatch desirability.

Flexibility & Value-Added Services: Hybrid capacity, fast ramping, and balancing services unlock new revenue streams.

SWOT Analysis

Strengths:

Well-established grid backbone and experience with thermal operations.

Strong engineering sector with experience in retrofits and emissions systems.

Regulatory framework targeting emissions reduction and flexibility.

Weaknesses:

Dependence on imported fuel increases exposure to price and supply risk.

Aging fleet with lower efficiency and higher maintenance burdens.

Social and environmental concern over fossil-based thermal generation.

Opportunities:

Retrofitting for hydrogen blending and bio-cofiring to extend utility value.

Deploying carbon capture and storage in select plants near storage or pipeline infrastructure.

Integrating digital systems to maximize thermal plant performance and predictive O&M.

Threats:

Accelerating deployment of renewables and storage reducing absolute demand for thermal generation.

Policy shifts that ban or restrict certain thermal fuels prematurely.

Fuel or technology supply constraints for advanced retrofit components.

Market Key Trends

Hydrogen Demonstration Projects: Pilot retrofits for hydrogen blending in gas turbines or boilers.

Digital Twins & Performance Analytics: Deployment of monitoring systems to improve thermal efficiency and diagnostics.

Emissions Retrofits: Upgrades such as selective catalytic reduction (SCR), flue gas cleanup, and NOx/SOx control systems.

Flexible Operation Modes: Thermal plants operating more dynamically to back up renewables rather than continuous baseload.

Decommissioning and Lifecycle Planning: Rationalizing old, inefficient plants when upgrades are uneconomic or unsustainable.

Key Industry Developments

Major Retrofit Tenders Awarded: Utilities issuing RFPs to modernize older coal or gas plants for higher efficiency.

Carbon Capture Pilot Initiatives: Selected plants initiating CCS demonstration or feasibility programs.

Hydrogen Readiness Assessments: Studies underway on pipeline compatibility, combustion behavior, and retrofitting strategies.

Industry Partnerships: Utilities, technology firms, and research institutes collaborating for performance optimization and emission reduction programs.

Regulatory Framework Updates: Authorities revising emission standards, compensation tariffs, and renewable integration policies shaping project viability.

Analyst Suggestions

Prioritize Retrofit Programs: Rather than new builds, focus on upgrading existing plants for efficiency, flexibility, and emissions reduction.

Embed Transition Pathways: Design retrofit projects with hydrogen/CCS compatibility to future-proof assets.

Adopt Digital Asset Management: Use predictive maintenance, performance analytics, and operational optimization to lower O&M costs.

Balance Flexibility & Baseline Operation: Tune plant dispatch to support renewables rather than competing directly as baseload.

Engage Stakeholders & Communities Early: Address environmental concerns, local impacts, and social license through transparency and planning.

Future Outlook

Through 2030 and beyond, Japan’s thermal power market will increasingly become a transition platform—balancing decarbonization constraints and grid reliability demands. Some plants will be phased out; others will be modernized for flexibility, emission reduction, or hydrogen readiness. The most successful thermal assets will be those that integrate digital performance, hybrid fuel capability, optional carbon capture, and operational flexibility.

Japan’s grid transformation will require thermal plants to shift from static baseload roles to dynamic support assets—providing reserve, ramping, and balancing services in a high-renewable environment. Retrofitted, low-carbon thermal systems will complement renewables and storage rather than compete directly.

Conclusion

The Japan Thermal Power Plant Market occupies a strategic position: a bridge between traditional fossil-based generation and a lower-carbon future. Its success lies in adaptive modernization, flexible dispatch, emission-reduction retrofits, and forward-looking infrastructure design. Stakeholders that embrace digital optimization, co-firing, hydrogen readiness, and operational agility will ensure thermal assets remain valuable contributors to Japan’s energy transition path.

In conclusion, the Japan Thermal Power Plant Market remains a cornerstone of the nation’s energy landscape, providing stable and reliable electricity generation. As Japan charts its course towards a sustainable and carbon-neutral future, the market will continue to adapt and innovate, ensuring a steady supply of electricity while minimizing environmental impact. The journey ahead involves embracing cleaner technologies, investing in research, and collaborating to address the challenges and opportunities that lie on the horizon.

What is Thermal Power Plant?

Thermal Power Plant refers to facilities that convert thermal energy into electrical energy, primarily using fossil fuels such as coal, natural gas, or oil. These plants play a crucial role in electricity generation in various regions, including Japan.

What are the key players in the Japan Thermal Power Plant Market?

Key players in the Japan Thermal Power Plant Market include Tokyo Electric Power Company, Chubu Electric Power Company, and Kansai Electric Power Company, among others. These companies are involved in the operation and management of thermal power facilities across the country.

What are the growth factors driving the Japan Thermal Power Plant Market?

The Japan Thermal Power Plant Market is driven by factors such as the increasing demand for electricity, the need for energy security, and the reliance on thermal power for baseload generation. Additionally, advancements in technology are enhancing efficiency and reducing emissions.

What challenges does the Japan Thermal Power Plant Market face?

The Japan Thermal Power Plant Market faces challenges such as regulatory pressures for emissions reductions, competition from renewable energy sources, and the high costs associated with maintaining aging infrastructure. These factors can impact the operational viability of thermal plants.

What opportunities exist in the Japan Thermal Power Plant Market?

Opportunities in the Japan Thermal Power Plant Market include the potential for retrofitting existing plants with cleaner technologies, the integration of carbon capture and storage solutions, and the exploration of hybrid systems that combine thermal and renewable energy sources.

What trends are shaping the Japan Thermal Power Plant Market?

Trends in the Japan Thermal Power Plant Market include a shift towards more efficient and cleaner technologies, increased investment in digitalization for operational optimization, and a growing focus on sustainability practices. These trends are influencing how thermal power is generated and utilized.

Japan Thermal Power Plant Market

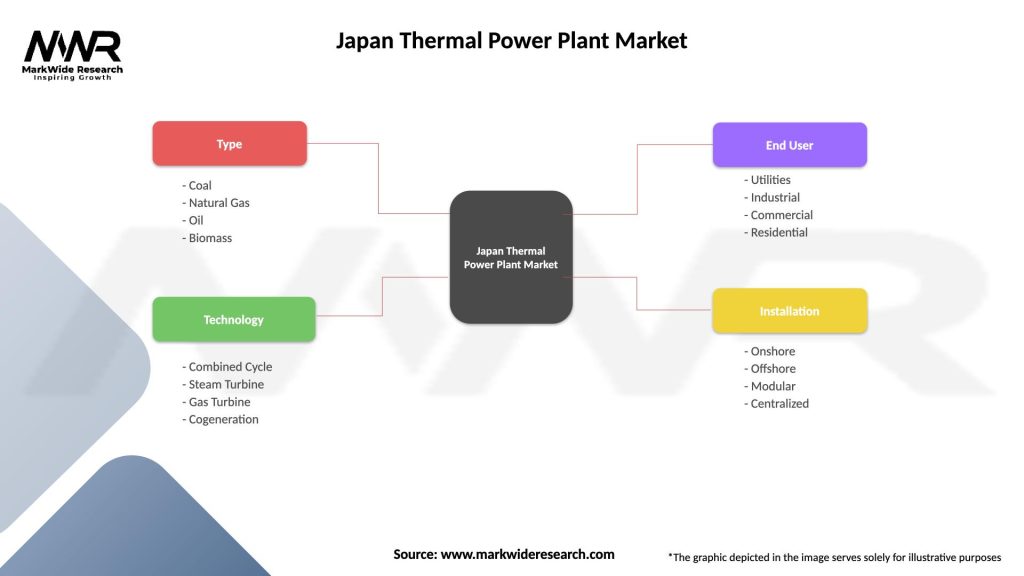

| Segmentation Details | Description |

|---|---|

| Type | Coal, Natural Gas, Oil, Biomass |

| Technology | Combined Cycle, Steam Turbine, Gas Turbine, Cogeneration |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Onshore, Offshore, Modular, Centralized |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Thermal Power Plant Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at